Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

389 -

Joined

-

Last visited

Posts posted by Spydertrader

-

-

Thank you for this useful post.In the attached, if one were to arrive at the mistaken conclusion that the last OB in the attached (decr red volume, 1515 eob, 1/28/10) was a completion of sequence and signal for change due to erroneous annotations --- would there be any possible way (perhaps using finer tools) to wash out with minimum damage?

Thank-you for providing a perfect example.

The following answer assumes Action only at Bar close. As such, one has no need to check the YM, STR-SQU, DOm or Tic Charts. However, at minimum one should see a warning flag on the STR-SQU (if not a completed cycle down on the YM). Since we don't have those tools at our disposal, we will simply look at the ES chart (Coarse Level Tool only) to locate our answer.

If one has determined the OB represented a signal for change, then one knows what must come next with respect to the order of events. On the very next bar, the market provided that which you did not anticipate (a pennant? WTF is this?).

Whoops! The annotations must contain a signifciant error. Once located, the answers is easy, the second 'A' (of M-A-D-A) indicated hold , but instead, the trader reversed.

Corrective action One (if unable to locate the source of the annotation error [why M-A-D-A resulted in a hold) - sideline.

Corrective Action Two (if by locating the annotation error the trader fully understands why M-A-D-A indicated hold - reverse back to the right side of the market (for your trading fractal).

As one gains additional experience, one will develop the confidence to reverse back to the right side, simply because "what must come next" - didn't, while still searching for the erroneous annotation.

Keep in mind (as the FBP continues to form) - and you have a full five minutes here - your brain is going to say, 'Wait a minute. If this bar finishes as a FBP on decreasing B, where the hell is my increasing R?" By then, you'll already be looking for that errant annotation.

HTH.

- Spydertrader

-

Spyder, when trading with complete certainty does one still make use of wash trades?Sure.

Errors happen from time to time - even to the most experienced in any field.

For me, a wash trade results out of two possible scenarios. The first scenario involves an error created by myself, while the second develops as a result of market geometry.

In the first example, I (for any number of reasons) experience a momentary break in concentration (a family member steps into my office, my phone rings in the middle of analysis, someone sends me an IM [email, text or posts a question to a web site] or I simply have grown impatient with a long trending day). As a result of my own lack of focus, I annotate a chart incorrectly using an improper line weight. A bar or two later, my brain begins to think, "Hey Wait a minute here. This [the market] isn't acting like it should. Something must be wrong." Such thoughts cause me to 're-check' my chart anotations in very rapid fashion. Normally, I locate my error in plenty of time to correct (witha reversal trade) my annotation error placing me back on the right side of the market (for my trading fractal) - even profiting a little bit extra than I had anticipated. Sometimes, too much time has passed (or the market has moved too swiftly) for me to change direction without experiencing a small loss (1 to 3 tics). Although not a regular occurance, errors do happen (I still make them now and then), but most of the time, one's 'experience' provides the warning bells necessary to correct the incorrect annotation without taking a big hit.

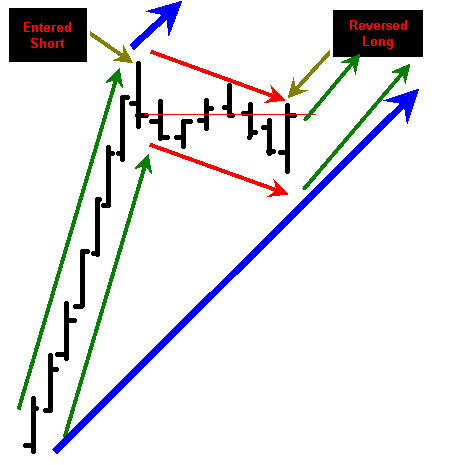

The second area where an experienced individual would see a wash trade (or even a small loss) results out of how a particular trend might develop. See attached. Should a trader find themselves in a High Pace environment with a strong trend (in either direction), noticing a completion of The Order of Events, a trader might choose to reverse in an effort to remain on their trading fractal throughout the day. When this Non-Dominant Trend coincides with a 'Drop Off' in Pace (often seen during the middle of a market day), the Non-dominant trend can develop with very little (sometimes zero) slope. If the trader executed a Reversal Trade Short at an IBGS Type Bar, and after completing The Order of Events required of the Non-Dominant Trend one executed a Reversal trade Long at another IBGS Type Bar, the Geometry of the market itself (where the respective bars closed relative to one another) might create a wash trade (or sometimes, a small (1 to 3 tic) loss. When I experience such a market environment, I don't even concern myself with it. After all, had I chosen to use a Medium Tool (the YM) during my trading day, I would have entered the market (on both ends of the Non-Dominant Trend) prior to any 'overlap' in Price. Since the YM isn't part of our trading arsenal (at this time), I shrug the whole deal off.

Considering the trader in question (you, me - anybody) would have already banked that nice run upwards (before attempting to trade the Non-Dominant Trend) what ya' gonna' do? Cry over a three tic loss after a 15 point profit? I don't think so. :haha:

Knowing one always has the ability to wash out of any trade allows the trader to not focus on things beyond his / her control. We can no more control the slope of the trend than we can the weather. And while errors do happen (from time to time) - even to those of us with the most experience with The Price / Volume relationship (including myself), developing the ability to quickly recognize and repair improper, incorrect or erroneous annotations should be your goal - vs striving for 100% error free annotation.

HTH.

- Spydertrader

-

-

This does imply that it is the lateral that is the context does it not?No.

With respect to your "hint to take a look at the YM",there obviously must be a reason to do so.

Yes.

Is it that we are given permission to look at the YM because price (in this instance) was in a formation (a Sym at 9:45 and indeed followed by a FBP) rather than just a lateral?No.

-Spydertrader

-

is it correct to conclude the following;

1) that by price being within a lateral we have permission to look at the YM?

No.

2) and in doing so then the lateral is both the object and the context?

No.

3) and if so that the YM is to be included in the information we are using, in order to know which way price will exit a lateral?

No.

- Spydertrader

-

I'm having real trouble reconciling the above in bold.

When presented with a situation (problem) where no clear solutions appears to exist, I often encourage people to look at said situation from an alternative point of view.

By "anticipate", (in this respect we are "anticipating" increasing black volume to tell us we have the 2b of b2b2r2b) are we talking about WMCN in terms of the volume sequence that must complete, yes or no ?Yes.

So how are we to deal with the M in WMCN when you say that we had it by virtue of it not happening.?I can only deduce, from what you say, that if price finds itself within a lateral then WMCN may not apply?

No.

- Spydertrader

-

TIA for any comments.I encourage you to change from Candlestick Charting to Bar (OHLC) charting.

- Spydertrader

-

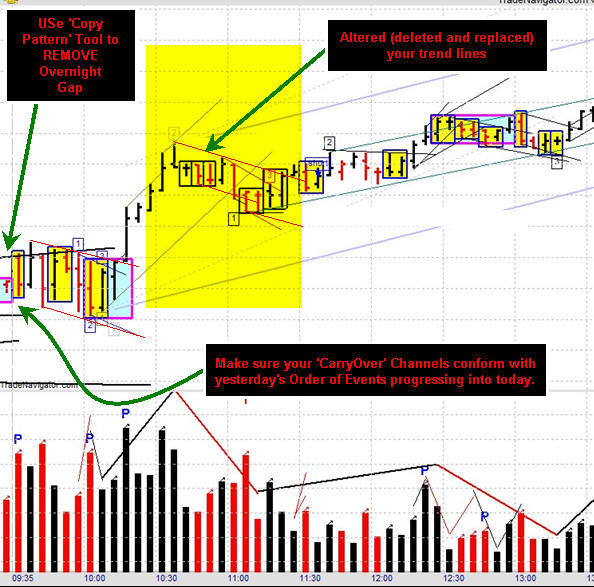

I included gaussians today.

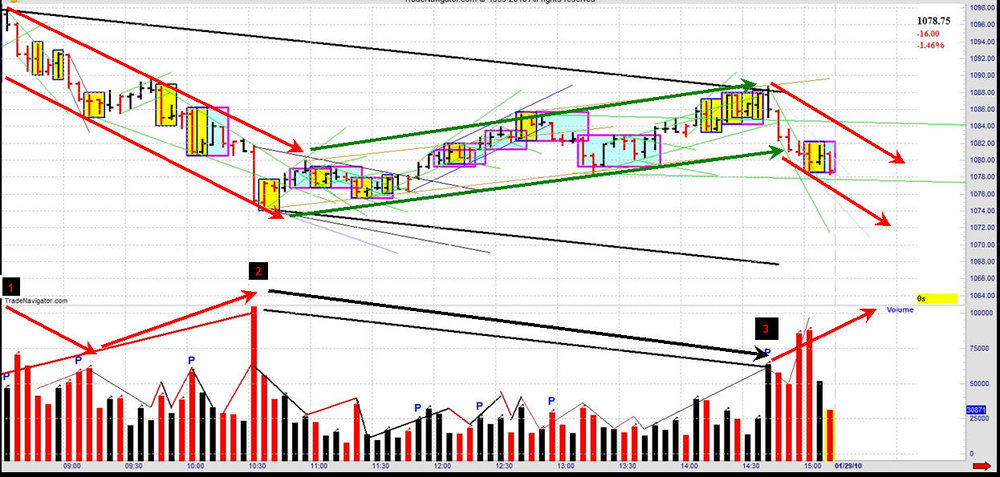

Attached, please find an over view of 'the bigger picture' as Volume moved Price from Point One to Point Two and from Point Two to Point Three. After reaching Point Three, Volume moved Price in the direction of the 'bigger picture' FTT (until we ran out of day).

All one need do now, is 'nest' the various faster (than the 'bigger picture') Gaussians within the Price and Volume Containers in an effort to learn what must always take place before a specific order of events has completed.

One can go as far down the rabbit hole as one wishes.

- Spydertrader

-

Can volume sequences overlap?If you logically think this through, you'll realize you already know the answer to this question.

All trends overlap at the FTT (Point One). No Trends overlap at Point Two. Ocassionally, some trends overlap at Point Three (what Jack and Neoxx discused as "the golden triangle").

What Volume Sequences cause Price to move from Point One to an FTT?

What Volume sequences push Price from Point One to Point Two? To Point Three?

Once one arrives at an FTT of a specific fractal, then the non-stationary window (for that specific fractal) has closed. As such, 'sequences' are not shared in the fashion your question specifies.

- Spydertrader

-

Do you mean the bar before bar 1 that starts the lateral?

Correct.

And if so, does it mean that this bar is important in the differentiation process?If one becomes confused when attempting to determine Dominant vs. Non-Dominant, I simply provided an alternative method for differentiating how a Lateral Forms. Otherwise, one need not even pay attention to it.

- Spydertrader

-

Four laterals for today. The last one forms with both dominant and non-dominant boundaries.Five.

- Spydertrader

-

Can anyone recommend a good software package for stocks/etf's that have built in screeners for end of day data? In particular I am looking for a screener for candle patterns.Trade Navigator has an EOD scanner with numerous 'built in' settings - plus the ability to 'roll your own' criteria using both technical and / or fundamental data.

While I no longer trade equities, I wrote a fundamental scanner for The Trade Navigator Software Which is avilable free of charge. My point isn't that you might find the fundamentals scanner I wrote useful, but rather, I'm not a programmer, and I found it quite easy to create that which I needed. As such, anybody should be able to do it as well.

HTH.

- Spydertrader

-

Just to clarify something, defining the boundaries of the lateral as Dom or Non-dom appears to be contingent on the order of events.Then name the differences anything you like. Up / Down, Left / Right, Goat / Hedgehog or whatever other binary pattern suits you. The vocabulary isn't nearly as important as recognizing a subtle difference in the object itself (at this point in time). For example, the first example of a Lateral (today), moved in the opposite direction of the previous bar (Note, how I did not use Dominant nor Non-Dominant here). Whereas, yesterday's examples formed in the same direction as the previous bar (to the actual lateral). Clearly, such a thing would represent a subtle difference.

At some point in the future (once you do have a better handle on Order of Events), you can always change the vocabulary.

- Spydertrader

-

Seriously, folks. This ain't that damn hard.

Start with a Sym pennant. At some point in the future another Bar creates a Lateral boundary with Bar 1 of The Sym Pennant. Said Bar does this to the Dominant side of the formation, Non-dominant side or Both. No limit exists between Bar 1 of the Sym and the bar which creates the lateral boundary as long as no bar between the two exceeds the extremes of Bar 1 of the Sym.

Now, you have a set of Laterals on which you can place your focus. Laterals which form in a different way, you can differentiate at another point in time. For now, act as if they do not exist.

We now have a group of Laterals where we can easily differentiate.

1. Bar 1 Direction - Dom vs Non-Dom

2. 'Forming Bar' Lateral boundary - Dom vs Non-Dom Side

3. Volume (all bars)

If it helps, you might try sketching things out on paper in an effort to 'see' the various situations which develop. However, do yourself a favor and start with a Three Bar Formation before moving onto any other types. Doing so, you'll soon see how many of the possible permutations do not have any effect in the overall outcome.

Once you can see the various situations, you then focus on Order of Events (noting any differences from one situation to another). For example, the lateral which formed today beginning with the 11:10 Bar began at a completely different point along the continuum than 'Ezzy's Lateral.'

Lastly, everyone needs to spend some time focusing on context in an effort to understand the differences which exist here.

The end result of all this is you'll know (each and every time) based on the current context, and the current Order of Events, and finally, the actual formation of the Lateral itself exactly what Gausian Annotation the market has indicated for your chart. As such, you'll know what must come next with respect to the specific action required of you (the trader) - hold or reverse (if already in the market) or enter or wait (if you are sidelined.

- Spydertrader

-

Tuesday, Tapes OnlyFor now though, just focusing on tapes, as I still feel not close to 100% comfortable on them.

Since you are already using Trade Navigator Software, you might want to download the Special File known as PVFiles. It might make your life a bit easier.

See Instructions here.

- Spydertrader

-

I did place this in an order of events when saying in post#1278:-

Let's review your question where you specifically asked for clarification:

Ezzy's lateral would be one that we knew would exit opposite from the direction from which it entered (entered going up, exit going down)

because it was a dominant lateral, the first bar of the lateral being on decreasing volume,

and having "created with" the upper boundary of the lateral?

You asked if we would 'know' based on a certain number of criteria listed. In the same question, you did not include all the criteria required to know the outcome of an event. You did correctly articulate the status of each portion of the area under discussion.

How should I have answered your question?

Never the less, am I correct in that the discussion should be only about the type of lateral that starts with a Sym?Again, your question leaves out important criteria. TIKI's chart (that I have mentioned several times) has two laterals which start with a SYM. Are we talking about both of these laterals or just one? Again, how do you wish me to respond? Last time, I provided a detailed answer which confused you. This time a short answer is surely to facilitate additional questions.

And now knowing how the only 3 ways that this type of lateral is created, namely:1. Starts with a Sym.

2. That the boundaries of a lateral have a bar which creates a lateral boundary with Bar 1 of the Sym via:

a) a dominant boundary.

b) a non-dominant boundary.

3. both dominant and non-dominant boundaries.

You see in the (directly) above question, you included all information required.

As such, my response to you is, 'Correct."

that we are now to move onto the other similarities that exist within this type of lateral.?Once you learn how everything is the same, then you may move onto looking for that which presents a subtle difference within this specific pile of Laterals (as you correctly descibed above).

Any discussion about how a lateral exit is to be had at a later date?One cannot draw conclusions unless and until one has all the information needed to reach a conclusion.

has anyone yet?Of course not, however, that hasn't stopped anyone from reaching incorrect (and often erroneous) conclusions.

I have been discussing both. Namely how the "sym lateral" is created and a lateral exit. Apologies, although hopefully some clarity has been arrived at for both.No need for apologies here. The point of all this is to learn a process for learning how to teach yourself how to learn to trade. People don't need books, numerous threads, me, Mak, Jack or anybody else to learn this stuff, but they must have a process in place for learning how to learn.

All anyone ever needs is a chart and their own brain.

- Spydertrader

-

Three individuals have (thus far) posted the correct answers. Hopefully (by now) everyone can see how each of these correct answers form in the exact same fashion - irrespective of the number of bars contained within it the lateral itself. Now, that we can see the similarities (ensuring everyone is speaking about the same object moving forward), we can begin to learn to spot the subtle differences which indicate exactly what the market wants us to know.

However, before we head down that road, I encourage everyone to review the thread beginning with this post until now.

I think you'll find the results of your review quite enlightening.

- Spydertrader

-

then all examples, except for # 3 (which doesn't begin with a Sym pennant) meet the test.Incorrect. You see. You believed you had this down correctly, but not quite 100% accurate. Hopefully, it now makes sense why I didn't want you moving forward prior to completing this portion.

- Spydertrader

-

What...?Read, the response S ------ L ------- O ------ W ------ L ------- Y.

- Spydertrader

-

-

If the Dom and Non-Dom boundaries are defined not based on the direction of the 1st bar of the lateralI did not say this.

You are one step beyond where you need to be at this particular point in time. Unless and until one finishes the similarities step, one cannot move to the subtle differences step. You have yet to indicate you have fully grasped step one (although it appears you are almost there).

As an analogy, when you reviewed the "Seven Cases" post (about how to draw tapes using adjacent bars), did you see direction on those bars? Or, were all those bars without opens and closes?

- Spydertrader

-

Thx.I still need clarification from your reply.

You refer to more than 3 reasons why we knew the Ezzy lateral (I wish this lateral would live up to it's name sake) would exit opposite from entry..?

Review my answer. My response to you should indicate the following ...

"While yes you did accurately assess the individual particulars of the area under discussion (decreasing volume, dominant direction, etc), you did not in your post (which listed three reasons for knowing the direction of Lateral exit), provide the additional (hence my use of "more than three [that you provided] reasons") pieces of information (context and order of events) one should know prior to reaching a conclusion about this specific event. In addition, you have not yet completed the process of understanding the simiarities of this specific type of lateral, nor have you fully reviewed the various subtle differences which would allow you to accurately see all the various information provided by the object itself. As I result, I recommend avoiding reaching any coclusions which take you outside the current area of discussion."

[end translation]

Step by step means finish one step before moving to another step.

- Spydertrader

-

Romanus' examplesI encourage you to remove the arrows from your examples. We have not yet looked at the direction as part of the prcoess of similarities - direction of the Bar , however, may represent an important subtle difference.

- Spydertrader

-

So TIKI's first lateral (grey shaded) does not conform because the boundaries of the lateral are not "created, with".TIKI's 2nd lateral (red shaded) does conform because it has bars that "create, with" the boundaries of the lateral??

Correct. However, try saying it this way ...

"TIKI's second example does comply because it has a bar which creates a Lateral boundary with Bar 1 of the Sym."

Perhaps, you'll find the above verbage easier to 'see' in your minds eye (and on a chart).

"What are those 3 ways"?

that the boundaries of a lateral have bars that "create with"

1. the upper boundary.?

[EDIT] 1a. or more correctly, a boundary in the dominant direction (dominant boundary)?

2. the lower boundary?

[EDIT] 2a. a boundary in the non dominant direction (non-dom boundary)?

3. both the upper and lower boundaries?

Great. Dominant Boundary, Non-Dominant Boundary and Both Dominant and Non-Dominant Boundaries.

Easy as that.

- Spydertrader

The Price / Volume Relationship

in Technical Analysis

Posted

As per the instructions provided by romanus, my comments referred only to the specific context provided in the chart he posted.

However, with respect to your specific question, in the example provided by romanus, such a thing is simply not possible.

- Spydertrader