Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

389 -

Joined

-

Last visited

Posts posted by Spydertrader

-

-

Yeah you're dead right, I don't understand. What's going on?

What's going on?Near the inception of this thread, I responded to your question by providing the 'ideal' Volume 'picture' one needs to 'see' when trading any market. Another post provided the overall template for the Price - Volume Relationship. I then attached a chart, so you could see how one applies this knowledge onto an ES 5 minute chart.

I guess that's it for "explanations"..............Having a conversation with a person who does not yet understand the language spoken represents a difficult proposition at best. If you wish to learn the market's language, begin by learning to annotate a chart in order to represent thyree types of trends - short, intermediate and longterm.

HTH.

- Spydertrader

-

Highlighting these 'formations' :o in yellow might make them stand out more.

- Spydertrader

-

Thanks. I think I understand the basic concept but I would like to see how the volume example given earlier by "Spydertrader" corresponds with the channels on his price chart. Perhaps he would be kind enough to post it.Posting my chart for today isn't going to provide you with much help as you'd not understand the annotations. However, I posted the following chart last October. The attached chart has a few more 'explanatory notes' than the chart I use each day.

HTH.

- Spydertrader

-

We did some cleanup in the coding. Can you try clearing your cache for your browser? Thanks.Worked like a charm. Thanks much.

- Spydertrader

-

-

-

What is the ideal volume on a channel up/down pattern?Thx!!

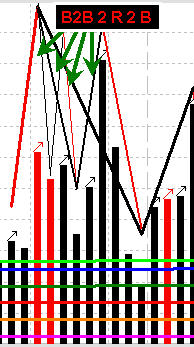

B2B 2R 2B

or

R2R 2B 2R

- Spydertrader

-

When you do your morning research, how do you determine what stocks are "In Play" for that particular morning/day ?The work required for determining which stocks to trade, on any particular trading day, begins the night before.

First, a trader needs to cull the entire Universe of equities down to a manageable number of 'high quality' companies. The filter I have used with success includes the following criteria:

Price: $10.00 to $50.00

Average Daily Volume: >200,000 shares

Float: 5 million to 60 million shares

Positive Earnings

Positive Earnings per share

Insider Owned Percentage: >5%

Institutional Holdings > 5%

One can then sort the list of 'high quality companies' by Unusual Volume (current volume / 65 day average volume), and watch those comapnies "in play" bubble right to the top.

One can further cull the list by focusing on companies which have 'rank' (stocks which cycle 20% [or more] a minimum of five times over a period of 6 to 8 days in the last 6 months) or stocks which find themselves 'in dry up' (period of super-low volume)

Attached, please find a list for tomrrow.

- Spydertrader

-

what are the best indicators for the ES?Price and Volume.

- Spydertrader

Ideal Volume in Channel UP/Down

in E-mini Futures

Posted

Fair enough.

FTP = Flat Top Pennant

FBP = Flat Bottom Pennant

Sym = Symmetrical Pennant

OB = Outside Bar

Lateral = Left to Right Movement within Bar 1 of the formation

B2B = Black to Black (Change in trend direction from down to up)

R2R = Red to Red (change in trend direction from up to down)

Dominant = moving in the same direction of the channel

Non-Dominant = movement contrary to the channel direction

Tape = skinny line (Short Term Trend)

Traverse = Medium Line (Intermediate Trend)

Channel = Thick Line (Long Term Trend)

HTH.

- Spydertrader