Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

bakrob99

-

Content Count

725 -

Joined

-

Last visited

-

Days Won

1

Posts posted by bakrob99

-

-

Sittting on hands right now after a very nice (for a Monday) morning set of long side trades setups mostly in NQ. NQ has been much stronger and is giving better rmovement recently for my favoured setups.

30M ES was strongly negative since about 10:30 EDT and a short at 94.75 was my setup which I didn't take as I was still long biased..

-

Mr Negotiator - could you start us off this week with one of your excellent composite profile charts?

Thanks!

-

So did I. Stopped wasting time after a while. Probably no algorithmic strategy possible with it. It maybe helpful in discretionary, if somebody finds it useful.I treat it like an oscillator and use divergences which are quite reliable to signal the end of a trend and the start of a new one

-

It's the same chart you posted two months ago.

Answer me this... if you're using 15 minute bars to trade on ..then why do your strategy performance reports have up to 42 Bars in a day trading system?

-

Is that you T. H. Murrey?

-

knight-mare. hope they can wake up and shake it off..this is bad bad news when professionals blow it like this...Quite the contrary. I think it's good news for the small trader as it will give pause to people contemplating funding these types of algos.

-

That is what their business is. They have done well and typically represnet 10% of the share volume earning over $119 million but they made a software change and lost a bundle in a very short time.

It might be tough to actually test in real terms - but shouldn't they have a shutdown procedure that comes in before $440 Million down for the day !!

Unbelievable.

Anyway - I am kinda happy that the algo guys can screw up and are not winners every time.

-

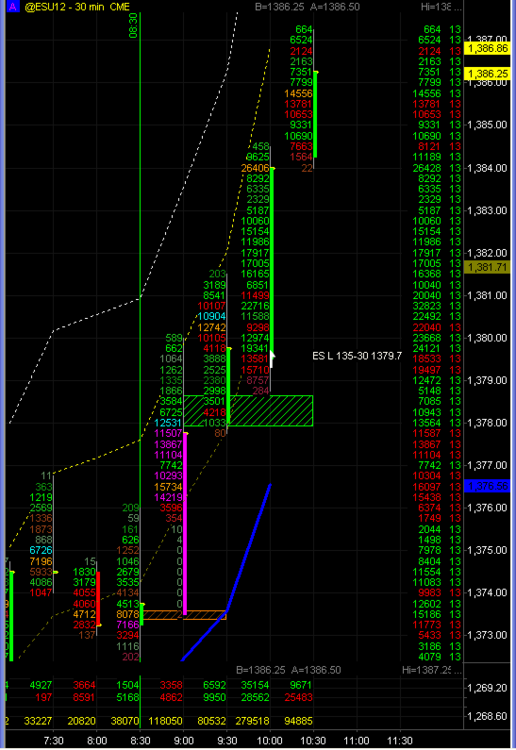

...At least now I know for Monday 1385 is an area to watch where buyers and sellers want to do business.It's an area that the market will tend to return to and "test". Rather than initiate a trade there - consider taking the trade from above or below back to it. That is the "gist" of responsive selling as I understand it.

-

One of the opportunities I look for is this "last hour trade"....I call it last hour because the setup happens at (or within a few minutes of) 12:00 here on the west coast....The BOND market closes at 3PM which can cause this liquidity shift. Linda Raschke called it the Bond Market wiggle (or something like that)

-

Lots of volume now at 1385 - 1389... certainly migrated higher.

-

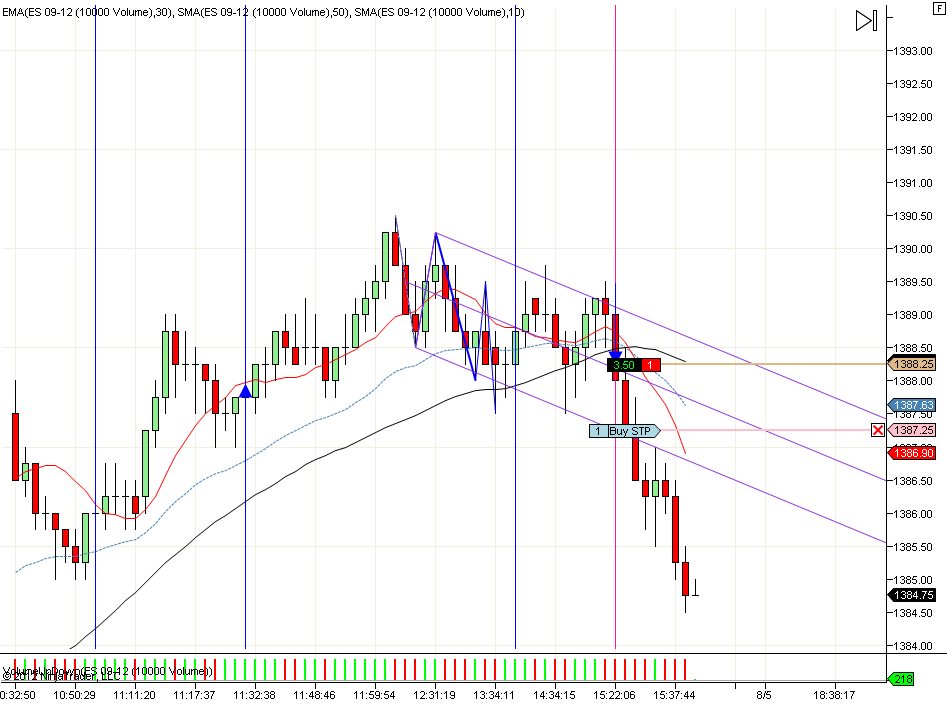

Downsloping median line told the tale of the tape for me. The 4th Lower High and the failure to take it out on the push up... Algos came in and provided an iceberg.

Break of the downbar of the 4th lower high on a sell stop entry. Also short the NQ but foolishly scalped out of it at +12 +20 ticks.

Normal pullback in the scheme of things but that's it for me this week. Too tired listening to music now.

Ninja platform is a demo for me.

-

ALGOS ..... arrrrrrgh ! waste of time....

-

We've been in a 3 pt range for 3 hours. Market can't go down or up. But when it goes you'd think it will do it reasonably quickly. OMG ... I almost fell asleep,

-

Possibly. It's a good place to start imho. I would then read "Markets in Profile". ..Personally - I'd read "Markets In Profile" THEN "Mind Over Markets". The latter can be a little daunting and I think the former gives a better framework. At least it did for me.

The CISCO link I posted a week ago has a lot of information on it and if you scroll down that can be a good beginning source. As well, don't forget the orginator's CBOT website.

I continue to buy pullbacks even though "I think" the market is extended. So what ! Market doesn't care what I think.

My system says buy and I am buying. One of them will get stopped I'm sure but until it does I'm a buyer and a believer in 1400. Prove me wrong by selling an see how it works for you.

Ok, I did take a recent short in the EURO but scalped it with a 12 tick gain.

-

long 1385, target (break 88 first) then I got 1398, target, as the next pivot (r2). stop at 1384.Lets see what happen

If you;re long was at 10:55-11:00 AM time frame then there was no fill at 1385.00

If you're on SIM you should take market order entries or wait until your fill would have occurred. One of the key differences going from SIM to REAL is the good trades youmiss because there is no fill. Just a heads up.

My long entry was a little higher at the same time based on the pullback to the prior low area and minor support with positive Up volume coming in.

-

-

Sizeable volume and aggressive buying suggests 1400 might be in the cards. Best long I could get was 1379.75. Let's see what's up.

-

Is it just me, or have anyone notice after a big down day like today, always at the end about 2:40-3:15, price action goes up.Is this short covering or real buying?

Short covering. And responsive buying at the lows.

I mentioned earlier in my post above that the larger players (funds) were unlikely to take positions in advance of the NFP (today). Without the longer terms traders - the market will behave in a responsive manner like this move which was an opportunity to buy at lower prices.

True trend days (down) do not rally into the close but close near the lows as the MOC orders are dumping the offside positions between 4 and 4:15 EDT.

What none of the Market Profile traders mentioned around here is that 1348.50 was the MONTHLY VPOC and this was a test of it.

-

Are you saying the larger funds are trying to get a head start and used the comments today from get a good start?Nope. I'm saying the opposite - that they are waiting for the NFP so my expectation was that this day would not be a true trend day.

-

...That means either #1 we're only 1/2 way through the decline today or #2 everyone knew Draghi wouldn't do anything or #3 the market did not rally because of his remarks but because of something else.How about #4. We still have the NFP tomorrow and the larger funds are waiting for it.

-

Hey .. I guess it's not all good for the algos and they can screw up too.

Blames the software. Who was watching it?

-

bakrob, originally I mentioned the code was available on my blog for a fee (as an after thought after developing it). However, because of your interest, I will write an article up and share it here for free. ...That's great to hear. NO rush. When you have a minute I will look forward to automated analysis of my discretionary trades. Thanks.

-

...I even have a Tradestation script that allows me to import my discretionary trades and then optimize them within Tradestation. This allows me to see what "would have worked best". The computer using the same entries that I took with a larger stop had almost a straight-line equity curve. I plan to do some imports of my recent trades and evaluate....I would be very interested in that script. I didn't know that could be done.

Care to share it?

-

Not feeling well today and so I'm not trading. ...I'm sorry you're not feeling well - but not trading today is probably a good thing . I expected a narrow rangebound day but this stop start business is enough to get on my nerves

Day Trading the E-mini Futures

in E-mini Futures

Posted

You mean give up some profits, right ?

Let me ask you a question.... DO you get any smarter when you have a position on than when you are out of the market? I don't.