Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

bakrob99

-

Content Count

725 -

Joined

-

Last visited

-

Days Won

1

Posts posted by bakrob99

-

-

Nice longer term chart. Shows that this pullback is quite probably just a good buying opportunity on the way to new highs. I don't see much "panic" in the markets these days compared to say, August 2011 or even 2007- 2008 when we had 80 - 100 point daily ranges. So the markets are just drifting higher.

-

That is all you need to know about trading.

It might be nice to know what the trend is in the timeframe you're trading. Why? Better probability of a winning trade and a greater profit. simple.

-

Where can I get that filter?

-

I have been using median lines to help with exit targets but they are also useful for entries too (no surprise).

I have been watching this latest selloff (6 down days on the daily) and with a median line drawn on the RTH session 60Min chart that has an upsloping median line at 1321.25 (as at this morning)

There was also a downsloping median line which intersected the upsloping line at EXACTLY the time and price that was hit this morning prompting me to get long at the IB Low.

The more I work with them the better my idea of trend and reaction points.

Several trades today had exits perfectly timed by using median lines after the market started rallying.

Looking at the 60 min - I don't expect much resistance until 1340.

We'll see.

-

Tough so far .... selling is persistent but buyers are present = C H o P p Y

I expect a strong rally .. but waiting patiently for evidence of it. In the meantime - out of my short and watching.

-

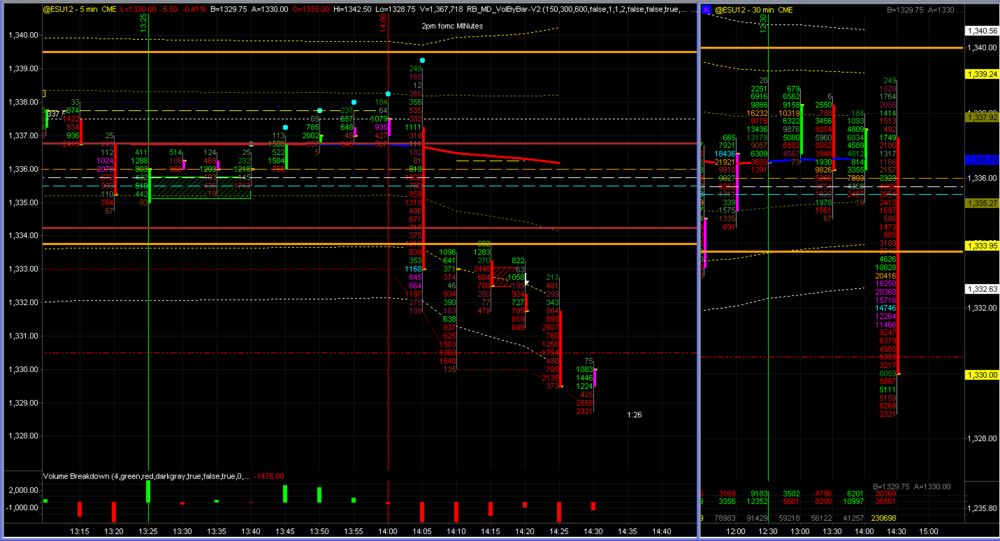

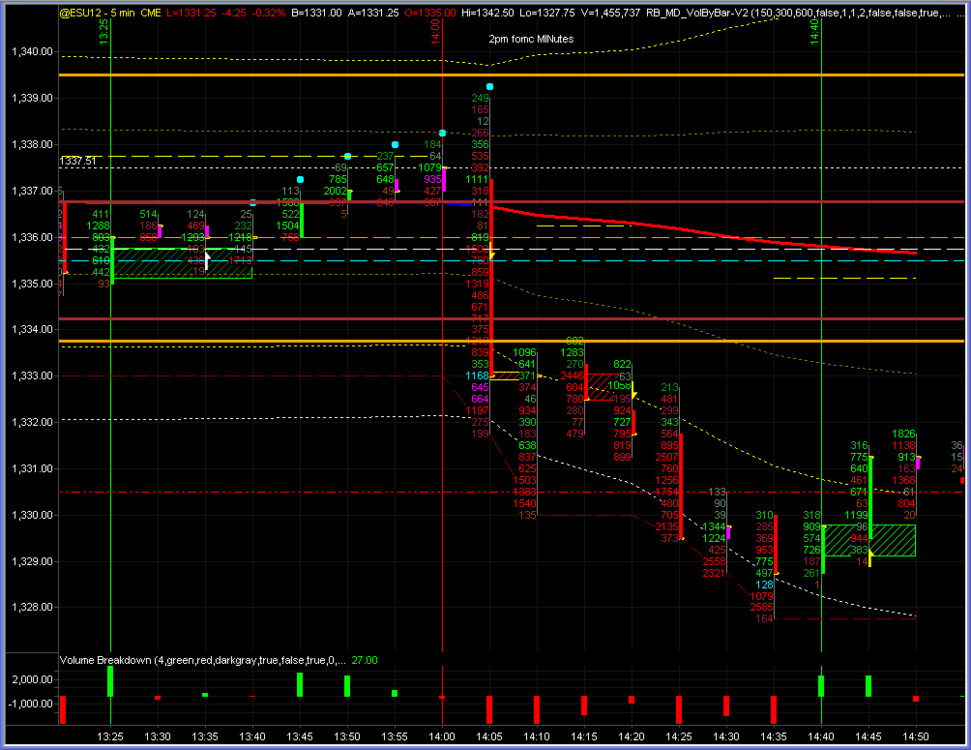

OK Back at the VWAP and this is where I am getting off the bus. Really good trading this news event. Market can still rally but I'm done for the day. Look for resistance around 1336.

-

-

Update: 14:33 Fading the pullback to the IBL was the key for me. With selling coming in aggressively at 1333 - 1332.50 that was the short. Not sure how far this is going but I don't have too much to stop it here.

-

We finally hit 1330.50 ... managed to get short on a break thru the swing low at 1334.50 so that was nice. Out now and expecting another push down... but watching/stalking.

-

Markets that keep testing and retesting your entry before they finally move in our favour. Get on with it.

-

Yes ... I realized that. But I thought it would help take your mind off of this chop before the minutes come out.

And speaking of the minutes - I expect that the reaction to them will take longer for institutions to digest so we may not see as much movement as early as one might expect. But the move once underway should keep going for a while.

-

Here's an article which is interesting and can keep you from overtrading prior to the FOMC minutes release.

Economist's View: The Puzzling Pre-FOMC Announcement "Drift"

It's on point.

-

I'm short at 1336. 1/2 off and stop at 1337.25 See if we can take out the low. Who knows?

-

10:56 EDT Bulls are hanging onto the overnight low by the skin of their teeth.

Possible Bullish Gartley fwiw.

I'm expecting it to fail and 1330.50 to be tested shortly

-

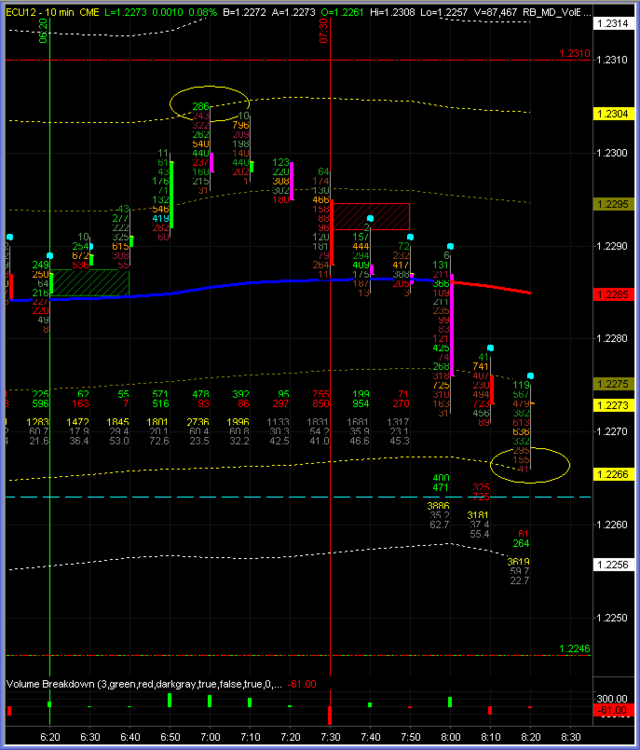

Nice bounce off the Settlement in EC, Rallying strongly and I expect the ES to follow

-

A break of lows with volume would have me holding for 1316.50.

UPDATE 09:48 EDT upside I would target 1343.00 if we take out the prior swing high at 1337.

-

I had a signal for the long at 6:20 EDT but I missed it as I was just getting my coffee and waking up. I got the short which was a confirmation entry at 7:35 EDT.

I am currently long at 1.2270.

-

The premarket moves in the EC often provide easier price action to capture and a great risk reward. Today the marekt rallied thru the VWAP and touched the 2nd standard deviation then rotated down thru the VWAP to complete the route at the 2nd minus standard deviation, where .... surprise it found buyers.

I find that during the premarket the ES and EC can confirm each other's intentions so I watch and trade both when they are in agreement.

-

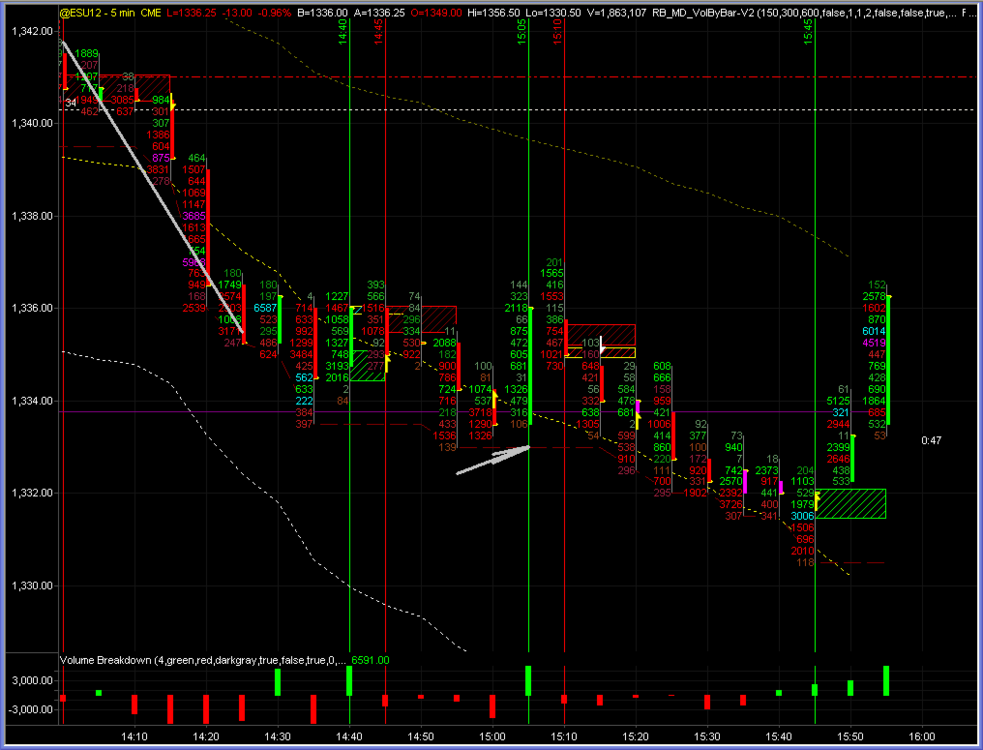

Last week's low at 1342.25 has provided resistance here. The weekly low is a powerful support-resistance zone. Price will have to break thru with some solid momentum in order for this market to put in new highs.

There was significant buying of the 61.8% retrace of the last swing on the daily chart whihc suggests that 1400 and higher could be in the cards if this market rallies today. However, sellers won the battle yesterday so it's unclear whether the market will find buyers today.

All eyes are on the FOMC minutes. The market wants to see if easing is likely and if it interprets the minutes as unlikely - then new lows will be made and the 1320 then 1300 areas are likely. On the other hand - if the minutes suggest that easing could be in the plan - then the upside targets of 1384 and then 1402 could be made.

In the meantime - expect it to be choppy and rangebound until 2PM EDT.

-

By the way, for what it's worth - the 1330.50 low yesterday was the 61.8% fib retracement to the tick on the swing with the low at 1302.50 and the high at 1375 as represented by the last 10 days of trading.

-

...That is a nice visual and if you ever get a chance to post more charts I'd certainly appreciate it. ...I have posted charts in this thread and some others. You can see them by reviewing the posts for my User Id (see all posts by bakrob99 under thread tools)

... What charting program is that ? If you don't mind....John

It is a custom indicator that I have developed in Easylanguage. As a result it will run in any platform that supprots Easylanguage which was developed by Tradestation. I am using Tradestation 9.0 here.

-

Bakrob,could you give us a brief explanation of your chart when you get time ? perhaps you have said more in prior posts so I apologize for having you repeat the answer. Are we looking at the net delta per tick on your bar chart ? I like that if we are

John

This chart shows the net volume of Upticks/Downticks per 5min bar. I also look at 30 minute but on the 30 minute I use total volume, not the difference and I track the bar's VPOC (highest volume price)

I look for buying represent by different shades of green and blue (brighter is higher delta) or Selling (shades of red and magenta)

I like to see 3 or more green / blue volume prices at a level of support. In this case we have the standard devaiations with the yellow dashed line being 2 std deviations below the VWAP. I look to trade responsively back toward the VWAP and possible higher rotation.

The opposite is true for shorts.

That's about it.

-

-

The only buyers around are the guys taking profit from their shorts. The market looks like it wants to go down to 1320 so this might not be the best place to expecta turnaround. But it is 1530 EDT and I'm keeping my eye out for a pop. 1332.25 still holding (sorta).

Update: 15:50 EDT: Well, we finally started to move up. Stopped myself out once then got long again and hoping for higher while trailing stop. Who knows. This might find a lot of buyers before the close.

If You Are Losing Money in Forex,what Will Do Next?

in Beginners Forum

Posted

This is a joke - right? You're not actually expecting traders to give you advice based on the information posted.

Hey - how about... Oh yeah go for those revenge trades. Get your money back right away after a loss. That always work well, doesn't it? Get your emotions really going then just start hitting buy and sell. Eventually you'll make it all back.

Of course, you don't expect an answer because you haven't been serious about posting sufficient information in order to provide an informed reply. Makes one wonder what the purpose of the post is?