Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

bakrob99

-

Content Count

725 -

Joined

-

Last visited

-

Days Won

1

Posts posted by bakrob99

-

-

This just keeps getting better and better. Corzine of MF Global won't be having any charges laid against him. Unbelievable.

No Criminal Case Is Likely in Loss at MF Global - NYTimes.com

-

Question for Db (well anyone can answer I notice Josh and Bakrob99 were in similar sitiuation today)For me the consolidation pattern at the resistance point you are discussing is a short - so if I were long I would definitely take profit. But it is unlikely I'd be in a long at that point having exited on the prior exhaustion bar. In fact, I was in the trade which was entered with a 4 tick stop and got 14 ticks of MFE for a 12 tick exit giving a 3:1 RR.

-

Perhaps everyone should read this before commenting

Guest Post: The Sentinel Case - Another Nail In The Coffin Of 'Market Confidence' | ZeroHedge

This is clearly absurd when funds can be stolen and then used as collateral with a bankthat can then claim they "acted in good faith". Give me a break.

-

I am long based on the Settlement price which held, above the VWAP and BUYING comping in strong.

This is what it looked like: http://www.traderslaboratory.com/forums/attachment.php?attachmentid=30589&stc=1&d=1345057798

Timing:

-

I think the play should be short the highs and buy the lows. Of course, I am taking this from Bakrob99 plan the last two weeks. LOL. Its good learning time for me. Either way up or down, I am fine with. This is my first summer trading so i hear its slow like this. As I look back this time last year they had really big ranges and lots of bad news out.I got long at 1402.25. Not really a low but it was a switch to positive volume. Now I am just trailing a stop. We'll see.

-

Some big limit orders sitting at the settlement in ES. Not sure if they're going to stop the descent.

-

I... what would your plan be?Come back after my knitting lessons. In about an hour.

-

...perhaps it's better to just do something else.Yeah ... Do something more exciting like ... Learn how to knit.

-

Looking topped out to me. I show significant selling and fragile support. Looking for lower. If we can take out 1401.50 with some gusto then looking for 96 92 and possible lower. But not expecting a huge range. Just not that many contracts being traded.

-

Sorry if this is off topic.Db

I don't see how it could be off topic. Seems good to me.

-

Once again the NQ has been much friendlier to trade than ES IMO. Nice moves up with out the jarring up-down Algo crappola.

-

Interesting lack of unity here between the e-minis.Yes .. a good opportunity to get long the NQ and hold to yesterdays VPOC at 2434.

-

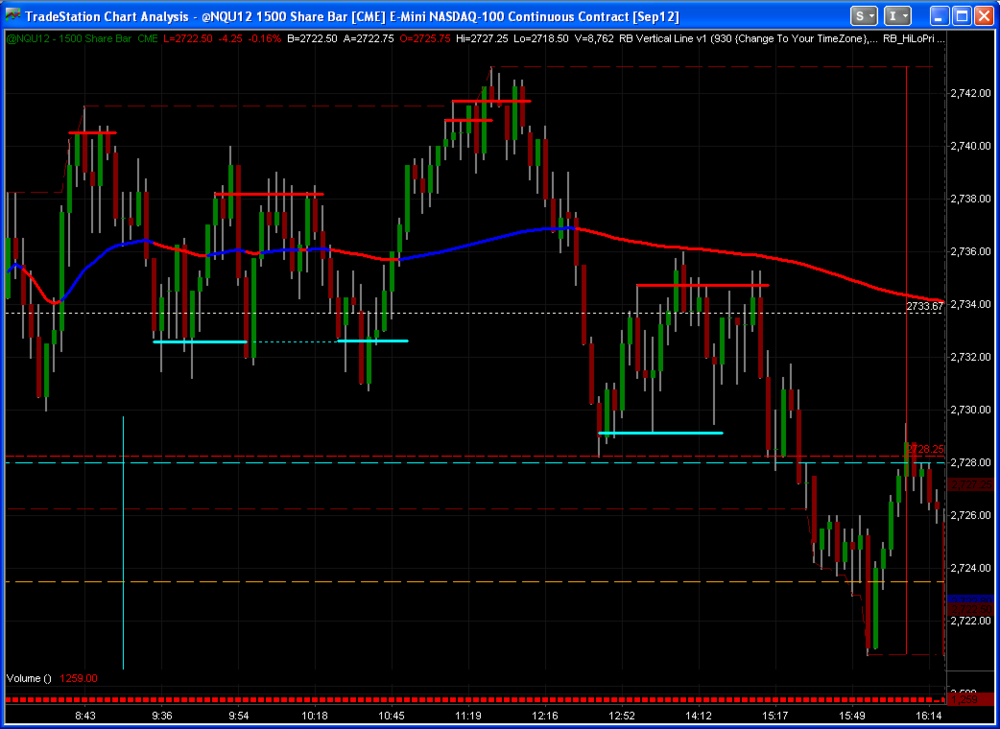

...But I don't know what to call setups if I am just buying and selling off supports, resistance, supply, demand, and price retracement.Here is a chart that I drew what I call my WALL setups (as price action was unfolding, not just after the market had closed).

I am looking for repeated tests and a pop above (or drop below) so you get the pop before drop, or drop before pop. After they have been tested and retested these provide very good entries with small stops.

If you're not sure about them - then you can wait for confirmation but you'll miss the best price if you do.

Confirmation for me comes in the form of a negative delta on volume at price (or positive for a long).

Taking these entries in the direction of your trendline would have given you the opportunity for maximum profit on the short you missed.

I have mentioned these price patterns before and the key is that you need to gain practice drawing them as they unfold and watching the result. Do it for a month and you will then have a basis for making trade choices.

-

more BS on top of a pile of BS ...

check out Knight Blames Trading Fiasco On "Dormant Program" Glitch | ZeroHedge

-

NQ continues towards gap (2728.00)

NQ has been 10000 times better to trade than ES today IMO

UPDATE 12:40 EDT filled nice !

-

Selling highs and buying lows has been the key for me in the NQ today. ES had a nice short off the open and that was it. Gap filled and bounced. BUT the NQ didn't fill and in the absence of much volume to the upside i am thinking a fill is upcoming on the NQ

-

1397 long back up to 1400.50 ... giveing it a shot.

tight 5 tick stop

Will adjust profit target based on price action and length of time in trade.

Update: stopped, just a bit too early probably. Needed another test of IBL .

-

So far the ES has paid more for the short side than the NQ which seems to be hanging in and hasn't even made it back to the VWAP. Perhaps higher is in store.

-

============Am I right that you basically expected a reversal from 1392ish judging by the fact that price simply didnt go further down? Sorry for asking, trying to figure out how could I have noticed that for myself, as your prediction nicely materialised.

Trading respoinsively involves evaluating the market at its extremes and determining the likelihood of it reverting back to prices which have been determined by the market to be fair. The 1392 was a prior low and I expected a reaction. My target was a gap fill up above and when the 1392 bounced I was waiting for a shift towards the buyers to get long.

AT 11:10 there was a similar shift to upside momentum.

I exited before my target because I had a SHORT signal at 1398.25 which I didn't take because I was still long - I should have just reversed but that is not something I do often.

-

...Could also be a one/two move type day with the rest of the morning and early afternoon dead until possibly a move into close. You never know though.I won't be trading late today on a summer Friday afternoon. A scalp short off the open and a nice long confirmed off the bottom and I have more than made my daily goal. Most of this week it's been good early on and then chop... so just take the few good trades before 1030 and get on with your day.

Thanks for you posts and charts. I find them useful.

-

1392 gently tested for bakrob

Long from PVP 1393.50 after Delta turned positive .. out 1/2 at 1397.75 and hanging in for possible gap.. The 1392 test fond no sellers at all and this market is rangebound which means to me .. trade responsively (and responsibly).

Update 10:33 EDT Stop now at 1395.75. Rallying to target possibly.

Update: 10:45 EDT Tightened stop to 97.25 Either up or out.

-

1392 got hit as expected and a nice bounce. Possible gap or half gap fill in play.

-

So you think this is the calm before the storm then?I think that the volatility is about as low as it gets. And the $ticks 20 day average of Highs and Lows show that extreme $ticks are now at +969 and -889

That is very low.

As well, there has been a lot of accumulated trades occur this past week at these highs - so a pullback "might" be in store. And the targets I spoke about are not very large in scope.

My trading won't really change except to the extent that if and when I get in a short I"ll be trying to hold it longer and if and when I get long I'll be having a tighter target.

-

Mr Negotiator,

Can you tell me when you decide to change your Composite charts - order under what conditions. The last set of CLVN's and CHVN's are starting to make me keep track of them again. My own work generating these profiles using my own developed indicator had mixed results but the values on your recent charts have been very indicative of inflection points that actually work.

I understand that you use IRT to generate these babies. Does the program do so automatically?

(As an aside I once did a demo of IRT but didn't like the user interface - I may have to revisit it.)

PFGBest in Liquidation Mode

in Brokers and Data Feeds

Posted

I appreciate your comments and welcome more. But I think the main point should be that Individual Investors should not be put into the position of having to judge their FCM's credit worthiness. Rather - the industry should protect investors funds as sacrosanct... and the only way to manage this is with a credible insurance against loss.

Without an insurance program, and relying strictly on balance sheet judgments, the natural tendency will be for larger FCM's to dominate the industry which will reduce competition and limit technical development as the smaller firms will be unlikely to attract traders.