Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

bakrob99

-

Content Count

725 -

Joined

-

Last visited

-

Days Won

1

Posts posted by bakrob99

-

-

About 60K in the last 4 months. I think that is all that matters. Dont you???Can't say based on the info provided. If your account is 7 figures, you'd be better off in Tbills

On the other hand, if you're saying that win rate is useless information without considering others factors - I agree completely.

-

Significant divergence here between NQ (lower high) and ES (Higher High) at 14:30 EDT

-

To see if anyone there was stupid enough to believe that they'd stumbled upon such a thing as an actual newpaper from the future . . .BlueHorseshoe

Maybe you should have one made up and try it.

-

Couldn't we leave the newspaper in the lobby at Goldman Sachs? :rofl:BlueHorseshoe

Why would you want to give it to them? Would you think they would help the market reach the target early? Or would they be fighting the move?

The more that people found out about it, what would the effect on price action be? Anything?

-

How do you determine overbought? The only way I know overbought is those indicators. And I know you are not using indicators. hhahaah:cool:You could use statistics to determine mean reversion probabilities.

Friday's LOW is finding buyers in NQ.

-

I think the ES may find some support around 1407.

-

Unfilled gap at 2763.50 in NQ logical target. Of course - there are lower ones too.

Good call dB... Managed to get short at 2776.75 and again at 2776.25,

There is a 161.8% fib extension at the unfilled gap too.

-

I think all you could say is that it is not a guarantee - but I for one would certainly think that being able to see into the future even if the information is limited would still be a help.Even if you adopted a strategy of....Everytime there is a breakout away from the number you took profits quickly, everytime there is a break toward the number you let it ran. Take all profits using a really tight trail when an exisitng long is above the price level...v v for shorts.

A simple strategy like that might be enough to swing the difference......and all you are doing is taking profits quickly...

So when the market is trending up like it has been for weeks, and the "known" 1420 or higher target is in mind, what prevents us from following exactly a strategy like that as if we had the future newspaper?

This is the point that I had in mind when I started the thread - that having a future target which can be based on many different technical or fundamental factors, and the DISCIPLINE to trade in its direction is the key to building profitable and sizable positions.

Ever since the 1320 low test and rally up almost 100 handles - trading intraday, on short timeframes, without overnight positions - it is hard to do as well as a position trader might have done had he entered long near the 1320 lows one month ago and held on to it. Possibly adding contracts as it closed highers.

Intraday - faced with narrow ranges and choppy price action - much tougher going since then with many more entry and exit decisions.

I posted in another forum about 3 or 4 weeks ago that I thought 1420 would be hit fairly shortly. And while we haven't gone that far - we've got quite close and there's still certainly time left in this most recent swing to hit 1420 and much much higher.

Reviewing my results since that post - I would have done much better to just enter and hold and add as it traded into profit.

This concept - but on a daily basis often plays out when you realize around 10-10:15 am that a trend day in underway and you out of a position with a small profit but missing the bigger move. The key is to get in - stay in - and add ... not scale out.

Many intraday traders lose on the trend days fading the move. This no longer happens to me. I welcome trend days and have strategies to play them which I have posted occasionally. But mostly I am exiting and re entering and in almost all cases - holding the original entry AFTER one has evidence that a trend day is in place - would produce more profits.

-

I am assuming that price history is not available in this magical newspaper.

Sadly no.

So your point is that even having perfect knowledge in advance is not really a help in terms of making money from it in the futures market?

-

I think this thread is interesting but would be more interesting if someone actually took the work to create a hypothetical or pick some previous dates to see how this would play out.Be my guest. Throw another scenario at it.

-

I must be missing something....where did 1460 come into it?I read it differently - I thought that you know two pieces of information about the future.....

"How would you trade it if you knew what the ES would be at September 25th 2012."

I like the idea of the thread as it involves scenarios, but even with the best money management, a long history of probable scenarios for the market moves, and fantastic risk management, nothing is guaranteed. You might have had the account with MFG of PFG or similar and they go broke on that day.....bye bye money even if you had won.

I am assuming the paper said it closed at 1460. It doesn't matter which price it is. If it said it closed at 1360 How would that help? You'd have to make the same but opposite decisions to take advantage of the short side.

In my mind- it's similar to the problem you face when a TRENDDAY comes along after days of consolidation. You "know" it's going to close higher - how to take advantage of that. The best way if to get on board small and start building an hold on. Start with a trailed stop loss which becomes a trailed profit exit.

As for your risk management - exactly right. Having perfect knowledge of price at the future date (with the exception of options strategies as was pointed out earlier could be designed to take advantage of this knowledge ) still poses risk management challenges.

-

Hi bankrobber,Lets start small , 1 contract, and build a position, buy on pullbacks, whatever.

The market rallies on major news the very first day (Spain wins the lottery). You hold 1 contract.

The price goes way past the target and for the next 19 days sells off to the target.

And every time you buy a pullback you lose more.

So you end up with 1 contract and a small profit.

You can't start small:2c:

kind regards

bobc

PS Taylors Trading Technique will solve the problem, but I am not proficient enough to explain it.I will talk to WHY? and mitsubishi.

You start at the open at 1411 with 1 contract. Price moves 5 pts in your favour. Add 1 contract. Trail stop to BE on 1st contract. Price moves 5 pts in your favour. Add 1 contract. Trail stop to +5 on first, BE on 2nd. Price moves 5 pts in your favour. Add 1 contract. Trails stop to +10 on 1st, +5 on 2nd, BE on 3rd.

According to your scenario - ( market rapidly moving in your favour) I think you'd do pretty. well.

-

this thread is the biggest heap of BS I've ever seen on any trading forumI respect your right to your opinion - but I think you may be missing the point. The real answer I think that will come out is that even if you know with a certainty what the price will be in the future - to take advantage of that information still requires that you make a reasonable trading entry decision using normal techniques which will allow you to hold for more profit and build a position, increasing size as the position becomes more profitable.

The reason is simple: If you went all in at the first opportunity you might discover that you could not withstand a normal market pullback against your position. So, in order to "solve the riddle", you will have to start small and build as the position gains profitability but still trailing a stop to protect losing your profits. Any other way - and you would run the risk of ruin.

The lesson may be that to be a Supertrader and really make some money you need to start small and build positions.

If you don't agree - you could perhaps mention another method which I have overlooked.

-

I just as easily could have posed the question about an intraday close. How does KNOWING what the close will be help you at the open?

You still have the same problem - You need to have an entry strategy or trade small enough that you can withstand any move against you (unless its the Flash Crash day !).

-

The best way to play this might be a binary option weekly on the SP500 though. This would give you a limited loss and guaranteed profit... you could still lose in the futures..

The Binary option is a good one ...

But notice how having perfect knowledge only goes so far to help in the decision. I think it comes down to Money Management.

I think I'd go long with 1 contract in the Futures and enough margin to cover a substantial move against. Then as and when the account gained in value to warrant another contract, add 1 to it and trail a stop). As time and price moved in your favour - add another. Build a position BUT notice this wold not guarantee that you could withstand a move against.

The OPTIONS may be the only "safe" way to play this.

-

If I used a market order, why wouldn't I be filled?

BlueHorseshoe

1. I enjoyed your rant about the Father thing.

2. I misunderstood your entry technique - I had thought you were waiting of r apullback equivalent to some MAE calulcaiton - but I guess your idea is to go ALL IN AT THE OPEN USING A MARKET ORDER with a stop equal to the MAE calc?

-

Even knowing where the market will end up, you could mess up with futures, but not with options.

Good point,

How would the knowledge influence you if you ONLY HAD the futures account to manage?

-

Damm time travelers only ever leave the business section - I want the horse racing section to know which bets to parlay.It is an interesting thought experiment - if you are a day trader then really you only get one day to trade - thats the day you know of the close.

If you believe in the butterfly effect (I think this is the right reference) then by acting on that info - do you then change the future?

There is also the possibility of experiencing a crash (if you go long) between now and the day that takes you out.

All things considered - an option or bet taken on where the index closes on that day would be what I would use. (give a small range so as not to arouse suspicion) and see what odds you get on that - might be better leverage that a future or normal option.

Sp even having knowledge in advance is not helpful. You would wait until it was very close to Sept 20 and what if on that date it opened at 1460? What would you do then?

-

I think my strategy would be to use the very maximum amount of leverage that I thought 'safe'.So, if the newspaper told me that prices would be higher on 20th Sept than they are today, and 20th Sept is (I can't be bothered counting) 20 trading days away, then I might examine all instances of a close that is higher than twenty days prior, calculate the maximum adverse excursion that would have been endured if holding a long position throughout each of these periods, use the largest of these MAEs plus a fraction as an estimate of the worst drawdown that I might have to endure, and then postion size a long entry such that should the greatest historical MAE plus a bit occur, I would have sufficient account margin to maintain the position.

In other words, I'd go "all-in" using an approximation of what might happen between the two known certainties ('now' and 'then') to control risk.

Is that the right answer?

Is there a prize?

BlueHorseshoe

1 NO prize.

2. What if you weren't filled as it rallied off the open?

-

If I knew that, say, The S&P was going to be at 1455. I would sell as many in the money puts as I could below 1455, I would buy as many out of the money calls as I could below 1455, I would sell as many calls as I could above 1455, assuming that option ex is Friday the 21st.Even knowing where the market will end up, you could mess up with futures, but not with options.

Options and Perfect knowledge are made for each other.

Okay BUT what if between today and the Sept 20 close the market sold off 100 points? The increase in volatility would drive up the value of those put options you were on the hook for, right? And the calls would be worthless.

-

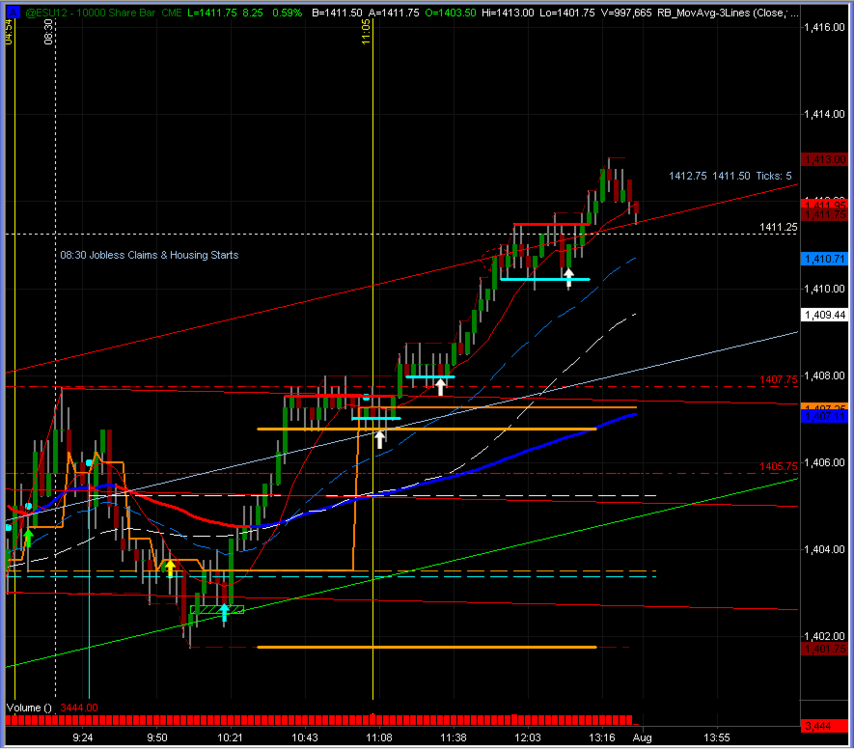

Here's the chart:-Thanks for the chart. 1426.50 is the key reference for me right now ... but with today being OEX day I'm looking more to trade the NQ and stay out of the potential slop and algo in the ES. Will be interesting if we can get some momentum again today. Overnight trading is thin but still pointing higher.

-

How would you trade it if you knew what the ES would be at September 25th 2012. Let's say a recent time traveller accidentally left the business section from his newspaper dated Thursday September 20, 2012. There was no other references to the prior week's or days.

How would that knowledge assist you in making money?

What strategy would you employ to maximize your profit?

Does perfect knowledge about the future price help you in your immediate decision?

Scenario 1: Let's say you discovered this today and decided to buy the open and hold on. And then discovered that today was a down day and your out of pocket $1000 at the close. Then what do you do.

-

Man o man. Look at this ES just taking off today.Sometimes you have to just bite the bullet and get in.

Here are some entry choices using a consolidation that I worked with today.

The think to remember is when the market takes off with lots of momentum then getting in even after a small retrace if usually productive. The smaller the retrace - the more bullish the mood of the market.

-

What does MFE means?MFE maximum favourable excursion ( I keep track of them in ticks)

MAE maximum adverse excursion

track these for every trade and setup you do.

This provides a basis for determining the most efficient exit and stop loss

How Would You Trade It if You Knew ...

in General Trading

Posted

This implies that you have an account large enough to manage 2000 contracts. An account that size would typically be owned/managed by someone who was familiar with accepting risk and managing it in order to derive substantial profits. So I think there would have been opportunities to profit prior to 20 seconds before the close.

Having said that - your statement suggests that there is nothing to be gained trading futures with a known target unless that target is very close in terms of time and price.