Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

tradingwizzard

-

Content Count

951 -

Joined

-

Last visited

Posts posted by tradingwizzard

-

-

Really... seems to me that she is in control now... no need to beat the breast (so to speak). Honestly... I think she's smarter than that. The FED is going to unwind. I'm sure they will take care of it in a responsible manner. Not to worry... it's going to happen, and everything will fall into place.markets trying to force Fed hand......still tapering?......maybe yes, but they will come with some stunt like keeping the rates lower for the next 100 years or so..........and usd will be vanished......this is positioning for fomc already, make no mistake.......

TW

-

bye bye usd.....welcome 1.3921 in eurusd.......

TW

-

did the EU hike the rates ?

)>.......any bear in the house? eurusd making me proud here...

)>.......any bear in the house? eurusd making me proud here...TW

-

opps......where are the eurusd bears?

TW

-

so euro finally tries the upside.......hmmmm

TW

-

Hi tradingwizard,check silver for a buy.

I think it is over extended to the down side.

I don't trade commodities

TW

I like the euro more...in my pockets

-

boy I am so bullish the eurusd and the freaking pair just moves to the downside..it must be something wrong with me.

TW

-

There are a number of Eurozone economic reports scheduled for release this week including the German ZEW surveys and Flash PMIs. If there is any surprise weakness in Eurozone data, the sell-off in EUR could drive EUR/JPY below 140, which is a very important support level. We know that ECB President Draghi is concerned about the outlook for the Eurozone economy. The last time they met, they made no mention of the improvements in Germany. If 140 is broken, there is no major support until the 138 handle.well, if you happened to watch data out of Europe lately, you would know it came better than expectations......so euro lower is a dream under these conditions

TW

-

Best to stay out and not enter a trade now unless you are very long and hoping for 110 this year but otherwise it could spike to 106 or drop to 103. S&P 500 could see mid 1850's next week so with a strong S&P 500 the Dollar could rally further.from my point of view it is developing a contracting triangle and this contracting triangle seems to break in the same direction like the one on the eurusd will do.....the winner here is going to be the eurjpy

TW

-

Base your trades on your analysis and on your understanding of market movements.

TW

-

Trade nr. 5 Going LONG EURUSD here in 1.3550 with 1.3489 stop loss and 1.3688 take profit

bullish on the pair both on technical and fundamental grounds

-

Really... seems to me that she is in control now... no need to beat the breast (so to speak). Honestly... I think she's smarter than that. The FED is going to unwind. I'm sure they will take care of it in a responsible manner. Not to worry... it's going to happen, and everything will fall into place.alright, I guess we're about to see it pretty soon

TW

-

Trading wizzard, can you please give me your take on the eur/usd and why you are so bullish other than you are going with the trend, because recent developments are starting to convince me that a reversal is soon. and the bears will be in control in 2014 just fundementally speaking.thanks...

hi there,

plenty of reasons.....

first, everybody is bearish on the pair and this is the first sign something is fishy with the direction all he people is looking at......usually it is the wrong one when trading currencies.

2nd, fundamental news, economic news, believe it or not is coming extremely strong out of Europe.....Spain PMI Services 53 (well above 50), Retail Sales a big boost above 1. something percent, well above expectations.....December car sales at 4 years high....and the list can go on.......

3rd....the flows out of Aussie and Canadian dollar are puring into Europe, as the region is more attractive now since the crises

4th.....on the technical side we have a running variation of a contracting triangle on the daily chart/even weekly that is poised to go above 1.40 level

and by the way.....I am trading only technicals, so the first 3 points are only for my delight/or our readers delight.

TW

-

True.But new Fed chiefs don't, initially at least, radically depart from their predecessor's direction.

They make their over time.

This isn't that complicated.

Draghi in Europe did.

Carney at BOE changed everything when came.

Why not Yellen?

TW

-

Ain't gonna happen.More of the same is in order.

never say never

TW

-

Got my EURUSD fill at 1.3620 put stop buy at 1.3712 will see.good luck.....I am looking for price to move well above 1.37 these end of week

TW

-

You may be right about that. My take from the FOMC minutes is that there is a growing consensus that the risks are beginning to outweigh the rewards. If you consider that the FED has not begun to actually unwind their holdings, just a reduction in the rate of purchases... another taper move is not a big deal (my opinion). The FED has stated that they will do the taper in measured moves... certainly leaving it at 75B is within that guidance.Thankfully, my trading style dictates that I only concern myself with what will happen in the next 5 minutes.

I agree but backing off one month after starting would be Yellen signalling she's in control now

TW

-

EUR/USD limit sell at 1.3620 if it fills stop 100 pips target 1.3300quite aggresive huhh???

....I'm bullish as hell

....I'm bullish as hellTW

-

extremely interesting to see the employment date in Australia......following worldwide trend or is Australia a leader?

TW

-

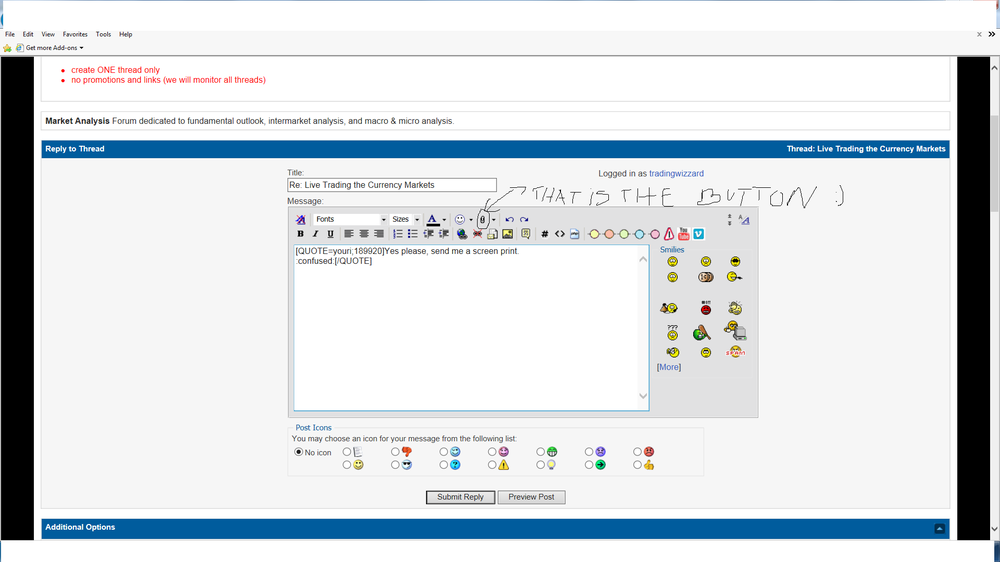

Yes I found a button . I will play with it tonite.ok, just click on it and basically you can attach any chart/picture from your computer.

cheers.

TW

-

-

Yes sure but I do not know how.:crap:

you made me laugh

.......when you are posting, look on the right side of the Fonts and Sizes tab, and there is a tab where you can upload images from your computer.....

.......when you are posting, look on the right side of the Fonts and Sizes tab, and there is a tab where you can upload images from your computer.....let me know if you find it if not I will send you a Print Screen

TW

-

I am interested in this joe ross trading group .I taken the trading seminar with Joe ross method and I was mentoring by Mihai Vasiliu from Romania .

Mihai has Joe Ross franchise “tradingeducators.eu” for est and nord of Europe .

My aim is to begin profitable with joe Ross’s setup .

PS : Sorry for my English , I am from Romania .

tavone

hey handle...

it seems you have your first member that showed up.....

TW

-

Had limit buy from Friday at 0.8980 did not happen miss by 5 pips when opened charts was to late AUD/USD was above 0.9020 a bit to late, move my stop to 0.8933 about+40 pips if within 2-3 days it will pop up to 0.93 will take profit. Still have limit sell on EUR/USD AT 1.3759 will see.hi Youri,

Do you mind to share a chart on audusd (a bigger time frame if possible, like the 4h or daily chart? )

thanks

TW

Metatrader Broker for Trade Future and Index ?

in E-mini Futures

Posted

hi,

for forex, look for a broker that is offering a five digits account as usually that means ECN and spreads are below 1 pips or around.

good luck

TW