Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

tradingwizzard

-

Content Count

951 -

Joined

-

Last visited

Posts posted by tradingwizzard

-

-

euraud short more than 100 pips in profit........what to do, what to do............

-

three trades open, analysis posted, one booked....markets to do the talking now....probably not important breaks until Bernanke Wednesday.....not Thursday, because usually then it is just a copy/paste of the prior's day speach

-

hi Dave,

nice meeting you.......quite an offer you have there

-

Not fishing last few days..have not been feeling well...you know old age..i guess..I am glad to see some traders coming out of the closet and trying to actually predict next market move...predict is such a powerful word you know....some give an occasional wink to it...others respond in a deluge of words slaying the very possibility of even the word predict existing...

pre·dict

/priˈdikt/:

Verb

Say or estimate that (a specified thing) will happen in the future or will be a consequence of something.

Synonyms

foretell - prophesy - prognosticate - forecast - presage

Predict - Definition and More from the Free Merriam-Webster ...

Predict - Definition and More from the Free Merriam-Webster Dictionary

to declare or indicate in advance; especially : foretell on the basis of observation, experience, or scientific reason. intransitive verb. : to make a prediction.

MM predicted the rise of the ES and did quite good but alas he got stopped out of his. I predicted the fall of the ES and it has yet to happen...i have paper losses but have my position...its a bear market you know...up is down and down is up.....

" up is down and down is up"....I couldn't helpt this one, no offense...it's like all that discussion with the new normal....good news is bad news and bad news is just......bad news.....what the heck is new normal?

-

given the fact that I was quoting something, I don't think it is that hard to see to what I am agreeing with

-

no! no! no! you don't understand MM. When a trade goes against me and the secret code has not yet failed i simply look to double up and preferably triple up in the same direction as my original position..that is i double and triple average down my losses. When the predicted move comes i only have to travel in the predicted direction a small amount to be in the money...after that it is "sail on silver girl ....your time has come....."I thought you retired until it breaks lower...am I missing something?

-

I trade as if the markets are cyclical -- the price is hard to predict but we do see movement either up down or sideways. So therefore I do not try and pick a direction but instead chose a strategy that allows me to have]both sides of the market. So to accomplish this I use different strategies depending on choice of the underlying. For example using a future contract long on the ES and buying 2 ES puts to have a close to equal market exposure which may be measured with the delta on the options and the delta of the future being close to zero delta. Now with that position the market is eventually going to give me a profit on one side -- either the puts benefit from a move down in price of the future or the long future will give me a profit on a price move up.I can monitor this with the change in delta and when the delta changes by 8 or 10 I capture that profit by adjusting the trade back to the original deltas. On the ES this provides a profit of say $200 and I then wait for the market to move however it wishes until the delta again changes to offer another profit opportunity. Another strategy which I use will be a pairs trade -- such as trading 2 NQ contracts short against 1 ES contract short. The ratio can be 2 to 1 or 5 NQ to 2 ES futures. So again the strategy is non-directional and is based on the belief that markets are cyclical. The ratios are based on the point values: 20.00 a point on the NQ and 50,00 a point on the ES. So 5 NQ's equal $100 and 2 ES contracts equal $100. On the 2 to 1 ratio it is close enough as then it is $40 vs. $80. I have a mechanical system to pick which contract I will chose short and which one long -- but it really doesn't matter -- again to the fact that the NQ and ES normally trade in lockstep so when there is divergence (one stronger than the other) there will be a reversion to the mean. In all my trades I need no stops and both of these as examples illustrate the fact that duration trumps direction. These trades give me "time to be right" and will not shake me out of a winning trade with a stop being hit. Perhaps this very confusing to those who hold to the belief that the proper way to trade is to pick a direction and use a stop. I can demonstrate the profitability of this strategy of trading easily by showing actual live examples but that will necessitate some way of posting live trades. Meanwhile just try it in a paper account and you will see it is hard to lose money. Another advantage to these trades is the fact that you receive about 85% margin relief from the clearing firm. This proves that the trades carry much less risk as the margin is to protect the broker from loss. I hope this illustrates the point in a way that makes it somewhat clear. There are rules that make the trades very mechanical and when followed it generally produces consistent profits. The more volatile the markets you trade the more opportunity for profit. So CL (crude oil futures) works well. The reason, of course, is the more swings (since you are holding both sides long and short) the more opportunities to take profits and readjust your trade deltas. Now you can easily see that you have profit on one side of the trade and a loss on the other side of the trade and therefore how can that produce profits. The answer is in the cyclical nature of the markets -- you take profits mechanically when the market gives you the profit and you are left with an "unrealized loss" on the opposite side of the trade. Then the market eventually swings the other way and the loss on that side becomes a profit and you "rinse and repeat". I doubt that many will grasp this from this post but hopefully at least it will shed some light on the subject.

amazing post, I find it really good........seriously

-

-

Eur/usd was expected to stay bearish until Retails sales data release which is to be released in another 15 minutes. Market has already gone below key support level of 1.3000 but directional movement is still unclear. I am staying on hold until retail sales data.Usd/jpy has already crossed 100 level. There was a chance of bullish movement towards resistance level of 100.15 but not as sharp as it has moved. It is currently trading just below 100.50.

I am bearish on the pair, looking for 95 to come again

-

50/50 is the ideal situation which will happen rarely and yes u will either loose or win if u trade randomly. In the end result will be either in favor of loss or profit. But who would take risk, with real money, to test if he makes profit or not. This can obviously be tested on demo if someone has enough time.I believe no one has enough time to test this randomness for a long period.

of course it is 50/50......in the end, you have only two choices.......to BUY or to SELL.........right?

-

Politicians say it is growing ..however with QE running at 85B per month on a say 15T economy (and who is to say that is not overstated) QE = 6.8%Try pulling (tapering) that out of the economy and see what happens.

As always, life is a race and the race in Bernie's case is to retire before the whole ball of wax blows up in his face

wait wait wait.....not putting labels so easily.....without the QE it would have been much worse

-

The Port of Los Angeles | MaritimeThese are the TEU statistics for The Ports of Los Angeles.

All TEU transfers are down, which strikes me as unusual in a growth economy.

who says it is growing?......I would be curious how would it fare without the QE program

-

Trade nr. 4. GOING SHORT USDJPY HERE IN 99.55 WITH 101.60 SL and TP 95.00

chart and explanation for this trade a bit later

-

[quote

PS And while we are wasting time.....ASIA UP

BUY @ 1301

Target 1347 by Wednesday

STOP 1290

will watch that one with interest

-

Trade nr. 3. GOING SHORT EURAUD HERE IN 1.4351 WITH 1.47 SLand TP 1.3867

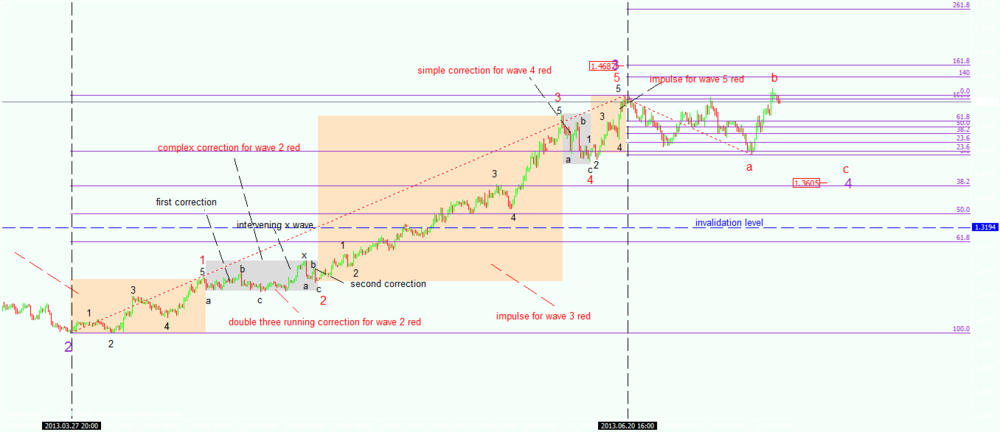

the rationale of this trade is based on the fact that after the third wave to the upside that completed around the 1.44 area we have a nice abc to the downside, which, however, doesn't seem to be the correction needed for the 4th wave.......the reason is that this move that made a new high is not looking as being an impulsive one......it is channeling too well, corrections are almost the same, etc.......therefore more likely it is a b wave and b waves in an irregular formation rarely go above the 140% out of the previous correction, wave a, and this is giving us the SL level......target to the downside implies new lows when compared with the recent ones, so our TP level is just conservative

-

Fitch became the third ratings agency to strip France of its AAA rating, to AA+.not a news for Europe as a whole anymore

-

great article, great post.......thanks for sharing

-

Sales of new U.S. homes increased more than forecast in May to the highest level in almost five years, while home prices increased more than forecast in the 12 months through April. More Americans signed contracts in May to buy previously owned homes than at any time in more than six years.while this is encouraging, I am still looking to see how the US economy will perform without the current stimulus......extremly bearish outlook for the usd IMO

-

I sure hope the Retail Sales will take it out of this ranging movement. I guess market participants are pretty puzzled about what the next move should be after that initial surge...for what it is worthing, it doesn't look like an impulsive move......looking for it now to break the 1.2750, but most likely will not move until Bernanke starts to testify this week

-

There are profitable automated systems, some are even written in MQL 4 !But leaving that aside, you now seam to be describing a mechanical system operated by 3 independent people. How does that differ from any other automated system ? And how does 3 people following simple mechanical rules suddenly become an art ? Where's the art in performing a simple clerical job ?

Who exactly is calling the trade entry ? Is this some 4th person ? And how can they ever enter a trade if person 2 has to confirm risk reward etc.

I don't want to discourage posts in this forum, but they lap up this sort of mumbo jumbo over at the zoo, I'm sure they'd love it.

couldn't agree more....

-

I bought two dozen courses on various forums and spent $20, 000 on courses , only to realize the mentors were selling and advising but not trading , even the mentors were failing with 80 % and relying on selling education and advising others , instead of mastering the 20 % to eliminate the 80 %.If you could master the 20 % , then you could reduce the 80 % , but then the same old saying "a leopard can never change it's spots".You could change the leopard's habitat.

If this is the case , why are so many failing , at least 95% fail according to hundreds of discussions on Google search?If your advise was the correct advise , why the 95 %.?Why not 40 % like accountants?

because those 95% that fail don't master the 20% needed to eliminate the 80%

-

target give by the blue line reached, now looking for the brown (main bull/bear line for the move to the upside) to be tested again

-

Assume these as facts , market trends only 20 % of the time , 80 % of potential trending entries fail or just about break even.. Devise you position size , so if you have 4 to 8 non performers or losses , you can eventually recover the losses and can survive up to 30 losses in a draw down.It can be done , rather a martingale revenge trading system.

again the 80/20 discussion

-

No!Most trades are 20% mechanics (system) & 80% is the individual psyche and psychology. If it was not correct , 10 different people would not execute the same system with different results , whereas 10 computers would execute it the same.

School Exams and results results :Same teachers and lectures in same school , but you get 40 different sets of marks..

there is a saying that in any organization 80% of the work is actually being done by 20% of the people.......in other words, without that 20% the organization would fail........let's say we're in an industry and the compony is manufacturing something...........80% are "mechanics" like you say, and the other 20% probably management and the best 20% out of the 80% mechanics........

in your case here, I would say 20% is trading 80% is questioning if your decision was wrong or right.......without the first 20%, you won't have the 80%.........so master the first part and the second will just dissapear.........

Brand New Investor Needs Advice

in Beginners Forum

Posted

no no .......I was just wondering