Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

4271 -

Joined

-

Last visited

Posts posted by brownsfan019

-

-

Guys, I am thinking of getting a new wireless router. Can you provide me some ideas of what brands/models to look at?

Also - how difficult or not so difficult is it to install a router? When I had the one I currently have installed, I had a computer guy do it for me. That was a mistake b/c I didn't learn anything about it. I want to learn how to do this stuff, so if I get a new one and follow the manual, should I be ok? I mean, is it pretty straight forward?

Thanks!

-

Here are a couple great sites for those new to e-mini's:

CBOT - mini-sized Dow ($5) Quotes Electronic

>Scroll down to Index Publications and look for mini-sized dow info.

-

Hello guys,I am a newcomer into this thread.... I've been having trouble keeping up with all the posts that come across on this board now. It's growing! But man! How did I miss this thread?

Amazing stuff brownsfan... it got me studying volume charts for the past 2 hours

What triggered my attention was your statement on how you want to see the fight and not the breather. That is so true it blows my mind that I never though of it. I have a few things that I want to clarify, hopefully you guys can help me out.

What triggered my attention was your statement on how you want to see the fight and not the breather. That is so true it blows my mind that I never though of it. I have a few things that I want to clarify, hopefully you guys can help me out.First, I am experimenting with a 1000 share bar chart. Is this correct? Or do you guys use a 1000 tick count chart? Also, Im still trying to find the ideal count on the YM... so any input on this would be appreciated.

Also, I want to go over the absolute basics of volume. In an uptrend, a healthy trend will show more volume on the rally and less on the decline. Now with the volume chart, would this be shown by more candles printing on the rally and less on the decline? Also, when plotting a volume chart is it not possible to plot the volume histogram panel as well? My TS is having issues doing this.

Now one of the things I am having trouble seeing is the comparison in volume at a double top or a test. I like to watch for less volume on a test of the highs or lows. With a volume chart how would one observe this? Does one need to gain a feel of the fast/slow process of candle formation?

Also, great explanation on the chart Paul. And good point on candles not offering profit targets. My question is what determines your exit point? If the same confirmation method is being used for an exit, wouldnt you leave a good amount of points on the table? This is the hardest part I have with using candles.... the exit point. Due to my nature as a pivot and tape reader, I do look for exits at a pivot. Now majority of the time I end up exiting too early. Exiting early is something I can live with... but exiting too early is a horrible habit. Wide range candles is also an exit bar that I look for... just curious to see how you guys exit based on candles. Thanks

Hey Soul! Welcome to the party!

I'll try to tackle your questions and I'm sure others will have opinions as well.

YM Chart settings - It really depends on how 'fast' you want the candles to print. I use under 1000, closer to 500. That's just me, I like things to print. The actual # is not important. It's simply how quickly do you want things to print. And the type of chart on TS you want is the Share Bar Chart.

Trends - in a good moving trend, you should see more candles being printed. It's amazing to watch them fire off during a move, esp around econ news. As for a volume histogram, I don't see the point since each bar will be identical. If you set your chart to say 500 on the YM, each volume bar/histogram if displayed separately will be exactly 500. That may be why TS doesn't like it.

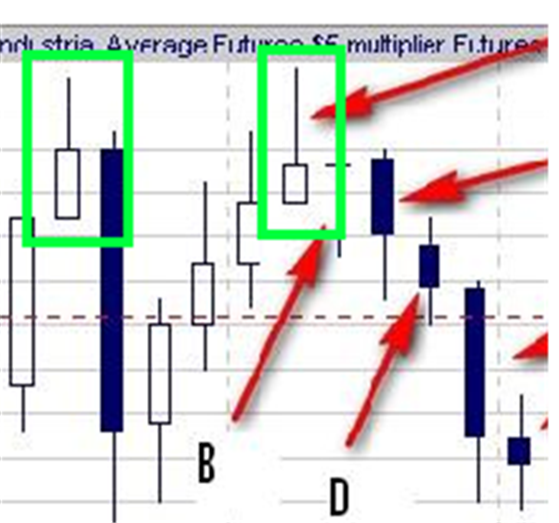

Double tops - you are correct, since each candle on a volume based chart is identical in volume, you have to learn to read the candles better. For example, in Mr. Paul's post with a chart, there is actually a nice double top. See my attachment. To me, there is a clear as day double top with two very nice looking inverted hammers (aka hanging men). For a traditional candlestick trader, that's a reason to short right there. You could actually short the first leg, which was a small winner or loser, and then reshort on the double top test and have a nice trade.

Exit point - here is probably the biggest issue with candles, in my opinion. They offer clearly defined entries and stops. Profits however, not so much. Here are the options that I have found:

- Fixed profit target sitting out there.

- Trailing stop.

- Exit only when a candle pattern that is opposite of your current trade appears.

- Some combination of these if trading more than 1 lot.

And there is no perfect answer, you have to test different setups and see what you like.

- Fixed profit target sitting out there.

-

Here ia a Candle Pattern Recognition TradeStation RadarScreen Indicator.Good ol Rumpled one.

Robert,

You bring up something that needs to mentioned -

I HIGHLY RECOMMEND YOU LEARN TO READ CANDLES FOR YOURSELF.

Do NOT rely on a computer program to find your candle formations.

Why?

Here's why:

- Computer programs do not have the 'flexibility' to be able to see a candle pattern.

- You are relying on someone's interpretation of candle formations and the ability to put them into code.

- You really need to know how these work, look, feel, etc. before relying on a computer program. It's like when you learn how to add and subtract in school... why bother when there are calculators? You need to LEARN it before turning it over to a computer.

I cannot stress how important this is. I've tested many, many programs out there and other than Nison's MarketScan (which is only on his website, not a downloadable program), I have not found ANY worthwhile.

Here is my opinion - when I see a 'hammer' a program may not simply b/c the shadow/wick is not quite long enough. In intraday trading, you MUST be flexible on what you call a hammer b/c the picture perfect hammer does not show every day. And if you rely on that program to find your hammers, you'll be sitting waiting for the perfect one b/c the program is set by design to find the textbook hammer. Well, as we all know - real life doesn't always look like textbooks. If so, we'd all be multi-millionaires from trading by now.

Robert and others that are studying this - take the time to purchase Nison's books/DVD's and learn to find these on your own. When I looked at the charts posted here, it took me a whole 2 minutes to just see all the candle patterns on them. And that comes from training your eyes and repetition.

Just my 2 cents...

- Computer programs do not have the 'flexibility' to be able to see a candle pattern.

-

Paul - great chart with explanations.

I think you found a great example where the candlesticks worked well.

There looks to be another nice short around 12:30pm on your chart as well - two hanging men back-to-back. And then about 5 hammers that signified that down move was over and a small move up on those hammers.

I will say this - I LOVE hammers/hanging men. I actually call hanging men 'inverted hammers' simply b/c I see hammers easily. I don't see the hanging man. So, if I ever write inverted hammer, it's just an upside down hammer.

-

At this early stage of my recent volume candle enlightenment, I have come to the conclusion that volume candles are the most accurate v/s all other types of chart reading.I now believe this because volume candles equalize each bar's importance. With "VCs", no bar means more or less than the last or the next. They just tell a story. A story you can trust because you know what each VC represents.

With time or tick based bars, you don't know the importance of any bar. You don't know how much emphasis to put on any bar or pattern. You can't trust them. You might as well use a line.

Now there are other indicators that may quantify volume but none will be as accurate as the VCs because VCs are the indicator!

Most importantly, it evens out the chart. It doesn't matter what volume interval you use because whichever interval you choose, all bars represent the same.

Wow, this is deep. I think this just saved me about $25,000 or more. I'm a total believer. It's so clear to me now. Thanks again. Wow, that all I can say. Wow...... :rolleyes:

Robert - I will be happy to accept a 50% 'savings' fee of that $25k. Just send me a PM and we can arrange for the bank wire of $12.5.

Thanks!

-

Would love to see some charts.

Also have a trading 101 question: What is the difference between a tick chart and a Volume Chart?

VSA tells us that volume=activity and thus tick based volume works where actaul contract volume is not offered. Do you believe the same?

The Russell doesn't release volume during the day, only tick volume, would you thus not trade that market or just use ticks?

Ok, that was a joke. Thought a little humor would be good here, it's getting a bit stuffy in here. :p

Charts - I will try to post some, but what may actually be better is what I did with Tin - post a chart and I can screenshot it and annotate my thoughts so you can compare with yours. Just an ida.

Tick vs. Volume - A tick chart moves when there is a tick. I don't care for tick charts b/c if the market moves up a tick based on a handful of contracts traded, I am not interested. I want to see and KNOW there is volume being traded there, not just a random tick. A volume chart only produces a new candle when XXXX contracts trade - whether that is a couple ticks or not. I guess it depends on what you consider important - any and all movements or volume. For me, it's volume. I view a tick chart similar to a minute chart in that you can trade off both of them, but for me, a volume chart speaks volumes that those charts cannot.

ER2 - not sure what you mean, I use volume based charts there just like all the other e-mini's. At least, that's what TS is showing me. HOWEVER you bring up something that makes sense to me... My TS charts on the NQ and EC (CME based contracts) NEVER match the volume I see on my T4 trading dom; but my YM (CBOT based contract) matches perfectly to my trading dom... Can you provide more info on what you mentioned? Any links to the CME and/or CBOT that explains your statement more? Thanks!

-

BF: I'm a Broncos fan, but that doesn't mean I can't be a fan of yours

Would love to see some charts.

Also have a trading 101 question: What is the difference between a tick chart and a Volume Chart?

VSA tells us that volume=activity and thus tick based volume works where actaul contract volume is not offered. Do you believe the same?

The Russell doesn't release volume during the day, only tick volume, would you thus not trade that market or just use ticks?

BRONCOS???

Forget it, I am out of here.

Do you know what Elway and the Broncos did to my Browns in 86??????? I practically throw up every time I watch 'the drive' on ESPN. That was the LAST time the Browns had a competitve team!!!!!!

That changes things.

:mad:

-

Here's a chart of todays action that I followed along with. It's a 764V chart. Why that? Well..I couldn't remember fib numbers off the top of my head and this is what I came up with. Oddly enough, I see clearer signals from this chart looking back over a couple weeks than I do with one based on a fib number.The blue arrows are pointing to haramis and the red arrow is an engulfment.

Simple, straightforward.

One thing I was going to recommend Tin was to post what the volume setting is at to put things into context.

Now, to help everyone understand that candles are NOT bulletproof, I attached the same chart of tin and highlighted all candle patterns that I saw. I did not take into account the indicator at the bottom, just pure candlesticks. I did this not to put a damper on this party, but to show that while candles are extremely good at finding ends of trends, they also sometimes can put you into a trade a little soon (early to the party as I like to say). Which then leads to the discussion of where and how do you place your stops if trading off candlesticks... Perhaps another thread discussion altogether.

I want to bring your attention to the part I highlighted in purple. The reason is that you see you first get a hammer (long signal), hanging man (short signal) and then another hammer. I bring this up to point out that if you take the first hammer - end of a little downmove and looks like a double or triple bottom (note the first two hammers that failed in my opinion) and right after you enter, you get a candle formation that is opposite of a long trade - a hanging man, and then right after that you get another green hammer and IF you are still in your long, you made some money.

One last thing - and Nison says this a lot to - candles do not provide a profit area/target. As you can see in the chart that tin and I posted, you can see patterns that went for points and others that didn't do much. That's the other part of the equation - where and how do you exit?

Again, I am not trying to convince you to stop researching this, I simply want to point out how these can work in real time. It's very easy to say that you would take the hammer or engulfing at the bottom of a trend, but there's also other hammers, engulfings, etc. that appeared in that same move. Why would you not take those?

Like I mentioned Tin, I think the actual number being used for the volume bar setting is irrelevant. If you want a quick moving chart, use a smaller number; vice versa for a longer term chart.

-

Tingull started a new thread on volume based candles so any topic related to it should be posted there for now. Very interesting topic brownsfan... I am definitely going to look into this myself. Just wondering if TS has this feature? I am actually a little familiar with this as Ive seen charts with fat candles and narrow candles (high volume vs low volume) so I am assuming it is the same.Soul - TS does have this feature, they call them Share Bars.

And as mentioned, I am NOT using equivolume candles. Those just look funny to me!

-

Just a couple of questions and observations:1. BF, what do you think about Mark's approach? His knowledge of candle trading is far beyond what most sites have to offer? (Mark ((NA)) is a trader on another forum-I am sure you know of whom I speak)

2. Have you done any research into WRB's - Wide Range Bodies ?

* I like the idea of a chart picking up speed as activity picks up. But one needs to be able to compare volume in x period of vs volume in period x+1. Time is the fourth dimension. It is not a random concept.

Your body knows when to sleep and when to be hungry. Your body knows when to age and when to die. Time is elemental.

If you are looking at volume candles and you say the chart is speeding up, are you measuring distance X time ? So time plays a role in the perception of the chart being created. But with no way to make relative comparisons. Plus, the close of a period (1 min , 2 hour, or day) is the last agreed upon price for that TIME. Note a certain volume number. That is, the emini closes at 4:15 regardless of contracts traded. And since this the last price that buyers and sellers come together, certainly it is of some import.

Pivot - I'll do my best to answer...

1) I've chatted with Mark and have visited his site many times. I've never purchased his manuals, so can't speak on that.

2) I've learned and studied 'traditional' candlestick trading, which does not do much with WRB's. So, can't say much on that either.

Re: chart speeding up, what I mean is (and I like to keep things simple) is that I know what a 'normal' morning 'should' look like in terms of how many candles printed. By knowing this, when I see many more OR less than normal, it grabs my attention. I am a VERY visual person, so the charts tell me everything I need to know.

Not sure if that answers your questions completely, but I am a pretty simple trader. My chart (which I posted on here) is volume based candles and 2 moving averages. That's it.

-

I am enjoying this too! It's like a light bulb just turned on!Q: What are you trading?

A: Shares and Contracts

Q: How are they measured, Time or Volume?

A: Volume

Q: What kind of chart should you use, Time or Volume?

A: VOLUME!

hahahahaha I love it!

Now I just need to figure out (1) how to determine what size volume bars to use and (2) how to read candles!

I guess the volume bar size that you should use needs to correlate to price movement of the instrument somehow. ie. How much volume causes the price to move. I'm going to start reading about and studying this right now.

I think this may be the golden ticket. Thank you for pointing me in this great direction.

::EDIT:: Go Browns!!!!

Robert - you just went thru what I went thru when I first learned of them. You have to keep an open mind, but WOW they can really improve your trading.

As for reading candles, get Steve Nison books. He's the best and is the candle 'godfather'. His site is http://www.candlecharts.com/. When I got into candles, I got ANYTHING from him I could get my hands on. I have most/all his books and DVD's. I highly recommend the DVD's. I am more visual, so a book only did so much. I've gone to one of his live seminars and while it wasn't cheap, it was well worth the cost of admission. He also now has a MarketScan which is pretty slick. He puts out a newsletter too, so make sure to sign up for that. Maybe some of you could go in on the DVD's to share the costs ... if someone has a DVD burner...

FYI - I am not a shill for him, just a very happy customer.

As for the size to use, it's really up to you. The smaller the number, the quicker things move, so you must be nimble if trading on a smaller number. A smaller number would be under 500 on the YM in my opinion. As I mentioned, don't fret about the actual number. There's not much difference in a YM chart with 300 and with 400 as the setting. It's really a matter of how quick do you want the candles to print - just like a minute chart. Play with some settings and see what you like. The key is to do this in real-time!!! It's easy in hindsight to say that you would have taken a hammer, but what you may not be seeing is that the hammer formed in 30 seconds and you had about .5 seconds to make your decision to go long.

Bear in mind guys, when these things are printing, there's no time to be messing around.

You have to act and act quickly.

This is part of the reason I don't spend much time in the chat room. I just can't watch 3 charts, execute my entries timely and chat.

One last note - I mentioned this to MrPaul in a PM, but I want to mention here - if you use candles in traditional analysis, be prepared for rough days in trending markets. The candles in traditional analysis are meant to signify the possible end of a trend, which work great in markets that move up and down during the day. In a strong trending day (like the 500 pt day on the dow) you are going to take losses and possibly many of them depending how many times you want to fight that trend. While that is not easy on the psyche, over time, there's money to be made in the market using candlestick analysis.

As Nison likes to say... May the candles light your path to succesful trading (or something like that).

-

Brownsfan,Really enjoying this thread..how did you intially come across volume candles, any educational resources out there?

Paul - you know, I first learned about them at elitetrader. That site is mostly garbage, but there are some nuggets if you spend the time reading. I honestly never thought I would get much from a site like that, but one friendly trader brought it to my attention in one of my threads and since then, I just started studying and reading about it.

As for books or other stuff, I have not found ANY. Perhaps a mention in a book or something, but nothing really dedicated to it. I have given some thought to writing something up about it down the road.

If you are interested in the et thread, here's the link - http://www.elitetrader.com/vb/showthread.php?s=&threadid=80582&highlight=odd

Keep in mind that as normal over there, the thread delves off into childish name calling and such; BUT there is some good info throughout, esp at the beginning.

-

Excellent. Thank you notouch and brown. I did a little looking over some 5kV charts and some 25kV for a longer term view. Interesting things that I'm seeing there. Its weird to not see the volume bars on my chart! HAHAI might just have to start keeping a volume based chart up on my screen to watch from now on. See if it's gonna be something I can benefit from.

Tin - just like minute charts, volume based charts can be based on how 'quick' you want your charts to move.

Try out all different intervals and see what you think. I've read that you should use fib numbers, but I like round numbers. So, I wouldn't worry about setting it at 450 vs. 500 or 1000 vs 1500. Taking a sample of say 500, 2500, 5000, 10,000 could give a nice little sample to look at.

-

now (brow and notouch) you are presenting good arguments.... should I see some charts ? thanks in advance Walter.Walter - I can post charts, that's not a problem, but as notouch said - you really need to see them in real time. They are just going to look like normal charts unless you pay close attention to the times on the charts. I would suggest opening a chart up with volume bars and compare it in real-time to your time based chart and see how things look.

-

And...do you think dojis hold more importance on a volume based chart? Say...after you witness the doji and all the sudden price starts moving fast as hell, you wanna be in on that as quick as possible, yea?Tin - I think most/all candle patterns hold their water much more on a volume chart vs. a minute chart. The underlying theory of candles is to visually represent the 'fight' between the bulls and the bears. We also know that the more volume being traded at a particular time, the more movements usually happen. So, if you want to see volume and you want a visual representation of the bull/bear fight, there it is on one clean chart.

-

Very nice. I would love to have you do a video presentation sometime on this. It really is an interesting concept that I've never dove into. And candles are your bread and butter, right?Thanks brownsfan, I appreciate the insights.

Tin - I posted a chart setup of mine here on one of the threads and what I use is simple - volume charts, candles and moving averages. That's it.

I guess in essence I am 'reading the tape' as I know many guys here do, but I do it in the form of my chart, not a separate window. When candles are rapidly forming (as notouch's chart showed), I already know there is heavy selling pressure, I don't need a seperate window to show me that (and be a distraction in my opinion).

-

tin - notouch summarized the volume based / share bars charting format very well. Basically in real-time, I can tell just by watching my charts if there's a lot of volume coming thru or not. I don't need tape, a separate volume indicator, or anything. As notouch said, you need to try watching real-time to really see the value.

Here's an example while using a candlestick formation - in traditional candlestick analysis a doji symbolizes that the current trend may be coming to an end as the bulls and bears went back and forth and noone won. On a time chart that doji can be saying: 1) the trend is over or 2) the bulls and bears are simply taking a breather.

Now, with a volume chart, that doji tells me that XXXX contracts traded in order to produce that, not just traders taking a break. In order for that doji to be produced, the bulls and bears did in fact have a good fight, which is what I want to know and see. I don't want a 'breather', I want a fight.

As another trader asked me when I first questionned the share bar method, he asked if I watch my clock when I trade. I replied no. Then it hit me, the time it takes a candle to form is irrelevant. What you want is a candle that is telling you something - either there is action going on or not much is happening right now. I personally want the action/momentum and to participate in that. I don't want to enter a time where volume is low and moves are little. I can't stand trades that take hour(s) to develop. I just don't have the patience.

The other big thing for me is that on a time chart with candles during big moves, you aren't going to be able to do much till it's too late. In other words, if the contract moves points over a 3 minute timeframe, that candle is useless. So during big moves, I saw giant candles forming and watched the action take place w/o me. I knew something was going on, yet I had no way to take advantage of it. That same move on a volume based chart can possibly provide me with MANY signals. It's night and day.

In the end (for me at least) this is what pushed my trading over the edge. Volume based charts provided me a quick and easy way to visually see what was going on. Rapid candles = rapid volume movements that I want to participate in. Slow candles = low volume that does not help my trades.

-

Brow : if you use volume based charts you are not able to measure the diference on volume from bar to bar.... time based will let you see on the same period what diferent volume you got on each bar.Walter - I see how the immediate reaction is that you will not be able to see large volume surges. Allow me to explain how the volume based bars do in fact 'show' you the volume surges - when candles are printing quickly, that in turn means volume is surging. When candles are taking a while to print, you 'see' that volume is just not there.

I think I mentioned this before here, but volume based charts were by far the one thing that took my trading to a high level. I was using time based charts and while it was decent, slightly adjusting the chart to reflect volume and not time, took my trading to the next level.

I understand that most traders want a purely mechanical way of trading, but in my experience that is very difficult to do. You have to be able to visually look at a chart and make a snap decision. I have no idea how some guys here are able to do that with indicators galore on their screens, along with a couple charts, etc. Paralysis by Analysis at it's best.

I would suggest MrPaul and others that are able to, also test your strategies on a volume based chart as well. The worst thing that happens is that you are unable to use Volume charts. The best thing that happens is that your trading catapults to the next level, as it did for me. I'll take that risk to reward setup all day!

-

If you guys are going to get serious about candlestick trading, you need to read Steve Nison's books. Just start there. He has the best books on candlesticks hands down.

Idea for MrPaul and others looking/trading with candles and volume - if you like the combo, simply use Volume Based Charts instead of time based charts. You will find:

- Time based charts will NOT allow you to participate in fast moving markets as the candles can become VERY skewed.

- Do you normally stare at your watch while trading? If not, time based charts have a fundamental flaw.

- Why take up screen space with a chart that has candles and volume separated, when it can be combined into one neatly presented chart?

Keep in mind guys, candlestick trading is my bread and butter. If you are new to this, make sure you study it first and get confident before placing real money on the line.

A few pointers:

- Decide if you are trading with the trend or against it. Candles can be used in both scenarios.

- If you trade against the trend, make sure you have a hard stop in place and honor that stop.

- On an intra-day basis, be 'flexible' with your candle patterns. In other words, do not sit and wait for the picture perfect hammer.

I'm sure that a simple volume based candlestick chart will not be 'enough' for some people reading this, so good luck with finding the right indicator(s) to use in conjuction with this. There's always going to be trades that the indicator(s) 'save' you from and others that prevent you from making money.

Once again, the key is consistency.

- Time based charts will NOT allow you to participate in fast moving markets as the candles can become VERY skewed.

-

Interesting video James! Thanks for posting.

-

James - it has gotten better since I mentioned this. At times it can lag, but not nearly as much as it was.

Just an fyi.

-

Good points Tin. Very important to be able to step away from your business and have a life outside of trading. I actually have found that once you have a methodology in place that you consistently use, you 'study' less and less as you have convinced yourself that what you are doing works.

When you are desigining your business plan, that is where hours and hours can be eaten up outside of actually trading.

It's a big relief to be able to wake up and realize that the plan is in place, you just need to follow it. The only problem I had was figuring out what to do with all the extra free time! Since graphic design and website design has always been an interest of mine, I am going to start taking courses at the local community college in these areas. After that, might be something with cooking.

It's amazing what a proper trading plan and business plan can do for you and your family. It's simply a matter of getting to that point. (I know, easier said than done). For those that are serious about trading though, keep in mind that there is light at the end of the tunnel. It's just that most people will never actually get to the light.

-

Guys - I think he's talking about a 'large' ES contract - just like the YM vs. the DD.

[Volume Based Candles] and how to profit

in Technical Analysis

Posted

Robert - sorry, I wasn't clear. I do not have problems seeing inverted hammers (hanging man) on the chart, I simply refer to the hanging man as an inverted hammer. It's just an upside down hammer, that's all. When I said I don't 'see' the hanging man, I meant that I do not understand the description - why a hanging man? I don't know, so inverted hammer works for me.

I can understand the training wheels argument, but I can also see the thought process of - well, this appears to be working, so why bother taking the time to learn! Again, it's like going to school... Microsoft Word can spell check for you, calculators can do all the math you could possibly need, etc. - so why bother learning the basics the 'hard way' yourself first?

And for me, I could not feel comfortable putting my entire trading in the hands of some guy I met on a forum. What I mean is that I have NO IDEA how HE defines candles, which can be VERY different from mine, so to rely on his definition and coding of candles is just dangerous to me. Again, I truly believe you are going to miss out on many trades by relying on a software program to tell you when there is a candle pattern. The other issue I saw with programs that recognize candles is that you are going to get candle 'alerts' on the entire chart, when you really just want to see candles at the beginning and/or end of the trend. Hammers appearing in the middle of chop is just noise and you do not want to be alerted to every little candle formation when there are so many.

I'd be interested to see some charts, so when you have the program running, post some charts where his alerts go off.