Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

4271 -

Joined

-

Last visited

Posts posted by brownsfan019

-

-

Mark & Pivot - good examples and advice. It all makes sense even though I may not agree 100%.

notouch - we simply do not agree on the idea here.

--------------------

In a nutshell here's what I am attempting to do - instead of focusing on just one market while in a trade (which is very easy to do) and missing other opportunities, I am simply taking the 'opportunity' that is in front of me and executing this on 3 markets (no ER2 for me ... just yet...).

And the reason is simple as I stated above - there is no possible way to know which of the three markets (ES, YM, NQ) are going to move after you enter the position the most. You just simply do not know. So to throw all your contracts into one market is extremely risky based on that premise in my opinion. It also comes down to slippage issues as well. I can't throw a 50 lot on the YM and expect little slippage and/or that to be unnoticed. I can take that 50 and spread it over 3 very easily, esp the ES and NQ. But if the YM is what ends up moving the most and I am not in that market simply b/c I forced myself to choose just one, that would be cause for concern later.

I guess if you feel that your trading methodology is solid and you can make serious money trading, why would you limit yourself? Look at the AM moves this week - having traded all indexes together would have been a nice week of trading and all you do is simply enter positions based on your analysis.

Now, if you are trading 2 or 4 contracts, this probably doesn't make much sense at all. That would be more of a nuisance than anything. But if/when you are trading some lots and slippage is something you have to consider, spreading your trades out over 3 markets is something to consider vs. forcing your hand on one market.

-

Here's another interesting tidbit in my analysis - by 'borrowing' signals, you can actually get much better fills in the other markets that you are trading vs. the one that showed the signal.

Why?

Easy - one market may lead the others. And since there is no dominant leader each day, you are simply using the leader to your advantage... Thereby your 'borrowed' signals may in fact show more profit simply b/c of better fills, even if placing those borrowed signals at the market.

Some food for thought.

-

I guess the point notouch is that if you focus on one market and one market only, you may not even get a setup to begin with; whereas the other markets may have given you a setup. Since I use candlesticks, how things form on the chart is paramount.

And since going into a trade there is no way to know for sure which market will 'pop' I'd rather be in the one that does for sure vs. hoping that I am. You have a 75% chance of being 'wrong' in terms of picking the one of the four that pops. Those odds are terrible. If you are in all 4 or all 3, you have a 100% chance of being in the one that does 'pop'.

We know that the US indexes typically move in the same direction, but there's no correlation between the move and the amount of that move. A move on the NQ can easily produce more profit in terms of $$$ than the ES. Why would you want to restrict yourself to just one?

-

For those that trade multiple markets, do you exclusively look for your setups on each respective market or do you initiate a position if one of your correlated markets shows a trade?

Example: we know that the US indexes move in correlation most of the time. Very rarely are you going to find the ES down while the YM is moving up. Knowing that, could you not take a trade on more than one market if you get a signal on one of your charts?

Here's my thoughts - as I've been looking at better exits with WRB's and such, I've also noticed that if I have a YM trade and it works, odds are that an NQ trade would have worked as well, even if the NQ did not provide an actual setup for me. The thought process being that if my analysis is correct, why not exploit that on multiple markets.

If we assume that one can implement that, you could trade some sort of combination of the ES, YM, ER2 and NQ.

Now, I know the next question will be why not just focus on the one and trade larger lots there. Good question. First, unless you are just trading the ES, trading larger lots could create some slippage issues. Second, and more importantly in my opinion, while your analysis can be correct it's not always clear to tell which market will provide the most bang for your buck. In other words, if you just trade the YM at $5/pt, your 'opportunity cost' is another consideration.

Anyways, just thought I'd share something that hit me like a ton of bricks this week since we have some great volatility here with us this week.

PS

Not exactly sure what part of the forum this should be categorized under, so feel free to move it mod's if need be.

-

My humble observation - that was a nice strong downtrend. Why anyone wants to stand in the path of an oncoming train is beyond me. That's the issue with pivots and other static lines like that - during a trending move, you are going to get killed. Now of course the argument is that the market does not 'trend' much and in the general discussion that is true; however, in daytrading where you are going for intraday moves, the market can 'trend' much more than what the talking heads on CNBC discuss or much more than your account can withstand.

-

Thanks momentom, I appreciate the info.

-

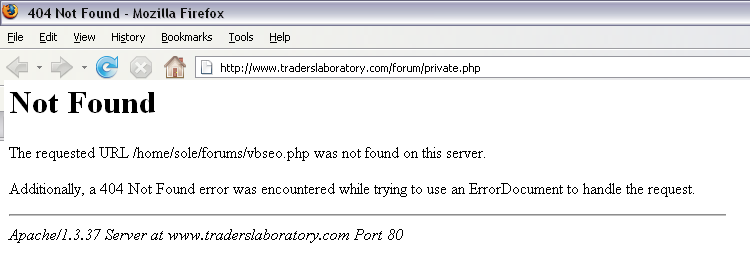

Do you not see the attached chart?There's nothing attached to this message.

To be sure, check your post after it's on the forum and see if your attachment is there. As of now, nothing is there.

-

No idea as I don't use Tick or Trin. Maybe someone else can chime in.

-

wei - thanks for the info, I appreciate it.

Regarding Metcalf, he was a special player here. Never the 'big' name but always had the ability to change a game!

-

Seeing that I am trading at 7am EST with the EC, I've been taking a look at the DAX and STOXX Charts to give me another option or two to trade during the hours leading up to the US open.

Just wondering if anyone here is trading the DAX or STOXX futures contracts and your thoughts on these markets.

I'm not looking for strategies on how to trade them as I am simply going to do what I am currently doing, but just wondering if there's some idiosyncrasies I should be aware of.

Note to my buddy Pivot - you may want to look at these with your WRB analysis... Just an idea.

-

W/o seeing any charts or anything, here's my suggestion - don't try to catch falling knives grasshopper.

-

wei - I understand that this, just like anything worth doing, takes time to learn... With that being said, I would like to start to get my feet wet b/c I've always wanted to be able to create a website from nothing or create graphics, pictures, etc. More of a hobby if you will.

As for where to start and such, I would just like to be able to take a blank 'piece of paper' and create a basic website for now. I don't need it to do much right now, I just want to be able to say that I created a site from nothing. Something that can have multiple webpages, some graphics, text, etc. Not much more than that for now.

Thanks for the help!

-

I'm interested in learning more about designing web pages and graphic design. I understand that Adobe is king here, so what would you recommend for someone new to this? Just not even sure where to start... For example, Adobe's website has quite a few programs available, but not sure what is recommended to 'get your feet wet' and not feel overwhelmed.

Thanks!

-

Quick question for those that have read the thread - has anyone else looked at and/or implemented WRB's into their trading? Not sure how much more to really talk about from my point of view. I can post the occasional chart, but I think you guys get the idea if you read my posts.

Just wondering if anyone else is using the methodology.

-

I know trader 273the thing is that I use different computer from my trading one to chat or surf the web. I do this to avoid getting virus attacks. so I was a little lazy to get a graphic from my trading maching and put it into the lap top which I surf. Anyway, thanks for your interest.

malvado xetra

Mal - I think you can use a program like SnagIt w/o worrying about a virus slipping in. :p

-

Interesting cooter... very well said.

-

That is interesting Cooter.

As for the dissection of this futures trading 'pyramid', my understanding is that you basically have:

1) The exchanges that provide the marketplace.

2) The firms that clear there.

3) The FCM's that either clear and/or work with the firms in #2.

4) IB's are marketing co's of FCM's. They simply provide the customer service to you and market their own name, but all back office is handled elsewhere.

You'll find some FCM's that only deal with IB's and they focus on the back office items. You'll also find some FCM's that market themselves and/or work with IB's.

The most important part of this equation is that the more firms and people involved, the more costs that must be passed on somewhere... I sometimes get broker prospecting calls and when I tell them my rate is under $4/round trip and that they need to beat it or we can end the conversation, many retail brokers don't even understand how rates can be that low. Well, the more hands in the pot require higher costs. I recently had a guy pitching me $25/round trip. :rolleyes: I just laughed....

-

Cooter, According to the NFA, they are registered as an FCM. http://www.nfa.futures.org/basicnet/Details.aspx?entityid=0326789&rn=Y. Assuming that is correct, that would mean they can perform trading operations at a level higher than an IB. How all the back office items work, I am not sure on exactly. I understand that an IB (introducing broker) simply markets their own name and handles customers, but all the trading goes thru another company, such as an FCM. Now, how exactly Open ECry handles it all, I am not sure.

Very good question and observation, but I have heard mostly good things about Open ECry and thought their software was very nice, esp at no extra fee.

-

I saw the threads in here and thought I would ask about the ag's. I looked at them at one point, but I think the lower volume did not appeal to me.

I suppose when trading size that the indexes and EC are probably best.

-

-

-

RE: Infinity's platform - I have not tried it. I contacted them awhile back regarding commission quotes and they could not get in the ballpark of what i was paying, let alone beat them.

RE: Open ECry - I have demo'd it and it is nice. It depends on what you need, but there are some useful features on it and it should have or will have soon MIT orders if you need those. I believe it has trading from the chart as well. So, it's a good platform if looking for a decent trading platform with charting at no extra fee(s). And their commission rates are very good as well. They are an FCM so there is no 'middle man', i.e. an IB. I would get a demo version if interested.

-

Are you trading the ag's live tin? If so, what kind of slippage are you seeing?

What are the best times to trade the ag's? In other words, when are these things moving?

-

My reco's for futures brokers are:

- Mirus Futures http://www.mirusfutures.com

- ProActive Futures http://www.proactivefutures.com

- Open ECry http://www.openecry.com

For trading software, I continue to use and recommend T4. http://www.ctsfutures.com/content/t4/

It is not the cheapest software around, but the speed and hosting is top of the line. By hosting I mean that your orders are actually stored at CTS Futures (designers of T4). Should your internet go down and/or the exchange, your orders are still working. For me, that is very important as internet outages are inevitable. By holding your orders on their servers, they are able to offer additional services, such as MIT (Market If Touched) orders whereas some software packages cannot do that b/c the order resides at the exchange and some exchanges do not support MIT's or other certain types of orders. Mirus and ProActive both currently support T4, although it may be referred to under a different name. Mirus calls the platform Dorman Direct and ProActive currently calls it T4.

Note - Open ECry supplies their own trading software at no cost, which is an attractive option depending on your needs. The platform is nice as well, so it's a great option, esp for those looking for inexpensive platforms.

Recommendations posted on April 8, 2007.

Feel free to PM me with any personal questions or to confirm my reco's at a later time. Businesses and needs change over time, so it is completely reasonable for my reco's to change before altering this post. Please perform your own due diligence before starting a new business relationship.

- Mirus Futures http://www.mirusfutures.com

"Borrowing" trade signals

in E-mini Futures

Posted

notouch - please do not think I am attacking or anything, just opening this discussion up some more.

Your comments ring very true to me. I thought the same thing - why not just focus on one of the indexes and push your hand there. The problem arises when that one market does not give you a signal to trade, meanwhile another index or instrument may have (as Mark illustrated).

Now, the part I put in bold raises a question - you said to go all in on the 'best signal'. What does that mean? I only take my 'best' setups period. I don't consider an 'ok' or 'mediocre' setup... I don't understand why someone would enter a trade that they consider anything but their best. We know trading is hard enough as it is, but if you take a trade w/ little confidence, I can't see how that would work out in the long run.

And in the end, even your very best setup can fail or not provide as much move as you expected; whereas by simply applying your best setup to another index may have provided the profit target you expected even though the setup didn't even appear on that chart. The best example I can provide is the ES vs the NQ. The ES doesn't always move nearly as much as the NQ can. I realize the points are worth different amount of money, but even with that difference, there are times when the NQ is by far the best choice at that particular time. Again, there's no way to know that going into the trade, so if you are in the ES, NQ, and YM and all move in your favor, you made money. And of those three, one will normally provide a bigger return than the other 2. The problem however is that you don't know that till the trades are completed.