Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

1444 -

Joined

-

Last visited

Posts posted by TinGull

-

-

HAHAHAH!!!! Thats freakin' sweet!

-

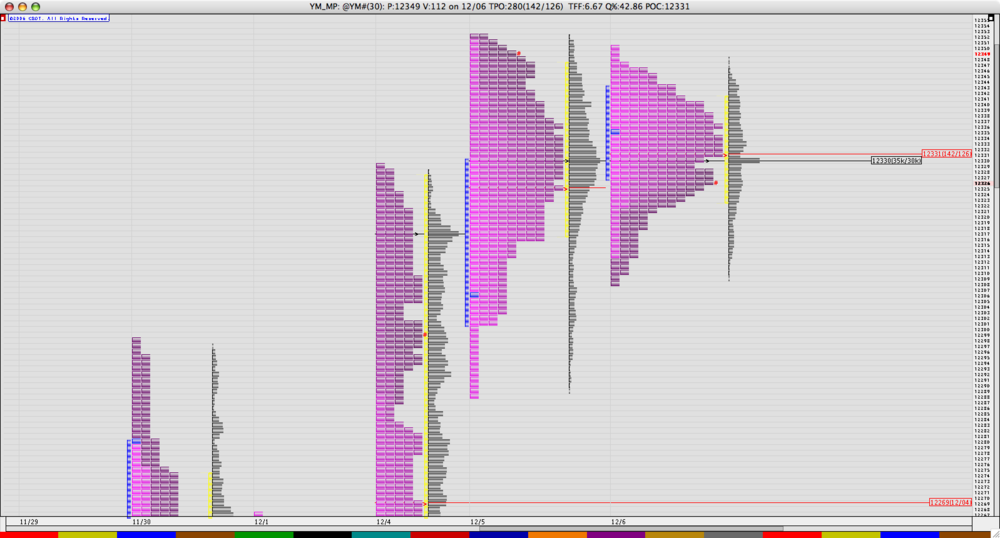

Pretty chart....just had to post it! Figured out how to make my charts look real nice.

Also...notice the naked POC from the 4th....at 12269....I hear the sucking sound of the vacuum pulling the price there....wwwoshhhhhhhhhhhhh

While a narrow range day and a near PERFECT looking profile are usually a precursor to a nice vertical move, will it be up, or down? Looking at the dailies I'd say we could head down to pick that NPOC up for a ride. If we managed that, it would take out yesterdays lows and I think we'd see some movement to the downside and try to take out 100. We're really hitting our heads on the backside of the uptrend line.

Just my 2 cents...markets gonna do what it wants to and I'll try and ride it. I LOVE trend days, so here's hoping!

Meanwhile...enjoy the pretty profile!

-

yea...I was very timid with the choppiness of things, and the slowness of things. One of these days I'll get over myself

-

absolutely! I'm there every day....all day....too many days?

-

you're my hero! I didn't get an ounce in today. System never triggered anything worthwhile.

-

How many points did you pull??

-

Thanks James! Gives me something to do during this boring day...

-

absolutely. just say when!

-

James, I wanna know how you know that the day is gonna be boring!! There was only 3 of us in the chat room today...and yesterday, you knew it would be boring so you overslept....man, I gotta have this knowledge....

-

37 point range today.....May 8th we had a 39 point range. That was the second smallest range this year, and it was just before a HUGE tumble. So...with today being the most boring day of the year, I ask:

Tetris? Or Minesweeper?

-

No probem at all!

-

Program trades are basically systems that are put together by some institutional folks. Its purely mechanical, and often times not really "supervised" per se...

When something happens in the market (sometimes a premium differential between the futures and cash market of SPX, sometimes other things) that was pre-defined in a system, the buy or sell orders are triggered. A lot of fund managers won't use that, though. They usually do things manually.

-

Its worth it to have the piece of mind knowing your computer is going to be solid...

-

Thats the gist of it. I think he draws his lines at 5pm. Haven't seen him around these parts lately, though....might be off doing some teaching/mentoring. I know he does that often.

-

Absolutely. The new Macs are all using Intel CoreDuo processors, so you can get a program called Parallels Desktop (80 bucks) and a copy of Windows XP home (100 bucks) and have a blazing fast computer (mines a 2.16GHz CoreDuo) that will run all PC programs and have the safety and reliability of a Mac. Amazing stuff!

-

First of all, I loved this book. It gave me TONS of insight into how the news can affect the market's movement, and also it gives it to you in various situations. The same news can have a different effect in a bull market versus a bear market versus a completely sideways market.

There's not a whole lot of trading "how to's" in the book, but it's not about that. This book teaches you how to think...how to think about different economic numbers can have an impact on your current plays, or how the news can set you up for a play you're about to put on. Overall, a really awesome book and very well written. I love all the little stories about traders he has every chapter or so.

-

-

I dont think the number of new online accounts and the number of knowledgeable people working those new accounts go hand in hand...I do think that with so much electronic trading it is bringing a lot of bright people to the game, but more than that there's a lot of people with false hopes. I think that's the majority of it. The surge in electronic trading is bringing in a lot of fresh money into the markets for the seasoned pros to take advantage of, and then those youngin's don't have a lot left afterwards and end up quitting...just like always.

So....I guess I take door number 2?

-

Welcome Testa! That was my main strategy as well for options...until october. Had a few iron condors and some bear call spreads and was rocked by that uptrend on SPX and RUT!! Took me for a good ride, and then decided to trade the eminis so I didn't have to have a bias that remained in place for a month or two at a time.

Credit spreads were good to me up until then, though, and I think that overall spreads are a good place to trade. Hopefully we'll be able to open up some discussions on this forum

Torero, as far as how one approaches putting on a position...this is how I look at it. First, see if we're trending...if so, sell a position to benefit you in that trend. Uptrend...sell a put spread. Downtrend...sell a call spread. If we're kind of in a range (which I would suspect we're starting to see happen now after that mega uptrend since July) Iron Condors are great in that kind of market. There, you're picking two areas to sell both a call and a put spread. For instance...look at a chart of the SPX... selling a 1350/1340 put spread and a 1420/1430 call spread would prove to be a nice way to go.

Why? You've got 3 areas of support and a 50Day MA to break through before you'd be taken out on the downside and start to lose money. Now, if we're at 1341 on expiry, you're getting the full credit. I will close my positions between 4-10 days prior cause the vega exposure is too great. That means that the delta is moving so fast as it comes on to expiry it can either really help your position, or really kill it. 4-10 days gives you good time.

For the call spread in the IC, that area is a bit above where we're at now...and it looks like a top is forming. We've been seeing some real rocky trading lately, and the trend is seemingly sideways for the time being, and then I'd love to see a nice correction down to the bottom of the IC. At that point, it's gonna take some time to get back up to around that 1400-1420 level, and by then you could have exited that call spread with profit and if we're around 1400 or higher by expiry (january)...then let that one expire worthless.

There are a few volatility models to show you expected percentages of probailities, and one that I use is in my ThinkorSwim platform. It'll basically say that based on past performance, this option has xx% chance of expiring worthless, which is what we want when selling spreads.

Hope that helps a little bit....

Chris

-

Yea, thats they I used to be...now after this past week, I'm sticking with what I've got cause it works. I may have only pulled 10 points off a major swingy day, but little steps for me right now getting back on my feet.

-

HAHA! Will do

-

No worries on the off topic-ness! For a notebook, get a new MacBook. Those things are just like 1099 and will seriously last forever. They are like a wallet. So thin and so sexy. You could even get a black one (but those are 1499....). That's what I want to get next.

-

Well, today I experienced what feels like one of the biggest breakthroughs I've had in a LONG time. I was chatting with MrPaul so I owe it to you for showing me some things. First, why did I need the breakthrough? My losing streak was too big! Something wasn't right. What had changed? Had the market changed? Well....not really. It still ebbs and flows. It's been a little weird lately, but not enough for my setups to never work. Paul asked me why I didn't think they were working? Was there something that was making me hesitate? Or something taking my focus away? I thought...I've been trying to learn the tape. I'd been trying to base my trades on watching the tape go by, and since I haven't learned that at all and was trying to base trades on it, my losses were stacking up.

So, the point to all this is when you're adding something new to the mix for yourself, do your hard work and really understand what you're looking at before you make trades based on that new information. Without the full understanding of it all, one may be making mistakes. I did, and it cost me a bit. More mental frustration than anything. BUT, I've got my head back on straight and I'm ready to take the market back on tomorrow!!

-

Ah! Yes, but with the intel mac, you don't need to worry. You can use all the PC progs you want. And you'll have a machine that will last you 5 times longer

Rollover day is on Thursday 7th December 2006

in E-mini Futures

Posted

Yea, I'm kinda confused too...I don't have good pivots from yesterday.