Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

1444 -

Joined

-

Last visited

Posts posted by TinGull

-

-

I just got into the last chapter of Trading in the Zone and Mark said something that I absolutely loved!

"[Trading] is simple, but it's certainly not easy."

Just thought I'd share, because its so true. The game certainly is simple. You push a button after you've done your analysis. The trade either works or it doesn't. Easy? Nope, it ain't easy. We all have struggles with our minds and the market. But, it is simple!

-

I'll try one

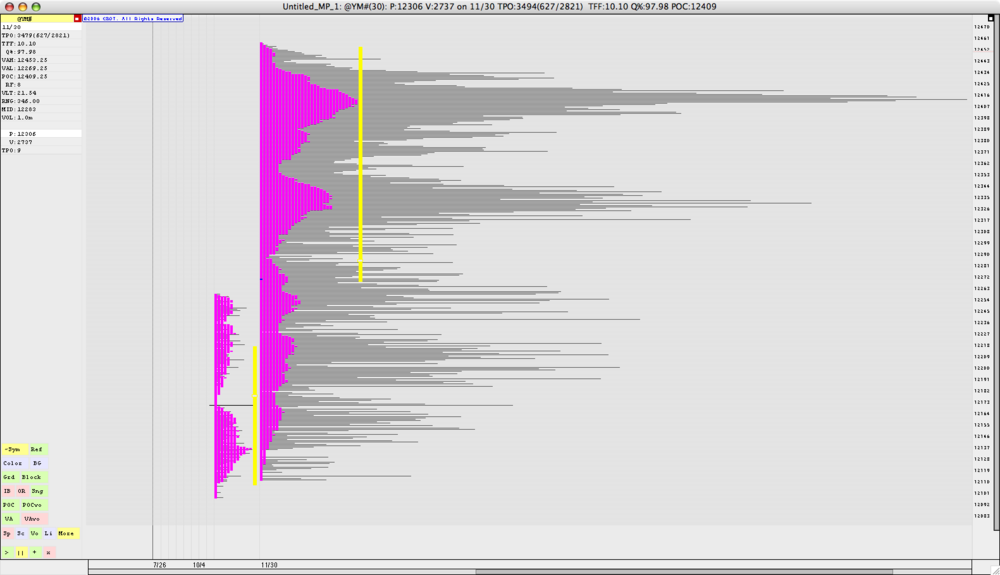

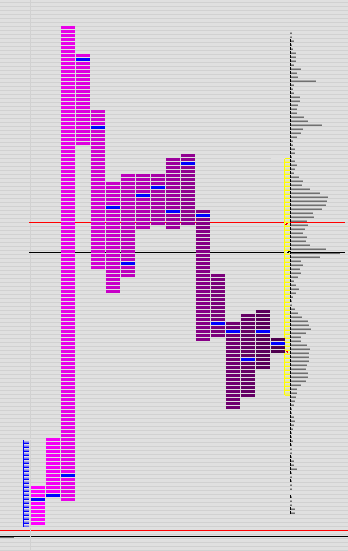

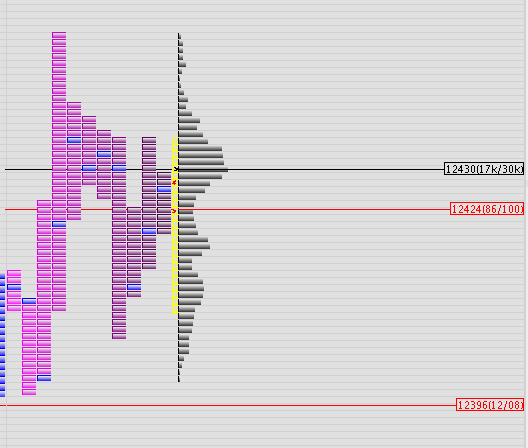

Here's the volume for the past 10 days on the continuous YM symbol. Now, keep in mind the last few days have been on the new contract, so it's a little skewed, but you can see how things are developing.

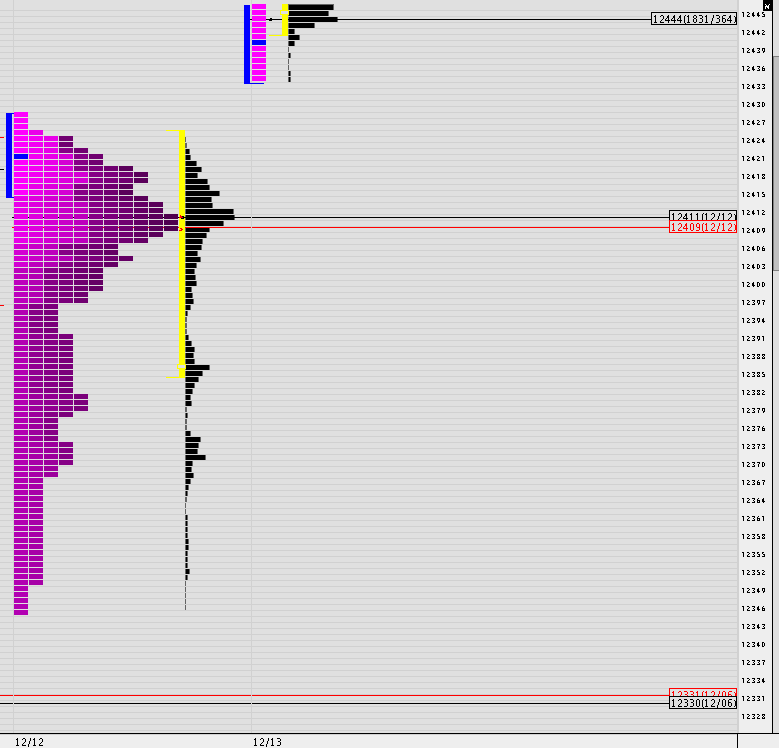

12412 is a the highest volume area. Lots of traffic there. Where there is lots of volume or little volume, expect those to be area that have a high probability of a turnaround. 409 also happens to the POC for today...So we'll be looking for a retracement down there.

12355-65 area was showing very little traffic. IF we were to get there, I'd look for a reversal there. Price has been rejected there. Why? Who knows...it just was.

For today, I'll be looking to buy a retracement to 425 area which is the VAH. Things are VERY strong premarket, and so far it's looking like the gap could hold. So, I'm looking for a small deflation of price to value of yesterday, and we should reject that to find a new value in the markets, higher than yesterday.

-

Looking at what TS uses versus what I use (InvestorR/T) the language in TS is much easier to code with.

-

yup, same here

-

A good friend of mine, one of the most intelligent individuals I know helped me with some issues I recently had with my trading.Aww, Paul! Thanks for thinking I'm smart ! JK HAHA!

This is a really nice exericise. I did a similar thing when I began my sales gig a couple years back and writing all of that down and looking at it every weekend to reflect really was a huge help.

-

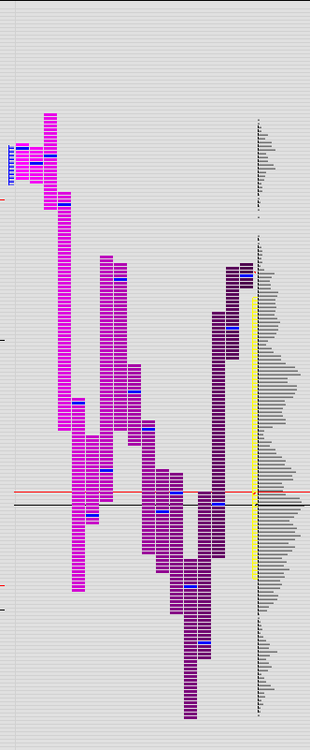

Also, in the screenshots, the IB is the blue area at the left of the first round of TPO's. Sometimes there's a little fakeout, but if you do get faked out, so far it's looking like the other direction will provide you with more than enough to make up for the fakeout loss.

-

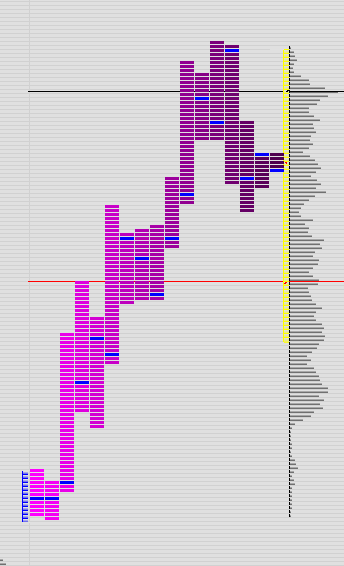

I want to start a little discussion about the initial balance on MP. I've been noticing lately some patterns that are very interesting to me, and I wanted to get some other folks thoughts on it all.

So what is the initial balance? Its the range of trading over the first hour of the session. My sessions I have starting at 8:30am and closing at 5:01 for the YM. What I've been noticing is the size of the IB range and the explosiveness of the day. Also, the move to the outside of the IB range can have it's explosiveness told by the size of the IB usually. I know MrPaul trades with respect to an initial balance, though I don't know for sure his trading strategy with it.

So, here's a couple charts I wanted to post up over the last few days. It's interesting stuff and I think definitely warrants a discussion.

I'll post a series of pics, each of a different MP chart from the past 10 days or so of the YM. The IB lasts from 8:30 to 9:30 AM EST. This is very similar to Rauls Morning Breeze strategy, in that it's a kind of bracket strategy.

-

Yea, with 420 being VAH and the PP on my charts...we'll see if it breaks, and I'll be in on the retracement

-

My continuous charts I'm not trusting until next monday. I just use the actual symbol for the March contract right now, and then when the expiration is overwith I'll move back to charts with the continuous symbol. My @YM charts show a HUGE gap up on last thursday in the middle of the morning session. But, they don't show things that high. Maybe you got some future charts!!!!

-

James, you're numbers a quite a bit different from mine. On my YMH7 charts I don't see it ever breaching 500... and I know the Z6 charts never did...

-

Hey Robert! No worries, we'll get you the answer

I the charts I have setup for myself on the YM are from 7:30-16:15 CST. It's always given me a clear picture of the pivots and the Market Profile pivots as well.

I the charts I have setup for myself on the YM are from 7:30-16:15 CST. It's always given me a clear picture of the pivots and the Market Profile pivots as well. Welcome to the boards!

Chris

-

I feel exactly the same for the big lesson I learned. I was taught by the market to just go with the flow for not only trading, but even more so in life.

-

And ThinkOrSwim is going to be implementing that soon, as well.

I think it sounds awesome!

I think it sounds awesome! -

50 billion!!!! For me, I'm lucky to make 3. Its not 'cause I'm so picky, but more so because I hesitate. I'm working on it though...

-

Like meditation, right? I'm starting to finally realize that there is a HUGE wall inside my mind that is preventing me from moving forward. I am trying to figure out what this wall is and why it's there so I can bust that baby down.

-

Thanks Kiwi!

-

Wow..I just spent the last 10 minutes re-reading that post....and I thought rollover day was confusing!!!

-

At least today is overwith...hopefully tomorrow will bring a nice day to trade. I'm soooo sick of the sideways!

-

Interesting, I'll certainly give that a try. I'm more so looking for things to perhaps practice outside of trading itself. Maybe things I can use in my regular life

Thanks Kiwi!

-

Hi there,

Wondering how I could practice my focus? I see great things when I look at a chart as it's happening, but for whatever reason I'm not paying attention to a setup as it's happening as best as I'd like. I'm seeming to be looking for one particular setup, and all else is being blocked, while other great setups happen. Just curious what you folks do to practice your focus?

THANKS!

-

Hahahaha!!!!

-

HAHAH!! True, very true!

-

Carmel? Or Kettle Corn?

-

Just noticed the volume on the new contract...its still wayyyyyy less than the current Z contract. If this doesn't change, I'll trade the "old" contract for today.

Best stats for tracking progress?

in Technical Analysis

Posted

Kiwi, I love it! The one thing I've been trying to make myself do is concentrate solely on the setups and making those as perfect as they can be, and then believing that the money will come along later. I completely agree with grading the setups and looking at you P/L later on down the road (weekly).