Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

AbeSmith

-

Content Count

619 -

Joined

-

Last visited

Posts posted by AbeSmith

-

-

Hello. Yesterday on Bloomberg TV or CNBC a guest was talking about China being more immune to the global economic slowdown. Here is an article about China stock market rising due to new economic data that came out Thursay:

http://www.chron.com/disp/story.mpl/ap/fn/5482567.html

There is a chance that a fed rate cut will stimulate the global economy, if only in the short term. If that is the case then I think China would yield the higher return. The FXI is an ETF that follows the Chinese market closely.

You can see a blue line around 147 designating the resistance that was broken and now price has come back down towards the resistance and closed at that area. A good swing trade might be to buy it here. You can place your stop just below the main low around 134, or might want to do a tighter stop and just test price action on the retest of this s/r level at 147. I'm already long FXI from 150, with a stop just below the low at 134. But I might move the stop a bit higher. Not sure.

Anyways, I'm not sure about this setup. If you are new to the site you should know that I'm new to trading so be careful.

Would welcome any comments about this setup. Do you think market will stay above the main low that was formed at 1/22 ahead of the Fed meeting? That is my guess. Do you think Fed will cut rates significantly and cause a rallie? I'm not sure. Do you think this trade is too risky?

-

24 hour currency markets is a red herring. There are only certain times a day that a small trader should be trading. Assume you trade a currency against the U.S. dollar. This is of course the main way currencies are traded. In fact, if you trade two currencies where one is not the dollar, it is called a CROSS rate. Think the dollar is important. Well if it is, then times when the U.S. treasury market is open and the U.S. stock market (NYSE) are open must be too. Right away you can see that trading the GBP/USD pair after 1700 (5pm est.) starts to make less sense.Now you need to add in the type of brokerage firm you are trading with. Even though your firm may "sell" the point of the 24 hr market, many of their clients may trade during more traditional trading hours. Since your trade is either matched against another client or the broker themselves this matters. The fewer people trading on your brokers platform (no centralized exchange) the worse the fills, and the less trending the moves tend to be. Speaking of trends, the high propensity for currencies to trend is their greatest asset for traders.

The other thing that is sort of misleading is the no commission hype. Yes there is a cost to trading and it is called the spread. Some futures brokers charge less than $10.00 a round turn. In the forex you are doing good at 2 pip spread: 2*$10.00= $20.00 (euro).

If you want to trade forex:

1. Think about a broker that not taking the otherside of the trade.

2. Think about the time you will be trading.** The best time starts at 0200 hrs EST. (which is the London open) and goes to 1200 Est. Unless it is a Fed Day, and then the market can be active until after 1500 (fed announcement at 1400).

3. If you live in the Western part of the U.S. these are less than ideal hours for many. Especially those with families. Then again, it might be worse if you live on the East Coast. But either way, don't think you can come home from a 9-5 and trade after dinner and before Lost starts.

4. Currencies trend. Certainly some try and scalp but a more trend catching approach works better.

5. No centralized exchange. Thus it is hard to the most important data: Volume. The fact that volume is so hard to get in this market, should tell you of its importance: the big boys don't want poeple knowing what they are doing. And with volume, it can be seen. (some brokers offer tick volume and it can be used. Esingal does offer volume based on a certain number of banks. But if you use many broker provided platforms you will not get volume.)

Thanks PivotProfiler. Good info.

-

I traded 6E in the past, very little volume. It may moved like EURUSD but the volume is a concern. EC is not but it's too big for what Abe is looking for (12.5$/tick). With FX, you can go at micro-lot ($10K) with a cent per tick. I think anyone can trade this lots as a substitute to paper trading. We're talking super peanuts here, can't get that with e-minis. I think anyone can afford trading with so little risk involved to test out the market.Anyway, wish you luck with your research Abe.

If you live in the West Coast it's not so bad since London opens around midnight, if you can spare 1-2 hours after that, this where most of the moves and volume take place. East Coast, it's no question the hours are hideous if you're working fulltime during the day. But if you swing trade them, there's no sense in sitting in and watch it tick, place your orders and you're done. Trends are seen more than eminis imo.Just to give you an idea, take a look at this chart. It's been going since last night. Globex don't trend like this, everything dies at globex except in times of crisis. it's almost 500 pips already in a nice trend. Doesn't happen alot but trends tend to be smoother.Thanks Torero. Good to know.

-

Interesting charts Abe. I guess the questions to ask yourself are:1) Do I trade trending markets better over range bound markets?

2) Does FX actually trend as much as I think it does? In other words, have you done some serious, in-depth research or just cherry picking nice looking charts?

3) How do non-trending FX days compare to the indexes?

I agree with the suggestion to trade the EC/6E on the CME. It's a currency based futures contract so you get the best of both worlds in my opinion. Not huge volume there, but again, I have to wonder how much is needed in the beginning.

Well Brownsfan, I'm by no means cherry picking nice looking charts. I'm new to Forex and this is my observation of EURUSD. So I don't know the answer to all these questions, but they are valid questions which I will be finding out about.

-

Just to throw this thought out there...I am NOT sure about this statistically, but they both seem very similar if you look back over time. There are days in January where the ES trended down much nicer than the GBPUSD (on the same day). FX also has a tendency to skip levels at times with news announcements and create congestion zones for the rest of the day. If you are trend trading it just depends on what levels and timeframes are currently being hit (where Market Profile steps in). I do think both are VERY tradable. In my opinion the factors that will determine which is best include such things as capital, hours you can trade, and strategy.

Thanks Hlm. Good points.

-

Hello again. Here is an article related to EURUSD. It says that fears of a European rate cut have reduced following some comments by their Fed. So market seems to be bullish on EURUSD. Also, the US Fed meeting is coming up before the Euro fed meeting. The US is Fed rate announcement is scheduled for Jan 30, while the ECB announcement is scheduled for Feb. 7th. I got stopped out on my swing trade, but might be looking to find and entry again for the swing trade. Then if price continues to rise I might sell some ahead of the EUR fed meeting.

FOREX-Euro bounces back as rate cut hopes ease

By Ian Chua

LONDON, Jan 24 (Reuters) - The euro strengthened against the dollar and yen on Thursday after tough talk on inflation from European Central Bank policymaker Axel Weber dampened expectations of a possible near-term interest rate cut.

The yen retreated on the back of the bounce in the euro and as European stocks extended their rally, after earlier gaining on lingering concerns over the health of the global economy.

"For the time being, the ECB are maintaining a very hawkish line so no signs of any rate cut any time soon," said Chris Turner, head of FX strategy at ING.

"You're then left with sharply lower U.S. rates, stable European rates and with equities doing quite well at the moment ... the market is just going to focus on the dollar bearish story."

Weber said the U.S. Federal Reserve's surprise decision to cut interest rates by 75 basis points this week hasn't shifted the ECB focus on euro zone inflation, dampening mounting expectations that it too will have to cut rates soon.

The euro climbed 0.3 percent to $1.4683 by 1206 GMT and was also up 0.3 percent

versus the Japanese currency at 156.60 yen , well above an early low of 154.86 yen.

The dollar was steady against the Japanese currency at 106.65 yen , off early lows.

Higher-yielding currencies such as the New Zealand also benefited, gaining 0.6 percent to $0.7715 .

The euro had come under selling pressure in recent weeks as signs emerge that weakness in the U.S. economy is having a knock-on effect on the euro zone, fuelling the argument for a rate cut by the European Central Bank.

Some of those concerns also eased slightly after German corporate sentiment unexpectedly rose in January, bolstering policymakers' assertion that the euro zone economy can withstand turmoil in financial markets. [iD:nL24345341].

CHANGING LANDSCAPE

The turnaround in the euro helped reverse earlier demand for the low-yielding yen when investors remained worried about the U.S. economy despite Wall Street's positive performance overnight.

Optimism about a U.S. government plan to rescue ailing bond insurers, which could prevent investors from being forced to sell billions of dollars of bonds the insurers had covered, sparked a comeback in stocks, but was greeted initially with scepticism in the currency markets.

The FTSEurofirst 300 <.FTEU3> index of top European shares jumped 5 percent. (Editing by Ron Askew) ((ian.chua@reuters.com; +44 207 542 1028; Reuters Messaging: ian.chua.reuters.com@reuters.net))

-

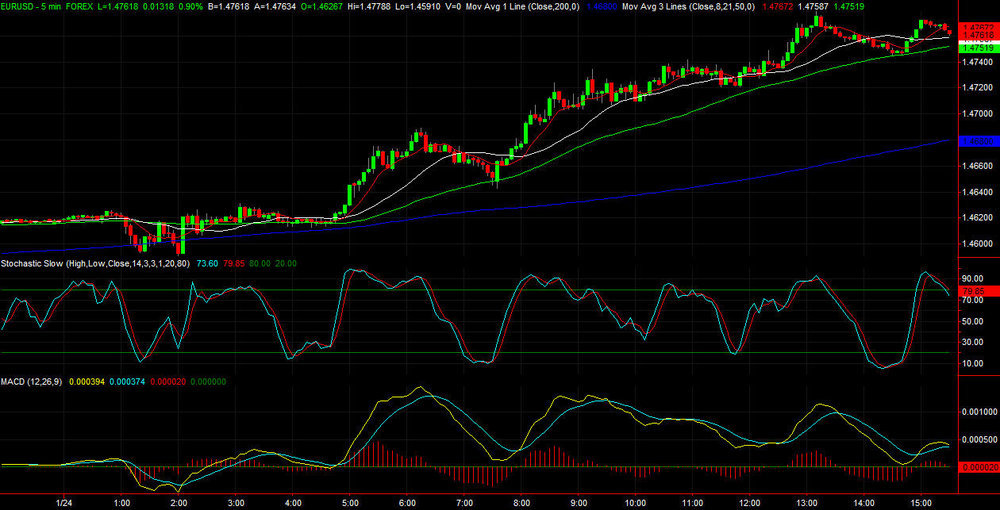

Tor - thanks for sharing! I'd love to see some charts for comparison purposes. Just wondering how some fx charts compare to the e-minis. I personally would like to see 5 minute charts. Or is there a good site to get past charts as well?Brownsfan, here is the 5 minute chart of EURUSD and YM today, in that order:

As you can see, EURUSD was orderly today. Followed support and resistence very well, and lacks in the eratic movement one sees in the YM.

Now look at YM. Like something out of the wild west.

I'm not saying one is better than the other for you. You seem to be comfortable with eminies. Anyways, here is the charts you were curious about.

-

AbeSMITHIf you really want to get into currency, why not opt out for currency futures (CME), a highly regulated market and the moves are similar to the forex market, except you can employ the traditional trading platform (DOM) to execute your trades with a reputable brokerage like infinity brokers:thumbs up:, you know the commissions, you know the spread, hassle free administration.:thumbs up:

Thanks monad. I will surely look into it.

-

Abe, check out out EFX, MBTrading, Oanda. Also read this forum thoroughly to understand the issues involved: nondealingdesk.com. I traded with MBTrading for 2 years and haven't had problems so far. Only last few days, I've gotten delayed quotes (not sure if it has to due with unusual volume in the markets).Ok. Thanks Torero. I will look into those.

-

Hi Abe - sorry for my scaremongering post! Let me admit a bias, I am with BF on favouring eminis...There are two types of brokers in FX, the market makers and the ECNs. The market makers are where the customers trade against the MM (notwithstanding that the MM may well hedge customer trades so neutralising this effect somewhat), the MM provides the liquidity but the risk (well, one of the risks!) the customer runs is the MM triggering stops etc. and generally behaving like a bucket shop. Having said this I think some of the MMs are getting better, realising that they can make money from a customer in the long-term as well as the short-term, so behaving less like a bucket shop. I think the improvement is also coming from some tighter application of regulations especially in the US. This makes MM brokers located in the US probably the best. Also, avoid any MM broker with 666 in the phone number :haha:

The other type of retail FX broker in the one that customers are shown prices coming from banks and the deals are routed through to the banks. These are the brokers that use ECNs - article here is a good run down but it might be a little dated so check the named brokers (and there some others not named here too). These types of brokers usually charge some sort of commission (better way of saying that is the commission is usually visible, not hidden in the spread) and their spreads can be a little wider than the MMs at times (an MM can provide an extremely tight spread if they know which way your coming from

... anyway a spread is sometimes irrelevant, you're only looking for one side of it right?

... anyway a spread is sometimes irrelevant, you're only looking for one side of it right?I don't know anything about IB sorry...

Have you been to the website Forex Factory? I think its a really good FX site, probably the best I have seen. I use their economic calendar even though I don't trade FX ... FX people generally seem to value good economic analysis/info.

Ok. Thanks Mister Ed.

-

Abe - I am all for FX trading, you just need to know about some of the less pleasant aspects of it before going all-in.This article I took from here - post number 3 - well worth reading and thinking through.

---------------------------------------------------------------------

Hi Tom,

Quote:

hmmm...let me think about this...what is my commission? (yes, Virginia there really is commission in forex...it's disguised as the spread and the extra commission we do not see is the altering of the price that your broker shows you....)...assume a 4 pip spread

OK....I risk $400 to make $1600...wow! but...but...my fee on the

sale is $4 x 100 when I sell short & then $4 x 100 when I buy to cover

so...it seems I have just paid 1/2 of my profits to the broker.

what am I missing here? does this make sense?

Yeah, it makes sense to me.... It's called getting RIPPED-OFF!!! The reason most people like Forex is because these jackass brokers tell people they can get started with as little as $500 and open up an account... this is insanity... do the math: 2% on $500 = $10 bucks... what trade are you going to find that carries a $10.00 risk??? Hell, the pip spread 2-3 pips which is $20. $30 dollars... Anytime I see brokers doing this I just light them up on the spot, because they know damn well people are not going to make any money and they are just ripping people off left and right.... it's pathetic!!! I don't blame the innocent people for this (because they don't know any better), this is why they need to regulate Forex.

Joe Ross wrote an excellent piece on Forex in 2005 (and it fully warns people about the stupid games the brokers and banks play on retail traders)... this is why you can't trade Forex on 60-minute or less time frames... they will clean you out. Since 2003 I have watched people try to day trade forex and it's not pretty...have you noticed how the Forex "hype" has slowed down? Here's why?

Brokers can deceive you about there being no commissions. $30 minimum/round turn (called the spread) is in reality a commission that eats up your capital at an astonishing rate. Even winning traders lose money and end up with negative results because of this outlandish overhead. Trading futures, you should never have to pay a broker more than $10/round turn, and usually quite a bit less than that.

Guaranteed fills. True but… The only way a broker can guarantee fills is for the broker to become the buyer or seller of last resort. That means the broker is running a bucket shop. All forex brokers are the buyer and seller of last resort.

Brokers do not all tell the truth about volume. They show the volume for all forex trading, which doesn't even come close to the volume they truly have at their own brokerage, which is where you are trading. Volume in currency futures is considerably higher than the volume traded at any single forex broker, often greater by a factor of ten.

Leaning. Brokers say they are charging you a 3 pip spread to trade the popular currency pairs. But in reality a broker may be making as much or more than 10 pips on your trades. He does this by skewing prices. Since you are not trading at an exchange, the broker can feed you any price he wants to feed you. He can buy at the bank for perhaps 7 pips less than he sells to you. He then charges you 3 pips for the privilege of being ripped off for a total of 10 pips.

Unregulated. Forex may sound like an exchange but it isn't. It exists entirely in cyberspace with every broker and every bank having different prices for any particular currency. There is little or no regulation, even for brokers who register with the CFTC and the NFA. Forex brokers do not have to mark to market each day as do futures brokers. If your forex broker files for bankruptcy or absconds with your money you have zero recourse.

No guarantee. If a forex broker does go out of business, you could lose all your money. There are no guarantees and no one standing behind it. Futures brokers are required to mark to market at the end of every session every day. They have to put up cash to cover every open trade on their books. Futures brokers have gone broke, but no futures customer has ever lost one cent of the money in his trading account because of a failed broker. Nor have they had to wait for their money. It is immediately available.

You can get exactly the same action in the euro fx futures as you get in the "Euro" forex. Commissions are as low as one tenth per round turn depending on volume, through a regulated broker, trading electronically at an exchange where you know the true price of the currency.

What is the true price? A forex broker can only give you the price of a currency as quoted to him by the bank through which he trades. Banks have differing prices for a currency. You never know what the real price is because there is no central exchange through which all prices flow. Besides not knowing the true price from the bank, you can also be deceived by "leaning" or "skewing" of the real price at the bank. Forex brokers commonly lean the prices.

Forex brokers are not necessarily truthful. They lure people in with hype and false advertising: "No commissions!" "Guaranteed fills." "24 hour trading:" Who in their right mind is going to trade in the middle of the night unless they have a special need. While it is true that total forex volume is greater than in the futures, futures, volume at the exchange is greater than the volume at your broker for the most popularly traded currencies. The only place where the liquidity differential matters is in currencies like the Mexican peso, the Brazilian real, and somebody's drachma. Those thinly traded currencies may be more liquid in forex. But if you trade anything but the few most liquid and popular currencies, you are going to be paying at least 5 pips, and often more. Unless you have a particular commercial need to deal in Polish zlotys, Indian rupees, or some other thinly traded currency, you don't need forex.

You are told by forex brokers that there is little or no stop running. This is one of their biggest and boldest fabrications. The truth is there is far more stop running in forex than in futures, and possibly as much stop running as in the stock market. I have friends who work in forex as well as many traders who of necessity have to trade forex. One of my students is a market maker in forex. These are people who should know, but in case you don't want to believe me or them, simple observation of forex trading will reveal the vast amount of stop running that takes place there. Who is it that runs the stops? Why it is your friendly forex broker. The broker has a vested interest in seeing to it that your orders are filled. Stop running is nothing more than order filling. The broker sees to it that everybody's order gets filled.

Probably you have heard that if you are winning regularly in forex, you may be barred from trading. Is this true? Yes it is. The fact that it is true is just another proof that when you trade forex you are trading at a bucket shop. In the book, "Reminiscences of a Stock Operator," we are told that Jesse Livermore was banned from trading at certain stock brokers because they couldn't stand him beating the house. The same thing is true with many forex brokers. Since they are the ones guaranteeing you a fill, they are in effect the buyer and seller of last resort. The truth is that most forex brokers have precious little liquidity at their firms. In order to give you the impression that there is liquidity, it is the broker who gives you your fill. It is the broker who does the stop running that supposedly doesn't exist in forex. But if you are regularly beating the socks off the broker, he will ban you from trading at his firm.

Now you know the truth about forex. I challenge any and all forex brokers to prove that I am wrong. I will change or remove anything proven to be untrue in what I stated above.

THere is nothing wrong with FOREX on longer term charts, but don't try and trade it intraday or you will expeience all the problems above. This means trade Forex on a 60 minute or higher time frame.

---------------------------------------------------------------------

Don't get me wrong Abe - FX is OK, but what is written above is accurate and you need to be very careful. Unregulated does not just mean the price can move without limits, it also means that when you ask for a price the price is what the broker you are dealing with wants it to be.

There are, or course, reputable brokers, but try to find one that is part of an ECN, the prices will be close to the real market adn you will be dealing into a bank rather than with the broker itself as the market maker.

Thanks Mister Ed. How would you rate IB as a FX brokers, and also do you know if they do any of the evil things mentioned above? Are there any other reputable FX brokers that you might recommend? Thank.

-

Abe,

Allow me to play devil's advocate:

1) The e-mini's are virtually 24 hours as well.

Broswnfan,

With eminis, if you want to get out of a swing position afterhours, aren't there some restrictions? Like limit order only, wide spreads, less liquidity? Not sure about the restrictions but I know it is more difficult to trade.

2) That volume number is an interesting one. I wonder how much volume a small trader needs in order to be successful?

Doesn't more volume tend to cause less eratic movements? I heard that YM is more eratic than S&P because there is less volume on YM. So I assume with the high volume on Forex it is not as eratic. Watching YM and Forex closely on an intraday basis the past few days I have noticed that YM was alot more eratic.

3) We could find charts showing less/more volatility at certain times. Personally, I thrive on volatility so that works for me but I can see what you are saying here.

4) Same with the e-mini's. YOU control the leverage being employed.

With emini's though the control is not as much, both in terms of amount of leverage I think and fluidness or exactness of how much you want to risk. In YM, each contract is a big chunk, with one tick moving as much as $5 in the YM. But with Forex you can more closely control how much you want to risk. For me 1 YM contract is often too much. So I'm often finding myself getting stopped out in the YM volitility, partly because I don't want to risk the money for a wider stop.

5) You may not hear about servers going down b/c there is no centralized place to trade forex! You are trading against the broker! It's all on the broker's servers!

6) I would agree here but I've also read how certain types of 'bucket shops' will go stop hunting and since there is no centralized price center, there's not much you can do if Company A shows price there even though Company B does not...

And as you said, there is next to zero regulation here. That alone is enough for me to stay away. When there is no regulation, that only helps the BIG boys. Lack of regulation only hurts the small, retail trader.

I would like to see more regulation to keep them honest. But Brownsfan, don't be so quick to shun Forex. There must be some good Forex brokers out there that are not bucket shops. IB I hear is ok in that sense. A talented trader like you might do well in Forex.

I'll be interested to see how your forex trading goes Abe but I would guess if you go through a 'stop hunting' time period or the spread being outrageous during econ news, you may reconsider. And make sure you do your homework on what broker to go through!

I need to do more research about Forex.

Good luck Abe.

Thanks.

-

Thanks Paul. I just would like to add a list of pros and cons of Forex and YM. Ofcourse the Pros and Cons may not apply to everyone, but for me it seems that:

1. Forex is 24hrs, live. That means that there is no premarket and postmarket restrictions.

2. Forex has more volume.

3. Less volatile.

4. And is very flexible as far as how much money you want to risk. Can be highly leveraged, or low leverage.

5. I'm not sure how reliable the Forex trading is, but I have not heard about Forex servers going down.

6. I have not heard about Forex trading being closed because it was going down too much in value.

Now, I would be interested to know the disadvatages of Forex. One disadvantage I know of is that it is not very regulated. But if regulated means closing down trading because it is going too far in one direction then that may not be good however.

-

Hello. I would like to say that I'm a "traitor." I have been betting against the US Dollar and have been doing ok. I'm also considering "betraying" the YM and moving to Forex. Forex is open 24 hrs, and it is more flexible to control how much you want to risk. But with YM, for a small time beginner trader like me, it is too expensive, even with 1 contract, and very volatile. And now there is a $55 a month charge for the YM data at TS.

So I find it fitting to change my avatar to Benedict Arnold. He is recognized as a traitor, and phonetically that is like trader.

-

Great narrantion, Abe! Here's rooting for you! You caught on right. Stay with the trade, just move up the stop loss as it marks new higher lows (on whatever timeframe you're trading at). That way, you'll make your way your breakeven and then to your profits and also giving it room to move up. Good luck!Thanks Torero. I'm watching this one closely. It was very exciting.

-

-

OMG. My first Forex trade!!! I woke up today without the alarm. Said to myself today I will not set the alarm. I will wake up whenever I feel like it. I woke up aroud 8CT, and by the time I did my morning routine 10 minutes before the open I found out that the fed had cut rates 3/4 point, Emergency cut. So I said to myself, wow. I looked at the forex and my first thought was, when did the cut happen. Looking at the spike on the chart I assumed it was around 7:25CT. Then I noticed the classic 1-2-3 pattern often when there is a fed cut. 1 is the initial spike. 2 is a retracement. And 3 is the second rally. I noticed we were in the 2 range, and price was consolidating. Then I decided to calculate how much to risk and where to place my stop. Since I was looking at the daily chart I had a swing trade in mind. So decided that with the stop at 1.43 I could risk a little over 1K if I buy 50,000 euros. So then I entered into my IB TWS account and first I noticed that there were 2 choices, Ideal and Ideal pro. So I did some reserach online and found that Ideal pro was the one to go with. Then I placed the order for 50,000 Euros at 8:40CT, hit transmit, and BAM, the DING sounded and almost instantly my TWS spreadsheet showed a -505 loss in realized P/L, with the trade closed!!!!! The portfolio section also showed no signs of a trade. But the trades section only showed the buy! And the account section was showing the trade active with the P/L changing. OMG. So I called IB, was placed on hold. Normally I would panick and get upset, but from prior experience I knew that the most important thing was to remain calm. I theorized that perhaps I was overleveraged and IB closed out the trade. But that didn't make much sense because I had 10K in my account. But suffice it to say that I do not like to read instruction manuals and so do not know what the leverage is. This got me in trouble once with a GOOG swing trade. So I was on hold for several minutes and right when the IB representative answered the phone, I mean right at that exact moment, the TWS spreadsheet erased the -505 loss closed out trade and showed an active EURUSD trade.

So now the trade is active. My stop is at 1.43. But I'm considering what to do with it. Tighten the stop to break even perhaps. Take some profit at 1.48. Fed might continue to cut rates in the next meeting.

Anyways, the lesson I learned is, don't panick. Don't loose your temper. It will make the situation worse. This time I didn't panick or lose my temper.

-

-

Ok guys and gals. The EURUSD is starting to look interesting on the long side. Stochastic is heading towards oversold. Smaller red candle on the 17th pointing to slowing down in direction. Also, reverse head and shoulders pattern. And fed rate cut helps to make it go up, right. Perhaps we'll get a surprise rate cut, like 1 basis point. That would make it go up? Anyways, still to early to enter at this point. But just wanted to point it out and see if anyone had any input. Probably best to wait for it to bottom and after it shows signs of reversal, perhaps 2 days of green then go long.

-

The problem with targeting the 1.5 level is that if EUR/USD = 1.5 then USD/EUR = .666! It's not surprising price backed away from that level. Who knows if it will ever get there. You're entering the trend very late.Ah yes, the good old 666.

-

TS has excellent charting, and for 10 roundtrips per month you get it for free. But the YM data is $55, and the order execution is slow.

I spoke to a TS representative some weeks ago and he said very soon they will have a demo version of TS. That was my biggest complaint about TS, is that they provided no demo. I lost some money on account of that. But if that is fixed then the next biggest complain is poor execution. Infinity is the way to go with that, and also IB. Though customer service at IB is the worse I have encountered.

-

The Bear. http://movies.yahoo.com/movie/1802837661/info

Very nice and touching movie. Saw it last night.

-

Yeah, this thing is first Chinese stock that has been added to the nasdaq 100. Wow. It sucks you missed it, but there will be other trades.Yeah. It sucked big time. Maybe next time I can find a good stock to trade, and actually trade it.

-

Chinese Google!! Please tell me you picked this one up? I watched this thing for a while. Just need to be very careful because the range on this stock is crazy. Depending on how the markets act from here this thing may see some more upside. Either way good luck man.No. Missed this one. Thanks.

Eurusd 1.50000

in Forex

Posted · Edited by AbeSmith

Hello. Today EURUSD came down. I bought some at 1.46732 (represented by arrow in chart) and place the stop at 1.45560 (blue horizontal line). Might add some more if it gets close to support around 1.45800. Basically we had a breakout of that pivot and now it is coming down and might be retesting it. There seems to be a guantlet of support here, visible both on the daily and 60 minutes. Technically I'm comfortable with the play. Fundamentally I haven't seen anything to make me want to change my stance.