Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

373 -

Joined

-

Last visited

Posts posted by MrPaul

-

-

Are you interesting in next day direction (Up|Down) forecast?Small introduction:

I'm financial analyst. Last 8 month I'm try to construct market direction forecast based on fundamental information. At this time I have one model for MSFT (Microsoft).This model have accuracy nearly 87-92%. This model don't construct for prediction price, it's not possible. I want to know,if this information is valuable for traders? Next step in this research i want to collect a list of market instruments for analyse based on your preference (near 3-5 symbols). For trial period (near month) i want to publish forecast on this forum. I will be very grateful to administration of this web site for help in organization of this experiment. You can post your ideas,wish for forecast and market symbols in this threat.

Thank you!

PS: Sorry for my bad English.

To be completely honest here. A directional bias based on fundamental information that has only been tested on a few stocks for about 20 days isn't going to get very far.

You're going to need at least 100-120 days of reliable data to impress anyone. 20 trading days could be just to close to randomness imo.

Good luck though!

-

Hello. Does anyone have recommendations about a good investment for 10k for about 10 months? I'm interested in mostly low risk. But would also be interested to entertain some medium risk investments. -

Welcome to the site.

Post away!

-

My recommendation would be to never EVER place a stop above a non market generated pivot level. Projected Support and resistance like R1 and S2 are just that, projected.

Until a market CREATES a previous swing high/low it doesn't take much effort (money) for the level to be touched.

I highlighted in blue where a more proper stop could have been placed. In red are others throughout the day if you were trading to the downside.

Professional operators will not put capital to work unless they see an opportunity or have an objective to fulfill, keep this is mind when looking for places to put stops.

Stops places a couple ticks above/below a prior swing high or low, above a consolidation area or just below.above a retracement are ideal.

In my opinion stops placed above below projected support or resistance such as pivot calculations, fibbonacci levels, market profile value areas, etc. etc. are less than ideal.

-

Searching Google for "Trading on Volume ebook" results in this as the first result...

Free Ebooks on Volume Analysis - Traders Laboratory - Active ...

Hello, I'm searching for free e-book versions of the following books written on Volume :- 1) Profits in Volume and 2) Trading on Volume. It will be.

http://www.traderslaboratory.com/forums/f30/free-ebooks-on-volume-analysis-2702.html - 37k -

lol

-

Thanks Brownsfan!

-

My background is primarily in software development and management consulting and I'm looking to make a career shift into trading. I've spent the last few months studying for the CMT, but I've yet to meet a trader that has heard of it (mta.org if you are curious). I learned a lot in the beginning, but I'm starting to feel a diminished return on my time. Does this credential carry any weight?What can I do to make myself attractive to a prop firm and get tied into the trading community better?

What exactly is your objective? Just to make yourself attractive to a prop firm? the CMT imo means less than series 7 and a solid track record, but im sure opinions will differ.

-

lol ....."They had more MM's, Oreos and Grape Soda then garage sale items." :o

-

Show Off !!

All us married men think.........Yeh those were the days.

lmao, I needed a good laugh.

-

Welcome to the site!

-

I believe the Chandelier Exit/Stop was first introduced by Alexander Elder in the book "come into my trading room". That may help someone looking for more information on it.

-

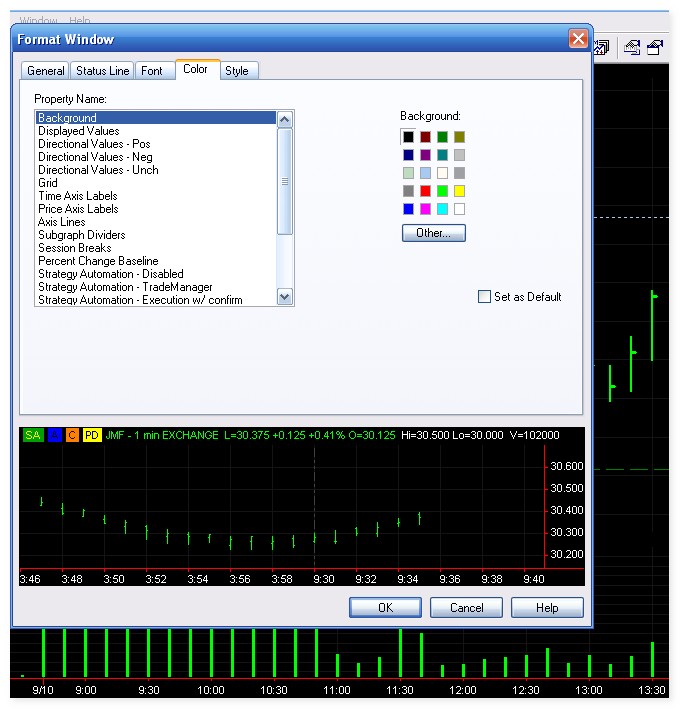

I don't know if it's of any help now but, I keep a chart saved as "print" that is formatted for printing only. All I do is change the symbol and values when needed.

-

-

what charting software is that?

-

I hear that those people who like to download torrents use

Mininova.org

Torrentspy.com

-

Good analysis, good trade! Thanks for sharing

-

I usually don't post trades on this thread but I'm leaving for the day so I thought maybe someone could glean some insight.

First red circle is where I initially sold 5. After a test of the previous swing high, there was no demand.

Second red circle is where I added another 5 after a test/stop run and additional weakness.

Yellow circle is where I exited after the downward move had exhausted itself and it was vulnerable to a pullback.

Green lines are roughly where my trailed stops were placed

Simple price/volume/pattern analysis, nothing more.

-

Liz Claman just said she was going to "...rock out with her stock out..."

Thats the biggest news on the day thus far :o

-

Thanks for the replies everyone, I'm going to get on the phone and see what's up.

As far as trading larger size on ES I have thought about this as an alternative, but my edge with the Russell is being able to read it very well and actually be positioned on the right side of those wold swings! haha.

For some reason (perhaps psychological) I have a much tougher time reading the ES, at least at the same level of proficiency.

-

I thought I might stir the pot here a little.

First off I do agree that you should read a contract, and yes you should certainly employ common sense when obtaining a loan for any amount of money BUT....

Don't you find it interesting that these lenders actually thought they would lend money to underfunded, uninformed, ill advised people and thought that because the going was great and the housing bull would carry on forever that they would win out big with their bait and switch style teaser rates?

Perhaps I'm laying it on too thick but I say "boo hoo!" You want to take a gamble at the upper end of a housing bubble/boom and then when the market closes in on itself and THAT SAME sub prime market YOU HAVE BEEN EXPLOITING collapses you want to complain?

We all know about risk/reward, supply/demand, fear/greed manias and depressions in stock and futures markets, how is this different than someone with more money than intelligence over-leveraging themselves at the top of a huge bull market?

Now I should note that I do not think that people were "victimized" or that they should be taken pity upon. My point is that in the context of lenders, that if you play with fire you run the risk of burning yourself...

-

Am I missing something? ER2 still trades on CME, o at least I do every day. The change takes place in Aug 2008 not 2007Really?

If you don;t mind my asking what broker do you use? Both that I use cannot calculate the required margin for the Russell mini on the Globex platform.

and that started on August 17th, the same date that ICE officially took over.

Here's the PDF that was emailed to me when I questioned about it:

http://www.nybot.com/news/pressReleases/files/ICEAnnouncesRussell2000Launch072507.pdf

It says August 17th 2007

-

I myself began to exclusively trade the ER2 a few months before it moved to ICE. Now that it's not on Globex I have tried trading Soybeans, YM, and ES.

In my opinion all of these contracts suck compared to the ER2. If it's not the range that's too tight (ES), it's the tick value (YM), and if it's not either of those its the slow thin trading (S).

If you mainly traded the ER2 what have you been trading lately and how are you liking it?

-

Setup 2: -7. -7.Again Abe not a bad entry, you just got taken out on a stop run. A stop order thats placed after a hammer should always be placed under the hammer until a reaction low has been formed. It would take effort (money) to run a stop below that.

-

Setup 1: -10. -10.Abe,

That actually wasn't too bad of a trade entry wise. The only thing that was of alarm to me is the huge volume on the downmove. That much volume just for a simple down bar is showing that their could be a bunch of demand included in that volume.

The next few bars show this because the makret can't make it's way down ( demand is holding firm).

This should just be something to note. healthy volume on a down move is good, showing that there is little in the way of things to stop it (like a thick floating area of bids).

Kinkos

in General Discussion

Posted

James,

Make a holographic portfolio

1.) It would be cooler than anyone else's

2.) it would save the earf

Problem solved....

:o