Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

373 -

Joined

-

Last visited

Posts posted by MrPaul

-

-

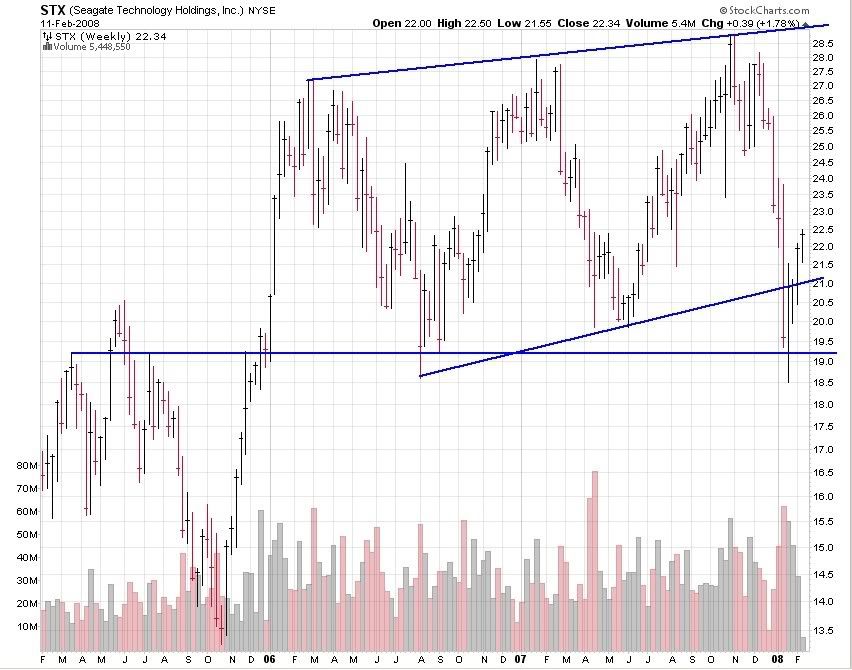

I second what Mister Ed says about taking profits near the previous highs. I think this stock has more interest to the down to sideways side than to the immediate upside at this juncture. Here is a weekly chart of STX alongside a daily chart of it's main competitor Western Digital. I also included a sector snapshot to visually display that that this isn't the most active sector in the market as of right now.

This was a nice swing trade if purchased near the swing lows...

P.S I'm surprised no one has mentioned the possibility that the large orders could have been short covering by a large entity as well...

-

Ed-Apparently PP doesn't feel the same-- here is a PM I got from him:

STOP TRYING TO SPEAK FOR ME

--------------------------------------------------------------------------

YOU AR NOT ME. USE YOUR OWN CHARTS AND OWN EXAMPLES. IF I CAN I WILL BE DELETING THE TEXTS AS WELL.

My witty reply was unable to be sent to his mailbox (full!) I'm sure with the combination of him deleting his work and sending sweet messages like this to all participants re-posting his charts, his mailbox is completely swamped with demand for answers with little supply to go around.

Go ahead and do whatever you like Sledge. Your efforts are appreciated. The individual once known as PivotProfiler needs to realize that when you post on a public forum, you make it public business!

I find it interesting that the individual known as KPCurrency on another forum which I believe is the same person as PivotProfiler has not deleted any charts from that forum. Maybe he was not able to?

-

That is the reason that after informing people of the existence of the continuation thread, moderators lock the primary (first) thread before it becomes huge. SIMPLE AND EASY.It is also helpful when the initiator or the main participants of a widely followed thread, are encouraged by moderators to keep a secondary thread with the Key methodology and a list of pointers to the most beneficial posts of the main thread. SIMPLE AND EASY when moderators actively moderate.

So Mr Paul, I for one, am requesting that this thread be closed, and that the moderators (or one of the main contributors) create the continuation thread after posting the appropriate notice.

I certainly hope that the main contributors to this thread see the reason that I am asking this action and are not in any way offended.

cheers.

Unicorn.

Unicorn,

As of 2/08/2008 your request has been considered and denied. Please direct your personal comments or concerns to TL's private message system to avoid derailing this thread (or any other) any further.

Thanks and have nice day

Paul

-

Hi Tingull (starter of the thread), or whoever moderates this thread;Is it not time to make VSA thread number 2 (the son of VSA - or whatever) ?

Why are you guys letting threads become huge monsters ?

Unicorn,

We tried that, but no one participated in the second VSA thread entitled VSA II and continued posting on this one. Therefore VSA II, the thread was scrapped.

-

I had to drop out due to the phone audio issue as well...

As far as spam is concerned I have been receiving it in email addresses that were not given out to Joel, so I think its just a wave of spammers hitting random inboxes.

Hopefully something else can pan out.

-

trying to access webinar but says waiting for organizer?

anyone else?

-

Original article:

Psychology Today: 10 Ways We Get the Odds Wrong

10 Ways We Get the Odds Wrong

Our brains are terrible at assessing modern risks. Here's how to think straight about dangers in your midst.

By: Maia Szalavitz

Is your gym locker room crawling with drug-resistant bacteria? Is the guy with the bulging backpack a suicide bomber? And what about that innocent-looking arugula: Will pesticide residue cause cancer, or do the leaves themselves harbor E. coli? But wait! Not eating enough vegetables is also potentially deadly.

These days, it seems like everything is risky, and worry itself is bad for your health. The more we learn, the less we seem to know—and if anything makes us anxious, it's uncertainty. At the same time, we're living longer, healthier lives. So why does it feel like even the lettuce is out to get us?

The human brain is exquisitely adapted to respond to risk—uncertainty about the outcome of actions. Faced with a precipice or a predator, the brain is biased to make certain decisions. Our biases reflect the choices that kept our ancestors alive. But we have yet to evolve similarly effective responses to statistics, media coverage, and fear-mongering politicians. For most of human existence, 24-hour news channels didn't exist, so we don't have cognitive shortcuts to deal with novel uncertainties.

Still, uncertainty unbalances us, pitching us into anxiety and producing an array of cognitive distortions. Even minor dilemmas like deciding whether to get a cell phone (brain cancer vs. dying on the road because you can't call for help?) can be intolerable for some people. And though emotions are themselves critical to making rational decisions, they were designed for a world in which dangers took the form of predators, not pollutants. Our emotions push us to make snap judgments that once were sensible—but may not be anymore.

I. We Fear Snakes, Not Cars

Risk and emotion are inseparable.

Fear feels like anything but a cool and detached computation of the odds. But that's precisely what it is, a lightning-fast risk assessment performed by your reptilian brain, which is ever on the lookout for danger. The amygdala flags perceptions, sends out an alarm message, and—before you have a chance to think—your system gets flooded with adrenaline. "This is the way our ancestors evaluated risk before we had statistics," says Paul Slovic, president of Decision Research. Emotions are decision-making shortcuts.

As a result of these evolved emotional algorithms, ancient threats like spiders and snakes cause fear out of proportion to the real danger they pose, while experiences that should frighten us—like fast driving—don't. Dangers like speedy motorized vehicles are newcomers on the landscape of life. The instinctive response to being approached rapidly is to freeze. In the ancestral environment, this reduced a predator's ability to see you—but that doesn't help when what's speeding toward you is a car.

II. We Fear Spectacular, Unlikely Events

Fear skews risk analysis in predictable ways.

Fear hits primitive brain areas to produce reflexive reactions before the situation is even consciously perceived. Because fear strengthens memory, catastrophes such as earthquakes, plane crashes, and terrorist incidents completely capture our attention. As a result, we overestimate the odds of dreadful but infrequent events and underestimate how risky ordinary events are. The drama and excitement of improbable events make them appear to be more common. The effect is amplified by the fact that media tend to cover what's dramatic and exciting, Slovic notes. The more we see something, the more common we think it is, even if we are watching the same footage over and over.

After 9/11, 1.4 million people changed their holiday travel plans to avoid flying. The vast majority chose to drive instead. But driving is far more dangerous than flying, and the decision to switch caused roughly 1,000 additional auto fatalities, according to two separate analyses comparing traffic patterns in late 2001 to those the year before. In other words, 1,000 people who chose to drive wouldn't have died had they flown instead.

III. We Fear Cancer But Not Heart Disease

We underestimate threats that creep up on us.

Humans are ill-prepared to deal with risks that don't produce immediate negative consequences, like eating a cupcake or smoking cigarettes. As a result, we are less frightened of heart disease than we should be. Heart disease is the end result of actions that one at a time (one cigarette or one french fry) aren't especially dangerous. But repeated over the years, those actions have deadly consequences. "Things that build up slowly are very hard for us to see," says Kimberly Thompson, a professor of risk analysis at the Harvard School of Public Health. Obesity and global warming are in that category. "We focus on the short-term even if we know the long-term risk."

Our difficulty in understanding how small risks add up accounts for many unplanned pregnancies. At most points during the menstrual cycle, the odds of pregnancy are low, but after a year of unprotected sex, 85 percent of couples experience it.

IV. No Pesticide in My Backyard—Unless I Put it There

We prefer that which (we think) we can control.

If we feel we can control an outcome, or if we choose to take a risk voluntarily, it seems less dangerous, says David Ropeik, a risk consultant. "Many people report that when they move from the driver's seat to the passenger's seat, the car in front of them looks closer and their foot goes to the imaginary brake. You're likely to be less scared with the steering wheel in your hand, because you can do something about your circumstances, and that's reassuring." Could explain why your mother always criticizes your driving.

The false calm a sense of control confers, and the tendency to worry about dangers we can't control, explains why when we see other drivers talking on cell phones we get nervous but we feel perfectly fine chatting away ourselves. Similarly, because homeowners themselves benefit if they kill off bugs that are destroying their lawns, people fear insecticide less if they are using it in their own backyard than if a neighbor uses the same chemical in the same concentration, equally close to them. The benefits to us reduce the level of fear. "Equity is very important," says Slovic, and research shows that if people who bear the risk also get the benefit, they tend to be less concerned about it.

V. We Speed Up When We Put Our Seat belts On

We substitute one risk for another.

Insurers in the United Kingdom used to offer discounts to drivers who purchased cars with safer brakes. "They don't anymore," says John Adams, a risk analyst and emeritus professor of geography at University College. "There weren't fewer accidents, just different accidents."

Why? For the same reason that the vehicles most likely to go out of control in snowy conditions are those with four-wheel drive. Buoyed by a false sense of safety that comes with the increased control, drivers of four-wheel-drive vehicles take more risks. "These vehicles are bigger and heavier, which should keep them on the road," says Ropeik. "But police report that these drivers go faster, even when roads are slippery."

Both are cases of risk compensation: People have a preferred level of risk, and they modulate their behavior to keep risk at that constant level. Features designed to increase safety—four-wheel drive, Seat belts, or air bags—wind up making people drive faster. The safety features may reduce risks associated with weather, but they don't cut overall risk. "If I drink a diet soda with dinner," quips Slovic, "I have ice cream for dessert."

VI. Teens May Think Too Much About Risk—And Not Feel Enough

Why using your cortex isn't always smart.

Parents worry endlessly that their teens will drive, get pregnant, or overdose on drugs; they think youth feel immortal and don't consider negative consequences. Curiously, however, teens are actually less likely than adults to fall into the trap of thinking, "It won't happen to me." In fact, teens massively overestimate the odds of things like contracting HIV or syphilis if they have sex. One study found that teens thought a sexually active girl had a 60 percent chance of getting AIDS. So why do they do it anyway?

Teens may not be irrational about risk but too rational, argues Valerie Reyna, a psychologist at Cornell University. Adults asked to consider absurd propositions like "Is it a good idea to drink Drano?" immediately and intuitively say no. Adolescents, however, take more than twice as long to think about it. Brain-scan research shows that when teens contemplate things like playing Russian roulette or drinking and driving, they primarily use rational regions of the brain—certain regions of cortex—while adults use emotional regions like the insula.

When risky decisions are weighed in a rational calculus, benefits like fitting in and feeling good now can outweigh real risks. As a result, teaching reasoned decision-making to teens backfires, argues Reyna. Instead, she says, we should teach kids to rule out risks based on emotional responses—for example, by considering the worst-case scenario, as adults do. But research suggests there may be no way to speed up the development of mature decision-making. Repetition and practice are critical to emotional judgment—which means that it takes time to learn this skill.

VII. Why Young Men Will Never Get Good Rates on Car Insurance

The "risk thermostat" varies widely.

People tend to maintain a steady level of risk, sensing what range of odds is comfortable for them and staying within it. "We all have some propensity to take risk," says Adams. "That's the setting on the 'risk thermostat.'" Some people have a very high tolerance for risk, while others are more cautious.

Forget the idea of a risk-taking personality. If there's a daredevil gene that globally affects risk-taking, researchers haven't found it. Genes do influence impulsivity, which certainly affects the risks people take. And testosterone inclines males to take more risks than females. But age and situation matter as much as gender. Men 15 to 25 are very risk-prone compared to same-age women and older people.

More importantly, one person's risk thermostat may have different settings for different types of risk. "Somebody who has their whole portfolio in junk bonds is not necessarily also a mountain climber," explains Baruch Fischhoff, a professor of psychology at Carnegie Mellon University.

VIII. We Worry About Teen Marijuana Use, But Not About Teen Sports

Risk arguments cannot be divorced from values.

If the risks of smoking marijuana are coldly compared to those of playing high-school football, parents should be less concerned about pot smoking. Death by marijuana overdose has never been reported, while 13 teen players died of football-related injuries in 2006 alone. And marijuana impairs driving far less than the number one drug used by teens: alcohol. Alcohol and tobacco are also more likely to beget addiction, give rise to cancer, and lead to harder drug use.

If the comparison feels absurd, it's because judgments of risk are inseparable from value judgments. We value physical fitness and the lessons teens learn from sports, but disapprove of unearned pleasure from recreational drugs. So we're willing to accept the higher level of risk of socially preferred activities—and we mentally magnify risks associated with activities society rejects, which leads us to do things like arresting marijuana smokers.

"Risk decisions are not about risks alone," says Slovic. "People usually take risks to get a benefit." The value placed on that benefit is inherently subjective, so decisions about them cannot be made purely "on the science."

IX. We Love Sunlight But Fear Nuclear Power

Why "natural" risks are easier to accept.

The word radiation stirs thoughts of nuclear power, X-rays, and danger, so we shudder at the thought of erecting nuclear power plants in our neighborhoods. But every day we're bathed in radiation that has killed many more people than nuclear reactors: sunlight. It's hard for us to grasp the danger because sunlight feels so familiar and natural.

Our built-in bias for the natural led a California town to choose a toxic poison made from chrysanthemums over a milder artificial chemical to fight mosquitoes: People felt more comfortable with a plant-based product. We see what's "natural" as safe—and regard the new and "unnatural" as frightening.

Any sort of novelty—including new and unpronounceable chemicals—evokes a low-level stress response, says Bruce Perry, a child psychiatrist at ChildTrauma Academy. When a case report suggested that lavender and tea-tree oil products caused abnormal breast development in boys, the media shrugged and activists were silent. If these had been artificial chemicals, there likely would have been calls for a ban, but because they are natural plant products, no outrage resulted. "Nature has a good reputation," says Slovic. "We think of natural as benign and safe. But malaria's natural and so are deadly mushrooms."

X. We Should Fear Fear Itself

Why worrying about risk is itself risky.

Though the odds of dying in a terror attack like 9/11 or contracting Ebola are infinitesimal, the effects of chronic stress caused by constant fear are significant. Studies have found that the more people were exposed to media portrayals of the 2001 attacks, the more anxious and depressed they were. Chronically elevated stress harms our physiology, says Ropeik. "It interferes with the formation of bone, lowers immune response, increases the likelihood of clinical depression and diabetes, impairs our memory and our fertility, and contributes to long-term cardiovascular damage and high blood pressure."

The physiological consequences of overestimating the dangers in the world—and revving our anxiety into overdrive—are another reason risk perception matters. It's impossible to live a risk-free life: Everything we do increases some risks while lowering others. But if we understand our innate biases in the way we manage risks, we can adjust for them and genuinely stay safer—without freaking out over every leaf of lettuce.

Maia Szalavitz is the co-author of The Boy Who Was Raised as a Dog: And Other Stories From a Child Psychiatrist's Notebook.

Mortal Threats

How good is your grasp of risk?

1. What's more common in the United States, (a) suicide or (b) homicide?

2. What's the more frequent cause of death in the United States, (a) pool drowning or (b) falling out of bed?

3. What are the top five causes of accidental death in America, following motor-vehicle accidents, and which is the biggest one?

4. Of the top two causes of nonaccidental death in America, (a) cancer and (b) heart disease, which kills more women?

5. What are the next three causes of nonaccidental death in the United States?

6. Which has killed more Americans, bird flu or mad cow disease?

7. How many Americans die from AIDS every year, (a) 12,995, (b) 129,950, or © 1,299,500?

8. How many Americans die from diabetes every year? (a) 72,820, (b) 728,200, or © 7,282,000?

9. Which kills more Americans, (a) appendicitis or (b) salmonella?

10. Which kills more Americans, (a) pregnancy and childbirth or (b) malnutrition?

ANSWERS (all refer to number of Americans per year, on average):

1. a

2. a

3. In order: drug overdose, fire, choking, falling down stairs, bicycle accidents

4. b

5. In order: stroke, respiratory disease, diabetes

6. No American has died from either one

7. a

8. a

9. a

10. b

Sources:

* Centers for Disease Control and Prevention (Division of Vital Statistics)

* National Transportation Safety Board

Psychology Today Magazine, Jan/Feb 2008

Last Reviewed 28 Dec 2007

Article ID: 4495

Psychology Today © Copyright 1991-2008 Sussex Publishers, LLC

115 East 23rd Street, 9th Floor, New York, NY 10010

-

-

James:Which pivot formula do you use? Classic? Do you calculate them on 24h trading? It seems your charts are not 0930-1615 ET.

Mr Paul:

Should I see something on your website? It's blank right now.

JJ:

James is using Investor R/T, as mentioned above.

Regards,

Bert

edit: LOL, post 1422 (JJ's) was the last one when I started typing...

I was in the process of starting a really great blog, but then I totally lost interest and am still wondering what I should do with it.

-

Through remarkable faith huh - lolYou forgot to list your website and price for your holy grail Mr. vendor.

I edited the post and deleted the web address

-

After you gather what you need like a motherboard, ram, processor etc etc etc

go here:

http://www.youtube.com/watch?v=lVJ5ZEbf6F4

that's a great start, and how I learned to build mine (I viewed about 5 different ones)

-

Hello guysI've been watching pivot points for quite some time now and I beleive price pretty much reacts when it reach to these levels. I would like to know how do you guys use them for entry. Do you fade the pivot with a resting (stop) order already in place? I trade ES and I use practically all the leves (daily, weekly and monthly) as well as daily midpoints.

By the way, this is a wonderful site. Congratulations.

Frank

Hi Frank,

It's good to keep in mind that Pivot Points are only PROJECTED areas of support or resistance. It's not the level itself but the level and what price (and volume) does near, at, or just beyond it.

I would take a browse through the Volume Spread Analysis threads on the board to get a better understanding of what to look for at these pivot levels.

-

Hello. I would like to say that I'm a "traitor." I have been betting against the US Dollar and have been doing ok. I'm also considering "betraying" the YM and moving to Forex. Forex is open 24 hrs, and it is more flexible to control how much you want to risk. But with YM, for a small time beginner trader like me, it is too expensive, even with 1 contract, and very volatile. And now there is a $55 a month charge for the YM data at TS.So I find it fitting to change my avatar to Benedict Arnold. He is recognized as a traitor, and phonetically that is like trader.

Well Abe,

You seem to be taking smart steps on your road to becoming a trader.

That is, you are discovering what your risk tolerances are and what kind of markets fit your personality and situations.

Good luck

-

that's awesome!

-

-

1. Clicking sell instead of buy vice versa

2. Having the chart scrolled back and glancing over a few minutes later thinking the data feed had frozen.

3. Forgetting what day it was and "not trading" ahead of an economic report that wasn't do out until the next day around that time.

Good thread :o

-

I feel for the guy, who would have thought we would sell off that much...Gotta take the lesson and move forward.

I had to lol at this though...

"....While searching for random links with the search term "I HATE MY LIFE" and "I SUCK AT TRADING" I found an interesting website which showed what people want most out of life."

that's pretty funny :o

P.S

Shouldn't that last video be entitled "The *Futures* Market ruined my life?

-

...since his Dancing Tours did not allowed him to talk with any informed Brokers, Analysts or other Investors"Informed" brokers and analysts...now that's funnier than any self serving BS :o

-

Yes and I couldn't be happier! :thumbs up:

-

I would say it's much easier to grab 4 ticks with the YM than 2 with the ES. Technically because price needs to trade through your bid/ask on ES you technically need three ticks in your favor to garner a two tick profit.

Although, I personally think trying to grab a couple ticks at a time is ridiculous unless you are a truly skilled scalper doing it hundreds of times a day.

-

A couple quick questions -How do you quantify high, low, ultrahigh, ultralow volume bars?

How do you quantify small and large range / spread bars?

Many thanks.

You can qualify them by looking at the bars relative to the last 30 or 40 periods.

-

Thrunner,

Can you please PM or post a link to the .eld file ?

thanks!

-

Would you play this outright, or with an options strategy?

-

Trading Log?

in Tools of the Trade

Posted

404,

Since I've been exclusively day trading futures and only repositioning my longer term accounts monthly/quarterly I just use Microsoft word to record my P/L

Since I just get a P/L statement for my futures acct. I don't need to record each trade.

You could try using this free trade tracker excel spreadsheet from tradersaccounting.com

http://www.tradersaccounting.com/pages.php?pageid=21

Just select "Trade Tracker Pro"