Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

2232 -

Joined

-

Last visited

Posts posted by SIUYA

-

-

thanks for the link nate.

I am not trying to do a fully automated system..... far from it. The thing I would like to attempt is a far simpler version of events of being able to switch on an off a collection of simple automatic trading systems (or even just Entry systems) if you like.

The tough part as I can see is manually, quickly and easily being able to manually tell a computer when to apply the system..... that is the human brain still provides the context. I also dont really care too much for statistics in the sense most people apply them and look at them, if anything its only being more interested in saying given these areas then what are the stats . This is more gut discretionary trading from experience of knowing (or at least thinking I know

of when to apply things) This way you can quickly switch on and off the systems as the market moves.

of when to apply things) This way you can quickly switch on and off the systems as the market moves.That way I and the system dont need to understand the relationships between candle charts etc for all such past events. All I need to be able to say to the system is that between this point and this point, that the market has just fallen/risen too much, I wish to be able to apply this..... and then it might be something as simple as a MA cross over, whereby you as the human determine, I think the chop has been enough now, take the next (of the next few) MA cross overs.

(I use this as an example as I use neither candlestick patterns or moving avgs - the candle sticks I use just give me a visual map when I look at

it. Also tick data is not necessary as some of the systems are very simple limit placing orders.)

The picture I have added might show it better. Just say I determine as a trader my zone is based on the previous spike high. A couple of random lines later define my zone, and my stop. After that I can actually say within this zone, apply this system.... and only this system. That way I can just not watch the market so closely in the meantime, and I also know that the system is not going to go haywire in the meantime. Once I have the trade on I the system can mange it or I can exit it manually. I am wondering if there are any off the shelf systems that can easily apply this whereby the zones are quickly placed, and moved etc and varying systems/strategies are able to be used simultaneously.

There seems to be a few people like yourself that have worked on this.... maybe its a lost cause.

However I will persist and I am sure you will persist!!!!:crap:

-

The only reason the Hunt brothers didn't make money on their silver investment is because the federal government directly targeted them and forced them to sell. They didn't anticipate having to sell their silver with a gun to their head.

.

I think the real reason they did not make money on the the trade is that they were the only buyers and when it came time to sell there was no one left to buy.

Blaming the government is a bit like saying the casino only stopped me playing because I did not have enough money to keep increasing my bets enough to bankrupt them.

Beyond all the conspiracy theories and sometimes poor government policy the governments role is ideally to limit market manipulation and provide for a fair and orderly market when the participants cant or wont do it themselves.

But I think you get the jist of what I was saying based on your original questions.

-

thanks Ed - interesting that you started the first method, and transitioned. Its a question I have always asked myself. I started from the opposite spectrum and just had an intuitive sense of what seemed like a low risk trade without any maths involved. Then I discovered all the theory.

Which is better? Is there a difference? is it more a physc issue? Is it a matter of focus and intensity? a matter of trying to get the timing just right on a trade?

Is it better to risk 1 contract for $500 per trade, where you might get it wrong 3x or risk $1500 for that one contract and really wait for the right (or better) setup?

Whilst you can backtest some ideas intensely in order to try and answer this using statistical models, no one has yet satisfied my answers about context as yet. With all the debates about robots, EAs etc not working, I also wonder how accurate the backtests are.

Ideally you can actually track your actual trades for a long period of time to get actual stats. But then there is the assumption that you will act in exactly the same way going forward and that context again will not change.

This debate gets away from the thread of increasing position size over time, but it is still related in that there are questions raised on when to scale in, scale out, how long to run something for etc; etc;

But for me not all setups are equal and therefore should not be treated the same. Particularly in the short term trading arena where there are ample opportunities every day, and hence you can afford to wait for only the best ones.

-

cunparis - "I've seen examples of trade intensity preceding market turns"

Just a note, there are probably plenty of examples of any indicator that might be found to do this. So it needs to be seen in context.

Also just to add to the debate - I hope without being seen to take sides as this is not the intention - it seems to me that the trade intensity is more about attempting to see a greater than normal volume fire through the market quickly - regardless of who is doing it and weather or not it originated as a buy or a sell.

When you see this, and the market price does not move sufficiently either with the prevailing trend, or as a reaction to it then it can possibly tell you that a "possible" turning point has been reached or at least some resistance or support has been found at this level. combine this with other factors and it might be useful.

This can have value to some one watching it closely enough.

eg; if a normal 1min time frame has 100 contracts trade in it, and the market is ticking up in an orderly fashion, all of a sudden 1000 trade in a minute and the market does not race higher, it implies the market has suddenly reached some resistance. This may imply that the current price may be a short term or even longer term turning point.

Can you tell, who it is, or what their intentions - i doubt it, and is this really relevant - probably not. It seems more along the lines of what someone mentioned previously that its a measure of execution styles, and abnormal volume without price movement.

(or I could be totally wrong

)

) -

Look up what the Hunt brothers tried to do in silver

-

I thought this was an interesting article I found that may or may not have some application/interest to the volume ideas discussed here and in a few other threads

Volatility: Friend or Foe? | FINalternatives

a guest contributor article on

Volatility: Friend or Foe?

Jun 9 2010 | 1:02pm ET

(I think everyone should be able to view it without a login, otherwise I will try and reproduce it)

-

LeoBust - I agree with you - while fully systemised strategies and very disciplined traders generally push for the idea that every trade is kept the same risk percentage. Over the years, I find that not every trade is the same..... particularly in terms of time frame. This is largely as I am not really much of a day trader so possibly the divergence in ideas.

A good example maybe whereby shorts are taken as a larger percentage in a clear downtrend, while longs are limited in size.

However, this might also mean that too many setups and trades are being taken out of context? Just food for thought.

-

adding to what Blowfish says - the important part to remember is that it is a BET.

(dont let the word spread confuse)

It is much like the FX brokers that offer varying levels of leverage and varying amounts you can bet on direction. There in lies a lot of the flexibility.

One point that I am not 100% sure of however is the taxation point of view. While everyone gets excited that the gains are tax free in the UK, does that not mean that losses are not tax deductible?

-

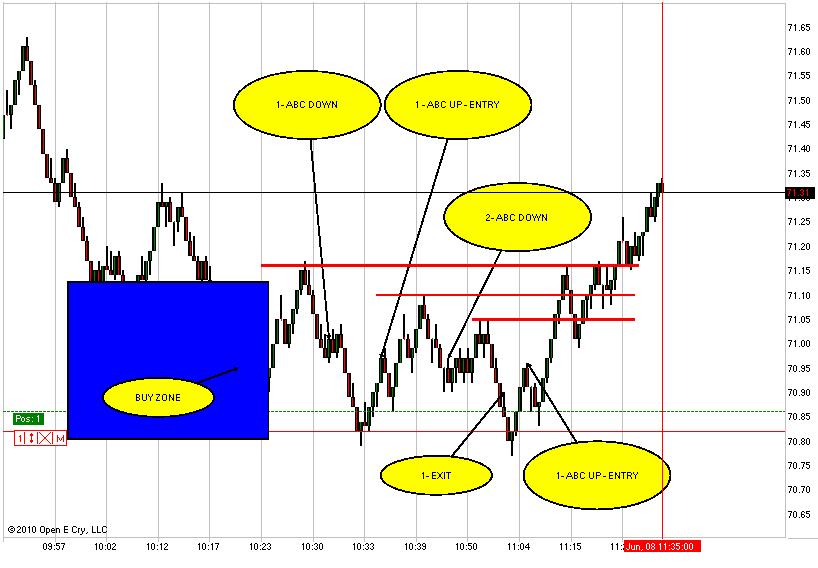

Thought I might share this setup I am currently using in Oil.

Its nothing knew, it takes a fair bit of patience and waiting, but it offers a reasonable way of entering (or so it seems to for me

)

)Basically using a 5 tick range chart (anything else would probably work also if it captures enough to complete a swing)

1) wait for what you expect is a buy zone

2) wait for an abc down

3) entry on the next abc up (in this case I pre-empted it and snuck in early)

The red lines are the swing high points. I ideally would like to see these get taken out and then to me the down move is complete to let the swing up ride. Exit is whatever trailing stop you care to use.

I hope it is self explanatory.

The worst thing about this setup is the waiting and determining a buy zone (based on previous days bases), also note that there was an initial entry that stopped me out as well.

-

Tresor - then you are really in problem - the Europeans cant even agree amongst themselves about regulations and they will probably over regulate the wrong people.

Given your comment "Pure nonsens and communism: the government decides who can be a money manager instead of the market."

they also decide who can drive, drink, vote, practice medicine. etc; etc;

When you consider the amount of poor money managers out there, imagine if there was no regulation.

-

Tresor - what does the regulator in davey jones locker say

I would be more worried if the US regulator thought they could regulate people outside the US. There are two issues...... where your management company (or you are based) and where the clients are based.

-

MC - as a suggestion if you are struggling with the greeks, is to largely ignore all of them except for the delta. (Later you might wish to expand the knowledge)

Most of the greeks are bandied around by people to confuse with jargon, when in actual fact they are largely only relevant for people trading books with multiple positions in them. The greeks then allow them to amalgamate their risks across the books into one set of numbers - the Greeks.

If you are only trading one or two positions then focus on your exposure - the delta. Especially if you are going to go short options. Just remember - when shorting a naked option - the most you will make from it is on the day you sell it.

I would imagine the rest of the greeks will be largely irrelevant to you.

-

forrestang..... thanks.

I agree with what you are saying, yet as part of the value of open discussion I will back the side of the thanks button. I try to use it so actually say thanks especially to those who I might not agree with, but can acknowledge their point of view.

On a serious note, I actually think that the thanks button is actually good as you can see the names of those who thank, not just a poll, or just another post saying thanks and cluttering things up. Its open and disclosed.

Possibly there is a suggestion here to have two extra buttons..... keep the thanks, add an "I agree" and an "I disagree" button or something similar.

Additionally I think the internet, and its threads do require an extra level of ass kissing and buttering up with everything people say, as context and non verbal (written) ques are extremely important in communication, and this is not possible on line.

Humans are like chickens - like pecking orders. If it was not the thanks button, it would be the number of posts, the number of threads started..... anything.

At least this way I feel that thanks which is often not offered freely enough in society is a nice thing.

I also found this a while ago....

-

Update on last request idea: You can actually see the orders on the chart at any time, in the chart windows properties section under Trade Mode > show Orders > always.

However it would be nice to be able to at least amend the orders ONCE they are already established. That way, you only need to switch the trade mode on and off when inputting new orders, not when constantly adjusting orders.

-

Much like the dieting industry

-

Technical analysis is nothing more than a tool that helps traders manage and quantify their risk, trade management, money management. Its a road map for a repeatable series of trades.

(this incorporates all entry, exit levels, discipline, emotions etc;)

-

anybody play backgammon.

When you add the betting element this can also be a great measure of risk v reward analysis.

-

Just thought I would share.

Ouch. bought back, shorted again, bought back. Running one short......

then there is slippage on the last lot..... 14 ticks..... wow there must have been some sort of inventory number

(makes the idea of backtesting v reality interesting, and sometimes I wonder why I trade through numbers....net net its probably break even)

Never chased the long..... sometimes I hate this job.

-

-

interesting article.

I wonder how these firms will react when their star recruits go all in with the firms money!

While I think there are a lot of traits that are similar I also hope that people don't think that it is the be all and end all....otherwise we will know where the next financial crisis will come from.

its a good idea for those applying for a job to at least learn the rules.

Maybe bankers should all be tested with a game of monopoly, and journalists with a game of scrabble.

-

tj a quick question you write..."I also trade my own account but I find it difficult to manage my trades accurately, 100% of the time while maintaining a level of reliability and quality to the trades I am calling live for my membership. I have a hierchial system of priority that dictates my actions. I always put my tradecalls first and that has hurt my own trading about 10 to 15% of the time, which makes a huge difference to my overall personal trade results."

I dont know how these trade rooms really work, but I would like to know how this occurs. I would have thought if you are making calls live they are off your actual trades. If your calls are correct, why not just trade those? thanks.

(I understand that as an individual trading making calls and then not sticking to their plan/calls makes sense, but I would have thought a trade room was different)

-

thanks for the reply nate...however

I am NOT trying to quantify regime change.

I believe as you clearly do, if you could program such measures then its worth gold. I dont believe you can quantify it, hence back test it, hence you cannot auto trade it.

I am looking to see if someone who has good programing knowledge is able to help direct some advice in terms of how hard/cumbersome it might be for the zones being inputted by a trader throughout the day...... that is the user needs to watch it but constantly adjust throughout the day. This way you only need to adjust zones for where you want certain auto trading strategies to occur, not specific price points or triggers. eg; you only want a cross of a MA within a certain area, and no where else.

I believe this would be far less work than just watching and waiting, its kind of like trying to get the best of both worlds. discretionary/context trading and auto trading

-

two points ....

"The more confirmation we wait for, the lower the risk-reward of the trade."

This actually depends on the time frame being traded..... sometimes, traders do not wait long enough for the best risk reward trades. I think that this applies when trying to really time the market, particularly short term. A lot of trades require more rather than less confirmation in terms of setup, however, once the setup is confirmed, then yes - strike, dont keep waiting.

Tom De Mark also uses some timing technique as a tool that looks similar. For me these and the fib numbers can help me keep out of trouble if you like as it helps with context.

I feel all timing and fib levels really add to context as a tool, again, you dont want to believe it will offer the be all and end all solution.

thanks Mitsubishi looks interesting.

-

clearly not from the response.

I guess that means there is a business opportunity here.

Creating Scarcity in Intraday Trading

in Day Trading and Scalping

Posted · Edited by SIUYA

I will change your wording a little to see the flaw in what appears to be a somewhat logical argument.

Let's say a stock is at $10.00 per share. You buy up a large number of available shares, driving the price up to $10.10. At this price, day traders may not be inclined to buy, but other traders who are looking TO EXIT long-term investments won't care about such small intraday fluctuations. They are looking for much larger growth over much longer periods of time ELSEWHERE. So, despite the slight increase in price, they SELL anyway. Since there is NO demand and GREATER supply, the price FINISHES to rise to AND FALLS AGAIN. After waiting some time AS THE PRICE FALLS, you sell.

See my point.

You need more than a nice fantasy. Either all you are doing is relying on the greater fool theory. That is that so long as there is someone to follow you in the price will go higher.

or a random selection of entry and exit points.

Now clearly momentum trading works this way, but you need setups, triggers etc;