Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

214 -

Joined

-

Last visited

Posts posted by TIKITRADER

-

-

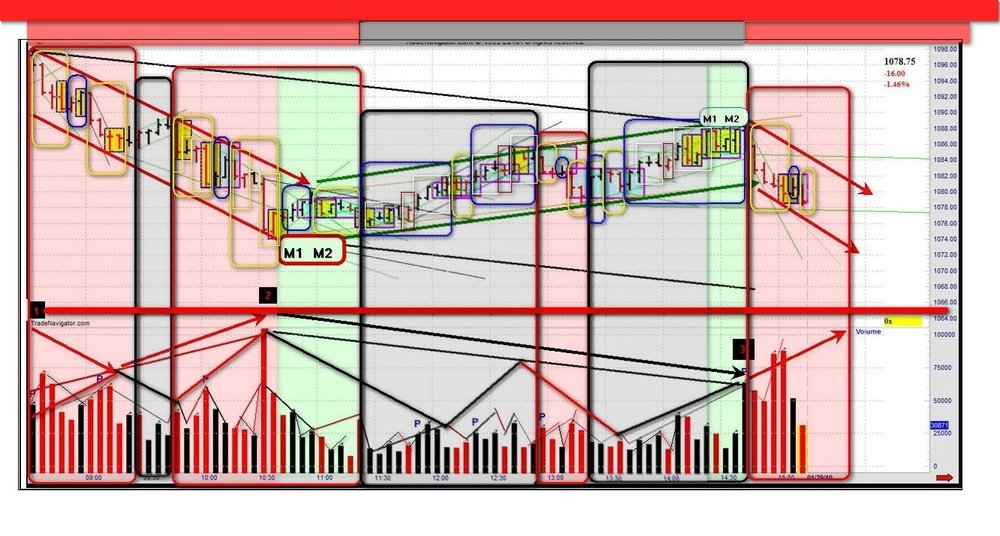

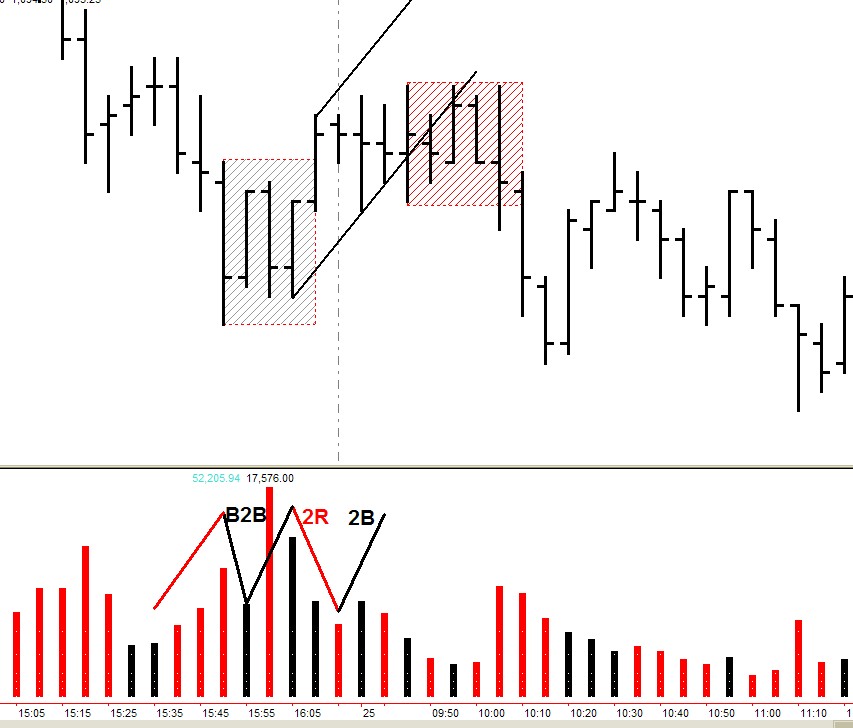

In this image is a lateral. This should be one that fits the the current topic.

Can the direction of this lateral exit be known with just the information shown ?

is there enough information here for . . .

1) Differentiation

2) Context

3) Order of events

This is for anyone who wants to answer any or all questions.

additionally . . . Spyder, could you just give a yes or no to each question here if possible ?

EDIT: All bars are finished, none are forming

-

-

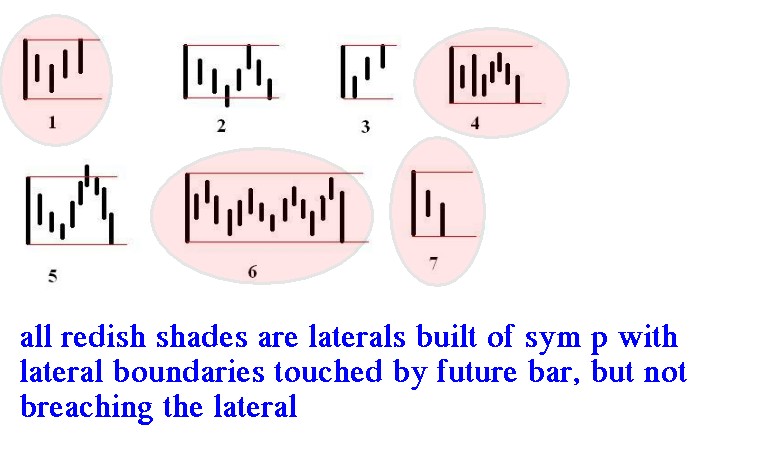

These highlighted laterals have similarities, although some that have similarities may be sub-grouped a little different. ( not sure if this really makes a difference )

as example . . . start with symp then continue for some time before touching lateral boundaries.

or start sym p then followed immediately by a bar touch of lateral boundaries

* also I have not noticed in drill an outside bar following the symp , and before a touch of the boundaries. Not sure of the importance of this yet if any ( #4)

-

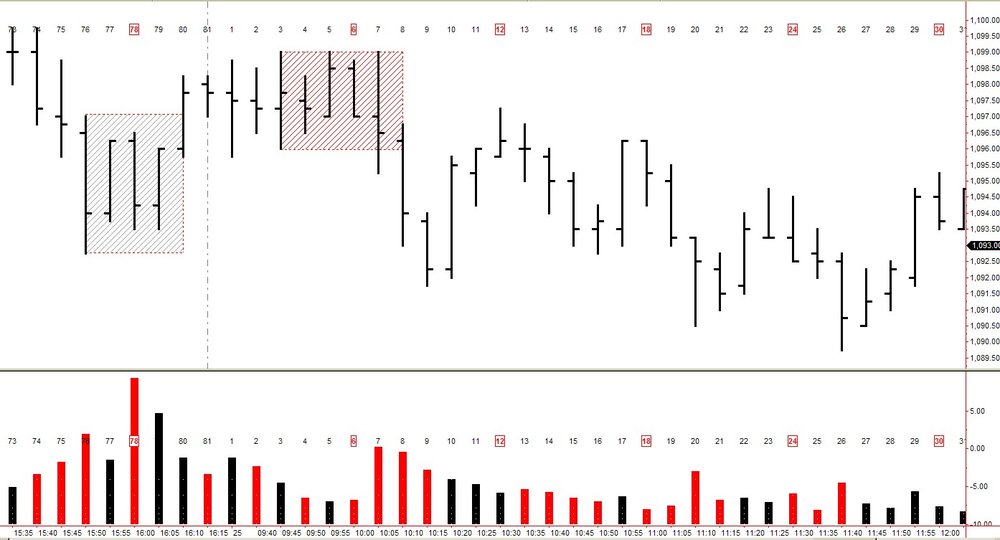

Just to clarify the chart snippets I posted contained a gray shaded lateral and a red shaded lateral.

It is only the red shaded lateral that meets the requirements of the drill.

The gray shaded lateral that begins on bar 74 of previous market day is just for annotated purposes and has no like to the current topic of laterals.

-

-

Tams wrote this, it may help.

http://www.traderslaboratory.com/forums/f46/lateral-formation-6581.html

I do not know if it will work as is or need an adjustment.

-

-

-

-

The first lateral starts with a dominant bar, while the second starts with a non-dominant bar, .--

innersky

Yes I see this and agree. Laterals form from bar 1 of the lateral, as a dominant bar, or a non dominant bar, and that begins creating the lateral. Respective of the fractal they are on.

While a series of laterals within one fractal exist as dom, non dom, dom ( ex: traverse ), on another fractal they may each be dominant( ex: tape level ).

( which may help eliminate fractal jumping and staying on course)

jbarnby had begun to differentiate and posted this in the past

http://www.traderslaboratory.com/forums/34/price-volume-relationship-6320-27.html#post72076

and a reply to his work posted here

http://www.traderslaboratory.com/forums/34/price-volume-relationship-6320-27.html#post72091

-

I'm happy w/ all them except oil. I could not figure out a way to craft the word oil in a way that sounded more natural. If anyone can come up with a better way to phonetically spell oil, please let me know.any luck with this ?

did you try . . .

oyyell

oy yell

oiyell

oi yel

oyyull

tried different things out. sounds ok on some. adding spaces or comma can help change a word.

you can always go with Crude. hahah

attached one sample. needs a filter, but the idea of using a comma or space controls her voice. this was an old sample and oil is not in this.

-

One more of my favorites.

Infiniti G37

Pricing and features here

2010 Infiniti G37 Sedan | Photos, 360s | Infiniti USA

-

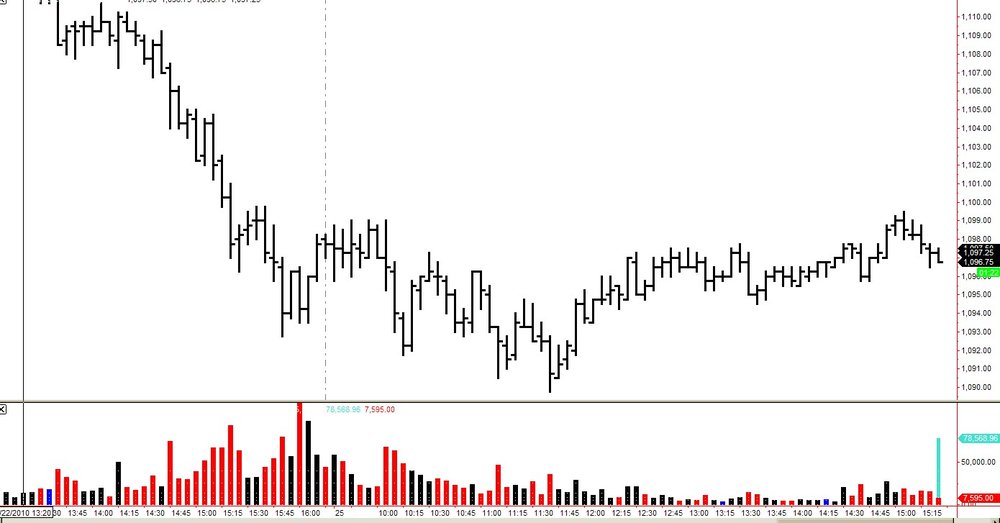

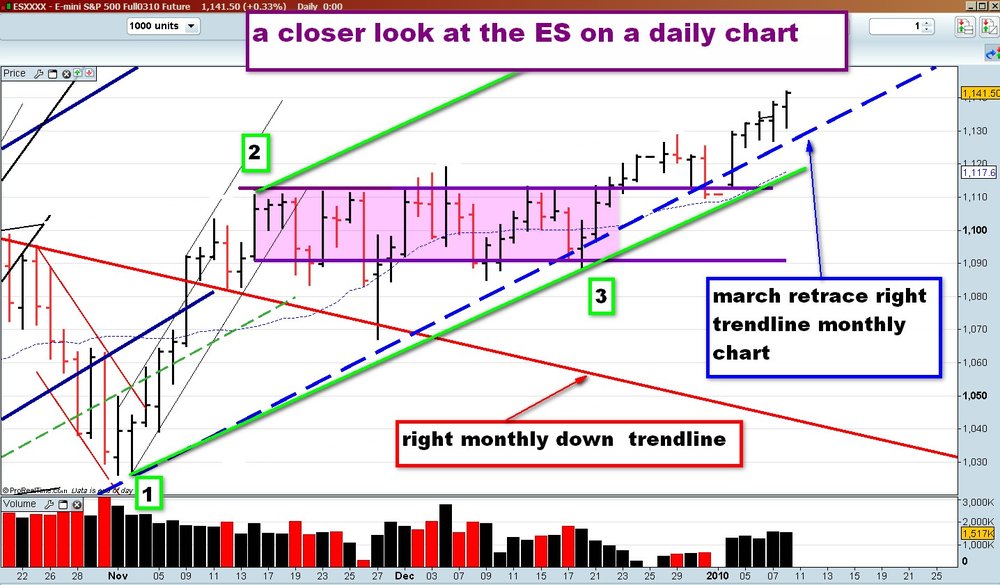

Already the discussion has glean one very important characteristic: Each of these specific laterals start with a Sym Pennant. But, is this the only characteristic of these specific types of Laterals? Surely, something else must set them apart from all other things which appear similar. In other words, why (on my own chart) have I annotated yesterday's midday period (1-14-2010 @ 12:35) as an example of these specific types of Laterals, but at EOD (1-14-2010 @ 15:15) I have not?

HTH.

- Spydertrader

P.S. (All times Eastern and [close of] ES [bar])

One thing that is different about these two is

12:35 lateral does not form within the boundaries of another lateral. ( Initiating lateral - bar 37 )

15:15 lateral forms within the boundaries of an existing lateral ( Initiating lateral - bar 69 )

-

I really like the Cadillac STS.

This is a nice everyday car.

-

As simple as I can be on laterals.

I could group laterals into . . .

The bar that initiates the lateral either

1) closes above the open

2) closes below the open

or possibly

3) could close at the open.

*Confirmation of a lateral does not occur until 2 bars form,complete, and close within the boundaries of the initiating bar

-

The new Fisker Karma looks like it might be a fun daily driver.Nice interior. That has some nice lines inside. Good one

-

Enter a newbie trading live....and it's sweaty palms....jumpy mouse finger....pounding heart....and eyes darting around like someone that dropped the soap in a prison shower.. . . The market lets everyone win at the beginning. It likes to let you win until you get overconfident and trade more contracts. Then it's time for the Kleenex and the antacids as you scream yourself to sleep in the fetal position. At that point you'll truly understand the meaning of regret. That is....once the imodium kicks in. It is then....that your journey will begin.

rotlmao . . . old post but great

-

-

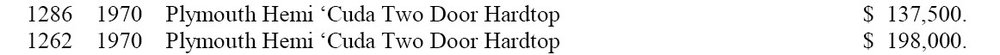

WHAT !?!?!I could buy a BRAND NEW Porsche Turbo for that price !

and I had two of these when I was young and they cost a few thousand. oh well LOL.

I think right now with the kids educations I can set this dream aside for a long time.

-

-

Great thread.

I am going old school.

Had two of these as a teen and early twenties.

They were not hemi, and that has been my dream to get. I had 1970 -340- engines, one in red and one in white.

looking to collect two or three and even a Plum Crazy colored convertible Challenger 1970

Space to keep a collection of cars is a problem.

1970 Hemi Cuda

Plum Crazy colored convertible Challenger 1970

-

-

Here is a mobile app to track investment accounts

Mint

Track all your investment accounts, 401k, mutual funds, brokerage accounts & IRAs | Mint.com

I will continue to list these apps as I come across them. I have not tried them out so if anyone has good or bad feedback comments welcome.

-

I think you can also do it with OEC. I haven't used OEC, so I don't know how good it is. You can sign up for a 15 day trial I think to check it out.

Yes OEC does offer replay

Open the pdf for Market replay

OEC - Futures and Forex Electronic Trading System OEC Trader Plug-Ins

You can sign on for $25.00 month for a full demo that offers all the markets listed here, live data including futures, forex, and options and the market replay

OEC - Futures and Forex Electronic Trading System Margin Requirements

The Price / Volume Relationship

in Technical Analysis

Posted

One more lateral that meets current topic.

Differentiation

Context

Order of events