Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

677 -

Joined

-

Last visited

-

Days Won

2

Posts posted by MidKnight

-

-

Hi there,

How is the payout modeled?

You say these options are standardized and traded on exchanges - what exchanges and where is the spec please?

Any losses and profits in Forex trading can be managed with the regulations to limit or stop orders. Actually, the maximum loss in this trading is an investor loosing all the money in the trading account.Please, get a grip and show some respect to your audience here. I don't think anyone here is going to trade FOREX with such extreme leverage that one trade would wipe them out. With binary options you could still bet your entire account on one trade and lose it all.

The R/R you mention does not interest me as it is less than 1:1 - and you said 1:0.8 was a maximum!

I've dabbled with barriers before and found the added element of time to my trade idea tricky. The better payouts were in the 2-4 week area. I found it a lot harder than trading the futures/spot markets.

Hopefully some of the more experienced chaps can chime in (zdo?).

With kind regards,

MK

-

Hi there,

Candlesticks vs bars? Its just personal preference. Forget about the hype of fancy and cool names candlesticks have. I use both bar and candlestick charts and my preference is to use bars when I want structural charts and candles when I want to do bar by bar analysis. Both are showing the same things its just your preference.

Magee book is a classic and still a great book today. I'm sure you'll get heaps of book recommendations from others, but a few that I liked were:

- Trade your way to financial freedom by Van Tharp

- Evidence Based Technical Analysis by Dave Aronson

- The Art and Science of Technical Analysis by Adam Grimes

With kind regards,

MK

-

Well here it is, albeit a little late. Better a bit late then never ( lost my ISP for 3 days due to a freak storm ).http://http://traderspodcast.com/

Episode #189 is Rob's interview of me. We talk about our Random Trading experiment.

Rob brings up some possible ways of improving the results which I think are Bullshit.

You may want to edit your URL as its wrong - drop all the http stuff.

Of course its BS, Rob is not a profitable trader and never has been.

-

Speaking of S/R. I've long long being a serious advocate of S/R zones. However, in an attempt to learn something new I read a book that challenged the usefulness of S/R. I was gobsmacked at the suggestion! But I persevered with his exercise, and that is; open a chart and hide your price bars, draw some lines at random on the chart and now make your price bars visible. My world just fell apart. I often saw the same interactions on these random lines as I did on my S/R lines. Do the exercise a few dozen times, change the symbols, change the timeframe - same result from my study.

:doh: WOWSERS! :doh: :doh: :doh: :crap:

With kind regards,

MK

PS: The book is: The Art & Science of Technical Analysis by Adam Grimes

-

-

Yeah handle, what you mention about when you are feeling afraid/confident - I think that is universally how trading works for us humans. The same thing happened to me when I was scalping. Interestingly, when I moved out to higher timeframes such as swing trading, the feelings of afraid/confident heavily diminished and a new feeling rose called disappointment. I think this may be due to how quick the positions play out. In scalping the trade is done and then off to look for the next one - it is much more immersive and perhaps the shorter duration and increased frequency taps into our more primal reflexive feelings.

BTW, what is the software you use for journaling?

With kind regards,

MK

-

Thanks for the reply. I'd like to see the coin flip pull that off for some more trades, but I agree it was pretty incredible/inspiring. We all focus on entry when we study our trading, but maybe instead we should be focusing more on exit and trade management.

With kind regards,

MK

-

So what was the outcome - Prediction or Random winner?

With kind regards,

MK

-

For once I would like to see a thread called consistently winning....only if you want to see the largest and most deadly mass descent of haters in your thread ever :hmmmm: :fight:

-

Hi MidnightHave you studied Joe Ross methods?

I have

The reason I was jeering was because I felt handle was not using JR methods .

He was making it up.His entry points did not make sense.

His very first post shows selling on a 5 min chart and then holding overnight for a 10 tick profit. JR would never do that.

And when I offered to swap methods , he declined.

And then he stated he bought at the open, which did not tie up with the arrows.

And when Mr. Horseshoes asked for a tick chart,he was dead in the water.

So before moralizing about TL, go and study all the posts carefully.

Better still , show us handles method.

regards

bobc

Who cares if his methods do not fit your understanding of JR methods - its his log for his benefit - not yours. And since you have never undertaken JRs private tuition who are you to say this isn't how JR trades today.

Regarding his first post holding any trades overnight - it is you who should study carefully.

-

Poor guy. Starts a journal to keep himself honest. Gets jeered by Bobc and Patuca. The whole time the original poster stays extremely polite about it. Finally gets sick of it and leaves. This forum has become more like ET over my absence since soultrader left...real shame.

-

I said out the outset there would be no negativity on thethread. That's what I meant by yada yada. Easy solution. If you don't like him don't listen.Yes almighty whatever you say. I suppose you are going to go through every post and clean up the "negativity"? No probably not, only when you say so. I would hardly describe what I posted as negativity especially when compared to other stuff around the place.

-

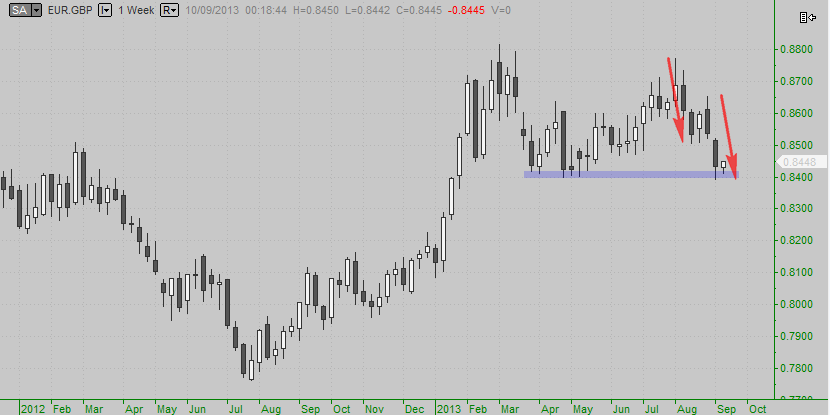

reason for the close is that I am expecting eurgbp to reverse or at least consolidating at current levelsSame'er.

All my best,

MK

-

finally made it to update the first month results, a good July to say the least....400 pips is not bad by my standardsNot bad by my standards too bravo! :thumbs up:

With kind regards,

MK

-

What I do is examine my trade log and test out various scenarios to find what is best with the compromise of what I can live with

What is best may not be easy psychologically to deal with so you need to know yourself. I highly recommend at least 50'ish trades from the trade log or a couple months of data (whichever spans longest time) before starting to run the scenarios.

What is best may not be easy psychologically to deal with so you need to know yourself. I highly recommend at least 50'ish trades from the trade log or a couple months of data (whichever spans longest time) before starting to run the scenarios. Its important to use your real-time trade data only rather than backtesting with hindsight bias. Your mind will play evil tricks on you if you do not.

This is the best advice I can give - sorry it is not easy to do. An in depth walk forward analysis is a crucial part of my trading, maybe it is helpful to you too.

With kind regards,

MK

-

There are plenty of approaches that can work for over 90% winrate and are extremely profitable. I've seen live accounts running the same strategy for over a year doing this. (check out myfxbook.com or fxstat.com or zulutrade.com)

These strategies generally fall into two categories:

a) some sort of grid trading that has enormous MAE for a tiny gain.

b) very infrequent trades based on some sort of fundamental drive that ends up building positions

Both of these suffer from unknown price exit points when one is wrong and they compensate for it by extremely small positions with ammunition to spare for scale-ins. One thing they have in common though, is they are usually the most profitable systems on the above mentioned sites. Some absolutely unbelievable.

With kind regards,

MK

-

Interactive Brokers because it lets me trade pretty much any market in the world and being in a non-USA timezone that is important to me. Their commissions and spreads I would consider to be competitive. Their customer support and excessive regulation within the USA can be a major problem/headache.

I also use Oanda and have found them to be good.

With kind regards,

MK

-

Thank you to thirds great tips .These really reflect what I was and am still doing wrong. But now I can use these to refine my trading plan. I was always thinking about a 1:1 risk reward a d once I get to that target I will take half the position and put the stop at break even. But seeing having higher R/R is good I think I might try this out with a wider stop.

Thank you !

It is usually a balancing act in your method. The higher the RR, the lower the win% will be. There will be a point within any method where the higher the RR lowers the win% too much that it is not profitable anymore. Also a high RR needs to be realistic and not just set as high because you need it high if you know what I mean. What does you trade log say - How would you trades that you have taken be if you set your targets at N*risk? How would they be if instead you set them at an ATR multiple?

In my personal testing of every trading method I have explored over the last 9 years of full-time trading, taking 1/2 off at 1:1 and leaving the rest at BE is a bad idea. It sounds good, it feels good, and it produces worse results than if I had just taken the whole thing off at 1:1. The only exception to this was very short-term scalping in high volatility conditions. Your mileage may vary and that is what your trade log is for - test out the scenario against your real, but historical results.

With kind regards,

MK

-

But he doesn't know the problem, and instead only assumes that is the problem. No mention in the reply was there something like: "my stops are too tight because when I run the scenario of using a volatility stop of blahblahblah against my trade log then my results are significantly better". This is just an example and I'm not suggesting that as one scenario to test (although its a good area to explore

)

)Without tracking results and then testing various trade management ideas such as trailing stops, BE stops, initial stops etc. Trading development will be slow and there is no way to know where the problems lie.

With kind regards,

MK

-

......and to add to what the mighty Bluehorseshoe has asked you to clarify:

- what does your trade log say about your method? (real-time only not backtest)

All of us self-taught retail traders have been there for years, so don't feel like you are the only one. It's nothing personal between you and the market, this is trading and the first few steps of a long and often winding journey.

With kind regards,

MK

-

And really good point on the time thing. This never gets enough attention IMO. But, there is usually 1 good trade in asia. 1 good trade in london, and maybe 1 or 2 good trades in the U.S. session. The hour before and after the "open" of each session tends to be the hour that "the move" is going to be found. Combine with a few other basic concepts like previous daily highs/lows, etc..., and this can be a real "bread and butter" money maker.Just to elaborate a little on what ForexTraderX said. The reason most of the "good trades" happen around the opens is because that is where the news is scheduled to come. I've plotted time of day distributions based on these "good trades" across 5 years of intraday 60m data and while the time of day that the good trades come is fairly consistent, they also did clump up with the news times. I have not yet figured out how to trade news events so for now, I disregarded the information from the distributions I did.

Also to add more about time in the Forex world. I feel there are consistent opportunities that happen at about the same time when the market is trending for the day. Remember, people are involved to move a market and the boundaries of the participants has an impact (ie, people are going home, new players are getting to work and starting the day). I don't really consider these type to be in the big mover category, but they are predictable scalps.

Now if I could just figure out more of the event trading stuff I could drastically shorten my day!

With kind regards,

MK

-

Hi Chaps,

I still lurk here from time to time. Good to see you are still keeping at it Cory, absolutely anyone can make it in trading if they persist. I strongly believe that.

I've had the worst year since 2008 this year. The quick summary is my city was pretty much destroyed by 2 major earthquakes in Sept 2010 and Feb 2011. The ongoing aftershocks has kept me on edge and frequently knocking out power and water services. Dealing with the government bureaucracies to get my insurance covered has been highly stressful. In the end I got sick of it all and moved 3/4ths of the way across the country. The insurance still has not been resolved over 2 years later. I sold the house with cracks in walls you could fit your fingers through. Not much fun living in a house like that when you are getting snow outside - heating was an absolute waste. When I moved the aftershock count was over 12,300 and still rising nearly every day. Anyhow, enough of that....I've now moved to a near sub-tropical climate and am hoping to get back to more normal things again.

We should get back to posting content in this thread.....

All my best guys and take care. Hope to see some posts here - I'll play too!

With kind regards,

MK

-

Simple solution really....don't give banks information other than a physical address and your phone number. Do all banking face to face as it should be. The more we try to use technology, the more holes will exist. Technology will always have holes and ways through it.

All my best,

MK

-

Hey Cory,

Whatever you decide to do with your trade management - may I suggest that you rigorously follow the same approach over a decent sized sample of trades? They say 30 is the minimum to be considered for statistical significance, but I like to do 50 or 100 sizes as a minimum. Collect data for a decent sized sample that spans, say a month of trading activity (or longer if you need to get a higher sample but the approach is low frequency). After you collect the data, run the scenario of some simple trade management variations. Such as, how does xyz trailing approach affect results, or what about moving to BE, or maybe never moving to BE, or scaling out etc.....you can run many simple scenarios and see the outcome. From there you should be able to make some basic assessment on probabilities and expected outcomes. The main benefit of this is that all your trade entries are not done in hindsight but you can clearly see how various trade management approaches can make or break a decent approach. I've done this since my second year of trading and still conduct this on a quarterly basis today (quarterly because my frequency is fairly low).

All my best,

MK

GBP/CHF Weekly Pivot

in Forex

Posted · Edited by Mysticforex

We shall assume the target you wrote is a typo?