Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

677 -

Joined

-

Last visited

-

Days Won

2

Posts posted by MidKnight

-

-

Perfectionism has been my weakness. Trying to get very low MAE entries and near perfect exits. Logically, I knew this was asking too much. After all, humans are imperfect, algorithms and models used to trade are imperfect, therefore the market is imperfect. But my mind defies logic sometimes. I started to conquer this when I focused less on the actual entry trigger and focused more on the general market conditions with zones to enter and scale-in around. Rather than before my single all-in entry off some type of strict rule bound trigger. I had to get lots and lots of exposure to taking a little heat on an entry. Perfectionism still affects me today, but it definitely has less control over me than it did for my first 3-4 years of trading.

Good thread.

With kind regards,

MK

-

There was a decent thread on that 'other' forum some years back where a trader I very highly respect was questioning MBTs liquidity providers for the FX market. A guy from MBT was replying to thread (from memory, I think he was the principal for MBT) and wouldn't give any information on the guys queries about who was providing liqudity. The MBT guy kept saying it was part of their proprietary process or some equally obscure and nonsense response. The trader kept pressing but the same responses were given. I thought that was pretty shady. I mean what is so proprietary about saying UBS, deutsche bank etc are making our markets. With IB you can view the FX product info and find a list of all the banks that are making the markets for the ECN FX product. It is no secret, and it shouldn't be a secret for you as a customer - IMHO.

With kind regards,

MK

-

What gets you with the unmanaged stuff is when the GC kicks in, you usually get a noticeable stall in performance. If your code is continually allocating memory and also marking references to null just as often, you are gonna get the GC kicking in quite often and it wouldn't be unusual for it to kick in when you don't want it to

Damn Murphy!

Damn Murphy!With kind regards,

MK

-

Bit of debate about starting account sizes and that some would have preferred larger balances. If the goal was instead a huge % gain on initial stake then the initial account size criteria all changes - just putting that out there in case it wasn't considered (of which I highly doubt from the astute folk here).

With kind regards,

MK

-

LOL - what a well written, inspiring and funny piece. Thanks for the post

-

Yeah but you are talking about trading EUR/USD, not USD/EUR, so you will be required to be within the EUR minimums....

-

I realize IB requires minimum 25k positions, but I believe you can size in increments of 10k...just has to be >= 25k total...I think.Hiya,

Just to clarify here, through idealpro you can trade any size on EUR/USD that is above 20 000 euro. There is no requirement that you must trade in 10k increments. The only requirement is that the trade must be within 20 000 - 5 mln euros. If you wanted to trade more than 5mln, you would do it through multiple orders.

As an aside, I honestly don't know why you seem hung up on wanting to trade the futures vs trading EU spot through an ECN broker.

With kind regards,

MK

-

As kiwi said, with IB the spreads are from the banks. You are gonna get spikes and spread widening in any market Corey around key events, this is inevitable. I know what you are saying about Oanda though, they will widen it some 15-30 seconds before the event and depending on the volatility after the event they will keep it wide for another 1-5 minutes.

In comparing Oanda with IB during minor to major scheduled news events, I note than the spread at IB often does widen right at the event but it only lasts for a fraction of a second. If you blinked, you probably missed noticing it. Again, this is no different than any futures or stock market around key events. My feeling is that a ECN model like IB is the fairest you will find in the FX world. View the product details on their site to see exactly which banks are providing liquidity for their offering.

With kind regards,

MK

-

As someone who has undergone commercial aviation training back in the early 1990's. You would be surprised how little simulation there is. There is no simulation at all for the entire commercial license (your first 200 hours) and you only start doing sim when going to multi-engine IFR stuff due to the cost if you crashed the real plane. It is not because sim is a better teacher, strictly the costs...The same is said for major airlines that have sims for jets. It is a cost thing but not because it is a better teacher.

With kind regards,

MK

-

Following along closely guys. I'll be very keen to see if you guys employ similar trade mgmt / money mgmt approaches.

With kind regards,

MK

-

As a minor aside Randy1953, you can set attachments on this forum. I'm not sure why you were having issue, maybe it was due to the file extension? I believe that not every file extension can be attached, I think it says which are allowed in the manage attachments dialog.

With kind regards,

MK

-

You guys assume the broker is at fault there but we just don't know that. Remember, interbank is not a centralized exchange and it is easily possible that the banks Oanda use are providing them with quotes near to what they are showing there. I'm not trying to defend them or anything, just putting it into perspective that we cannot just assume they are being dodgy with those quotes.

Spot FX brokers that follow an ECN model are the best way to go as you have the best chance of getting the best bid/offer from a variety of banks.

While I do agree the futures have benefits if you are trading in the USA timezone and you are only trading from 3 (EUR, GBP, JPY), maybe 4 (maybe add CAD) currencies. If you are not trading a USA timezone and/or are interested in any crossrates then the spot market is all you have.

As a minor aside, futures contracts are too big for many small traders making scaling out not an option for their method. Flexible position sizing in spot FX is another advantage IMHO.

Like everything in trading, its not a clear cut & dry answer for everyone's circumstances and needs.

-

Looking forward to it. Money management and trade management is where nearly all my effort goes these days....

-

Then change the resolution from 1 minute to 3 minutes to 1 hour to 4 hours, etc. What you will notice is that point C will vary GREATLY from one resolution to another resolution. E.g. when on 1 minute resolution the ray crossed the price bar at 122, on 5 minute resolution the ray may very well cross the price bar at 132, and on 30 minute resolution the ray may cross the price at 112. You do not know which trendline to trust.This is a result of incorrect bar thickness and / or bar spacing on respective resolutions

Hi there,

Unless I totally misunderstand what you are saying here, the problem you describe has nothing to do with error in the charting package but is a sad fact of trendlines. By changing the interval you are adding / removing bars and that is going to change how your trendline interacts with the bars. It's no error with the charting package, it is just a fact with trendlines and IMHO, really makes trendline concepts flakey.

With kind regards,

MK

-

I bet 99% of the people in here are brokers and vendors.I'll take the other side of your bet!

-

Try and plot CVD as Fulcrum does alongside with cummulative up/down tick volume delta... and look at it - can you figure out anything from it? Tell us if you could.Hi there,

I have indeed done this for quite some time on Asian futures. I'm not sure I understand your question though. Figure anything out?

With kind regards,

MK

-

Also, possible typo's in your dll function calls??? I see the odd space where there should be none.

-

Hi there,

Just a hunch, but at first I would think the exception is coming from the dll and not from the code unless you are possibly not passing in a float as the required float param. That would be my first place to look, but I'm no EL expert....

With kind regards,

MK

-

Yes, back in the day it was not easy to get clean BID/ASK differential data (or charting software that even knew how to show that data.....INCLUDING NeoTicker). Also, after all these years you can see not even Neoticker has any decent off the shelf Cumulative Delta tracking tools. LC does not at all seem interested in CD, so I am never surprised when he makes comments like that.

Well now we have MarketDelta, Investor RT, NT7, Sierra Charts, and soon TradeVec and the next Tradestation summer release that will have Cumulative Delta tools.....COOL!

Traders who want to pay attention to the order flow are asking for these bid/ask differential tools everywhere, so I wonder how good LC is at spotting a trend?

Hiya FT,

I can't entirely speak for how LC trades, but I know he has done extensive work on market internals, and that is why neobreadth exists. He is a trader, and what you see in Neoticker is what tools he and the TickQuest traders need - not necessarily what others want. The model is more about giving you the tool to make anything you want in any language you want.

Delta tools are available from the forum or one can code it up however they like in whatever language they like.

Yes, I am a Neoticker fan

With kind regards,

MK

-

The ADP Employment Report had some effect on the EUR/JPY..this news was NOT "market moving" or "high importance" on Econoday or DailyFX, yet it still caused the Oanda spreads to widen to 10 ticks! I have a feeling I'm going to end up getting taken out on one of those news spikes one of these days...

Hiya Cory,

Use the forex factory calendar as the reports there are coloured by how they generally affect currencies. You'll see that the report is marked RED

Forex Calendar @ Forex Factory

With kind regards,

MK

-

You raise a good point about bid/ask in that is it really worth it to have bid/ask instead of the more reliable uptickd/downtick?I'm pretty sure I remember reading at the Neoticker forum that Lawrence Chan (long time system developer, trader, and owner/creator of TickQuest, the makers of Neoticker -- What a mouth full that was!) always recommends using up/dn tick on any data feed due to its higher reliability across data sources.

With kind regards,

MK

-

I agree that guy is awesome. When I first saw that vid sometime last year, there was another guy doing very very similar stuff on the DAX that I thought was even better. Both these guys were uploading around the same time. Sadly they have stopped it seems....Anyhow, here is the other guys channel.

-

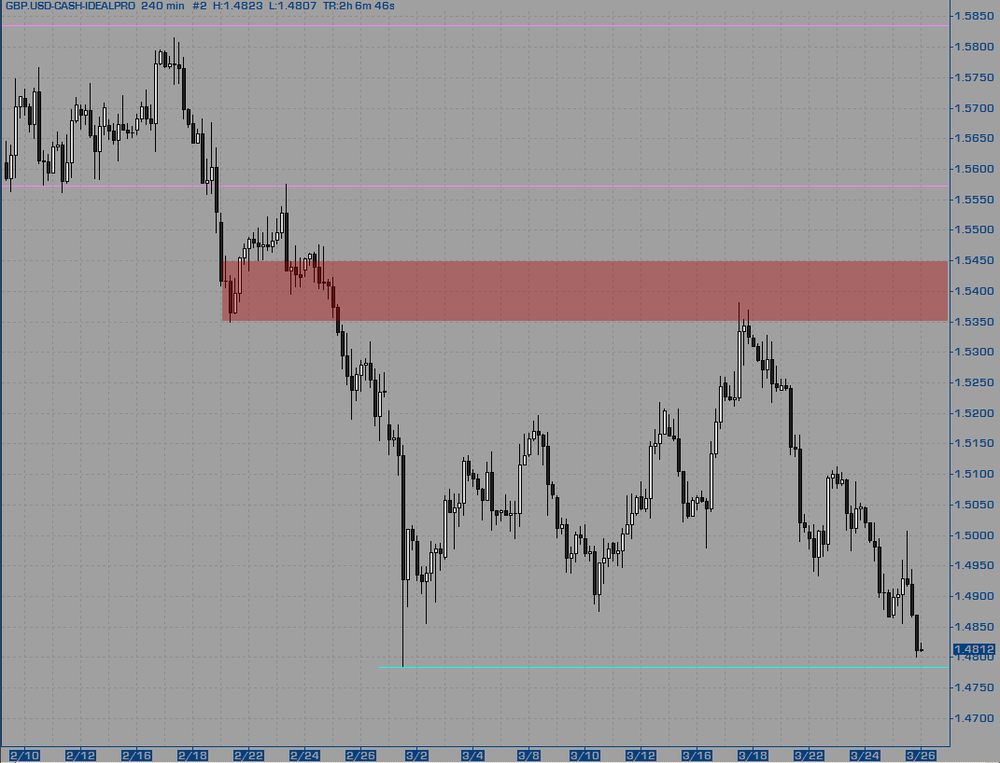

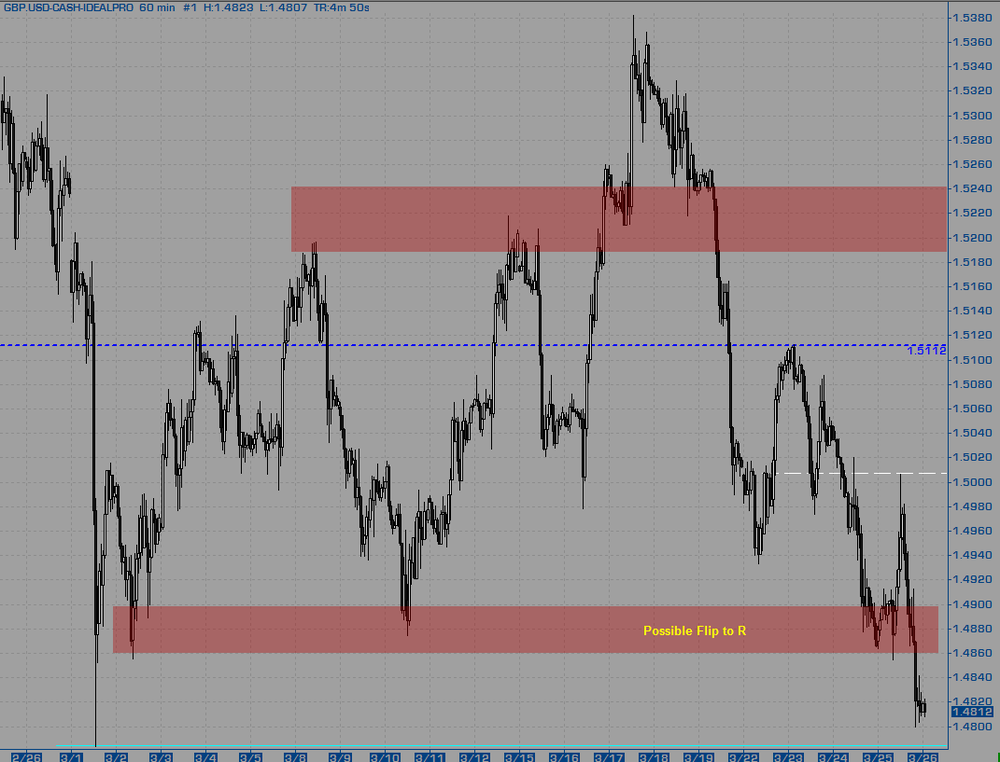

Major trends continue to reassert themselves with EU driving to new yearly lows on two separate thrusts last night and GU breaking the last S level to stop just short of new yearly lows.

NOTE: Review my target determination approach this weekend as it feels that I may be treating the less significant S/R as if it will be a major turning point and setting my targets too far away. When trading with the immediate trend or at the major S/R then use the larger target approach and use 1/4s, otherwise use 1/2s or 1/3s and take profits quicker. Plenty of the smaller wiggles do 60-100 pips and there is just no sense in me only taking 1/4 of position off within that area to get stopped BE on the rest.

Attention Points

1.5190/240 pivotal S/R

1.4940/500 immediate trend R

1.4850/900 flip of what was the last S before capitulation low

++ 1.4814 --------------

1.4783 capitulation low

Longs

I really need to stay off any longs today until we either break that low in a very fierce manner of extreme selling (does not include the stops that will probably trigger on a break of the yearly low) OR until we trade back up through the 1.4850/900 prior S level and pullback into test it. I don't think this will happen today, but if it should....1/4 off before 1.4980, 1/4 off before 1.5080, 1/4 off before 1.5140, 1/4 off in the 1.5190/240 area.

Shorts

Should the market rally be unable to punch out a new yearly low before I start trading tonight then I will look to be aggressive on a rally up to the flip S/R in the 1.4850/900. 1/4 off before exceeding PDL 1.4800 area, 1/4 off on a possible stop run spike moving to new yearly lows, trail the rest for a possible decent run lower of couple hundred pips.

No short plans if the market instead breaks to new yearly lows without rallying to the flip S/R.

-

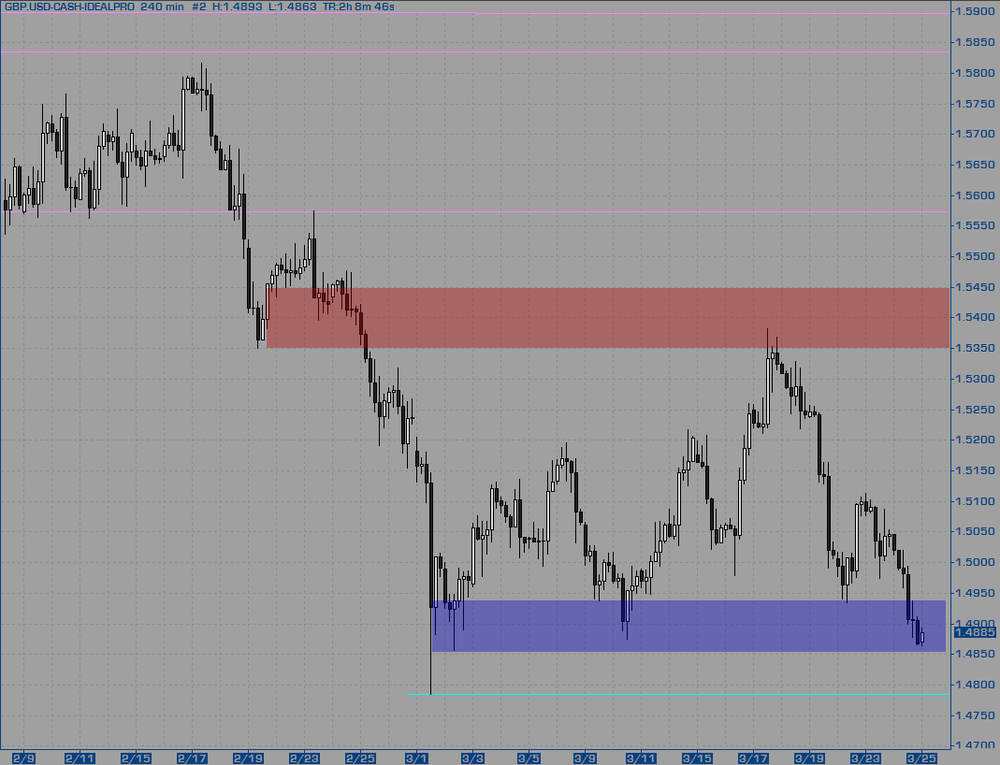

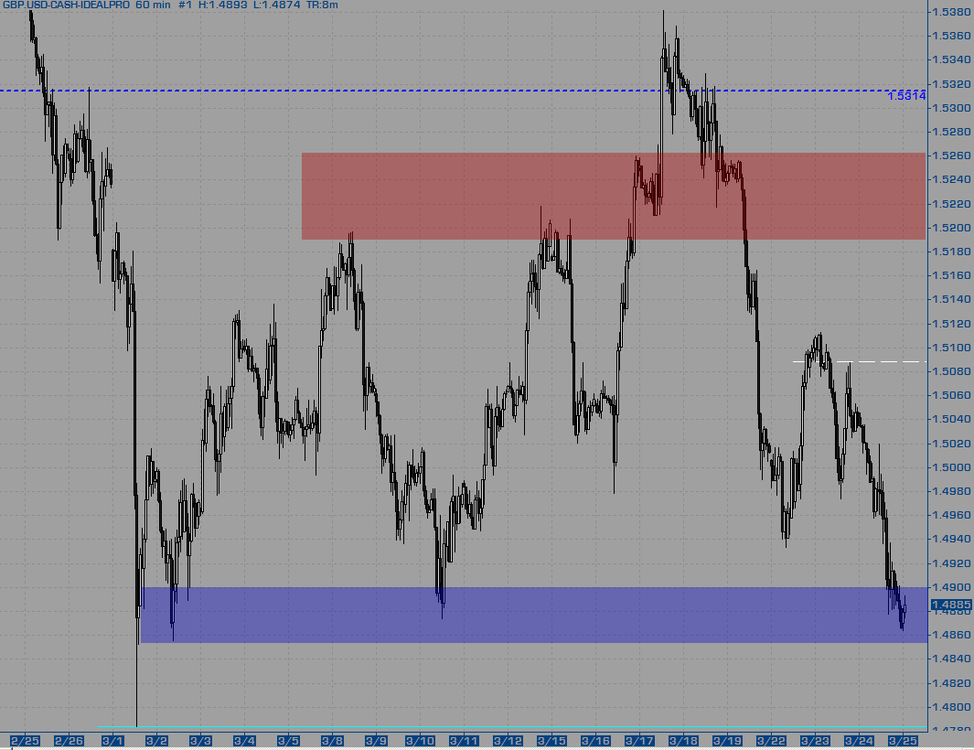

Pretty good down day testing this lower S while the EU made a new yearly low. I'm happy to look for longs down here into about 1.4850 area but also be aware that both the immediate and major trends are down and with the EU dropping fairly hard it could easily pull down GU with it.

Attention Points

1.5190/240 pivotal S/R

1.4940/80 minor R

++ 1.4886 --------------

1.4850/900 last S before capitulation low

1.4783 capitulation low

Longs

Obvious longs only while above PDL but within this last S before capitulation low area. Below PDL but within this zone I can be a little more aggressive. It really all depends how Asia reacts to the Europe and USA sessions. 1/4 off before 1.4940 trades, 1/4 off before 1.5020 trades, 1/4 off before 1.5080 trades, trail the last 1/4 for a move into the upper pivotal S/R 1.5190/240 area.

Shorts

Because the immediate and major trends are down I am OK with selling the minor R in the 1.4940/80 area. 1/4 off before 1.4880 trades, 1/2 off before the low of 1.4783 trades, trail the last 1/4 for a move to significant new lows.

The Race

in Traders Log

Posted

Hey Thales,

Just an idea as I think I have seen you mention that you have an IB account. Why not use a small sub-account as your EJ entry rather than go through the FXCM micro account? I'm not sure if you thought of that, or if you did, I'm curious why it was decided against.

With kind regards,

MK