Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

677 -

Joined

-

Last visited

-

Days Won

2

Posts posted by MidKnight

-

-

Also, the first entry was far to premature for the expectations I set for the trade. I knew as much to expect at least one new low.The second entry was too late to initiate the position (or at least not as favorable a position as I would have liked. The ideal buy point, had I been following properly, would have been a buy stop 125.35 or 125.65. Had I been paying attention, rather than slacking off sleeping, I would have liked to have bought at 125.35, added at 125.65, and raised the stop to 125.80 on the break above 126.25.

So, the results so far have more, in fact, everything to do with poor execution of plan on my part than on the plan itself.

For what its worth, my daughter told me to do just as you said I should do on the first trade - stop and reverse. But, I guess it just didn't matter enough to me. Perhaps I shall have to take this more seriously, and only initiate positions when I can do so as I would do in an account that mattered to me. In other words, I guess I should trade it as though my equity depends upon it, and not as though its just a $25 chip I found on the casino floor for a free drop in the slots.

Best Wishes,

Thales

Hi Thales,

While I can see why you are saying what you are about trades 1 & 2 of the OIRC experiment, I also know you have taken trades that look just like that (as per what is shown on the 15m chart, not including other contexts) before and they have worked. Had those trades worked out instead you might be using words like, the first entry might have been premature because it looked incomplete but I still felt the odds were good for a sizable pop. I was just chatting with some trader friends about systems vs discretionary trading last night. Systems take away a lot of the responsibility one feels for having a losing trade. It's almost an attitude of it wasn't my fault it was a loser, the system did it. But with discretionary trading every trade can be 'fixed' in postmortem analysis whether it be the entry, exits, management etc. It's the complete acceptance of the results that I think make discretionary trading so hard. I'm not saying you don't accept them, your post just reminded me of this conversation, maybe I've taken things slightly off track....

Back on track then....you know what I'm saying here, I am sure. The leverage you are using one needs to get very lucky immediately because there just isn't any leeway for negative outcomes that are part of the probabilities. I wonder why you want to use the leverage this high?

FX trading is tough because of its 24 hour nature. In my review I see a lot of very obvious trades but.....maybe not so many during the hours I am available. In the past I have tried living around this by setting alarms on the computer at key areas and basically sleeping whenever I can. Like Brownie commented the other day, this will burn you out. The idea looked good on paper to me, but in practicality, it nearly killed me

The set and forget type approach can work, I think, but maybe it is harder with a tight style of play that doesn't allow for probes - what do you think?

The set and forget type approach can work, I think, but maybe it is harder with a tight style of play that doesn't allow for probes - what do you think?With kind regards,

MK

-

....For JR, you have to constantly trade 3 units, sell 1 to cover costs, sell 1 at a take profit, run the last unit.Keep pyramiding, so that by the end of a large run, you may have accumulated quite a large position with the trend.

Hi DugDug,

I've thought about this a lot for a while now but ended up thinking that the concept is in conflict. I mean if one is going to be scaling out quick and fairly quick (exits 1&2), but then later on adding to the winner (the pyramid part) - the whole thing seems in conflict to me. One is adding to the trade when the risks for continuation are diminishing. At least that is how I decided upon it

Ya know what I'm saying?

Ya know what I'm saying?With kind regards,

MK

-

...............................................

-

Hi Thales,

I was wondering if you are still considering doing that 'set and forget' experiment? Even if you did it with a demo account it would probably still give worthwhile information both to you and to anyone you chose to share with (hopefully this thread)

With kind regards,

MK

-

Also they step up their "security anti terrorism " paperwork, that means they freeze your assets and ask questions later if you have anything unusual.Hiya,

This 'security' has been active for a couple years already. I had this happen with an IB account about 2 years ago. What annoyed me about the whole thing was that they freeze it automatically and didn't bother to tell me about it. It took me well over 6 hours and 4 separate phone calls until I could actually speak to someone that was able to address the problem. I was livid. Someone outside the USA and outside the EU could really garner some solid business if they setup a quality brokerage firm in locations with less absurd regulation.

Oh yeah, I also think this forex regulation is dumb. Reduce leverage on FX but you can go right ahead and trade the ES with only $500 day trade margin at some brokers. All the leverage reduction does is reduce the small players, and they are not the ones moving the market anyhow, so what is the point? It's not going to stabilize anything.

-

Over the last 3 months I have learned that much of my regular pain with trading was/is from trying to achieve perfection,catching nearly the exact top or bottom on an entry and taking no heat and then exiting at virtually the exact right time to exit to maximize most virtually all of 'the move'. I've long known its an unrealistic expectation but I was on small time frames scalping and felt this type of mentality was virtually unavoidable to make both the math work and the fast paced trading of scalping working. Over those past 3 months I have been exploring a longer term approach on currencies that does not get perfect entries or exits by any stretch of the imagination and to my huge surprise it works quite well. I sometimes take quite a bit of heat for quite a bit of time under this approach. As noted by Frank in his first post, I have also noticed that I do not 'go on tilt' within this time frame like I easily do in small scalping time frames.

Moral for me: Everyone is imperfect. The market is made up of everyone, and therefore is also imperfect. I am imperfect. Making money from trading is imperfect. Accept imperfection.

With kind regards,

MK

-

-

I went through those books back then, and it seems it's basically a mix of the fields of computer science and statistics. I'm not sure of MK's background completely, but the computer programming reminded me of this.All this to say...there's more than one route to huge success in this game. I think this approach isn't really fitting with MK, and that he seems to have some issues/disagreements with the concept and the logic behind it...which is totally fine..."different strokes for different folks."

Maybe this would be something he (or anyone else) would be interested in.

I dunno, just thought I'd throw that out there.

-Cory

Hi Cory,

Another book on the subject that I would wholeheartedly recommend is Evidence Based Technical Analysis by Dave Aronson. The stats approach is the only way to truly say there is an edge, otherwise any claims of edge are virtually assured to be distorted by discretion in real-time and under hindsight by various biases.

I've said in here many a time that I am all for discretion and I in fact embrace it my own trading. Your post here makes it seem as if my 'discussions' with Thales might be viewed as confrontational, but from my point of view, they are not. The questions are meant to try and dig a bit deeper into his thinking because I am sure his trading is as automatic as waking up in the morning and quite possibly what he thinks is so obvious it isn't worth explaining, well...it might be. Yeah, I do not agree with some of Thales assertions about 123s, but I don't think I have any issues with the concept or logic behind them - do I?

With regards to the approach fitting me or not, I'll let you know when I am through exploring.

All my best,

MK

-

I was thinking more of a business objective statement rather than a book. Assuming your goal is indeed to profit from your operations - what sort of profit do you expect and how would you like to acquire it? At the very least you might consider pondering those for a while, even if you think initially you already know the answers. There is something beyond mere technical considerations that is causing your difficulty, MK. I truly do believe the answer to your quandary is within you, and not ina anything I can do or say technically about the maner in which I trade.You have to be willing to work on yourself.

There are other points in you post to which I will have to respond later.

Best Wishes,

Thales

Before I quit my job as a programmer to trade full-time I purchased Van Tharps Peak Performance home study course and over the last 5 years I have worked through the entire course 3 times. Shortly after trading full-time there was some areas in Tharps course that didn't make sense to me (the parts integration stuff) so I contacted a local NLP consultant to guide me through the process. We did a few sessions together before I started doing it on my own. The huge majority of 'trading' books are psychology / motivational books. I own very little technical literature.

Is there more work I can do on myself? Absolutely! But that is true for anyone. I also feel that blaming ones psychology for lack of trading success is often an unfair scapegoat. If you read any of Steenbarger's stuff on traderfeed, he has written several times that all the proper psychology in the world won't matter if one is trading without an edge. It really is that simple. No edge, and it won't matter at all. If have an edge, then the psychology comes into play.

Yeah, I can do more work on myself, and maybe surprisingly to some, that is a part of why I trade - continuous self-improvement.

With kind regards,

MK

-

What I am saying is that H-L-LH (short sequence) or a L-H-HL (long sequence) can manifest itself at varying degrees of trend. By degree of trend, I am referring to extent or magnitude of price movement when price is followed as a continuous flow of activity (time is also a factor, though on the degrees of trend that manifest themselves intraday, time is much less a factor than when considering larger trends).I do not advocate trading all such sequences, especially those of small degree.Hi Thales,

I think I am going to bow out of this discussion as I feel we haven't really made any progress on original discussion that all trend changes are preceded by a 123 and that 123s are an edge. To me, you seem to be mixing varying levels of degree to assert your statement, were as, I am saying that all trends do not reverse with a 123 of the same degree as the trend. I am also baffled how you can say 123s are an edge but you would not advocate trading all of them across their varying degrees. For if it was a true edge, one would want to be trading all of them unless one had extra filtering to enhance the edge.

I think you are concentrating on price as blocks of activity that exists in discrete units known as bars. You see inside bars. I see chop zones (chop zones, like the trade sequences themselves, exist at all and varying degrees of trend).No I am not, but when a 15m chart is posted it sure makes it a lot easier to communicate the chart due to its static nature.

With kind regards,

MK

-

G'day Thales,

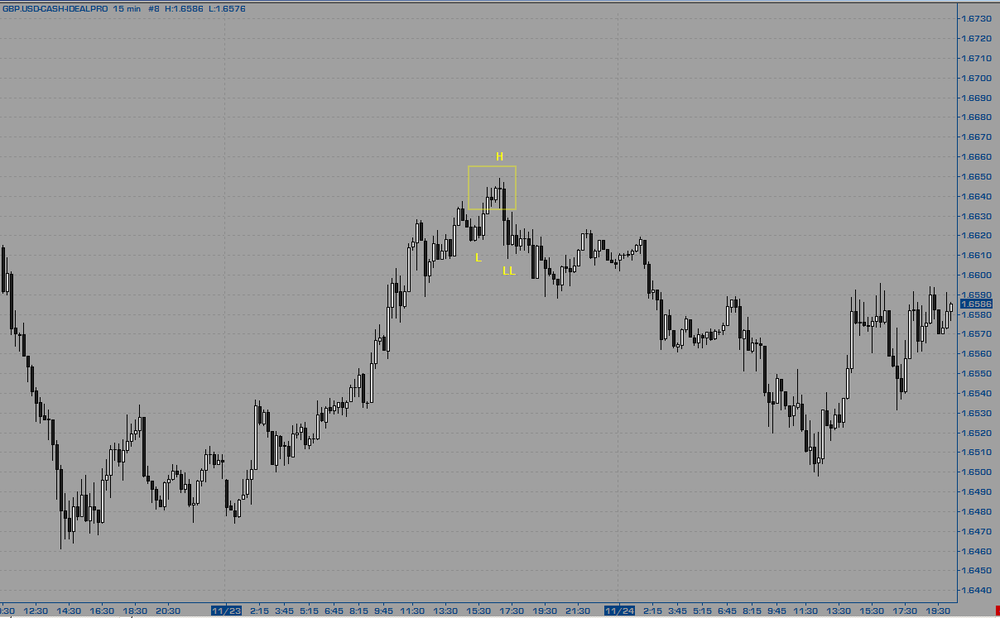

Is it that you think them not clear, or you think them too insignificant to warrant trading off of them? After all, the very definition of trend and what it means to change trend direction demands the presence of a 123 at the point of the turn. Even a "V" bottom has a pullback that prints the first reall higher low.It seems you are using the 123 definition to encompass anything that gives a first HL or LH - I am not as it was my understanding that a 123 was in the following sequence of a HH-HL-LH or LL-LH-HL. I of course am in agreement that every PA trend change starts with a first HL or LH. Perhaps I have a misunderstanding of the JR 123 definition, but I thought it had to be in the sequence I describe which will exclude some sharp trend reversals.

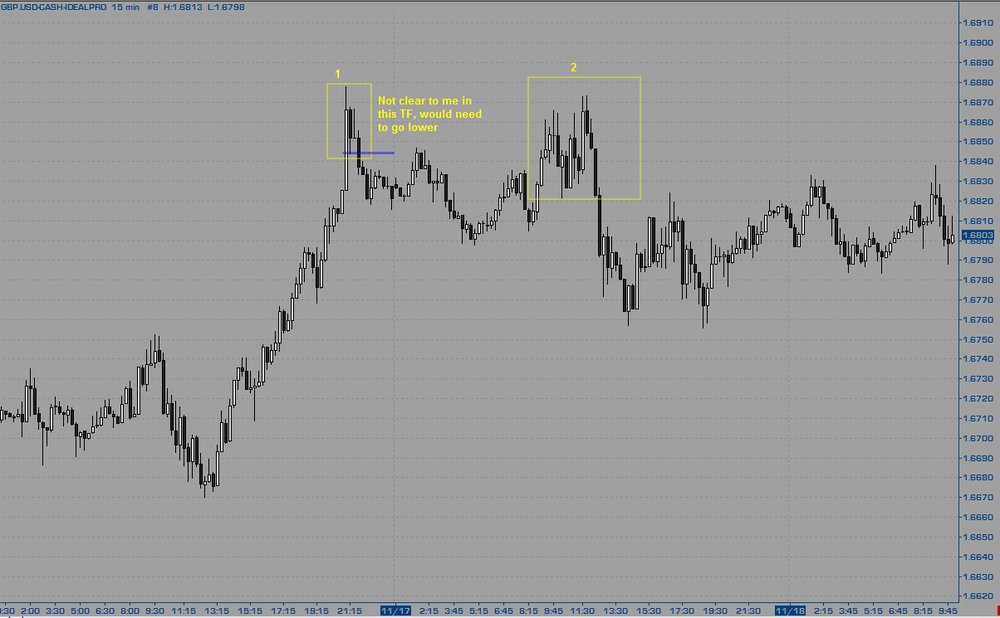

Some of your marked 123s are nothing more than inside bar breaks on the 15m time frame - and those to me are certainly not clear. If one is considering those as a 123 on say the 15m chart, then to be consistent, without need of context (because 123 is an edge as you say) one could take every inside bar break and it would have a positive expectancy. I've tested this programatically 4 or 5 years ago - and it wasn't an edge then. You see what I mean here? Sometimes you trade them with this small inside bar look, sometimes you don't. I'm not trying to point out any 'flaw' in how you are doing things, just trying to hopefully hit home to you how much your discretion comes into play and really the 123 itself is the smallest but most mechanical piece of your trading.

You said that you did not agree that every trend change does not start with a a 123. I think you must mean, even if you are not aware that this is what you mean, that not every trend change commences with a 123 you would consider tradable. This simply means that you have developed some criteria by which you "filter" your interpretation of price action. That is fine. But you need to recognize that you are doing so, and if you are not aware of what those criteria are, you need to try to figure it out for yourself. But every trend change starts with a 123. And every trend is a cascading of 123's in the same direction (except for a sideways trend, which is either a series of 123's alternating in direction, or a series of alternating HL's and LH's (coil, hinge). What I think you are saying is that there is a size or degree of trend change that you think is optimal, and not every trend change seems to offer a clear opportunity compose of the size swings you prefer to trade. I may be wrong, but I think I am not.Hopefully cleared up and answered above....

But they do go somewhere, I guarantee it! Its just you have to learn what to expect from a swing sequence depending upon its magnitude.This guarantee to me implies there are no losers if one trades the 123s which I know not to be the case. If we go back to my exploration I don't recall any comments about me not seeing the 123s. When I trade a 123 with say a 20+ difference between point 1 and 2 and say at least 50% of the range from point 1 and 2 is for point 3. Then it breaks point 2 by just enough to trigger me in to the trade and then reverses, you are saying that I am expecting too much for that magnitude of swing? I seem to remember that happening a fair bit in my exploration and certainly happened a lot during the early exploration in my first year of trading that I was previously describing.

This is the statement that led me to write all that came before. Of course you require volatility. We do not get paid without it. But it seems to imply that you are looking to get something out of your trades that can only be had infrequently.All I meant by the statement was that I find markets easier to read in terms of timing more exact entries and exits when the market is highly volatile. I have no idea why, maybe it is partly due to the speed of the oscillations and the pace of the market. It just seems that I always have best results under these conditions and tend to actually sync up with the market well.

If you were to press me what I think is criss crossed in your trading, my best current guess would be that you want trendfollowing type profits, but you want to get them on a time frame that minimizes your participation in the market. Again, I may be wrong, but before you dismiss my musings out of hand, why not consider them for a few moments. While I may be wrong about the specifics, I am right (as are you) that something is wrong. Let's try to think it out for you.I don't get what you mean by the part in bold. Yeah, I do hate being on the sidelines on large multi-day moves that to me give little opportunity to participate (like GU late last week). When I did review for this past week, After we had done the large move up and then started to creep higher, the easier trades to me appeared in the USA session which is way past my bedtime. I actually like to be active in the market but I find with FX it is easier to only look for 1-3 trades a day rather than the 20+ I am more accustomed to on the Hang Seng.

What do you expect to get out of trading, MK? I think that may be a good question to return to if you are to move forward. I mean this sincerely and in a helpful spirit. I hope you receive it as such.Massively broad question Thales. I could write a book on it

With kind regards,

MK

-

Hi Thales,

My utmost thanks for taking the time to respond to my screenshots with your own images and thought process.

Likewise, you cannot cleave trend from price. And if you cannot cleave trend from price, you cannot disregard that trend exists at all levels, diffuse through price action. When I hear someone say "I could have seen it if I had dropped down to a lower time frame, I know that that person has not yet grasped price movement. He is watching bars or candles, not price. I have said many times that I do not need a 1 minute chart to see a small degree 123 so long as I am watching price live. I do not even need a chart. I just need the DOM.I do not agree that all your 123s are clear, it seems to me that some of them you have marked are simply bar breaks. Yes, I used the taboo word of 'bar'

I understand what you say above but if one is entering off those small 123s that are not clearly visible from the 15m chart then there will be a HUGE amount of these. So much so probably as to overwhelm the trader which ones to take and which ones not. I know this from my first year of trading experience when I was determined to be a price action trader. My training was to involve myself into as much PA as possible every day. I thought that to speed up my process I would look at very small time frame tick charts because this would expose me to more price action per day. I was trying to trade the obvious 123s, very similar to what is advocated here but I lost out huge just because there was so many of these patterns on a small time frame that do not go anywhere. I was doing this on futures of the bund, stoxx, and euro mostly. Back then I was naive and unaware of contexts.

I understand what you say above but if one is entering off those small 123s that are not clearly visible from the 15m chart then there will be a HUGE amount of these. So much so probably as to overwhelm the trader which ones to take and which ones not. I know this from my first year of trading experience when I was determined to be a price action trader. My training was to involve myself into as much PA as possible every day. I thought that to speed up my process I would look at very small time frame tick charts because this would expose me to more price action per day. I was trying to trade the obvious 123s, very similar to what is advocated here but I lost out huge just because there was so many of these patterns on a small time frame that do not go anywhere. I was doing this on futures of the bund, stoxx, and euro mostly. Back then I was naive and unaware of contexts. I am still frustrated at my inability to make the JR 123 style work for me, that is why I keep going on about these here and questioning your thinking in hopes that just maybe I will see the shadows for what they really are. To date in the majority of my trading, I have been unable to extract consistent profits with a single entry unless the conditions are volatile. I would like to be able to hone my skills to be able to trade with a single entry so I can do an all in approach and enter every trade at its max position size. That is I keep spending some regular efforts trying to apply this. Yes, I understand what you mean by varying degrees, but it looks to me that you know when to apply the smaller degree and when not to.

With kind regards,

MK

-

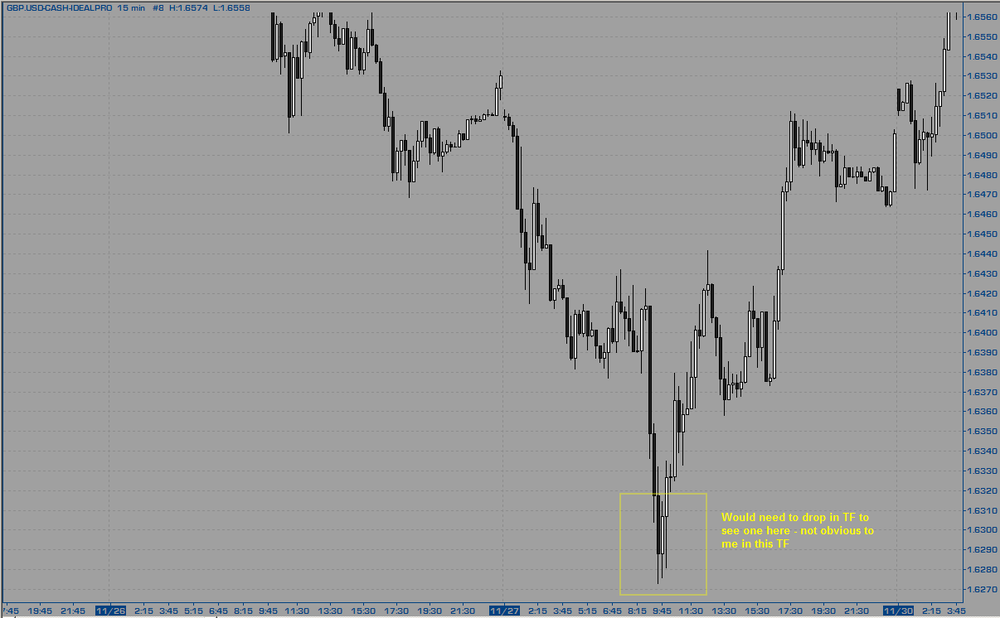

Every trend change starts with one.I need to run out to do some errands, but later on, I will post several 'trend' changes that do not start with a 123 reversal, when measuring trend as per PA and comparing across the same degree.Here are just a couple chosen at random. Now one might say but if one went down to a lower TF there was probably a 123. While that may be true on virtually any 123, even if one had to go down to the tick level, I don't see how that thinking is practical and could easily steer most traders to overly focusing on the micro 123s, which IMHO will lead to overtrading, frustration and probably net loser overall. It's not much different than me saying every reversal is proceeded by a bar break. It's true, but is it practical and easily applied profitably? (non-rhetorical). However, I do wish every reversal was a 123 that I could recognize as opportunity

With kind regards,

MK

-

Otherwise, I do not see how this approach cannot provide an edge. Certainly, context will sharpen the edge. But even on its own, so long as it is uniformly applied as respect to the degree of the swings, how can it not provide an edge?I think BFish brought up great points and points that are no stranger to this thread either. I know you are unable to see how it cannot be an edge, but you are looking at through the eyes of experience, so of course you are going to say that. I think there is something to it still, but it is a discretionary feel about it, rather than something I would say on its own is an edge.

Every trend change starts with one.I need to run out to do some errands, but later on, I will post several 'trend' changes that do not start with a 123 reversal, when measuring trend as per PA and comparing across the same degree.

-

-

If it is OK with the thread, I am trading an experiment very lightly in a small oanda account of which I wouldn't mind posting real-time in this thread. The purpose for me is to evaluate if I am excessively micro-managing my trades. I'll be posting 60m or 240m charts because that is really where the trade idea comes from, even though I am entering on the 5m chart.

I haven't fully figured out my trade management with a style like this, but it won't just be set a stop and targets then walk away - stuff happens after entry and I do think it needs to be monitored in some way, but not excessively like I have been doing. My recent holiday study did reveal that a significant number of my general trade ideas were good, but it was my excessive micro-management that was hurting the bottom line.

This is generally S/R trading along with a trend component based on how I evaluate trend. There are times where I will go against my definition of trend, but in general I do not. I'm looking to take 1/2 of the position off at what I consider a significant 60m S/R area, then another 1/4 off at what I consider a significant 240m S/R area - possibly even the entire position. It will sort of depend on the context - is the market generally swinging or is it generally trending? That sort of thing.

Trades in general will last 1-2 days and I'll be doing this on GU.

I'm currently long (despite my trend read as being down) since early yesterday so will not be posting anything until a new idea comes to me.

With kind regards,

MK

-

Euro is on a tear today, no idea why....just mass liquidation of the dollar I guess...Maybe even taking advantage of low liquidity in Japan session today because it is a holiday there.

-

Hiya,

Sadly, 8 trades is too small a sample to draw any conclusions from. They say, you need at least a sample size of 30 to start seeing statistical significance. Once you have a minimum sample of 30, I would bootstrap to increase the sample size to around 1000 and then start evaluation.

With kind regards,

MK

-

I do my best trading when I sleep - and I'm not kidding. I think I'd own an island right now if I would just have set my order, my stop loss, my take profit, and walked away until I was alerted that either the stop or the take profit had been filled.I couldn't agree more, Thales. Over the holidays I conducted a pretty solid review of my FX trade ideas (trade idea to me, means having the general context right) since coming back to FX land a couple months prior. To my astonishment it is my micro managing that is massively affecting the bottom line. My overbearing desire to book profits early because it looks like it might start moving against me soon and/or moving to BE before a test of my entry has happened.

I need to simplify more rather than make things more complex with excessive micro managing.

With kind regards,

MK

-

hi folks,thank you for the help you have provided with the above chart. I would like your opinions of the following stock as well. I have provided both the longer and shorter time frames

............sell......

Edit: I'm not suggesting sell on this bar, I mean I should already be short and be holding that short from the 3 thrusts up move or at least from the false break high at which point I would be entering pretty aggressively.

Edit 2: I agree with previous poster too, which is the shorter timeframe? For some reason I had assumed it was the first chart.....

-

Hi Folks,I'd like to hear opinions on this stock chart. Any thoughts?

I'd be long intrabar (or immediately after that bar if price was up too fast) on that last bar shown after it probes down and price stalls then pulls up beyond the prior HL.

With kind regards,

MK

-

No, you must roll your own.

-

Across I've got the EJ, EU, GU, UJ...down I've got the 15 minute "normal view"....Hi Cory,

I was wondering why you are tracking it across several pairs? I'm sure you can recall my little exploration with this type of trading. Tracking multiple pairs was the main criticism with what I was doing. I'm very surprised Thales is not bringing your attention back to that considering how much focus this point received back then.

Happy holidays!

-Cory

And you too - stay warm

With kind regards,

MK

-

Two subjects for Sunday morning: scaling out and indicators.Scaling Out.

.....My own approach is to treat each part as a separate setup (trades 1, 2, and 3) and evaluate it W%, winloss ratio, Pf and expectancy.

Hiya Forrest,

In my records, I have done the approach kiwi describes above for a couple years. The same is also done for my scale-ins. In general, I have found the move quickly to BE approach detrimental to the bottom line unless I am exiting the bulk at my first target. If I'm attempting to get many R multiples, unfortunately, this is a killer for me. I solve this now by scaling out and leaving my stop where it is until a successful test has been proven.

With kind regards,

MK

Reading Charts in Real Time

in General Trading

Posted

I never received replies from any of my PM's :hmmmm: :hmpf:

while true I do not mind, just trying to crack a grin