Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

677 -

Joined

-

Last visited

-

Days Won

2

Posts posted by MidKnight

-

-

What if you are already flat? I guess I am asking what your thoughts are about tonight in regards to a game plan for you trading. Not an example necessarily.....so I am just attempting to pick the brain of the only experienced trader I know of posting ACTUAL examples of what's going on in your mind as it happens.A good query I think. I know that when I have been day trading indexes and it starts putting in a strong directional move, my natural instinct is to fade fade fade. It's no surprise that on rip roaring trends I get hammered doing that, but I have such a hard time participating with a strong move after it has already move so far. I too would love to hear your thoughts on forrest's query.

With kind regards,

MK

-

Reporting for duty :yes sir:

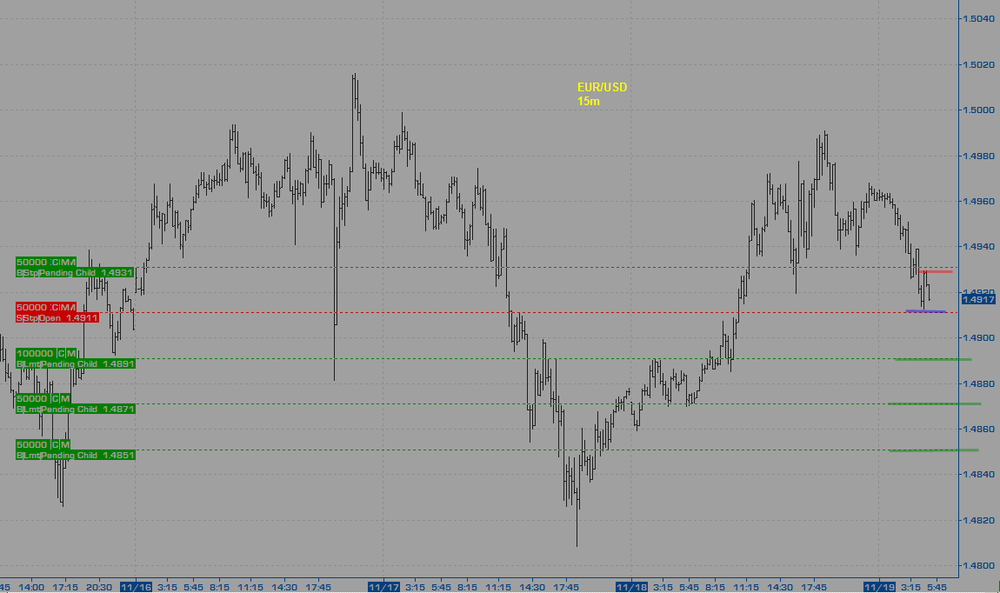

Nice movement in Asia today. Most of what I looked through was coming up on S/R areas so I would be preferring more pullback rather than something shallow and simple. EUR/USD still has some room to go before I can see any S/R I would deem as noteworthy. Here is a possible idea for it.

EDIT: 2215 EST, or maybe the other way?

-

Where's MidK? Looks like they're running tonight.:yes sir: G'day - I'm here! Adjusting to the new sleep schedule means I generally won't be starting up till around this time (1500-1600 local time). It's all a bit fragmented right now, but I just woke up from a 3 hour nap. I haven't explored the markets with my eyes yet - but I'll get stuck in now! :yes sir:

With kind regards,

MK

PS: Don, I agree with Thales - maybe you could expand more what you are meaning with respect to fractals. Thanks in advance.

-

Nice trade, Midk. Last night (your morning) I thought the EURUSD looked like it might break up. But I otherwise felt so out of sorts with what the markets were doing, I doubted I was seeing it correctly. Well done!As an aside, I do let me nine year old daughter read these posts, so maybe we could avoid certain types of language in our posts, etc.

Congratulations on that EURUSD trade!

Best Wishes,

Thales

Thanks Thales. My apologies for the language, I didn't even consider it offensive at the time. It was just that phrase often said. Sorry about that though, I'll pay more attention to my wording in the future.

-

For the most part, we are looking for trades, given the current environment, that will let us get 20-50 ticks at a first PT, while keeping our loss, should we be wrong, to less than 10 ticks on average. Again, if volatility picks up, these numbers will expand. If volatility contacts further, these numbers will likewise adjust downward. I remember a few years ago there was a period of time when the 6E was putting an a average daily range of just over 60 ticksIt's a good point and historically, always a weakness for me. I'm rather slow to adapt to the change, probably mainly out of fear for missing out should the market really break. It's a terribly unprofitable behaviour of mine. I try and chip away at it regularly but it's taking some time....

Reading over some of your recent posts, it would seem to me that you are trading as a day trader, but expecting the moves of a somewhat longer term swing trader. You need to adjust your expectations both to your approach and to what the market is willing and able to give you. From September 2008 to about July 2009, there were many multi-hundred tick move days put in by the majors and the Yen pairs. It even took me a while to reign in my expectations in terms of tick moves as volatilty as drawn back down. I had become accustomed to 50-100 tick PT1's and 100-150 tick PT2's. Those opportunities are just not presenting themselves several times a day like they were months ago.Yes, its true, Thales. Good observation. Again, linked that behaviour 'fear of missing out'. My trading has always been like this unless I was scalping. My theorized reason why it doesn't seem to bother me when scalping is because the frequency is up and ends up compensating for that fear knowing that the next trade is only minutes away. Scalping isn't how I want to trade though, but it does seem to get rid of some of the psychological issues. Of course, it adds others :doh: Oh, the joy of trading....

-

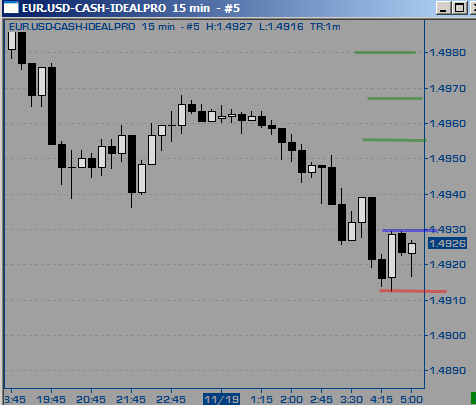

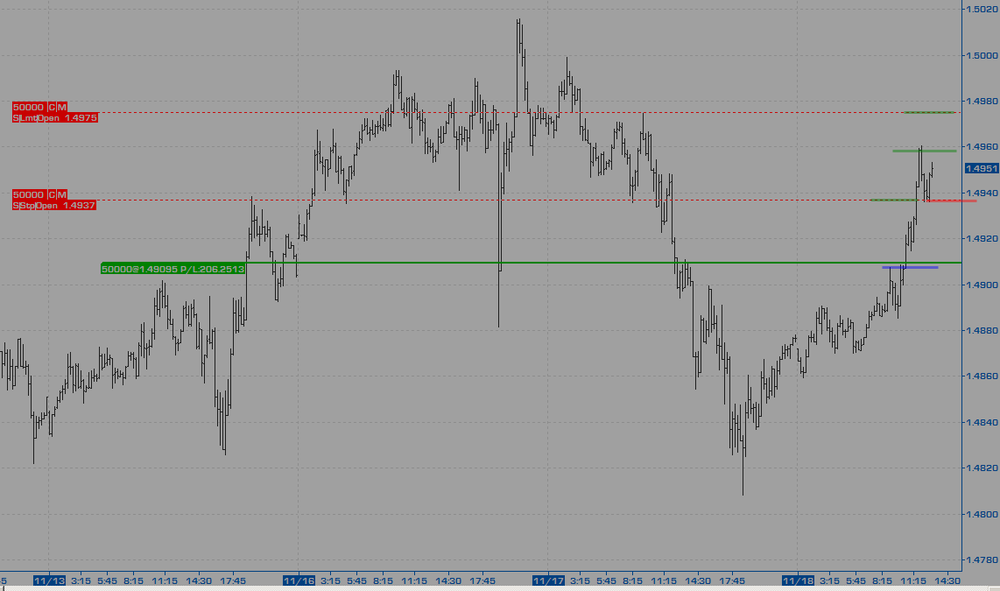

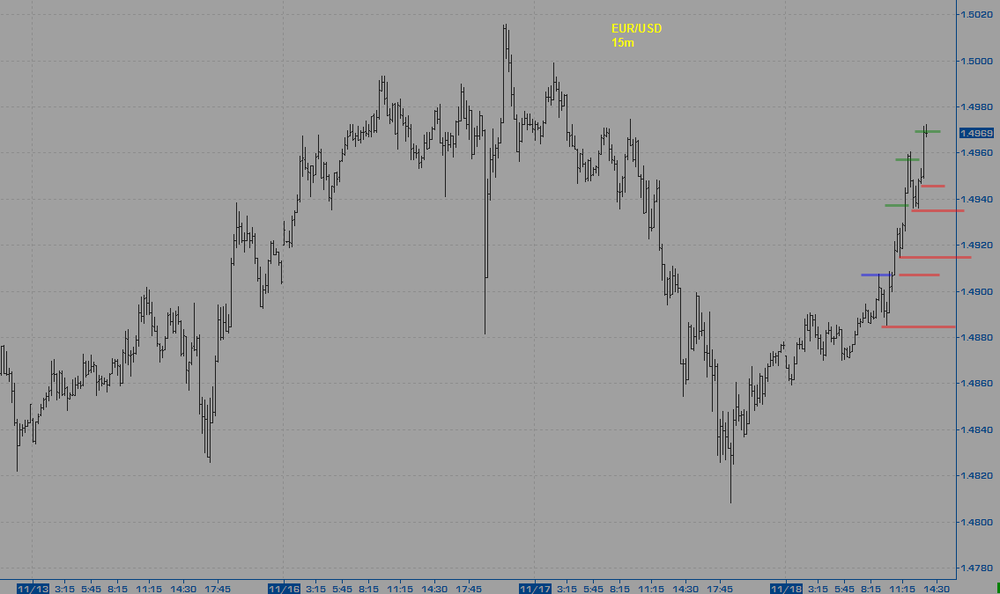

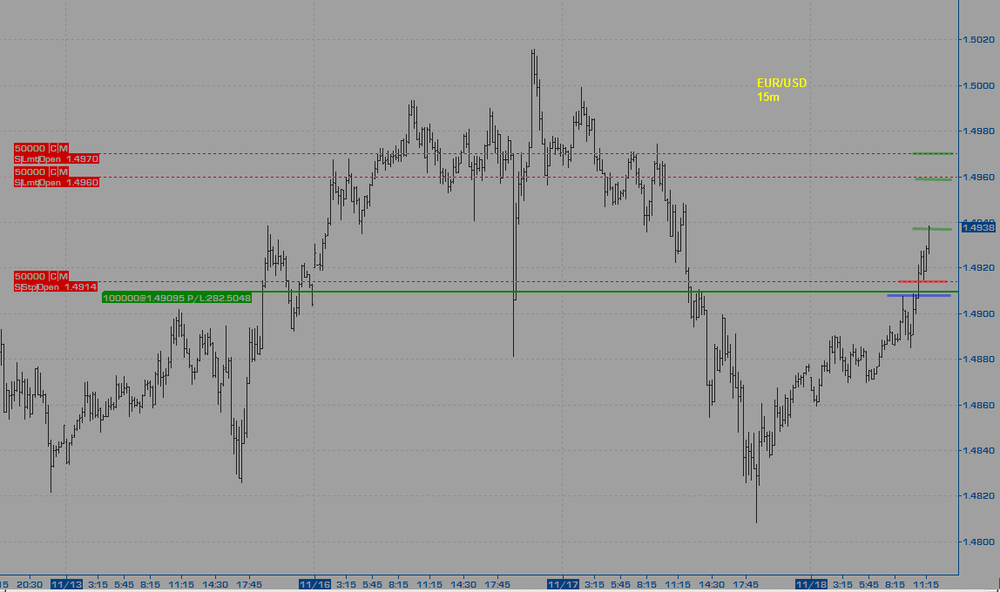

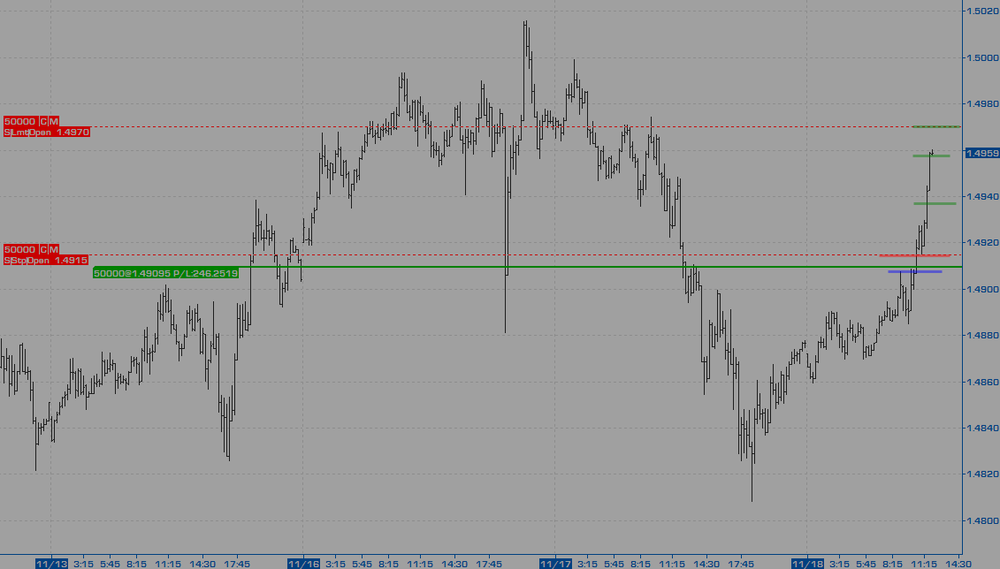

Filled on T1 for 27pips and stop at 1.4915EDIT: 0459, Filled T2 at 1.4957 for 47pips. 3/4ths of the position is gone now.

Moved stop up 1.4937. Maybe premature as it hasn't taken out the high yet...

EDIT: 0619, possible LH in the making.

EDIT: 0639, closed trade at 1.4969 for 59 pips. It's stalling here and I'm not going to be a dick for a tick tonight. Target was set for 1.4975. The gain on the trade averaged across exits was 40 pips. A decent result I thought, especially since the risk was so quickly reduced because it moved. Probably my first real feel for getting things moving as soon as it broke out.

-

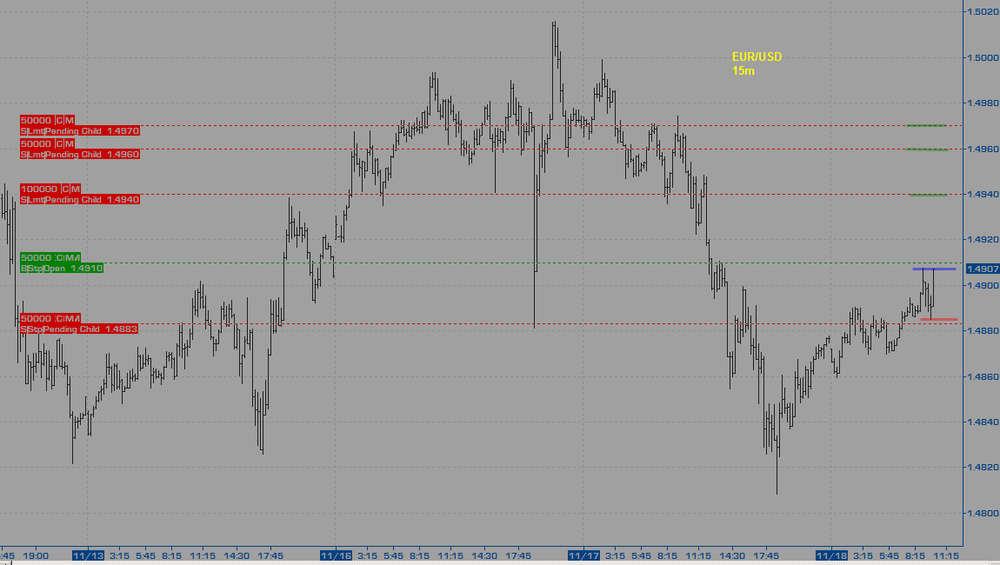

Aloha,Here is a possibility with the euro right now, If this fail here we could get some good down, but I think I'll use a different pair like AUD/USD for that if it ends up happening, since it is hitting the R from yesterday as I type this.

EDIT: 0346 EST, long and moved stop to 1.4898

EDIT: 0401 EST, moving stop to BE

Filled on T1 for 27pips and stop at 1.4915

EDIT: 0459, Filled T2 at 1.4957 for 47pips. 3/4ths of the position is gone now.

-

Aloha,

Here is a possibility with the euro right now, If this fail here we could get some good down, but I think I'll use a different pair like AUD/USD for that if it ends up happening, since it is hitting the R from yesterday as I type this.

EDIT: 0346 EST, long and moved stop to 1.4898

EDIT: 0401 EST, moving stop to BE

-

Hey Thales :yes sir:

I was thinking more about the S/R stuff and thought that maybe you put more emphasis on the recent past few days trade than you would on say S/R from a couple weeks or a month ago - would you say that is true? I know every situation is unique, but just meaning in general. I have been doing the opposite, putting more faith in the obvious S/R, but it is usually weeks or months ago - maybe that is part of my problem. Not assessing the recent past few days action properly while approaching the bigger picture S/R.

Thanks in advance for the info.

Signed,

Private MK

-

EURJPY opportunity. This is countertrend as the movement is still in the main downtrend supply line. It is on the demand line of a new uptrend that could go up to the main supply line, but who knows....EDIT: you can't see the main supply line of the main trend (down) - sorry.

Hi JohnJohn,

You could play this one either way - how com you are choosing to play it for longs if you have the trend as down?

With kind regards,

MK

-

I do not have time to go back and find the posts now, but many times (and recently, I might add), I have stated the following:1) The only time an initial stop should be hit for a full loss is when I am stopped into a position, and price immediately races against me, and it crosses the stop line quicker than I can hit the flatten button; or I place an entry order, with OCO stop and limits, and the trade occurs while I am alsleep or occupied with other business.

2) I always have an initial stop loss, at least one profit target at 1R +/-, and a price level at which I will move the initial stop to BE.

G'day Thales,

Yes, I didn't mean to imply that you hadn't stated this. Only that when people that are collecting stats (like myself) and discussing R, it's sort of an inaccurate assessment of performance with a style such as this because it is rare to take a full 1R loss. I am starting to get the impression that your trade management is as rich and expansive as your evaluation of context.

In trawling through every post and screenshot in this thread I have noticed times where the stop management is aggressive in both real-time and with after the fact posts, but I have only noticed more relaxed stop management on the after the fact posts. Maybe there is some hindsight bias on those? I don't know. It's always nice to catch 'the move' - indeed it is what I have been trying to do on every trade throughout this exploration. But as one can see, it is probably hurting me more than helping me. Maybe the 'playing it tight' type of management is the way to go.

With kind regards,

MK

-

Hi BlowFish,

I believe Thales would see that as a 1-2-3 in the making with 1 and 2 complete and anticipating the current bar or the next few to put in the 3. I shouldn't speak for him, but that is how I understand the chart.

With kind regards,

MK

-

Hi Forrest,

I hear ya on that. Part of the problem may be the general market condition. But I don't know exactly. Time of day has an effect in FX for sure, but I cannot come up with any consistent rule on it. Sometimes the biggest moves start in Asia or the Asia/Europe overlap, but usually it does not. I guess it all comes down to what catalysts are driving the market. In my cursory study over the past year of intraday data on a couple pairs, recently, many of the large day moves are happening in USA session keying off news release. I have no solution or idea how to exactly use this information as I'm sure it will change soon enough. Maybe give up sleep?? :\

On the subject of R/R. I've been commenting about it quite a bit recently, especially how I'm unable to get even a consistent 1R result on my winners. But, I just realized that the notion of what is at risk with Thales Family Trading Co. techniques is not really the initial stop. Yes, sure, it is at risk at the beginning, but I don't think I've seen him take a full stop out yet. Just yesterday on a short EJ trade he commented about one pattern for aggressively moving to BE. I'd be surprised if his average loser is even 0.5R. Maybe when considering the R/R stats, it would be better to take it from your average loser. If nothing else, it will at least make the numbers look better :thumbs up:

With kind regards,

MK

-

Hi JohnJohn,

Yes, I have a journal. A few of my posts are my thoughts after reading through the journal entries. With regards to EJ, S/R is not a single price like you are describing it, but more like a zone, in my view. I would still consider EJ to be at support, but that is just my outlook.

With kind regards,

MK

-

I would be hesitant to enter into a long position because of the immediate congestion (resistance) area at the level of entry.I think this is the problem that MK was writing about but if he didn't I still have a problem with it.

Hi Gabe,

That must be a different problem

This is the type of long I'd be keen on taking because of the bigger picture S/R. However, my results are poor. Maybe forrest's post above is correct in that it might be digging in.

This is the type of long I'd be keen on taking because of the bigger picture S/R. However, my results are poor. Maybe forrest's post above is correct in that it might be digging in.I really don't know anymore.

With kind regards,

MK

-

What would you think about the EURJPY currently?Best Wishes,

Thales

I would be more enthusiastic about this one. However, I would be more curious as to why you are. The GU trade you were commenting on how the trend was of importance to the context, now in this case it doesn't seem to be coming into your context as the 15m trend is down (by my view).

All my best,

MK

-

Yes I would have taken the trade:Price just bounced off higher time frame support near 1.6666

Formed a higher low in the direction of the trend.

Next larger time frame resistance near 1.6740

Steve

Hi Steve,

I see no higher TF support there at 1.6666 area. If you are referring to the high made in late OCT, keep in mind it did blow through that zone 5 times since this time it 'working'....

-

G'day Thales,

Thanks for all the charts. I'm not sure what you are alluding to in recap4 over what is shown in recap3. The same goes for recaps 7 & 8 with the light blue rectangle.

-

Let's see if we can determine the source of the struggle and frustration. Let me ask you (and this is for MidK, Forrest, and anyone else who cares to answer) what do you think of the long GBPUSD trade I posted this morning? Forget about the fact that it was a winning trade. If you were watching, did you see it as I did? Would you have taken it if you had seen it? Why or why not?Best Wishes,

Thales

Yes I saw it, but there was no S/R to act upon plus I was short gbp/chf at the time. I saw the pattern happening on gbp/chf, but again there was no specific support to act upon and I was working off the assumption that once R is tested, it will go to next S.

With kind regards,

MK

EDIT: Thales, while you may call that testing support, the zone is too large for me to trade off and it is only the 15m support view. Sure sometimes this view is valid, but is it reliable? Is it more reliable looking at the more obvious bigger picture S/R? I had thought it would be....

-

You two have just managed to confuse me. You guys are avoiding trading near S/R? I go through hell and high water to find trades that occur near S/R..... i.e. a bounce off of an established bed of support, looking to get long for example. Or are you saying you don't want to trade INTO S/R zones AFTER having initiated a trade?Hi Forrest,

I'm saying that I would be looking for longs at 240m support, not shorts. I've seen many a post where just the opposite is happening.

With kind regards,

MK

-

I agree with your # 2.I have skipped trades because they were on SR zones only to see them turn a decent profit.

About #3 I think you are inacurate because most of the trades that I am aware off that Thales' daughter took hapened during her sleep so there was no way for her to know that volatility will be there or not.

Gabe

Hi Gabe,

I didn't make that clear. The USA session is consistently more volatile intraday (one bar to the next and even intrabar) than any other session, especially compared with the Asia session.

With kind regards,

MK

-

Hello folks :yes sir:

As I'm slowly waking up from a fragmented sleep, I can't help but wonder why my results to date on this exploration are so massively different than anyone able to have success with this, especially the Thales Trading Co. results which are pulling in 30-50% gains on account on a weekly basis. If this style of trading is so simple as has been repeatedly stated, and it works, then at least some success should be possible for total newbie trader, let alone a full-time trader with 5 years of market immersion under their belt. If it is so simple, than ones 'thinking' rather than 'seeing' would not be an issue. For one would would be acting on the price action and the S/R areas.

Here are some of my thoughts on why I'm experiencing such stark contrasting results:

1) Thales overlays a rich contextual filter within his trade ideas.

2) While I have been paying huge emphasis on S/R (I'm referring to 240m chart). Going back through all the posts in this thread, I have seen many a trade posted where S/R isn't even considered (expressed verbally in the post) in the trade idea. When I look at it in hindsight, I feel like I wouldn't take those trades just because its right at S/R area. I'd be fearful of a false breakout. But what can I say, they seem to work.

3) Time of day has an impact on the success I think. Because Thales Trading Co. is mostly trading when the markets have volatility, it greatly helps. Price action is not just price action. Need the volatility to squeak out a profit.

4) Thales Trading Co. seems to have many little ways to move BE fast. I haven't been doing that. Partly because I hate being shaken out, but also partly because trade management is not how an edge is tested. An edge should stand on its own without trade management, of which is used to enhance an edge. Yes, I have some very very simple trade management for the exploration, but nowhere near the extent that Thales Trading Co. does.

5) So far, my results have been massively hurt by leaving on runners, holding out for the big move. I would be far far far more profitable taking everything off at 1R or even 0.5R. This is contrary to what is advocated in this thread, mind you.

6) I'm sure there are more, but my sleep starved brain hurts and that is all I can think of for now.....

I think the approach has some good concepts in that it frees the trader up from the question of where do I enter, where do I put my stop, how do I take targets. That aspect of trading becomes semi-mechanical. However, without the addition of context in some profitable fashion, it is difficult to gather any gains.

The hard thing about price action and S/R is that it is hindsight. You don't know that is support until it bounces, you don't know its just a test until it's reacted. You don't know its a HL until its printed a HH. The method accepts that of price action through waiting for confirmation. So far I'm finding that the extra confirmation isn't giving enough room to squeak out a profit. Last night was a good example with my short gbp/chf. Nearly a 100pip range for the day up until I went to bed, yet I could barely squeak out a MFE of 30pips. That's the cost of confirmation.

I am struggling with this approach, and that shouldn't be possible if it is a 'simple' method.

With kind regards,

MK

-

-

As per GBP/CHF plan posted earlier today. I'd be happy to short this break.At BE finally. Feels like the end of the road lower, I'll be pleased to be wrong about that.

Hi eNQ,

Sorry no idea. I find IB mentally difficult for FX trading. Different lot size minimums per pair, different margins per pair. Unable to know where you stand in your positions with a quick glance. Even placing orders is more mentally involved than I would like.

With kind regards,

MK

Reading Charts in Real Time

in General Trading

Posted

Just an observation - have you noticed how the same pattern is occurring across many of the pairs at the same time? Does it factor into your thinking / pair selection? (I know you try not to think consciously, but subconsciously maybe )

)