Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

HAL9000

-

Content Count

241 -

Joined

-

Last visited

Posts posted by HAL9000

-

-

How Long Does It Take to Become a Profitable Trader?As long, as it takes! Period.

Hal

-

You must have a reason for wanting to learn a language. What are your reasons. If you elaborate more fully here then the answer to your question will become more obvious.Just two things:

I share BlowFish's view.

And beside of the reasons, I would like to ask, how much time are you willing to invest to learn and use a language. 1 hour a day? 2 h? Full time?

And for how long? 1 month, 2 ... a year?

... and some more thoughts:

I guess beginners underestimate how much man months go into an application,

even if open sources are used.

And alone from scratch, well lets talk about man years or even man decades.

You make errors, open sources contain errors, ...

and they all have to be fixed at some point.

Just fixing them, how much time will it need? Especially if you don't understand the open sources you use.

So you have to learn, how they work

and so on.

-

42I remember, but what was the question?

Back to this off topic,

When I started to use forums, I tried to answer unspecific questions too.

Sometimes I have asked for more details, a better question.

Often, the second question wasn't better than the first one.

Written down in 30 s without a further thought on it.

But I have tried to help.

After some time I have recognized, that this questions guessing

leads to nothing but wasted time on my cost.

So that said, I avoid it now.

But sometimes a question is so strange (or a comment attached to it),

that I can't stand it; surely I will not be specific in my answer.

If I am able, I will answer general or specific questions.

When I read the question, I feel/see, if the writer has spent some time on it, before s/he posted it. So when s/he spent some time,

I might too.

And a thank you for some help, doesn't hurts.

I think, I have now had my ego trip with this post.

But that's how it is, if I answer, I answer because I like to do it,

while I try to avoid to waste my time.

Anything else was said before here by others.

Maybe my view is more how I deal with it now.

Hal

-

hey I am learning java not because I wanted to do something in TA but because I want to learn some programming language. But after reading above posts I am curious to know where will I stand w.r.t programming for technical and stat analysis visa vis other languages if I learn java language in depth if it is possible. ThanksHi Delta,

I guess nobody can really answer your question.

But I will tell you what I think.

Quite some time ago, I decided to implement an application, that should use

my brokers API. Because there is a Java application and a demo of its use available,

and I liked to learn Java (I have used other object oriented languages before,

my first one was SIMULA) I started to learn Java using NetBeans as development platform.

Btw. an advantage is, that you can use it for free and don't have to buy expensive software.

Now, as others have already written here, to learn the language and concepts is one thing,

and I don't know how long a real beginner needs for that, but there is a second point.

Are you able to develop all parts of your software alone?!

Lets explain, if you like to have charts, will you code all this,

or will you try to use open sources. Then, are there open sources available for your needs. Do you have to modify them?

Now to statistics. Same story as above.

So my conclusion is, with using Java (or comparable languages) you can do

nearly everything you like. But you have to do it.

So it is really the big question, what you would like to do with your

application. And before you start to learn Java, you have to check, if there is an easier, cheaper,

more efficient way to solve these tasks.

If there is none, well you might need to implement your application,

but for the majority of people, its easier and better to use already available platforms.

Hal

P.S.: I still like Java. I go on developing my own ideas, but it was a long tough way so far. And the way goes on.

Last but not least, if I can help you learning Java, just ask, but remember,

I am also still learning it. :helloooo:

-

... just do it ...

... its ... better ...

Hal

P.S.: Sorry but I am in the mood, WHY has her/his analytic mode, very clean and helpful,

but as I use ... myself sometimes, your (elo...) use of it, just avoids complete sentences.

But for analytic purposes, even a complete sentence might lack syntax and/or semantic.

But ...

Anyway, I don't like to read the word "pi**ed" so often.

Yes, I also go hunting from time to time, but ...

So please: PEACE

-

And I would like to add: Add range bars too.

I recently discovered them for myself,

and at least for me, their use makes sense.

-

I found this post on "Re: Trader P/L 2009" interesting and have nominated it accordingly for "Topic Of The Month May, 2009"

-

-

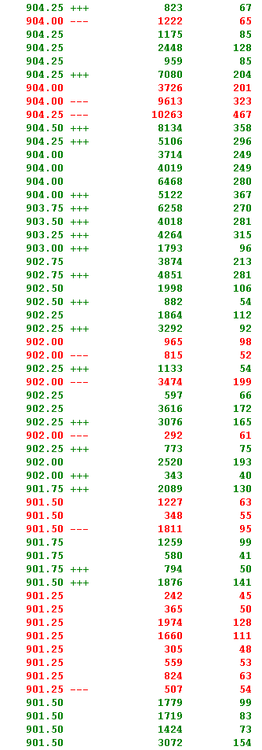

I don't understand the illustration.Basically its a 5 sec tape, if you read it from bottom to top,

price is rising on high volume and a high number of trades (ticks).

I don't know how a usual tick tape would look like,

maybe there would be more red in between,

but I think, that the use of "snapshots" can filter out some noise.

I have posted this because during this run,

I can't see something like minority control.

It just tells me -> up.

Surely, there are other moves, where price is moved on relatively

low volume compared with other moves within the same session.

These, I would consider are under minority control.

But maybe these moves are just a correction to the last

starting point of a high volume move.

For example: buy 10000 contracts,

wait and sell 2000 (correction) down to the starting point,

buy next 10000 contracts.

This might work if not everyone likes to buy.

Anyway, just my thoughts and finally the market does what it does,

so I don't know if all these interpretations are worth something.

I think trend lines have more value.

-

You are describing the concept of "Minority Control".Hi Tams,

I think I guess, what you mean, but could you elaborate a little bit.

BTW, I have taken some tape screenshots yesterday (ES, after close, somewhere between 4:00 and 4:15 pm EST).

But its not Bid/Ask, its the vwap of 5s bars.

So one line represents: 5s vwap, # contracts, # trades.

FWIW, have a look:

-

I've been sim trading the es for a few months now and When trading stocks, you buy at the ask and sell at the bid which makes sense, but with futures it's the opposite, buy the bid and sell the ask...?Hi Mark,

in my view its the same for stocks and futures.

If you try to buy a stock, you can limit your order below the market price, so that your order is part of the bid.

If you try to sell a stock you can limit your order above the market price and it should be part of the ask.

For futures its the same.

If you don't use limits, and place market orders instead, you buy at the ask and sell at the bid. Whatever it is.

So its about order types.

-----

Tape reading; well, that is another story.

But yes, if the price is rising there is more pressure at the ask, vice versa for a falling price. Does tape reading make sense, yes, but it needs time,

and maybe the use of simple trend lines on charts can save much time.

-----

Just my thoughts.

Hal

-

They covered it, Sonny Curtis and The Crickets was the original, but the best....I didn't knew that, thanks for sharing.

But now back to sim trading.

I switched to the ES, because I think it is behaving somehow "cleaner" as the NQ.

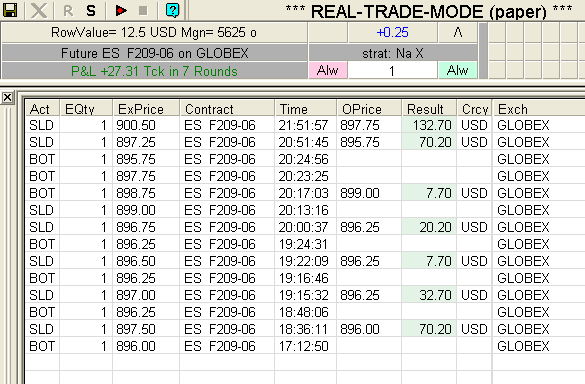

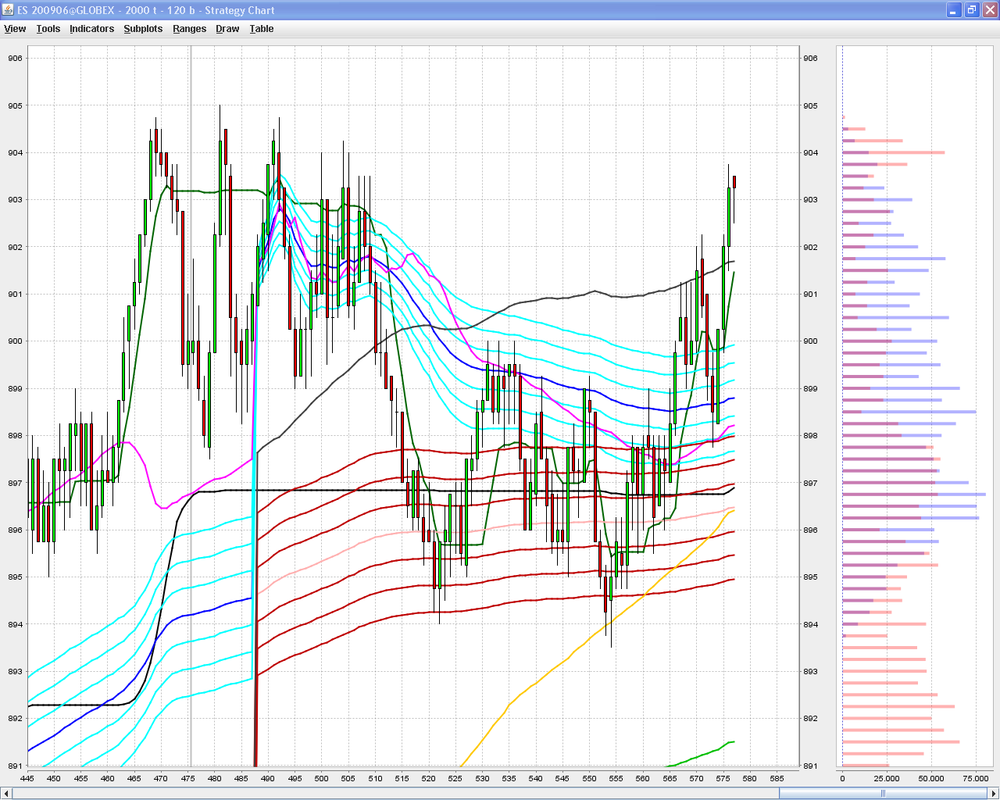

Today I used my new charts. So I don't know what my results are worth.

I try to reduce the number of my decision points and my other problems.

But what a choppy day.

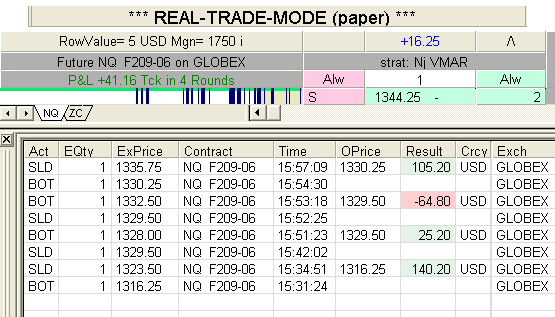

Anyway, here are my results:

And for fun, I have also attached the chart I have used today.

-

I fought the trend and the trend won

I fought the trend and the trend won

I think there was an old Clash song:

I fought the law and the law won.

...

I have done my sim trades today after implementing the last days

and even up until the RTH started. Well the beginning was OK,

but then I said to myself, that now would be time to quit.

Anyway, I traded on and felt in this counter trend mode too, and even more worse, I toggled short, long, short, long.

In real I would have ended with a big loss, based on many "small losers".

I guess it is partly a mental thing: Impatience, greed, and fear.

Once I recognize my mistake. Then it will be different.

I think, I am my worst enemy.

Maybe, I have just to find my peace.

Relax, open my eyes, open my mind.

The pictures are there, which are showing

the law of the market.

Up and down and up and ...

Just wait until it fits.

It might be so easy.

-

Quod erat demonstrandum!

If I remember right.

It means something like:

"What had to be shown"

(sorry for my English, I guess I could it better explain in my mother tongue).

It is usually used, behind a successful finished proof.

Hal

-

Hi,

if I see it right, in the second video MultiCharts is used.

I think you have seen this already, but just in case.

Well, I don't use EL myself, but one thought about these "snapshots":

My broker made clear right from the start, that he uses this method.

Currently I think, that many brokers use it. In this way or another.

But in my view the raw data, would simply overload the internet at some times (for example FOMC days).

Using this method, they control the data traffic, they know the maximum load for their servers

and they know they maximum throughput. If they just would send every single tick out,

they and you would pay this in time (i.e. you lag or crash).

On the other hand, it seems to me, that nowadays (electronic age)

you don't just order 200 ES contracts, instead you order 200 times 1 ES contract.

You "pulse" your order. From the commissions side it should be the same, so it makes sense to me.

I use a tape reader that is based on 5s bars which are received 1s late,

these bars provide also the wap, volume and number of trades, but

my broker says they should be accurate, and it seems to be true.

Looking at these information, you still see the patterns

(i.e. move on very high volume or move on very low volume to prepare ... whatsoever).

I think you see it even better.

OK, just my thoughts.

Maybe I look for some screenshots of my tapereader tomorrow to show,

what I meant to say. If you like?

-

I don't use EL, but if I see it right, there is a little syntax error in your code:

JMA_phase2(-50),

vars:

Just try this instead:

JMA_phase2(-50);

vars:

I guess, this might do it.

-

Hi Sensei,

I think that there is no disagreement.

You have a plan, and if you start small, and if you can survive a loss, and if know what you do (and I think you do), you do it right.

I use sim trades, because I focused a long time on all these indicators,

but I still have to work on my plan. So this is my problem, not yours.

And for me, in my situation, sim is right.

I think finally its up to every person her/himself to decide, what might be the best way to reach her/his goals.

I think, I just wrote my posts, because newer newbies than myself

read this thread, and might come to the maybe premature opinion (IMO),

that sim is useless at all.

Again, there is no disagreement.

Use sim as long as necessary,

then trade real.

Hal

-

I found this post on "Re: Accuracy? Who Needs It..." interesting and have nominated it accordingly for "Topic Of The Month April, 2009"

-

One more,

in my view sim trading is an important part of the educational process of a trader.

After this step is mastered, real trading is the next one.

Sim trading should give you the confidence, that might give a trader a higher probability to reach his goal: consistent profitable trading.

Otherwise, what its worth, if someone says:

Execute your plan!

Whatever plan it is, it has to be tested before,

and my belief is, testing means simulation.

Well yes, its a different story if you sit on a 500k real account, and like to play with one NQ contract for fun, because sim is boring. But that is gambling in my view.

:helloooo:

-

All my trades are real money, I am a firm believer that unless you use real money it is just a game and means nothing. Demo trade to learn the system and software but any results are completely useless.

First of all: Welcome!

Well, but I have to disagree with your above statement.

At least partly. And maybe we even think the same way,

but let me explain.

I quite often saw the discussion of sim trading versus using trading with real money, even with just one single contract.

Also I have heard quite often that good traders (if they have made it) have

blown out two or three accounts.

So now, here is my view:

If you start, whether you are completely new, or you have traded other

instruments before (stocks for example) always start with a sim account.

But if you sim, trade only the amount of contracts, you would trade in real.

Don't cheat, double up and double up until you see green.

And test, as my kind of dose escalation study yesterday (but I had similar sim days before without the intention of yesterday).

If you are able to sim trade consistently, well it doesn't mean that you are able to trade with real money as well. That's were we agree, I think.

On the other hand, as long as you are not consistently profitable in sim trading, why should you assume, that it would work out with real money.

So long, if you still have one, keep your job.

Well, I don't have one anymore. Maybe I am a dreamer.

So once more welcome.

And I hope, that we have just said the same thing using different words.

Hal

-

agreed. i've been happily using the old Matrox g200 for a few years with no problems. it's PCI and has 8mb per video port. plenty for charts. $50 and done.hth

Me too, a g200, bought used.

Warning: OT is following!

It was in the PC I bought used too.

A PC that was leased by a bank before, for guess what? Trading.

Maybe a nice idea for beginners, or ...

I got the whole thing for the amount of the VAT, that the bank has paid for the new one. :rofl:

Hal

-

OK, my trades are done for today.

In hindsight I should have just entered my first trade and ...

but in hindsight I am able to show you wonderful trades on my charts.

Only that real trades are a different thing.

Its so easy to fool yourself and others with hindsight.

And now its time for my homework.

I will figure it out.

-

the name of the game is "Staying Alive".;-)

LOL

Hi Tams,

yes your right.

And so far I have survived, I am still alive and kicking.

When I look at my cruel days in a positive way,

I think that whenever I recognize what I am actually doing wrong,

then I also know how to do it right.

Time will tell.

-

Brown,

thanks and you are right, this is one crucial point.

Another thing I realized today is, that I cannot wait for my "real" entry. So I enter too early, but especially at decision points of the market this leads to random results. So its not real trading, more guessing.

These entries together with too high targets lead in result to stops and BE's.

I will try to work on my entries first now.

Less entries, but clearly defined using limited orders.

Then stops, targets and money management.

Otherwise I will have good days and bad days,

but the bad ones will eat me alive.

Hal

A Fractal Market

in Technical Analysis

Posted

Jon,

I believe it is fractal,

but I don't think that it is right to assume that you can "predict" the macro derived from the micro picture.

If at all, you can "predict" the better choice for the micro picture from the macro picture.

Basically the fractal thing tells me, that you should be able to use systems in their own context.

Another thought of mine is about drift and noise. At some point, if you go in smaller and smaller time frames, drift should disappear while noise should stay. While noise might just end up only in commissions, drift should lead to results.

But what about playing drift using noise.

And this all in a fractal context.

I guess this was all academic.

Anyway, if you find a good system that uses drift and noise at the same time,

please tell me, I am searching it.