Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

728 -

Joined

-

Last visited

Posts posted by Dinerotrader

-

-

-

Here is a scenario:

You consistently make money trading commodities. You have a friend who wants to give you $100k to trade and only wants 15% return on his money per year. Nice possibility there to make some money. How does that trader legally manage his friend's money in the easiest(least amount of red tape) way possible? My general understanding is that you can get a series 3 license and become a Commodity Pool Operator. That is the gist of my current understanding.

I'd be interested to hear from those that have walked this path or can provide a lot more detail on this process and what it takes.

-

We saw rejection here at 70.24, and before at 70.20. 4 ticks apart is pretty good for the tests, but not great.The next part is the rejection part. In CL I consider a major move to be 100 ticks, thus I want to see rejection of around 100 ticks, hence the 70.20 level.

Maybe its because its a Friday. I'm not seeing the 70.24 rejections you're talking about.

-

-

Good to see you back Jon. If your willing to share, throw up some trades you are stalking to discuss, especially on Oil. In the end, I am hoping to make long term and short term trades part of the plan.

How quickly are you moving stops to B/E?

-

Quick follow-up on my post on RIG which was being discussed here from last week....the short on my 60 minute chart from $68 remains open, target is down to the $54 level so it is really getting pretty close now -- would be a time to drop a trailing stop probably just above $65. On the 130 minute chart that I like as well, bigger moves, short from $66 with a target at the $53 level -- probably would pull trailing stop down to about $69 on that one -- needs more room.Please post a chart if possible so we can see what you are saying. Thanks.

-

-

Kept on ripping almost doubling from the lows. Damn. :doh:There's always more opportunities. Find a good setup and post a chart.

-

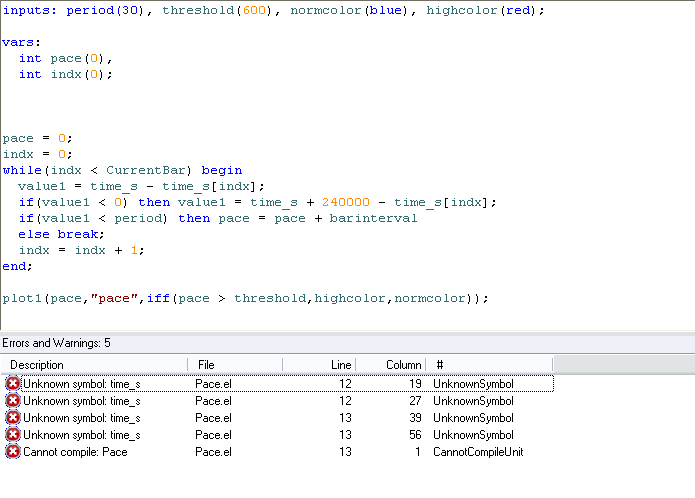

I am total inexperienced related to coding. What would I need to do try to get this indicator in EL so I could use it in OEC?

-

-

-

Hmmm ... the last three posts in this thread are mine. I guess this thread is dying.Its been struggling for a while but at this point just post if you find it useful for your progression. I am sure I will be posting regularly again to it but I got caught up on some method changes again and I don't like to post when I am experimenting instead of trading to maximize daily gains. Post if it helps you. I always found that it helped me.

-

-

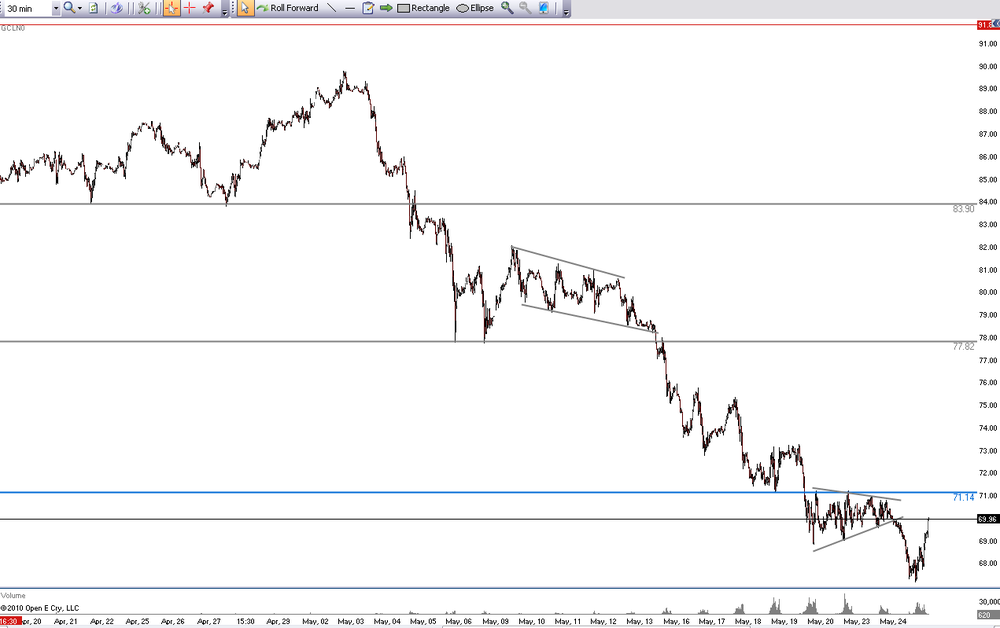

Timing the exits is always the most frustrating part of trading. Right now I am finally feeling good about my stock exits. I sold all my stock positions which I swing trade at the blue arrow (see ES chart below). I sold that day because the prior day move up felt like that last big push at the end of a trend when all the late comers jump in. There was also some trendline break that I noted. I was up on all my positions and had a good profit so I was ready to cash out. If I had to do it again, I think I would have exited at the red arrow after the ES had failed to really make significant higher highs. I don't short stocks so hopefully everything will keep tanking and I can start looking for longs again.

-

All joking aside, if you become a consistently profitable trader then I will bust my butt to do the same. If I could spend 12 months studying charts, reading others' posts and studying on my own and be profitable, count me in!I'll say this in my best Jeff Goldblum impersonation I can muster.

Ahh, the tough part is that you have to spend all that time/money NOT knowing if you will ever become profitable. There is the catch.

-

You sound like my brother, oddly he is 25 years old. He also has a signed script from an episode, not NOT jokingNow that is a nice "show and tell" when you bring the ladies by the house. "Check out my signed Goldern Girls script." :rofl:

That is awesome! Thanks for sharing that Bathrobe.

-

Brownie,I think I remember reading in a thread where you mentioned a screen capture program. If I am right, can you please mention it again because I really need one. Thanks in advance.

I'll answer for him. Snagit. I use it everyday.

The huge benefit is how much you can automate. I have a shortcut key to save screen shots to file and it automatically numbers the files by date and puts them in a specified folder. I also have a shortcut key to take a screenshot straight to clipboard for pasting in an email. Once you get your shortcuts setup, it is a big timesaver for chart capture management. I also use it to print all my charts at the end of the day for my folder for later review and markup.

-

I had a little breakthrough last night looking at my charts and had to do some experimentation today to get a feel for a change in my setup. No post for me today.

Don't you love that feeling you get late at night studying charts when you think you might have discovered the key to really changing your trading. Even though I know it always turns out to be less revolutionary than it seemed the night before, I still love that rush. Have a good weekend.

-

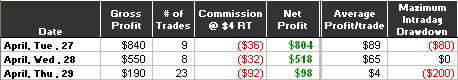

SIM

+$98

Really bad execution today. Part of it is to blame on my lack of a definition in my pullback setups but still, too many rogue trades. I cannot tolerate having any of these days again if I want to live again. Just shows my lack of discipline which is unacceptable behavior for me at this point.

-

-

SIM

+$804

I am hoping to be posting everyday again. My current focus is on only taking valid entries based on plan, minimizing intraday drawdown, and increasing my win rate. I started a little journal of notes for each entry like JEH does on his post so I can analyze each trade and hopefully correct some core problems. After trading live off and on for a week or 2, it wasn't very hard to get to a place where the money didn't bother my analysis except for intraday drawdowns. Once I saw a -$400 on the screen, it became hard to continue taking trades per plan. I will soon probably implement a rule to stop trading if I have closed losses that exceed $300 but for now I am trying to tweak the entry setup so I will continue taking trades until 1st ~3 hours of trading are over.

There is always discussion of SIM vs live trading and everyone has to decide on their own what to do. I have decided to mostly SIM trade and take live trades once SIM appears to show that I have a valid setup, money management, etc. I stop live trading if it appears I have miscalculated something in SIM that isn't translating to live correctly. I do this because I believe the switch between live and SIM should be simple (for me) if my strategy has been properly defined,executed, and proven in the past during SIM. Live trading exposes problems that need to be fixed and I don't have enough money to work through the correction process with real money. SIM works well for this, for me personally. Everything I can fix and work on in SIM will be done there first before I try to stay trading live. When I switch to live trading, I trade EXACTLY the same as I do on SIM.

I respect all the good advice from those that are far more experienced than myself at trading but this makes sense to me and my available funds for trading.

(Note: If your simulated trading doesn't accurately reflect the mechanics of your live platform such as entry fills,etc., using SIM to practice can cause serious problems to your trading education. The ES often has this problem on SIM and this is partly why I don't trade the ES.)

-

Gold and Oil

Just curious if anyone uses gold and oil as indicators for the other since they are often very correlated markets.

Here is the chart for both gold and oil from part of today. I noted the time 7:25 on both charts which is arizona time, add 3 for ET. Oil was doing a lot of consolidating moves but I was watching gold and it gave me a slight leaning to the long side. I ended up taking a long just before the move and got 62 ticks. Just curious if anyone else uses other markets as an indicator for oil or whatever they trade and if anyone sees any legitimacy to employing such a method.

-

As someone who has undergone commercial aviation training back in the early 1990's. You would be surprised how little simulation there is. There is no simulation at all for the entire commercial license (your first 200 hours) and you only start doing sim when going to multi-engine IFR stuff due to the cost if you crashed the real plane. It is not because sim is a better teacher, strictly the costs...The same is said for major airlines that have sims for jets. It is a cost thing but not because it is a better teacher.With kind regards,

MK

Yeah, aviation is a bad metaphor. Sports works better.

-

Little league, Pop Warner football, junior varsity, varsity, college ... lots of practice, yes, but lot's of real live win or lose competition as well. Even pilots log thousands of hours of live, in the cockpit aerial maneuvers (help me out here jands) and do not learn their craft simply playing an expensive version of Nintendo.Thales

Gotta have both it seems. Figuring out how to balance them without simply losing all your money and losing the ability to even participate in trading is the challenge. Capital preservation while in my early years of trading appears to be my current leaning. Just my

coming from a futures nintendo player so not worth too much.

coming from a futures nintendo player so not worth too much. I think you're on the right track, Cory trading with real money but in very small amounts. I hope you can crack this at such an early stage so you can give us all your unique perspective.

SPAM Management

in Announcements and Support

Posted

Just wondering if the new Admin could put a quick note here on what the best method is to deal with SPAM. My current understanding is that if a spam posting is reported by some specific number of members it is auto deleted but I am not sure about this. Just wanted some clarification so I could follow the best procedure as we get bombarded with penny stock postings.