Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

728 -

Joined

-

Last visited

Posts posted by Dinerotrader

-

-

Thanks for your comments. I'm curious, if you had one massive screen that gave you the same real estate as the six smaller screens, would you rather have that?I definitely think having more small screens is better. I think it is easier to manage multiple tasks by giving them their own screen than it is trying to use all the space on one large one.

-

These days I honestly feel my short-term daytrading is a lot easier than trying to game the long-term for investment purposes. Every time it seems to want to get going it does seem to get overloaded on the sell side. Like you waiting for that opportunity on the longer term horizon stuff but still not feeling it - in the meantime the short term stuff is providing opportunity.I barely have time to deal with my stock trading so I limit myself to only taking long positions. I just sit on the sidelines when there is no reasonable up trend in place.

-

-

I do not know what your trading performance is. If I were you I would double think the loan, unless you are 99% sure of your trading strategy.I agree, a loan for trading without strong past trading performance is pretty risky and 99% of the time, a bad idea.

-

Let us hope these specific regulations will not be used against Dinerotrader and let us wish him all success in his new career.Not quite there with the new career but just wanted to know what kind of red tape I need to be aware of if a wealthy friend wants to loan me $20k-40k to trade with. Not a lot of money but I'd rather be aware of what goes into doing it the right/legal way.

-

Amp futures along with Ninjatrader and Zenfire offers free, well, everything. The software is free and so is the real time data. I personally took advantage of this for over a year and was never bothered about opening an account or about buying anything.I think it's worth a positive review because this means that everything you need to study the market, build a trading plan, get screen time, and even get used to the software is free for as long as you need it. I think it's a great deal and it certainly made my life easier.

Can you simply sign up with all three and maintain the same account for free? I remember when I wasn't with OEC, others would say stuff was free but you had to sign up with a new account every 2 weeks and other crap like that.

-

-

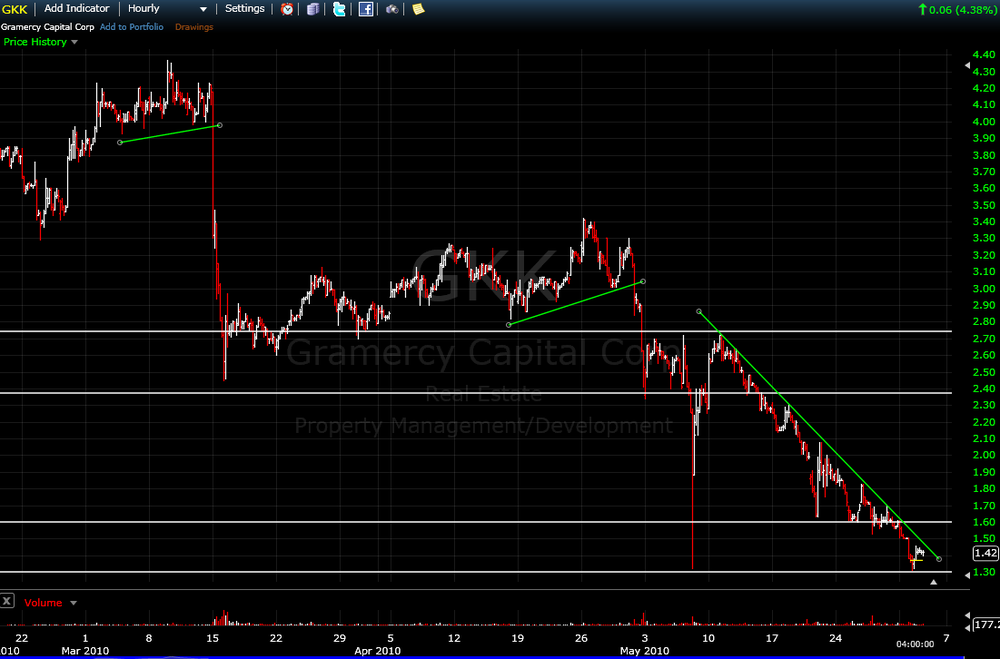

I annotated the chart with the places I see as S/R (support/resistance) levels and some more obvious trendlines. I normally trade close to the S/R levels trying for a reversal or breakout so I wouldn't be taking any positions right now on this. I could imagine price making its way back down towards the lower resistance level and trendline and then making another run up and I would look to play that if it occured. Many ways to play this and make money if you are willing to be patient for a low risk high reward trade setup. Base your analysis on support and resistance first and build off that. Also keep an eye on what the ES (S&P futures) are doing because if it is continuing to make lower lows you'll have a hard time making long positions work on any stock no matter the technical or fundamentals. My

-

-

-

Alright Jon, let's review the setup. Leave out anything you aren't comfortable sharing. My understanding is you are looking to trade the breakout of significant levels with very tight stops in place. You are defining significant levels as an S/R level created by major reversal in price which happens at a minimum of 2 times with the 2 swings occuring within ~5 ticks of each other.

You have another criteria related to a large rejection which I am still unclear of. I believe it is that the move away from a level needs to be large (70-100 ticks on oil) in order for you to call that level signficant and thus tradable.

Once you have a level established, my understanding is that you take a couple shots at catching a swift breakout quickly moving stop to B/E.

Do you still use volume to try to confirm momentum is coming in to make the trade work?

How did you come up with your profit targets on each instrument?

Setup summary:

1. Define significant level: Very close reversal price points mixed with large rejections

2. Keep stops at 1:10 of profit target

3. take 3 tries and then move on

Here is an example of a level I would have considered. The first 2 arrows show some difference in the reversal point but the 3rd confirms the first reversal price level. I circled the breakout level.

I'll try to post some real time levels that I think would meet your criteria to discuss.

-

-

I hope the pictures come out ok.Pictures are unreadable for me. Try attaching them using these instructions.

-

I'm in at 1.51. Little risky entry than I wanted but couldn't wait around on this today. Initial stop is at 1.29.Had to exit because ES started breaking down after testing resistance. I'll be watching for another entry.

-

-

-

-

-

-

SIM

-$380

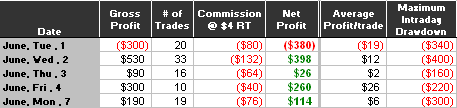

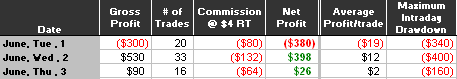

Well, I finally got most of my new system down so I am going to start posting my daily results again. I was up $490 today at one point and then just got bulldozed by the trend. I won't be using a "stop trading after X number of losses" for a couple weeks and then I expect to start using such a rule. I am only trading oil. My hope is to get back to live trading in about 6-7 weeks.

-

Still working out some system tweaking.

Good to hear things are going well.

-

How are things going Cory?

-

Volatility, or lack thereof, is definitely a concern. I'm not really worried about getting chopped up as I am the setups simply not happening often enough in lower volatility.Crude and 6E are definitely the two best instruments I've found so far.

I would really, really, really like to at least be able to watch HSI. So far it looks like I have to open an account with IB though.

I don't want to move to FX either. Any suggestions on volatile instruments would be appreciated.

Natural Gas has really good directional moves often times. Seems to go in cycles though. Gold works too.

-

Took that CL long. Was able to get a few tries in but it was rejected instead of breaking out. -6 ticks on all which was in line with my 70 tick target.I thought of you while I watched it chop back and forth around that level. Very annoying but that's how it goes sometimes. -6 ticks isn't too bad. Nice work keeping your losses small.

Interesting Charts for Technical Trades

in Stocks

Posted

SMP

Support has held up well several times, short term down trend line broken. I'll be looking for an entry if Monday is looking bullish.