Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

728 -

Joined

-

Last visited

Posts posted by Dinerotrader

-

-

-

Brownie, I know a number of folks have posted out loud that they'd like to see you participate. I hope you do, as well as a number of other pnl folks such as bathrobe, and dinero if he's ready to go live again.

Right now it is just me and sick, but I think the more traders the more fun, so I hope to shake a few more Racers out of the stands and into their cockpits.

I'm not worthy to be even noted in the same post as Brownie and Bathrobe. Still have to SIM to work some things about. I dream of the day when I can join in. I think some great discussions will come from the competition if everyone can avoid talking about whether someone's account is real or not, etc.

-

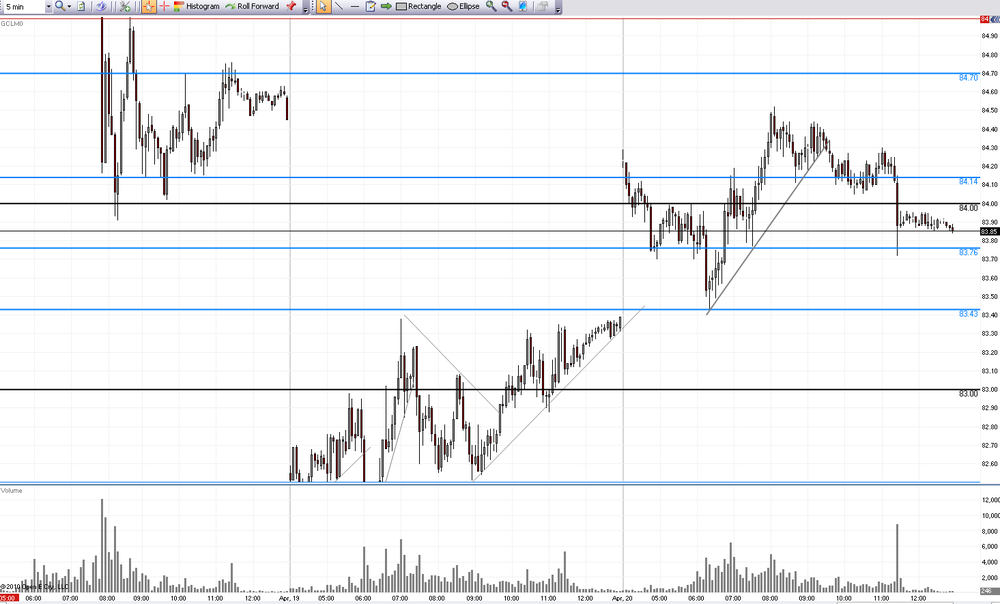

Here is a look at a 5 minute GC (time frame is really irrelevant) showing a 2B long opportunity this morning just before your long entry on the TL break. You posted a GC chart earlier in the week on another thread that had a very clear 2B short opportunity. That pattern is very common across instruments, and it is a good one to practice seeing. Even if you do not take the more aggressive 2B entry, it should put you on alert for a more conservative entry (e.g. 123 with or w/o a TL break).Best Wishes,

Thales

Natural gas has been serving up some monster moves from these also but on an every other day basis. The big hammer candle just before the break was what I am starting to label the gambler's "tell". I like the TL break but the hammer just adds that extra umph. to my odds of success.

-

-

-

Current look at the 6E ...Best Wishes,

Thales

Good to see you back Thales.

-

I don't use ninja and never will so that leaves me with the 1989 order entry platform that collective2 provides (complete with delayed quotes). Not going to work!But, I'll be honest...if I blow my account out again I will definitely be using their service to get my mojo back!

Their interface certainly sucks. Seems like some reputable platform should start something similar. it is a great idea but the execution isn't all there. I still plan on making it work because the idea makes too much sense to pass up. Risk free trading income.

I have just realized I need probably another year of method work, strategy tweeking, trading in varying kinds of markets, etc. before I should expect to possibly be ready to be a consistent trader. I thought I was about there but I am not. I expected a shorter time horizon for profitability but that has been stressing my trading efforts to much. I thought if I skipped some of the time wasters profitable traders suggested I skip I would cut down the time it took to become profitable by enormous amounts but I think I overestimated this. While people are wasting time on buying systems and searching for the holy grail indicator, they are also getting in screen time and experience that can't be short cutted.

-

however, that's where I got messed up when I began posting on here...I would set overly conservative profit targets, pull the trade early, or trail too tight.Funny because that is the same type of thing people start struggling with going from SIM to live trading. You have to do what makes sense to you at the time. Good luck.

-

If you are just looking at stocks, I like freestockcharts.com for getting started unless you are imploying some sort of fast scalping method. Very easy to customize, add indicators, and it is free. It is a great place to start learning the basics of support/resistance and easy to annotate charts. It also depends on what kind of strategy you will end up using which will constantly evolve over the next few years of your education. I use OEC for futures and have looked at stock on their platform a few times but don't have much experience with stocks on OEC.

-

Thought I was back but still need to work on my strategy. Good to see everyone's daily progress. Cory is killing it. Cory, look into collective2 to start an account there. Hopefully, I'll be back soon.

-

-

For those that trade oil, what types of strategies do you find most beneficial? I mostly trade reversals based on S/R, 123 setups, and lately been trying to work some trendlines into what I do. My usual problem is that some days I am raking it in and others, I get chopped to death with the small ranges. Overall, I am mostly working on getting my entry signals limited to 3-6 per day and upping my win rate on those. I started using a fixed stop loss of 12 ticks to limit my intervention in each trade and that has appeared to be good for me thus far.

I think EnochBenjamin has a thread in the Candlestick section of TL explaining how he watches for tweezer and shooting star candle formations which breakout of the VWAP.

I thought it would be good to get some general strategy ideas from those trading oil to include in this thread.

-

-

I have been experimenting with trendlines lately and am curious what your logical basis is for using them. In other words, what reality do you thing a trendline is showing that will have predictive value.

Does it illustrate market psychology, is it just usefull becuase everyone else is also seeing it, does it just help you see the scoreboard of the game between bulls and bears?

I was trying to determing which trendline I should favor, one drawn with contract volume based bars or one using time based charts. This lead me to considering much more about why I should really include them in my analysis.

The more I use them, the more I realize I like them just because of the context they put price in. Just the same as the price and volume give me context, S/R and trendlines seem to give context at another level which makes other considerations easier. For example, price reactions to an S/R level feels easier to understand when it is at the end of an upward trend which hasn't been broken.

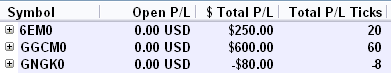

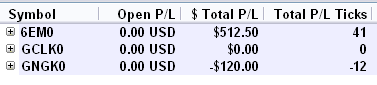

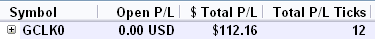

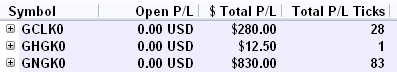

Anyway, still playing around with them trying to see how and if they will fit into my strategy. Just thought I would continue this thread with a few thoughts in case anyone wants to discuss them more. Here is my SIM blotter I posted on the P/L forum Friday for my Gold trades. I was watching for trendline break along with some short term S/R to get an area to look for an entry. Once a major move starts on oil, gold, or gas I look at trendlines for pullback setups.

-

This is the easy, and most reliable way, especially if you are using OEC. Just plot the current front month and the next month and watch for when the volume changes.We alread hashed this out in prior posts on this thread in more detail than necessary.

-

As with anything, trying it out for a few weeks will let you know if you like it enough to continue using. It is also one of the few out there that is so cheap to try out, you don't have anything to lose. I always get responses to all my tech support questions very quickly. Lots of OEC threads to learn from here instead of a manual which is nice.

-

-

Thanks for all the discussion and responses. Hopefully, they continue. I am working to develop a trade strategy that lends itself to increasing my lot size as my account grows. Begin with the end in mind, as Stephen Covey would say. I'd like to end up a 50 lot trader but that will only happen if I have a strategy that can hold up to the various issues that arise with larger lot trading. I'd be interested to hear what trading method attributes you think are important to be successful at increasing your lot size over time.

-

My argument would be"why scale up" in the first place?IMO,

Because the goal is always to make as much money as possible with the least amount of work. Scaling up requires no more work but makes you significantly more money if done correctly.

-

As dinero and brownsfan know I have thought of possibly doing this but one of my major concerns is if I have entered long and then feel price is going to stall or turn around, on my account I can get out using dom; however, they say on their site that if you use the ninja dom you may not have your order sent to C2 (some sort of error sometimes occurs) and you would need to log in and get out using their ticket. This would create a loser that was really a winner on my end and would be detrimental as to the only reason I would be doing this is a track record. Obviously I would have made money and any subscribers would have lost which would lose subscribers if I had any and I would feel bad for them as well.If you could expand on your experiences with them it would be very helpful.

I don't have very much experience with it yet but I know if you are in a postion there is a small "close position" button on the order screen that you could quickly click and exit your order immediately at market. You would just need to keep that ticket screen open in the background. If you need to exit at limit you would have to prepare the order ticket for a limit close of position before you needed to quickly exit and manually enter the price once you were ready exit. You can use there system in test mode to make sure it is performing as expected before starting your track record. Like I said though, I have very little experience with it.

-

I wish they would make it so you could have multiple line tools with different defaults. I draw S/R levels that are color coded and trendlines that are color coded and it would be nice to just have 5 duplicate line tools with different defaults for thickness and color. That would save me a lot of chart drawing time.

-

-

SIM

+$1095

Okay, getting back to SIM to work out a new strategy. Worked really well today but I always do better on days with larger moves and natural gas went down big. I will be watching a couple other markets since the setups I am looking for occur for less frequently than my old method. I'm expecting 2-6 entries per day.

-

I have been looking at tick charts and I decided to try them this week. I do like than better than time based charts. Beans have a lot of volume and volatility at the open and then trails off , and with tick charts, it is easier to trade the volatility in the first half an hour.This is just my opinion from one days trading and some 'eyeball' backtesting over the last month of trades, so take it with a grain of salt.

I am using the same rules/setup I used with 5 minute charts, and that will have to trade. I took 8 trades in the first two hours trading tick bars which is way too many for my taste.

When I was trading soybeans I always used tick charts to get my entries. In fall last year, soybeans would really make some good trending moves so trading wasn't all that bad but they got much more choppier as time progressed and became harder for me to trade profitably. Throw up some charts if you can. I miss those charts with the crazy open ranges.

Cory2679's Log

in Traders Log

Posted

Do all high performing athletes, astronauts, etc. extensively practice their craft in simulated environments to develop skills and habits for the real event. Yes they do, and they do it much more than they do the real thing because when the pressure is on, they want their trained habits to have already become instinctual reactions to whatever is placed before them. Is it possible to develop bad habits while training? Yes. Is it possible to develop good habits? Yes.