Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

185 -

Joined

-

Last visited

Posts posted by 4EverMaAT

-

-

I have from time to time considered setting up my trading strategy for autotrading.Problem is that I am really not interested in starting from scratch to attempt this myself ?

Would rather hire someone to do it. The question is, Are there any reputable programmers

available for hire ? If so where would I look ?

TIA

I know how you feel. I'm not a programmer myself. vWorker.com is your best bet. I know a few people and can provide contacts if you'd like.

-

You are describing something more of a hedge. I have done this for clients a while back and used options instead of shorting the stock. It was a cheaper alternative to putting up the margin on a $4 million dollar position. There is nothing wrong with trading in and out of the stock if the company allows you to take positions. Some companies want you to disclose all positions that you hold to make certain that there isn't a conflict of interest with some of the companies that they do business with.What about using single stock futures?

-

what portion of the backtest data is walk-forward tested? I suppose that would be difficult without tick data, but tradestation does include tick data, correct? I think between 6 months and 2 years? And minute data goes back even further.

-

For the past 12 years I have had a standing offer to anyone who had an autotraded system or black box that could reasonably compare with my discretionary trading performance over a period of just one year, and I would gladly pay them one million dollars for it. To date, no one has stepped forward. Does that say something?One time a few pals of mine pooled together and purchased a robot (I think Gomega) which claimed that if the robot could not trade at least 5% monthly profit for 3 months with default settings, we could get full money back. We followed their instructions 100%, even using a VPS which wasn't a requirement, and provided their requested proof. They never argued with the proof, but instead said "we'll pay you back when we can". Obviously we never got our money back, but I did learn quite a bit from a different EA that was purchased. Lessons learned.

The terms are simple. One million for an autotrader system that can just come close to my personal discretionary trading results. No more than 5 losing days per year and those must not lose more than 2% of the trading account balance on any losing day. No periodic tweaking allowed either when market dynamics trash the auto trader system. It must be able to automatically adjust to whatever is going on in the market at any given time. It should be able to trade any market that moves and be profitable in volatile, choppy and trending markets.Takers?....I didn't think so. There is a reason why you and I don't autotrade.

Let's take a closer look at this:

If you are going to demand that the automated trading system be left completely unattended during the contest period, then likewise, each method and exit must be documented in such a way that an onlooker could see what your rules are, and that the rules are being applied consistently each time. Just like the robot can adjust itself, you would be allowed to adjust your strategy, but it must be a logical adjustment that was already laid out in your original trading strategy prior to contest begin. You couldn't come up with a new rule after the fact. Pretty much, like the original turtle trading system, it would have to be mechanical, transparent, and clearly defined ahead of time.

Not lose more than 2% of trading account balance on any losing day. Or not more than 5 losing days per year. I don't know if anyone could guarantee that, meaning that each person's strategy may not work well under that condition. Wouldn't a more effective challenge would be to see how much the person could make by a certain date?

Now if you insist that you want to keep your system private, which is perfectly fine, then you must allow the other contestants (robots) to trade completely their own way also.

edit: added link for the original turtle trading system rules pdf

-

or babypips. I did get a chance to follow some of the price action threads and it seems like when I ask some basic questions about entry/exit, etc, the rules always seem to be very subjective "depending on how price moves around the next bar or the bar after, etc..." no specific if-then rules.You may want to consider forexfactory if you haven't been there yet. Lots of truly fresh meat ... their 'Trading Systems' subforum seems to be very active, see the attached picture. All of these updated in the last 10 hours alone! Plenty of real newbies there who are searching for the latest grail that will help them be successful without actually engaging their brains. Just look at those thread titles -- all "systems" designed to make trading easy...remove the trading decisions from the human and offload to a computer =>

remove the discretion =>

remove the thinking =>

remove the accountability ...

equals... "it's not me, it's my system"... repeat the process with a new "system"...

Isn't that pretty much how it goes?

The irony is that a complete system:

- imitates the trading decisions of the human, but allows instructions to be followed unattended, and can be scaled to handle faster market conditions in a more consistent manner than human mouse click.

- removes second-guessing.

- encourages thought and even improvement, see below.

- forces you to be more accountable. Because it would have required a logical set of instructions to begin with. Plus you have the added benefit of observing how your system works outside of yourself. Like sketching a concept on a whiteboard or mindmap.

Obviously with a blackbox system you cannot know this. Build your own OR buy a system that is easy to understand and you understand how to control the different "levers".

-

Correct, the price of each individual unit (share or contract) bought or sold.I'd be really impressed if you told me you had been able to dig that information out of FOREX. I've heard it was embedded and hidden in the feeds but haven't ever been able to confirm that.

3 workarounds to doing it:

1) (less precise): use futures contract equivilant fx contracts and calculate proportional volume into its spot FX equivilant. Also CME and other institutions may actually be starting to do some OTC transactions on an institutional level.

2) (broker-specific): measure the price difference per incoming tick. If they offer some sort of level II volume statistics, use it. I think FXOpen ECN, InstaForex (surprisingly), maybe MBTrading, Interactive Brokers, and maybe the newer tradestation feed does offer some sort of level II insight.

3) (broker-specific): see if you can get a feed with as many liquidity providers/brokers as possible / api access and get the actual level 2 volume as they keep track of it. Then you would compare the net price movement and net volume for each tick. Obviously this is the most accurate of the 3 and the most expensive/difficult.

The inherent problem with forex is that each individual broker "makes" the market available to its clients. much of the retail volume is aggregated and re-aggregated, plus there is a lot more that will never be shown in the higher-tier interbank markets, unless some of those providers start revealing real-time volume information.

Exchange traded products every tick is accounted for; so no problems getting accurate tick data. Forex brokers tend too "filter/smooth" their datafeeds. You'd be surprised how many actual ticks would come through if they didn't smooth the feed. But then there may be additional platform stability issues, etc. And for historical analysis, tick data is lacking from many brokers; forextester is one of few companies offering tick data collection.

If metatrader 5 had been what metatrader 4 was now, this data might have been more accessible already with more traders.

My APAMI indicator, which measures net distance between the current price and a previous price point, (qualified by retracements) did reveal some interesting aspects about how price really works. More on that hopefully by the end of this week :haha:

-

I'm not quite sure the problem with "Setup" is. A trader either has a system/method or they don't. If they don't, they won't be a trader very long. If they do, they they have "Setups"...unless they just sit on their hands and never enter the market.It's important to note that markets are NOT living breathing entities. They are merely the product of a vast number of trader's pushing and pulling price up and down helter skelter in a nearly random fashion..."nearly" being the operative word.

Humans build bridges and skyscrapers but the products of their labor are NOT living things. Traders are alive, Markets are not. Once the trader realizes this fact, they quit seeing the market as the enemy. As a trader, your only enemy is yourself.

You should more clearly define "system". For me, a trading system (or any system) must be completely mechanical; all decisions are accounted for ahead of time. You have your primary objectives, plus the appropriate "if-then" statements for any detours.

Whether you call them a Setup, Entry Point, Trigger Pull or Pull My Finger, what difference does it make? It's where a position is taken and whether it wins or loses is irrelevant. Any trader who takes "Setups" just because they are there will never make it. A lot of factors are in play at any given moment and a great Setup that worked an hour ago may have little chance now.

Every market entry must be highly filtered based on all of the pertinant factors happening NOW. This is where excellent coding skills can be extremely effective. Only the best programmers who are also good traders will get it right. Computers can filter and test 10,000 things and spit out the answer in the blink of an eye. The key is in the coding...but that's a topic for another time in another thread.

Here's the trick to using computer automation, or any type of automation/system/etc: the computer can only do what it is told to do. The computer is not a magician, however it can usually compute repetitive tasks much cheaper, quicker, faster, etc and with greater precision, flexibility, etc than with the human labor attempting the same tasks.:missy:

-

The use of the phrase "price action trader" has become laughable lately because too many that use that phrase are traders that still indicators on their charts...usually just one or two indicators. Yet, when you ask them why they have indicators on their charts...they say the indicators have no impact on their trade decisions. :doh:No, no, no, no, no! You've got it all wrong, Roztom! You obviously need lessons:http://www.priceactionmasterclass.com

That'll be $2000 please . . .

(ps can't quite believe that the URL above hasn't actually been registered!)

This thread was one of the best that I've read, and bluehorse's skit on fish.....classic:rofl:

The central problem is actually the mis-use of the word in general, where the author does not define the terms that they are using in addressing their audience. The audience has to then assume that their own definition of price action is the same definition that the author is referring to. In the ambiguity, some members of the audience will say "oh, that's what I was looking for". Of course, when you put the actual method or strategy of replicating the price action in practice, you may find out just how deadly ASSumptions can be.

This can be solved by the author simply defining the terms they will be using.

BTW, "risk" is another one of those general terms that are tossed about; very few people actually define what risk means to them and how they calculate it.

-

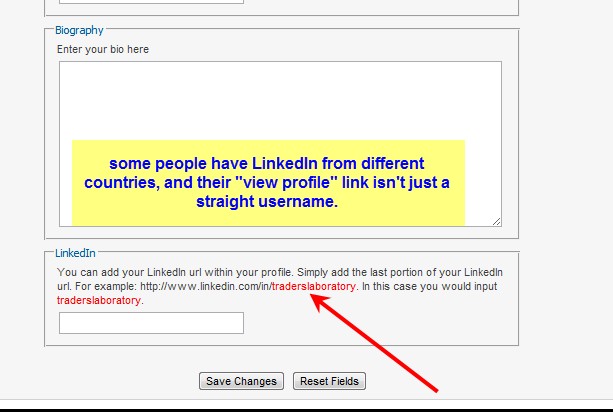

In the edit profile section:

non-standard linkedin profiles need ability to be added. my linkedin link does not look like the example you give.

http://www.linkedin.com/in/traderslaboratory

vs

http://th.linkedin.com/pub/jon-grah/51/14/895

perhaps the user should be able to add their entire link, and you can just check to see if the linkedin word is contained within the first part of the url?

-

what market are you trading? I take it futures? Some brokers have their own free charting platform. Use it. If they give you free API access, then you may be able to use NT.

forex usually has metatrader 4 with most of the retail brokers, so free demo accounts.

wrbtrader has a point, in that using the broker you plan to actually go live with is the best option, if available. If not, then pick 2nd choice, 3rd choice, etc from a list of brokers you plan on going with.

-

You are correct.If trading decisions are made based on visually or algorithmically tracking completed transactions and not the bid/ask, this levels the playing field and it becomes irrelevant the size of the participants or the size of the trades in the specific market you are trading.

You are also correct in stating that there is a point or apex in regards to the amount of money one trades or a fund trades. There is a saturation point that each individual or entity needs to know like the back of their hand.

The volume and the agreed price on each volume unit would be what you consider to be the "completed transactions"? Easy to do with exchange-traded products. OTC like forex is a little more tricky, but can be done.

-

1) Why you smoothed the price was not very clear.

2) I'm still lost on exactly what is "Hysteresis".

3) If the goal was to improve profitability, then the statistics currently available dont seem to prove this. Saying that your trades were more profitable simply because of less trades and an increase of profit per trade doesn't take into account:

- the fact that the drawdown did not decrease by the same proportion as the trades became more profitable.

- the sharpe ratios and annual rate of return remained the same for SMA cross, Band Cross, and Price Proxy Band Cross

- perhaps a more clear definition of what a "winning" and "losing" trade was (where were the TP and SL, what where the based on, etc).

From my point of view, the most profitability would be achieved by optimizing the management of the positions while in the trade (position sizing). But that doesn't seem to be explored in this scenario. The OP focus was on improving perceived entries and that by having "better" (more accurate forecasting) entries, the overall profitability increases. If anything, the OP data gathered suggests that entry accuracy alone cannot be the cause of greater profitability.

-

...............I think you are right but just to make sure we are on the same wavelength could you define in about three sentences your understanding of a 'logical method'?

Many thanks for your informative articles.

Koyasan, this is a good question. i tried to address it in the previous post, but I think the OP should elaborate on his logics (sp?) to get a better understanding on how to "Play the odds"

-

Just to elaborate, a logical method must include precise rules for entry detection, entry, and exit strategies for any condition that the market throws at you. As a former turtle trader eluded to, any decision that is left up to the trader after the fact will cause indecisiveness, and eventual losses. The entire process should be mechanical, so that there is a precise course of action during each aspect of the trade.

coincidentally, a fully mechanical system would be 100%, not necessarily 100% winning trades, but 100% consistent in doing whatever it is designed to do, which is ideally to profit

-

--------------------------------------------------------------------------------TA is IMHO the only way to objectively take action from and enter into a trade with a real plan that you follow consistently. This is also the only way you can realize if your plan works or not. At leat you can put some numbers to your trades (even proffesional BlackJack players have an objective system with technical rules, they can't take the dealers word for it). Everything that happend in the market (fundamentals included), is happening in the market (fundamentals included) and will happen in the market (fundamentals included) is already considered and taken into account on a price chart. For this reason you can put a plan towards the future with Technical/Objective analysis. How can anyone make a consistently profitable trading plan/system by looking at the news on CNBC?? You cannot just say: Ok of Bernanke says the buzzword "Interest rate" i will short. The experts you see on TV who are giving you their view on the markets are probably working for an institution/bank/fund that looses when you win.

Just giving my opinion and i'm definately not an expert here.

Is it not funny when the experts say that a certain market is very strong and bullish that always two things happen: Your spread widens for about the double or triple and after that the market drops like a brick in mid air.

Well,....my

It's the interpretation of the TA or FA that gets traders in trouble. An indicator is just that: indicates or detects a certain market condition.

-

losses would also be large if the market moves against you.

Are you referring to futures or forex. Typically in forex, the major brokers you will see about $3-5 per round turn trade for a standard lot (100,000 of base currency) which every pip move is approximately +/- $ € £ 10.00 . Oh yeah, there is a spread also between 0.8 and 3.5 pips for the majors and cross pairs.

Futures the spread is usually 0-1 tick + commission which for a discount broker is $4-5 round turn with all the fees.

edit: Jack beat me to it, lol. But looks like I was right on the spot with my answer, and it's been years since I traded futures.

-

followup: the article point number 2 (Reason 2: Empirical evidence for TA is negligible) confirms what former Turtle Trader Curtis Faith emphasized that, besides ensuring the entire process of trading was mechanical (and therefore objective, testable, measurable, etc), position sizing is the most important aspect that the user has under their control. Not spending countless hours on predicting the best point of entry.

I eventually got the hang of this, and developed a spreadsheet to assist in formulating a proper money management strategy; one that can handle all market conditions according to the size of my trading account.

-

Just different sides of a coin really. Focusing and choosing to prefer once side over the other helps to get at the very root of what deludes most traders. Isn't the ultimate goal to figure out the core (fundamental) aspects of what drives the market, then see what entries and exits (technical) can allow us to best extract profits?

We assert preferences to the market, and attach ourselves very heavily to these preferences. As long as you get to the end goal, and can duplicate the results, does it matter what adjective we use to describe the process.

edit: see new post

-

We all would love to keep our trading machine ideas completely in-house, but the reality is that for most people it does take a steep learning curve to incorporate all of the "if-then" aspects of a strategy into a programming language. It's not just machine translation, but requires interpreting the essence of what the system is trying to accomplish, and using the correct functions so that [your ideal charting package here] can display and autotrade your strategy successfully.

Even if I can explain the problem accurately (logically), do I have the technical expertise and time to physically code bug-free? If it is a hobby, and I have loads of free time on my hands, fair enough. But as a business?

Outsourcing can be wonderful, but it is NOT drag/drop operation. It takes the patience of Job to ensure that what you say - what the programmer understands = flawless execution. Initially, it can take many long days of back and forth deliberation, proof of concept, etc to get on the same page. What if the person bails? What if they run off with your project, etc. (think Facebook). This is not unusual when outsourcing to emerging economies, or your own backyard as was the case with Facebook. That's the risk that you take to save a few dollars. vWorker acknowledged this problem (entrepreneurs not having technical expertise to properly supervise project) and came up with Tech Sharpra.

As someone who has gone through the process with MetaTrader 4/5, I can tell you, then end was rewarding....but it was quite a ride. You have a greater appreciation for finished products in every industry; most people never see the back-of-the-house stuff.

edit: sierra chart has its own programming language? Wow, things have changed. They used to insist on using Excel to do the heavy lifting. If they still offer free historical tick data (or 1 min data), with some of their packages.....its hard to beat for a new trader. But i do agree with another poster that it may be worth it to invest in a more comprehensive charting package (maybe multicharts?) that has the proper backtesting/debugging modules, plus the charts should do what you want them to do. Hard to say which package is "best"; you just have to trial them all and experience which one(s) fit well.

-

I am just generally saying that anyone who wants to be long for this business should figure out first, based on their risk capital at what percentage loss per DAY, how many trades will they get at a fixed percentage of original starting capital... before going out of business..I think that most are not adequately capitalized and are risking too much on any one opportunity.

My belief is in this business you should (my belief) assume the worst not "hope" for the best.

A new trader must anticipate the issues that will arise emotionally when initially putting $ at risk and how that will lead to random results and also sequential losses.

The objective of a newer trader is to survive the learning curve and this is assuming they have a viable edge that they consistently execute. Hopefully they have taken the time to SIM trade and have done the necessary work to recognize an edge and can execute it consistently. Hopefully they have a trade plan - a business model so they know where they are going and what it will cost to get there. (Losses are cost of production) If you can't manage your overhead you are going out of business.

This is a business first of survival. The $ will come if you stay in business.

..............

In addition, trade management is the next important item to reduce risk.. Assuming again you have a viable trade plan, trading multiple contracts allows you to quickly reduce risk by scaling out. One may think this is more risky since you can take a large hit if you are wrong before you get your first scale. It happens. On the other side, if you know where the high probability areas are where you will get your scale you can reduce or eliminate your risk on a trade. Obviously, this is not for novices but trading all in/all out imho is ludicrous and does nothing to reduce risk.

IMHO, this business is ALL about risk management. Most novices spend 90% of their energy on setups/entries. Regretfully, that is not the problem. It's everything else. Risk management and Profit management - the Exit. If you don't have those answers then this will be a short term hobby for most.

Sometimes you have to lose it all before you can fully grasp with experience how the market works. I'm not saying it must be this way for everyone, but Scott Shuburt asked a question in one of his videos: "How many times are you prepared to lose your account equity as tuition of grasping the fundamentals of how the market works?"

-

The systems that we create are often to maintain a sense of predictability in life. The fear comes in the curve fitting we often apply to nature. We get used to our predictability and begin to wrap assumptions around how our lives will play out. Many of these assumptions take place (or are maintained) unconsciously; on-the-fly stereotypes as the mind is conditioned to justify everything it perceives. Two minutes of honest scrutinty and it is a big shock when you peel back the stereotypes and you see yourself and everyone around you lying all the time.Rande....I find it hard to agree with what you say but you challenge and help clarify my thinking, a very big thank you. A few comments I would like to make:It seems that the basic premise of your argument is that as traders we have to overcome the evolutionary biological bias of our brain, which predisposes us to seek certainty and avoid uncertainty. I’m not so certain this is the case. I would have thought that our evolutionary bias is to manage uncertainty and find ways to minimize the risk inherent in not knowing the outcome of an event. Primitive man would be well aware that not all hunting expeditions would be successful but if tactics and weapons could be improved upon then the success rate would increase. Trial and error, creative thinking and perhaps even random events could all be used to manage uncertainty. The future by definition is unknown and therefore uncertain and I believe that as humans we have evolved to live with this uncertainty without becoming paralyzed by it. Uncertainty has not stopped us from exploring our planet and beyond and uncertainty does not prevent us from getting on a plane or going about our daily business.

It is true that you can only control what is in your power to do so, mainly yourself; your point of view. But the mind usually wants to take responsibility for everything, as the fear of no control (no self) is at the very core.Control is not as you suggest an illusion but something we all seek in the knowledge that only absolute control is usually unattainable. King Canute could not control the tide but we have learned how to harness its energy to generate power. I can have absolute control over how I bake a cake but I cannot control whether you will enjoy the taste. I don’t know when or how I am going to die but I can at least control some of the factors that will help me live such as food and exercise and general lifestyle. When I drive my car I don’t know if some other driver will crash into me but I can control how I drive. I am not seeking certainty otherwise I would never drive again, I am actively managing whilst at the same time accepting uncertainty. I am seeking to control the factors, which are in my power to control.

......................

It's realizing that as much control as you like to think you have is real, *poof* it can all be over in a flash. Did any of it really matter? It does while you are alive, right? So risk shouldn't be something that is run away from, but it is acknowledged fully as inseparable part of trading (and life). Most trading plans (particularly of the directional predictive type) don't account for the uncertainty. Traders want their trades to go the way they want them to go.

As a final thought how exactly would you help ‘John’ become a successful trader?

I suppose that only Rande can answer this, but I would suggest practicing "The Four Agreements". That will definetly remove many of the self-limiting agreements that cause a trader to suffer. Until you challenge, or at least acknoledge your core fears, you'll never have the courage to let go fully. Rande could help by providing support pointing out the fears and laying out some template in which can assist the client in removing fear or no longer giving them attention they don't deserve.

-

I'm not sure what exactly you're trying to say with your post.. but I have an idea because Ican relate.

Having been a successful poker player, I can pretty easily weed out the good advice from the bad. And let me tell you, 90% of poker advice is bad. 90% of poker instructional books are crap written by losing players who wouldn't stand a chance in a game with real professionals. And the people with the firmest opinions are usually in those 90%. I think trading is probably similar.

So as I attempt to learn trading, I am constantly filtering through books, posts, and other material trying to find some solid ground to base a foundation on. So far, I've yet to find anything that I feel is really useful. Now, as you're saying, maybe I'm not 'ready' to understand some books and missing the point, but I don't think so. Ultimately I need to follow the path that I think and feel is appropriate. I haven't found that path yet in the markets. I just don't think many people have a clue (just as with poker). The closest thing that has grabbed my attn is dbphoenix's price/volume stuff spread across this site, t2w, and et. But even that doesn't fully satisfy me. I reckon most people are just gambling in the markets with no real edge. I don't want to waste my time doing that. I've spoken with one prop trader through email who I believe actually knows what he's doing, but the communication is sparse, i think because he doesn't want to give anything away.

........

The scarcity model of economics has gripped many people, including myself sometimes. But all anyone has to offer you is their story. The truth that most traders are looking for is usually right in front of them. We are so trained to seek recognition and approval from peers/others, it's amazing. The irony of the whole thing is that you must test for yourself anyway any method or strategy to see if it will work for you. There is a shortcut to this testing that I will summarize: figure out what's true about the market first....then you can do what you want.

-

That might be how you look at it.I let the chart (prior time and price action) tell me where my risk is.

Don't have a clue what profitkeeper is but then I like to keep things simple.

If account A has $10,000 and you have 1 lot of EUR/USD long at price x, and account B has $10,000 and you have 4 lots of EURUSD long at the same price x, the risk of ruin is greater in account B since it would take a shorter pip distance from price x to wipe out account B than account A (exactly 4 times less distance). It also takes less distance to reach profit objective in acct B than account A This isn't my point of view, its arithmetic.

Letting the "chart tell you where the risk is" is excellent. And if the charts tell you where the all the risk is, the lot/position size would be irrelevant. But we know that's not true with the above example. Perhaps what you meant is that you let the charts determine potential entry/exit points. [edit] In which case you make a choice as to what size to enter and how much to scale up or down.

What often happens is we have preferences. And this is fine. I'm not blaming anyone for their preferences, but the markets are completely objective. Every lot or position has a price.

I'm not really interested in 'risk of ruin'. I'm not interested in 'ruin' in terms of my trading account. That money is there because it is money that I can afford to lose. If the account is 'ruined' then I won't be.Many people will say that this is pretty much gambling. I'm under no illusion that trading is anything other than a structured form of gambling in which the trader positions themselves in relation to a range of probabilities (of which risk of ruin is just one). How a trader choses to do this is up to them alone. I am quite comfortable risking the money in my trading account against my perceived probability of return on it.

Yesterday someone posted a great link to an article about Taleb and Niederhoffer. Either could go bust; the former could only go bust by slowly 'bleeding to death', whereas the latter could only go bust by 'blowing up'. This was where each had chosen to position themselves within a field of probabilities.

It doesn't matter what fancy money management algorithm you use (imagine how sophisticated LTCM's risk management must have been, for example), the only way to avoid the risk of ruining your account is to stop trading it, and if you continue trading, then the only way to avoid the risk of ruin to your finances as a whole is to ensure that you only trade with money that you can afford to lose.

BlueHorseshoe

Gambling has more of a "negative" or "Las Vegas" loose/wild connotation whereas business is usually associated with more careful planning and pre-meditated calculations.

Dont get caught up on semantics. Regardless of what adjective you use (gambling, chance, risk, business, etc) Bluehorse just about sums it up the reality of risk. Nothing will ever manifest without taking some action. The idea of "risk free" rewards may make for a good marketing campaign, or a demo account, but in real trading, its about determining the best choices to make and then actually making them.

-

Similar yes but not the same.Unless .......... you go "all-in" then it is win or (blow your account) go home.

But for anyone to say that a routine 2-3% risk should adjusted to 10 or 20 times that amount because the probabilitites suggest so just doesn't understand what a career in trading entails.I understand one size doesn't fill all but seriously folks.

A doubling of a 5% risk to 10% is reasonable or something along those lines but going from single digits to 30, 40, 50% is playing with fire.

Definitely! I made a lot of backtest experimenting with how much I could risk and get away with it, 4% was the highest I could go, anything higher would blow the acount, it's hard to say how much you can risk for any given method, I believe it is a very individual number and how good your system is and how good you are as a trader, with some trading methods you could possible risk more or less depending on profitability, win ratio, risk to reward etc, there is so many factors playing,

The point was that if your strategy revolves around predicting high probability direction movement, you should be betting considerably more than lower probability signals. This is consistent with the oft repeated (but never explained) "Let your winners run and cut your losses short" In order to let winners run, you either need to put it all in on initial entry, or space it out (pillar, pyramid) as the direction is favorable. This is where position sizing is critical, because it spreads out your risk and you can adjust profit targets to bank larger profits. I invite people to use the ProfitKeeper equity tool to manage their exits. It forces you to be profitable if you use position sizing that matches your strategy. Then you can lock in profits depending on how much you risk.

How much one chooses to risk is up to them. But yes, the more positions you put on for the same account balance, the greater the risk of ruin. The good news is that you can apply betting strategies to minimize the risk. One example, if you were betting in 20% per opportunity to trade (either a single trade or series of trades), you can have a profit target of 60%. If you were betting in only 5%, the profit reward might only be 10%. As demonstrated in profitkeeper, you can auto-adjust the amount of profit you want to take depending on your strategy.

And backtesting, beyond testing the fundamental aspects of the system, is worthless IMO. Walk-forward portions, particularly forward testing is useful so that you can visualize if the core aspect has merit. A side benefit (with historical data) is that you can step test (optimize) particular parameters to see what would have worked better in certain market conditions. Without tick data, this would be difficult to accomplish accurately.

Auto Trading Brokers

in Automated Trading

Posted

the OP would have to advise on what instruments he is trading. But metatrader 4 is common among forex brokers. MBTrading supports metatrader 4.