Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

185 -

Joined

-

Last visited

Posts posted by 4EverMaAT

-

-

oanda supports mt4 and you can join the contest with that mt4 subaccount(click on "add account" and then "advanced options")

Good to know....although Oanda did a bad job integrating mt4 (compared with most other brokers). Maybe they improved their; i'll have to see.

Does oanda still shut down during news announcements?

-

We are at the halfway point.Anyone interested in a new contest for October ???

same oanda, or different broker? different platform (metatrader)?

-

Turns out someone decided to use their brain when determining the yardstick by which to measure results. a risk adjusted ROR is actually a shit hot way of doing this. it keeps is 100% pure without any arbitrary restrictions and yet gives the answer to the REAL question which is: who can make the greatest return with the least amount of risk.For example, the last 4 weeks I'm up about 9% in my account. but my drawdown from any given day end to the following day end is less than 2%.

Now, you could take another guy, and he could have a 99% ROI for the same 4 weeks, but if his drawdown day to day is 40%.... well, I would argue that I'm the better trader, even though I made far less than him in terms of ROI. OF course, if he did a 99% ROI with only an 8% drawdown, I'd say he probably is the better trader.

The Varengold bank contest winners were actually part 1 of a larger follow-on challenge to trade real money accounts. They used to offer cash prizes, with the 1st place winner eligible for trading a managed account somewhere between 250k-$1m, and they get . The last contest there were no immediate cash winners, but the top 3 were eligible to be flown out to headquarters to trade a large account and they get a % of the profits.

The point is that VG want to make sure that the same method used to win the contest will be used to continue winning when the trader migrates to a live account. It was almost like an american idol for trading; the larger goal was searching for real talent.

I like it a lot. And I think it would be the perfect solution to this situation. furthermore, myfxbook is already equipped to provide those numbers if i'm not mistaken.

this idea has got my vote anyway.

Technically any of the contest hosts can create their own Risk Adjustment (or use the standard deviation model that varengold bank used), but they choose not to. i think the Risk Adjusted ROI of 352% isn't as aesthetically pleasing as gross 12,000% ROI.

-

-

Hi 4Ever in blue jeans,Your post makes interesting reading.

Does your study include real money traders, or just play money contestants?

Because if its real money,then I should change my leverage to win big.

I believe there is more luck than the experts make out

regards

bobc

Mostly play money contestants. Not many real money contests out there, although the prize money is real, so there is a real incentive to make it to the finish line.

Varengold Bank has been one of the few contests that i've seen that actually weighs in the volatility of the % gains throughout the contest without restricting the trader's ability to trade. They call it "risk-adjusted rate of return", which takes a standard deviation of the difference of the daily account balance for each trading day. That's why someone with only 30% gross returns but has low risk trades can still have a high risk-adjusted rate of return and an equal chance to win the contest. Using a flat 'no more than x% drawdown' is a more artificial barrier and does not give certain traders the room to execute their strategies fully.

-

Yes it is correct. By not using some kind of DD rule the Contest has turned into exactly the kind of Rodeo I was hoping to avoid.To me at least it doesn't make sense to expend anymore energy on it.

Oanda only allows 1:50 leverage anyway for its trading products. But they do also allow smaller lot size increments. Not bad percentages considering the trading is being done manually.

MyFxBook had a recent contest with Oanda. The winners' percentages were some of the lowest ever; only 500% winning percentages. Most contests allow metatrader 4 and allow 1:200 - 1:500 leverage. It is not uncommon to see 1000-5000% monthly gains.

I do think I know where Mystic is coming from. He wanted to avoid the "all-in-ers" I've done a study where I evaluated the trade history of those who won....essentially that's what it comes down to. Those who have contests that are solely based on absolute gain % the top earners bet it all in (as much as their margin allows) on what they consider to be high probability trades.

It's more of a luck approach and it is more likely when people are trading with play money (nothing to lose)....not to say that it cannot be done with real money either as noted by bobc

Dear In the mystic moonlight,Its the Rodeo riders that come first in life.

George Soros come to mind with his bet on the pound.

I read elsewhere today a post by Colonel B.

To be successful in trading you must buy the Red candle.

...............

-

.........The correct way to play most reversals is to let the market show you the move is over. How? By watching the move stop, and then go sideways for a time before moving up again. That’s what the big players do – they have to (they are risking a lot more than we are).

........

The only way to see that the move in one direction is over is to actually see the move turn the other way. Irony of that strategy is that after the fact, the market has already moved and trying to trade 'counter-trend' at that point would be 'pointless'. The market going "sideways" does not guarantee anything; you are merely predicting, betting on the market not continuing to trend in the same direction. Unfortunately, the trader does not have the benefit of hindsight.

-

Would the orders be linked in a One [fill] Cancels the Other (OCO) fashion?

-

In the previous article, I covered the core components necessary for a complete, successful system. By successful, I mean a system that can produce measurable and reproducible results in a mechanical fashion. Once you obtain an system that can be implemented 'manually', where all actionable steps are worked out ahead of time, then you would want to reduce the number of steps that the trader is required to act upon i.e. automate.

By manual implementation, I am referring to a trader being required to physically participate in all of the steps of the system. Automated trading implementation is when the steps are implemented without human intervention. Semi-automated means some of the steps (preferably 1/2 or more) and fully automated means that after initial setup, the system can run without human intervention.

Here are some of the major advantages of automation:

1) Increased accountability: When developing systems, you have an idea of what you want and you build your system accordingly. You also know what your system should not be doing at any given time.

- You can log every relevant statistic that was calculated during system operation for further analysis. Spread, slippage, order execution, errors reported, changes in parameters, etc. Any bugs that come up are reproducible, although this may require many hours sometimes to properly isolate the root causes. At least there are only so many variables as the broker usually provides the trader with either a api or the end user trading application.

2) Increased transparency: Fully mechanical systems are usually transparent by nature, at least from the sequence of the tradecycle. When it is operating automatically outside yourself, you have the opportunity to look at exactly how your strategy works with a birds-eye view. You have a greater ability to see the system for what it is, which is very difficult to do manually. Your own biases and emotions can often cloud your judgement in actually pulling the trigger, even if all the steps are per-determined.

It is difficult to cheat (intentionally or accidentally) when the whole process is in front of you.

3) Easier to Optimize: Once you have verified your core strategy has potential, you can then begin tweaking some of the main parameters and secondary parameters to match opportunities you observe. You can add, remove, and/or replace different components, forward test them alongside an older version of the same system and evaluate performance. Backtesting is more useful for testing the validity of a function used, whereas forward testing or walk-forward testing aims to confirm real-world performance of strategy.

An example of a few optimizations I used:

- Implementing a "maxSpread" indicator that disallows trading when a currency spread exceeds a certain value.

- Implementing NoTrade times so that a tradecycle does not begin to close to closing time or opening time or whatever time I designate.

It is important to note that performance matrices are not limited to equity curves or equity monitors

4) Scalability. While your strategy will be WYSIWYG, the actual implementation can be inconsistent due mainly to human error. I hinted earlier that performing repetitive tasks on queue every time manually is difficult for reasons I'll explain below. A machine can take advantage of the same trading conditions consistently, every time. So for much less physical effort you can take advantage of [strikethrough]the same amount of[/strikethrough] more opportunities. This is also known as leverage; another very important concept that blends in perfectly.

- You can focus on multiple instruments simultaneously as the robot/indicator will be doing the repetitive tasks of the signal, entry, and exits. If you trade manually, there are only so many charts, indicators, etc that you can keep track of. And I've seen people with what I call "cockpit dashboard" looking charts with loads of indicators PER CHART, and multiple charts and terminals (windows) open waiting for alerts from those charts.....some 10-50 charts sometimes. How many charts can you pay attention to at once, let alone trade with only two hands, two eyes, and maybe 2-3 monitors? How long can you keep this up for EVERYDAY? Unattended implementation of your trading strategies is the only way to maximize market exposure-to-attention span ratio.

There are some notable disadvantages to automation, mainly in the actual development process. It does take resources to build and a lot of personal follow-through to see a system develop out to its full fruition, let alone a working beta. Lots of risk involved in terms of costs vs success of completion. It deserves another thread, but I can say that the advantages outweigh the disadvantages as much as someone attempting to take a bus, car, or plane from Miami, FL to New York City will reach their destination much faster and more efficiently than walking or bicycling.

Automation is part of a larger strategy that Ramit Sethi [i Will Teach You to be Rich] summarized in his Big Wins Manifesto; while not trader-specific, he gets at the heart of the psychological differences in people taking action that achieves reproducible results vs those who have one-off approaches that may work some of the times or are 'good enough' to get by. It's summary of his work in behavior psychology and how it relates to making money; practically required reading. A few quotes here worth noting:

"True masters of human behavior understand our shortcomings, and use systems, automation, and a judicious use of our limited willpower to tackle the things that really matter — while ignoring the rest."

"There’s a limit to how much you can save — but not to how much you can earn. You can’t out-frugal your way to being rich."

I am more focused on addressing why more traders are not implementing [semi or fully] automated trading systems. Well for one, it would require a system that has structure. Rules that do not have benefit of hindsight and would have to be adjusted/tweaked using real-time observation. This can be a big blow to a trader's ego, that may want to insist that constant human intervention is required. Others have already written off automation because of the aged excuse of 'if it were so easy, everyone would be doing it'. I don't know why so many people are attached to the 'popularity' indicator, despite numerous historical and real-time examples that show popularity alone is a horrible way to prove a method or system's effectiveness. How popular was Enron, Bernie Madoff, MF Global, PFG[Worst]?. That's for a different article. Some people don't have the technical expertise to build their own systems exclusively. You may need outside help, but certainly no need to reinvent the wheel. The fundamentals of how buyers and sellers agree in contract don't change.

Ok, let's end with one more quote: "Are they [people trying to get rich] really not “trying hard enough”? Or is there perhaps a systemic problem urging people to waste their limited cognition on near-meaningless tasks with little reward…and should we instead focus them on high-leverage areas that will result in massive payoffs?" [emphasis added]. Isn't this the whole point of speculating in financial markets? I hope what I have presented has improved your strategy design in some fashion.

-

Anyway, like the title of the thread suggests if you want to comment on or ask questions talk about a different aspect of MM then please do so! :helloooo:Drawdown is just a natural part of trading. Just like an airplane must maintain lift regardless of the altitude height, or a ship must stay afloat regardless of how deep the water. When you get to your destination, the heights and depths that were used to get there are irrelevant. The risk returns to zero when no trades are open;)

Trying to use time like a 4 hour or daily loss limit to artificially stop out what you think is or is not an acceptable loss doesn't respect that the market may have its own point of view on how far prices will trend. A much more accurate stop loss would be based on a range of prices, which can be adjusted depending on how many positions you take on. Once you reach your profit target (or stop loss), the drawdown in between didn't matter.

Drawdown only matters in terms of knowing the maximum positions you can hold vs amount of available equity, no different that knowing how much gas you need or what your mechanical limits are. I just want to make the clear distinction between determining position limits based on mathematics and overall mechanics of the trading strategy vs fear under the guise of 'preference' or 'risk tolerance'. One is personal, the other is not:cool:

-

-

..........It has been difficult for me, as it took me some time to build a customized method which meets my risk/return parameters, in which I believe 100% and which suits my personality best. There is so much BS out there, as you have already mentioned. And in fact, like BlueHorseShoe mentioned, in today's world, there is actually too much information, so that it's difficult for a newbie to distinguish good from bad......

Your discontent is helping you get at the heart of the confusion. The greatest inspirations come from 'unlearning' what you think is correct. Trying to navigate through the oceans of available knowledge to find 'right knowledge' is difficult. Take the easy way: intuition, common sense, etc. You can save yourself a lot of time and effort tapping into the wisdom of others and more importantly, yourself.

To quote from Jed McKenna's Notebook: "The truth is always simple, and never lends itself to any debate or interpretation."

........"Read all the books": I've read twenty-six books, or about 4.25/week. Most of these are pretty quick reads, well-written, and thus easily and quickly understood. If a book was not easily understood, if it was poorly written, or if I found myself struggling to make sense of it, I closed it and never looked back. At least six books fit that criteria, so technically I read twenty or so books, and started but failed to finish six or so. I'm about done with the books,...................

+1. Emphasis added.

I wonder whether I am a "head-banger"? The problem is that "successful" isn't really a measured outcome. If you mean being able to turn a very modest but consistenet profit trading a limited number of markets in a limited style, then I am not a head-banger. If you mean having drawdowns and a risk profile that I am not really comfortable with, and then constantly searching for ways to improve these, then I most certainly am a head-banger. And it's been two-and-a-half years now . . . Please can someone tell me whether I should continue or quit?

Rather than just saying "successful", mightn't it be more helpful to have in mind a specific goal? Also, could a learning goal be more helpful than a profit goal? What if you reached the end of six months and hadn't made any money, but towards the end you felt you had gained several specific insights that would enable you to make great progress in your trading if you were to continue? At the end of six months I would be more interested in knowing what definite progress you have made than what your P&L shows.

......

People asking abstract questions but expecting concrete answers. Blue is correct in wanting a clearer (more solid definition) of things like success. And I can concur that profit goal may not be the only attainable goals here, although for most speculative traders it is (or in my opinion should be) one of the primary factors that is used to evaluate the effectiveness of a trading system.

-

I like the "before" chart

I think the point of the before/after was to show that the after chart with only 1-2 indicators was pointing out nearly the exact same thing that before chart with several seemingly elaborate indicators. But that's the whole point of an illusion: To distract your attention away from the real goal....usually that is looking for profitable setups. With the before chart, someone can really think "wow, these indicators are really leading us somewhere". But the after chart is drawing the same conclusions, but cheaper and less cluttered. That's what I gathered anyway.

-

Price trends until it doesn't. When a trend hits a wall, i.e., S or R, what matters is what price then does about it. Does it bore its way thru and continue the trend, does it veer off sideways, or does it reverse? Volume can be informative, but it's the price movement that matters.Stay tuned.

Db

Isn't volume the basic unit that allows the price movement? In exchange-traded products accurate volume stats are readily available. Based on what I was reading from another one of your post here, you recommend removing volume bars.

Now I do think that the majority of indicators smooth (average) out results, which creates lag. A 'proper' indicator, should merely display or guage what is going on in the markets. So counting the amount of volume per unit price movement (or price movement per unit volume) could be a guage. An alert could be set if prices move beyond a certain levels.

Indicators are not that bad

There are lots of examples of this in the Trading By Price thread and the Support/Resistance thread.Db

Interesting stuff. It isn't mechanical, but I like some of the fundamentals that go into the approach. Mainly emptying out what one expects the market to do and conduct more observation. The main problem I see with the entry/exit approach not being mechanical is that it is difficult to develop consistent results. But least it is your own conclusions drawn from your own observations, which is a step towards figuring out what is true about [whatever you are observing].

The whole concept of trending has been ambiguous for quite some time. The very loose definition of:

Up trend: a series of higher highs and higher lows

Down trend: lower highs and lower lows.

still leaves open how long the trend must be for the individual to consider it a trend? Mathematically, there is virtually unlimited up and downtrends occurring at any given time, depending on how you 'look' at the market, when you look at the market, etc. I agree with your conclusion that time[frame] isn't a factor in price movement. People using lagging indicators attempt to use a 'timeshift principle' (switching among several chart timeframes) in an attempt to compensate for the lag. This is akin to trying to shorten the long way, instead of just taking a short path.

-

Right now I am with my wife in beautiful island doing our summer vacations. One of my dreams was to analyze my charts in the morning drinking coffee by the beach. I did that yesterday. Believe me it is not worth it. The sun was too bright, the table too low, too small and uncomfortable and I, instead of relaxing, I was paying attention to my charts.Even in the hotel room it is very brutal to pay attention to the markets. While on vacations there are so many activities to attend, swimming, sight seeing etc, that don't allow much time to work properly.

Right now I manage to steal few minutes from time to time to manage my positions or to read my mails and that's it. But I still feel that I don't do a decent job with my charts.

I could imagine if your strategy has many hours of "chart time" or screen time

, then it would be difficult to travel and trade. I use a vps, so that the desktop stays on 24-7 when testing and trading live. I only have to use RDP to connect. You can do this from any windows/mac/linux, smartphone or tablet (preferibly android/iPhone.

Probably one of the biggest issues I have noticed is being able to get a decent broadband connection if you do any kind of short term trading. I have slowly been trying to work out the kinks, but there are definately certain things you take for granted and only really notice when you are somewhere else.One of the other things is screen size ... I use 2x - 24" IPS monitors at home and then have to adjust to using just my 15.6" notebook screen.

And also what type of mouse you travel with ...you take for granted that surface you normally work on at home, but a lot of places use glass tops and any number of other materials ... I have both a Logitech Anywhere MX mouse and a Logitech Performance MX mouse that both work on glass.

...stupid things I know, but its amazing how it can create issues you weren't expecting.

I would agree somewhat. If you are more of a backpacker, it would be best to test different spots first. Usually major cities have high speed internet with little issues.

You can bring a spare flat panel LCD monitor either in your carryon if it is less than 19", or in your check-in bag. Pack it well so nothing breaks. As for the mouse, bring/buy a mousepad to be safe.

-

metatrader 5 is what mt4 was supposed to be the first time around, but things happen for a reason. one positive thing about metatrader is the consistency it brought to forex and financial market. The first time an entire community got behind a trading platform. it was free and had programming capability. all these years futures and stocks have been around.....trading platforms have been fragmented and kept in-house.

the trading platform is a self-directed trader's primary connection point to the market. By becoming a de-facto trading platform for retail forex, metaquotes removed the "what trading platform should i use?" syndrome. it allowed traders to "dive right in" and not have to re-learn new platform if they want to switch brokers.

-

We are getting there slowly, but I have to say this is an exasperating business!We have 10 trading days to go, give or take a day. Time is beginning to run short to get entries in.

I am thinking we must have fouled up somewhere ... maybe forex traders need the incentive of a prize in order to participate?

You are not as well known as MyFxBook, Automated Trading Championship, Varengold Bank, mt4i, or other platforms that hold forex contest regularly. And non-metatrader contests are much less likely to have followers as metatrader contests.

Announcing it on TL's homepage or making it a sticky somewhere. Maybe a thread sub-folder under 'Announcements' titled 'Trading Contests' would garner more dedicated attention.

-

Over the past couple of years or so, quite a few people have had to ponder this very question. From Bernie Madoff, to MF Global, and PFGBest. Like our lives, we spend all that energy building up our trading accounts only to find out that *POOF* it can all be gone as if it never were.

-

I find the OPs question very interesting. Often times you see jealousy from people who are surprised that people somehow figured it out sooner. Maybe it isn't the fact that they didn't spend all their time chasing superstitions and assumptions. They 'cut to the chase' and only spent their time on systems that made sense. If they happen to find or develop their own profitable system in a short amount of time, then good for them. It almost reminds me of the Apple vs Samsung patent wars.

There was a thread recently where someone asked for specific advice on a profitable trading system. A few of the posters blasted the guy for wanting to be spoon fed. I would think anyone who wants to target something objective, would want objective steps to get there. Does it really matter where you start if the destination is the same?

.......Unless you have a well-tested and consistently profitable trading plan, you should stop immediately. Otherwise you will likely only waste the next five months.

Db

I love this quote. Betting on luck and chasing superstition is not going to somehow improve your chances of having a working system. The system must work at the core levels.

-

You can use in-house stops or a equity-based stop loss (or take profit) that is monitored in-house by a script/expert advisor/etc. By keeping you stops off the exchange or off the broker server (forex), there is less risk of manipulation. The only real risk is that your platform/datafeed fails, in which you would have to call in to exit your position(s).

-

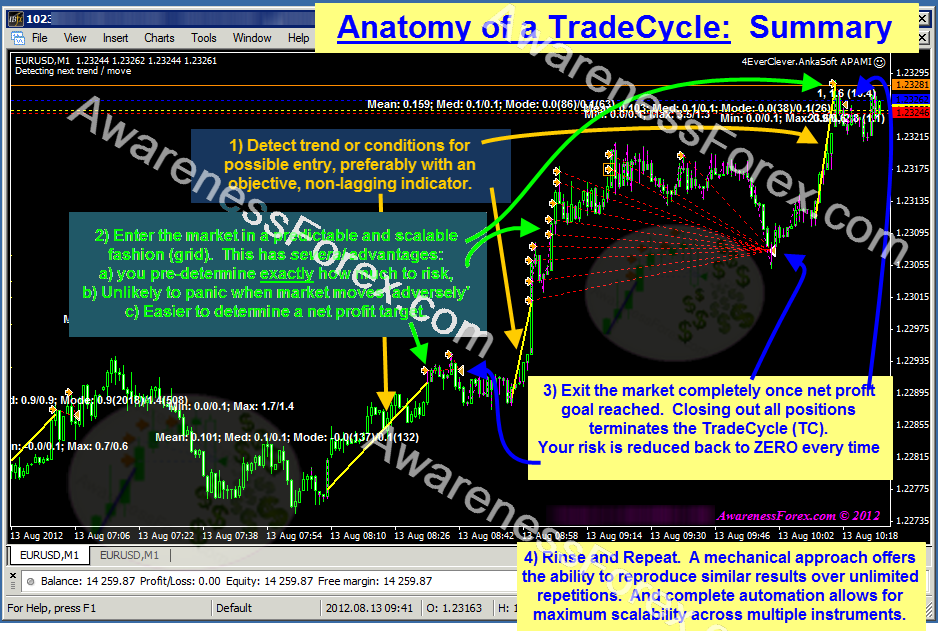

It is interesting to note that the definition does not indicate that grid formations focus on order entry into market. There is still no definition of the exit, or explanation as to how traders exit.

One possible exit strategy is to close all trades in the grid when the trades have collectively reached a net predefined profit target.

-

Have you ever wondered how it is possible to be completely objective with all of your trading decisions? If you only trade occasionally or as a hobby, then it may not ever occur to you to write down or formulate your trading methods. If you are or planning to trade with real money either for yourself or professionally for someone else, maximum levels of accountability and integrity to explain how the profits will be made are desired. Let me be more blunt: You cannot expect to make any type of consistent profits betting on a few lucky trades from some blackbox.

There are certain fundamental processes or functionality in any system. By fundamental, I mean 'core', 'primary', or basic components or processes such that, if you remove or disable any one of these cores, the system will not function properly. There are also secondary or auxiliary components that are nice to have, but are not necessary for the systems intended purpose. These are usually cosmetic or preferential in nature. Take a car for example. One of its primary functions are to take you from point a to point b. If you remove the radiator system from the engine compartment, can the car still function to serve its primary purpose? With no method to cool the engine properly, it will quickly overheat and make the car inoperable. What if you removed the radio? The drive may be boring, but the primary function of the car may still be sustained.

It is important that you make this clear distinction between primary and secondary functions when designing or evaluating a trading system that is built to make profits. You want to ensure the primary components, working together in its designed flow, will produce the advertised or projected profits. Likewise, when one of the primary components fails, you can pinpoint the point of failure and apply the appropriate workaround. Too many traders choose to have their attention focused on secondary functionality, and many more charlatan system vendors exploit this. Some examples of secondary functionality may be chart/indicator color, trades 'win' %, worrying about scalping capability, and perhaps the worst lagging indicator of all: popularity :crap:. (this deserves further commentary in an upcoming thread)

A complete trading system has to have at a minimum:

1) an ability to determine satisfactory condition(s) exactly when to/not to enter the market. (collectively known as an entry signal or alert)

2) Actual entry or entries of trades into the market related to the signal generated in step 1.

3) an ability to determine satisfactory condition(s) exactly when to/not to exit the trades made in step 2. from the market. (collectively known as an exit 'signal' or alert)

4) Actual exit(s) of trades generated in step 2 from the market, based on exit signal from step 3.

Steps 1-4 above in sequence is what I call a tradecycle. A tradecycle could technically be applied to managing individual trades, each having its own independent tradecycle running simultaneously, trading the same or different instruments. I have found tradecycling is much more effective when applied to 1 or more trades of the same instrument in series (like a basket). You could still trade several different instruments in their own tradecycle, and preferably in their own account.

I use a combination of trend detection with non-lagging indicator, reverse entries (counter-trend) in a grid formation, and a closeAll exit strategy when net profits have been obtained. In this way, steps 3 and 4 are combined. Although not part of the tradecycle, a new step emerges: repeat as many times as possible:cool:. When you have a mechanical system, it is desirable to maximize repetitions (not to be confused with aggression)

. The maximum profitability is derived by maximizing the number of tradecycles. So then we start talking about automation, dedicated servers, etc (another topic for another day).

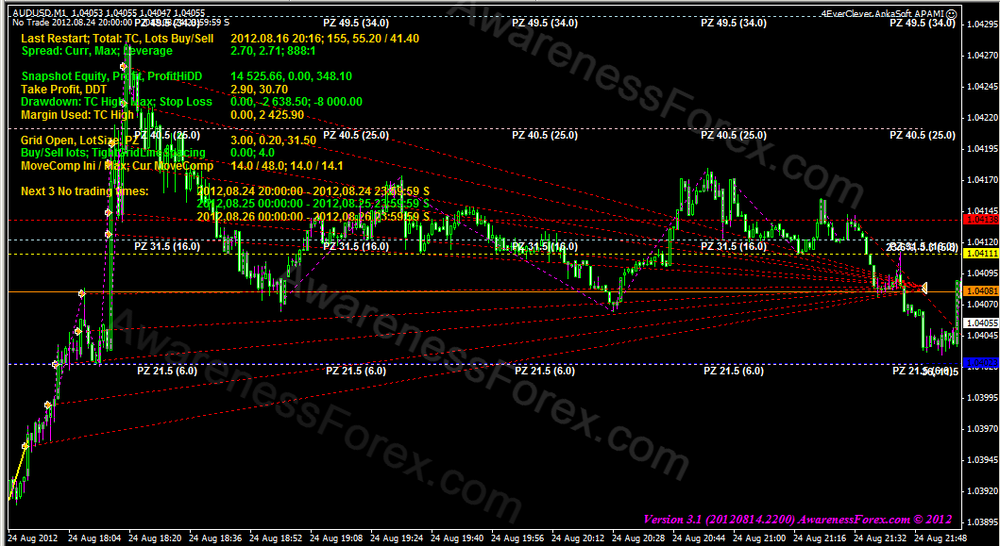

. The maximum profitability is derived by maximizing the number of tradecycles. So then we start talking about automation, dedicated servers, etc (another topic for another day).This is easier to understand when you can see it visually. The screenshot shows a few tradecycles with a breakdown of each step. The grid was set to 0.2 lots sizes each, 2 pips apart from the initial trade. These were actual trades done on a live demo account. Live real money accounts have traded the same way (better in a few cases) with the same settings.

I have to see the reaction to this article before i figure out what part 2 will be about. I'm thinking more details about why tradecycling is the best approach for mechanical trading, the worst case scenarios (risk management), etc. I do hope that more people are aware that trading does not have to be difficult or mystical. Buying and selling mediums may change, but the core motivations of what drives people to agree on a contract (and a price) are always the same. At least no one can say they haven't been given a specific method to get started

Additional note: the indicator used is a custom, non-lagging trend detection indicator known as the Awesome Price Action Move Indicator [separate thread sometime soon....will be released free] But you could use something as simple as a moving average crossover or a coin toss trend filter if you wanted. As long as the filter is consistently applied.

-

This isn't strictly true.BlueHorseshoe

I am interested in the elaboration. I'm familiar with [concepts like] neural networks. But unless I'm missing something, ultimately the robot can only adapt (add/subtract rules) based on what the original rules stipulate for adaptation +/- any rules that have been modified since the start.

If we approach it this way, essentially you'd be trying to reinvent the wheel. Price is way too linear; how many outcomes do we need to account for?

-

......I have been trading for some time now (15 years) and I have been always fascinated by blackbox trading. All the secrets surrounding this way of trading is just great, it is no wonder that they call it blackbox trading, because it is very hard to find a good algoritm.

"They" call it blackbox trading because there used to be a time that trading systems vendors sold their systems in a 'black box' looking device that connected directly into the phone line and computer. This box was designed to magically spit out profitable orders, yet be tamper proof so that the end user could not determine how the algorithm worked.

I recommend you stay away from blackbox systems, unless you want to lose a large portion of your money before even getting started. If you're doing this for fun, then it's not so bad. But as a business, you need to be clear about the steps taken for you to be profitable. You don't have to be a programmer, but you need to understand basics about how the trading platform and trading system work in the same way that you do not have to be a car mechanic, but you do need a basic understanding of how a car functions to be able to operate it properly.

Anyhow I started this post, because I want you to shine light on me

and make me more (wall) street wise on this topic.

and make me more (wall) street wise on this topic. .......

In an ideal world I would want to have self learning algoritm, but if you could give that to me you wouldn't be posting on this forum I guess (please tell me I am wrong :rofl:).

........

If you are familiar with this kind of an algoritm based trading or you know which way to go with this, please get in contact with me. I am willing to learn badly and do business.

Cheers,

Pieter

Wall street wise? Watch the sequel Wall Street: Money Never Sleeps. Avoid the mistake that the young protagonist makes. That'll wise you right on up.

Self learning robot? If you are referring to the ability for the robot to adapt to various trading conditions, a robot can only perform (or adapt) according to the instructions that have already been given to it.

I do have something along the lines of grid combined with counter-trend trading, but it deals only in forex (metatrader 4/5) It is not blackbox, but grey box in that you are fully aware of how the system operates, can make adjustments, etc.

Comparing ECNs with Market Makers

in Forex

Posted

when you read your contract carefully, you'll see that all retail brokers and are market makers. This isnt a bad thing....somebody's gotta be the counterparty to your trade to deal with it properly. as long as you get filled reasonably....who really cares.

the stigma that comes with MM term is a few less than scrupulous brokers did stop hunting, fake spikes, intentional price freezing, asyncronous slippage (positive slippage, no positive gain, negative slippage, trader gets full negative slip). This was further placed in the spotlight when the infamous virtual dealer plug-in got into the public view. metaquotes and related companies went through great lengths to suppress video and other proof of how it works. real eye-opener to see how easy it is to manipulate price feed vs orders. it is rare that a broker today will use the dealer (blatantly) as the competition is much better now and there are several reputable choices.