Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

29 -

Joined

-

Last visited

Trading Information

-

Vendor

Software Vendor

-

Favorite Markets

whatever

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

Metatrader Broker for Trade Future and Index ?

Quantower replied to dowjonestrader's topic in E-mini Futures

Try OANDA, LMAX, Pepperstone, FXCM, ICMarkets with Quantower platform https://www.quantower.com/ -

In the latest update of the Quantower platform, we have released a new trading panel, called Multiple Order Entry, which allows creating a predefined list of orders. In this video, we will show you how to add orders to the panel, combine them into groups, modify their parameters, and most importantly, place them to the market. https://www.quantower.com/

-

Quantower started following R-Trader Rithmic, Which Platform to Choose?, Order Flow Advice and and 5 others

-

Try professional trading platform Quantower for FX, stocks, options, futures https://www.quantower.com/

-

Day Trading the E-mini Futures with Predictor

Quantower replied to MadMarketScientist's topic in Commercial Content

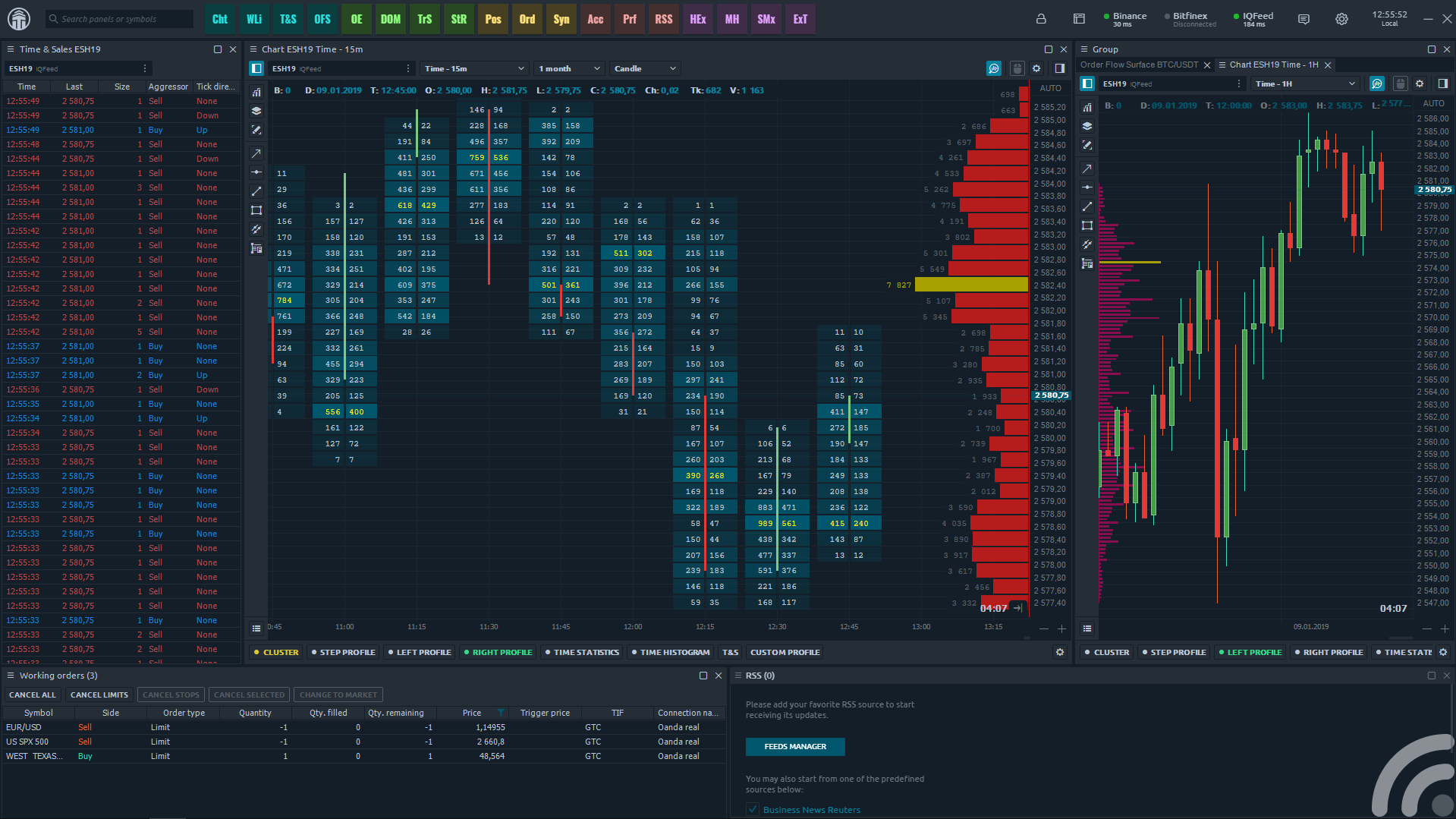

Time & Sales panel in Quantower platform got a new feature called Aggregated Trades also known as Reconstructed Tape. This mode allows tracking large traders, by summing up trades that match in price, direction and time. By adding various conditions for coloring or filtering rows via Setup Actions menu, you will see only the desired values. -

Volume Imbalance on the cluster chart and support of Ritmic Plug-in Mode Cluster chart in Quantower platform allows you to see the traded volume at each price level and understands the intentions of traders regarding the future price. In the new version, we have changed the settings and added 3 types of cluster chart: Single, Double and Imbalance. Single cluster shows only one data type per each bar. Double cluster allows you to select two data types that will be shown in each bar. For example, you can select Volume for the first data type and Delta for the second data type. Imbalance in footprint chart highlights the price levels where a buy trade volume is excess over a sell trade volume. Diagonal Bid/Ask imbalance displays aggressive buy market orders lifting the offer and aggressive sell market orders hitting the bid. In the cluster chart settings, you can specify the ratio between buying and selling volumes diagonally at each price level. For example, Ratio = 3 will show on the chart all the imbalances, where the excess of buying over selling will be above 300%. Additionally, you can set three different levels of imbalance and specify color settings for each of them. Stacked Imbalances shows zones of multiple consecutive imbalances that occur on bid or ask side. These zones are important support/resistance levels because they are levels where participants aggressively wanted to get into the market. So when the market retests those levels, the same participants may appear again. Unfinished auction is also known as unfinished business occurs at bar high/low prices where both buy and sell volumes were traded. The appearance of the unfinished auction indicates a possible continuation of the movement. Added Rithmic Plug-in mode Starting from May 1, the CME exchange сhanged the rules for determining a professional market participant, and as a result, increased the fee for the market data. In order to correctly define the professional participant, Ritmic has changed the connection parameters in their platform, as well as in API for platforms such as Quantower. To avoid additional fees for subscription to market data, a trader needs to login through the R Trader Pro platform and activate the setting in Quantower, which is called Use RTrader. Hide Extended Hours data out of Custom Trade Session In the previous release, we added Custom Session, which allows you to specify one or more active trading sessions on the chart. Now we have added the "Show out of session history" option, which shows or hides extended trading hours outside the set session on the chart. This option will be useful for stock traders, who are used to analyzing not only the main session but also pre- and after- hours. DOM Trader improvements Added a tooltip that shows the size of the order that trader is going to place. This will allow hiding the order entry sidebar, focus only on the trading process and always understand the order size that will be placed in the market. Also, for Binance and Binance futures we have improved the Cancel Orders function, which will cancel all orders simultaneously (!). For those who actively trade cryptocurrencies and place a large number of orders, this option will speed up the cancellation of working orders.

-

https://www.quantower.com/ We provide History Player or Market Reply panel for manual and visual backtesting. For more details about History Player and how to use it, please read our help guide. Also, we have Trading Simulator panel for demo trading on real-time data of one on several connections in our list.

-

Connection to Binance Futures Our team is proud to release the most requested and popular connection, Binance Futures, which allows analyzing and trading futures on the well-known cryptocurrencies. To start trading on Binance Futures via Quantower, just open an account or use your credentials to login to the platform — API Key and Secret Key. If you have any questions regarding the connection, please check our connection guide. Binance Futures allows you to trade various instruments and manually change the leverage for each one. To change it, open the Symbol Info panel and select the necessary symbol. At the bottom of this panel, there is a Leverage field where you can change the value and apply it by clicking the Enter button. Dynamic VPOC indicator POC known as Point of Control is the price with the maximum traded volume for the specified time period. At this price, as well as near it, large traders and institutions accumulated their positions and it serves as a very strong reference point for all market participants. Price usually makes quite strong reactions to POC levels. However, you should not blindly focus only on the POC line. It's vital to apply it with price action methods and reading the current market context. Dynamic Volume POC indicator shows the change of POC price during the whole trading day. The starting point for calculating the indicator is set from the beginning of the trading day, and the calculation starts again on the next trading day. Besides the main POC line, the indicator shows the dynamics of the Value Area, which is a range of prices where the majority of trading volume took place. Value Area is set at 70% by default. Last Bid/Ask Trades in the DOM Trader Added two new columns called Last Bid & Ask Trades to the DOM Trader panel which shows the recently traded volume for both Bid and Ask separately at the current trading price. One of the main features of these columns is that when several trades executed at the same price, the cell will show cumulative volume. As soon as the price changes and trades are executed at the new price, the data will be written to the new cell and will also accumulate. At the same time, the values at the previous price will remain visible. Thanks to this, you will be able to see absorption or exhaustion at important support and resistance levels, or assess who dominates the market, buyers or sellers. To activate these columns, right-click on the columns' header and enable Last Bid/Ask Trades. Also, if necessary, you can clear the accumulated data in these columns by clicking Reset Bid/Ask. Multiple connections in the History Player and Trading Simulator panels Now in the History Player and Trading Simulator panels, you can add symbols from different connections for testing or for demo trading on real-time data. For example, you can conduct backtesting in History Player with EURUSD forex pair from any forex broker, and 6E euro futures from Rithmic. For more details about History Player and how to use it, please read our help guide. For more details about Trading Simulator, you can find in our Knowledge Base Updates for TPO Chart New view for TPO Initial Balance Added a new view for TPO Initial balance in the form of a Bar near the profile. In the profile settings, you can set the view for initial balance as a Bar or as Area. By default, it set in the form of Area (filled letters). Improved TPO price scale Changed the behavior of auto-scaling for price scale when the depth of history is changed. Additional useful improvements Calendar spreads in symbols lookup now available as a separate node. All main contacts are visible at once, and the list of exchange еspreads is collapsed into a separate node. New options for Export data to the file. In addition to the existing Export options, we have added the possibility to specify the separator type and time zone. Total row in the Market Depth panel shows the total values of all Bids and Asks. This allows you to estimate the prevailing buyers or sellers We’re super excited to share this update with you and can’t wait to see your feedback about it. If you have any suggestions for things you’d like to see in a future update, let us know! P.S. All new updates we published in our blog and in our Telegram Channel Quantower Updates

-

Connection to FXCM is ready to use! The long-awaited connection to FXCM is already available in the Quantower trading platform! This broker is one of the most popular FOREX brokers all over the world, which offers a wide range of trading instruments, such as 40+ FX pairs, CFDs on commodities, indices, as well as the main cryptocurrencies. Connect your accounts through the Quantower platform and trade directly from the chart or through Order Entry and FX Cell panels. In addition, for a comprehensive analysis, use the advanced platform functionality — TPO Profile Chart, Symbol Overlays, various chart types like Renko, Kagi, P&F, Range bars, Heikin Ashi. Follow our step-by-step connection guide or watch the video guide above and start trading through FXCM from Quantower platform. 2 new improvements for Alpaca connection — OAuth authorization and Bracket Orders OAuth authorization In early February, Alpaca Markets added support of OAuth authorization, which ensures the security and privacy of users when connecting. This protocol allows users to authorize without disclosing API & Secret Keys to 3rd-party platforms. How does it look? Each time you connect to Alpaca Markets, a browser window will appear with authorization to your personal account via email and password. Quantower does not have access to these login credentials and doesn’t save them on its side. Bracket Orders In addition to OAuth authorization, Alpaca Market broker added Bracket Order. It's an advanced order type that allows cutting losses and simplifies the trading process. The order itself contains 3 orders embedded in it: Limit Order or main order Take Profit limit order Stop Loss order When a Bracket Order is placed, the system will first execute the Limit order. Until the Limit Order is triggered the ‘Take Profit Order’ and ‘Stop-Loss order’ does not get activated. If the main order is executed, the system will wait for the conditions for exit from the position to be fulfilled. When the condition is met (stop loss or take profit), the position will close and the other bracket leg will be canceled. Multiple custom trading sessions Trading activity and volatility can vary for each trading session. And if you need to analyze the distribution of trading volume for different sessions, it is better to use Custom Trade Session. In the chart settings, set the time range for one or several trading sessions and inactive areas will be darkened on the chart. All volume analysis tools, including Volume Profiles, Clusters, VWAP, on this chart will calculate the volume data only for the active (specified) range. Custom trade sessions are available for next panels: Chart, TPO Chart, DOM Trader, DOM Surface Improved the management of lists in the Watchlist panel Watchlist panel allows you to create lists of symbols, save and switch between them in a couple of clicks. In the latest version, we improved the list management mechanism by adding two options: Add to Watchlist option allows you to add a previously saved list to the current list of instruments Replace Watchlist option clears the current list and adds the previously saved list to the panel Connection to Intrinio One more integration in our connection list! Intrinio is a data feed that provides historical and real-time pricing data on Stocks, ETFs, Forex and various economic and macro indicators. The full list of provided data, as well as the subscription price, can be found on their official website. Now, what are you waiting for? Update the platform or download the latest version, and let us know what you think P.S. All new updates we published in our blog and in our Telegram Channel Quantower Updates

-

The long-awaited connection to FXCM is already available in the Quantower trading platform! This broker is one of the most popular FOREX brokers all over the world, which offers a wide range of trading instruments, such as 40+ FX pairs, CFDs on commodities, indices, as well as the main cryptocurrencies. Connect your accounts through the Quantower platform and trade directly from the chart or through Order Entry and FX Cell panels. In addition, for a comprehensive analysis, use the advanced platform functionality — TPO Profile Chart, Symbol Overlays, various chart types like Renko, Kagi, P&F, Range bars, Heikin Ashi. Follow our step-by-step connection guide and start trading through FXCM from Quantower platform.

-

If you decide to trade with IC Markets or Pepperstone or any other cTrader brokers, you can use Quantower platform for it.

- 9 replies

-

- commodities

- cfd

-

(and 2 more)

Tagged with:

-

Quantower update! https://www.quantower.com/Here is what the latest version has to offer: 37 Predefined Options Strategies Volatility Smile chart for Options Series Cumulative Last Trade Size in DOM Trader Added OCO orders for Rithmic connection ________________________________37 Predefined Options StrategiesIn this release, we improved the Option Analytics panel by adding a list of 37 predefined option strategies that you can apply for analysis or trading with one click. For convenience, all strategies are divided into 4 categories: Up Trend Down Trend Volatility Based Arbitrage strategies For each strategy, you can see a general risk profile scheme, description, and structure, i.e. what options (Call or Put) it consists of. Once you have selected the desired strategy from the list, click on the “Add Strategy” button and it will appear in the bottom table “Test & Real Positions”. In this table, you can analyze several strategies at once, simply ticking off the necessary strikes. It is important to note that all option strategies are built on the strikes closest to ATM (at-the-money). To extend the strategy profile, you need to manually add the necessary strikes via the Paper column in the options desk.Volatility Smile chartAnother improvement that we added to the Option Analytics panel is the Volatility Smile chart. It shows the implied volatility values for all strikes on the same line. This allows you to compare the value of options and understand is their overbought or oversold relative to each other. Cumulative Last Trade Size in DOM TraderChanged the display of the Last Trade Size, which was located on the price axis. In the new version, we placed Last Trade Size in a separate column and added a mechanism for accumulating trading volume, if the price did not change.For example, if the previous trade was on the Bid side, and then the latest trade is on the Ask side at the same price, then the Last Trade Size will add the value. But if the price will change on one tick up or down, then the Last Trade Size will be reset. Added OCO orders for Rithmic connectionIn the last release, we have already added Bracket Orders, which allow you to reduce losses in case of an unfavorable trade. Today we present OCO orders (One Cancels Other), which is a widely known and popular order type among traders. Using the trading functionality of the Quantower platform, you can set two independent limit orders and combine them into an OCO group. When one of the orders is executed, the second will be automatically canceled.Additionally, for each limit order, you can set Bracket orders (SL and TP) and then merge them into a group. As ever, we’d love to hear what you think about Quantower, your feedback helps us improve whole the platform. Keep an eye out for future updates!

-

Quantower platform is a fast, modern and powerful trading platform developed by Quantower company. Thanks to wide customization, modularity and progressive solutions, our trading software can meet the specific needs of even the most demanding traders. Quantower has combined the best charting and analytical functionality in one application which gives professional traders more ways to reach the right trading decisions on different markets: Forex/CFDs, Stocks, Derivatives (Futures/Options), ETFs and ETNs. Key Benefits & Features: ✔ simultaneous connections to different brokers & data providers ✔ Futures, Stocks, Forex, CFDs, Options, Indices, ETFs trading ✔ 10+ chart types and styles – Time charts, Ticks, Kagi, Renko, Point & Figure, Linebreak, Range, Volume, Candles, Bars. ✔ Volume Analysis tools – Volume profile, Cluster chart (Footprint), Time Statistics, Time histogram, Historical T&S ✔ VWAP and Custom VWAP (anchor VWAP) ✔ Power Trades Tool shows the execution of a large number of orders in a very short time ✔ Options Analytics panel for creating & analyzing Options Strategies, Risk profiles and Volatility Skew. ✔ DOM Surface panel shows changes of all limit orders in Order Book, their placing, modifying, canceling and execution. It allows you to see the intentions of large traders regarding the future price, high liquidity price levels. ✔ TPO Profile Chart shows the price distribution during the specified time ✔ one-click trading via Chart and DOM Trader panels ✔ various order types – Market, Limit, Stop, Brackets etc. ✔ panel for simulating of real-time trading on any trading or quoting connections ✔ creating & trading of Spreads and Synthetic Instruments ✔ manual & automative backtesting of trading strategies ✔ creating algorithmic strategies via Quantower Algo ✔ full customization of trading workspaces, panels, templates

-

Rithmic provides full depth of market, Market by Order (MBO).

-

DOM Trader is good enough (very strong) in Quantower platform. There are volume profile, Imbalance, Delta profiles, REcent Bid / Ask volume (a.k.a. Last Trade Size)