Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

166 -

Joined

-

Last visited

-

Days Won

1

Posts posted by suriNotes

-

-

-

Thanks elovemer!!!

Suri

.... suri.... you da man -

-

I am not a follower of Elliott Wave theory but BSE's SENSEX (weekly) chart caught my eye for EW formation.

Here is SENSEX chart with Elliott Wave and Parabolic Arc pattern. Look for the Symmetry in Wave 3, Wave 5 lengths. Also, Parabolic Arc pattern retraced to 62% of the entire prior move.. Could correct more??

** This chart is not MP based chart, but I thought it may be pertinent Indian Markets chart that I follow. **

Regards,

Suri

-

-

Hi James,

Thanks for your post...

Here is a little better illustration of How 2Bs' are traded from my old files (2B Buy logic provided).

ES Weekly is shown with 2B Top detection and trade-setup.

Basic idea behind 2B Top sell is:

Wait for the bar to [CLOSE] below the breakout bar. {Confirmation Bar for 2B Top}

Sell below the [LOW] - x ticks of the Confirmation Bar. {Trade}

2B detection process and trade-triggers are little elaborate (code-wise).

Regards,

Suri

Hi Suri,Ive attached your chart with revision to indicate the confirmation point for the short. Can you please confirm if this is correct? Thanks.

-

Double Bottom/Double Top patterns are reliable when they are confirmed and do have high reward/risk ratios. The confirmations only occur when price reverses and trades above/below [X] bar high/low or SwingHighs/Swing Lows and exhibits strong momentum with Gaps/wide-range bars etc. There may be other forms to detect Double bottoms. Failed Double Bottoms and Double Tops may be signaling stronger prior trend and could be forming multiple bottoms/tops.

One of the way to trade Double Bottom/Double Tops (Irregular DT/DBs) popularized by Trader Vic's 2B detection... 2B Tops/Bottoms also fail and 2Bs tend to be more reliable in Longer-Term charts when they are forming near other support and resistance areas.

Presented here is a case for such 2B Top/Bottom patterns for @ES Weekly and @ES Daily Charts... Just a scenario. Also, note the third chart, where @ES Monthly retracing (near) to 100% of prior Swing.

Nothing signifies it is a Double Bottom, but just a case... Every major analyst is shooting for S&P 600 soon

On Weekly charts, @ES needs to close above 782 and on Daily Charts @ES needs to close above 752 to confirm 2Bs...

Regards,

Suri

-

-

-

Hi bubba,

Here is @ES X5 Pattern formation...

Usually in X5 patterns, the retracement of "B" gives a clue of what type of Pattern it may be forming. There are other rules it may have to form. But when "B" is retraced beyond 61.8% (Gartley), it may be suggesting a potential Butterfly or Crab pattern.

In this chart, B is 71%, suggesting may be a Butterfly (near 127% to 684) or Crab (near 162% to 614).

BTW, thanks for your kind comments about my book.

Regards,

Suri

noticed this pattern when i got home this evening. i haven't seen 1 of these on the daily before. anyone considering buying this low? i don't know about this 1

(not that i KNOW about any of them of course)

-

-

-

-

-

Hi daedalus,

Yes, Entries are very important.. A planned Entry leads to a Planned Exit...

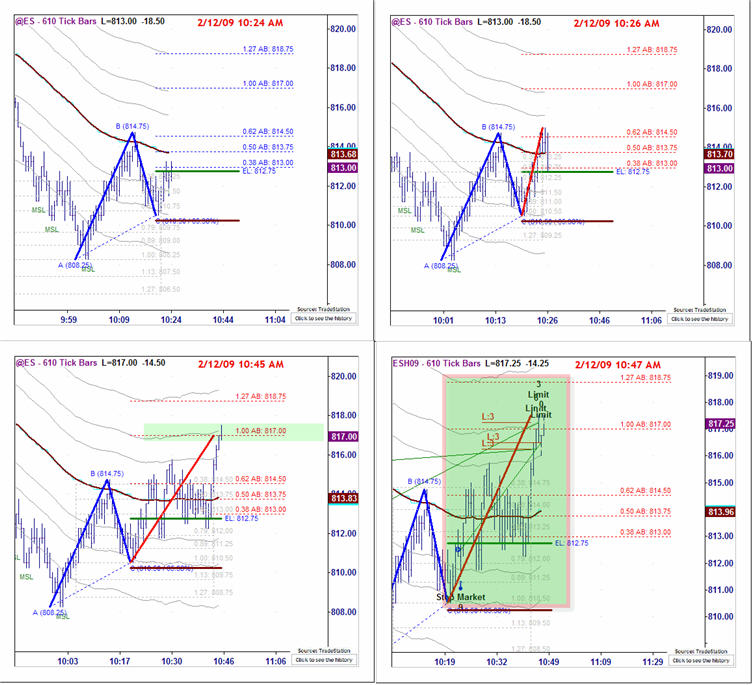

I use an entry algorithm to compute and mark EntryLevels on my ABCs (see EL levels on the chart. It will also compute/mark STOP levels). Depending on various types/sizes of the ABC, this EL can be 2BarHigh/Low +/- rangebased ticks or Wide-RangeBar H/L + rangeticks... On Daily bars I use slightly different algorithm, using Gap H/L + rangeticks or Wide-RangeBars H/L etc.

Regards,

Suri

Suri - I too have been a big ABC trader for years... I was just curious what you were using to trigger entries? Entries always seem to be the most important, avoiding catching the falling knife. -

-

BlowFish,

I agree with you on Market Symmetries and Geometries..

It is really amazing how they work.

Bryce Gilmore, Larry Pesavento, Michael Gur, J.D. Hamon and

Scott Carney (to name a few...) have done phenomenal work

on Market Symmetry/Geometry.

Here is a pattern confluence of ABC Bearish and an example of Time projections (using TS Fib. Time Extension Tool)...

Price is the most valuable information in all research. But 'Time' fascinates me more than 'Price'. Wish I had more 'Time' for my research

Regards,

Suri

:::

Personally I find the 'symmetries' and 'geometries' in the market remarkable.

::::

Another consideration with this pattern (and many 'geometric' patterns) is that it gives a projection in price and time. Not a bad thing to be aware of.

-

Next week, I'll be presenting a small session (30m) on "How to trade ABCs" for TradeStation Securities at the TradersExpo in New York city. It would be great to meet you guys, if you are attending...

Sunday, February 22nd

2:30pm - 3:00pm "How to Trade ABC Patterns using Fibonacci Grid Structure in TradeStation"

Regards,

Suri

-

Hi Bakrob,

Currently we are working on ABC and X5 pattern based Automated Strategies for TS... A very good friend of mine is working on ABC Auto-Strategy for NinjaTrader using the same ABC algorithms. But we may be far from releasing any functions or strategies.

Regards,

Suri

Suri - Does your pattern code offer any hook or way to use it in an automated strategy. For example - can you put your protected code in a Function and allow a strategy to call it and get the value so it can be automated? -

Hi bakrob,

I do strongly recommend anyone who can develop trading ideas/theories/ write code to build systems/indicators for themselves. It does add strong research sense, hands-on experience and clear trading knowledge. There is also true joy in accomplishment of converting an idea to a rewarding system/indicator.

However, there are some drawbacks... Coding can be extensively time-consuming. Even if you have excellent programming skills, if you embark on a wrong trading idea or concept, it could be incredibly frustrating and could take months/years before you realize it was a waste of time. Of course, Programmers will never admit to it

There are only very small percentage of programmers who can actually trade or want to trade. Very few programmers have Trading domain knowledge and very few traders have programming expertise. Most Programmer-Traders find bugs/issues or random/silly reasons with their own code (during the Trading time) as an excuse to NOT to trade. It is well documented (in Trading Psychology Books/Blogs) and could be one of the reason "Why Can't you Pull the Trigger". I suggest to all my programming/trader friends to separate Trading-Time from Coding-Time... Trade during Trading-Time and STOP and then Code. Never mix-them.

I went on a path of writing Gartley pattern (for TS) from public domain code and for 3+ years added patches and random ideas... After 3+ years, I found out that original idea of the public domain code concept was purely WRONG and it will never find right Gartleys. After that, I spent next 2+ years writing Gartley (All X5 patterns) from scratch with my new algorithms and now it will find every X5 patterns with clear trading rules etc. I am still working on it to complete...

My current Auto ABC w/PRZs amd Targets pattern took almost 2+ years, 4 completely different concepts/versions written from scratch... But the current version is absolutely my best work to date, and became my bread-and-butter pattern to trade.

Regards,

Suri

Thanks Suri. I am thinking about buying the Pattern Detector you offer... but I am also working on one myself ... -

-

Good AB=CD explanation and trades, bakrob...

All harmonic patterns (Gartley, Buttefly..) and ABC's need to be traded in market context. For me the context comes from Fib. Grid Structure consists of Confluence of Pivots (Floor, FibZone, Globex), FibBands and Market Structures.. I detect ABC patterns (in Real-Time, no-delays) to plot all levels (PRZs, Targets), the formations. There are about 30-40% ABCs NOT tradable and could be randomly forming... They need to have a form and structure (Size, Shape etc..) and building around certain levels. So, market context is critical to filter them out.

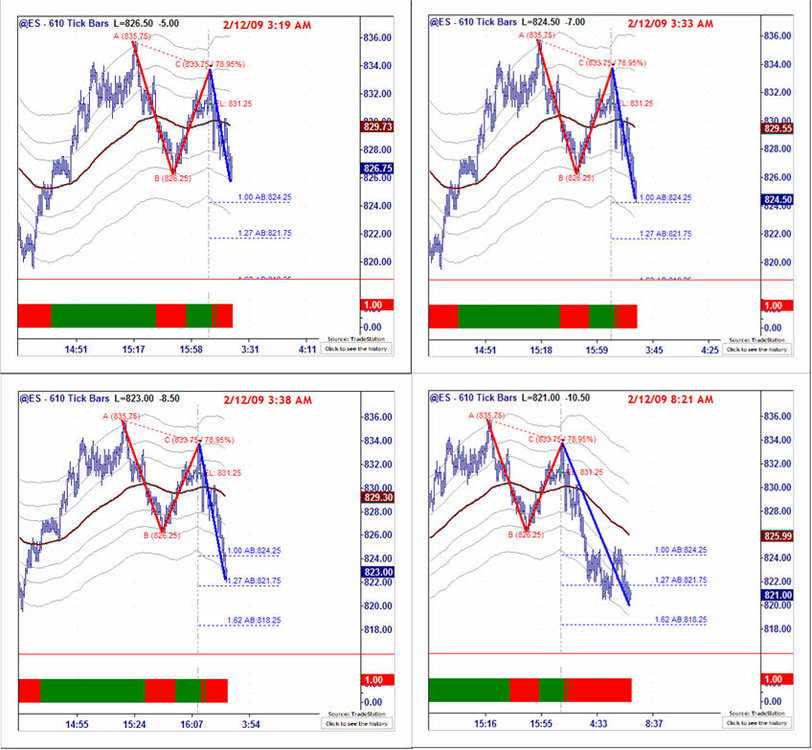

Here are some of my ABCs captured in Real-Time yesterday and today...

Regards,

Suri

-

-

I am still in research mode to identify the pattern (this may take a while) before building trading rules etc.

First @ES.D 30m chart, I thought I found one, but I realized this may not be a WolfWave. (Reason: Fails the rule SwingHigh4 < SwingHigh2).

Second @ES.D 30m, this may be Wolfwave. (I am not quite sure about SwingHigh1). Plotted the ABC Bearish setup with Projections.

Let's Watch and see if it works.

Regards,

Suri

This is Getting Quite Annoying

in Announcements and Support

Posted

I was away for the last three weeks (in India) from my Trading PC.

Last night, when I opened TL website on my Trading PC, I see the URL Not found message... I remember few-times this happened in the past, I logged out of TL and re-login TL, and the URL Not found message stopped.

Regards,

Suri