Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

WHY?

-

Content Count

388 -

Joined

-

Last visited

-

Days Won

2

Posts posted by WHY?

-

-

I thought you might relating intraday vol to the cycle because when I look at your post #63 you state you thought that 10-11 was a "for sure SS day". Then on your post #74 you mentioned "why" you thought that 10-11 was a day to short, that reason being the extreme vol around 1570 intrady on another previous day. So, I kind of put the two post together and thought you might be saying that the vol around 1570 on another day caused you to think that 10-11 was a for sure Short sell day.I am not relating my volume analysis to a taylor dayAlso, the pinball; isn't that Rascke's way or a modified Rascke way to rephase the cycle? Doesn't that operate on volume? Or have I totally misunderstand what pinball is about? It could be a way to get a clearer rephase???

If you arent using your analysis of volume and relating it to Taylor I would encourage to try and do that. You might discover a better way to rephase Taylor. Angell had his way, Rascke hers, Taylor could have, if he wished. I built rephasing into mine. I just havent really found that much benefit, if any, to rephasing. Maybe Taylor knew that, therefore he did concern himself with it??? Look at it this way. Over a 10 day period we are talking of aprox 3 - 3 day cycles. Taylor method is short term trading anyway, unless you are using it to trend trade. A lower low made 4 months ago wouldnt affect the price action today in terms of short term trading..at least not that much. Me thinks that the most recent price action, say 10 to 15 days, within its context (accum, dist, markup, markdown) would have more to do with the pressures of the market that would affect say the next 2 to 3 days time frame. So, I really just wouldn't worry too much about a day that 3 months ago was a buy day but when I rephase today that same buy day 3 months ago is now a sell day. It really doesn't matter. What matters is the shorter time frame. That is probally why Taylor never cared to go back more than 10 days. Does this make any sense or have I just confused the issue even more?

-

Dogpile is it possible you are trying to use intraday volume info to help you determine if it is a B,S, or SS day? If so, then you could get caught on the cross currents of the day. Taylor is an EOD system that would use daily charts to make its decisions (if one uses charts at all). The intraday action at any one point would not determine what day of the cycle it is. That is determined by overall daily action as represented by a daily chart or just the numbers. All with an emphasis on the open, high. low close of THE day to determine the next day of the cycle. Each day that decision is already made BEFORE the market ever opens. The only thing intraday action is used for is for tape reading to fine tune the entry points within the main daily trend. But the main daily trend is already anticipated before the market opens.<<What do you think dogpile have we bottomed on the S&P? Today is a taylor sell day.>>lol. happily, I don't have to make that judgment --- I just take the set-ups as they come.

<<May I ask you where you would start and why?>>

well I was wrong on my count but I will tell you why I thought 10/11 was a day to look to short.

Because we had built a ton of volume at 1570 on 10/5. We tested up away from that on 10/9. 10/10 we build a lot more volume at 1570. 1570 had become a 'heavy' point and this price was high in the range. The gap up on 10/11 surprised me somewhat but given the volume profile and the fact that 4 of last 5 days traded 'low first, high last' -- I felt that it could be a bear trap. It was.

Taylor-wise, there were 2 low to high days and a violation of the 2nd high -- that is a short set-up in its own right. This was my thinking at the time. I was right on the bear trap and made decent money that day -- though only 5 or so points. This past Friday was a MUCH better day for me. The key to me is to just make money every day and occassionally you make that big win. 10/11 was not my big-win day, 10/19 was... just the way it goes.

Take today for instance, I mentioned in an earlier post that it was a Taylor sell day. With the previous weak condition of the market and the low close of 10-19 one would not expect an "ideal" sale day but a possible chance for BV. However, once it traded down and made the BV you would use intraday tape reading to decide if it had bottomed. If so ,you take a long position. In all fairness that would have been taken after the open this morning and not in pre market hours so one could have gotton in about 1499 or 1500 around 10.a.m. The rules on a BV state to sell the long position at or thru any penetration of the low of the previous buy day (in this case 10-19). By 10:30 you could have sold the longs at 1505 or should you have chosen to wait a little longer you could have sold the at 1515 or so. So you capture 5 pt or 15 points on the main part of the trend. You are out of the market for the day. The reason you don't hold that long for long or overnight is because the market is still weak. Showing a litte more strenght but still weak. BV are indications of weakness.

-

If you like name a individual stock or two in tc2000 you would like to track and/or the QQQQ and I will help in that area. I suggest get a decent price stock that has good volume and also out of curiosity pick a stock under 1.50 share (from .20 to 1.50) that has at least 100,000 shares on average (more is better) a day and doesnt trade in highly defined range, and we will track itHello WHY?,Recognizing that my trading ignorance would fill silos: When you reference the dates and numbers below, is that the SPX? If so, I get my EOD data from TC2000 - so when I get home tonight, would I be able to look at the SPX and follow along?

Any chance you would consider picking an EOD stock or something like the QQQQ or SPY to occasionally discuss?

TIA

Gary

-

What do you think dogpile have we bottomed on the S&P? Today is a taylor sell day.

-

May I ask you where you would start and why?WHY, if you were to just look at the S&Ps from scratch right now, pretending you haven't looked at them in last month -- can you tell me where you would start and why? and then correlate this back to why 10/11 was a 'buy day' ? or why 10/10 was a sell short day? doing something like this might help me get something that right now, looks pretty much indecipherable. -

Remember this: Taylor clocked the "normal" price action or what he would call, "on average". He also clocked the aberrations and averaged them too!

-

Nice to have you on the thread! Maybe we can keep it going. Angell did make some contributions to understanding Taylor. But, we have to realize he modified Taylor so you could go long or short on any of the days. Could that be a contributing factor to the "hit and miss"? Or, perhaps you are not combining live tape reading with Taylor? Are you doing this as EOD or trying to capture slices of intraday cross currents? My software allows me to rephase. I wanted the option to do so, thus giving me the opportunity to play around with adjusting the cycle. I don't know for sure that I have seen any real reason to be rephasing except, for perhaps, maybe one. Here is what happens when one advances the day forward or backward one. You rephase and get another day but a few days (maybe the very next day) down the line you rephase and your back to the original setup. It "might" give an edge for the moment on that particular day and allow you to say, go long, when you were looking to short but over the long haul it doesn't seem to make that much difference, at least, that is my current thinking. The market makes aberrations but usually comes back in line again. You could have probably just as well stuck with Taylors plan and used his rules that would deal with the aberrations??? Sooner or later you will be rephasing right back into Taylor again anyway! To sum it up rephasing might help for the moment, and give you an extra trade or two, but sometimes it will also "take" a trade or two from you! For instance, you have a buy day with the opportunity to go long or short. The market makes an aberration, you bump the day forward one and it it seems to get you back into better sync with what is happening but alas now you find you are in sell day and have lost a shorting opportunity of the buy and also perhaps a long opportunity UNLESS a BV is made! On the other hand, it could add a possible trade to your opportunities for the day if say it was a sell day and you bumped back one day to a buy day. Another problem with rephasing is that it also can mess with your thinking and get you confused. You are looking ahead trying to anticipate what the price will do over the next few days and all of a sudden you now got a different three days in front of you. For instance, what was once a HB (higher bottom) on a buy day 2 days ago (and that would have forecast bullish sentiment) now becomes a sell day that doesnt have the same significance, in terms of anticipating the future. So, rephasing not only can take trading opportunities from you it can cloud the past that helps you anticipate the future. So, what am I saying? By all means play around with bumping the days around with whatever calculations you wish to use and perhaps you might discover something that works better than Taylor or Angell or Raschke, but also keep in mind that apparently, Taylor saw no need for rephasing. Correlating volume with rephasing might be a promising area to look at???? Does this make any sense? Again, I would always encourage people to STUDY Taylor over and over. I know it is hard but remember he is the one that came up with the system. Sometimes, I think the dude made it hard to understand, on purpose. Try reading a fairly long paragraph outloud to a friend and tell them beforehand to listen carefully and then tell you the gist of what you have just read! You both will get a laugh out of that!I would also like to thank Why and Dogpile for their contributions and hope that this thread continues to grow.I have been keeping a spreadsheet for a couple of months now using the methods outlined in George Angell's "Winning in the Futures Markets". So far it's been somewhat hit or miss. He talks about "rephasing the cycle" when the price momentum indicator changes direction, and pushing the cycle forward a day when the unexpected happens. Unfortunately in September there were many days when the cycle got of out sync. He also advises stepping aside for a few days when this happens until the cycle resumes.

I plan to review the concepts in this thread again and also study the Raschke material.

I tried to review the Taylor book, but I soon got a migraine so I'll need to revisit that at a later date.

-

Hey man you are welcome. I thank Dogpile for starting this thread. Not many folks can, or are willing to discuss Taylor. I've been trying to figure him out for years now. Finally, got enough under my belt to get my software up and running around year 2000 but I am still learning Taylor. Sometimes I wonder if the man didn't write like that on purpose. Sometimes, you can read a paragragh and just start laughing because it makes no cotton pickin sense. Sometimes, you feel like throwing the book in the garbage can. Sometimes you think - this guy is crazy! But, somehow I hung onto his book, and went back to reading his book. It is literally the most worn out, marked up book in my trading library. Finally, it started sinking in some. Then, I finally came to grips with the way he writes, and well, that made it alot easier for me. He has his own "language" of writing.I'm danged indebted to you and thread starter "dogpile" for making me aware of Taylor. You are "Going the extra mile" to help people, and I for one really, really appreciate what you do. -

Good perception and some orginal thinking on your part here! However, the rules do matter on the buy day also because "how" it does whatever it does, is important and the rules can help you there. Also, the rules for each day, in themselves, help to anticipate the next day. For instance, never buy a low close on a SS day helps you to anticipate a BU on the next day. Also, buying a BH on a buying day helps you to anticipate bullish prices as being most likely ahead for the next few days because an HB is usually profitable. Buying on a BV helps one to see that the market is weak and may continue that weakness and it may take two ro three sessions before it is back to making penetrations of the buy day high on the sell days and of the sell day highs on the SS days, so you would think in terms of adjusting your strategies to reflect or anticipate the next day. Maybe this makes sense?? Anyway, it all works together. The rules are important for each day. It is not "just" that the price was made first or last but it is also "how" the price was made that helps you to anticipate and what that tells you about the next sessions or next few sessions. Page 15, and page 89 in the book should answer your question. Taylors method was his manner of tracking the markets and staying on the right side of the trend. He developed the rules to help him do this. There may be ways to modify his system without hurting the underlying integrity of it. That is, playing around with the days and seeing what happens. All I know is that Taylors way is as good, if not better, than the other modifications I have seen of his method and as good as my messing around with the days. So, I would say the inventor of the system probably had/has a reason or reasons why he set it up the way he did. We may never know the reason because I guess, or hope, Taylor has gone to the happy trading grounds if he no longer lives. I don't know but I have tried to see if he is still living but have never had any success finding out. If he is he must be laying low or too old to care???excellent, thanks.I am clearly having trouble figuring out which day is a buy or sell or sell short day according to Taylor. (This was what Rashke said in her section of the book too). I thought 10/11 was a sure sell short day but you are calling it a 'buy day' -- and it is permissible to short a buy day if you suspect 'high made first'. So I was shorting that day thinking it was a 'sell short day' and you were shorting that day because it was a 'buy day - high made first'. What you name that day really doesn't matter in this case --- we are both shorting on the expectation that the high will be made first.

The problem arises on the other days; 'sell day' and 'sell short day' -- since you never go long on a sell short day but I might go long on a sell short day because I actually think the the sell short day is a buy day.

at the end of the day, your software is doing something that I am fundamentally missing. Can you outline the most basic rule for what sets up a 'sell short day'? ie, you know for sure it is a 'sell short day' if __________. The only thing that truly matters is which is the sell short day -- because you cannot go long a sell short day, per Taylor. It also matters which is a 'sell day' because you are only to go long on a Violation of the 'Buy Day Low' -- if it is a 'sell day.' It just doesn't matter if its a buy day so much because you can go long or short, per Taylor, depending on if you think the high is going to be made first or not. Thus, the rules for a buy day are not important -- except to the extent that locating the buy day might help you figure out which is the sell day and which is the sell-short day. Thus, this is an open question that I hope you are understanding -- how do you figure out the 'sell short day' -- from high-low calculations? or from counting over from a buy-day + 2 days? or some other way? same question for a 'sell day' -- how do you know for sure that the day that the next trading session is a 'sell day'?

This was long-winded but probably more than crystal clear if you interpreted Taylor already (and have therefore proven you can understand some poorly worded material).

-

I might say this: Taylors system is a comprehensive system that "clocks" price movement itself (without use of indicators) and then determines probable future price (or anticipates...i gotta remember to use this word) based upon those calculations. However, it is my belief that knowing how to read the tape greatly enhances Taylors method. Tape reading is the final thing that determines entry and exit prices. I would recommend reading any books on tape reading. I have long ceased to look at chart patterns. (they make work for some but I can't get it right...I hate candlesticks). Some of the old timers stuff on tape reading such as Gann's The Truth of the Stock Market Tape (hint you can get your public library to probably get it for you), Rollo Tape, Oneils other stuff, Livermores book, Wycoff stuff, and Tom Williams VSA and Clif Drokes Tape reading for the 21st Century. Good ideas on tape reading can be gleaned from these books. Those ideas will enhance Taylor. However, Taylor can be used without such enhancements. I have trained semi-literate people to use Taylor in about 3 weeks using my software. The basics, that is. Enough to get them up and trading. I am talking here about people that have never bought or sold stock and didn't even really know what stocks were. I had to use examples with them like going to the market to buy oranges or tomatoes. And supply/demand in the markets where vegetables are bought and sold daily. Trying to explain shorting to them was fun! I say this to say that you don't have to be highly educated to trade like Taylor. Granted the average person would struggle with his book but his concepts really aren't that complicated. He just words things, in hard to understand ways. It took me quite a while to get my dad to understand how you make money when something goes down in price! Anyway, maybe I ain't supposed to mention peoples books??? I don't know. Forums are different. If I ain't well I guess the mod can delete the post.

-

I answered that already in a previous post but you short it and hope to also go long all before noon.so this is just a general question and is why I ask what Taylor does on the 'day after' -- when a buy day ends up trading High first

You do absolutely nothing. You pass. Why, you wait for the next day (buy day) for a good shorting opportunity. Never go long a short sell day. Why? you might get caught in the wrong trend. You might get lucky and get away with it there there will be a day you get hammered. It could trade down on the SS day, close weak or near the low, and never trade back up. That would indicate a weak market and an upcoming BU on the next day (a buying day) and you are better to go long on that buying day instead of taking the chance on the previous SS day. Maybe a quote from Mr taylor will help clarify. I am putting () in the quote to clarify what he is saying; "Now, we go back to the close of the Short sell day and we find that is was a flat closing, then from this indication we expect a lower opening on the buying day and so far this would cause the low to be made FIRST (on the next day i.e. the buying day) and is a stronger indication when made early in the session (on the buying day) that a rally would start from this low (on the buying day) and hold the gains for a strong closing, which in turn indicates an up opening (on the sell day) and a penetration of the selling day objective- the buy day high" p30. There you have it! Mr Taylors reasons for not going long on a SS day. It could close weak. His reason for not going shorting on an SS day high made last is because it is best to short it on a buy day high made first (next day since the trend is up).or the day after a sell short day when the sell short day trades low first, high lastTaylor said and I quote "one of the fundamentals of speculation-to be able to protect your capitol and be in a position to act on a more favorable opportunity when it comes along" p63 He also said "Never make a trade unless it favors your play" p11 Another one... "he must not and cannot ignore the prices printed on the tape"... here is a good one..... "you can believe the tape at all times, learn to read it and believe in nothing else for short term trading"...and ..."the real heart reading the tape is to be able to detect concentrated buying and selling and to the determine the trend of the prices"p12 (Dogpile you will like that one). Here is a Taylor quote that cracks me up "The intent has been to keep the method as simple as possible". Now that is funny! On the other hand, it is hard to make something simple. Ask any teacher.

How many of you actually have Taylors book and have studied it or are studing it? It is ok to hear what someone else says about Taylor but nothing like going back to the original source. If you have any questions about what he is saying on any particular page I will will happy to give my input. You have to understand his style of talking to be able to catch his "drift". Know what I mean?

-

Look guys and any gals that come along on this thread (ever notice you don't see many women traders on trading forums) I do alot of my posting in the wee hours of the morning. Sometimes I am sleepy. I only need 4 to 6 hours sleep a night but I need that much or I am not any good. Anyway, I try to post dates like 10-11-07 ..etc so as to make sure we are looking at the same day. When talking of Taylor one is discussing a buy day, a sell day, and a short sell day. It can get confusing so I try to pin it to a date. But, my software also allows me to rephase or recalculate the cycle if certain aberrations appear in price action. When I run a recalculation it may, or may not, change the cycle. Taylor says to never change it. However, I built this into my software to play around with it. I am saying all this to say: If I make a mistake give me a chance to correct it. I, many times, am posting while sleepy and may have accidently been in the rephased cycle price in my software instead of the pure Taylor cycle price. Plus, I ain't so young anymore and can't think as fast as I used to. But I think BETTER!

PS 1) How come you don't see many women traders on these type of forums? (looks like they would make for the best traders since they can multitask head over hills over most men and can run back and forth simultaneouly on both sides of the head i.e right brain/left brain stuff is natural to them. 2) Why do you think Taylor wrote his book the way he did? Did the man actually talk like that?

-

LOL most all newbies and a few of us older traders still hunt for the grail. Each generation produces another set of grail hunters. Has yet to be found...must keep searching.Don't talk like that, Newbies here would think you have the Holy Grail. -

No, 10-11-07 was a BUY day. Go back and read my post #51WHY, so 10/11 was clearly a 'Sell Short' Day.

Thus

10/12 = Buy Day

10/15 = Sell Day

10/16 = Sell Short Day

10/17 = Buy Day

So, 10 - 12 = Sell Day

10 - 15 = SS day

10 - 16 = Buy day

10 - 17 = Sell day

Taylor can be confusing that I agree on. Just reading his book is confusing.

What you thought happened:

Lets say for conversation that 10-17 WAS a BUY. It wasn't, but to answer your question, lets say it was. Taylor would have made a short play and possibly a long play. The gap up would have been the opportunity for shorting, once the tape indicated a slowing down. Taylor allowed shorting on a buy day. He also would allow going long on a buy day. By 12:30 it had dropped enough that had 10-17 been a buy day I would have probably looked at going long after covering my short. I know that is pressing the rules, but with the rather fast steep decline and it still a few hours from the close, I would have taken my chances. I prefer, and Taylor would also to see the long play within the 1 to 2 hours of the open. It is best to never push the rules past 1:00. The odds are greatly against you after this hour.

What really happened:

Like I said in my post #51 10-17 was a sell day. You can't go long on a sell day UNLESS a BV is made. You also don't short on a sell day. So, it would have been pushing the outer limits of rules to take the long BV play but a BV did take place by 12:30. One could have entered a long position at around 1538 with a stop loss at 1532 or so (tightest stoploss you would use). It traded lower after that but not enough to take you out of your position. Then it headed back up. On a BV the idea is to sell your long position the SAME day on any penetration of the PREVIOUS day's (10-16) low which was 1545.20. So, on this sell day 10-17 one would have taken the long BV opportunity and shortly been out of the market the same day capturing 7 to 16 pts depending on when you took your exit.

Hope this explanation helps.

-

A question or two if you don't mind.a) The first chapter references that fact that it is a BOOK method, and "It is not a charting system". I hope it can be a charting method becuase I'm a visual person. Do you use charts?

b) There were references to action in the morning. My problem is my job will not allow me to do much trading during the day. I'll have to do all my analysis in the evenings and place my orders accordingly. So - do you think one can use the Taylor methods with end of day data only? Or, is it necessary to be observing the markets in the morning to determine entries?

I don't mind at all. It is not a charting method. My software that I developed is not a charting software. I do look at charts some as I am attempting to correlate VSA with Taylor. It may take a bit of getting used to but charts really aren't necessary to be a successful trader. I might get blasted over that one but charting is simply a visual representation of prices. Actually, charts are quite subjective also. One guy sees a triangle and lo and behold another sees something else. However, price is just... that, price. It isnt subjective. It can't be subject to interpretation as to what it is. It is what it is. It is THE price. I think it was Rascke who said "the best indicator of price is price itself. All else are derivatives of price". That comment is pure gold. Patterns on charts are derivatives of price. Most all TA is simply that... derivatives of price. I like things simple. What are prices doing? What are they likely to keep doing? Taylor measured price movement from many different angles. I like to say that he "clocked" price. He believed strongly in averaging. Stocks, for instance, have their manner of trading. Some trade in large daily ranges. Some in more narrow ranges. Some stay in periods of accumulation longer on average than others. You get the picture? Some will produce pretty chart formations. Others won't. But all move in price increments. That price can be measured and quantified and averaged and projected into the future. Oops, I better hush or I will get the "no way to predict" the market people hammering on me. So, I will back up a step and use the term "anticipate" since that doesn't seem to rub people wrong. So, if price is the best indicator of price, and price can be quantified, and price follows a cycle or pattern, or whatever you want to call it, and that pattern or cycle is repeatable, or repetitous then it stands to reason it might could be projected ahead and help one "anticipate" the market. You just have to visualize numbers instead of lines and candles and triangles and head and shoulders...etc. It is like a paradigm shift. We all do it anyway. We watch our speedomotor as numbers. Not a graph. Team score are shown in numbers not charts, usually. However, I will say this about charts. They could be useful to see the "bigger picture" in terms of knowing if the present Taylor 3 day cycle is in accumulation, mark up, distribution, or mark down phases. And they may be useful in correlating VSA with Taylor..something I am working on. Charts are right brain, price is left brain. I would say generally speaking it is good to use both sides of your head! Know what I mean?

Is it necessary to be watching the markets in the morning to determine entry? I would say that it is best. However, not absolutely necessary. The biggest problem you might run into is an aberration like a large gap down or up on the open. That could potentially get you in a bad position. I would prefer to at least see the open before I would place my trade. I do like to watch the tape live to determine actual entry points. But, I have, simply placed an order to buy at a price my software gives me once I see that the open is not something wild and woolly. I have left to go do errands..etc and come back to see the order filled. I do like to at least see the open before I place an order. I think Taylor would feel the same way about it. Also, if you use his trend trading method i.e. pick a good trending stock that is a bull and accumulate a line of stock say over several buy days. Then you sell that long stock over several high made first buy days, several sell days, several SS days. You can also do this in a bear market shorting but of course with some things changed up. Once you accumulate a line you may be waiting 3 to 6 months to sell it. It all depends on what price does. However, in trend trading using Taylor method the open wouldnt carry as much weight as when using it for day trading, or swing trading. In trend trading you would be averaging your costs and also you would want to know some fundamentals about the company. I gotta go to bed. It is late. I don't need much sleep but I gotta have some sleep!

-

Let me ask you a few quesitons:1) Can you give just an idea of how your software projects prices to enter at assuming it is a buy day, or sell day or sell short day etc...? I don't need your code, I just want a direction in which to investigate. ie, Taylor talks about the 'spreads between the buying and selling objectives' (pg 76 in Pertinent Points). This is translated as the difference in highs and lows across days. Is this 'spread' used to calculate entries? If so, can you give some guidance on a direction to investigate?

2) How long did it take you to make a Taylor 'system' profitable? I assume there were some drawdowns along the way to refining your software.

3) Is your 'system' actually all mathematical or is there discretionary oversight by you? ie, can it be back-tested or does it rely on interpretation?

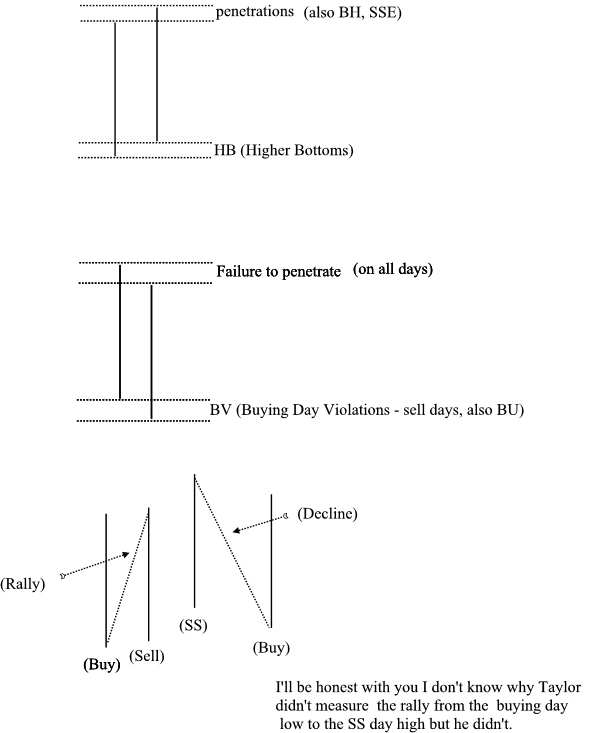

Please see the attached file for some things you might want to look at measuring. Don't forget to average out those measurements. Throw in some pivot points if you like. Just put two bars side by side and think in terms of pairs: buy day/sell day. Sell day/SSday. SS day/Buy day. Sell day to sell day. Buy day to buy day. SS day to SS day. Buy day to SS day. ...etc. Think of all the combinations. Then think of all the possible measurements. Then average. "Clock" the price. Taylor was a stickler for "on the average". Throw in some fibs. Maybe some of your volume work???? VSA looks promising.

My software is a stand alone program. Entry is in the end discretionary. The tape gives the entry points. My software helps anticipate what they might be. But in the end the Tape rules. Price is King and Volume is queen. The code is not TS. I started around 2000 writing the software i.e. having it written. It is EOD. It has been profitable early ..almost from the gate if one follows the rules. Break em and get burn't. I have been thinking of selling it (can I hear a shout ... vendor!!!!I'll probably get banned from here..this is probally my last post when someone screams vendor on the board...that will be fine with me LOL..i don't care ) but just don't know if I want to get involved in the technical support issue plus all the rules and regulations involved with selling such a product. Sec..CFTC..etc. I have trained others to use it. I don't know... just gotta think it over. Maybe one day I'll get up the gumption to make a buck or two on it?? By then some young fellow will come along and program Taylor up real good. I'll be sitting on my front porch in my rocking chair thinking of the "good ole days"!!

The system relies on correct interpretation of Taylors rules. The only back testing is to flip back thru the days one by one and see what it predicted and then see what really happened. It shows all that. Gives you a forecast and then a comparison with what actually happened.

I have probably said too much here. You might be that young fellow!!

-

Dogpile I am not sure why you think that?? That is certainly not Taylor. Everyday is/was either a buy, sell, or short-sell day. The cycle always happens. There are just variations of the cycle. But one cannot say it doesn't happen.In my view, there is sometimes a 3-day cycle and sometimes not.WHY?, it would be helpful if you could post some examples of some classic Taylor that is not the standard 3-day cycle -- which is a lot of the time.

Taylor was basically a swing trader. However, his system can be used for daytrading (in a limited sense), swing trading, and trend trading. However, the way it is used in daytrading is that you only try to find the main trend for the day and ride that trend. On the buy day, you might be able to capture two moves, or trends. You are allowed to short and to go long under certain conditions on the buy day. On the sell day under certain conditions you can go long but the sell day is mostly reserved for selling longs aquired on the previous day (buy day). The Short sell day (ss day) is only for selling short. No longs on that day. If one uses charts to trade Taylor (not at all necessary to trade his method) then you use only daily charts. His system is an EOD system. It it appears to me that you are attempting to use Taylors concepts on the many intraday cross currents that take place (judging by your 2 min ES chart you posted). However, Taylor was about catching that one or two main trends of the day. I do not know how Taylor would apply on the many cross currents that can occur within one trading session. However, I can detail the action of 10-11-07 for you. I would need no chart to trade the action on 10-11-07. My proprietary software doesn't even use charts. Lets look at the action on and near 10-11-07I just can't imagine ONLY trading Taylor, there wouldn't be very many trades --- but this is where you could enlighten me on a good non-standard Taylor trade that occured recently.We see that 10-11-07 was a BUY day according to my software. On a buy day, per Taylor rules, if the high is made first I am allowed to short it. Then AFTER the high is made IF it trades down and makes its low, and does so early in the session, (by 11:00 or at latest 12:00) then I can go long too. My software gives me 3 probable highs (besides 10-10's high ..so 4 in total) to be potentially made on 10-11-07. I won't get into the calculations of these highs but suffice it to say that they are places that the high "may" occur at. If the low is made after 12:00 then one cannot take a long position simply because it may close weak, or near its low. You don't want to carry a long overnight with a weak close on a buy day if you can help it. Remember, most longs purchased on a buy are held overnight and one would try to sell them the next session of the cycle (sell day). There is one exception to this. If you go long on a buy day before noon and then it heads up fast and hard then sell out on the peak because the next day prices could drop. In such a case you wouldn't want to hold the long overnight. It could continue on up the next day but the odds favor it heading back down after such a forceful rise. So what happened on 10-11?

First, on 10-10 -07 my software indicated to me we had been in an uptrend and that the velocity had picked up (check out a chart if you like). Also, we had a high close on 10-10-07. In addition, the previous buy day 10-8-07 made what Taylor terms an HB or higher bottom. That is, the low on 10-8-07 was higher than the low of the previous session. According to Taylor HB's are usually profitable therefore a bit bullish. Also the close on the SS day 10-10-07 was higher than the close on the previous day too 10-09-07 (a sell day). All this indicates strenght. Taking all this into account, I would be looking for a penetration 10-10-07's high on 10-11-07 and I would expect it early in the session. I am armed with my 4 potential high points but the final factor is the tape. That makes the decision for my entry. The market opens on 10-11-07. It immediatley begins trading up. It breaks thru my first high, second high, third high, and fourth high. I have no choice but to wait for the rise to slack off. However, please note the pattern is "right" for shorting a buy day. It traded up early and in Taylors lingo penetrated the high of the previous day (10-10-07 an SS day). Now, note my strategy is to go short because it fits the pattern. Remember, on the close of 10-10-07 I was already anticipating the pattern by the high close, uptrend, and increasing velocity and the other things mentioned above. So, I watch the tape on 10-11-07. It starts to tank out and I short at 1584. It trades on up to 1586 but I am not stopped out. Then the decline begins shortly after 1:00 p.m. and is in full swing by 1:30. It is a steep decline. I know I must cover the same day as Taylors rules require that I do, especially, on such a fast decline. I also know that this is my ONLY play for the day in ES. I CANNOT go long because here we are in the afternoon (it is past 12:00) on a fast decline and most probably will end up with a weak close. So, my long play is scratched. I know this. It has also broken south of all the fib levels, so this is a weak market. I don't want to be caught long in it. Taylors rules don't allow a long postion to be taken here, even though it is down, and one might think it will rise. But to go long in this weak market is dangerous. So, I pay close attention to the tape and try to capture as much of the decline as I can. By 2:30 to just before 3:00 it is trading low enough. I am out of the short at 1559 close to 3:00. I captured 25 pts. That is a big slice out of the days range. Do that on two or three cars and you made some dinero. Why mess around going in/out 10 times that day when what Taylor taught is to catch the main trend? Now, if after I shorted that early high, then it traded down, and made the low, and did all that before noon, I would have covered my short, and went long and would probably hold that long overnight, UNLESS it rallied hard off that low before closing on 10-11-07. If it rallied hard I would sell my long and be flat by the end of the day. IN such a case I would have made two plays that day. A short and a long. If on the other hand, it worked it way back up slowly after I went long, and closed say in the middle of the range on 10-11-07, I would hold that long overnight and try to sell it on the next day 11-12-07 (which is a sell day in the cycle).

To sum up: Here is a day that is less than the ideal pattern. Yet some good money was made by sticking to the rules and making this trade the way Taylor would have made it...i.e. capture as much of the main trend of the day that you can. And don't get caught in the many cross currents of the day. Know what you are anticipating. Look for it and correlate that with the actual tape. Always look to capture a goodly slice of the main trend.

Remember, the ideal pattern on a buy day is to FIRST trade down, make its low, trade up and close high. One would buy on or near that ideal pattern's low and hold that long overnight to close on shortly after the open on the next day (sell day). In he above case we have a less than ideal pattern that fetched some good money for us by following Taylors rules. To trade Taylor you need need charts (but you can use them if you like). You really just need the rules and know how to apply them in the context of the cycle and the open, high, low, close. I do think Taylor might could be enhanced with an understanding of VSA.

Thanks for you explanation of Friday's action. I hope mine helps you to see how Taylor would have probably traded the action on thursday 10-11-07 had he been around.

I would not know how to apply Taylor intraday on the many corss currents and I do not know IF it can even be done. That would be in effect saying that the "smart money" is also using mini swing low/swing high cycles intraday that can be understood by applying Taylor concepts to them. I think that would be taking things a bit further than what Taylor intended. His, was, and is, a swing trading system that can be used on a limited daytrading basis and in a 3 day manner. There is also a way to use it for longer term trend trading. But reading the many intraday cycles up and down and applying Taylor to them ...well ..I have my doubts that it would work but it would be interesting to see if it would. Taylors method dealt with price manipulation from a longer time frame than say a 15 minute chart..etc.

-

On these two you would be allowing short or long on any day. This means there is no three day cycle. Taylor would not allow short or longs on just any day. The reason for the cycle is that it is a mechanism for the "smart money" to buy or sell their line profitably and not cause extreme gyrations in the market ALL the time. If one scuttles the three day cycle then Taylors concepts basically have no manipulation context as their environment. The basis of his whole theory is that the markets are manipulated and the cycle reveals that manipulation.1) When there is a morning test of a previous day low - consider a buy2) When there is a morning test of a previous day high - consider a short

-

If one trades as Taylor traded then you know what the cycle is before the open. Then you trade by the rules depending on how price action turned out. Trying to adapt the 3 day cycle to actual price action will get one caught on the wrong side of the market.I note that the goal is to start with a thesis and then see how price action works out. Sometimes, you simply won't be able to figure out in real-time where you are in the Taylor Rhythm -- but you can have a roadmap with the 'idealized version' --- and then adjust on the fly as necessary.

Taylors concepts are fine but if you apply them differently then they don't have the same meaning and the 3 day cycle really becomes meaningless. For instance, take number your 3 above. Many times a sell day low WILL violate a buy day low. That is called a BV and it is an opportunity to go long. A morning low on a sell day IS NOT a long opportunity according to Taylor. The higher bottom you speak of must take place on the BUY day. That is, if the BUY day low stays above the previous days low(SS day low), then it is a good opportunity to go long because HB are usually profitable. But this is when they take place on a BUY day. No longs are allowed at all on sell days UNLESS a BV takes place early in the session.Personally, I like to just think in terms of concepts:1) When there is a morning test of a previous day low - consider a buy

2) When there is a morning test of a previous day high - consider a short

3) A 'Sell Day' low should not violate the 'Buy Day' low -- a morning low on a sell day may be buyable if it makes a 'higher low' vs the buy day low.

-

OK, will do at least for now. Have a great weekend!Totally agree with smoothdrive. Please hold on. That is one of the best and promising threads of TL. -

I would read chapters 1 and 2 then chapter 14 Pertinents Points then start back over with chapter 1 and read the whole book. You will have to read it several times. I have been studing Taylor since before the year 2000. My Taylor book is falling apart and is marked up like crazy. But then again, I ain't as smart as some folks! Taylors principles are good and sound in my opinion. His hand written method..well i think that could certainly be improved upon in the days of computers and ..well I have done that for myself.Hello WHY?Hold on please!! I'm hear to tell you there are many lurkers here enjoying your posts. I ordered the book on Monday, and my daughter just called me at work to say fed x delivered a package from amazon. So I'll start the book tonight.

I very much appreciate what you have posted here and I look forward to starting the book and kicking around some Q&A if you are so inclined. It sounds like the book is a little difficult to read. So, if you were just starting out with Taylor - how would you go about it? Follow the chapters in order/non-order - read a summary form an outside source etc?

Also, I saw that you have posted at the VSA thread -- Do you think the two methods can work in harmony?

TIA

Gary

As far as VSA and Taylor. I am learning VSA. I think at this point that VSA could perhaps help to anticipate the patterns that Taylor speaks about and confirm Taylors ideas. I have alot of trading books. If someone held a gun to my head and told me I had to give up all my trading books but one, I would choose to keep Taylors book. If they told me give up Taylors and I could keep all the rest I wouldn't think about it 5 seconds....I would help them load up the other books. I would keep Taylors. But I must admit the man sounds like he rambles along not making much sense until you learn to understand his writing style. You may think the man is crazy or just plain confused but if you can weed your way thru his book, and read it many times, and think about what he says, you will soon get the picture. If you have any doubts on Taylors writing, just ask. I will be keeping an eye out on this thread to see how things are going?? I have read Taylor so much I even catch myself writing like that man! That is bad now!

Please understand pages 99-126 (at least in my version of the book) are Raschke and Angells take on Taylor. While they make some good points, and perhaps some useful points, I personally prefer Taylor's way of understanding the cycle. Don't get confused thinking that Angell is explaining Taylors way of doing things because his version is a modified version of Taylor. But if it works for him..good! But it is not what Taylor taught in the strictest sense.

Good to hear there are a few lurkers here on this thread. It was looking like dogpile and myself were here alone.

-

Say day 1 is a buy day. Day 2 is a sell day, Day 3 is a Short sell day.you are saying that when the market makes a lower low after a buy day, especially if that low is made AFTER the usual morning 'reversal time', call it the opening 90 mins, then you actually aren't going to get a true buy day until more weakness plays out? You may get an up day, but don't expect the typical up day, up day, sell short day to necessarily play-out. Not sure if that is what you mean but I will read pg 48 and that area this weekend.IDEAL PATTERN:

The ideal day 1 is to see price trade down early in the session make the low (at this point you take a long position), it reverses and trades up closing on or near the high of the day. That is the ideal setup (for the ideal pattern) for the next day which is day 2. Day 2 it opens making high first and slightly penetrates day 1's high. You sell your longs (you bought on day1) and you are out of the market for the day. It then trades down, then back up, and closes near the high of the day making a good setup for the next day, which is day 3. Day 3 it opens and early in the session trades thru the high of day 2 and this is where you would short it. The selloff comes. You cover on the same day 3.

NOT SO IDEAL PATTERN:

Day 1 opens up early (giving you a shorting opportunity) it trades down but STAYS down. This is not a good setup for an ideal day 2. As matter of fact, the low close indicates it may make what Taylor calls a BV or buying day violation. If you went long on this low (because it was a day 1 and normally you would look to go long on a day one) it would be best to get out of the position BEFORE the close. Why? Because what is anticipated next is not good for your play. The low close on Day 1 is a setup for a possible BV on the next day which is day 2. A BV (buying day violation is when price violates the low of day one, on a day 2, and does so early in the session. So, lets say price does make a BV. It opens low on day 2 and continues lower than the low of day 1. Once the decline stops your strategy is to THEN go long there, having dumped your other previous longs, because it didn't favor your play. What you have effectively done is repositioned yourself in the market since your first long play on day 1 was a weak play. You then wait for a rally off this BV and then you sell those longs. You do so on any rally back up to the low of the previous day 1. That is, your long selling point now is the low of day one. Why? because a possible decline is now indicated. In an ideal pattern you would have carried your original long made on day 1 over to the next day (day 2) and it would have traded up thru the high of day 1 and that would have been your selling point. But seeing price hang near the low on day 1 and it getting close to closing time, you realize it is going to close low. You know it is not in your favor to be holding longs on a day 1 when the close is gonna be low so you dump them to then re-enter on the BV that will probably be made on day 2 (next day). I hope I am not confusing the issue for folks but Taylor shows the ideal pattern and then also had rules for when the ideal pattern just didn't pan out.

Now to answer your question. What you described in your question was a BV. When a BV takes place especially, if trend is turning down or markdown out of distribution is starting then pay close attention to that BV. Just the fact of it being a BV indicates lower prices or a down trend coming. It is indicative of a weak market. Taylor says the market swings high on 3 days (day 1 to day 3). Then comes a decline (swing low) usually made in one or two additonal days. However, sometimes there are variations. In an uptrend it may take 5 days to swing high. IN a downtrend 4 or 5 days too. When you find a BV taking place in a downtrend it is VERY indicative of even more lower prices coming or a LONGER swing low coming. Especially, if it was made in like the first or second day of begining of the downtrend. So, when a BV is made early in a downtrend your strategy must change. The cycle will continue as day 1, day 2, day 3 however, they probably will not be IDEAL (you called it true) Buy, sell, SS days. So, you can anticipate a series of less than ideal days on the horizon coming, because of the BV taking place early in the downtrend. You reason that the downtrend will could last 3 to 5 days more. With Taylor the ideal decline is the high of day 3 (ss day) down to the low of day 1 (buy day). So, this decline or swing low is normally made in 2 days under ideal patterns. But a BV previous to that swing low is indicative that it may be a longer decline. So, day 3 starts after the BV and the decline continues. On the next day in the cycle (day 1) it still continues down. If it closes high the decline has probably been arrested at least temporarily. If it closes low then look for more decline. When you have a series of less than ideal day 1, day 2, and day 3 you get what taylor calls failures to penetrate and BV's. When that happens you must adapt your strategy to market conditions. So, in a downtrend you would be going long on BV's and shorting failures to penetrate on SS days and Buy days. You would forget about going long on buy days because you would get caught in a possible BV the very next day. Taylor always looked to position and re-position himself for a favorable outcome. In short, yes, a BV indicates more "less than ideal" pattern days ahead and alerts you to adapt your strategy. Especially, IF the BV is made at the start of a downtrend. Hope this helps. Taylor is tough to understand, at least the way he writes, makes it hard to follow his train of thought. I have about wore my book out trying to understand the man. I have wondered if he didn't do it on purpose for some reason. I can tell you this he attempted to corner price like no one I have ever seen do. He sought to understand manipulation and to see how it plays out daily in the markets. Todays blast to the downside was engineered that is for sure. We got six days down. I would be looking for the market to head up at least a day or two. Then it might head on down some more from that point. Or, it might head on up. But longs were slaughtered today. Smart money caught every stop loss in sight and hammered on down. Smart money is whistling all the way to the bank.

-

Well guess I will quit posting here on this thread. Doesn't seem to be too much interest in Taylors concepts. Dogpile has been the main one to show some interest. I am learning VSA to correlate that with what I use, which is Taylor's concepts. I think VSA to be another tool to help anticipate the moves Taylor quantifies.

I might say that the price action today 10-19 (buy day) is what Taylor would term a BU (or buying under the low of the previous day 10-18 which was a short sell day). Notice that 10-17 was a sell day and 10-16 a buy day. What is interesting is a BV (buying day violation-a lower low than the precious day which was a buy day) took place on the 17th. THis was in itself a bit of an indication of lower prices to come. I quote from Taylors book (with parenthesis added for application to ES and this week):

"The violation (BV of 10-17) is in itself, generally a three day or more decline (we see this three days of decline the 15th, 16th, and 17th), and its seems to require a session or two (18th and 19th) to build up a rally that will (begin) penetrate the tops of the selling days-the Selling (day) and (the) Short Sale day." p48

In other words, what he is a saying is that a BV will take another session or two of trading before the price action gets back into the swing of penetrating the high of future buy days on future sale days and the high of sell days on future short sell days.

So, the BV on the 17th in itself acted as a sort of anticipation of at least 1 or 2 lower sessions to come. This is pure Taylor. Just another tool to help anticipate.

-

The weakness shown yesterday blew out south today on 10-19. Once thing to remember about Taylor system is that in his day they didn't have the pre market hours trading ...etc. I am sure that if they would have had it back then his system would have taken that into account. A shorting of around 1549 a little before the market close yesterday (I picked 1549.50 as one of the intraday highs off the low area of 1542 yesterday) and holding overnight would have paid off well today. If there is any adaptation to Taylor original system I would say it should be in this area. Taylor called yesterday 10-18 a SS day and today 10-19 would be a buy day. On a buy day if high is made first you short it early in the session. Then you look to cover the same day on the decline and reverse and go long IF the low was made say within first 2 hours of the session. Anyway by 10:30 this morning 10-19 one would have been out of their short position in the 1525 area and already reversed for a long position with a stoploss around 1516. A rapid sell off like this once the market opens makes for quick plays.

Taylor Trading Technique

in Swing Trading and Position Trading

Posted

Taylor would maintain that tomm 11-23 will be a Short sell day IF he had been trading this stock for say 4 or 5 weeks.

Great! Glad Taylor is perhaps helping you fine tune. Every bit helps!

Nothing wrong with that thinking! Actually, by rephasing via taylor 10 day deal and calling 10-23 a Taylor buy day you have just created two possible opportunities for yourself. A short (probable because of the high close today 10-22) and then cover and go long on decline IF made early in the session. However, I would take care on that long. We got a little strenght back in the market today but it is still an extremely weak market. I wouldn't ride any long up too far unless the intraday tape tomm shows alot of strenght coming back into the market. If you take a long position tomm and market is grudgingly going up and it is getting in the afternoon I wouldn't hold that long for selling on 10-24 (as would be normal) but I would cinch my profits before the day closed. A weak close on a buy day is not good news for a long position. As Taylor would say "cinch" your profits.

Yep, you got it. I will stick with Taylor on this one and call it a SS day. If the market would have showed more strenght today 10-22 I might would rephase (using Taylors 10 day guideline or my software rephase) and see if it would change tomm to a buy day. If it did I would be giving myself 2 opportunities. But since the market was stronger than 10-19 but still weak I'll stick to my SS bias for 10-23.

That is correct. But to make it more precise; To go long it must do so early in the session. You wouldn't want to go long if it made the low at the end of the session tomm 11-23 even if tomm is a buy day. Also to short tomm if you call it a buy day that opportunity must present itself early in the session. You would not short on a buy day high made last for you would be bucking the trend.

Interesting eh??