Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

Gamera

-

Content Count

606 -

Joined

-

Last visited

Posts posted by Gamera

-

-

-

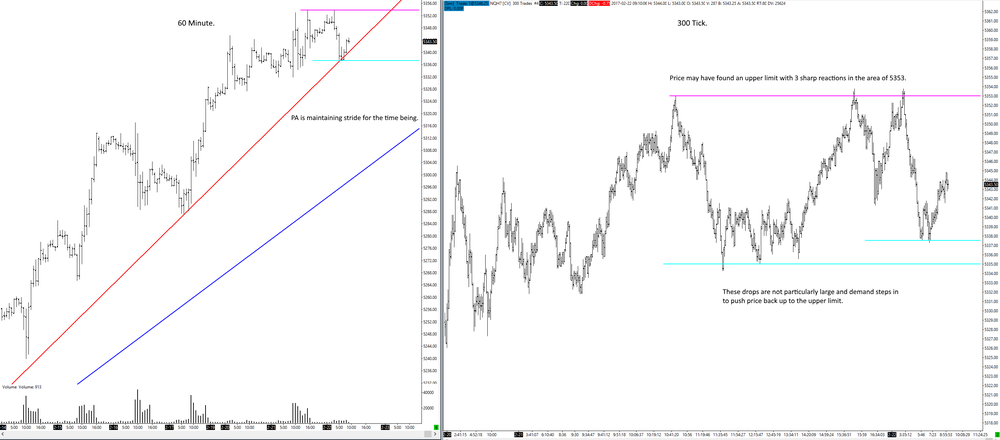

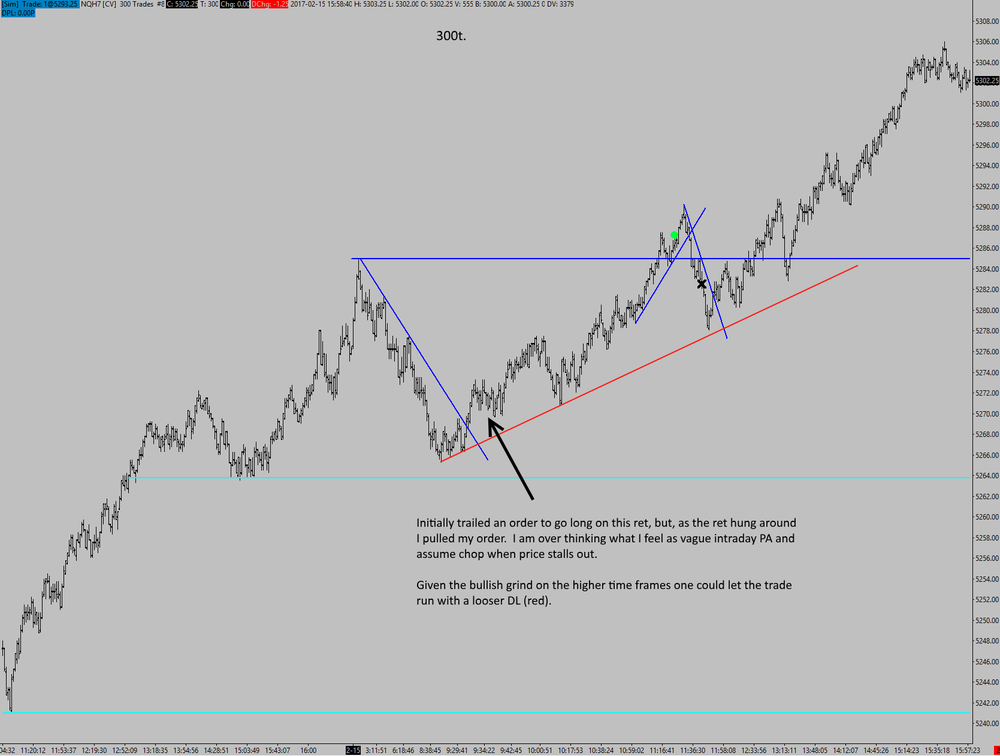

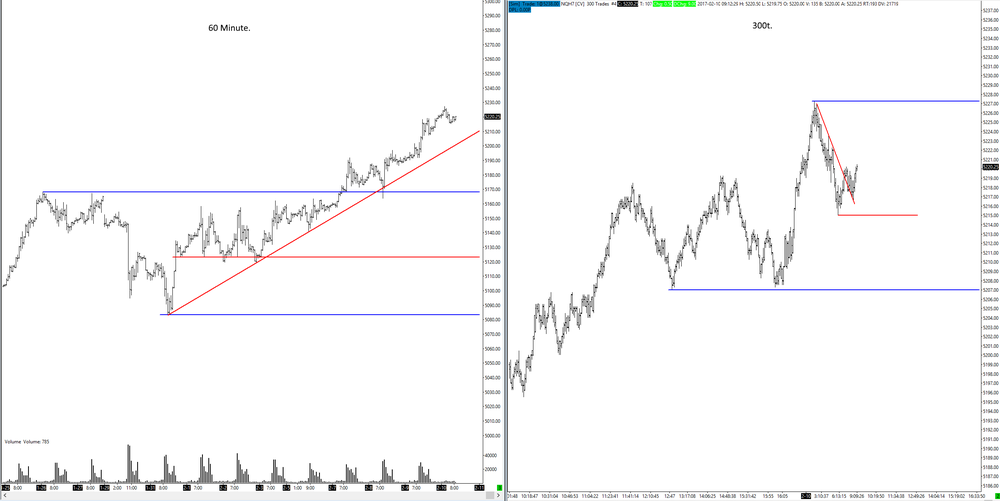

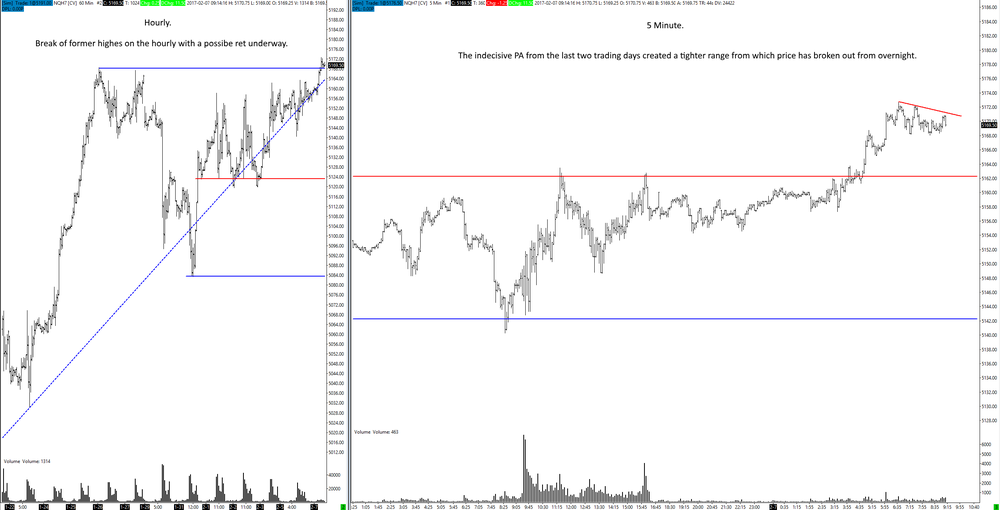

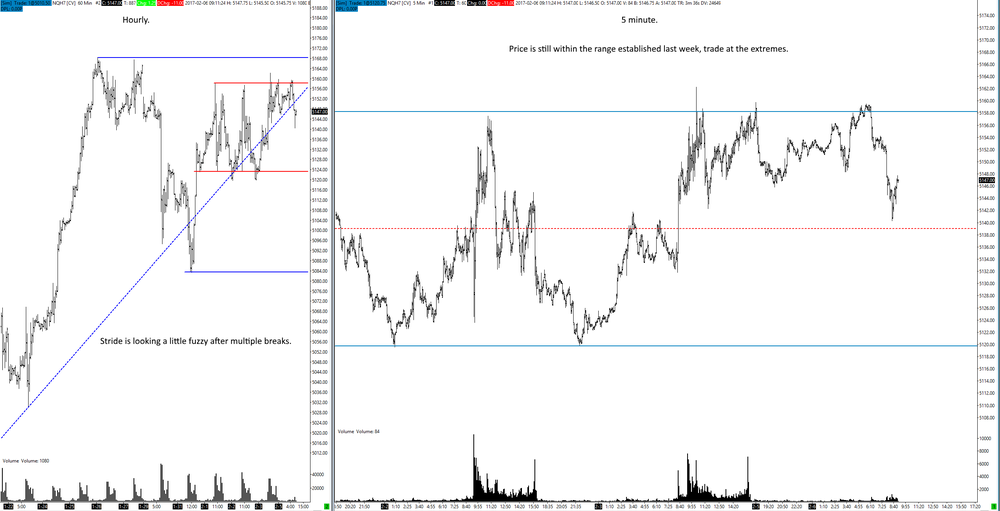

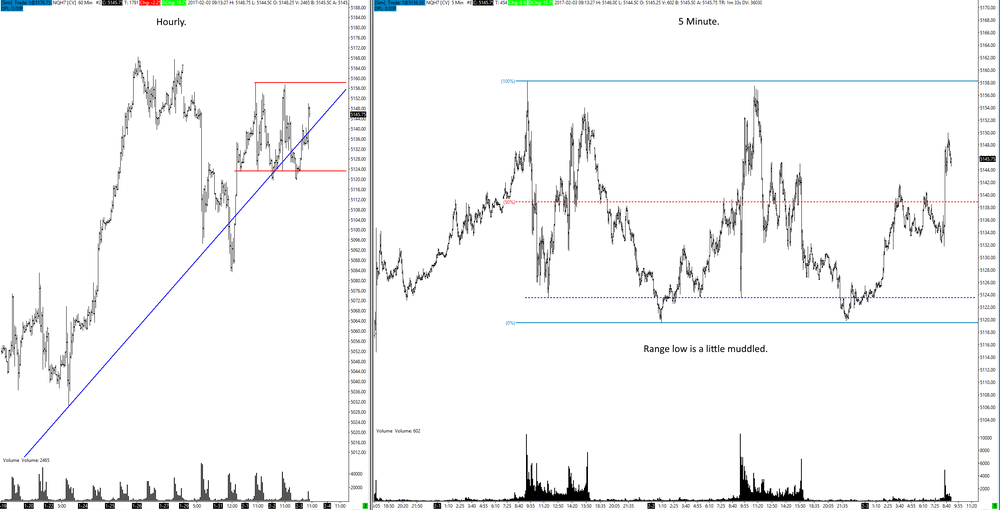

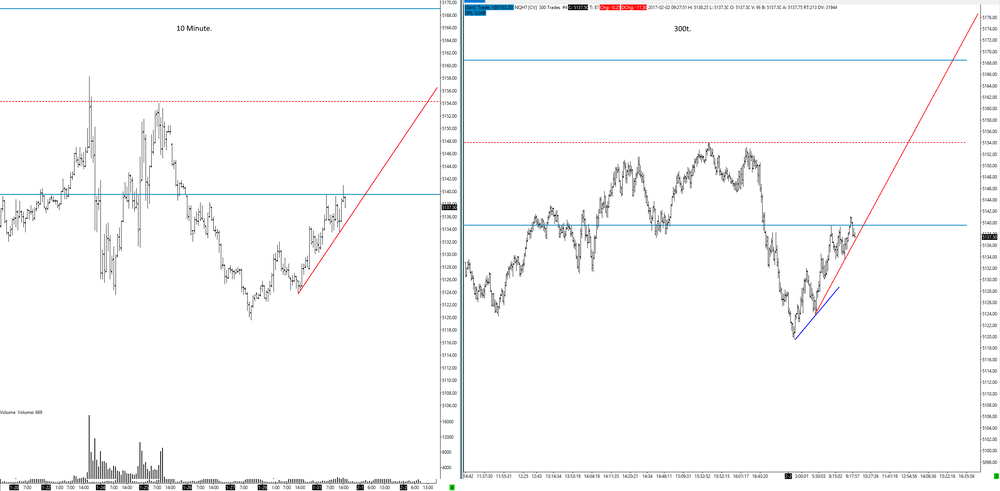

Trades and reasons for them are posted on the charts as it might be easier to illustrate what I was looking at on the charts.

Thoughts: A little frustrated at times as I am making mistakes, more precisely, I am floundering as the PA seems vague. I am placing a lot of emphasis on swing points and these don't really seem to hold up as well as I might expect, the market is pushing into new territory and these levels that I am looking at won't really be noticed by those that are driving price higher.

When a trade is taken one has to know who is on one's side, I don't want to bring feeling in it, but, price seems to be probing a lot, generally strong demand, but, a lot of deep pull backs on weak continuations from an intraday perspective.

I may have to put less emphasis on the intraday swing points, trade off of TO's from the hourly and perhaps be a little less discerning with trades via SLA i,e stop dismissing trades because they are at a level I am unsure about, the setup is the setup.

Second chart attached (300t) might paint a better picture than my words.

-

-

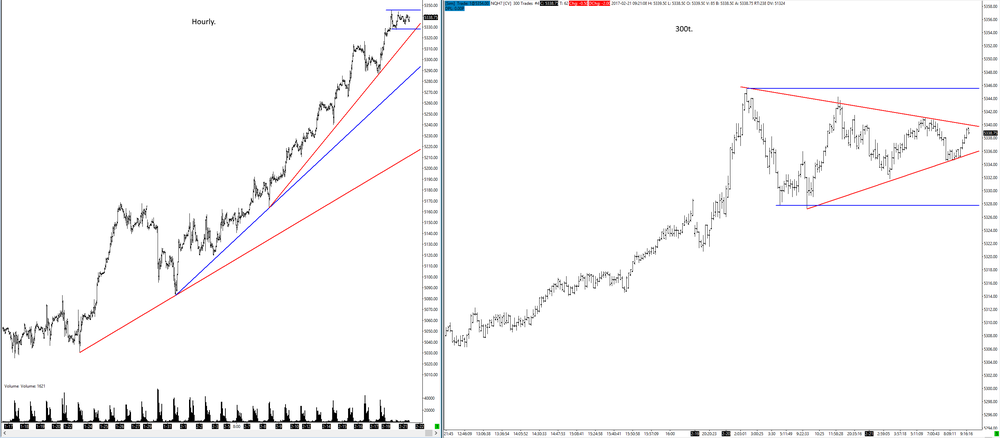

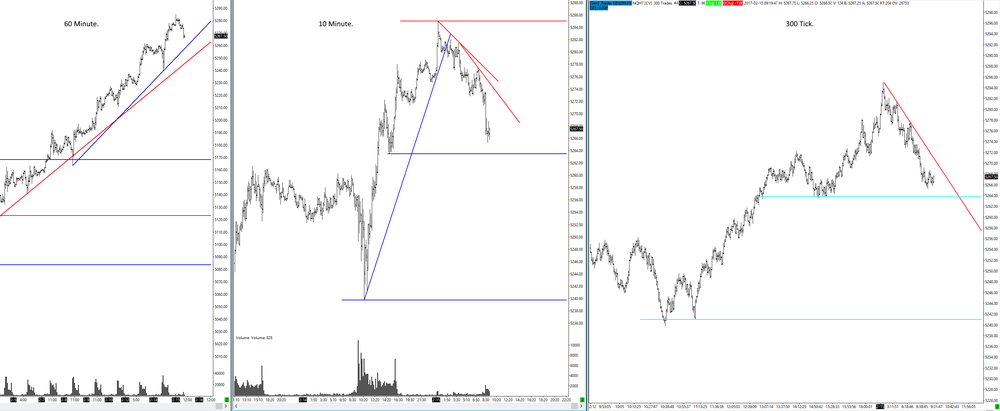

No trades for the previous prep and I was unavailable at open for the prep on the 17th.

Thoughts for trade on the 17th: Seemed to be a lot of hesitation around what I deemed to be an upper limit for price, once there was a little follow through it was just a case of managing per rules and exiting once the stride break ret appeared.

-

-

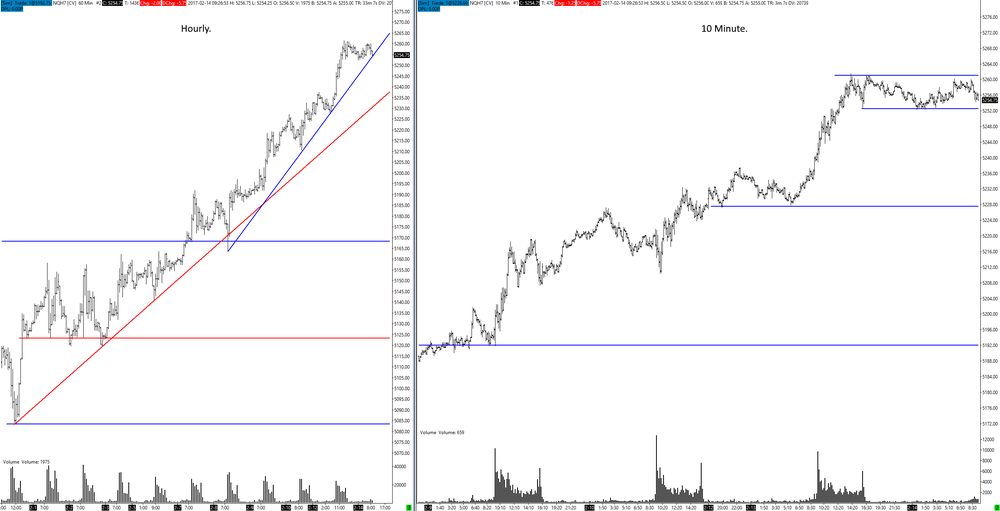

The opportunities are there for the taking, but, my "feeling" about the current PA is making me hesitant at times.

Trade 1: Long BO - 300t entry.

Price broke to new highs and the subsequent ret gave an entry a few minutes later. Price pushed higher before backing up and breaking the tightest DL, I held on through this break but exited as price broke back into the UL.

Thoughts: Standard trade that did not work out, more concerned by an earlier trade that I passed on as the SL break ret around open futzed around causing me to pull my order.

Shut down after exiting the trade.

-

-

-

-

-

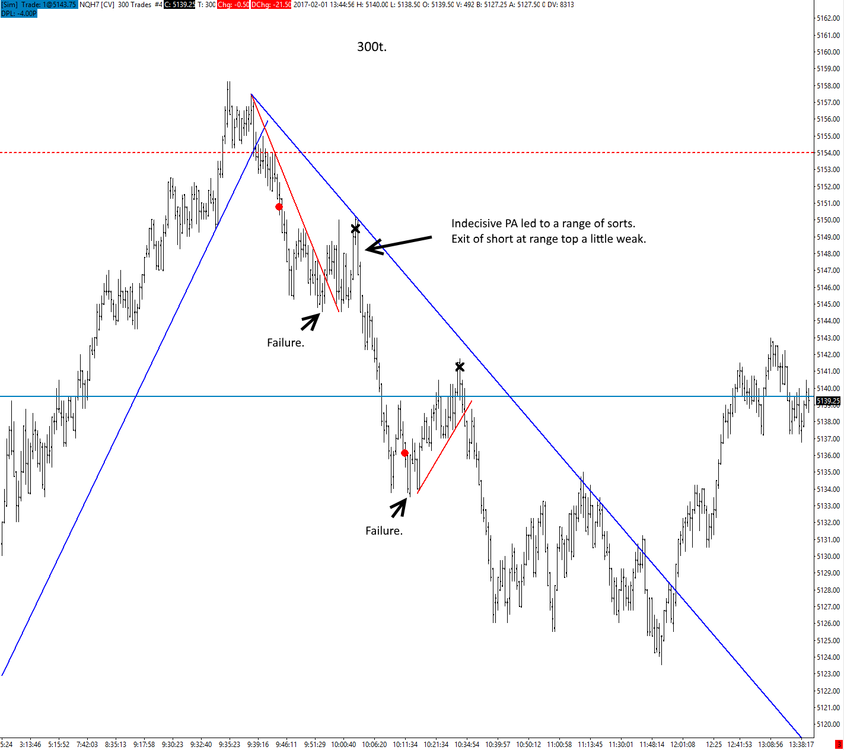

Only one trade for the day as the PA seemed to be lacking any direction by lunchtime.

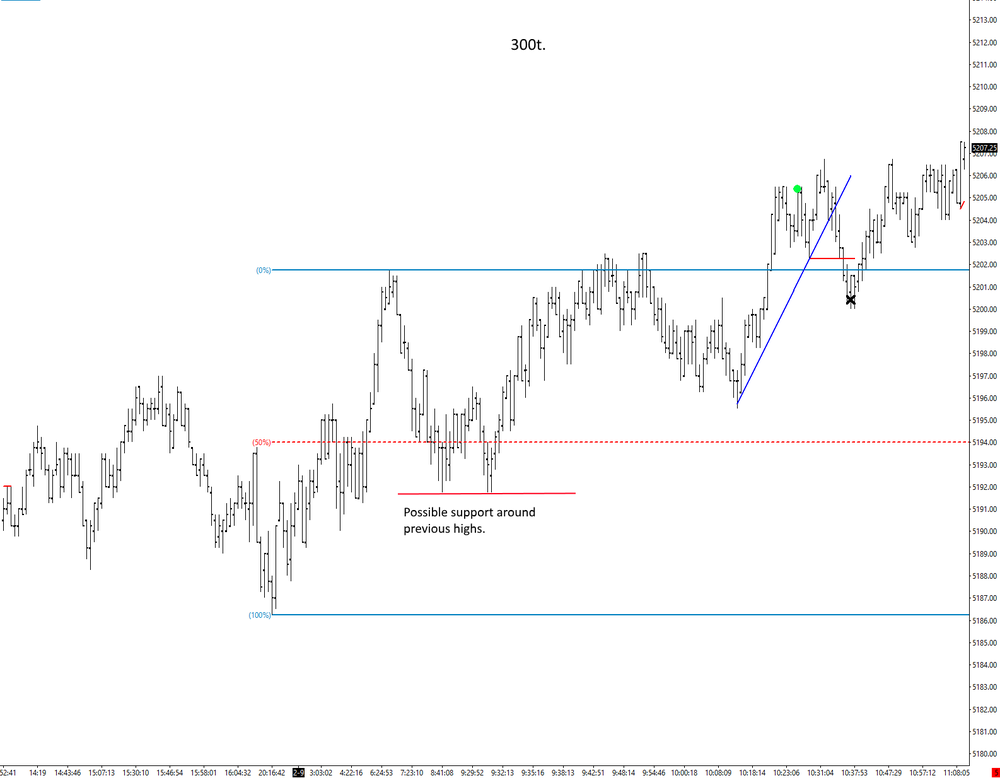

Trade 1: Long BO - 300t.

Working from the 300t posted in the prep there was a small range that I was keeping an eye on, price had opened near the mean of the range and had spent the opening hour waffling between this level and the UL before breaking out.

Whilst the UL was tested a couple of times there was no substantial break until 10:22, the subsequent ret triggered an entry long, there was a little follow through before price failed on a new push higher, the drop from here broke stride, swing low and re-entered the range invalidating the trade.

Thoughts: The first red flag was when price pulled back from the entry and then dogged higher, trade could have been scratched on the failure as this was not behaving as a breakout would be expected to.

-

-

Some issues that came up meant I missed the open.

Trade 1: Long SLA Reversal - 300t entry

Took a long on a ret after a stride break, whilst there was confirmation with a weak follow through price failed close to the previous days high and dropped off breaking the earlier swing low and triggering an exit.

Thoughts: Terrible trade, price had made a big departure from the SL earlier which meant the best entry was 30 minutes after open, I was aware of the previous days high but lacked patience as I was tilted prior to starting. There was a hinge that I was watching, and this was also the first ret after price broke back above the apex of the hinge.

Despite the upcoming DL is was poorly prepared and focused so I shut it down for the day.

-

Results for prep posted above.

Just prior to open the supply line was broken and price was in the process of retracing.

Trade 1: Long SLA reversal - 1m entry.

Took a long when the ret of the SL was confirmed, this was very close to the open and I was a little concerned about wicking, this concern meant I managed the trade very tight and exited when the ret swing low was breached.

Thoughts: Whilst entries at open can be riskier the trade in itself should be managed appropriately, the DP would have been placed around the lows prior to open at 5168. PA was not doing exactly what I wanted at open so I found a reason to get out for a smaller loss. A little whipsaw is to be expected at the open.

Trade 2: Long BO - 300t entry.

Failing to break lower than the pre-open lows, price quickly broke the opening high and retraced, this was a BO but I also looked at it as a later confirmation of the earlier stride break. Price rallied and broke stride a few times, these breaks were mostly weak (sideways break) which meant the DL was fanned a few times.

Price broke stride and created what was considered a DT at the time at 5185.25, there was no obvious reason for a change in direction so held off for a swing point/stride break, PA almost forced an exit, but, demand pushed price higher. Eventually there was a stride and swing point break which triggered an exit.

Thoughts: Not much to think about with this trade, considered a possible TP at 200 but price could not reach that level.

Trade 3: Short SLA Reversal - 1m entry.

Once the DL was broken one waited for the ret which confirmed, triggering the short. I was watching the earlier swing low at 5180.25 and saw price get a kick form that area before breaking stride, then there was a HL followed by a narrowly HH, price continued rising before the trade was exited on a swing point break.

Thoughts: Very poorly managed, the earlier swing low had stuck out as price had rallied strongly from this level, whilst the short was not a problem holding the trade when it choked on this level as long as I did is, I was clinging to metrics despite the evidence.

Trade 4: Long SLA Reversal - 1m entry.

SL was broken and there was a small ret, I hesitated and waited for another cleaner ret which triggered the long, despite breaking stride slightly after entry price continued higher. Price broke stride and the exit was taken.

Thoughts: It occurred to me watching the higher time frames (5min) that this was possibly a ret in a series of LH and LL (ret after 2nd leg down) so would have been a short lived trade anyway.

-

-

-

Price movement was limited for the last trading day of the week and after a couple of hours of not much happening I sat out.

Trade 1: Short UL rev - 1m entry.

At open price opened and reached for the UL before stalling and dropping back, price then spent the opening hour chopping about creating a hinge. Almost an hour into the session and price broke from hinge and headed for the UL breaking out by 4 points, plan was to wait for a ret and enter if price rallied again. PA dropped back into the range by enough of a margin to invalidate the BO and spiked to the UL a second time failing to break the upper limit.

Short was triggered and price followed through heading lower where it choked on the apex of the hinge, price chopped at this level for several minutes during which I tightened up the DP on the swing high. Price started heading higher meaning an exit was taken.

Thoughts: PA had spent the opening hour near the UL and was indecisive in direction. Though price was still in the range and a DP could be set via a BO rule the indecisive open, the hinge, and the failure on the test of the hinge lead me to see this whole area as chop.

I briefly considered a re-short on the second test of the UL but by this time I was not wanting to babysit a trade through what I suspected as chop through the lunch session. There is a chance this is an oversight as one never knows what will happen next but I don't have high expectations with that time of day.

-

-

Mixed day with sloppy prep or lack of attention made the work a little harder than it needed to be.

Trade 1: Short SLA rev - 1m entry.

Price broke stride at the former LL and fired in a quick ret on the 300t, this was right on the open so I waited for a ret on the 1 minute chart which came a few minutes later. Price pushed a little lower after triggering the short but was unable to follow through and reversed breaking stride where an exit was taken (300t).

Thoughts: I was aware that the price was getting into the PDL and ONL which was problematic for taking a short, but my prep was overly focused on the earlier range which price had been spending more of its time outwith.

Trade 2: Long SLA rev - 300t.

After reversing near the earlier mentioned lows and breaking the SL a ret occurred that led to a long being taken, at this point I was looking up to the previous highs from the last session. PA maintained stride and rallied for 10 minutes, price broke stride (red line) and retraced slightly before heading lower which triggered an exit.

Thoughts: Not much to think about from the entry, straight forward with the PA largely expected. This break in itself was not enough to trigger an exit which is why I held but looking at a potential exit and short one would track the ret to catch a further drop off, my problem is I tracked way to tight which triggered an exit.

I was influenced by the first trade loser and this trade having a nice profit so wanted to be ahead (P&L fixation) when trade closed out, if I had followed rule there would have been no exit.

No short was taken as a flip as I knew at the time a was slightly tilted.

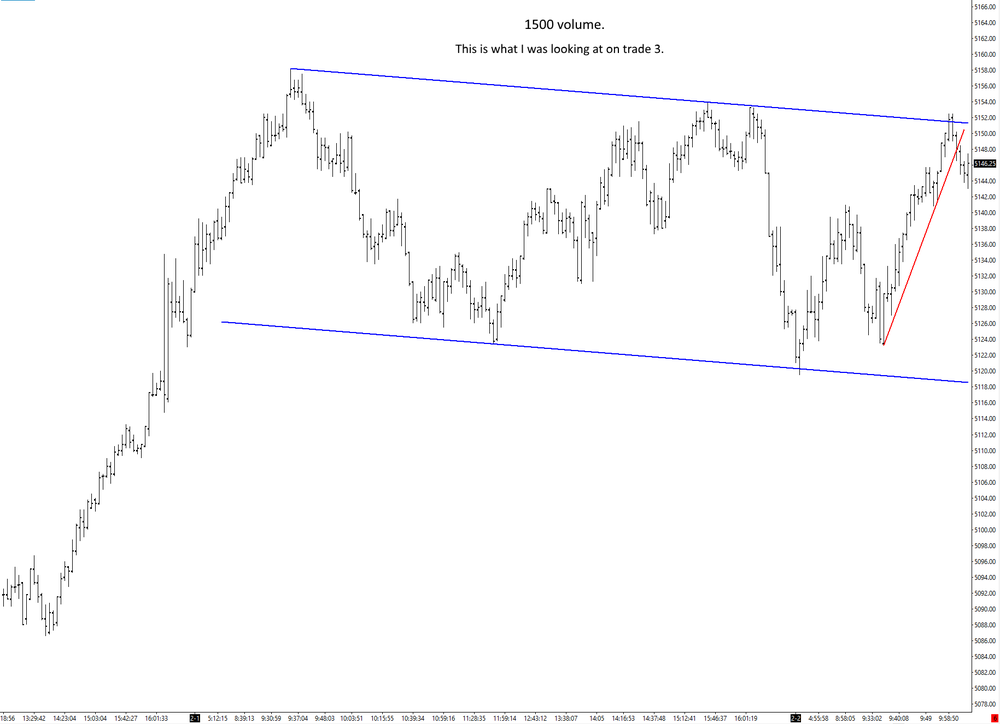

Trade 3: Short SLA rev - 300t.

Price had reached into the area of the previous days afternoon high and I saw what looked like a descending channel (1500v), there was a reversal off this UL and price broke stride and retraced leading to a short trigger. There was not much in the way of follow through before price turned up breaking the SL and triggering an exit.

Thoughts: A DP off the most recent swing high was a little wide for me, and I was chasing bunnies with the channel so opted to keep the trade on a tight leash.

After this trade failed I watched the small range this created before I saw the range that is posted on the charts now with a LL in the low 20's and a UL in the mid 50's.

Trade 4: Short UL rev - 300t.

Price had gotten close enough to the upper limit of the newly realised range to short any weakness. Price reached 5157.50 before dropping off and creating a LH which was a trigger. I sat the DP on a BO rule, PA did not initially seem to get far before backing up but each high was lower or equal to the last. Eventually price made a more substantial move and dropped to 5132.25 where it formed a another lower high, once this lower high was breached the trade was exited.

Thoughts: As price flopped around entry I briefly considered scratching the trade as I was impatient for the trade to get moving. I set a stop and got away from the desk, could still see the charts etc but the distance alleviated some of those concerns. Once price got moving it was just a case of tracking the swing highs and waiting for a break, unless it hit the LL of the range.

-

-

The prep turning point at the mean of the previous range held up but, the drop from this level was a little harder to manage.

Trade 1: Short SLA rev - 300t.

The 1 minute chart was a little flat in tracking the price behaviour so I opted to use the 300t in its place. Price pushed beyond the level from the prep by a small margin before dropping off again and breaking stride, the ret was a little sloppy and I hesitated a touch to place the entry.

PA dropped off and a SL was drawn, price retraced but stayed within the SL before making another low. This new low did not go far before price backed up again (dog/failure) I was working off the previous swing high so held through the stride break, price dropped again but failed to make a new low. I tightened up the stop and a smaller lower swing high and price rallied off the low and hit the stop.

Thoughts: Entry was sluggish and showed a lack of conviction, as price failed on the first push lower and backed up, the high from the lower low also failed at the first swing high after entry as did the exit high, price was indecisive at that moment in time. I may have been slightly influenced by a trade going back to BE (fear).

Price eventually went lower meaning a new SL could be drawn, I waited for a break of the previously mentioned range bottom and a trade would be entered on a ret.

Trade 2: Short BO ret - 300t

Entered on a retrace of the break out, price made a push lower but stalled out again before backing up, then there was another HSL and price drifted back to the range low. My danger point was above the swing high of the ret and on a range re-entry stop which were the same. Price continued drifting higher before eventually it met the criteria for an exit.

Thoughts: Having seen the way the first trade PB had played out I was aware that this might be doing the same thing, I considered moving to a stride break, but, how far do I let it slide before I act. The little DL drawn was broken and there was a ret, but I saw this as being within the chop and passed.

Stuck to the rules in terms of management was a little sluggish on the entries, after trade two I sat out as I "felt" that I was not seeing the picture.

-

-

A little late but yesterdays activity including the prep.

Prep: Price was still lingering around the hourly DL as open approached, the previous days afternoon support and overnight low had just been broken in the minutes leading to the opening bell.

At open price was chewing over the overnight low not really making a clean break of it, eventually PA headed lower, but, as price was still hanging yesterdays chop I opted to wait for price to reach the previous days low and see what happen there.

Price broke lower and I considered an entry short but PA retraced too far, a higher low formed and price rallied back to the BO level. After a couple of attempts to go higher price moved back towards the daily low where it stopped a few ticks short. I saw this as a potential range that was wide enough to play.

Trade 1: Long, range reversal - 1 Minute.

Seeing a hesitation at the possible LL of a range an order was trailed that was triggered as price rallied, there was still a little hesitation in the PA as it made weak continuations and deep rets (relative to the upmoves). I was aware the the hourly DL had been broken and the most recent high may have been a ret of that break.

As price was hesitating and not acting like it had found an extreme I opted to scratch the trade, I hesitated as there was no specific metric for the action, the behaviour that I would expect to see given the reason for entry just was not there.

Thoughts: Given that price did drop off in the short term it looks like a smart decision, but if price had rallied to the UL without breaking an exit rule it would have looked very different. I have an expectation to see certain behaviours depending on the context behind the trade and this was not acting right and also PA was in conflict with the hourly DL break.

For a rev trade the entry was a little sluggish but I was ok on this with the slightly wider stop.

-

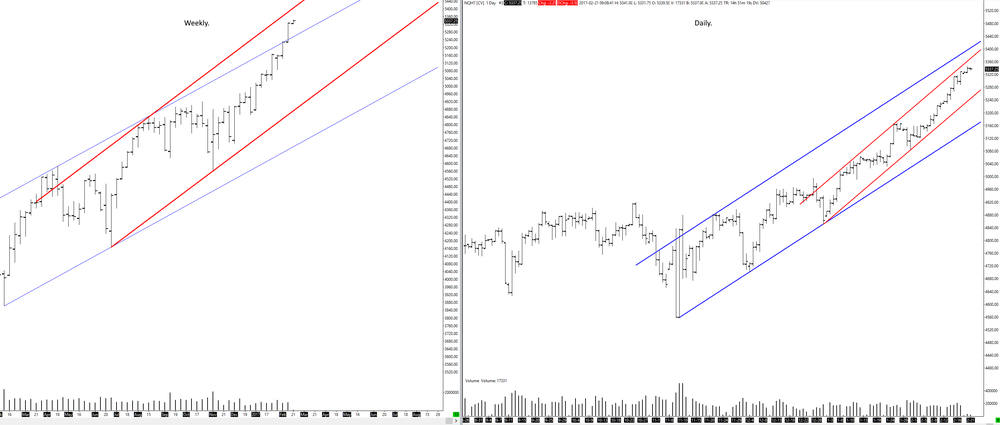

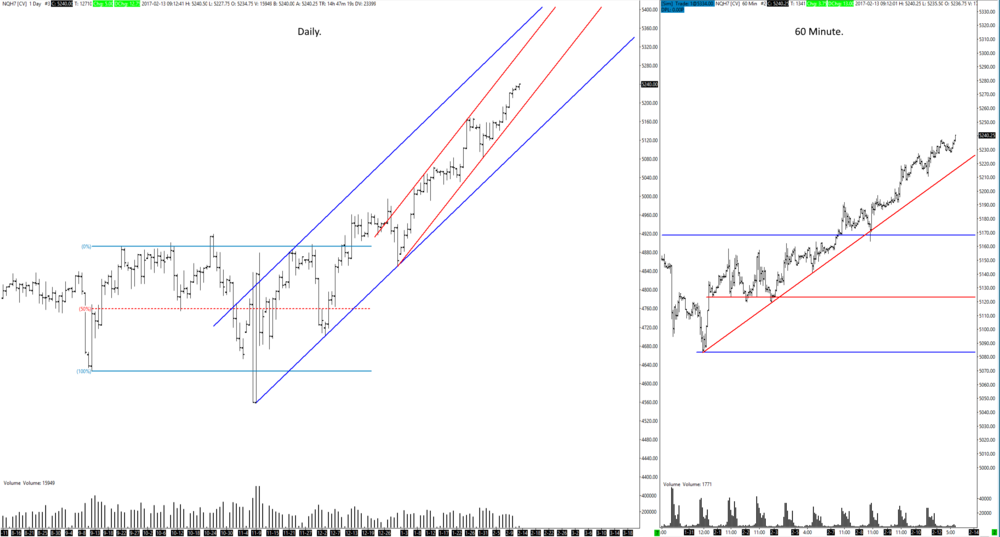

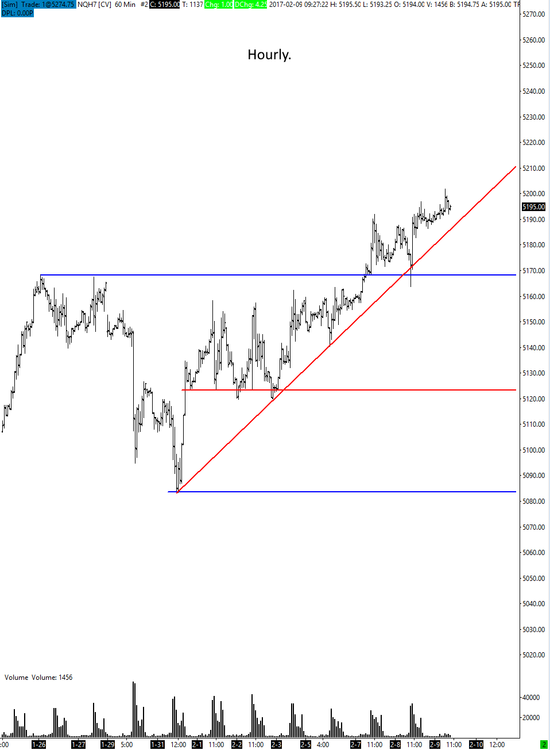

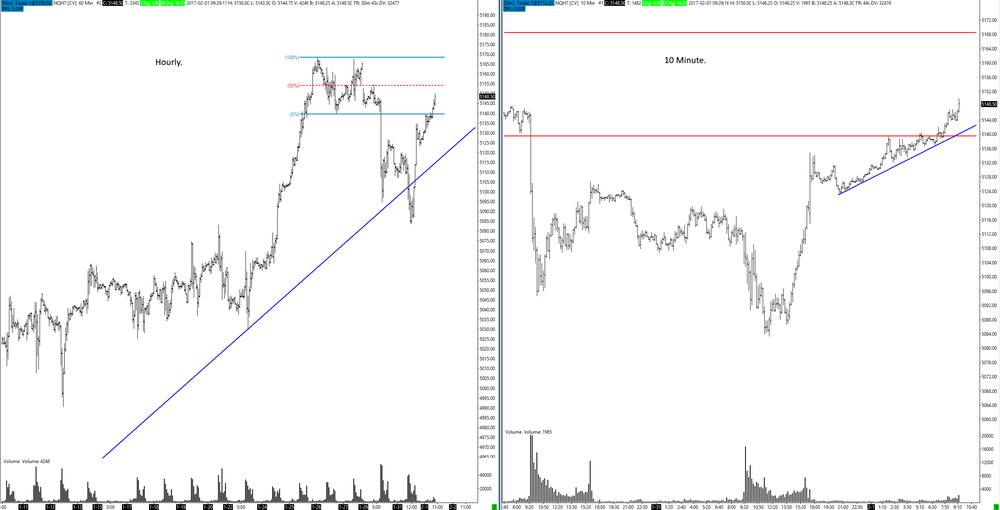

After a long break I am looking to pick up from where I left off, despite the time I have been studying since the start of the year I felt a little rusty when it came to tracking the PA and I think it shows a little. This is just sim trading live markets for the time being until I see that I can do what I'm supposed to do consistently.

With the excuses out of the way, I'll go through my thought process as the day unfolded.

I did not post anything lower than a 60 minute chart for the prep as I thought it was reasonably straight forward, trade any reversals off the extremes or wait for a breakout and trade the ret. I used different intervals which may get a little confusing, sorry.

Trade 1: Short BO ret - 300t entry.

Price broke the lower limit of the hourly range within a couple of minutes of open, the 300 tick chart showed a cleaner retrace so I used that to track an entry short. Short was triggered and trade quickly moved to profit, there were a few minor stride breaks but as I was managing on the 1m chart I was waiting for a second ret and it turned out to be relatively flat, SL was fanned as price moved lower.

After reaching a low at 5107.25 price retraced and made a more significant break of stride eventually triggering an exit.

Thoughts: Entry was straight forward, management was overly tight, there was no obvious reason to exit besides the stride break. During prep and as the trade unfolded the first bump in the road that stuck out was a confluence of the round number (100) the hourly DL and the 50% Lo-Hi. I debated leaving the exit for the swing point at 5119.50 (09:46 candle) but did not want to give back the additional 4 points (Greed).

Trade 2: Long SLA Rev - 1m entry.

After the break of stride price dropped off but failed to make a new low and started to rally triggering a long. Price immediately dropped as it ran into a slow SL (300t-1500v) trade was exited as price broke lower.

Thoughts: I was aware of the SL but was trading off the 1 minute chart, knowing the headwind the trade should have been scratched sooner when it failed so quickly.

Trade 3: Short BO Ret - 1m entry.

Price broke lower and retraced back above the swing low but the margin was minimal and the ret was traded as a BO, PA followed through and pushed lower, then there was a ret but it was within the SL so no problem. Price then pushes a point lower and backs up just as quick, price waffles for a couple of minutes breaking stride before breaking the previous swing point triggering an exit.

Thoughts: Whilst I took the trade I was a little resistant as price was getting into the previously mentioned speed bump. Exit was on a rule break but the red flag went off on the 5094.50 low (10:19) price made a weak push (DOG) before backing up fast, given the context I saw this as the point to scratch the trade and look for a long, but, I decided to back off and leave it for the stride/swing point break.

Trade 4: Long SLA Rev - 1500v.

Backed out onto a slower interval and waited for a higher low to form, which one eventually did when price rallied to trigger my long order, price failed to follow through and I scratched the trade.

Thoughts: Immediately frustrated on entry as I saw price was balancing equally around 100 and I was in the middle of it. My entry was likely too tight given the interval I was entering from. I considered holding for a DP off the daily low but opted to scratch as I was frustrated and losing focus.

Testing Times.

in The Wyckoff Forum

Posted

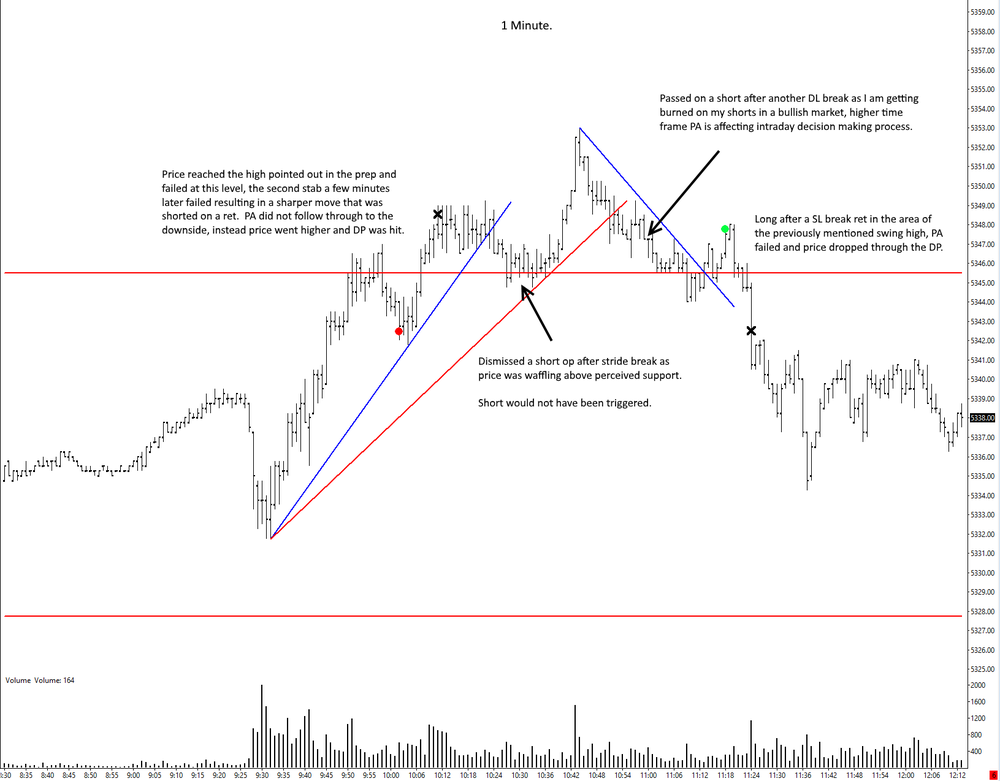

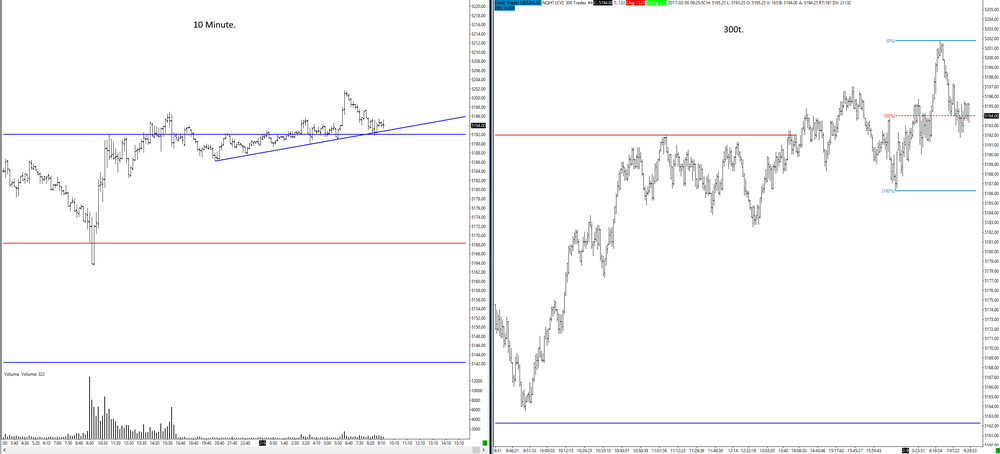

Still finding myself a little resistant to acting upon new information as PA points towards a change in direction. Trade 1 was an example of being overly attached to an idea and giving it more room than I should have, notes on chart.

Not much thoughts on the day, price spent the day inside the previous days range, after trade 2 I stopped as it was getting into a time of day where we would likely see price continue to meander.