Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

Gamera

-

Content Count

606 -

Joined

-

Last visited

Posts posted by Gamera

-

-

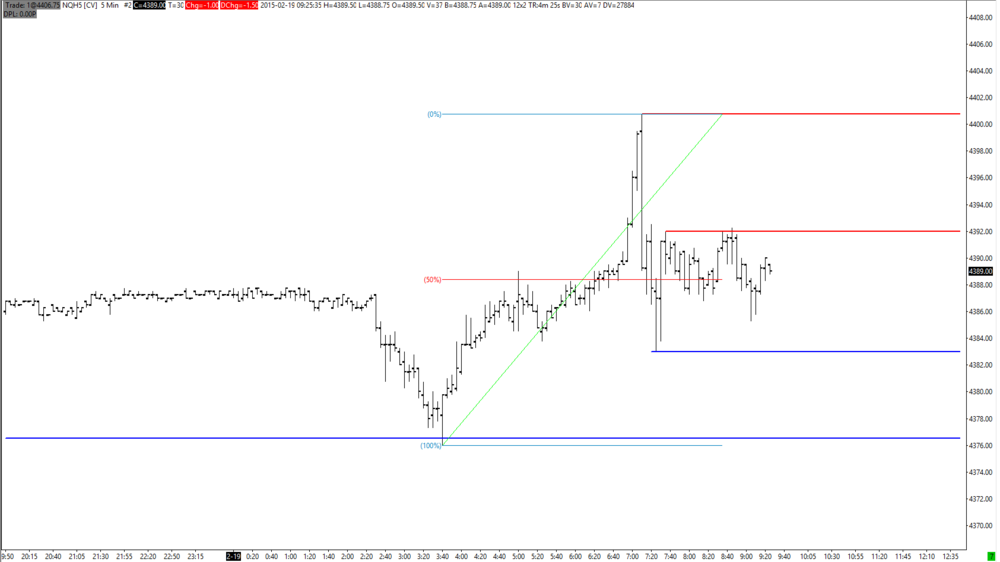

Pre market post. 76.5 still in play shorter term range might be more prevalent 83-92.

09:31 Price at PM high and testing, there is ON highs at 4401 above if this breaks higher.

09:33 Second test of 92.

09:37 price has gotten hung up at 88 on the downside, yesterday it struggled to get above this area, will have to watch if it has much influence today.

09:38 Breaking higher but the right tick keeps getting knocked back.

09:40 No drop off in price, it returns and breaks higher.

09:42 Pull back to resistance now support price will it retest and take off or drop down?

09:44 Ret not confirmed yet.

09:46 Ret confirmed.

09:49 Price grinding higher, guess a long on the retest at 92 with a 1 point or so stop would have been a good play. in hindsight of course.

09:51 As DB points out big round numbers can get a bit of attention.

09:56 Might expect to see more rets and overlap as we approach 00-01.

09:58 BO that seems to have failed, do we get follow through or failure.

09:59 Im triggered short.

10:01 LH and drop off.

10:02 92 first hurdle.

10:06 its a no go, stop out -1.75

10:07 Price breaks higher, SLA takes over.

10:10 Price seems to have broken out, again, and is putting in a ret.

10:18 Ret was confirmed price on a grind.

I lost sight of the bigger picture on that short, price rejected move upwards of the ONH so I saw it as an opportunity to short with price coming back into range.

10:21 We had a second breakout followed by a ret, a DL could be drawn in now to track the move.

10:27 I am hesitant to get long as we get further from the best entry, each entry onwards gets riskier, I think.

10:32 If my DL is right it has been broken.

10:34 After the last swing low price failed to get higher, this could be an upcoming short on further breakdown.

10:39 Price pushes higher, DL fanned.

10:43 DB, does your DL start at 09:35 lows?

10:45 DL breaking again.

10:47 Previous swing low (10:41) broken

10:55 unfortunately something has come up, no idea how long I will be.

12:10 Back, price has not progressed much since I left but there have been a few things of note.

12:21 Price seems to be in a drift lower.

12:31 Still drifting lower making successive LH's and LL's

12:36 Price makes an out of the norm drop and heads for the 00's again, will this be another retest or breakdown.

12:40 Ret or Rev?

12:45 2 bar pull back then a push higher suggests this is a Rev confirmed see if it follows through.

12:59 Have been thinking about the day so far and my last trade, PM we had a very clear area at 92 that price could not get beyond, also the ONH at 4401, price after a couple of tests broke 92 and retested from above. Now this is the point I should have taken the entry long, I even identified it at the time but for some reason I failed to act, (I am suspicious of the opening moves) this is a breakout of the PM range and the part that I am unsure about now is should SLA have taken over at this point or should AMT been in play until 4401.

How much credit does one give the ONH once the PM range is broken, my trade was taken on an AMT basis and the initial drop seemed to validate this, but I see now that if SLA was in use we got a break of the DL but there was no LH besides a 1 bar ret once price got back to highs.

I'm pretty sure if we were in clear air and long I would have endured a PB as a deeper retrace.

13:44 Still drifting.

14:08 Price drift to new highs.

14:15 Not much in the way of drop off from highs yet.

14:21 Now that price is dropping off could we assume that 4414 is important as price has been turned back a second time from this level.

15:04 Price heading back to 14 will we see a concerted effort to push higher or will this level hold.

15:07 BO

15:09 Long on the BO. DL from most recent lows.

15:11 Price not following through yet, pulled back to test level, still holding.

15:13 Ret still unconfirmed, is price behaving like a BO? not yet.

15:21 Trade exited -2.25 no follow through which I would have expected from a BO and price drifting back under 14 was enough for me on this one.

15:23 Also to add there was a DL break and LH.

Calling it a day, a little frustrated with my miss on the 92 trade but I'll get over it.. I hope.

Gamera.

-

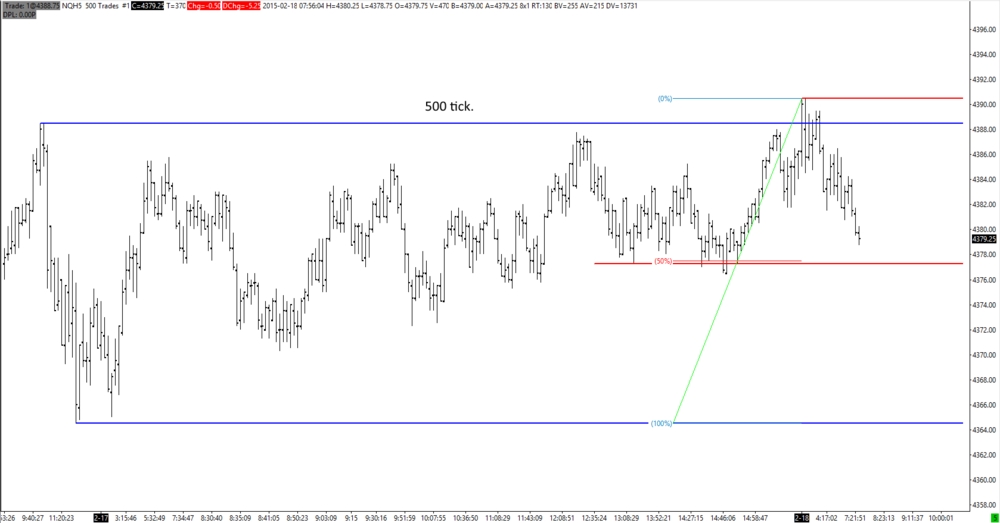

Half an hour until open, posting a chart covering PA and what looks like being areas of importance. Using a 500 tick to squeeze the picture a little, there are a lot of HL's from the low to mid 70's to think about, range bottom at 65 range top 88-90.

09:29 Price has DB'd off the 50% of range and off of an area that supported price yesterday.

09:33 Price halted halfway from ON high to low.

Not much to do until price gets to upper or lower extreme.

09:38 Price dropped off opening rally and made a deep pull back to lows but it made a higher low, ret confirmed.

09:40 Price running up quick.

09:42 Ret underway, I'll be watching this closely.

09:48 look like the ret might be a rev.

09:50 Not following through to the downside yet.

09:53 Price is trying to push lower but not making much progress, reminiscent of yesterdays action at 71.

09:57 84 has stuck for the last 10 minutes, price now breaking higher.

10:01 Price failed to follow through to the upside, LH followed by an LL.

10:05 Price still unable to make much progress to the downside.

10:07 Price equals previous high and gets rejected almost instantly. see if it tries again without dropping.

10:10 Price did not drop off too far and it took another stab getting a tick higher this time but it was rejected again.

10:11 Now we get follow through to the downside.

10:12 85-86 seems important.

10:13 LL.

10:14 Looks like a small downward channel has formed with the LL's and LH's, just a thought.

10:16 Price breaking towards range mean.

10:17 Possible DB.

10:21 Secondary reaction at lows?

10:23 Long triggered and exited on breakdown -2.5

10:25 Breakdown retracing to support levels at 76.5

10:28 Price re-entered range but looks to be dropping out.

10:32 Price has rallied back into the range, will be interesting to see if it can make it's way as far as 85-86 and how it will react there.

10:36 Price returning to to the range (76.5-88) would have merited a long as per AMT

10:39 Ret confirmed, now to see if 85 will get surpassed.

10:40 A rapid move up into range highs from the lows, price being held at earlier highs.

10:44 From an intraday perspective 85-86 is acting like a range top with the lows in the mid 70's?

10:45 Ret or rev?

10:48 Rev it is,

10:52 No follow through to the downside price breaks higher, rejected quick at 86.5.

10:52 Price currently in a sideways motion, testing down and up. About 4 points in it.

11:05 Price breaks lower, as DBpheonix suggested if buyers were interested price would not procrastinate like it is, buyers are not coming in behind the up thrusts to 86 to help propel prices higher.

11:18 Price is drifting lower.

11:26 Regarding my earlier stop out, I was about a point worse off on entry than I should have been, the second test was a higher low so I had that going for me, price broke support and at the time I do not know if this is a breakdown or a shakeout. Having read a little more of Wyckoff I think he wrote about price being in an obvious place where strong hands would be interested, but in order to load up for the mark up they would drop the price a little to shake out the weak hands that were reliant on support maintaining.

11:33 I forgot to add, I am not sure if "strong hands" would be that concerned with the happenings on a 1 minute chart, just a thought though.

11:38 While price rallied from the drift it got as far as 85 before dropping back a little, we'll see if price can move higher.

11:42 DT at 85 and subsequent drop.

12:07 I have a commitment to attend so I will be gone for an hour.

13:11 I see we have had another test of 76, price seems to have not done anything with this so far.

14:02 FOMC price rallies into 88 ret underway.

14:05 Possible second reaction?

14:09 Ret confirmed price breaks higher but is stopped at 89.

14:14 Price is putting in another ret, I would be interested to see if this ret fails making a lower high.

14:18 LH has formed.

14:19 Previous swing low taken out.

14:23 Price on a drop 76 is first hurdle.

14:29 Price has blown past 76 but seems to be rejecting this move lower.

14:33 Long triggered.

14:34 Price formed an HL at support.

14:37 Ret or Rev?

14:38 14:36 low is a little quick to be moving my stop, until price pushes higher I will track on the 76.5 low.

14:42 82 is the high-low MP.

14:44 Feels like a grind but it is behaving as traded.

14:45 Will still be keeping an eye on 86 though despite the previous high.

14:47 Old habits trying to kick in on this ret.

Thanks DB.

14:51 Price testing MP from above.

14:55 83.75 seems like a roadblock.

14:57 Trade exited. +3.75.

14:58 LH followed by a LL, I gave it time but it stopped me out.

15:01 Now we hit highs, where was this rally 5 minutes ago, joking aside I stand by my action, it is a reflection of my application of knowledge, skill and psychology at this moment of time.

15:04 Rallied hard into limit and stopped, DT?

15:07 BO to ATH.

15:09 We had a 1 bar pullback then a break higher.

15:10 Another RET, ideally I would like to see it come back a little closer to the BO level.

15:14 Highs being tested as resistance, either we go up or fall back into the range.

15:17 Long triggered, will have to see if it follows through to the upside.

15:19 A note of caution price has created a lower high... broken as I type.

15:22 This latest high has halted 2 ticks shy of ATH 15 minutes earlier, I think I am too focused on the little things now.

15:26 No real follow through to the upside yet, if this is a BO where are those buyers at?

15:33 Long exited as price is not behaving like a BO should.

15:35 A DL drawn from BO was broken we had a pull back that was halted at the BO the retrace from this low was confirmed when price re-entered the earlier range. AMT takes over again. I am on A self imposed cool down from last trade.

I am done for the day 3 trades 2 losers 1 winner for BE.

15:46 it is interesting to sit back and watch it unfold without concerning oneself with entries and stops.

Gamera.

-

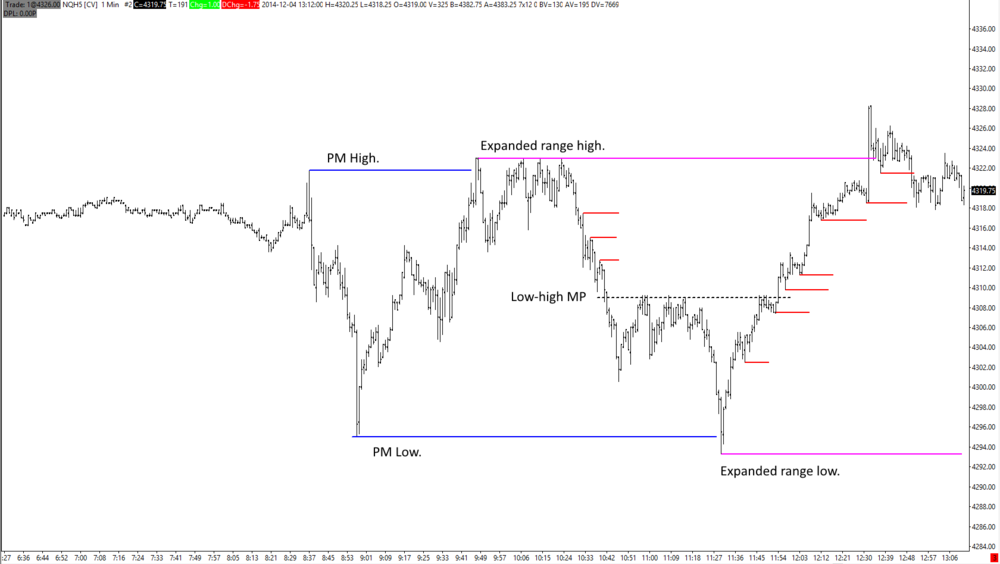

I was reviewing some of my charts and thought I would post an example of SLA and one of AMT covering the same day, I struggle real time when to differentiate one from the other as some days are less clear than others (like yesterday) I also have a tendency to scalp but I see the value in holding on and allowing AMT to work.

The charts are from the 4th of December and are used as they have reasonably clean PA.

SLA: I wont cover exits on the chart and some of my entries might be off the mark this is just my perspective and opinion and reflects my knowledge at this point, suffice to say a lot of trades are triggered around the mean.

AMT: PM high-low marked off, price opens at mean so it is just a case of waiting to see what it does, price breaks a little higher expanding the range, price is unable to push beyond 23 so a short would be initiated, have to sit tight on it as a tested a number of times.

Price drops in a climactic fashion through the mean stops and puts in a second test this push lower fails and as it creeps higher I might have exited, however we are close to the low-high MP and price fails here so if one was out at this point a short could be re-entered, price tags expanded range low (crystal ball) and there is not much to think about as price rallies to highs again.

30 points down 30 points up I don't think the SLA would have netted close to that.

Just so I am clear I was not paying attention to the range and approached this with an SLA mindset and gained an impressive 11 ticks for all my efforts. Could I have made it easier on myself? without a doubt yes.

Gamera.

-

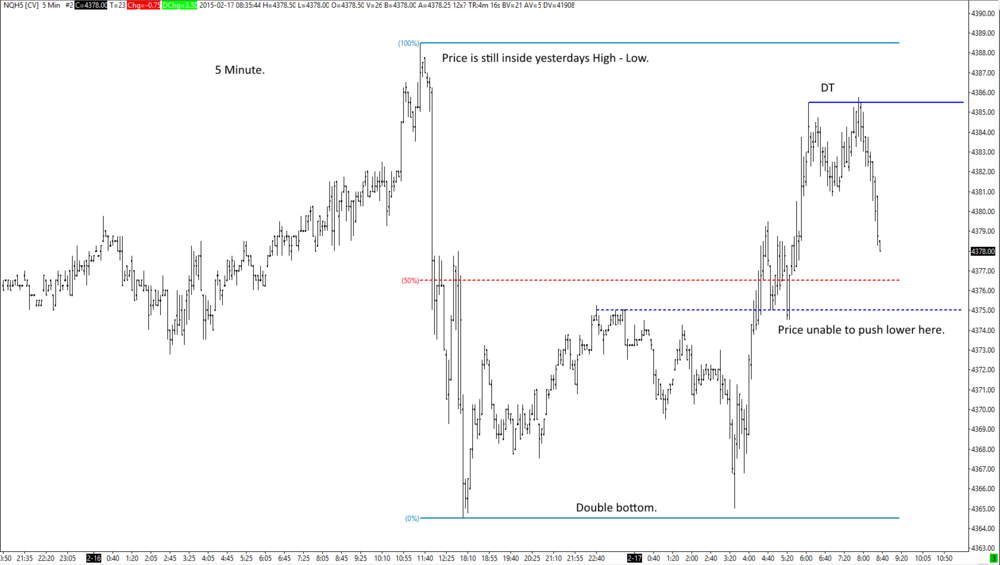

I'll edit post as we go along as not to stretch the thread too much. I might wonder into the weeds a little.

09:39 Price broke lower, halted at 72, this low to the mean is equidistant from previous days high, possible second reaction at 72 underway.

09:55 price chokes on pm range low at 77. ret underway.

09:56 ret confirmed, looking up towards range mean, high and previous days high.

09:59 Another ret a little deeper this time dropping out of the range, caution.

10:00 Confirmed, I might be a little too focused on the smaller picture but price to the upside is slowing.

10:05 After price drops to 75 (pre market s/r) it took off to 83 level highlighted in an earlier post.

10:11 Price took a second shot at 83 failed, the low has not been broken so the rev is not confirmed either.

10:16 Third shot at 83 failed.

10:22 price seems stuck for the last 6 or so minutes trading in a 3 point range?

10:23 PM range low at 77 tagged, now moving slowly towards upper extreme at 83, as Dbpheonix has already pointed out 86 and 88 are beyond this level.

Just so I am clear, I have not taken any trades yet, the 6 point PM range is a little tight for me to play, whilst the action at 72-71 was interesting and might have gotten me involved to the long side, I would have been more interested if it was nearer the previous days low/ON double bottom.

10:34 Price has again tagged 83, but it seems to be hanging around this time.

10:42 If one was inclined a DL could be drawn from the lows.

10:43 BO hesitates, is this how a BO should behave? I think not, but it is close to ON highs.

10:46 We have a drop off from 85.25 which is a tick shy of a predefined area (wider PM range my charts) 2 bar drop with a 1 bar ret.

10:52 I was going to say in my last update that I would like to have seen a deeper ret before considering an open. (a weakness of mine)

10:53 Dump off and so far we have had slight choke where we might have expected one, where will the drop end?

10:55 We get to 72, an area from earlier, will we get a secondary reaction.

10:59 Looking interesting.

11:03 We had a push higher beyond the previous swing high, price has so far failed to follow through BUT the 4374.5 lows are still intact.... barely.

11:06 We break lower, still the low at 10:55 is intact, this behaviour is happening around an area identified PM at 75. If we move to the downside we have 71 as the most immediate area and to a larger extent 65 (double bottom)

11:13 A little hindsighty, this looks like a DB, BUT the drop and then price waffling for 20 minutes is putting me off, the drop, I would have thought would have resulted in a quick and decisive action, from the looks of it I am not seeing that.

11:21 Then again I might be opening my mouth too soon, I guess these are old thinking habits affecting my thought process.

11:24 Possible range at low 70's on the lower end and 85 to the upside?

11:29 Price appears to be struggling at the mean of the PM range. wait and see if this is a ret.

11:31 Ret confirmed, but as I look, price is dropping off, more overlap and rets in this immediate area.

11:37 Price broke a tick lower and rejected it, price seems to be churning the PM range mean.

11:45 Price is breaking lower and fell out of the range but it has returned as a type.

Hinge? previous days high, 07:55 and 10:42 highs and last nights DB 03:30 to 09:50 lows??

11:56 If this is a hinge price is dithering at the mean.

There was/is a smaller hinge from the last test at 85 and the last low at 72 if that is the case price has broken to the upside and is currently in a ret towards the apex.

12:16 Price has dropped through the apex of the smaller hinge, the test to the downside is roughly the same as the move out to the upside. (as I write this)

12:28 Price appears to be dropping and is close to 75 again, but it is slow, below that there is the previous swing lows at 72-73 and this will coincide with the larger hinge low.

12:32 Where did this rally come from? four bar DB at 75.25?

12:40 Spike is halted, ret failed to confirm, price breaks lower. I might add this move is happening around the apex of a smaller hinge.

12:55 Price failing to do much, as I write price is testing the lower line of altered hinge.

12:58 Price is hugging the DL of the hinge.

13:02 We have moved off the DL of the hinge, the SL is at around 81 but this is descending all the time just a question of how long it takes to get there, if it gets there.

13;04 So much for that line of thinking, hinge possibly blown, 85-86 on the cards, also an HTF hinge SL from previous days high coming in at just under 85.

13:09 Ret either we continue or reverse back to mid-low 70's.

13:12 If price were to break higher it has a couple of hurdles close by that might limit or hinder an upwards move.

13:14 Possible DT into resistance.

13:20 Price breaks higher to 86.75 but rejects just as quick, no BO yet.

13:22 Price has not really dropped off that much yet, and is as I type making another run at it.

13:24 88 tagged 2 ticks short of ATH.

Considering an action if price pushes higher here.

13:33 Price is dithering at highs.

13:36 The inability of price to push higher at a known value at 88 was a possible entry (hindsight) price has dropped off and is currently putting in a ret, the possible range is in the mid to low 70's from an intraday perspective.

13:41 Ret confirmed.

As a side not, I considered a short, this short would have been triggered as price confirmed the ret with a stop just above the previous swing high, as it stands price would have tested me but the trade would be holding.

13:51 Price seems to be going in a 3 point sideways range, the inability of price to push lower would have had me alert if I was short at the time.

14:03 Price has dropped and gotten a bump at the apex of the hinge, previous swing high at 82.

14:09 Price broke the previous swing high at 82 by 2 ticks and it was rejected immediately, up to this point price is reacting to the apex of the hinge.

LOLR is still down a the present time.

14:22 Would like to see this area get cleared, price seems to be hanging around the apex.

14:24 Possible hinge formation, extending the earlier hinge DL puts this most recent low into play, a descending line from the highs at 88 gives an upper line. It has not been filled in too much so it might mean nothing.

14:36 TBH if I had taken a short in the correct place the behaviour over the last 10 minutes would have seen me bail.

14:54 After a couple of HL's and HH's price has again dropped off to the apex of the earlier hinge at 78.

15:11 Price is unable to push past the apex at 48, not sure if the apex is relevant now, or if the focus should just be on the inability of price to make its way lower after multiple attempts at this level.

15:12 Just noticed price is roughly trading inside the PM range, 77-83 over the last few highs and lows.

15:34 After tagging the highs from the PM top 85, price dropped off to 77, will we get a breakdown in the last half hour or could price rally back to highs?

15:49 Price breaking lower, will it follow through?

15:56 No follow through. yet.

16:00 After failing to break lower price rallies into the close.

An interesting day with a few good opportunities but a lot of twists and turns away from the extremes.

16:10 DT with secondary reaction.

Tomorrow is another day.

Gamera

Six people were here, two of whom were late and have left (we weren't exciting enough, I guess), and another has left. But that's trading intraday.

-

0933: Looks like the ES is going to be a drag again as the NQ nears a penultimate ATH

1117: Even though the markets are closed, I thought there might be some futures activity in the NQ given that we are so near a penultimate ATH. And price broke through the upper limit of the range at 1053. While it's unlikely that this will go anywhere, it's good to know.

1145: DT and a break of the DL

1236: While I don't want to insult anybody, how could one NOT know how to trade this given the range that I posted above? Buy the break up through the upper limit, sell the break back down through the upper limit. If one didn't, he needs to think about WHY he didn't.

1253: While this is tons of fun, I see no point in doing it if nobody's watching it.

Signing off.

End of Market

I shut down after the first hour thinking the holiday would mean a lacklustre day, not the first time I've been wrong and wont be the last.

There is still an hour before open so I might be getting ahead of myself here but this is what I am looking at so far.

Trading the SLA/AMT Intraday

in The Wyckoff Forum

Posted · Edited by Gamera

No chart for now, for me areas not as clear as they have been. on the downside a possible test of 00's and the recent PM low at 4406 on the upside 4413 and the ONH at 4425.

09:34 Seem to have been disconnected a few times, hope that it is dealt with now.

09:37 Price did push above 13 but with one test prior to open not sure how much credit to give it.

09:38 Price breached PM lows but seems to be rejecting this.

09:39 Price rallied to the mean of this PM range and dropped out 00-01 on the cards next.

09:41 Price back under 00, possible move to mid 80's or 76 if it fails to reject.

09:44 MP of this drop is at 04.

09:45 Price pulled back above 00 and put in a ret testing it.

09:46 This is still a ret in the drop though.

09:47 This is where my thinking might go off, we have a rapid drop into an area of possible support, we break and retrace back above, now price is making a second go at it. Short if it breaks lower long if it breaks higher.

09:51 Short triggered.

09:53 DB price breaks higher.

09:54 premature entry cost me on that one.

09:59 price seems to be ranging on 00 4 up 4 down.

10:05 Low, HH, HL prices seems to stick at 96 on the downside, and we have just made a new high.

10:08 06 was the PM low, price seems to be shying away from it again, my thoughts right now are that price is pushing higher but not making much progress and the rets are deep.

10:13 Price pushes PM low but pulls back slightly.

10:14 Testing that PM range again, if it can stick in 13 would be up next.

10:19 Sit tight and let it play out.

10:22 If a DL was in use here it would be broken. price seems to be choking on the mean of this range.

10:23 Ret confirmed.

10:24 Another ret.

10:29 Struggling to the upside now.

10:30 Price breaks lower.

10:33 Retrace back into range.

10:34 Just noticed 4405 is the open high-low mean.

10:35 Watching price once it gets 13-14 and 96 on the downside.

10:40 so much for that idea.

10:41 ONH up next.

10:41 This is a BO pull back.

10:46 We got a BO and a pullback now confirmed.

10:49 Another ret, stride is getting knocked. Greece?

10:52 Looking more like a rev, I would have to say I am struggling to make out what is going on right now.

10:59 Possible hinge.

11:01 DT in the making.

11:02 Could be right Fourtiwinks.

11:06 If this is a range it is a little tight for me to play 20.5 high - 15 low.

11:22 Price is trickling lower, no urgency in this move at all.

11:30 price still meandering, testing these most recent lows after an LH.

11:47 Tested 4413 seems to be holding up.

12:00 13 tested again and holds.

12:21 13 on the downside is acting as support and it looks like 20.5 is at the upper edge.

12:35 Eh, news somewhere I take it.

12:37 Price reacted to something and broke higher, this was quickly rejected.

12:41 Price came back to pre spike levels and has taken off again to the upside.

12:43 Price makes an HH and rejects retrace lower and trying to form an HL.

12:47 Deep rets and weak moves to the upside seems to lack strength, but with my read today we might blow out the top of daily trend range.

13:02 Price might be going higher.

13:40 Price grinds to ATH.

13:59 Still grinding, but, I have two lines on my daily that mark the trending range, price has hit one of them, the other is sitting at around 4500, the one that is hit now is an older channel that was widened by the dropout on October 15th and the blowout on November 21st, both channels track the same mean.

14:29 A chart might explain what I am thinking clearer.

15:09 We got an initial rejection of the tighter range extreme which failed and now price is hunting out the wider extreme which is now sitting just over 4500.

15:51 Thanks fourtiwinks. I'm done for the day, not a great week by any stretch but you cant win them all, have a good weekend guys see you on Monday.

Gamera.