Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

ForexTraderX

-

Content Count

612 -

Joined

-

Last visited

Posts posted by ForexTraderX

-

-

-

Those of us who actually trade for a living (some of us anyway), got short in the area of 1460 around the 18th Oct....my distribution shows theresistance there and the market starts the process of rolling over....this is a seasonal move that we expect to happen at some point in October....with a potential low of 1360

Your very late to the party having missed little more than half the move...but then that is exactly how retail traders act...isn't it....you come in late, you get on board and then taking a beating as the market starts to correct back forth in a range....

While I am not trying to be critical...I do have to call it as I see it....the COT is valuable in hindsight...but the report comes public way to late to be actionable in most markets....

The first attached chart provides all the heads up you need if you know how to interpret price action....it "tells you" (if you speak "price action", study a bit of history and add a dash of common sense)....that the odds indicate the S&P market is headed south...

The second chart is the daily chart from which my basic approach originates....as can be seen we have been in a months long up trend, then we went sideways as seasonal forces prepared us for the current "correction" back towards 1360...and in the next month or so we should revert back to a holiday "up" trend....into the new year....

Do we need COT for that...I don't think so...

I'm not so sure Steve...

Just because it's late doesn't necessarily mean that it don't provide actionable information.... it all depends on how a person is trading.

I'm not sure how others folks use it, but I pretty much exclusively use it to find historical extremes in net positions held by large specs.

For example, the CAD has been hitting some multi year record long positions recently. So, I've been fading those long positions for the last couple of weeks, and have managed to get several triple digit ticks/pips by adjusting my targets and overall market bias based on the information that the COT provided.

Had the CAD not had the record net long position held by large specs... then I would not have been able to take near the profit targets that I have been, because I would have relatively fewer tools to determine if a level of resistance would hold and stall my trade out before it could target. Of course, I would have made similar entries, but my targets would have been greatly diminished.

But it's not just targets, knowing the imbalance of the net positions are at extremes in the CAD allows me to just trade with the wind to my back. I've never seen such an extreme net position unwind without driving a currency market several hundered pips minimum... usually upwards of 1,000 pips... So, even though the USD/CAD has moved about 300+ pips from it's september low to now... I see very strong reason to believe that we will continue to move up to at least parity, and more likley, a retest of the 2012 high.

Shorting the CAD in all forms has been the safest, easiest trade for me over the last couple weeks... and I would not be able to trade it with such consistancy if it wasn't for the COT information that supports my technical trading.

Anyway, I hear your point with your intraday analysis, and levels, and entering moves early, etc... but I've been in and out of the USD/CAD since 9700ish,probably taken about 50+ round turns (at least)... but i pretty much always go to bed with a short CAD position on, and I'll make sure I'm short the CAD at all times, at least until we hit parity.... and it's the COT data that helped me determine the sheer magnitude of this particular opportunity.

FTX

-

2 - As far as I'm aware, virtually every trading educator out there has no prerequisites whatsoever in order to qualify for a course other than $. Think of good universities. Do they take anyone? (well maybe they do if you sponsor them with $ millions+!)

.

I couldn't agree more with this. Dr. Van Tharpe has done some work on personality types and trading, and out of 15 different personality types that Tharpe has catagorized and defined, 2 of them are "ideally" suited to trading. There are 10 that are probably able to become proficient in trading, but they have a bit of an uphill battle in some aspect of their psyche... And then there are 3 personalities that just are not up to the task.

Here's the test if anyone is interested... it's free.

And this brings me to another point that I think would make an appropriate #3 on your list Neg... if one is fortunate enough to have the aptitude to trade, and also has access to the best educational information... there still remains the process of converting that information into a format that suites the trader. I've seen at least 1 or 2 people who had everything required to become successful traders. In fact, both of them DID become successful, but their first mentorship experience was a flop, because they were learning from a mentor whos trading style was not going to work for their own personality.

FTX

-

-

Another really interesting looking trade setting up IMO is an AUD/CAD long... long from around 10.0210, then again at 1.0195-1.0190... And one final entry around 1.0180.

Seems like a bit of a reversal move from the bearish drop yesterday. with slightly better than expected news coming out of china, and the CAD just being so very overbought, and with the price action that has developed in the AUD/CAD over the past 2 days... I think a long from those points is kind of a trade I have to take.

No idea if it will make a profit, but the opportunity is there, and it should be taken.

-

Today in fact... it's looking like the GBP is likely going to be stronger than the EUR....

I'M long both, but if I had to choose just 1... I think I'd look to get long GBP/CAD instead of the EUR/CAD

and USD/CAD still looks solid for a long.

-

Well, at the risk of sounding something like a broken record... I'm looking to short CAD, against either EUR, or USD.

Between the two, sentiment seems bearish, and though we had a slight bounce off the lows in the equity markets (U.S. equity futures i'm looking at)... the asian equity markets are down for the day so far, and I'm thinking the S&P nneds to retest 1400 at least before we will have the possibility of a new upswing...

and since the EUR/USD has a high correlation level with the S&P... I'd say the safer bet is probably the USD/CAD long.

Not to mention that the USD/LFX (lite forex weight basket of currencies against the USD... similar, but different, than the dollar index) is showing on the daily chart what looks like a breakout yesterday, and is currently retraced to the point of the breakout... so, I wouldn't be surprised if we saw in general a risk off trade again today, at least until the immense amount of news and data releases comes out for the euro and other currencies today starting in about 90 minutes...

Yea. If one wants to avoid the news, the USD/CAD is absolutly the better way to go for a long USD, short CAD trade.

the best entry places are 0.9912, 0.9902, and 0.9886-0.9880.

Finally 0.9850 with a 30 pip stop, 100+ pip target would be a great opportunity IMO... it very likely won't trigger, but would be a great opportunity if it did.

The only thing about the USD/CAD long trade that I question is the news related selloff yesterday when the Bank of Canada announced that they were going to keep their prime rate unchanged. Based on just how overbought the CAD is showing on the COT reports, and the price action the last 2 weeks, and the fact we stll haven't hit parity, I think a long trade is still the play, regardless of the lack of easing by canadas central bank. (They did however warn of future possible rate decreases, in focus is how their housing sector does)... However, if we do have a deep retracement, it'll likely be due to the "aftershock" of BoCanada rate decision yesterday.

-

It is usually not a good idea to relay on what it "looks like" without confirmation. I don't recommend guesswork, unless you are really good at it.Just put up 1minute chart and watch how price approaches that level... That is what I call a great textbook example. Stall, BO, test - one of typical ways that suggest that price movement will continue,

Solid red line is 03.10 top, purple lines - various resistances from 18.10.

Also, contrary to popular belief and many technical analysis books... a horizontal line that marks support or resistance actually is less likely to hold the more times it is tested.

A lot of folks seem to get very worked up over this idea... not quite sure why. And it makes perfect sense also. A common chart pattern is a "double bottom". A less common chart pattern is a "Triple bottom". A even less common chart pattern is a "quintuple bottom". And rarer still? the "Octuple bottom"

If somehow support or resistance actually did strengthen each time it was tested, then octuple tops and bottoms would be more common than triple tops and bottoms.

Anyway Henry, this move up in the USD/CAD was the 2nd retest of this resistance area, and each time it made a higher low as it dropped than the time before... plus when we hit the sell stops as price dropped into the 9770 level, but then FAILED to quickly push down, but in fact stalled and started to reverse... it was all too clear that there was some big money that was busy accumulating around the 9770 level, and would likely push right through to a price that they could dump their obviously large long trade... and the best place to find enough buy orders for them to sell into and close out their trade would be around the 9880+ price.

-

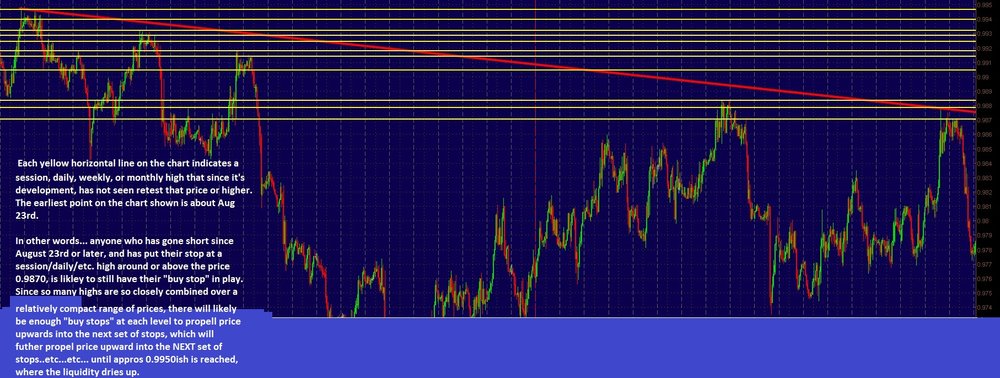

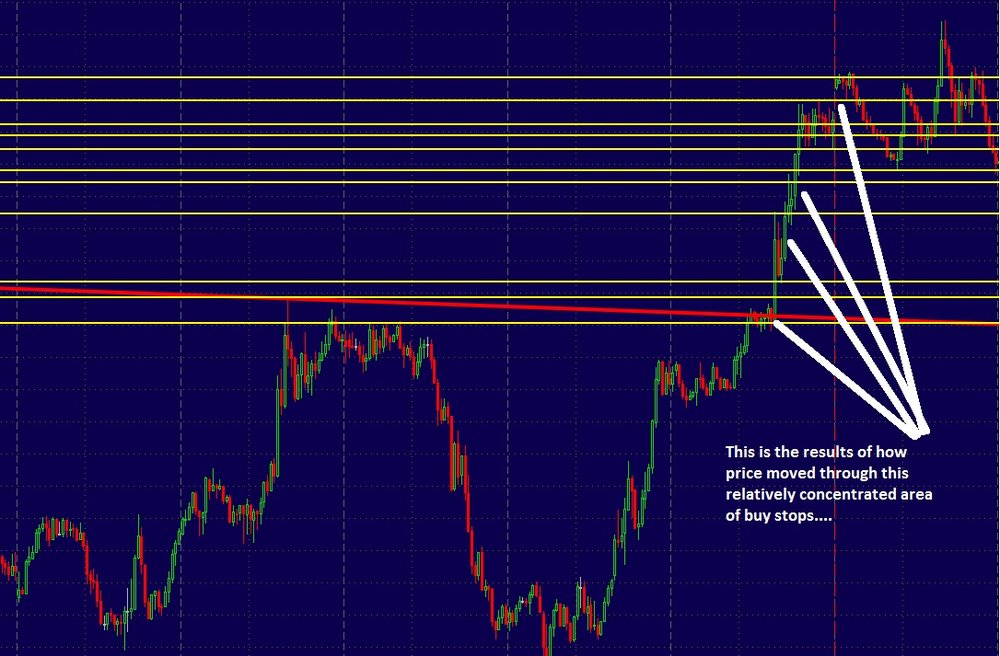

Also... another point on those stops and prevoius lows and highs and such, as I was discussing in the USD/CAD...

someone asked me a while ago a question that went something like this:

"Ok... so, if there is a previous hjigh for a day...say, yesterday. And yesterday was a pretty strong bearish day... it makes sense that a lot of people would put their stop right at or slightly above the high... and I get that the stop order will basically be a 'limit buy' order... so, once price moves up to test that high, shouldn't it suddenly jump up 5-30 pips as those limit buy orders (the stops of the guys who are short) are triggered? So, why do you look to FADE those moves? wouldn't it make more sense to use those buy orders to help push your trade up?" How do you know that it will not only bounce a bit, but often it reverses a great deal, say, 50, 75, or 100+ pips?"

At first glance, it seems that it WOULD make more sense to use a large cluster of buy orders to help push the market up.

Except, I'm really looking to see what the underlying message the market is telling me!

Lets say last tuesday set the high of the week. Price then sold off 200 pips by friday, and now it's the next monday, and suddenly, price is within about 15 pips of last weeks high.

It makes sense that there would be a high concentration of buy orders (stops, and a few limit breakout orders) above the high of last week made on tuesday.

So, price SHOULD hit this, and push up pretty fast, pretty strong!

Except... what if it doesn't push up. What if it spikes, and instantly reverses. Or, what if it tests the level, even pushes past it by a few pips...but then it just stalls, and starts to drop back. What if 2 hours later, it looks like it broke the high of last week by a couple pips, but since has been just consolidating, with lower and lower volume on the green candles as the last 2 hours has past....?

Well, what this tells me is simple:

1. There were probably a lot of buy stops at or just above the high of last week.

2. common sense says if there is a price point with a high concentration of buy orders, once price triggers those orders, it should move up quickly.

3. However, when price touched the high of last week, it did not move up quickly, but instead stalled, or even started to drop somewhat quickly. The Only Way price can hit a large concentration of buy orders, but yet stall or drop off, is if there is even a bigger bunch of sell orders right around the same price.

4. It's then reasonable to conclude that there is ample evidence of a large seller who is selling such a quantity that it is no only absorbing all the market orders being executed at that time and price, but also all the limit buy orders at that price.

5. Now that the "big money pro's" have essentially tipped their hand as to where their order is, as well as how big it is (big enough to absorb a high concentration of limit and market bids, and take the starch out of the bull move), and what their intentions are (selling), and the level of commitment to their trade (pretty significant, considering they picked a price point where there were a LOT of buy orders, and started selling there....and yet the market still moved down. So, this isn't a small short order they are placing... it's some serious size, and that means serious commitment)

6. So.... with this info that we can have some expectation of being correct more than we are incorrect... and therefore, using those "buy stops" to help push the trend further is all fine and good... but the REAL opportunity is when those buy stops are fully absorbed by sell orders... because losers getting stops hit is one thing. But to have big money traders using the losers stops to help fill their orders... now that takes serious commitment by some serious money... and that's the side that I want my trades to be on.

FTX

-

It is usually not a good idea to relay on what it "looks like" without confirmation. I don't recommend guesswork, unless you are really good at it.Just put up 1minute chart and watch how price approaches that level... That is what I call a great textbook example. Stall, BO, test - one of typical ways that suggest that price movement will continue,

Solid red line is 03.10 top, purple lines - various resistances from 18.10.

Ya, that's a pretty good observation Art on the way price approaches. It shows the majority of the "impulse" type moves are bullish, not bearish. This is one of many clues I like to use to help me figure out if i'm gonna fade a level or trade through it.

-

There are ways around that to a certain extent, aren't there - commodity pools etc, or just signing a load of waivers?BlueHorseshoe

Where there's a will, there's a way...

but I wouldn't advise it. If something is slated and marketd to the accredited investor sort... there usually is a good reason. One reason is that many such investments are of the "go big or go home" variety. For example, you invest in oil rights for a particular piece of property. Well, 90% of these don't push up enough oil to justify digging a well. You lose all your investment on these. But maybe 5%-10% will hit "black gold", and you'll make 25X - 100X your investment.

People that invest in such are doing so full well knowing that they will lose their 100K about 10-20 times before they see a return. But when they do, it'll be 2.5-10 million or more.

This is ONLY an example... but it illustrates the point. They are swinging for the fences, and even a loss isn't all bad, because it becomes a tax write off for another investment under their corporate umbrella that has too much profit, and they need to offset some with the losses incurred from the highly speculative oil deal that lost money.

This is why I don't ever recommend anyone who doesn't actually fit the requirements to be an accredited investor even try to invest in such sophisticated deals. They simply don't understand that the game at that level is often times about a home run, or a total loss.

When the day comes that you can lose 50K, 10 times over, and not worry too much because you actually needed the losses to offset your tax consequences on a different, profitable investment... well, that's the day you may want to consider some of the more exotic, restricted investments. If you can't lose 50K 10 times over this year, and actually benefit from it...well, there are better, safer, more reliable investments.

Like Day Trading, just to name one

FTX

-

ForexTraderX:On your # 6 post, page 1 you said you look to see a strong trend as defined by the 20 ema above the 50 ema for a filter. See above quote. I understood that to mean for a long trade you need to see the 20 ema above the 50 ema with both sloping up as a condition for considering a long trade.

But on your Oct. 18, 2012 #360 page p 45 you were saying you saw the easy trade for the day to be long USD/CAD. But on the daily both emas looked pretty flat and the 20 ema was not even close to being above the 50 ema at that time. So another rule or rules must have trumped the moving average filter. Please explain.

And congratulations on your great call for this long USD/CAD trade, amazing.

http://cdn2.traderslaboratory.com/forums/images/FH_Sahm/smilies/custom2/cheers.gif

See chart.

I posted some of the most important factors that I saw regarding that USD/CAD long trade... but I wanted to address some of the questions you brought up regarding this trade, and my "formula" that I included near the beginning of this thread.

The "formula" that I give in the beginning of this thread is designed to help people who are struggling to use a "turn key" analysis method for finding high probability opportunities once they have developed the skill for reading price action. If they have a relatively undeveloped eye for price action, then they will probably only be trading A+ pinbars, and bullish/bearish engulfing candles.

As price action reading develops, there are more opportunities to be taken advantage of, but regardless, the method I outline is something that I use on a regular basis, and it's also something that I believe most people can use once they have spent maybe 6 - 12 months watching charts and have developed their eye for price action and S/R levels.

Personally, I do a whole lot more than just this setup (though I do use it all the time still...it's probably my most straightforward "just grab a trade and make some money" setup)

Often times I'll take a trade that may conflict with this basic setup, for any number of reasons. If your watching my trades to see if I "followed my rules"... you'll be confused no doubt.

I tend to look at the market on a more organic level... a lot of market correlation, sentiment, etc. A lot of trades based on taking educated guesses as to who might be buying at what price... and why, and where they will best be able to get out, and why...etc.

It's sometimes more like a poker game than market analysis, but it works for me. However, many want something more mechanical, more concrete, and something easier to determine using empirical data rather than inference and educated guesswork. That's really what the method I outline in the beginning is all about. Sometimes I trade with it, and sometimes, I don't.

FTX

-

Ok... so, essentially, one significant part of the USD/CAD analysis that led me to conclude a long trade was a likely outcome was the way that various highs and lows had been developing over the past weeks, as well as which highs and lows had been retested, and which ones hadn't... as well as how significant various highs and lows were likely to be (for instance... a weekly high is more significant than a session high, usually because a weekly high is going to have a higher concentration of buy stops just above it than a typical session high would.)

So, with that in mind, take a look at the following charts. See if you can start to understand how I'm looking at situations like the USD/CAD long opportunity last week......

Henry... let me know if this sheds some light on my reasons for taking the USD/CAD long. Thanks.

FTX

-

Well... I completely underestimated the interest in the risk off trade today. That being said, GBP/USD should be right around a short/mid term bounce point here at 1.5919... I'd expect a bounce between 1.5920-1.5900.

Also, USD/CAD looks like it has bottomed out... and will push up to retest 9960 at least, if not the high of the day, and then on to parity IMO.

Kinda a volatile day in my account equity, but nothing too crazy, and over all I still have a good shot at recovering most if not all the loss within the next 24-48 hours with the trades I currently have on.

Nothing guaranteed of course, but it looks decent at this point for a recovery move.

will post some of the USD/CAD analysis next...

-

Alright, right now on the EUR/JPY, between 103.85-103.80....nice place to get long IMO...

-

Oh, also regarding the E/U and G/U setups i just posted about... stops would be 30-40 pips below entry prices... Personally, i've got a few mental stops, and I'm not suggesting anyone take any particular trade, only that stops should be lower than the lowest point I listed above by at least 20 pips.

-

I've started getting long in the EUR/USD and the GBP/USD.... though I think ideal entry points for the EUR/USD would be between 1.3000 - 1.2980, targeting around 1.3040, 1.3070-1.3080, and finally 1.3115.

for the GBP/USD, ideal entry would be between 1.5980-1.5960, targeting 1.6020, then 1.6040-1.6050, then 1.6065, and finally 1.6140.

Also, will start posting up some of my thoughts on last weeks USD/CAD that Henry had inquired about...

-

seems that what people are talking today is not too different from 5 years ago

"history repeats itself":confused:

I thought that was a guarantee Obsidian... I mean, I'm lucky enough to have a few more winners than losers to pay some bills with... and that's got to come from somewhere.

Now I have a bit better idea as to where it comes from.

As long as someone is winning in the markets... someone else is posting this question on a forum.

-

^^All that stuff is worthless. All that time trying to evaluate the person's secondary claims of large houses and large bank accounts would be better spent evaluating the strategy to see if it has any merit. The strategy and the person implementing it should be completely independent if the strategy is mechanical.

No, it's not worthless. If a person says they make $1,000,000 trading futures, and I they sign an IRS income tax release form, and I see that indeed, they made $1,000,000 trading futures, because the tax amount matches what it would be for a futures trader, this is usually very good evidence that they are what they say they are. It is no guarantee that they will continue such performance, I agree with that. But I know of no one with a mechanical strategy that will provide information on that unless a person is buying it for themselves, for a very large sum. If you've found such a person or strategy, well, kudos.

But Just because you may not be comfortable investing your money with an outside party, doesn't mean that it isn't a good idea, depending on who a person is, and what their goals are. And obviously not all market speculators are scam artists. Just the vast majority of ones you will find marketing themselves on the internet happen to be. So, there are some tools that a person can use to determine if someone is real, or fake. Nothing is 100% of course.... but so many online fall so incredibly short of even the most basic due diligence, it's pathetic. And of course those are the ones we hear who lose it all or screw up. There are so many of them after all... but I've known others who I have trusted and over all have had a good experience. But I trusted them only after I conducted a thorough background and fact check complete with tax statements, bank statements, and sometimes a little online private investigation.

As someone who has both invested in various entrepreneural projects, and had many parties invest in my own entrepreneural projects, it's NEVER 100%. I've made some investments that turned out bad, but overall, it's been very rewarding. I don't see an investment in a person who can prove what they claim in the market to be any different than an out-of-state real estate investment, or investing in a startup franchise.

But also, at least if you live in the U.S.... many of these investments and opportunities are not available to a person who doesn't have the proper income or net worth qualifications... and of course, NONE of them are offering their services for $100 a month, or a 1 time payment of $299, or having just won first place out of $1000 in the alpari demo play monopoly money psudo-trader competition, or whatever.

FTX

-

I don't trade spot fx, but someone who does recently told me that some brokers keep the same spreads (roughly) as the futures contract trades with, but then charge a fixed commission - this would allow you to trade the cash without the hassle of massive spreads.BlueHorseshoe

Yes, actually, well.... it's a centralized market, an ECN...problem is, there is often a real spread in the cross pairs (much like a real spread in the micro forex futures contracts, due to lack of liquidity and participation).... so from the couple I've looked into, it worked out to be about the same as my spot broker now. Now for limit orders it may be an advantage, but not so much that I've been compelled to go through the hassle of opening up another account with another broker...etc..etc.

In the not so distant future, I'll probably be looking into a more institutionalized setup, but since many trades I make translate to standard forex futures contracts, and the tax benefits of futures trading (in the US)... it works out well enough for me for now.

Anyway, back to multiple time frame discussions...

FTX

-

Another thing is when people talk about sport. I like football (or soccer if you're american (or welsh)) so I'll use that as an example - but it's definitely appropriate to other sports. In football, there's always talk of how "keeping things simple" is really great and how "doing the basics well" can win you games. I absolutely agree with that. But most of the YAFS who bang on about it fail to recognise the years of work put in by the players and coaches to know what they should be doing. Which simple pass is the right pass? When do I shoot? When is it right to play it down the wing? Blah blah blah. What about all the technical work which goes on in preparation for the game? The amazing sports science like diet or movement analysis to help make players fitter stronger and less injury-prone? Is that simple? REALLY????Of course, each one of those ideas is simple. But knowing when to do them, and how to do them with such excellence you can out play the other best and most talented, highest paid, super atheletes who's sole purpose in their career is to PREVENT you from doing that... ya. I can explain how to swim in a very simple way to just about anyone. Doesn't mean they will be the next Michael Phelps. And mind you swimming is easy. Yet to do it professionally does take years of devotion and mastery. Even though it's incredibly simple. Arms in circles. Kick feet. Turn Head. Breathe. Do again. but all the details and neuance that go into making someone take that to the degree where they can be good enough to swim for a living... yea, that's definately not simple or easy. There's a lot to it. So much that to be the best requires that you work with a full time professional who is telling you every day what you need to do better, how to improve this, that...etc. that dude is called a coach. A full time coach. for arms in circles. Kick feet. Turn Head. Breathe.

It may be fairly straightforward once learned and understood and practiced and experienced and gained some mastery of... but that right there is why it is complicated and somewhat difficult.

-

It would seem that my attitude to all this would be the opposite of most.1. Trading my own money I want the low volatility of returns that most fund managers target in order to attract investors. Whereas most independent traders tend to quote 'being able to take on greater risks to achieve larger returns' as a benefit of not trading other people's money.

2. If I was trading other people's money and, hypothetically, could do so on a completely unregulated basis with no question of repercussions, then I would swing for the fences with money management in the way that Larry Williams did in the competition. It's other people's money - what would I care about the volatility of returns or risk profile? There's no real downside, for me, and unlimited upside.

What do others make of this? Is this a logical conclusion, or should I be working with the other sociopaths at Goldman?

BlueHorseshoe

Actually... if your trading other peoples money, you don't want to do that. Here's why:

If you start your year off managing $1 million, and make even a 30% ROI your first year, with a drawdown that never exceeds 10%... you will charge your 1%, plus 20% of profits. You will make about $70,000

And, you will also get probably $10 - $100 milllion to manage in your second year. For this year, you will make 30% ROI, drawdown never over 10%, and you chart 1% plus 20% of profits. You will make between $700,000 - $7 million. by the end of that second year.

If you do this, you will be get about $200 million - $350 million to manage in your third year. For this year, you will make 30% ROI, drawdown never over 10%, and you charge 1% plus 20% of profits. You will make between $14 million and $24.5 million that year. In your third year. Starting with $1 million. 3 years later, you can very realistically be on track to make $14 - $24 million

Remember, with that type of return and low drawdown, you will have more money than you can imagine being thrown at you. Trust me. I know. The world can be a very, very, very rich place with money to give to you if you show a couple of guys some good numbers for a year or so. Because those guys have friends. And their friends have stupid money. And so do their friends, and so on... and every single one of them wants to make 30% per year with no more than a 10% draw down. Every Single One. Period.

If you trade your own money, you would need to acheive an ROI of about 230% - 290% per year, if you start with $1,000,000, and want to make $14 - $24 in your 3rd year.... mind you, if your drawdowns average 10% of your annual return.... well, lets just say you'll come close each year to wiping out your account while you kill yourself to make that type of ROI.

If you trade other peoples money, you can literally make $14 - $24 million per year by the end of your 3rd year, by acheiving only a 30% ROI, and an extremely pleasing drawdown of only 10% at any given time.

You don't swing for the fences because you don't get money from one person one time. You go for singles and base hits because you get money from many rich people, all the time, and that list is always growing, never dropping, if you can get that type of risk adjusted return.

If you can do that, it's better than almost any rich person can do with big money anywhere else. So that's why your phone will ring every single day with someone who wants to give you millions.

No joke. Sounds nuts. It's true. And it's why you prefer base hits to home runs if you trade OPM

FTX.

-

Satsified? no, of course not. who is?

Happy with? Yea... this year has been rough, no doubt, but last year was fantastic. The two years before that were very good. But before that, I never made consistent money.

I trade full time, I have a nice place with a nice family and though my wife works it's part time and it's something for her to do and enjoy. With this I am very satisfied. What's not to be satisfied about?

FTX

-

I agree. Guys with "verified" trading statements are just dumb!. They are suckas!Real verified statements are great... as in, audited and certified by a big 4 accounting firm, or independently audited by barclay's for inclusion in their database of hedge fund rankings...that's wonderful. A guy shows me this, a good return, and a low drawdown, and i'll give him lots of money. Lots.

guy has a myfxbook page, trading real money, verified track record and trading privledges... I talk to him. I ask many many question. On the phone. Not email. I do a background check on him, including requesting that they authorize an income tax release via their signing IRS realease form 8821, and then I submit it to the IRS, and get the information. I would also do a public record search of property ownership in the town he says he lives in, to see what, if anything, he owns.

Obviously, if he lives in a home that he purchased for $1 milllion or more, and his tax statements show he made a lot of money in trading profits (which often will show differently than earned income or income from another business)... And all of what I discover adds up with the story he tells me...

Then I will probably invest with him as well, as long as I like what he does, and my research matches his story without any discrepancy.

This type of verification I describe here is real verification. And something anyone should be happy to accept as proof that "this guy is the real deal"

If he only has a PDF file that has an excel spreadsheet in it with some numbers, a column called "trades", and another called "win", and "losses", and "profit"... or a web page with basically the same information...

if this is all he has and all he is willing to provide as proof... then I give him the same... an electronic letter with some writing. Except mine says "not interested. Find another sucker"

If someone is real, you can always find out. if they are taking investment, they should be able and willing to help you find out.

There is no reason in the world why a person would not provide real, independent proof of who they are and what they can do, if they are looking outside themselves for investment capital. If they will not cooperate with what I outline here...then RUN, do not walk, away. You will lose your money.

FTX

Watch A Typical Day Of A Real Day Trader

in Market News & Analysis

Posted

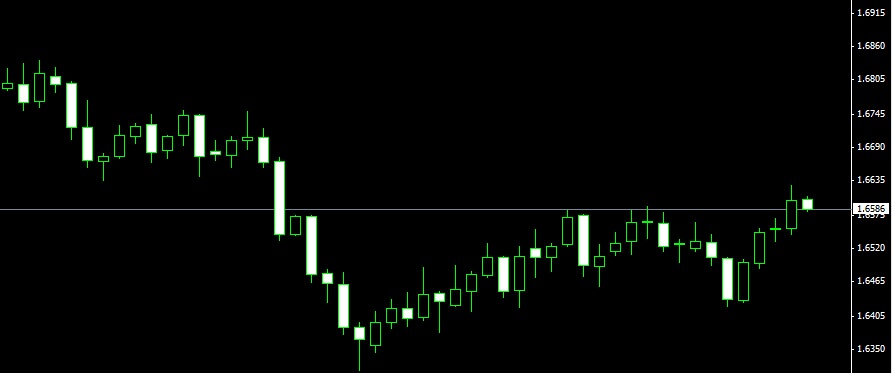

Here's a screen shot of the entry I got in the USD/CAD. Well... it was one of several entries, but nevertheless, it was a very good one.