Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

ForexTraderX

-

Content Count

612 -

Joined

-

Last visited

Posts posted by ForexTraderX

-

-

Just as it applies to the trading world, do you ever take time to touch base with reality ?Do you have a network of friends/associates you bounce ideas off once on a while?

Do you attend seminars/workshops to see what's new out there ( I know, I know, it's hard finding one that is not trying to sell you a bill of goods ).

Do you read books or other online resources ?

Anything you'd care to share with us on what helps you?

I cry out my innermost trading thoughts into the electronic void that is the internet.

I read books (very selective these days, as most of them publish information that I'ved worked hard to forget, and it's extremely rare to find a book that contains anything of practical application hthat I am not already familiar with at this point.. but yea. books)

I interact on internet forums like this one.

I fantasize about having a group of friends or even a fan base, and I picture myself opening imaginary fan mail, and even the occassional "dear john"...mostly from jealous trader wannabe's, who I then reply with the following statemen..... oh, ahem. where was I...?

Yep. books. internet forums. the ocassional magazine.

Honestly, wish sometimes I was less mature in my development as a trader, because I miss the cool, exciting time of learning new ways to measure and analyse the markets.... I miss the thrill of those "ah ha!" moments. But I don't miss the lack of profit. And I trade for profit, not ah-ha moments.

This is a lonely business. But man, it pays well.

-

Because past results are not indicative of future performance? Whereas effective diversification could be indicative of reduced risk?BlueHorseshoe

Blue, I'm gonna pick on you here a bit, but don't take it personally. Frankly, you ask good questions, and often have a well developed understanding of how markets work as well as an awareness of risk, etc....

But I think your missing the forest for the trees a bit here... here's how.

Your essentially quoting investment industry cliche's, but your taking them out of the context in which they were intended for, as well as not considering WHY these cliche's exist in the first place. I'll take them one at a time...

"because past results are not indicative of future performance" Ok. Fine. This is technically true... but if we carry it to the nth degree.... your boss might as well fire you from your job now, because, well, no matter how good you are at your job, past performance is not indicative of future results ya know. And if your wife wants to have a 2nd child? well, call up the adoption agency. Because just because you had it where it counts the first time around, doesn't mean that you can still "deliver". Sterility is a real fact of nature for some anmials, and after all, past performance is not indicative of future results.... etc...etc..

I think you see my point (gosh I HOPE you do... or I'm just gonna come off sounding like an inappropriate, insensitive, pervert of sorts!)

Ok...so, what exactly is this statement all about then? Well, after the great crash of 29, many rules were implimented over future decades that existed for the purpose of preventing greedy, slimy pitchmen from showing a trading record, and then making promises that "I'm this good at trading. And if you invest with me, I guarantee I'll make twice as much for you as I did with my trading last year!"

In other words, it is a legally required disclaimer designed to protect the investing party by letting them know that in truth, this is an investment opportunity that they have no real control over, and therefore must understand that it may not be as good as they would like to believe it is.

Now, what investments do they NOT require this disclaimer to be attached to? How about raising capital for a public offering.... or, starting your 3rd pizzaria, or investing in your 7th real estate deal.

But...how come? The key issue here centers around "Control". When you give your money to someone else, you give away your control. Therefore, the disclaimer acts as a way to keep your expectations realistic, as well as protect you from giving up control to a would be confidence man who promises the moon but gives back something less....

HOWEVER, if YOU are your own investor, your own trader, your own entrepreneur.... you have an infinitely greater degree of control in this situation. So while there ARE still black swan events, outliers, etc.... you can have a specific plan (like stop loss orders, drawdown limits, and many other things) that will account and protect you from each individual "threat" that you may encounter as you run your trading business.

And if your strategy is based in something that is pretty much intrinsic to the nature of the liquid, auction market model that 99.9% of the capital markets in the world operate under... then you can be pretty sure you will be able to continue to perform at a respectable, profitable level for probably decades into the future (unless human nature itself changes...but then all bets are off)

The point here is that the cliche "past performance is not indicative of future results" is actually NOT an accurate description of a universal truth! It is a LEGAL DISCLAIMER to prevent hucksters from overpromising and under delivering to the relatively unsophisticated investor. It has very little, if any, application with regard to a persons own ability to trade profitably...or for that matter, invest in real estate profitably, or operate a McDonalds fanchise profitably, or even wake up in the morning successfully!

And this brings me to the 2nd cliche that you use...

"effective diversification could be indicative of reduced risk?"

"could be" being the operative phrase in that sentence. It COULD BE evidence of total retardation, and I suppose it COULD BE submitted as proof that aliens walk among us...

lets forget could be for a moment...and go back to the very beginning of the concept of "diversification is a way to reduce risk"

The REAL story is that cliche was born with a twin sister... something we now like to call a "mutual fund" Because the industry had to cook up some way to justify criminally high fees and charges to your retirement account all for underperforming what you could have usually made just investing in the broader U.S. equity markets...

And the way they sold that sack of shit was by saying "ahh... you see, if you take your retirement money, and buy a stock with it. That company could go bankrupt. ANd if they do, you've lost your entire investment!! But, if you invest with our (name brand here) mutual fund, we will spread your money across such a cacaphony of generalized corporate holdings that if one company goes under, it's represents less than 1% of your entire retirement, so a bankruptcy or problem for a publicly traded company won't hurt you hardly at all (you're also doomed to underperform the market from here till retirement, all the while paying us miillions of dollars every year to suck at our jobs...but hey! look at the bright side... if IBM has a slow quarter, you'll only lose a few hundered dollars, instead of a few hundered thousand!!)

So, all cynicism aside... what EXACTLY is the risk that "diversification" has reduced??? It really only reduces the risk for a passive investor who does not pay much attention to, nor does he understand, what he is invested in.

But, does this describe a type of risk that applies at all to the active and engaged day trader??? No! not even a little bit! We are so tuned in, over stimulated, focused beyond belief, and constantly looking for "what caused this move?!?? what caused that move?!?!?!!!!" that there is really NO WAY that we run the risk of putting our money into a stock, or futures contract, or whatever, and then watching our money get flusehd down the drain because we were too lazy or ignorant to follow the industry, or the company, and see the 137 signs that it was in trouble (like that obvious and gorgeous downtrend the stock has been locked into for the past 9 weeks...etc)

You diversify to protect against the risk of lazyness. Of financial apathy. It gives you the luxury of being able to NOT look at the market for 12 months at a time, and usually not worry to much that the bulk of your money will be there next year.

If your trading a futures contract.... lol. I'm laughing just thinking about it. Go ahead. Try to go long or short any contract...and then turn off the charts, and tell yourself not to worry, you'll come back in a year, and see how things are going! LOL!

As warren buffett so elequently put it "Diversification is just a hedge against stupidity"

You need to consider exactly HOW these cliches operate... because if I tell the guy who runs the gas station at the corner that his business model is fucked, because he has no diversification, in that all he sells is gasoline.... well, he may be a one product guy, but something tells me he doesn't have a whole lot of risk in his business, dispite being a 1 product guy.

Remember, the entire existance of the antitrust case law that we have in the U.S. was because the U.S. federal government thought that some companies were too powerful for the good of competition... but funny thing is... standard oil... microsoft, ticket master... these companies aren't known for their broad "diversification"!!!

"Diversitication" does NOT equal "Less Risk"

"Diversification" DOES equal "reduction of a very specific, somewhat rare and exotic type of risk"

but as a day trader, your exposure to said rare, exotic risk is almost nonexistent.

Don't accept cliche's at face value. Try to find circumstances and situations that they DON"T work.... because that will provide you insight as to how they apply, and this insight will help you be better prepared to know the right course of action for your own financial decisions.

Hope this helps a bit. It's rather long, I do apologize.

FTX

-

So... are their prizes this time around? Because man... every time the first rolls around, I'm too preoccupied with all sorts of psych nonsense, and I don't even take a look at this thread for 2 weeks.

Then, about 3/4 of the month in, I click the thread, see the leaderboard, and kick myself for not entering.

That's ok. I'll just faux enter. psudo compete. "play pretend" and think of how cool I am for winning (or being ahead) in something I'm not even involved it. It's just gonna be a way for me to live vicariously through myself.

Too bad though for me though...because my pretend competing is doing pretty well this month:

FTX - Sample System | Myfxbook

:::shrug:::

oh well. another month, another train leaves the station of milk and honey...with the next stop, fantasyland.

FTX

-

Hey henry, I just made a post on another thread on this site that covered some other, seperate aspects of my thought process that went into developing my directional bias.

Some of these elements I mention don't apply specifically to the "double top" you brought up, but they DO apply in general as to how I develop my long term directional bias in situations just like this USD/CAD one we've been discussing.

Here is a link to that post. Read it, and let me know if this helps shed some light on how I do my analysis...

http://www.traderslaboratory.com/forums/futures/14233-never-catch-falling-knife-5.html#post164584

-

The areas you outline look like better places to exit than to enter.Certainly you can capture hundreds, but from the looks of those charts, it seems like you may have left 1000's on the table to capture the hundred if you are only catching the knife. But, If it a skill you have developed, then so be it. I am not the fool to condemn someone for taking money from the market. My comments mainly reflect my inability to catch the knife.

Well Mighty, like everything else in trading... it's always a work in progress. I'm a kung fu ninja killa when it comes to turning knives into paychecks... but i'm a goldfish trying to run in cowboy boots when it comes to holding on for any significant swing or trend.

Actually, because I think you can understand "the secret"... I'll take a moment to explain the basics of it.

It's easier for me to use a real example that I've recently done than to try to explain in the abstract... so I'm gonna go into catching knives in the USD/CAD earlier this week....

The first step for me in being able to identify which knives are actually made of money is I usually need to have strong conviction in a longer term directional bias.

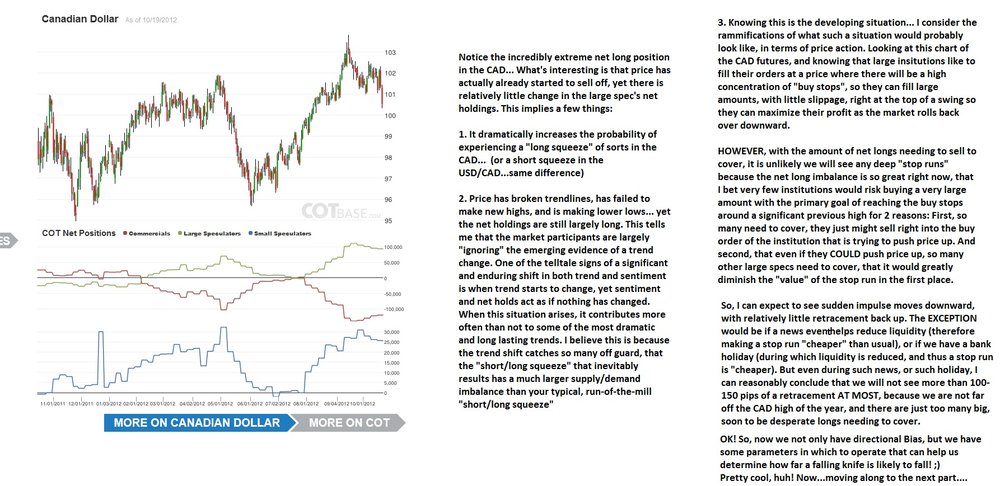

I can (and do) derive this from several different tools... most commonly the weekly and monthly candlestick charts. But in this case, it was a combination of a historical extreme in the COT report (large spec net long CAD at crazy record levels)...combined with recent price action, and also some upcoming news catalysts, and overall market sentiment regarding the CAD.

Lets start with the foundation of this bias: the COT and recent price action... I have included a picture that shows the COT imbalance under the CAD futures chart... it also has an in depth breakdown of my thought process and logic that helps me determine both direcational bias, as well as probable limitations to a falling knife (or in this case, a rising rocket. Whatever)

CHeck out that first picture, read the notes, and then continue reading down below, where my analysis continues after you've seen that first pic:

But this isn't all that I'm considering. One of the biggest supporting factors isn't even on the charts at all. I'm talking about market sentiment, and/or market tone. For many weeks this year, the mood of any news release or article relating to Canada and the CAD had a tone of "well, the canadian economy is one of the few brightspots of the G8 currencies!" However, over the last 2-3 months, the tone has shifted, even including the chairman of their central bank stating in a press conference that he is concerned about Canadas over priced housing and Canadas under qualified home buyer.... and that he would persue an "accomodating fiscal policy" to make sure it doesn't unravel too quickly.

Appearantly Canada housing and chinese public companies dodged the initial meltdown, but whatever. Anyway....

this change in tone has set the stage to make this week a very important week for CAD traders... because this week the bank of Canada was scheduled to announce their interest rate changes (if any)

Now, as it turns out the announcement was "no change"... but that didn't matter much to me last week. What DID matter last week was that CAD traders around the world had only 1 question "Is Bank of C going to lower their rate???" With that being the guiding sentiment.... I knew for a fact that the days leading up to the announcement would very likely be fraught with crazy jolting impulse moves down... because while it was possible that the Bank of C would not lower interest rates... Not even the craziest fool seriously was considering that the Bank of C would RAISE interest rates.

So last week, upcoming fundamental announcements would influence market participants in one of two ways: Either you did nothing, because you wanted to see what the announcement was... OR... you REDUCED YOUR LONG POSITION... just in case they lowered rates, and now your too big, without the needed liquidity to get out.

So I KNEW there was going to be MASSIVE pressure for a variety of reasons for the CAD to sell off. And with so many already holding long positions... there would be almost no pressure or catalyst that would work to kick off a buying spree.

I also knew about how far to expect such a sell off to go.... lets say...I could reasonably determine that 100 pips down in the USD/CAD spot would be about 1 standard deviation of my expecation for what a falling knife "would likely do"... Because heck, the world is too long already, and we are only about 200 pips from the recent high, and no big trader worth their salt isn't going to use any and every pullback they can get to reduce their long exposure.

OK. Now we have COT analysis that essentially gives us perspective on the global supply/demand liquidity imbalance.... we also have knowledge of how large institutions operate, and what we can reasonably expect from them in terms of where they will get involved to reposition their trades...etc. We also know what fundamental factors are likely to influence decision making... and more importantly, we can make a pretty good determination of how Large speculators will FEEL regarding the upcoming fundamental factors!! (ie: very worried that they will be too long, in a market that has no liquidity for longs to exit)

I'll tell you one thing for certain. Coming into this weeks Bank of Canada rate announcement... NO ONE was talking "lets get long the CAD, because we could see an increase of interest rates!!"

So... with all this in our favor that we can reasonably deduce from our observations of price, market tone, upcoming possible catalysts, a knowledge of how large speculators like to get into and out of positions, and the clear imbalance of longs/shorts in a market that really won't have the liquidity for longs to cover...

It's really not that risky catching a falling knife. I mean... come on. Yes, the USD/CAD spot market COULD fall 500 pips in 3 days. Because every hedge fund manager is about to wake up tomorrow thinking "Gee... I have the largest long position in the CAD that I've ever had in the history of my trading. I know what I'll do... I'm gonna go ahead and DOUBLE DOWN on that long position baby!!!"

C'mon. It's not realistic, and it' not likley. And besides, that what bet sizing, and stops are for.

But, The very important thing to understand is that a falling knife in say, the USD/CAD spot market last week, and also Sunday/Monday of this week... would have been unlike ANY OTHER FALLING KNIFE in any other market at this moment in time.

And it's this type of thinking, using logical deductive and inductive reasoning that allow me to see the forces behind the markets... and therefore, I could recognize a falling knife in the USD/CAD spot was not something I needed to fear, but rather a special, high probability opportunity to get long the USD, short the CAD, and hold on for a ripping ride as the "Great USD/CAD short squeeze of 2012" kicked off.

Now you see how I develop my bias, and how I have the conviction to stick with it. At least in this example. (rarely the patience, but often the conviction... ironic, yes)

Now, if you want to see how I look at charts to determine how I will enter, how I will exit, and what I look for, and what I factor in to determine the optimal entry and exit points, I suggest you check out the 3 pictures, and the notes, that I included in the following post:

So, in summary, this post here should give you an idea of how I determine if a falling knife is actually a super sale on the next best thing, or whether it's just a dog with too many fleas and is best left for someone else to grab. Think of this post as my "macro/bigger picture" approach and determination.

The link I just gave will give you a better idea of how exactly I pinpoint the "micro level / execution / triggering the trade" aspect.

Put the "macro" view with the "micro" view and you have the two fundamental components to my own personal trading methodology. It may be a lot of work and variables to consider, but hey, it beats the snot out of a moving average cross over system any day!

Phew... that was a lot of thought for me Mighty... I hope you find it at least interesting!

The revelation that I hope to impart here is that catching a falling knife is NOT a skill worth spending time developing. What IS worth spending time developing is the ability to know if a falling knife is actually a rare fire sale on something of significant value... or if it's just a basic, run-of-the-mill falling knife. Just a knife? follow the trend, or stay out. Actually something more than meets the eye? Worth an F'ing fortune, because it can provide 5:1, 10:1, even 20:1 reward to risk ratios, if you develop the skill fully. (best I ever did was a 320 pip target with an initial stop of 25 pips, risking 0.40% on the trade)

Anyway, would love to hear your feedback or thoughts on this process of mine... and most of all, hope you have a slightly different perspective on the red waterfall we traders like to call "a falling knife"

FTX

-

Oh hey guys... I've not been on skype for weeks now..had a computer problem that was interfering. However, I've got that fixed now...and I'll be around later on...

so if anyone wants to hit me up on skype. Feel free to do so.

my ID is: forextraderx

-

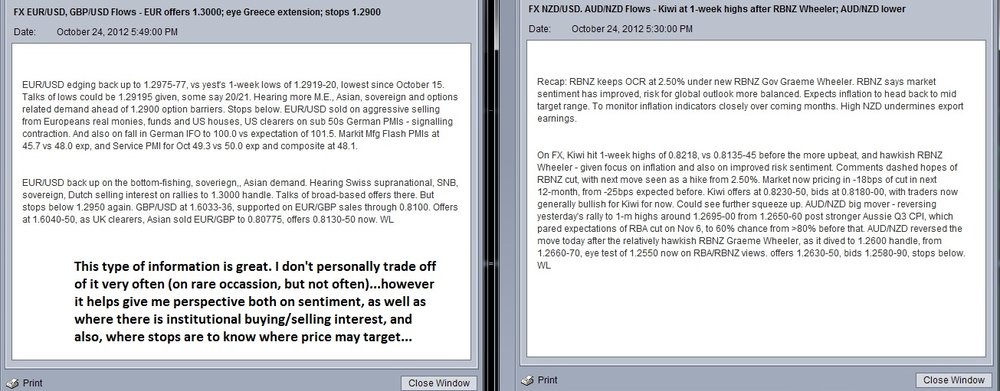

Hey guys... another thing that I use on a regular basis is order flow information that is sent out in my newsfeed.

For all you out there taht think "oh man.... the smart money just does whatever it wants, if only I knew where the banks were placing their orders, I would be able to make money trading"

Well, there IS a way to find out where the banks are placing their orders. Also where nations are placing their orders. It's not the "holy grail" you might think it to be...but it is helpful... particularly in knowing what levels price may target, and who is interested in buying/selling at around what general price points...

If your not making money in the markets yet... check out this pic that I included with this post. This is one of many pieces of infomation that I am using to base my trading decisions on.

If you are still trying to buy and sell when this moving average crosses over that moving average.... man, I don't know what to tell you. Except that my information kicks the living shit out of your information. And I'm coming for your lunch. Every. Single. Day. Your lunch... is mine.

Moral of the story? Either learn how markets work by doing whatever it takes to develop the skills to be able to read price action, understand the "poker game" that the big boys play, know what market microstructure means, and know how various market participants operate, as well as why they can really operate no other way. (commvercials vs. large specs vs soverigens, vs institutional money over all vs retail vs informed participants using a particular type of order, and most uninformed participants using a different type of order...etc)

Learn how to read market sentiment, gain some understanding of market profile, and definately learn how to incorporate volume into your market analysis. Also learn how to use your brain to make some deductive as well as inductive conclusions about the siginifigance of what your seeing on your chart. It's not just a pattern. a particular set of behaiviors and actions all contributed to form that pattern. Now figure out what those actions and behaviors were. And by who. And why? Get yourself a news feed. And don't you dare confuse some pathetic idealized image of what you think a trader should or shouldn't do or consider in their trading with your own self image and self worth.

I can't tell you how many jackasses have told me "I don't pay attention to the news, because all the news is in the charts!!!" Or... "price discounts all fundamentals!"

Mind you, I believe the only people I've heard this from are those that DON'T trade full time.

Know why? Because any real full time trader knows that the only way they make money is if they take it from someone else. And I'd be a real moron if I wasn't profitable, yet already had made my mind up about what information can help me, and what can't.

Look. I'm a real person, who really trades real money, and really pays bills and buys stuff with it. And this is my primary job. And I am relentless in my search for better information. Because better information is what enables me to take your money from your brokerage account, and use it to buy my car and pay my bills and take my vacations with the family.

And besides, something tells me that my auto insurance won't be very sympathetic if I call them up and tell them "well, ya know... I would have paid you...but, I'm a 1 minute chartists super scalper... and that means I don't look at daily charts, news feeds, or trends in sentiment. So, it's not like you can blame me for not making money and paying you guys... because my competition had better information than me!!! It's really all their fault I'm broke!!"

FACT: it's not all in the charts. Sometimes it's other places. You can choose to identify those other places...or you can choose to trade with less information and knowledge than me. I'll give you 1 guess as to who will more often end up on top.

FACT: does this mean you absolutely need more than a chart to make money? NO, it doesn't. But it does mean only a fool disregards viable solutions to a problem that they haven't yet solved.

That's it for this rant...for now. If your not making money, just go through my thread, and if you don't understand what i'm talking about, or why some of these things are important, or how I use certain bits of information... and your not making money...

Then the reason you are not making money is because guys like me know more than guys like you, so we are better prepared to take advantage of more opportunities than you are, while at the same time we avoid dangers or poential problems more often than you do.

It's really that simple. Learn how to understand the markets. Read the markets. Recognize clearly what the market is telling you. Or turn off your charts, and go visit Find Jobs. Build a Better Career. Find Your Calling. | Monster.com , and get yourself a career you are serious about. Because this one isn't it.

FTX

-

Anyway, I dont trust completely the stats that are supposedly 3rd party time stamped on those sights so doing your own tracking is the only way and how can you do that when you might be asleep when the guy takes a trade?

You mention that you don't completely trust the 3rd party stat tracking websites... I'm curious as to why this is...?

"trust" is a relative term of course. and I wouldn't personally make an investing decision based only on a 3rd party tracking site like myfxbook.... but in general I take it that the vast majority of the stats that we see are legitimate...

Do you feel otherwise? if you could maybe give more information about why you don't trust them, that would be appreciated.

FTX

-

Personally, I love absolute statements. Especially when it comes to things in the markets. I'm firmly in the camp that says "the only thing certain in the markets is change". Well, that and patterns. And range expansion days. and high volatility preceedinglow volatility. And orders congregating at daily/weekly highs. sometimes.... I think.

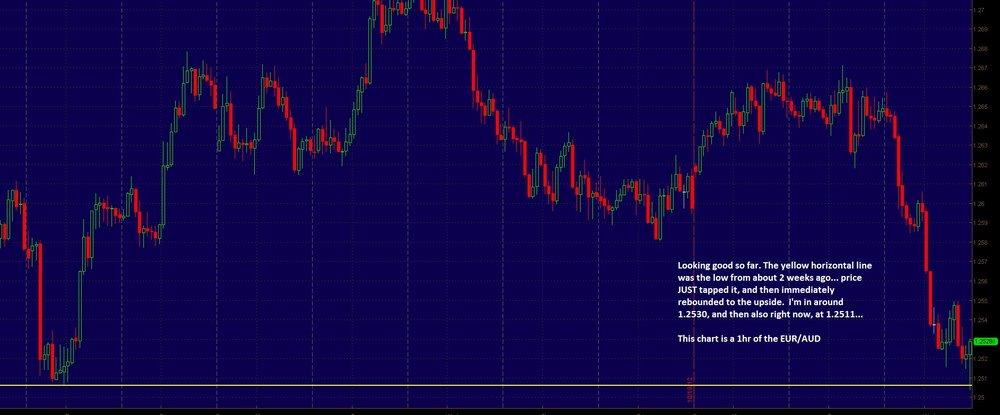

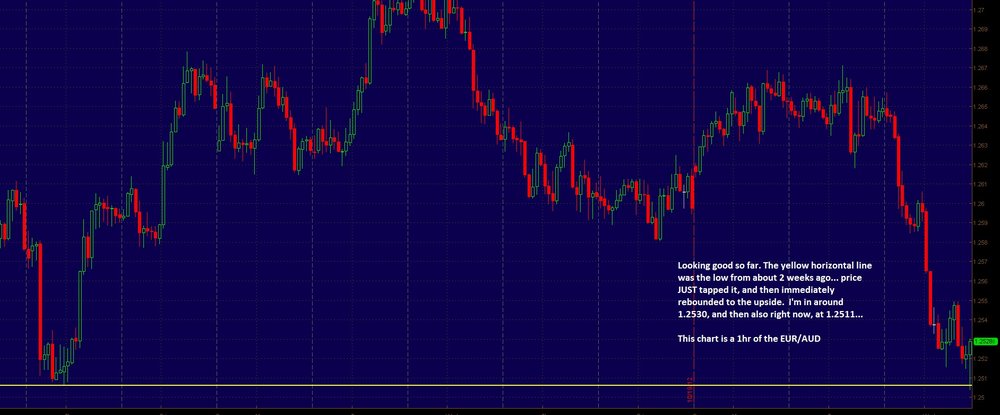

Well anyway, in the spirit of absolutes, I wanted to post up a few choice knifes I was happy to catch in my lap over the past few weeks....

These are jsut a couple that I had handy to upload. Actually, I do this on a regular basis (daily? weekly for sure) primarily because it pays pretty well. And i'm kinda sorta the "in your face market!" type guy. I like going against the crowd, and I like getting in 3 pips from the bottom, or 4 pips off the top.

Makes for some really sweet risk reward ratios. That's part of the reason I'm up about 10% for the month while my average risk per trade is about 0.10%-0.20% of my account size. I also like to jump in and out of trades a lot. Again.... I'm just a Contrarian kind of guy.

feel free to click on my signature, and you'll see myfxbook page, which I trade using real money (no demo nonsense), so anyone who may be skeptical can see for themselves.

So there. Proof (well, ok, not proof at all. But, some evidence no doubt) that falling knives can and often are wrapped in $100 bills! you just want to make sure you catch the ones wrapped in money, and not the ones that are just big and sharp and painful.

FTX

-

Being able to estimate liquidity accurately is also a crucial part of what the HFTs do - otherwise the speed is useless.BlueHorseshoe

Ya ya... there's more to it of course, but I wanted to draw the distinction between the literal definition of what "scalping" is... from what we often refer to as "scalping" just because the trade isn't held for long, or only goes for a relatively small profit/loss point.

most people don't actually mean "scalping" when they use the word "scalping"

FTX

-

Actually, none of this is about bull or bear candles, guessing, or predicting. It's about observing the behavior of price. While the kinds of exercises you suggest might be useful with some other approach, in this approach they would be several steps backward.I suggest that those who have followed along chime in and offer their opinions, suggestions, insights. I'm reluctant to jump in like the gurus do and offer quick and easy solutions to problems that are anything but quick and easy. But if you guys can't work it out, I'll offer my two cents.

Remember that this is a process, and there's no hurry.

Keep it simple.

Db

Well, actually your mention of "quick and easy" is about right... drill or no drill, wyckoff or no wyckoff, learning to correctly interpret what the market is telling you is like learning an abstract, visually based foreign language.

If I understand DB correctly, his point I think is best exemplified in the following parable:

The Jade Master - somerandom.com

Learning to read the market, is, pretty much exactly like this parable.

-

Actually, none of this is about bull or bear candles, guessing, or predicting. It's about observing the behavior of price. While the kinds of exercises you suggest might be useful with some other approach, in this approach they would be several steps backward.Keep it simple.

Db

Well, predicting isn't the correct word really (I don't have a "correct" word actually)... and I know Wykoff is more price fluidity than price compartmentalization and these drills do not adhere to the spirit of his approach, but I do think that if someone is feeling completely overwhelmed with what to look for that such "specific, quantifiable" activities such as this does help develop an elementary sense of market flow. I do see what your saying though DB regarding it possibly being counterproductive for a more qualitative approach as Wyckoff's....

so that leads me to the point that the poster I addressed was at... Other than just simply sitting and watching price to develop a feel for it over a period of time... is there any task or "homework assignment" that one could do to feel as though there is a specific focus for their time...

I know immersion is the best way to learn a language, and this in many ways, is like a language...however, there are also "tutorials" and such that can facilitate learning the language other than immersion... but is there such a thing that would adhere to the wyckoff methodology?

-

I am currently facing a problem. I am in the middle of the chicken and the egg paradox. I am formulating hypothesis, as a result of the discussions we´ve been having here in the forum and in the chatroom. I was even going to start today testing a year of hinges BOs, but then I realized something was missing.I went to the beginning of the Journal Thread, but I could not find it, so I look everywhere, and I think I found it in the trading in 90 min.

Now, I understand that following the scientific method, one must first Observe in order to formulate the first hypothesis. By defining a pattern for entries, I was forcing my mind again (have been handicapped from my systematic trading experience :crap:)) to look for the patterns I wanted to see instead of the patterns that are there.

Then I realized that I had to do exactly what Db said, I had to familiarize myself with the ebb and flow of the market and try to identify buying and selling pressure. Here is where I would need some group support, because after staring for 1 hour (I know I need much more time), I came to the realization that I did not know WTF (Not the Setup) was I looking for. Maybe is that I am way too moronic for this or maybe I am missing something, that is why I wanted to ask the more experienced W traders if they have any suggestions about the issue of screen time.

Am I supposed to start identifying patterns in the movement of price after I do this for weeks, am I supposed to look at a tick chart. I don't know, any help here would be appreciated.

Ya know, I'm not DB, nor do I adhere to his particular trading methodology (though I'm familiar with wyckoff, and know that his concepts are a viable, profitable paradigm from which to see the market through...) But I wanted to jump in here because I think I have a suggestion that may help you... REALLY help you, to acheive what your trying to do (which is the ability to recognize viable opportunities in the market that you can profit from)

There are two parts to this "trading drill"

Part 1: "What comes next?"

For "what comes next?", all you need is a daily chart that allows you to scroll one candle forward at a time. (any TF is ok, but daily is best to start with). You will also want at least 1-2 years of historical data if using a daily chart.

Start by putting about 120 daily candles on your screen (about 5 months worth)

Then, look at the price action as it appears on your screen... and make a guess as to what candle comes next? It is easiest to narrow down your options to 3 possible choices.

1. Bull candle

2. Bear Candle

3. Pass (too difficult to determine which is more likely, bullish or bearish. Or just don't know, etc)

So, once you have your guess, WRITE IT DOWN. Then, move your screen forward by only 1 candle. Were you correct in your guess? Great! Put a star next to the guess you wrote down to let yourself know that you took a guess, and it was correct.

Now, if your guess was incorrect, circle it so you know that you took a guess, and got it wrong.

If you choose "pass" then just move on to the next candle, and try to guess again.

The object of this game is to develop your eye for price action, so that you will be able to accurately guess if the next candle is bullish, or bearish, well more than 50% of the time. I personally can do get about 70%+ when I play this game using daily candles, but of course I also "pass" many times, and only guess when I am very confident that I know what comes next.

The NEXT game is "pick a level, any level"

The way to play "pick a level, any level" is to look at a chart (probably a 1 hr or smaller TF is best for this drill)... and then draw in a S/R level that you see. (horizontal lines only for now.)

THEN... write down what you think price will do when it gets to that line. Will it instantly reverse? Will it stall for 6 candles, and then reverse? Will it stall for a little bit, then either fall fast, or slowly push through that line?

Then... watch price as it approaches this line. If it does anything to make you think it will react different than you first thought... well, go ahead and add a new note saying this... and also say why you now changed your mind.

Try to do this at least twice a day, for several weeks. Believe it or not, within 2-6 weeks, you will find that you can "predict" with greater accuracy every week what price will do when it hits your horizontal line that you drew.

Try to do both of these drills each day. WIthin 2 -6 weeks, you will start to see exactly what you will need to in order to become a skilled price action trader.

Hope this helps!

FTX

-

Actually, it's a great question. Knowing market mechanics on an "atomic" level is a prerequisite to understanding orderflow, supply/demand imbalances, mean revision, short/long squeezes, and a whole host of other incredibly important concepts.

And of course, most people don't knoow any of it.

Anyway...there are bids, and there are offers. Lets say said large institution hits a "market order" (as opposed to a limit order)... to buy 100 lots of EUR/USD.

Lets say the last traded price was 1.3000

Now, lets say right now, there are only 2 lots available on the offer (the selling side) at 1.3000. Then, there are 18 lots currently available on the offer at 1.3001. Then, there are 40 lots currently available on the offer at 1.3002, and there are 200 lots available on the offer at 1.3003.

Here's how it works. His 100 lot bid at market (buy order) hits the currency exchange, and he gets filled on 2 of those 100 at price 1.3000. Then, since there are no more available on the offer at that price, his order continues to fill, but jumps up to the next price point, which is 1.3001. There, he gets 18 additional lots filled. So, he now has 20 out of 100... but there are no more on the offer (for sale) at 1.3001. So, his order continues to fill, but at the next highest price of 1.3002. At this price, there are 40 lots available on the offer. So, he fills an additional 40 lots at the 1.3002 price... bringing his filled amount to 60 lots. He has 40 more to go. Now, his order jumps up to the next price point of 1.3003...where there are 200 lots available on the offer.

So, he gets his final 40 lots filled at 1.3003. When he is done, there are still 160 lots available to anyone in the world who wants to pay the asking price of 1.3003.

Breakdown of his price:

2 lots @ 1.3000

18 lots @ 1.3001

40 lots @ 1.3002

40 lots @1.3003

TOTAL: 100 lots at an average fill price price of 1.300218

By executing this 100 lot order at market, the big player also was responsible for pushing price from 1.3000 up 3 pips, to 1.3003

Get it? Lemme know if u don't.

FTX

-

Excellent points…

I take them even further.

The really thriving traders I know are ‘rule makers’ not ‘rule followers’. They are not AND NEVER HAVE BEEN good candidates for ‘trading education’… am pretty sure this fits into Tharpe’s profile / test (and stats) … but don’t know exactly how

Ya Zdo... agreed man. I do better in terms of risk adjusted ROI as well as just straight ROI than most professional traders from what little anecdotal information I've come across (though some do MUCH better than me of course) I'm probably about 60% "rule maker", and 38% "rule breaker"... and about 2% "rule follower".

my current trading plan is 1 page, and has 2 rules on it. I don't have a method, or system, or a "setup". I take a very comprehensive and organic approach to my trading. It usually starts with me opening up a daily chart, and scanning about 30 markets to see what markets look like they might be setting up for a good opportunity. This could be recent candlestick patterns, but it could be an overextended move, a broken trendline, a very significant area of S/R, a retest that will complete a "market symmetry" pattern, or even something else, like a stellar "market profile" level, etc.

I make a few notes about what i'm seeing, and in which markets. Then, I start combing through correlated markets, weighted baskets of currencies, world equity markets, bond markets, COT data, etc, and try to use these things to isolate the best 2 or 3 opportunities from those that I picked out of the charts.

Once I feel I've got a good idea of where the flow of money in the world is trending, and what (if any) catalysts could change or alter this, I am almost ready to trade. The next thing I do is I match the story in my head to the market that I'm trading. After all is said and done, I have to believe in my trade, otherwise, I'll second guess the shit out of it. So, if I can't find an acceptable story to fit into what I'm seeing, then I just don't trade it.

FInally, assuming I have completed all of this, I then look at S/R levels on every time frame, from 1 min to weekly charts, and I also watch price action as it comes into these levels on every TF, from 1 min to a daily chart. I also look at levels that I know are havens for institutional interest, primarily because of the quantity/type of orders that are likley to be at those prices.

If all this that i'm watching makes sense, then I do something. Usually a lot of something. I sometimes put on a single order, and walk away, but more often I take 5-10 entrries on each opportunity, as I try to pinpoint the bottom or top of a move by less than 10 pips. I take many very small losses, but even more decent sized gains.

price starts to stall? I close part out. Pulling back? I close part out. just made a 5 min reversal candle after it's pullback, and looks to continue the move? I put more on. etc.

Sometimes I close it all out minutes later. Sometimes... MONTHS later. (i've been short german 10 year bonds since June, as one example)

ANYWAY... the point of this whole monologue here is to give the readers here some perspective on what a :"rule maker" looks like as opposed to a "rule follower". I don't have setups, methods, systems, or criteria that I need to be met in order to trade. I just know how markets work, I then have ideas about direction, and I build a new "blueprint" each day to help me get the most out of the opportunity i'm currently looking at, for the least amount of risk.

and to concur with your second point... I absolutly have NO idea how I would teach this, other than as a collaborative, organic, intimate, conversation with someone who just loves to learn about the worlds capital markets.

So who taught me? I did. I have no idea how someone could possibly distill my approach to the markets down to a "paint by numbers" approach. I honestly don't think it's possible. It's like doing a step-by-step guide to: "theatrical improv ", or "jazz solos".. It' can't be done. I would have loved to come across someone that COULD have shown me what I know now... but, I would not have been able to get it from a "trading boot camp", that's for certain.

As far as the Tharpe Trader Test goes... I'm the "Strategic Trader". Makes sense right? And that's just the point. The funny thing about strategy, is the process is pretty much the same, but the situation and influencing factors are in constant flux.... Definately not a place for "rule followers", "holy grail setup mavins", or "forex bootcamp profiteers"

FTX

-

I not only agree with you 100%, but if you notice in all of the Market wizard traders who made millions, I dont recall one being a scalper. Maybe getting in and out on news or a special reason or event, but can one person on this board show me a scalper who made a fortune? Tell you what, show me a scalper, in stocks or futures who can even make 50k a year or more. In Forex its almost impossible due to the spread...which by the way Im making a prediction and you can say you heard it here from me first. I dint just come up with this today...or last month. Due to the fact that more and more Forex traders are seeing with their own eyes and wallets that they cant win scalping, the way that in equities we went from a fractionaL SYSTEM TO A POINT BASIS SYSTEM OF SPREADS, i PREDICT THE WHOLE FOREX INDUSTRY WILL TRY TO WOO SOME OF THE SCALPERS BACK,AND EVEN AWAY FROM EQUITIES BY HAVING NO SPREAD ON MAJOR PAIRS BE MORE THAN 1 PIP! wATCH, IT WILL HAPPEN WITHIN 3 YEARS. There may be requirements to get that spread such as 20 trades a day or more but it will be offered. I also suspect they may start letting us the retail trader buy in between the spread...the way it is supposed to be!!!!!Define "scalper"... ?

true scalping has long since gone the way of the algo HFT bot... because only they are fast enough to simultaniously have contracts on the bid and on the offer, and they have the speed to pull one side or the other (or both) should liquidity start to dry up...

so I'm not sure how you would define scalper... I daresay I am a successful "scalper"... but I don't limit my trades to small pips and time frames. I also hold trades for days... and for just the right trade, I'll hold it for months. But I average well over 30 round turn transactions per day, and my average hold time is a few hours, but I also have an average win size of about 21 pips, and and average losing trade size of about 17 pips...

If i'm really "scalping"... it's in futures, not spot, and there my average hold time is less than 30 minutes.

-

-

-

-

Best return on investment? Well... if your new to trading, and haven't traded with consistent profitability yet... I'd say the best return on your investment would be a money market account.

If you want to know the highest leveraged product, it's probably the 6E contract (EUR/USD futures contract). It trades at $12.50 per tick (100 ticks in a cent. Also commonly referred to as pips. A pip and a tick is basically the same thing).

I trade this contract myself 3-5 days a week.

But be forewarned.... unless you've had a good deal of experience and success trading already, your much better off opening a spot forex account with a broker like Oanda for $100 or $300, and trading the EUR/USD using oanda as your broker, because you can set your risk to any amount you want. For example, you can deposit $100... and on a 1 penny move (which is 100 pips.) you can set it so you only risk $0.02 per pip.

Of course, you could set it to risk more, but it's a good way to start out.

If you don't have a history of successful trading, and you insist on trading the 6E futures contract at $12.50 per tick... well, pretty much everyone has made the same mistake. And for the few of us still around to talk about it... we appreciate your contribution to our business.

FTX

-

Hey Cat... you should post some charts of your trades, with some information about why you took them, where your stops and targets were...etc...

this way, people (like me) can give feedback and tips on what you are missing, and what you did correctly...etc.

Short of finding and hiring/persuading a professional trader to privately mentor you, posting charts and the like is probably the best thing you could do to learn at this point, IMO.

FTX

-

Mechanically? i highly doubt it's this easy.... but I've found that there is an objective truth in most things...and in many others, there is a subjective interpretation or point of view.

So how to tell one from the other? Know thyself...

If a person knows their own strengths, and their own weaknesses, they can start to identify various areas of competence in which they do have a more complete picture of an objective reality... as well as identify various areas or situations in which that clarity and objectivity may become quite fuzzy.... Knowing ones weaknesses will NOT provide clarity to understand the objective truth. What it will do is provide a "warning sign" of sorts... if a person can recognize that they are in a situation that is very likely to bring their weaknesses into play, then they would be wise to acknowledge the situation or viewpoint they are about to engage in is something they likely do not understand, dispite how they may feel about it.

When a posture of humility is taken, it is much easier to gain a more complete view of a situation or concept, than it is if a posture of "mastery" and competence is taken. such stronger postures are fine and appropriate when dealing in areas of a persons strength... but not in their weaknesses.

Know Thyself. This is one way to find better, more "real" answers and insights.

Another way is to recognize that we are not our thoughts, or our ideas, or our experiences, or our emotions, etc... These things all contribute to our sense of self... "ego" in the purest sense of the word.

And it is such self definitions that ultimately become greatly self limiting.

If I tell myself that I'm sophisticated. That I am more financially astute than most, and that I've spent an immense amount of time learning how to be sophisticated and astute... I've literally created a very constricting sense of self that... in other words...goes something like:

"Your information can be dismissed, because you lack the sophistication that I have. I find that I listen to a few individuals whom I respect for their financial knowledge, but if I don't respect your financial knowledge, then I will pretty much dismiss everything and anything you say that has to do with financial information. I've also worked my ass off to get to where I am in terms of knowledge and experience, and my pride in my previous work often casts an elitist shadow that others don't appreciate, so I "turn off" many who may have better insights, but are not interested in sharing it with me because of my demenor and attitude."

this is an incredible oversimplification, but I think most will get the idea...

I make a deliberate effort these days to "prove" a new idea is flawed... In doing so, it keeps me from quickly dismissing something that sounds' flawed, but may in fact be flawless...or at very least, partially helpful.

I also sometimes tell myself that I am not my ideas. I am not my knowledge. I'm just a curious person who wants answers. And answers can come from anywhere, and everywhere.

:::shrug::::

To be candid, I don't struggle with this concept of "which idea best represents the reality?"...because I am constantly looking for new ideas to replace the ones I have. I take pride in that process of always trying to replace my current models of the markets... and in doing so, I never become bound or limited to a "favorite" way of looking at things, because no matter how effective or helpful or clever... I simply don't identify myself or my actions or my feelings with any particular view of the markets. This makes new information and points of view very easy to consider, since doing so does not threaten my ego, my self image, or my status in the world.

FTX

-

Well... it's shaping up to be a banner month. Of course, it could all change from this moment, and I could end up wishing I had called it a month about 6 trading days before the month was over...but, such is trading.

One thing I DO make sure of is whenever I have a double digit month (like this month, so far up over 10%)... I usually pick a number greater than half my monthly profit to "lock in", and that's the least I will finish the month with.

For example, today I decided to "lock in" 6% of my profits. This means my absolute max loss for the rest of the month cannot exceed about 4% from where I stand right now.

Truth is, I will now dial down my risk until the month is over on a day to day and trade to trade basis... I will probably accept no more than about 1.5% drawdown on open positions, and I'll set my max loss per day at about 2% for now.

If at any time my monthly profits drop to 6%, I will shut down my trading until the next month arrives.

Why do I do this? Because I can't express how psychologically demoralizing it is to have above average success in any given month, only to see most or all of it wiped out in the last few trading days of the month. This way, I know i'm virtually 100% guaranteed to finish this month with a minimum of a 6% profit... and that's a number I can live with without regrets, and with a good attitude towards trading in general.

Here's to protecting profits.

FTX

-

If somewhere in the world a market is moving... it's a good bet that I'm watching it. But, if I had to narrow it down, i'd say monday - thursday, the first couple hours of the europe open... and then if i'm feeling up to it, the U.S. session until london closesForexTraderX:What days of the week and what hours during the day are you trading Forex ?

Are there days of the week and certain hours that you consider to be the best times to trade Forex ?

Thank You

Henry1000

Yes. Every day except friday. Also, first 2-3 hours of europe session, and first 4 hours of U.S. session.

Watch A Typical Day Of A Real Day Trader

in Market News & Analysis

Posted

Presently, my only real considerations today are what price levels do I want to see in the EUR/USD, EUR/CAD, and USD/CAD...and possibly the GBP/USD, to justify putting more money at risk on a long trade (in any or all of those markets)

That's it. That's my only real consideration at this point, for this incoming london trading session.