Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

todds

-

Content Count

81 -

Joined

-

Last visited

Posts posted by todds

-

-

The question needs refining to be more relevant to most of the members of TL. I doubt if anyone here has Buffett-like money and some of us don't have 50 years to compound.

It seems to me that imbedded within the original question was the assumption that the trader's account size afforded him/her the choice of trading style. An account of $150 billion leaves but one choice. In addition, for a trader who is 60 years old, long term investing does not allow them many years left to enjoy their success.

With that, how about refining the question to something like: assuming competency, who makes more money over a 5 year (or 10 year) period starting with a $50,000 account, the scalper, the swing trader, or the investor?

-

for me the issue is the scalability will limit you.

Otherwise....who one scalper might make more than a swing trader for the same amount of money......until you change the amount of money.

this is really the essence isn't it?

A competent trader will make the most money by trading the smallest time frame that can accommodate their account size and time allocated to trading.

-

The short answer is absolutely yes.The default is 25-29fps (29 for NTSC and 25 for PAL). This is the same frame rate that your consumer camcorder (regular or HD) uses to record live video footage. I suppose you could increase the FPS if you really needed to....not sure what the maximum is. I think the default of 25-29 fps is PLENTY for any recording enthusiasts, unless you are doing some very specialized hollywood film or are trying to film lightning (1000fps to see the flash only (in slow motion), about 7000fps to see the lightning flash path from the sky to the ground, 100k+ fps for a meteorologist or ecologist to map an exact path at every turn.

Animation is usually done in 12 fps.

I've never paid attention too much except when I am looking live during a news annoucement or volatile period. I've seen several changes per second at times, but never counted. 10 frames per second would give you 1 snapshot every 100ms. 20 would be 1 snapshot every 50ms. 30 would be 1 every 33.3 ms, etc. You may get 12 ticks of the same price in 1 second, but the chart wouldn't move. It is only when a change in price occurs there is movement. But how often does current bid/ask price change in one second? Even for the eMinis.

If you are using a broker or private datafeed subscription (e.g. eSignal) that is giving you true tick-by-tick datafeed, and you want to guarantee that you can see each individual tick price information, The best thing might be if you want to track historical changes is to open a separate 1 tick chart, time/sales, tape window, and/or DoM for each symbol that you want to record and compare it to your other compression charts you normally use for the SAME symbol and verify during heavy trading that the recording is picking up all of the movements.

To put it in perspective, Interactive Brokers sends "compressed" or summary ticks every 200-400ms or so, not true tick-by-tick data. It's free, much less likely to crash their data servers, and takes much less hard drive space to store, similar 60000ms (1 min) bars;)

I mostly use it on forex, and the majority of retail brokers tend to throttle their tick data to bypass metatrader and client internet limitations, but it is unnoticeable to most traders.

I think some people got thrown off with the fps thing. It's just like recording your monitor with a camcorder, but without having to buy camcorder.

I'm not really consciously tracking every tick change, just trying get a feel for which side is more eager. Large trades can pass through the time and sales window in a fraction of a second during active periods. I believe the subconscious can pick this up. In any case, I think the speed of recording you are talking about is fine for what I want.

Great information, thank you so much. Really helps!

-

you are referring to the PLAYBACK of the recording. Not the recording itself, which will be 12-29 fps. Depending on the codec you use (BSR uses Xvid by default which is universal), you use vlc player which you can adjust the playback speed of the video clip.Also, if you want to actually produce your own videos, you import the video into the production suite (Movie Lab, Camtasia Studio, etc) and you can speed up or slow down the video that way. This is more advanced and not necessary unless you are doing tutorials or how-to videos.

You are correct, I am referring to playback slow motion.

Will the recording speed of 12-29fps capture all of the time and sales data crossing the screen and changes on the DOM that you would see in real time? If not it wouldn't be worth doing.

Thanks for your feedback.

-

Interesting thread. I've been getting into tape reading the time and sales window and the DOM and was looking for a screen recorder that could capture a full session (7 hours) with the capability of slow motion replay. Most important is the slow motion replay. Do any of the products mentioned do slow motion? It's not always apparent from the product descriptions.

-

Interesting study...and the answer is...I lose a lot more money when I don't manage.

-

well, feel free to drop me a line on skype folks... so far, only had 3 people contact me since starting this thread, and one other person post up on the main thread here.I really only care to do this if there is some interaction. ask questions, or spit some ideas of your own out. lets discuss or debate theory, whatever. It's more fun that way. Really! (at least I hope so!)

ForexTraderX, I commend you for what you are doing and I am interested in what you have to say. I day trade some of the same instruments (CL, GC, NQ). However, I find it hard to follow your thread due to the large number of posts and sheer volume of commentary. Perhaps you would get more interaction if you posted less often, showing annotated charts that explained reasons for entry and exits (see Thalestrader's posts on Reading Charts in Real Time thread). Perhaps these could be end-of-day summaries. Forums like this do not lend themselves well to real time trading in the short term. The live chat room could be reserved for the real time commentary.

Just food for thought. Again, thanks for making the effort.

-

My trading success improved dramatically when I decided to take profits at 2 times risk on nearly all of my trades. The only time I veer from this is if price moves with dramatic momentum in my favor. Then I will trail closely until stopped.

Yes, I miss out on some good runs, but it doesn't matter. With this philosophy I can be successful only 50% of the time and end up well ahead.

-

I think a more interesting stat would be something like: what percentage of traders are successful who have put in at least 3-5 years of concentrated full time effort? Or, a graph that compares success rate against time spent in concentrated full time effort.

In either case it doesn't mean much personally. As someone said in an earlier post, to the determined individual, stats about the masses are irrelevant. A few are going to do what it takes to make it and the rest are not.

-

Who is "they"? Seems to me it's the same guy over and over again.You are correct that the people specifically introducing the legislation are the same, namely DeFazio and Harkin. But there is a growing chorus of influential individuals joining them calling for a worldwide FTT: Sarkozy of France, Merkel of Germany, and Bill Gates to name a few. Thankfully some do "get it" like Cameron of the UK and even perhaps Obama at this time (though I wonder how his feelings would change in a second term when there is no longer anything to lose). However, if the economy worsens and there is more civil unrest there will be a need for a "villain du jour" as you put it. In spite of how stupid and destructive such a tax would be, politicians are fully capable of such stupidity and destruction. It would behoove all of us, especially those participants on a trading website, to pay attention and spread the word lest the ball get rolling a bit too fast to stop.

-

If I am reading the bill just introduced (HR3313) correctly, and it passes, it will effectively end day trading futures and other instruments. The bill calls for a .03% tax on the underlying specified base amount for the instrument.

This would mean $10,000 worth of stock would be taxed $3 in addition to current commissions and fees. What is now a $9.99 transaction will be $12.99.

For ES which is currently trading at around 1250, the base amount would be 1250 X $50 per contract = $62,500. The tax would be $62,500 X .03% or $18.75 per side and $37.5 round trip. Add that to the current $5 per round trip and you get $42.50 per round trip.

I am not sure how many day trading models can handle $42.50/contract in transaction costs.

Peter DeFazio (D) Oregon has openly said he wants to eliminate day trading, claiming it is a useless and destructive endeavor. This would do it.

I hope I am interpreting this wrong. Please someone tell me I am!

In all likelihood it will not pass with a Republican House but this is the third time a bill like this has been introduced. They will keep hammering away until they get it.

-

And it's just my belief that trading, or sports, or business is 90% mental. Granted, you still need that other 10%, but if you look at any great sports figure they will tell you how they mentally rehearse and practice in their mind.Tim, I have heard this statement in various forms in trading and sports. When you or others say "mental" or "psychological" what specifically are you referring to? Are you referring to more broad definitions to include things like perseverance and determination, or is it more specific like a traders ability to follow their trading plan or a quarterback's ability to read a defense?

-

I've always seen a huge downside to protesting. The protests can get people's attention, and create a movement, but it should be possible to get people's attention and create a movement without the protest. It should be possible, . . . . maybe it isn't?So what's the answer? How does the general population get the government motivated to make good changes?

I have no problem with peaceful protest and many times it can be quite effective. Whatever one thinks about the Tea Party protests their effects were profound in the last election. But, there are protests for good causes and protests for not so good causes, so one has to look at what the protestors are protesting about and what they want. Funny enough, the Tea Party protests and the Wall Street Protests are kindred spirits in a way. Both know that something has gone seriously wrong with the system. However, they seem to have completely opposite remedies. The Tea Party essentially said government is too big and has too much influence, reduce it. Occupy Wall Street, though having no coherent message, seems to be made up of people who would expand the size and scope of government. So, depending on one's beliefs, one protest is for a good cause and one protest is for a not so good cause.

-

This kind of behavior infuriates me .. I am praying these demonstrations cause REAL change. I will be going to NYC on business in two weeks and will join for a day.MMS

MMS, it will be interesting to hear your report to find out if you still believe this movement will result in real benefit after seeing it up close. I am not so optimistic.

Someone got up in front of a crowd at Occupy LA, the west coast's version of Occupy Wall Street, and asked the question to the crowd: "Capitalism, thumbs up or thumbs down?" Most in the crowd responded with thumbs down. They seemed to be comprised of mostly anti-capitalists, pro-big government advocates, and various no-nothing ignoramuses.

I certainly do not believe that the banks and Wall Street are angels, and targeted reasonable regulation is necessary, but I would be a little more inclined to look favorably on the protestors if they moved their operation 230 miles down the road to Washington, D.C. where the real genesis of the bubble and subsequent burst occurred.

-

Yesterday I said this:

...Ignorant, French Revolution-like mobs like those on Wall Street will call for metaphorical heads to roll...Today I saw this:

Roseanne Barr: Behead Bankers, Rich Who Won't Give Up Wealth | RealClearPolitics

I didn't figure Madame Defarge would rear her ugly head so fast. I hope she was kidding.

-

As traders we should be very concerned about the protests happening on Wall Street. Many of those people have no idea what they are protesting against or how the changes they want will effect society. They know nothing about markets and nothing about how to "fix" our economic problems. They wont just be satisfied with slight adjustments to Wall Street, they want it shut down. If they got what they wanted, everyone on this site would be devastated. It would either mean the end of trading or much more expensive trading due to things like transaction taxes.

Thankfully the protests are still small and ineffective. As the economy worsens, and it will, these protests will gain momentum. They will blame everything on the Wall Street "fats cats" and their remedies will involve heavily regulating, or worse, dismantling the free market. As history has shown these remedies will not work.

As traders, we should know better. We understand that markets go up and markets go down. We understand that the market is fractal. There are infinite time frames for this up and down movement. Zoom out on your chart and look at the Dow over the past 100 years. The greatest impulse move in history created by the greatest credit expansion in history fueled by the greatest population bubble in history (the baby boomers) is going to be followed by the greatest correction in history. There is not a damned thing any politician or protester can do about it. The markets are returning to their trend lines after an historic move away. Unfortunately this correction will be painful. Ignorant, French Revolution-like mobs like those on Wall Street will call for metaphorical heads to roll. Those heads will include everyone who trades for a living, like you and me.

In my opinion these times are the most perilous in my lifetime for traders and for the free markets. Don't let the idealists on Wall Street fool you.

-

UPDATE: Full profit! I needed that.

I needed that.Good job holding through those pullbacks. What made you hang in there this time?

-

I really don't know what to do to keep myself from focusing on the money and letting my emotions get out of control. I basically sit down to trade with a knot in my chest these days. It's unpleasant. And that's a shame because there was a time when I found trading enjoyable/fun.My problem is not my fear of losing money itself, it's about losing my profits (and a pressure I feel to add to those profits). When I started a few weeks ago, I started with about $1k in my account...I didn't really care about losing that. I could trade as though I had nothing to lose and so my emotions stayed under control. It's the $150 of profit that I have that I seem to be scared to death of losing....so it's not purely about money, it's more about performance/profits.

I really don't know what to do. Any thoughts??

I know exactly what you are going through. I primarily trade another method that I don't post here because it's too fast. I'm also in the profit protect mode at this time.

Until we achieve a level of mastery profits are hard to come by. Losses are easy. I have decided to give myself permission to trade with fear, screw up trades, get out too early, etc and just focus on picking good entries and slowly (and I mean slowly!) build the account. Today for example I got out of oil with 16 ticks when I could have easily held for 60 ticks over the next few minutes. That's ok. I know that if I keep picking good entries I will eventually get to the point where the profits are large enough to give me a little breathing room. My guess is that $150 profit is not enough breathing room for you yet. Maybe it's $500 or $1,000. You'll know when you get there. The first profits will be the hardest to come by. Until that point I am trying to treat fear as a natural and in some ways healthy thing. Fear has kept me in the game to this point. Without it I would have wiped out a long time ago. Once we achieve a level of consistent mastery the fear will diminish as we notice the account going up more than it is going down.

The knots you feel in your stomach are the same ones that any young athlete feels before the big game. With time and consistent success they'll go away.

-

-

-

Somewhat of a shouldawouldacoulda short on the USD/JPY...I actually wasn't even around my computer to see this one setting up. I really need to get myself straight and come back tomorrow morning fresh with a better attitude/mindset. I think I've gotten a little bit derailed emotionally! So silly, I know.

However, I would have been hesitant to take this trade in real-time because it's such a small swing. From the blue line to the red line is only 8.3 ticks...with a typical FXCM spread of 2.4 ticks, that would mean a total "risk zone" of 12.7 ticks (it's actually 13.1 ticks on my FXCM chart), 35% of which is just the spread and a tick on either side! On my ninja chart, it looks like price has passed +3R, but in reality, maximum favorable excursion is only about 1.75R at this point... With futures, it might not have been so bad.

I think I'm calling it a day...

I saw that one in hindsight as well and was trying to figure out for future reference what features gave clues as to why that one worked out well. Obviously the fact that it reversed near a swing high resistance level played a role, but I haven't been very successful with some of those types of trades lately. Do you see anything else?

-

-

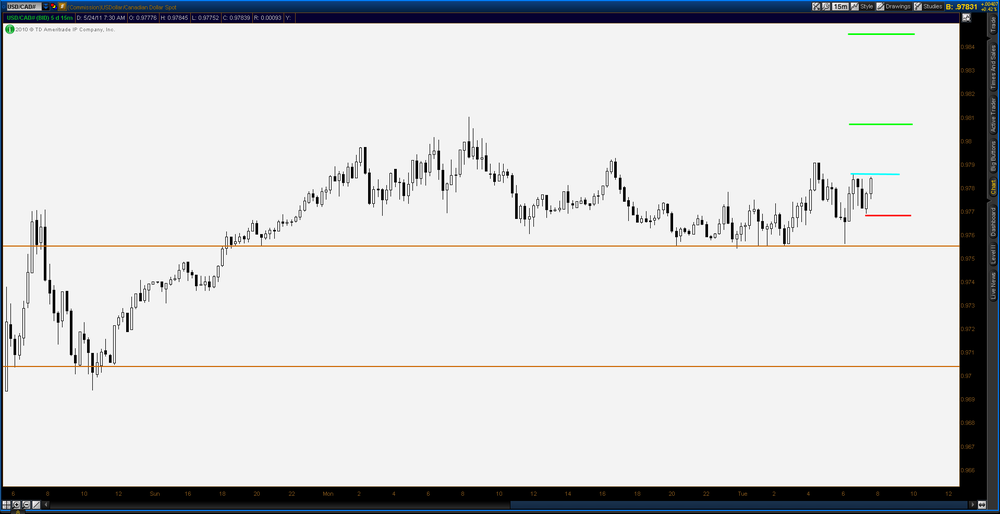

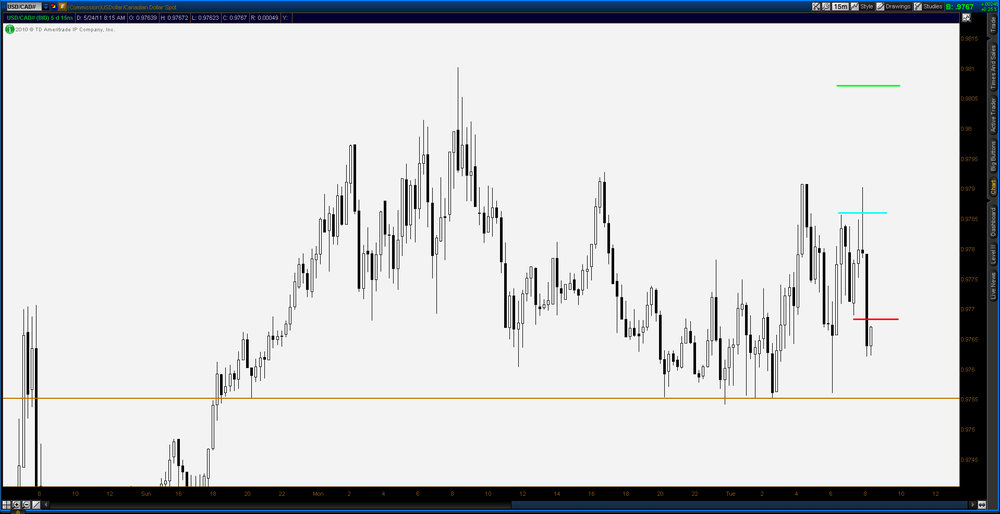

Looking at this USD/CAD Long. I like the hammer candle coming off support

Update: stopped at ISL. -1R.

Admittedly this is getting a bit tiresome. It has been a while since I took a trade that moved any manageable distance. Obviously my picker is broken right now. Not sure what it is. Each trade has a reason for entry but the things I am looking at are not what the market cares about apparently.

-

Think or Swim $Ticks

in Technical Analysis

Posted

I assume you are talking about $tick? Thank you for bringing this up! I was lamenting the fact that I couldn't get $tick with my Zen Fire data through my broker and completely forgot that I could get it with TOS. Thanks for the reminder.

$tick is not an indicator in TOS. You need to open a separate chart and enter $tick the same as you would a stock or futures symbol.