Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

todds

-

Content Count

81 -

Joined

-

Last visited

Posts posted by todds

-

-

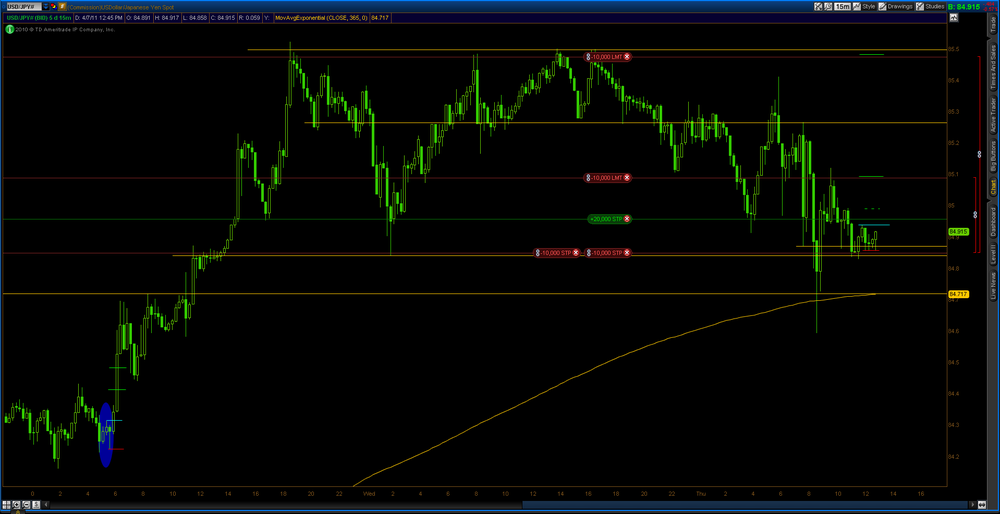

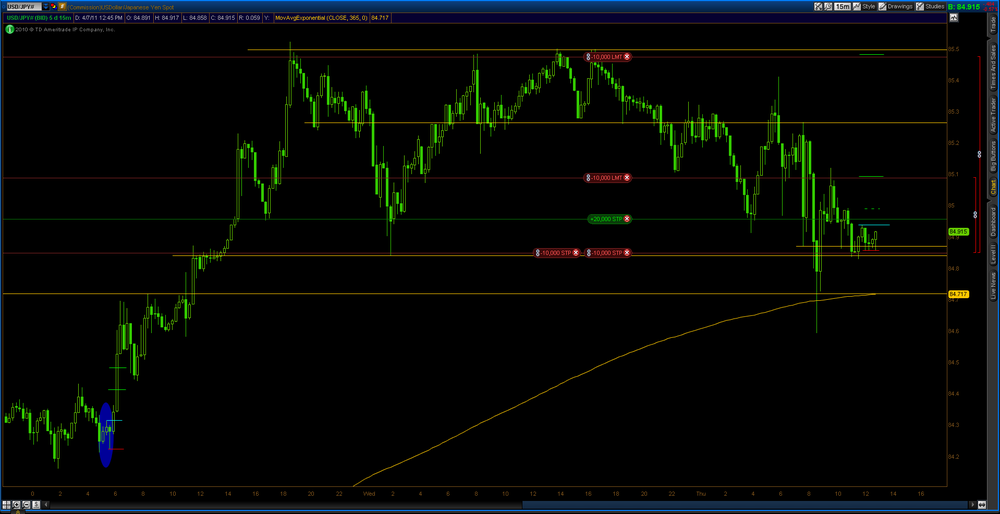

Looking at this USD/JPY long.I like that it is bouncing off support but don't like the time of day. If it chops around too much longer before breaking out I'll cancel until the Japan open.

Took partial profits when it dove back through the big round number of 85.00 and the rest under the breakout swing. This was a BE trade. It had promise for a while though.

-

-

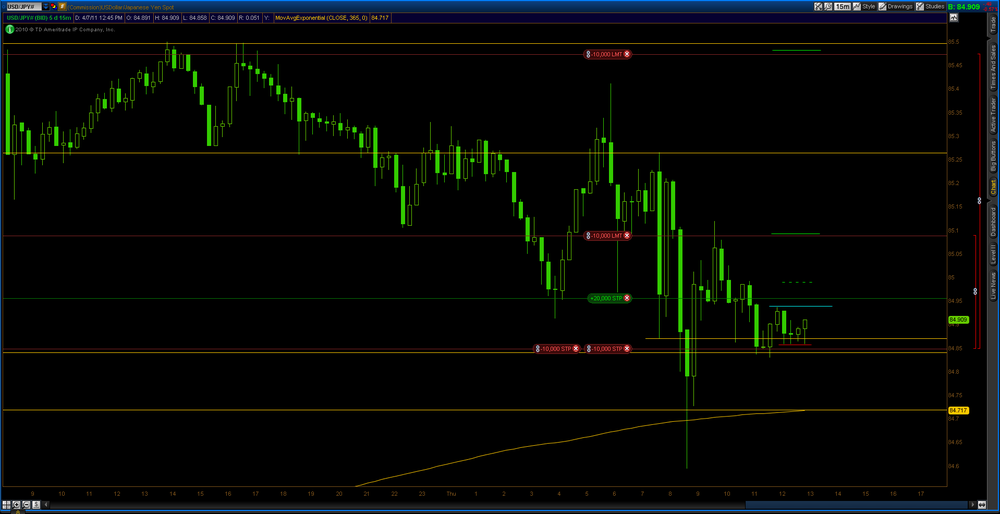

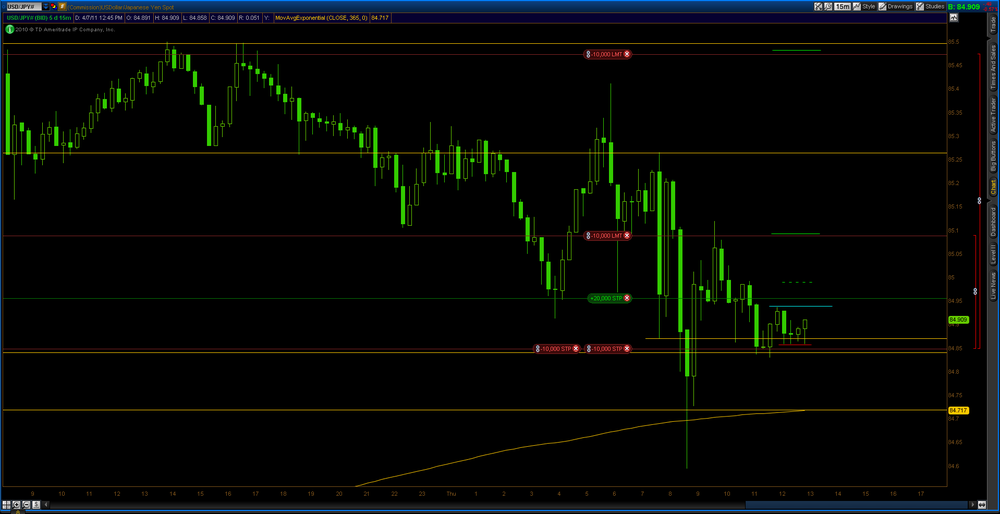

Mystic, my entry is the blue line, stop is the red line and TP's are the green lines. I caught my first TP then it retraced the entire move on the next bar and stopped me out for a BE trade. See updated post above for the entire trade. Brutal!Just as a follow up to the NZD/USD short the attached chart shows how frustrating trading can be.

See the stop out by just pips (blue circle) before returning to hit 2nd profit target. In a previous life I would have been furious, but it has happened so many times I am learning to just take it as part of the game.

Next!

-

Todds,Looks very inticing to me. what TP are you seeing?

I like the Weekly Pivot, as yet not hit, or , the 800 SMA about 12 pips above the weekly pivot. So far south you can't see either on the 15M chart.

What do you use for entry?

Mystic, my entry is the blue line, stop is the red line and TP's are the green lines. I caught my first TP then it retraced the entire move on the next bar and stopped me out for a BE trade. See updated post above for the entire trade. Brutal!

-

-

-

stop to BE. It's a slow mover but what you might expect for a retracement. Getting 1st PT would be nice.The 2nd PT is probably a little ambitious. It will likely need a big retracement before it gets there and I don't want to go through that. Took 1st PT and will trail stop for as long as she'll let me.

-

-

I like the story behind this one:5 waves completed

Bouncing off of a Support zone

Ultimate target is retracement back to previous 4th and 50% fib area

Good story, unhappy ending. I bailed at -0.5R when the price action signaled a reversal on lower time frames. It still might work but I am taking Thales' cue to get out with minor losses when price doesn't behave as expected. Next!

-

-

Indeed! A nimble trader should have been able to catch that long at the support...Yes, I have been kicking myself all morning for missing that one!

-

-

Here's a short that looks interesting in GBP/USD. I am just watching this one but I like the big down move preceding the correction. I would have preferred to see the shooting star candle in the blue circle nearer the top of the correction.Even though I didn't take it it's nice to know they work sometimes. 1st PT, stop at BE

-

-

Hi todds,I much prefer currency futures to spot fx...I hope to get back to futures someday. But, for now, to trade the small size I prefer, I'm stuck with forex dealers.

Make sure you know what is being plotted on the chart...the bid price, ask price, average of the two, etc. That's important when considering where to put your orders. If, for example, it's simply plotting the bid (which would be my guess), when you place orders above where price currently is, you'll need to take the bid price and add the spread +1 tick (or something along those lines).

Make sure you're aware of how your broker handles news and spread spikes. Oanda, for example, will spike the spread insanely (10-20 pips on major pairs!) for several moments during relatively insignificant news reports throughout the day.

If you genuinely believe that your broker is doing something fishy, you can always switch.

I'm currently with FXCM Micro. They're not necessarily the best (they could be, who knows), but I made the decision a little while back to quit broker-hopping and just focus on trading...it was a distraction. FXCM Micro is okay...the spreads used to be good but now they're not that great. They used to offer contingent OCO orders, but now they don't. At any rate, relative to other brokers, I don't have any major complaints. I've never experienced anything fishy either live or demo...and the demo has become more realistic in recent months now that it allows slippage (that's another thing...live or demo, one used to get virtually no slippage with FXCM Micro...no longer the case). If you want a demo account, you have to get a standard FXCM demo...FXCM Micro no longer has a demo (it's the same thing though, just a bigger balance and lot size). Typing all this makes me really miss the old FXCM Micro. haha. You don't know what you have until it's gone!

If I ever work up to a little size, I'd like to move to Interactive Brokers ECN forex...

Thanks for the compliment, but you give me too much credit...really. I have some good streaks but I usually get derailed. haha. I'm lacking real consistency. I've got issues.

That being the case, I really don't feel comfortable critiquing anyone else's trades...I fear I could do more harm than good.

That being the case, I really don't feel comfortable critiquing anyone else's trades...I fear I could do more harm than good. I'm hoping to increase my posting here over the next couple weeks...no guarantee, though.

Cory

Cory, thanks for taking the time to respond. I am starting to get how this thing works. I don't think my broker is doing anything funny, and they are an ECN, it's just a matter of getting used to how forex works. It's a little different than futures. Your suggestions have helped.

Reading through all 500+ pages of the thread was interesting because I was able to see how everything progressed. People come and go. You should look back on your early posts and compare to now. Your trades now look very much like those that Thales would take. I think it is just a matter of being extremely picky about which trades you take and which you pass on. I am learning that once one gets the general concepts about the entries, being ultra picky and only taking the ones that scream to be taken is the difference. The charts I posted recently have not been ultra picky but I just wanted to get something on the board. I am still working on this part of trading.

I hope this thread picks up again with the veterans. I was disappointed to see that it had slowed down after I got caught up, but certainly understand that people need a break. I do very much appreciate what Thales and everyone have contributed. They really could charge for this stuff. It has given me a whole new perspective on trading and led to other discoveries about price action.

Happy trading

Todd

-

Cory, I am somewhat new to Forex. I have been trading futures for the past two years. The fills and spreads in futures are very tight and consistent. With forex I have gotten a lot of weird fills both with live trades and sim trades. The attached chart is an example. It was in sim so it may not reflect what would have actually happened. My stop was way down there. I am not sure if this is my broker or if it is the way forex is. I recall reading about this type of thing somewhere in this thread.

What has been your experience? Who is you broker and do you like them?

By the way, I have read through the entire thread and followed your progress. Your entries have gotten very good over time. Feel free to critique my trades anytime. It would be an honor!

-

-

-

-

-

-

-

Interesting comments Ingot54. I had lunch with Jan Arps (Idiot's Guide to Technical Analysis) last week. He was born into a family where he was being taught TA from early on. He hand drew the charts that his father was following. He was taught from a very young age to become a manager of risk and uncertainty. It never occurred to him to glue fear and worry onto uncertainty. In many ways, he is a very fortunate man. He loves trading and has made a good business out of selling TA indicators to traders (Trader's Toolbox).Most of us are born into a world where risk, uncertainty, worry, and fear are associated with one another -- a very different world than Jan Arps. The brain organizes the developing self around the avoidance of threat and trading exposes this association of risk, uncertainty, worry, and fear (now embedded in the neuro-circuitry of perception).

Once it is exposed, what are you going to do about it? I know people who push through it like a bull and, end the end, re-build what historical adaptation dealt to them. I know people keep running into the same brick walls over and over again. At some moment, a person has to choose how they will take the bull by the horns and change their perceptual map that they produce effective living (and trading).

Staying blind to possibility shuts us off from developing our God-given gifts. Changing perception at the level of flesh is challenging. Ask any dieter or trader. You choose your tools and your path. It's your journey. I am fortunate that I have found good teachers and was willing to listen to them. And, yes, it did cost me money. But not seeking out teachers cost me time and money. The choice is always yours.

Rande Howell

Rande, was Jan's father a successful trader? I'm curious if he was taught at an early age a reliable way of looking at the markets from someone who knew what he was doing, thus avoiding the long process of discovery most of us who do not know such a person have to go through just to get the requisite skills necessary for any chance of success.

-

[Yes, no doubt. That would be a game ender but I took it as a given that we were employing a legitimate trade size for each coin toss. e.g. no more than 2% of capital.

That's why I didn't say that size was 'irrelevant' but just 'not as relevant' as you think.

But your answer does raise the following questions:

Is it the wiping out of the account that typically prevents the trader from taking just 3 or 4 consecutive losses in the market if he's only risking 2% max?

If not, is it because of some deep-rooted, psychological issue?

If so, then why is he not affected by this issue on the 3rd or 4th losing coin toss with the same level of paralysing fear? If it isn't due to his confidence in the long-term profitability of the coin-toss, then what is it?

I assume we are talking here about a trader who has never tasted lasting success. For this trader uncertainty abounds, especially if his method is predominantly discretionary. "Does my system still work? Have market conditions invalidated it? Have circumstances in my life altered my judgment? Did I simply get lucky during my testing period?" If 2% represents a dollar figure that the trader finds painful, then losing 3 or 4 in a row will be difficult to handle no matter how much he intellectualizes the expectations of his method.

I would agree that if a trader were given the opportunity to trade something as certain and unchanging as a coin toss with a 2/1 payout ratio for winners to losers and still couldn't pull the trigger then they might have some serious psychological issues. That begs the following question:

What if the person tossing the coin was a stranger and the trader never had a chance to examine the coin. How many 2% losers in a row would the trader be able to endure before he began to question the "system"?

[How many traders have you ever heard of who blew their accounts because they took small, consecutive losses? I don't know of any but I do know some who emptied their accounts on just one trade.

I don't know enough traders to answer your question but I bet there are a lot of traders who did serious damage to their accounts, and thus felt a lot of pain, through a hundred tiny cuts trading flawed methods.

[I completely agree that the golf instructor doesn't have to be a Champion himself. That qualification has never been a pre-requisite for me. No, my concern is with the golf instructor who:

1. Has never played golf and therefore, has no experience to bring with them.

2. Has no intention of playing golf.

3. Has no records of how many people have taken his golf course.

4. Has no records of how many have failed to improve as a result of his coaching and has no desire to find out.

Do you know of any champion golfers who have had such an instructor?

If a student who was serious about getting good chose an instructor with the above qualifications I would think there was more wrong with the student than the instructor.

4_6_201115min.thumb.jpg.dc14e056cc72e575957bce7e88746d2f.jpg)

4_6_201115min1stPTtrailingstop.thumb.jpg.72be07c0a738f60d4b7a314ac5d8e96c.jpg)

4_6_201115minfinal.thumb.jpg.1539f9b5591a651da27f37550ff6bdb7.jpg)

4_6_201115min1stPTtrailingstop.thumb.jpg.bf91707b8696f8f4fadde3fc382908fc.jpg)

4_6_201115min.thumb.jpg.5c0028872349b45ed9de238a5fd59440.jpg)

4_6_201115minstoptoBE.thumb.jpg.11125d4d8445cd76acc08272347e0814.jpg)

4_6_201115min.thumb.jpg.6dcff7ae5433d382afbd0ab7c2d49c75.jpg)

4_6_201115minFinal.thumb.jpg.6a77a7ea6b576e174a29020b72d6104e.jpg)

4_6_201115min.thumb.jpg.516029ecbff227b08184d97b2f65ad1c.jpg)

4_6_201115min.thumb.jpg.817306986d2ff7ddd7d39a7e8fcecfa2.jpg)

3_24_2011question.thumb.jpg.745ff893680d3ddb1bc22237e5060bd0.jpg)

3_24_2011.thumb.jpg.933ae969921bc51874a29be1ad360b40.jpg)

3_24_2011halfoffupdate.thumb.jpg.bb2c79f9099e188254c647241f2e6ba1.jpg)

3_24_2011final.thumb.jpg.5b8f523d5e845f4f46186667590a76c0.jpg)

3_24_2011.thumb.jpg.92a025cd8c4b678178c86457fc7c5b5d.jpg)

3_24_2011halfoffupdate.thumb.jpg.05fe32e4e152585a7222b6963740bf64.jpg)

3_24_2011.thumb.jpg.ebfb9a751a934abb688e84a97b88f97a.jpg)

3_24_2011onehalfoff.thumb.jpg.987000658e27d6df355a85c29ea0d577.jpg)

3_24_2011.thumb.jpg.673f3221301c2a99e080f3ee7783fdce.jpg)

3_24_2011final.jpg.6bcf7d159b3daf1c1c5a192df4760a88.jpg)

3_24_2011.thumb.jpg.63c408697b5d74315191c540a80b1291.jpg)

3_24_2011.thumb.jpg.30bd9b5d43dc8d847e194f114a82b227.jpg)

3_24_2011.thumb.jpg.293f487ee78b240ec76d034d6cd25432.jpg)

Reading Charts in Real Time

in General Trading

Posted

Yes, the quad top, followed by the big down bar and a lower high. It ultimately worked but it was very volatile and I barely got stopped out for a BE trade