Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

todds

-

Content Count

81 -

Joined

-

Last visited

Posts posted by todds

-

-

-

-

-

-

-

-

-

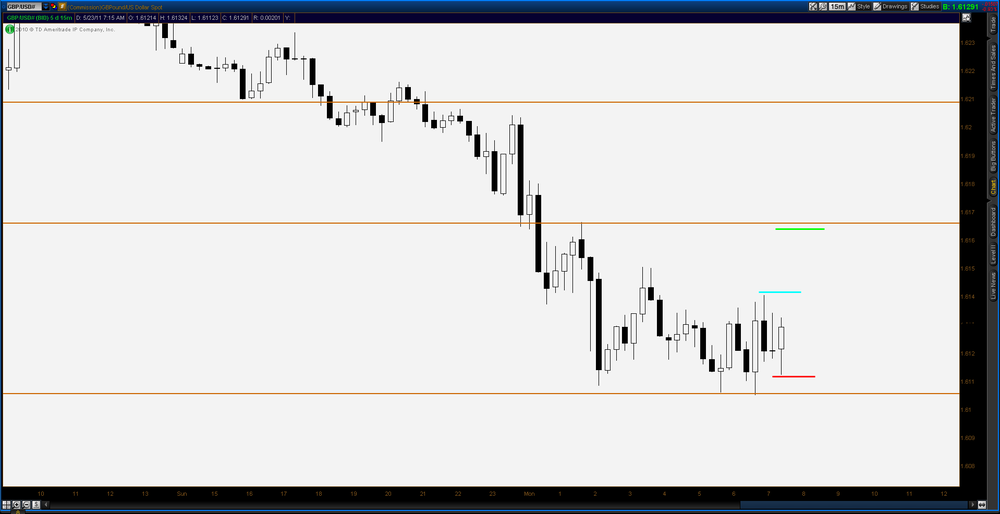

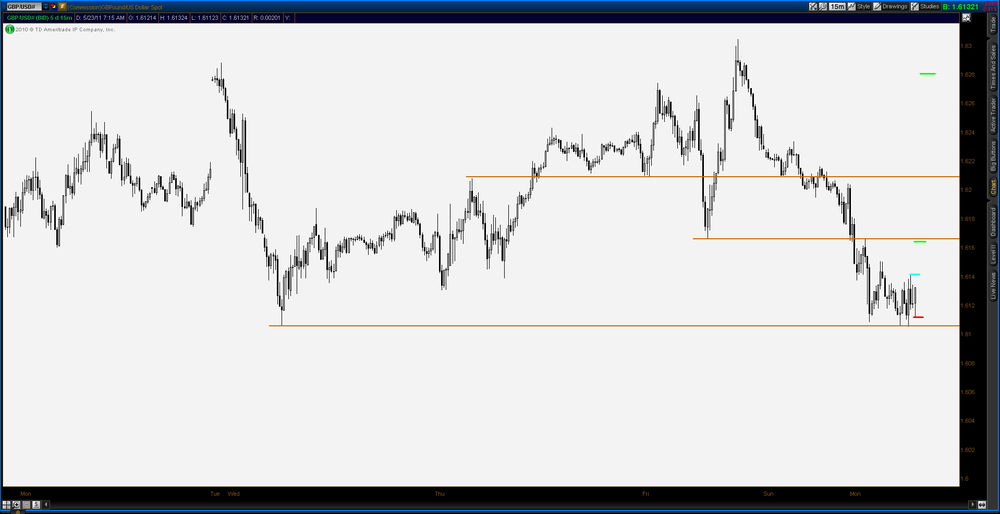

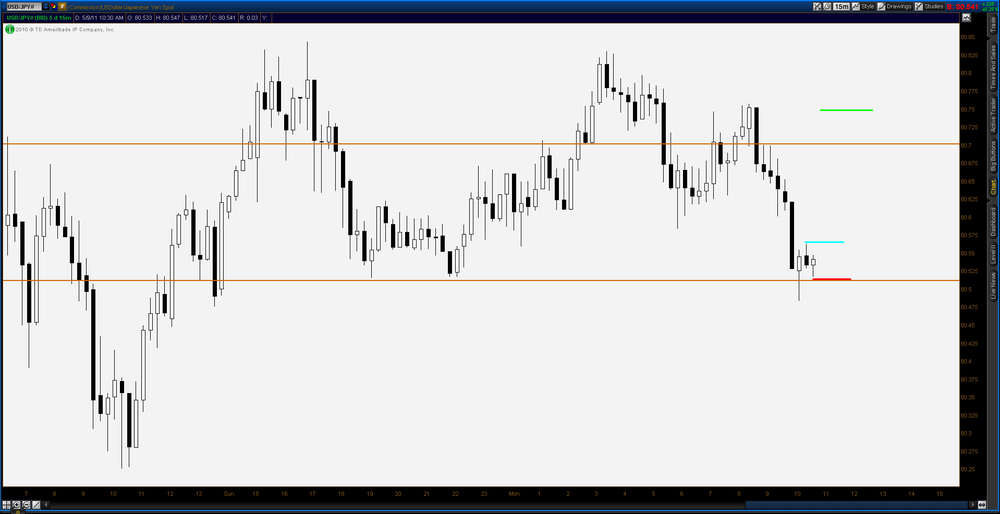

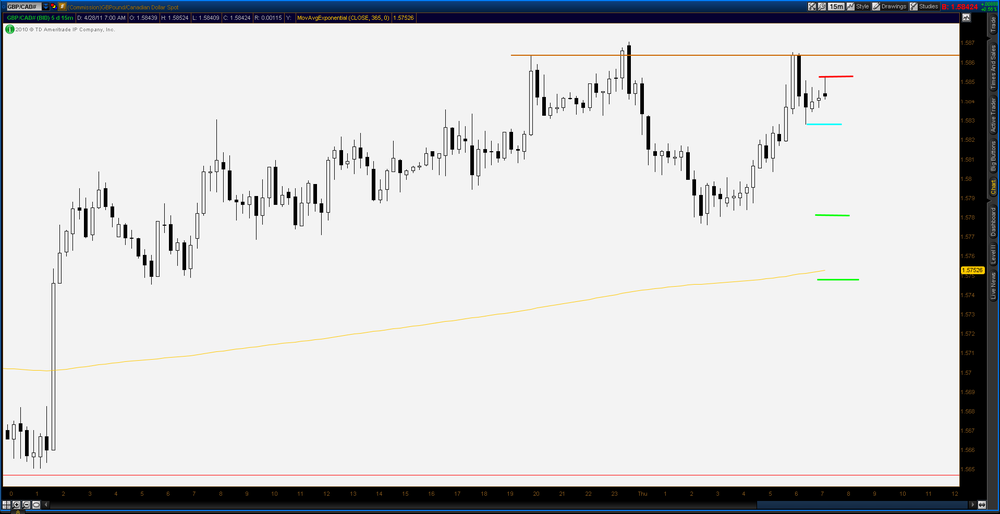

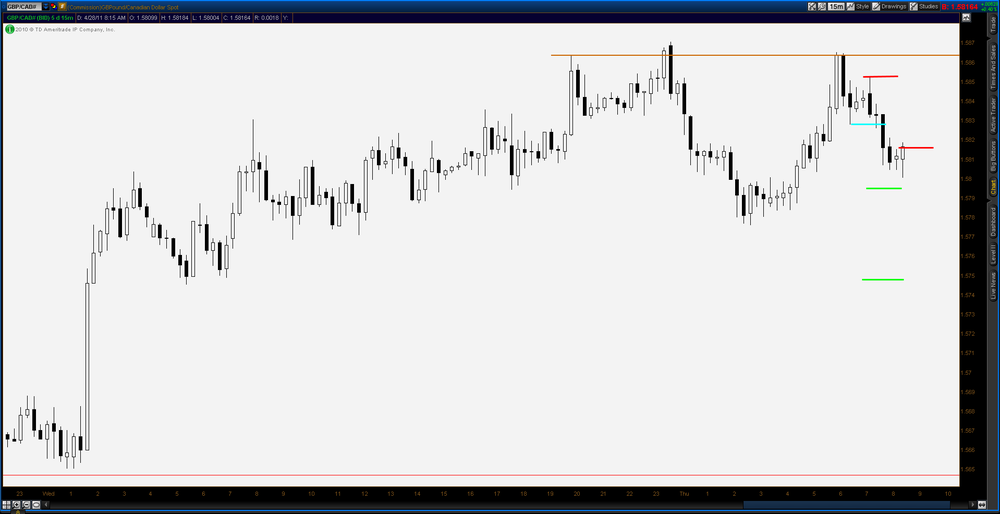

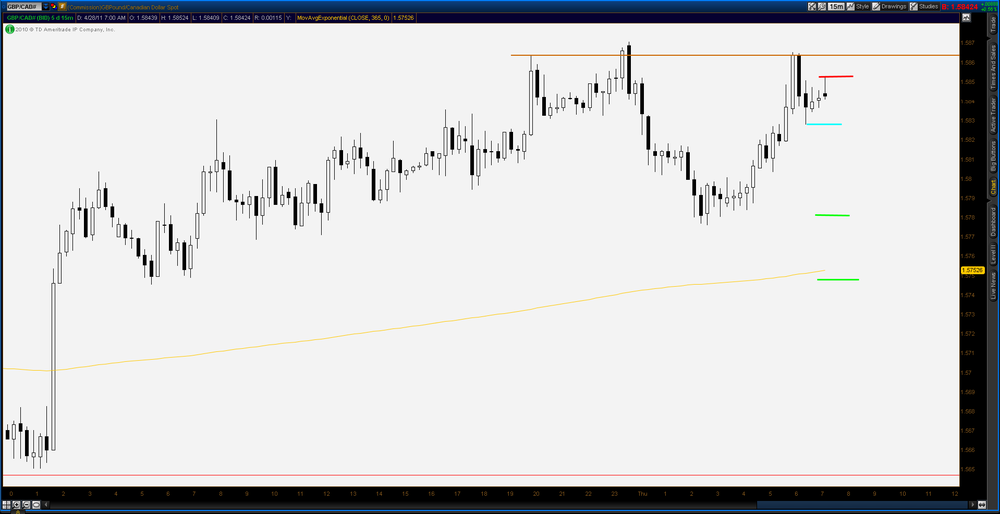

I only took two trades this week on the 15 min time frame using the methods common to the "Reading charts..." threads. One was posted and one was not posted. Both lost .79R for a total of -1.58R for the week(thankfully in sim!). I missed several good trades including a nice long on USD/CAD this morning.

Oh well, onward and upward!

-

-

-

The week is over.I traded this week on an FXCM demo account...I posted every single one of my trades to this thread...I was ever so slightly down for the week...

I would type up a little bit about what I did wrong, what I could have done better, the shouldawouldacoulda's, etc., but I'm afraid I'd get carpal tunnel.

One thing, among many, is what's already been brought up...squeezing stops too tight, too soon, and getting to break-even too soon. I was a bit more pleased with how I managed my last couple of trades, however.

One thing, among many, is what's already been brought up...squeezing stops too tight, too soon, and getting to break-even too soon. I was a bit more pleased with how I managed my last couple of trades, however.I think what it all boils down to is that I'm a bit out of practice. I really struggled this week. I didn't do my best work (which isn't all that to begin with!). I haven't been trading very consistently for a while...I've been allowing myself to be distracted by other things in my life and I think I've kept a little distance from trading because I've felt a little discouraged. I've been working on it a long time, and, well, you know...

I set and have so far acomplished a goal of putting an end to that trend. I've had monk-like dedication to trading and posting my trades to this thread this week. Posting to the thread helps keep me disciplined and focused. It's also nice to be able to look back and review the week that way. Plus, as a bonus, maybe someone out there could possibly be getting something out of it (what not to do!

). I intend to continue.

). I intend to continue.I think part of my problem over the past months or even year(s) is that I expect to already be able to trade wildly profitably, and then when I don't do as well as I expect, I get angry and stomp away. Then, I'll build myself back up, study and read, etc., and do the same thing again. What I need to do is trade consistently to practice, practice, practice, and to learn...I need to keep an open mind, keep my emotions in check, and make the most of every hour.

In other news, it looks like the blue bar under my name is 100% now...all I got was "Complete." Why don't I get something fun like everyone else?? (ie Market Wizard, Guru, etc.)

:o

:oCory, based on the number of trades you took I would say you did ok. There is a certain level of skill required to be in the market a lot and end up near break even. I know it is frustrating, I am in the same boat. You are pumping the pump and not much water is coming out, but keep pumping and soon it will flow!

I too am wrestling with trade management and when to move stops. At this stage though tightening the stops has been beneficial in most cases. My goal is to get to where I am taking more trades that get to +1R before they get to -1R. Until I see that happen regularly I will continue to be tight on the stops. This week I took four trades with the 123 method (all posted) and ended the week -.03R. Only one of the four trades got to +1R before -1R so the tight stops worked in my favor.

Right now it is all about waiting for quality set ups. If the set up is good the trade management will be easier.

-

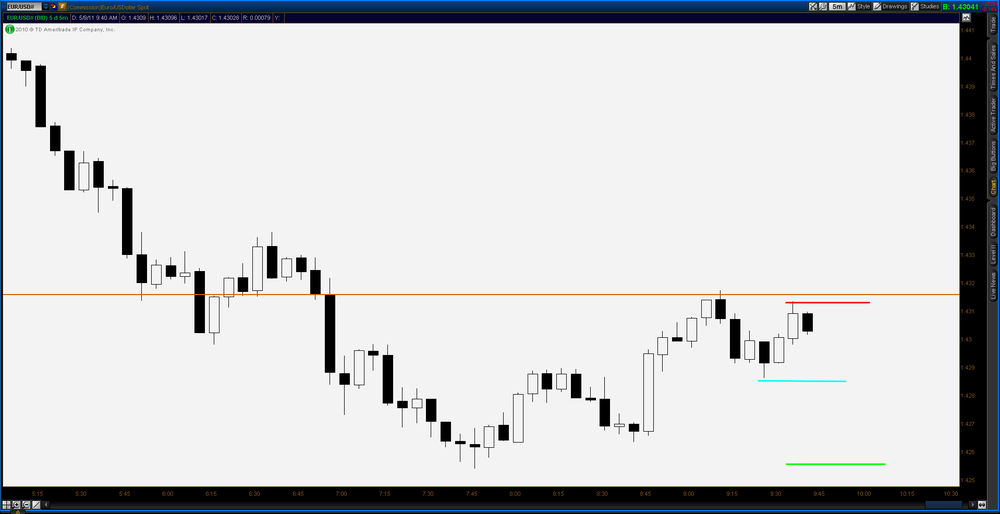

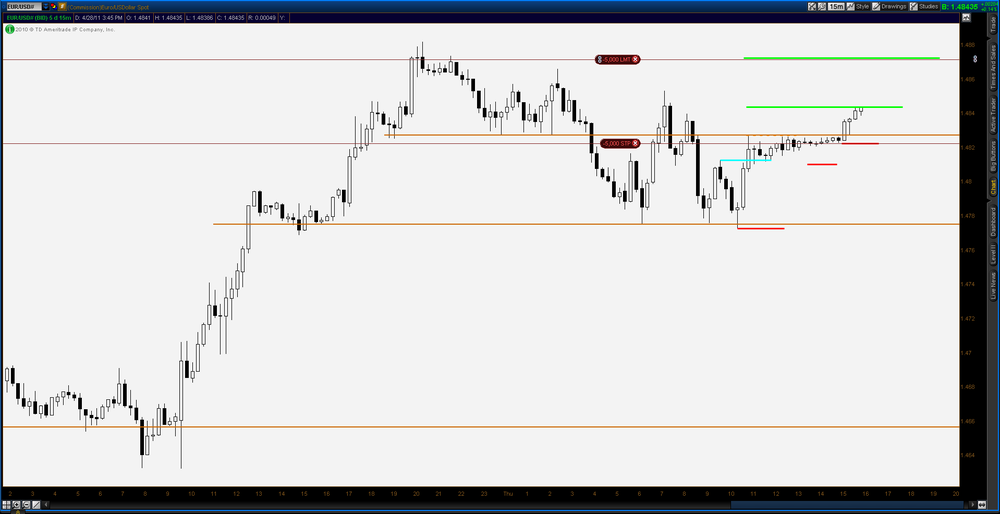

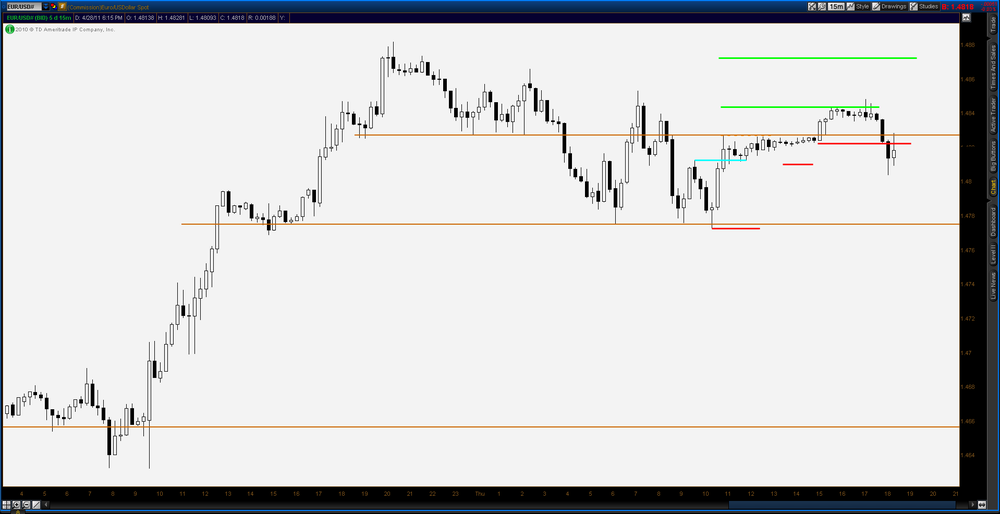

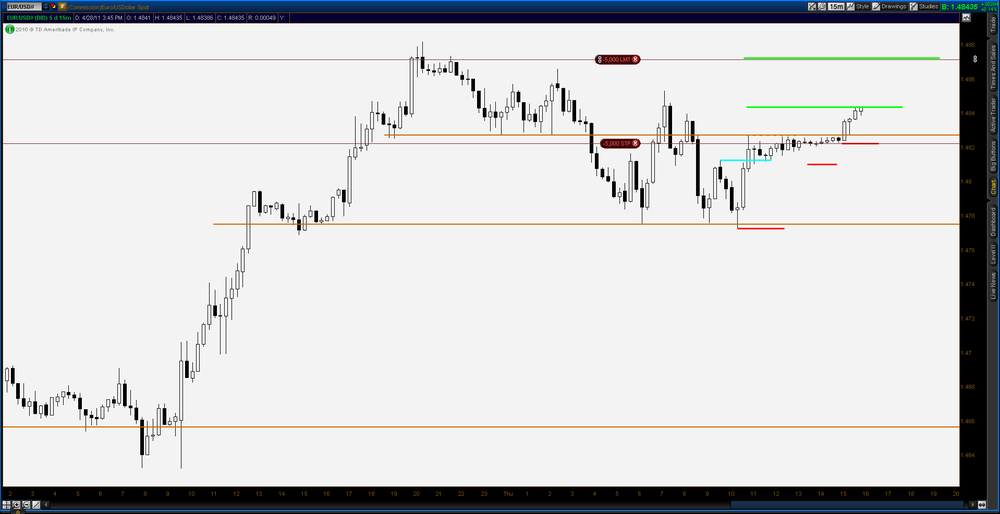

Potential EU short...Cory, I was looking at the same one but your dashed line representing a potential support area concerned me a bit. Will you move to BE when it gets there?

-

-

-

-

-

-

-

-

-

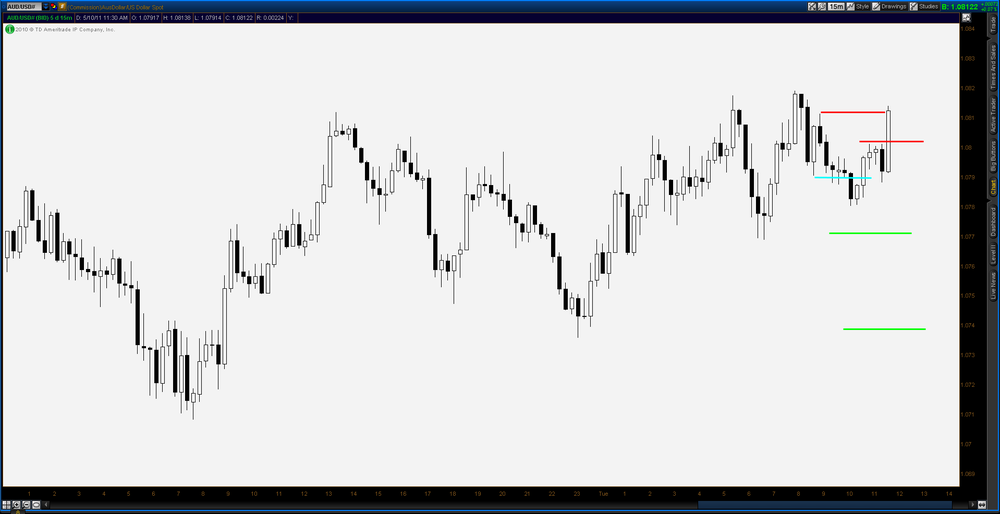

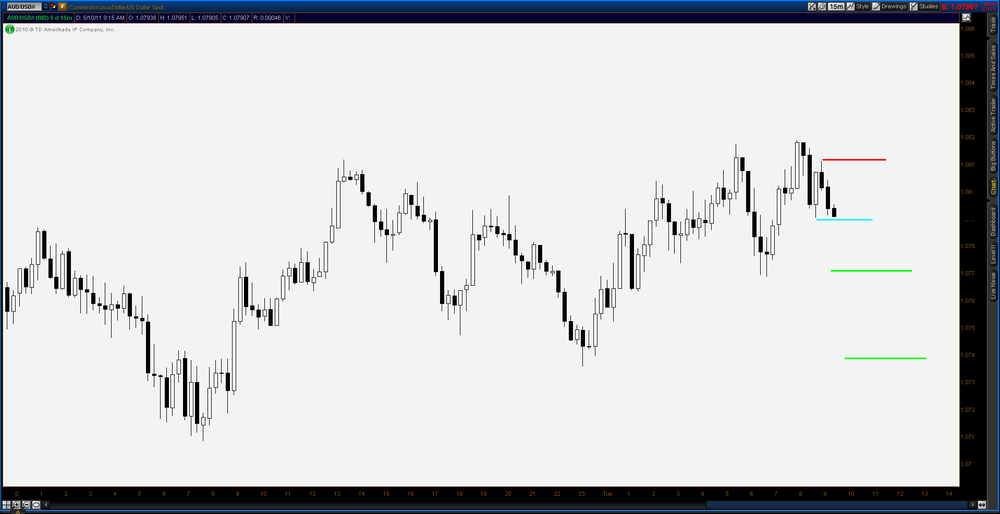

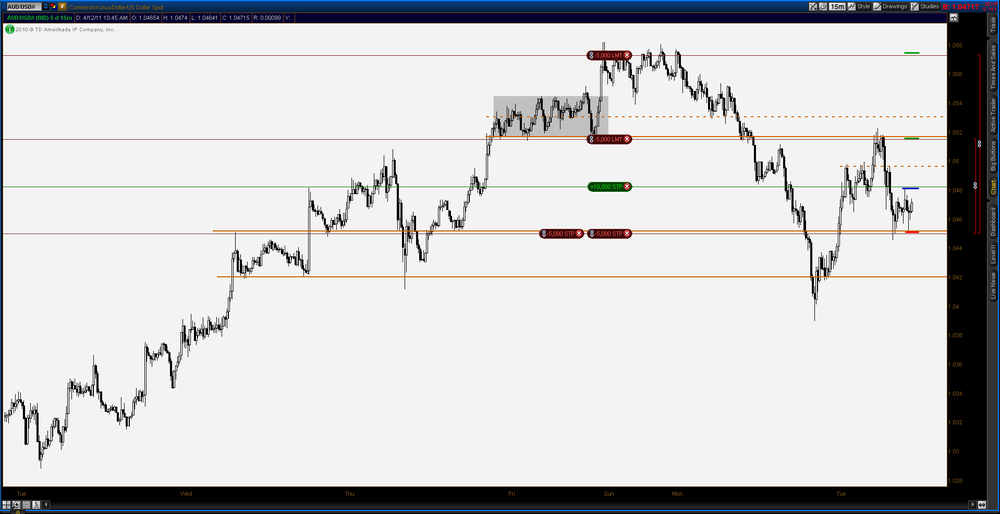

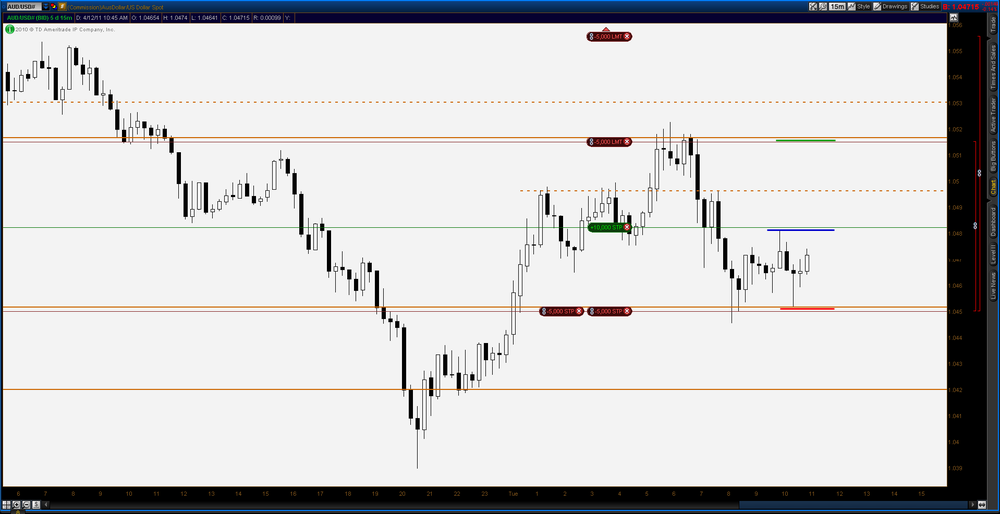

Looking at AUD/USD long. Zoom out view looks like a five wave impulse move up after a correction. Enter on 123 set up off support.

Update: Not happy with the movement out of the gate so I tightened up the stop.

Final Update: I didn't want to let it retrace way back into the pattern so I tighten the stop even more and got stopped out.

-0.11R trade

-

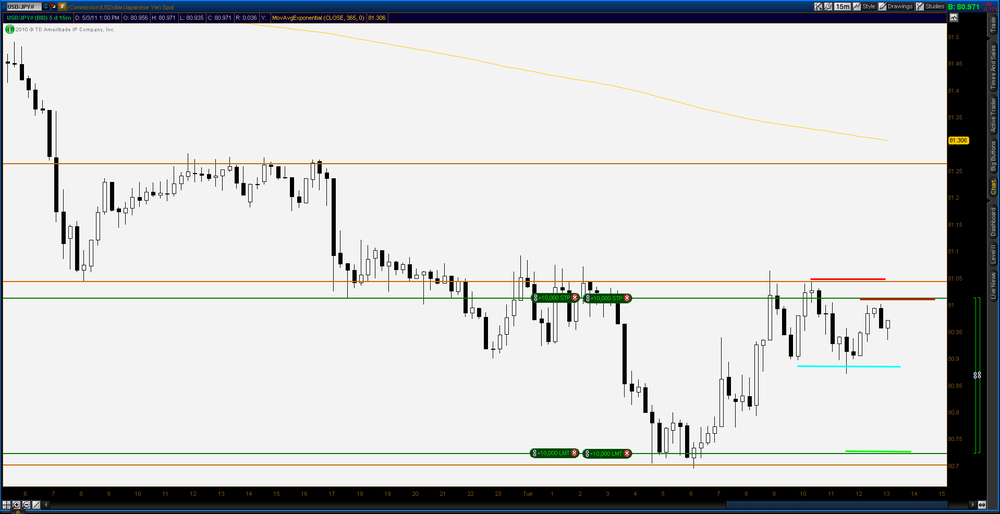

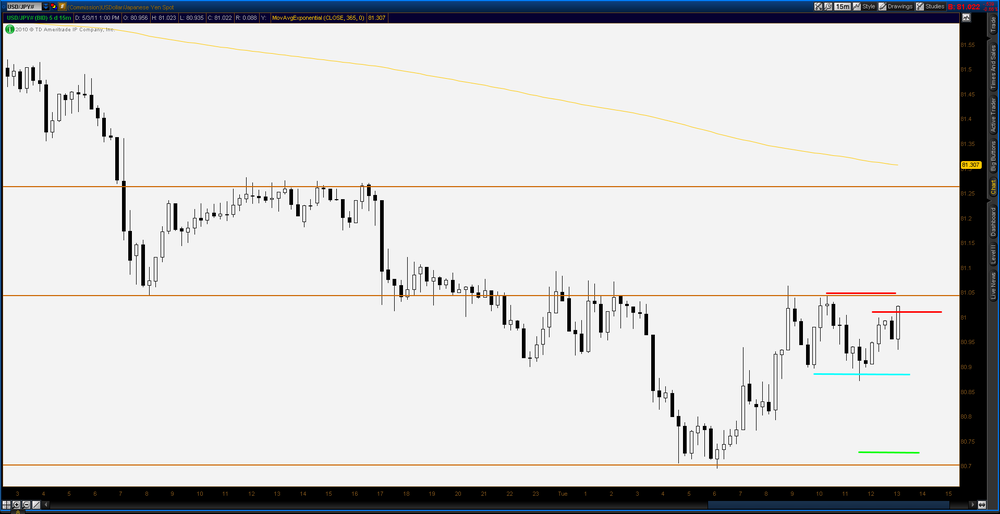

The time of day is not ideal but this long in NQ looked interesting.Took one off the table, the second moved to BE as price nearly made 1st target then came back down through the dash line with a shooting star look. Time of day caused me to be a little careful with this one. Probably shouldn't have taken it but sometimes the equities move after hours.

Update: out on 2nd contract at BE.

+0.37R trade

-

-

If you have a 1R 1st PT and a -1R initial stop, and if the above scenario happens with high frequency, perhaps you ought to consider changing your plan so that you do not move your stop to BE after PT 1, assuming you are taking half at a 1R PT1 and leaving half for a 1+R PT2.Best Wishes,

Thales

Wow, after reading the 500+ pages of this thread I have anticipated this day! Thank you Thales for taking the time to read and comment on my trades and thank you for all the guidance and information you have provided in this thread. It has opened whole new worlds in my trading.

I have been trading for a while and am essentially a break even trader to this point. I look at this as a minor victory considering the number of live trades taken over the past year, but I am ready to move to the next level. Your set-up and trade story ideas have helped a great deal, along with the things DB teaches on the Wyckoff forum and other price action threads I have been studying. I was especially pleased to read your thoughts on initial trade management and how you rarely let a trade take you out at full stop. I used to get very frustrated with BE trades and your ideas have allowed me to give myself permission to cut a trade loose at BE or even slightly negative and look for the next one without getting frustrated. Having said that I do feel that moving from a BE trader to a winning trader will have a lot to do with trade management. I guess it could be said that I am not a consistently winning trader because of trade management but I am also not a consistently losing trader because of trade management.

As regards to the particular trade in question I can sleep well with how it was managed. Moving the stop to just behind that big down bar seemed right to me. It was cruel for it to come all the way back on the next bar. The comment about getting nicked by one pip was more of a general lament about how ironic trading can be. Hasn't this happened to all of us a million times, lol?

Thanks again for your input and I hope you come back often!

Todd

4_11_2011NQ15minzoomout.thumb.jpg.ba766be46259b66ff2aed9fc9904c960.jpg)

4_11_2011NQ15min.thumb.jpg.2f44f4cac13042f4d0108374a08a82f5.jpg)

4_11_2011NQ15min1stPT.thumb.jpg.6da35ca325b96e24a9820c7614c033e9.jpg)

4_11_2011NQ15minfinal.thumb.jpg.51fb5ae7a048e405dd9c0ba32fcbd575.jpg)

4_11_2011NQ15minzoomout.thumb.jpg.9ebef478d94299e5e11dc155fec54d13.jpg)

4_11_2011NQ15min.thumb.jpg.a142c6b7f4a2c3ff69cade0e43f6ba5d.jpg)

Reading Charts in Real Time

in General Trading

Posted · Edited by todds

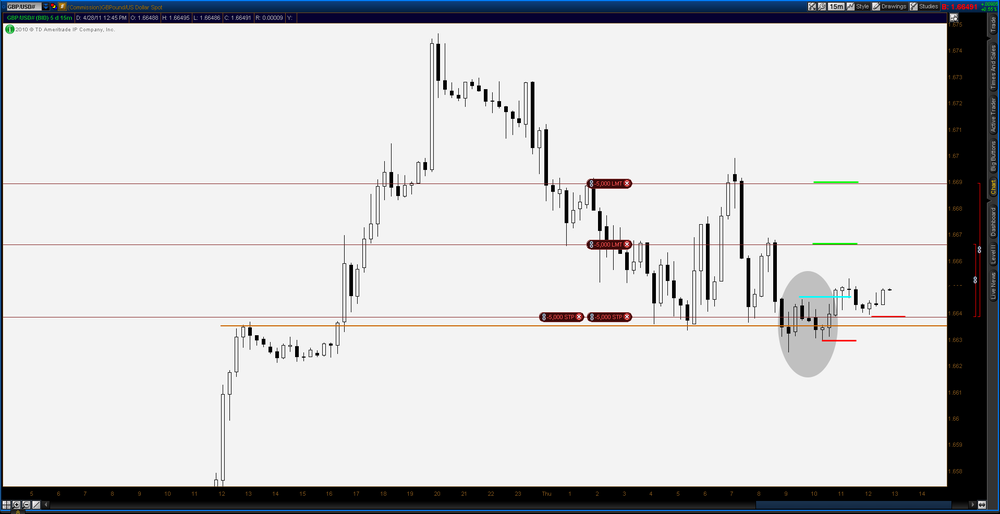

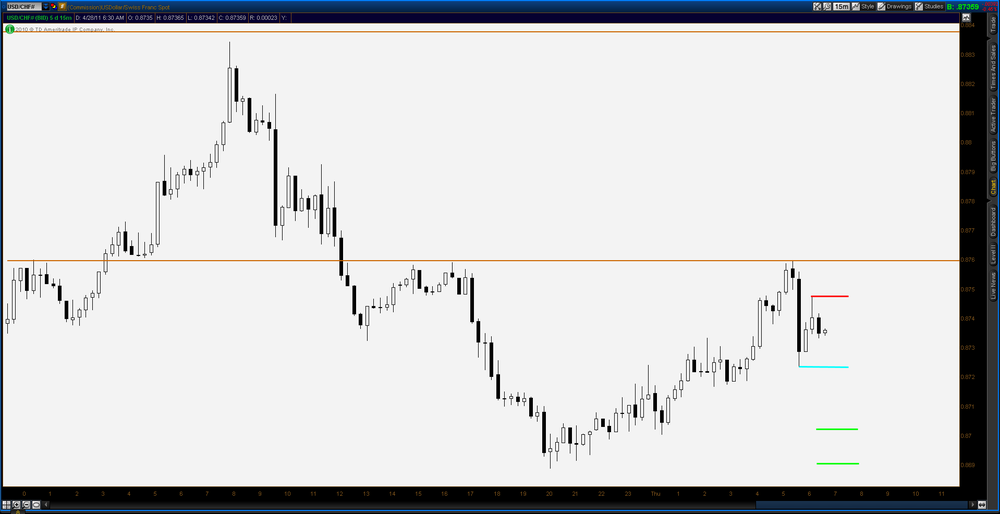

Possible short on USD/CHF

Update: stopped out, -1R