Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

728 -

Joined

-

Last visited

Posts posted by Dinerotrader

-

-

-

-

-

-

-

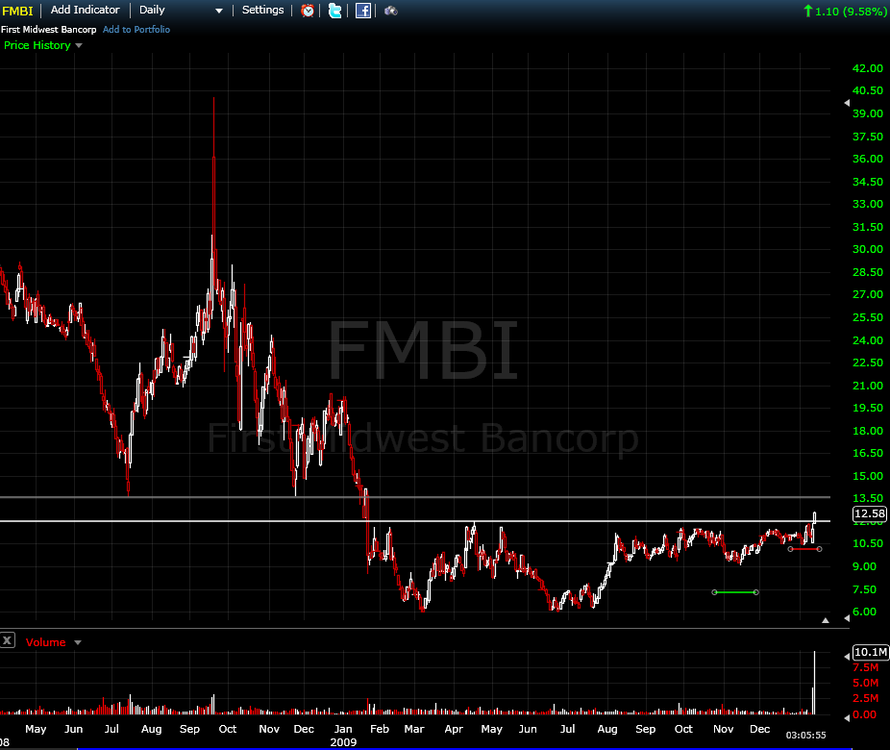

When it comes to stocks, I am mostly "long only," and if I short, it is usually by being long puts. I look for stocks breaking to new highs, preferably all time highs. I do like to buy pullbacks to prior breakout levels as well.Best Wishes,

Thales

Thanks for the thoughts. I'll try to find a stock scanner to look for all time high price makers. I've been messing around with finviz.com to see if I can get it to do what I want but it isn't as user friendly as I was hoping or maybe I am just slow. Probably the later.

-

-

HWDDiamonds I would think are going to make a come back as the economy recovers. Last I heard women still liked them. Just barely broke out of resistence and got a way before it touches the upper trendline. I'm a buyer with stop below the lower trendline.

Complete reversal at trendline touch. I bailed out with a 6.8% gain. Might get a nice reversal off the support line now.

-

@ dinerowhich platform this one?

thanks

I use "www.freestockcharts.com" for all my stock charting.

-

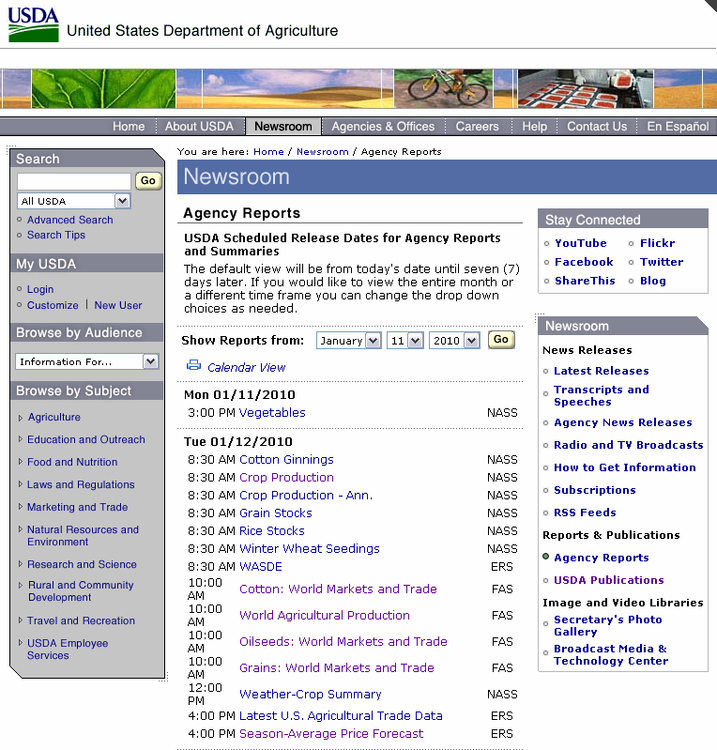

One source is the USDA Crop Report Page.Thanks for the link. I am still trying to figure out which report it was that had the information which caused the huge drop.

I just want to make sure I am aware of what reports have the potential to cause significant moves in the grains so that I can be aware of the days that they are released.

-

Was everyone who trades corn waiting for that forecast to come out or does the USDA just come out with that forecasts whenever the want? I'd like to be prepared if forecasts are scheduled to come out on the grains. Anyone know about this?

-

-

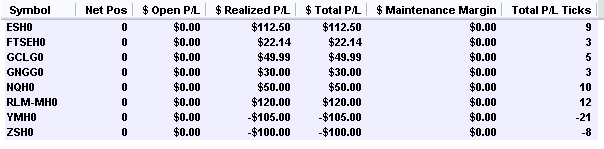

1/11/09: +487

Natural gas decided to break major support so I had to take the hit. Great R/R on it so it was the right trade but it didn't work out. Oil looked choppy enough that I decided that I should trail a little closer today but hindsight is telling me otherwise. Good day though for me especially since it seemed like everything was in slowmo for a while. Corn made the move I was expecting but I was moving so slow I had to cut it short. Had to quit at 11:00 ET.

Nice trading Subterfuge!

SIM results

-

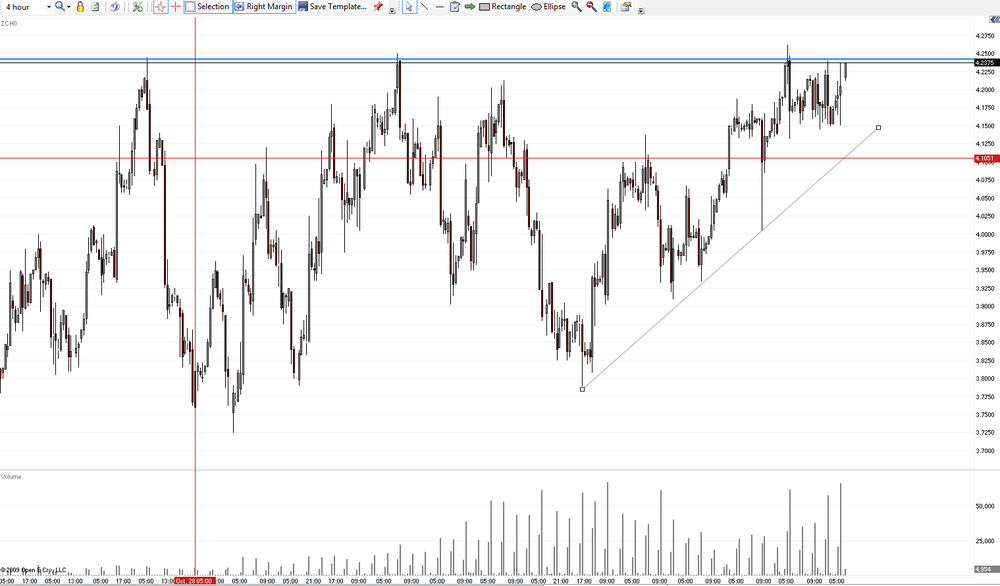

Corn - ZC

1/10/10

Price is right near resistance and its had a couple tries to breakthough without success. Monday might be a good day for the bulls to finally give in and let this thing go. Not sure if the extreme cold weather is keeping prices up right now. I wish I had some fundamental understanding of the grains futures price changes just so I understood the big picture a little more.

-

B4 I die I will own one of these.

Gabe

I have gone back and forth between the continental and the gran turismo several times. Bentley makes some classy stuff. Nice choice.

-

-

That Maserati is sweet...can I fit a baby seat in there?

This would be the weekend/"date with the wife" driver. I'll let me kids look at it from a safe 15' feet away. I've cleaned underneath my kids car seats before and really......I don't think so in the Maserati.

-

-

Actually, I talk about this a lot here in the thread, impulse/thrust/expansion/trending versus corrective/overlapping/contraction/chop zone.The market moves impulsively, expanding its range until it reaches a level at which S/R exists, or at which S/R is being established. You want to trade those moves.

After such moves, price will typically consolidate, the range contracts.

Ideally you play golf, sleep, play with your children during periods of range contraction and you trade during periods of range expansion.

Recognizing a period of rest or contraction is the dificulty, and that is where the notion of a chop zone is helpful. Once the market establishes a high and low of a short term range, and then pivots a lower high and a higher low without breaking the high or low of the range, it is time to stop trading and take your cues from the high and low of the range.

So, you see, I really do speak of this often: impulse/thrust/expansion/trending versus corrective/overlapping/contraction/chop zone. You just have to put it all together.

Best Wishes,

Thales

I guess you do, I am just slow to put it all together and I hadn't seen you post a chart with such compelling range expansion notes before so it opened my eyes to the significance. Thanks.

-

-

Well, since this forum is mostly full of guys and I didn't see a thread about cars, I figured I better start one. I bought and sold cars with dealers for a small part of my career and am still partial involved with the car business.

I look at cars often from a biggest bang for my buck situation and as such my current dream car is the 2008 Maserati Gran Turismo (see pic below). Maserati's depreciate very fast so I am planning on buying a 2008 in a couple years for around ~$50k. We'll see if it happens.

What is your attainable dream car if you end up making some good money with trading as we all hope to do or as some have already done?

Including a picture is a requirement for posting here.

-

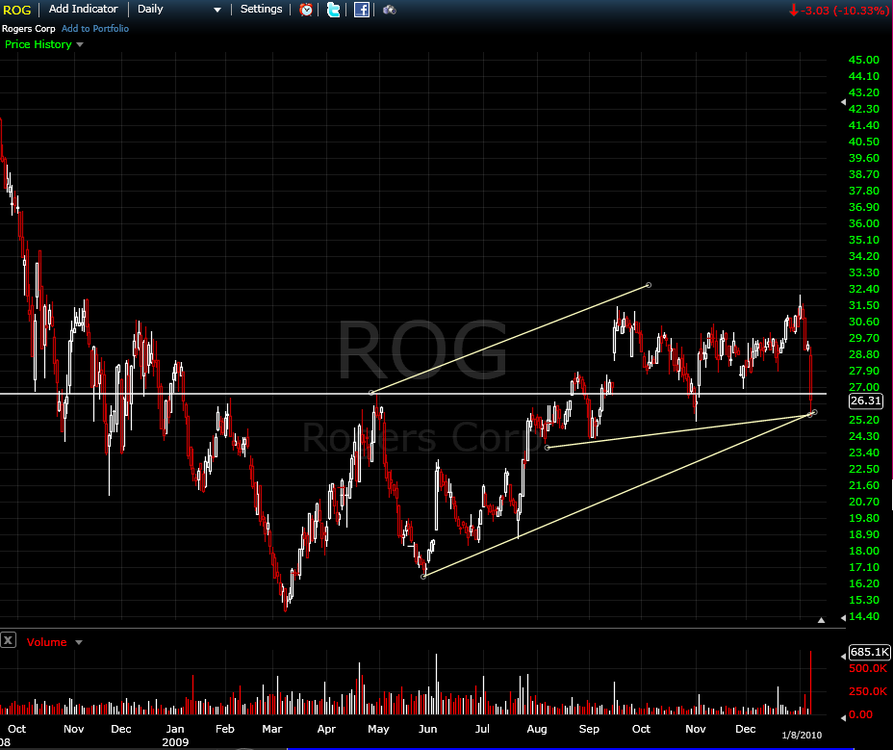

Does anyone else use this type of analysis to find trades? It seems like pretty elementry technical analysis but it has a simplicity that I really like. I really need to work on how to manage the exits on these. Right now I am up on every single trade I entered and am holding from this thread. I could simply trail at all natural stops (last pullback pivots) or set some proft target based on the expected range which would be derived from the range of the past year or less. Not sure yet.

-

-

Cars

in General Discussion

Posted

The reason I define the Gran Turismo as a big bang for your buck is that you get huge status props from having a boutique car but the price on a used maserati is fairly low compared to other boutiques like a ferrari or Lambo. If you drive up in a maserati it is a much different reaction than if you drive up in a car that people are used to seeing like a corvette or bmw.

If you want the fastest car for your money, go with a Subaru WRX or Mitsubishi EVO. They don't turn many heads but they are

For the sake of rambling, Porshe makes some amazing cars but they hurt their brand by trying to sell cheap versions of their really nice stuff. They need to decide if they want to be a boutique brand or a luxury brand with the likes of BWM, Lexus, and Audi. I saw a Porshe GT2 yesterday downtown and the engine sounded amazing. That car's sticker is $180,000. See pic below.

The Porshe Carerra is only $80,000 - see pic below

Most average people can't tell the difference. IMO, when you spend $200k for a car, you don't want people thinking you only spent $80k on it. Those are in 2 different leagues.