Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

728 -

Joined

-

Last visited

Posts posted by Dinerotrader

-

-

The margins are higher on the CL and recommended to trade with even more than a cushion of the bare minimum b/c:1) It's a full sized contract, this is NOT a mini.2) You've seen this thing move dinero and it can move so quickly and swiftly that if you don't have a decent margin cushion you literally could go into a deficit (which all brokers want to avoid at all costs).Regardless, if you don't treat sim like you will in real-time, then I think you are simply wasting your time. If you are 'only' trading 4 contracts on simulation and then trade 1 live, you will be tremendously disappointed in your live results b/c there's no way 1 contract can mimic the results of 4. You will sit there and wonder what happened or changed b/c on simulation you were making $XXXX and in real-time you are making $XXX.

If the plan is trade 4 when trading live, then trade 4 in sim. If you are planning to trade 1, then trade 1 on sim. I truly believe you are setting yourself up for major disappointments if you don't trade sim as you will be in real-time.

I totally agree that SIM needs to be as close to possible as real. I haven't decided the size I will trade live so I need to work on that. I might just plan on trading 1 live and reduce my expectations for my daily income, and then increase size when I am consistently making that amount.

About the margin... say I trade 1 CL contract and allocate $6,000 to that account. That means I have to lose ~$3,000 before I have a problem with a deficit correct? If my stop loss is at most $60 away from my entries and I don't constantly lose, it is going to take a while for me to have any deficit problem correct?

The above example is very simple and I mention it because I am worried there is something I am just not understanding/missing about this since bathrobe's broker guy thinks you need 4 times the margin amount in your account to trade at all.

Also, is there something that is actually different between a mini and a full size contract besides the mini's having a typically smaller margin amount? I didn't think there was any difference.

-

FWIW my original broker who was much more hands on and was also very conservative told me to trade one CL contract for every 11k in my account. This broker pretty much scared me from trading oil, making me believe you had to be a pro to do so.If Karma exists I am taking his money now since it is zero sum.

I have heard stuff like this before. What is the reason you would need 4 times the margin in your account to trade just 1 contract? I am missing something or maybe this is for people who trade with large potential drawdowns. Not sure.

-

That's a slippery slope to go down Dinero. I'm going to ask a personal question and you don't have to answer, but in your live trading account, how much is it funded with?Also, are you aware of the CL margins @ OEC?

$2700 for daytrading.

To compare, the RLM is $400.

Why do you think such a drastic difference?

If you are going to be trading multiple contracts on the CL in real-time, then do that on sim. If not THEN STOP IMMEDIATELY. You really skew the results by adding contracts. I know the $$$ looks nice, but if it's not what you will be doing in real-time then you are playing some big mental games with yourself. If not, then have at it!

Good points BF. I was only trading 4 contracts which would only be $12,000 margin for CL but I understand what you mean.

I realized that the desire to make more than $500/day was influencing some of my trading decisions when I was just trading one contract and of course I can always just throw some more contracts in the mix and make that it much easier if I have a winning strategy. I know you have a goal to make $500 per contract traded but I think shooting for that was hurting my ability to just maximize my profitability on each trade based on PA. Adding contracts is easy and getting more capital for trading is generally pretty easy if you can show you are consistent at making money.

Anyway, I am still thinking through this. I appreciate your advice.

-

-

Hi Dinerotradei've just bought 2 years of data(tick) from HISTORICAL TICK DATA ? Historical tick data for stocks, equities, futures, options, indexes and indicators!

ES and XX , i'm satisfied about the data quality , i've checked with another data and it's all ok .

i sent email, several time,to the support center and always they replied quickly.

Thanks for the post. Nice to here from a happy customer before I go spend some money.

-

If you buy data from anyone, ensure that they have gone through and made sure the data is clean. There is a lot of stuff that is full of repeated days, gaps, etc;the good stuff is not cheap. Make sure the data you receive is able to be changed because I guarantee there will be modifications needed.

eg; when is the close. As the exchange says, or the last recorded trade.

eg; when to the futures contract roll over months, to which month.

There will be big gaps.

I would suggest that if you want to look at announcements etc then tick data is overkill, its just noise. a 5 min chart would be plenty....but thats up to you.

Watch oil next time inventory comes out on Wednesday at 10:30 am ET and see how well a 5 min charts works for you.

-

Hi dinerotrader,I'm curious to know what you are going to do with all that past data and how it's going to help you:roll eyes:. Oil is not something thats' heavily weighted like the S&P or NASDAQ. Maybe I'm wrong and I'll except the fact that it's possible. I just can't think of one reason why 27 years worth of news related data will help you trade todays markets. It's really not that serious. JMO

Happy Trading

Ektrader

I wouldn't be looking for 27 years. More like 5-10 years. I have a fundamental belief that markets do some similar things over time and that you can learn from the past in order to determine what future movements have higher probabilities. I don't have the ability to trade using history but I would like to test some ideas that I have. For example, I would like to look at how oil prices reacted to the weekly oil inventory report going back over the past couple years. To do this I would need tick data since the moves are so fast when inventory comes out.

-

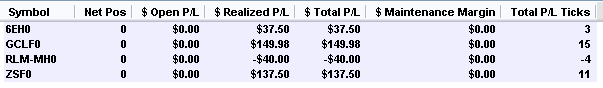

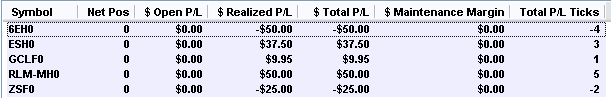

I was not at work to trade today so I had to deal with kids while trying to keep up with the CL, ZS, 6E, RLM, and the 6E. Not ideal.

I'll definitely be getting office space somewhere once I move to full time trading.

The G oil contract had more volume today than the F for the first time so I switch over and realized the price was way different ($2) and the got confused whether my S/R levels were still in the right place on the new contract.

The ES is so slow that I had to walk away from the computer just to stay in the trade.

The ZS had a good move but I wasn't watching it at the right time to catch it.

-

Quite awhile ago I purchased some data and it wasn't that costly. For the life of me I can't recall the name of the site or company but somewhere (buried deeply) on TL is the link. I'll see if I can find it somewhere around here.I figured someone would have already gone through this process and evaluated what is the easiest cheapest path.

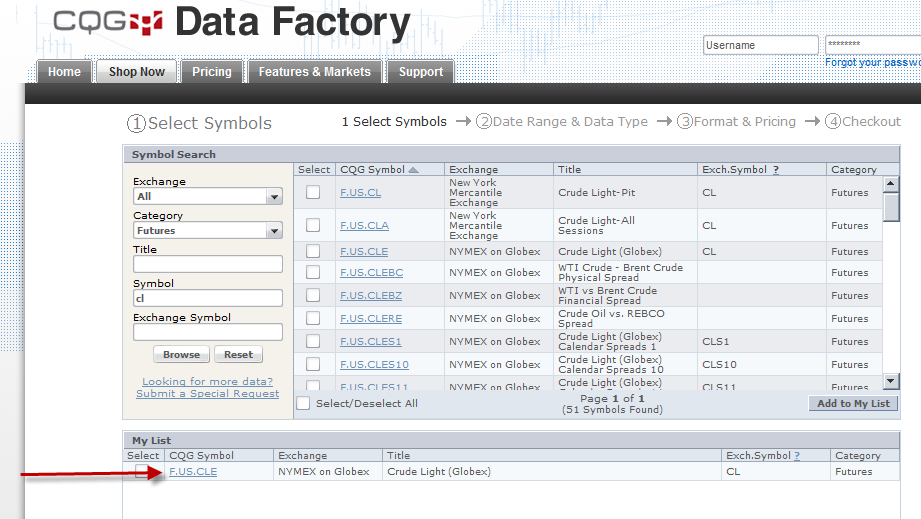

CQP.com looks like the main google search result so far.

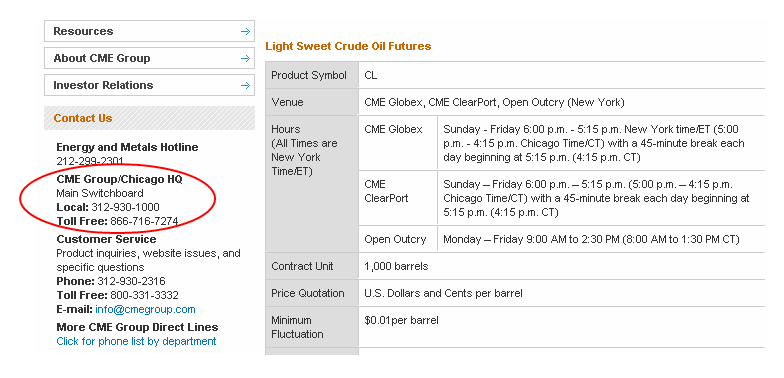

I need the CL globex, correct (noted below)?

-

If this is the case, they did some changes to their demo which is very nice. Last time I used it is about 9 months ago. You could make money by simply trading the bid/ask spread.I trade the Demo everyday and you definitely don't simply get filled if your order is the same as the current price. I miss fills all the time when price quickly hits my order price and reverses.

-

you are not the first one, nor the last one, to look for historical data.Your kidding me. I thought for sure I was the first and probably the last.

Your a funny guy Tams.

I'll look into this.

-

-

usually the respective exchange offers the data for sale.A friend recently bought 20 yrs of ag future data,

it set him back $900.

(I don't know how many symbols or exact # of contract months)

So I just call them up and say, "hey there, I am looking for a boat load of oil data, who do I need to haggle with to get a good price on 5 to 10 years of CL data?" or something to that effect.

Maybe I just need to find out if some other trader already bought this data and is willing to sell it to me. Thanks for the ideas.

Is there a specific charting service that is cheap that I can plug a bunch of expensive data into it and do my analysis?

-

you have to subscribe to Bloomberg or something like that.Not the most informative answer but I appreciate the effort.

but don't ever think that the speed of obtaining announcements will give you an edge in trading...

but don't ever think that the speed of obtaining announcements will give you an edge in trading...Just curious, what makes you believe this idea?

-

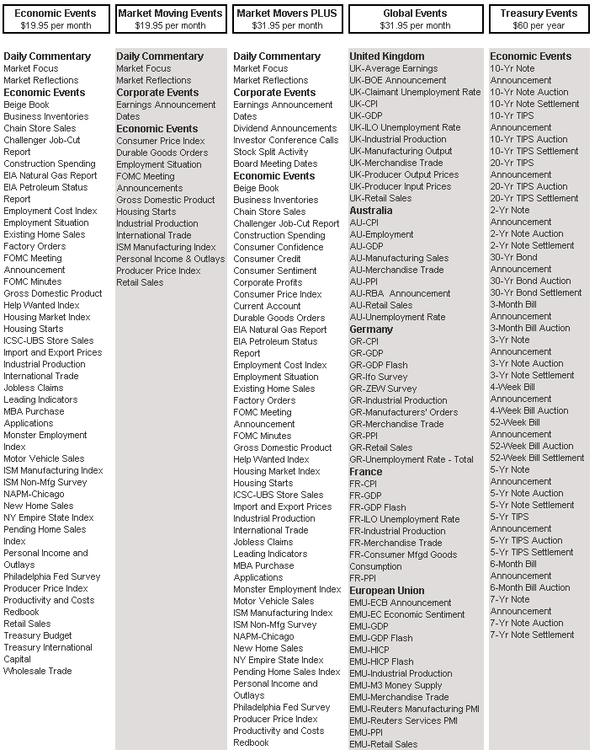

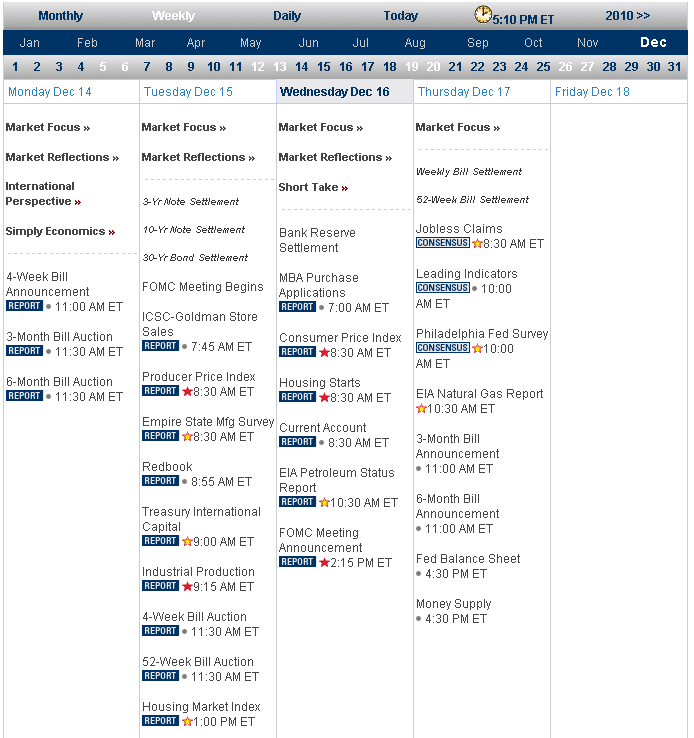

Econoday offers a service you can buy that puts them on your Outlook calendar automatically.I've never used it, so not sure if you can customize or not.

Thanks a million BF. Here are some prices they have for varying levels of reminder data. I'll probably get this unless someone knows of something else that is cheaper.

This brings up another question. If I want to find out the economic news as fast as possible, where or how do I get it?

-

Okay. I have been looking into getting historical data in varying amounts but now I am thinking, "doesn't someone just offer all available historical data for each given future?" I just want all the data down to the tick level for a few different futures.

I trade oil a lot and say I want to go back to see how price reacted to weekly inventory numbers each week for the past 2 years. I don't want a day, hour, or a 5 minute chart. I want to be able to look at what price did sometimes at the tick level.

So my question is who offers this and how much should it cost? I guess it is just a bunch of data with a price and then from there you can just use any ol' charting software to show you charts of whatever time frame you want in whatever scale you want.

I get ideas for different trading strategies all the time that I simply cannot even start to evaluate because I don't have nearly enough data.

Also, is there a good way to start saving the data I do receive (I use OEC) so that I can keep tick level data even when OEC stops making it available on their service?

-

Has anyone figured out a way to get economic news events automatically set as reminders on your computer so you don't have to manually set any of them. I'd also be interested in picking and choosing which news events I wanted reminders for.

I use outlook for all my reminders right now so my hope is there is a way to get some sort of auto import of those reminders into outlook. I just don't want to spend any time on things that can be automated.

-

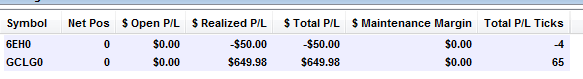

+ $284

Right after oil comes out I seem to do the best. My good "after inventory" trades had to offset my morning overtrading of oil. ZS gave me a picture perfect bounce of my support. I did better not overtrading today but still lots of work to be done on that. I guess I have a bit of a gambler inside me that has to be controlled constantly while watching the charts.

SIM

-

A few have mentioned that the OEC demo environment lately has been hit and miss with it working. I emailed a contact over there and was basically told that there has been a big surge in demo requests recently and it was overloading the servers. Starting tomorrow, it should be more reliable as more resources are being put here.Ever since your update I haven't had any freezing problems and the like.

-

-

-

-

-

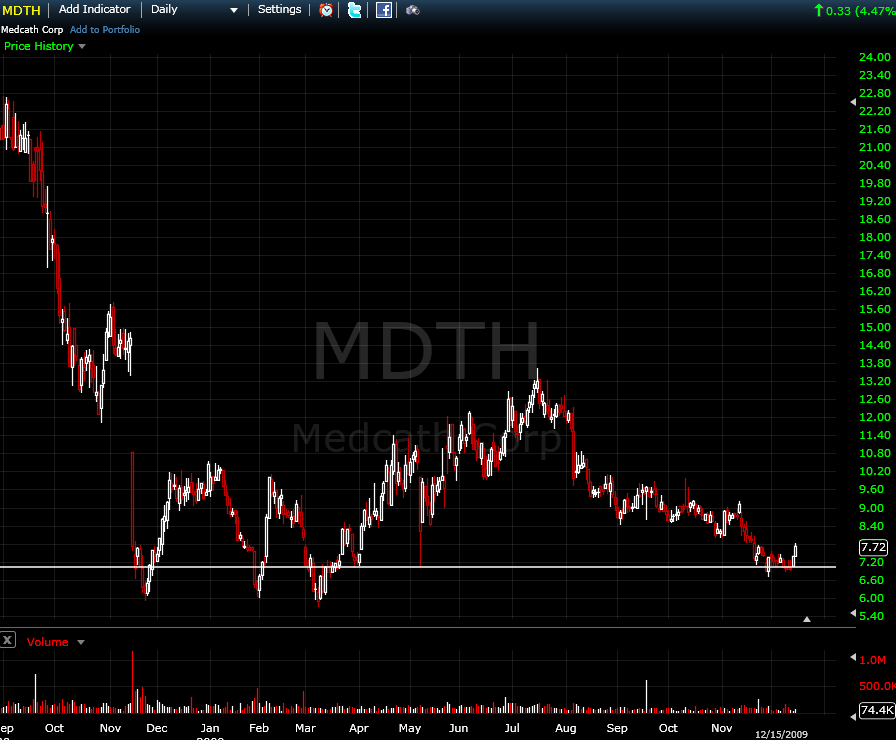

Interesting Charts for Technical Trades

in Stocks

Posted

Please do post a quick note here when you begin to initiate any longs and why.

Do you have specific criteria you use to decide if you are willing to enter new long positions or is it just a general feeling after considering all the market factors you observe?

What did you think of my H-L-HL here?