Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

728 -

Joined

-

Last visited

Posts posted by Dinerotrader

-

-

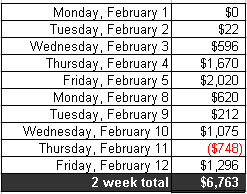

SIM

-$682

2 days of big losses and I feel the confidence draining away. Got stoped out of my long on GNG at the low of the day so I'll start moving my stops a few ticks farther and see if that helps. Still working on taking fewer trades.

I thought FOMC would provide some good movement but didn't do anything useful.

-

Dinero, your thread is being hijacked right now!!!

As long as the thread is about cars and we get some pictures as often as possible, all is good here. No worries about thread jacking.

-

-

Dinero - you don't need another broker if you want to keep this simple.Open a 'long-term' account at OEC then ask them to open a Trade Manager user for you where you can access both accounts w/in 1 login. Then you can trade in both accounts quickly and easily.

I'm pretty sure this would do what you need.

That is the answer I was hoping for. I like simple. Thanks.

-

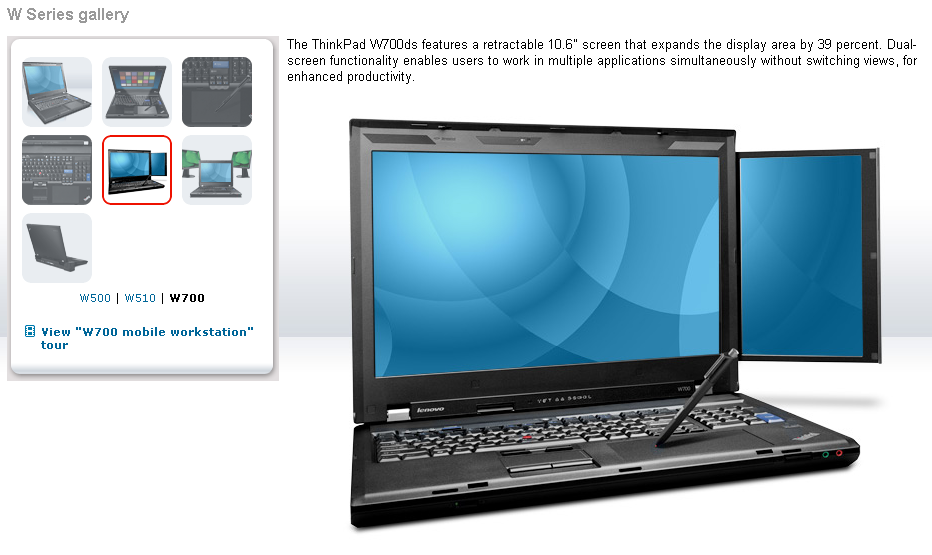

This is awesome. I have been looking at laptops for a while and had not seen this one even after exploring Lenovo's website. I build a lot of big Excel spreadsheets so this is pretty cool.I actually called Lenovo yesterday because you can't order the W700 right now. They said they are not selling it right now but are planning on selling it again starting in March.

-

-

Hi Dinerotradethanks for reply

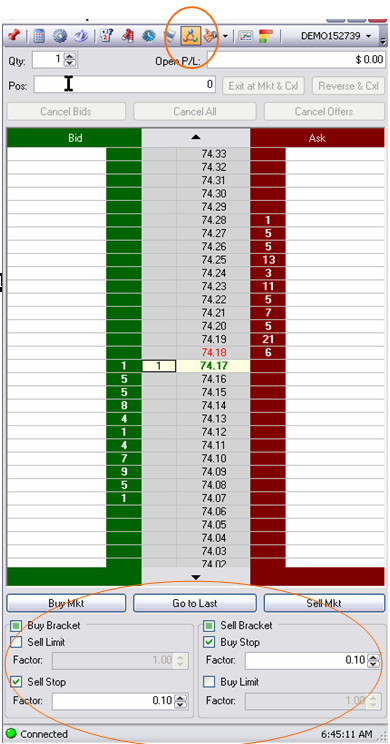

I'm testing Demo version ,I've seen this features but i haven't fully understood yet the difference between sell limit and sell stop ? I must tick each box ,or only one ?

I 've seen in the manual but it isn't very clear ,or better i don't understand English well

Manual isn't that great. You can tick on one box or both depends if you want automatic exits on both the loss and profit side. Use the Buy limit and Sell limit for your exit for taking profit. Use Buy stop and Sell stop for setting your stop loss exits. Play around with them and they will start to make sense. I don't normally have profit target exits sitting out on the DOM so I don't use buy limit and sell limits when I bracket.

-

You might like this with its extra screen...ThinkPad's are very reliable too.Here is a pick from the W series with the expandable screen. doesn't that little expansion look perfect for a DOM.

I haven't seen a better setup than this but I haven't looked too long. It might be nice to have some portable screens that were flat on both sides and had a collapseable stand so you could easily throw them in a briefcase or luggage.

A lot of it depends on how you trade. Some people need 4 screens to trade one future and lightning connection/processing speed due to their method of trading. They are going to require much more to get mobile.

I haven't heard of many on TL being traveling traders. I'd be interested to hear from traders who actually travel and trade at the same time. For some reason this appears to be a big perk of daytrading before you actually start daytrading. Then the realities of trading kick in. For me I think, "why don't I just make more money (trade more contracts) before I travel and then I can travel without needing to trade at all."

-

Hi

I'm sorry to annoy you again but i need an help about orders with DOM.

When i place an order, I would have the possibility to insert already stop loss ,both i go long or short .

I've seen bracket orders but i haven't yet fully understood how they work.

simply when i buy or i sell, together and immediatly at the exchange must be send the stop loss order.

This because if my pc or my connection stop to work . i'm sure i can exit from the market if it turns against me.

:beer:

thanks

If I understood your question correctly, you wanted to know how to put in a bracket order so you had an automatic stop loss entered when you put in an order.

Click on the little triangle symbol at the top of the DOM. This opens up the bracket selection options at the bottom of the DOM. Then just select what you want.

-

You can't be serious?Goldman sends me open interest reports for all commodities/currencies/fixed income/etc weekly for free - and it has a lot more data then smiley faces and weather predictions.

Ahh, I see I mis-spoke. Gotta check the details better before I post. That would be 10,500 for 5 licenses. My mistakel So more like $2,100 per person. Still way to expensive obviously. I wasn't all that impressed myself. They are just using it from a business perspective. They aren't traders.

-

1. Is there a way to roll all the S/R marked on one chart to the next contract's chart?Basically, keep the chart marking/setting the same except change the contract input data at rollover time.

Couple more questions

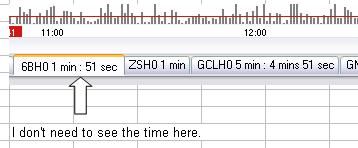

2. Is there a way to make it so the time doesn't show up and constantly update on the chart tabs?

3. Is there a way to minimize the chart screen? The only thing I can minimize is the entire OEC program so if I want to see my quotes screen, I have to move my charts around and out of the way instead of just minimizing them.

-

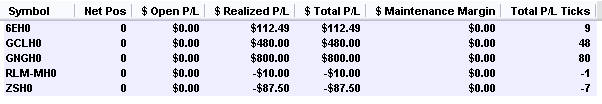

SIM

+$1,295

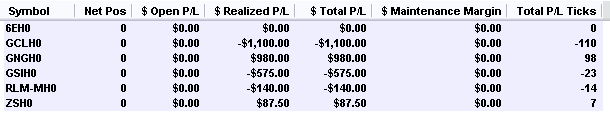

Good day on P/L but I blew my exits on 2 natural gas trades that cost me mucho ticko. Most of my early oil trades have been proving poor so I might start holding off on making trades until things get going. Didn't even watch silver. I am considering dropping the RLM. It doesn't seem like I have ever been able to get in synch with it on a consistent basis. The 6E didn't give me much to work with, 2 BE trades and 1 small profit.

2 Week Summary

Its been a good 2 weeks. I've been changing my trading methods a bit and so far so good. I only allow myself to trade 1 contract right now on every trade. I now know I have the ability to do well, it is just a matter of getting the consistency down, limiting losses, and trading the same way with real money. No small tasks.

This thread became like the gym. Crowed right after new year's day and then down to just a few in February.

-

Another way to look at it is this: Just because your broker will let you trade it, that doesn't mean you ought to trade it.Best Wishes,

Thales

Okay, I get it. I'll stop trading silver.

-

-

Another crappy day. Down $1616.sappjason,

Without sharing more than you're comfortable sharing, what is the basis behind your program trading setups, exits, money management, etc?

It would be nice to have a program trade for me. Then I could yell at the computer program instead of myself on loss days.

-

FWIW

I was dealing with these issues a while back. TDameritrade keeps a count for you so you know when you are about to break the rule which is nice. I also had 3 other trading accounts at another broker that I could use so that I could trade more often.

-

Take different trading accounts for different strategies/timeframes. Otherwise hedging makes no sense at all. There is only long, short or being flat as Cory said.That is what I thought. Managing trade of differing time frames sounds like a normal thing to me so I thought there might be a slight chance there was a way. I guess I could just setup with another broker for longer term positions.

-

Does anyone trade varying lot sizes depending on how "good" the setup is? I remember some market wizards saying that they did this. I only trade 1 contract on every trade because I have no good way of testing the statistics of my setups so that I could concretely say that one is better than another. I may think some are better but I can't prove it so how could I bet on it.

Changing lot sizes sounds like a very risky proposition to me unless you have some great way to put rules around it that make sense.

-

...I'm pretty embarrassed and disappointed with myself.I'm currently down 3.37R for the week. This is the worst I've done in a long time...

Remember that most of us reading your thread a pulling for you to do well. We've all made mistakes, had losses, entered bad trades, been embarrased at our losses, etc.....

Keep working.

-

Hey dinero, you might want to start looking at refineries stocks etc considering you're focusing on oil futures.Can help you to maximise profits... Good trading btw!Thanks, even though its all just SIM right now.

The only reason I trade what I trade is because of the price movement. I don't think any fundamental understanding I have about the future price of oil makes me any better at trading it. However, the way oil moves seems to be much easier to trade than other futures I have looked at. So basically, if you can find more instruments to trade that have similar price movements to oil, I would be interested but the mere associated of the underlying goods is irrelevent for me. I appreciate the idea though.

-

Is there a way to have 2 different positions on one contract in OEC. For example, say I trade oil get long at some major support level and plan to ride that position for several days. Then, in the mean time I see some good short positions for a 5-20 minute hold. How can I manage these positions?

-

2/10/2010

In case anyone was interested in seeing what the people who trade oil on fundamentals use for their analysis, I attached a pdf of a what the big oil and gas guys I know are looking at. Its about $11,000 minimum to subscribe to this for one year. I don't use it in my trading right now but I thought it was interesting to go through and consider.

-

I'm still waiting for the stock market to get its footing before looking for any new long positions, hence the period of no posting. I took profits on everything a while back when the ES started breaking through support levels. Everything looks like its on a blue light special sale right now but I am looking for more strength before making any bets.

I only have one position open which is in FORM at $15.71. I am happy enough with this one long term I will probably average down if we get closer to big support levels and cut it loose if it makes all time lows.

Note: In addition to my trading money, I actively trade all my retirement funds so when I say I only have one position, that means I am all in cash, no mutual funds, etc.

-

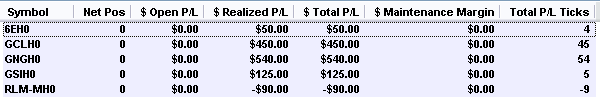

SIM

+$1,075

Tried a few new things that worked out. Getting pretty anxious to start trading real money but still have some ironing to do on myself and methods. Its interesting. The first time I tried to trade natural gas I decided the movements were horrible and not for me. Now I practically rely on it for my big moves.

Still not sure about trading silver but I like the idea of having some metals in the mix. Gold is too cliche, right.

We'll see if I can pull some consistent profits out of it.

We'll see if I can pull some consistent profits out of it. I always thought the idea of revenge in trading was for the weak minded before I got trading. Well, either I am weak minded or revenge emotions exist for everyone. Just because I had a bad day on the Russel (RLM) yesterday, I find myself almost muttering under my breath when I look at the chart today just waiting to get my money back. LOL:rofl:. I lost again of course.

Cars

in General Discussion

Posted · Edited by Dinerotrader

Jon, not sure if you read my prior post but it appears we think alike.