Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

3239 -

Joined

-

Last visited

-

Days Won

2

Posts posted by TheNegotiator

-

-

Hi all,I have an account with global futures, as they are an introducing broker my money is held by open e cry.

I have a £10,000 account and want to put more but just wanted to check with you guys how safe they are, what experiences have you had etc?

I am based in the uk and feel a bit edgy after the mf global fiasco!

Any feedback would be much appreciated.

Matt

Hi Matt,

I think open e cry are meant to be okay but then so were MF. I used to clear with those guys at one point so you just never know. The risk with a £10k account is that's probably your startup capital and so you can't spread it about or minimise the % of the capital held with them. I couldn't guarantee it and I haven't used them myself, but I think they are meant to be okay. If you have another £10k (or even £5k) why not open an account elsewhere?

-

Hello, today in the YM market there was a nice and solid smooth drop around 10:30, yet from 9:30 AM to 10:30 AM, there was nothing but slop and chop with some spikes taking out some stops,. From anyone's experience is 930 AM to 1000 AM problematic if you like solid directional moves? Why are there often crazy slop and chop spikes before 10 AM? If you are interested in intraday trend trading, when are the best times to catch a solid move.Thanks

9:30am is when the stocks open. The first 30-60mins is when a good amount of the days volume is traded. It depends what you mean by 'trend' but good moves can happen in the minis at any point (and more and more these days they happen overnight).

-

Euphoria and frustration over winning and losing trades makes no sense. One trade never makes a trader what they are. If it's indicative of an underlying problem in either yourself or your strategy then yes that could have implications on other trades. In which case you have to deal with it. If you have your plan nailed down though, you're far less likely to get to that emotional state. Having said this, everyone is human (I hope) and therefore emotions are inevitable. Knowing what types of emotions you are susceptible to and therefore being conscious of them when they do come up allows you to adjust better at the time and avoid costly errors of judgement. Doing exercise then allows you to release the tension and subsequently address what went on. Smoking probably masks the issues (and is pretty terrible for your health). Each to their own though

-

OP - The nature of trading is that it's not exact. This is why people lose money when backtest and curvefit then go live with a strategy. You have to account for possible inaccuracy and you probably already do. Think about it. Do you use a 1 or 2 tick stop? I doubt it. But actually, because different traders look at the same thing differently, have different objectives and timeframes and work with different sized accounts, the market still provides opportunity to make money. If we all looked at the same thing in the same way, it would be about the fastest and the biggest and the most agile.

(remember the only way to make money is being long those things that go up in price, and short those that go down in price- so all you need is a horizontal line )

)You need time too and therefore vertical. Time allows you to see how strong a reaction was at your level

Anyway MACD, Fib, MA, Stoch, RSI, CCI blah blah blah. They all DO WORK. They do exactly what they are meant to do (unless you have a really shitty platform!). It's not indicators that don't work it's the trader. Reminded me of a scene in Happy Gilmore. Skip to 57 seconds if you can't be bothered to watch it all and read Mr Larson's tea-shirt.

[ame=http://www.youtube.com/watch?v=eX-YjciFn4E]Shooter Mcgavin Hits Ball Off of Big Guys Foot - YouTube[/ame]

-

If we were to move lower next up would be 33.50, important high vol 28.00 (either reject old value - bounce, or accept it to some extent - trade through and build around it), then 24ish.

-

Appears that I got whacked in a stop run beneath the HVN hit earlier in the overnight session. I should know better but just getting back into trading this mother. With the naked POC sitting below at 1443.25 and we know everyone is going to be buying there for a reaction - damn why could I not bring my mind to think like a market maker who was going to run that zone after building it since Oct 3?To thems that trades this on a regular basis - what is an average stop run in the ES in points?

Would appreciate comments.

Thanks

slick60

Stops going off rarely take that much out. Maybe a point or two or perhaps a little more. But I think most of that was long liquidation as opposed to mechanical stops being sequentially hit...

-

I'd say go with the Stoxx over the Dax. Dax is a brutal contract, it's a big tick size and moves like it's on crack (for a stock index at least). The Eurostoxx is much deeper and trades more like ES, which all of you seem to prefer. A guy in my shop traded Dax and it wasn't for me.Yeah I would too. There was a guy in my old place who scalped the dax like a madman. He used to do pretty damn well on it though!! For most, I would say Eurostoxx is a good contract. Loads of ex-Bund traders moved to it when the Eurex bonds went crappy.

-

My perspective is,trading is not about theories,

or systems

or methods.

Trading is about execution -- how you can convert a concept into action.

There are many valid ways to trade,

including many that are freely and generously disclosed on this forum.

Some make money,

some don't.

It's all in the execution.

So don't beat the system up,

but instead, ask yourself why.

It's about so much more than just the method you use. It's about doing your homework before you trade, having a clear plan which you can follow, being able to follow your plan through thick and thin, being able to step up and be "on your game", knowing where to look for new trading ideas and how to develop a plan to test and trade those ideas, it's about not losing the plot when you have a few bad trades/days in a row or becoming euphoric when you have a winning streak, it's about protecting against potential unseen problems, it's about staying ahead of the game.

If you have a method which loses all the time, you won't make any money even if you have everything else covered, but then if you can't get past that first hurdle you need to ask the question of why that is. Is it because the strategy sucks or is it because I'm not using it very well.

-

I normally do not trade globex either, but it seems that the RTH session is often simply a liquidity filler for when the real moves happen during Asia and European sessions. Sometimes the US session moves, but so often it is simply diddle back and forth, for a nice Tokyo and Hong Kong open.Yeah I know what you mean. But I think there are possibly better markets if that's how you feel. You could look at Eurostoxx or Dax say in the European session or take a look at the asian markets if that fits your timezone better. Otherwise, maybe you'd be better off looking at NQ/YM/TF rth.

-

A post in another thread has me thinking about this point again and it is a big big road block for many traders. The ability to identify, accept and embrace their own failings. If a guy can't make money trading levels, does it make it something which doesn't work? Of course not. But often you see this sort of thing and people claim therefore that the idea is invalid. They look everywhere but in the mirror for reasons of failure. These are probably the same types who don't take their losses as part of the business too. Or that as a discretionary trader you can and will f&*k up no matter how hard you work. Obviously putting the preparatory effort in is a must, but there is a point of diminishing returns for this kind of work (and actually the relationship inverts). But losses and times when you mess up are information and data to be looked at to ultimately improve your trading. Be humble, accept your own mortal weaknesses and leverage this to move forward in your trading.

-

RE"Mind Over Markets" and also "Markets in Profile" by Jim Dalton.

Am I supposed to apply the principles he describes for MP on the volume at price?

THX

Use what you think is relevant. Not everything is. But auction principles can be applied to a bar chart just as they can to MP or VP. I view the books as auction books viewed through the eyes of an MPer.

-

Hi NYou being in jolly old England area, out of curiosity did you take the trade at the HVN / VPOC?

I have technical chart which showed great signal at the low and 2 min especially for 6 minutes supporting.

slick60

Nope. I only trade RTH hours in ES. But there's definitely a case for trading earlier on nowadays. However, there's FESX for European session.

-

TheNegotiator,Thanks for posting the charts.

I am an old-time price bar watcher; I am new to volume at price. I am trying to contribute to the thread as I can.

If it's not an imposition, can you offer a little description, or direct me to another area of the site where I might learn some of the basics of the volume at price patterns...

but specifically,

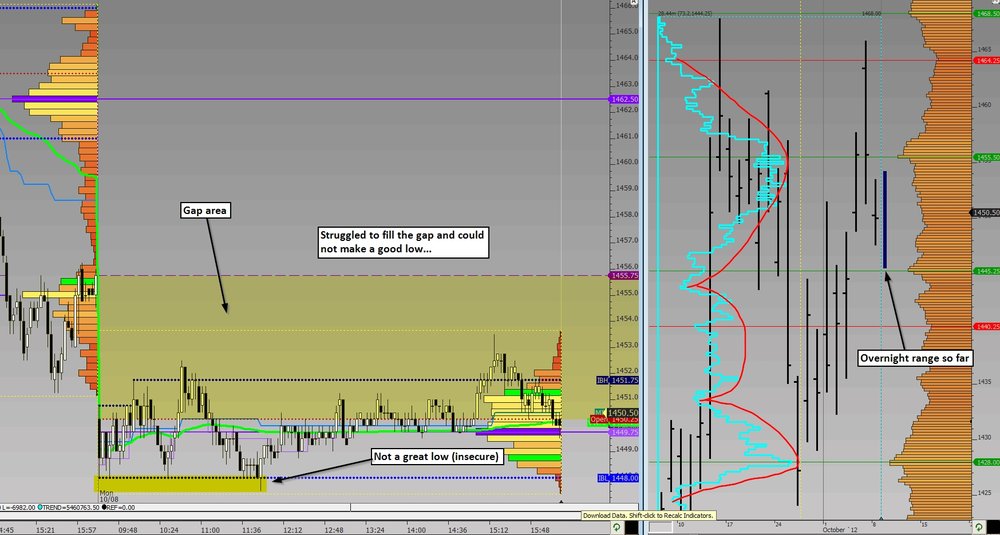

In the most recent chart you posted, you pointed out a Low and labelled it as not so good (insecure). What technical conditions do you consider insecure, that is, a good Low vs a 'not good' Low?

thanks

There are lots of places you could learn from but I'm happy to answer any questions you have here as I'm sure others are too.

The low is "insecure" in that it's been tested and tested without being able to encourage a strong reaction. i.e. it wasn't seen as a fantastic place to buy and so it didn't move quickly away due to the competition in that area. In fairness, yesterday was Columbus day so I don't consider it as important as a standard day. That being said, there were enough traders about to get a good reaction at an important price.

You may or may not be aware of a book called "Mind Over Markets" and also "Markets in Profile" by Jim Dalton. He also runs a website and sells an expensive course. However, I suggest you read the books.

-

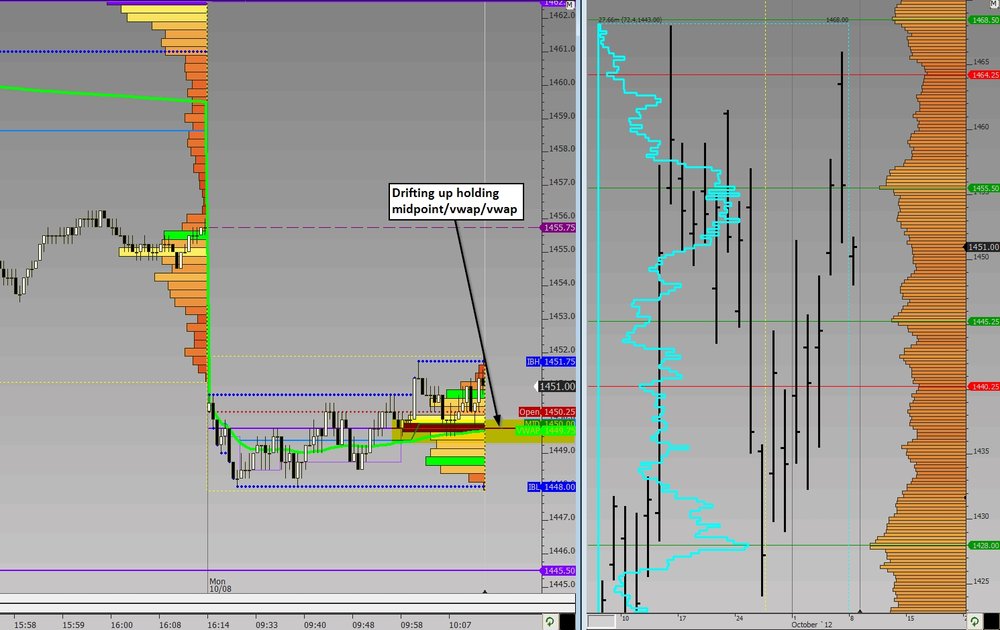

One point to note from the overnight session is that the 1445.50 naked (RTH) VPOC and high vol area was tested and rejected. Is that enough to move to test higher? Maybe, maybe not. I could also see the possibility of closing the friday-monday gap/important high volume price at 1455.50/55.75 then reversing down to test lower if a push higher fails. Just another option to consider...

-

-

Markets have high and low concentrations of trading activity at different prices.With that in mind I'll make 2 points. First is that if someone holds a position, the point where that position goes from positive to negative or vice versa is important to the owner of that position. Just think about how many people "move their stop to breakeven". It's a definite psychological factor. Just like 00 numbers. If there are many traders with positions there, that could cause them to act again at or beyond this point. Second is that other traders looking to profit from prior action will look at these previously important "action zones" and either trade with them in anticipation of prior business coming in once again to 'defend' their current position or look to trade a break where said positions are liquidated to a greater or lesser extent. This is why "stop hunting/running" exists. No levels = no stop hunting regardless of whether levels are self-fulfilling or not.

My feeling about people who claim "levels don't exist" or "price has no memory(or the market has no memory of price)" is that they do not understand the nature of trading very well. These are the guys who in the past have identified levels then tried to buy or sell every one then claim when they lose money that levels do not exist. Well, what do you expect? If the market was bound by the same levels then it would never go anywhere. Define a structure and assign context to the market which you trade, then you will truly understand how levels are so important. :shocked:

-

Thanks sdoma, I also wrote a custom indicator that computes the X-day median volume and range, but does so at one minute intervals, so I use this same measure, only in 1-minute granularity instead of 15 minute.In many of my old posts on this thread I mention the relative volume for the day so far, and this is how I compute it.

Yup. Remember those posts well. Relative volume is a useful thing to look at imo. Maybe you could either post your def here or charthub JD...

-

Just doing some really basic stats on the last 5 Columbus day holidays we can see that there is a trend of lower volume & range although still ES does move.Bearing in mind this is a 5 sample set, if things follow today and it's not outlier (which it could be if there's news or liquidation...) I would think that we could see volume between 550-825k and a range of 6-10 points ROUGHLY.

6 points and 778k - not a bad guesstimate!

-

Hello all, haven't checked in here in a while, thought I would say hello. My low buy area is 44-45s, and my high sell area is 62s, but if the market trades 55s which it looks like it is trying to do, it presents an interesting potential opportunity ahead of 62s, 55 being Thursday's VPOC, almost Friday's VPOC in the lower balance part of the day, and where the market settled Friday at 55.50.Also, Monday Oct 1 VPOC which was 48.75 was Wednesday's high, Thursday's low, and has so far supported the market today as well. Buy opportunity there, but my analysis leads me to conclude that it is better to wait for mid 44s/45s for a larger swing back up to 62.

How is everyone?

Hey Josh. Nice to see you buddy. Same went through my mind earlier when I saw Tom had posted too. My levels are pretty similar but not expecting too much today. Who knows though. As they say, ach

-

-

Not really managed to get anywhere yet. If we were to get above Friday's low 51.25 then we could move to 55.25 high vol and close gap to 55.75. Below current low at 48's and we could well slip to 45.50 naked vpoc, 45.25 high vol, 44.50 naked close, 43.75 low vol. Both sides are well within reach of ranges I suggested earlier. upper target to 55.75 is minimum of 7.75 pts range and lower to 43.75 is minimum 7.00 pts range.

-

Say that again, I don't understand what you wrote?where's your stop ?

-

short 1451reason: Trend of the moment is down, and I have 1452 as resistance from overnight price action. Waiting for 1449 to be tested and hopefully break through.

Where are you wrong? Above 52?

-

Good points. I think simplicity and complexity have many levels. What was simple for Einstein was very complex for other people. These are relative concepts. I think these concepts are more qualitative than quantitative and of course relative to circumstances.Absolutely. The idea of making things simple is to be able to work with your strategy in real time. If you're some really smart, super-focused trader, your workable capacity may be much higher than someone else.

Global Futures and Open E Cry

in General Trading

Posted

Found this review by Brownsfan:-

http://www.traderslaboratory.com/forums/brokers-data-feeds/1904-review-open-ecry-futures-broker.html