Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

3239 -

Joined

-

Last visited

-

Days Won

2

Posts posted by TheNegotiator

-

-

THank for the chart.I am long 1443, so i hope market takes out this 1445 area.

Looks like you got it! But why did you get long at 43.00 and why were you looking for 45.00?

-

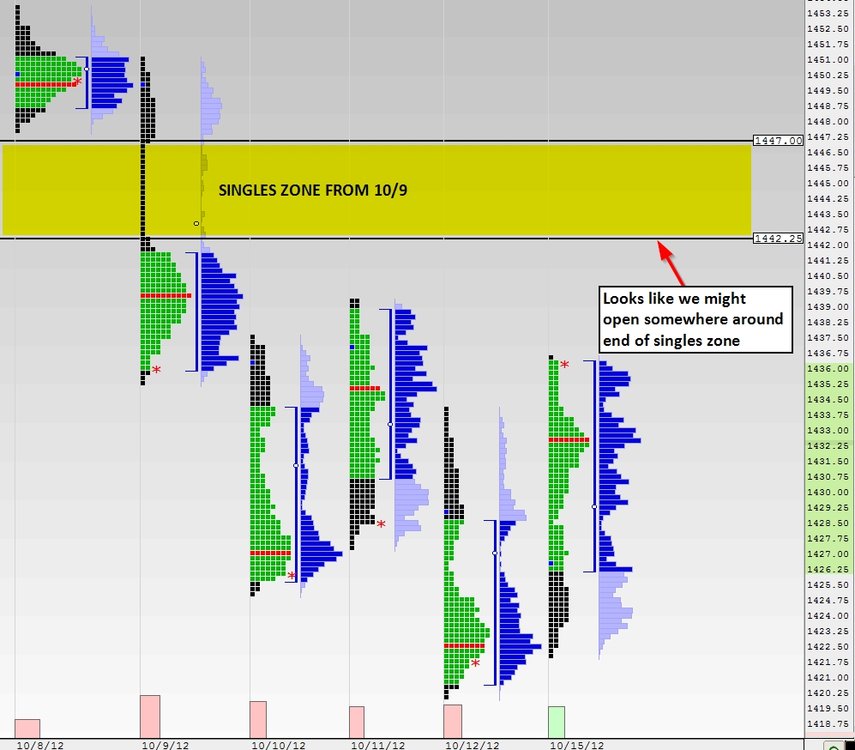

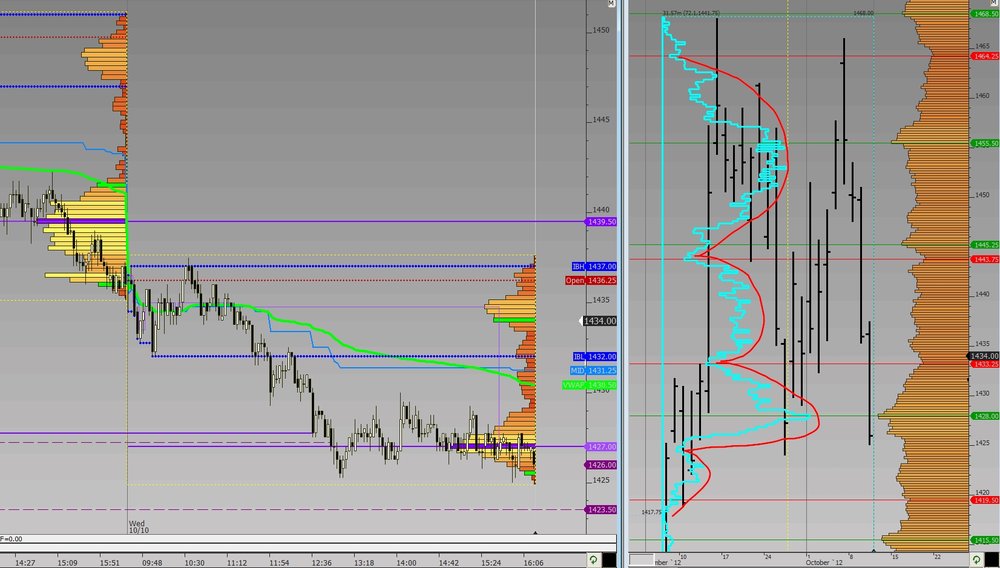

It's also important to note that the overnight high is right slap bang in the middle of the two developments in the cyan profile (from the chart I posted earlier) at 44.00 (low vol price also on the long-term profile is 43.75).

-

NQ seems to be dragging too.Dow is trying higher though.

-

NQ seems to be dragging too.

-

We are forming an Open Auction Out of Range type of open...

A break one way or the other could show us who's in control.

-

Gap is clearly a bit of a pull still so will see if we can hold or not. Big gaps often don't close on the day however, at 5.75 points this is not a big gap.

-

-

Fed's Lockhart and Raskin speaking (separately) at 12pm and Merkel & Monti (separately) are at 12:30pm. Just good to be aware.

-

Industrial production = 0.4% exp 0.2%

Capacity utilization = 78.3% exp 78.3%

-

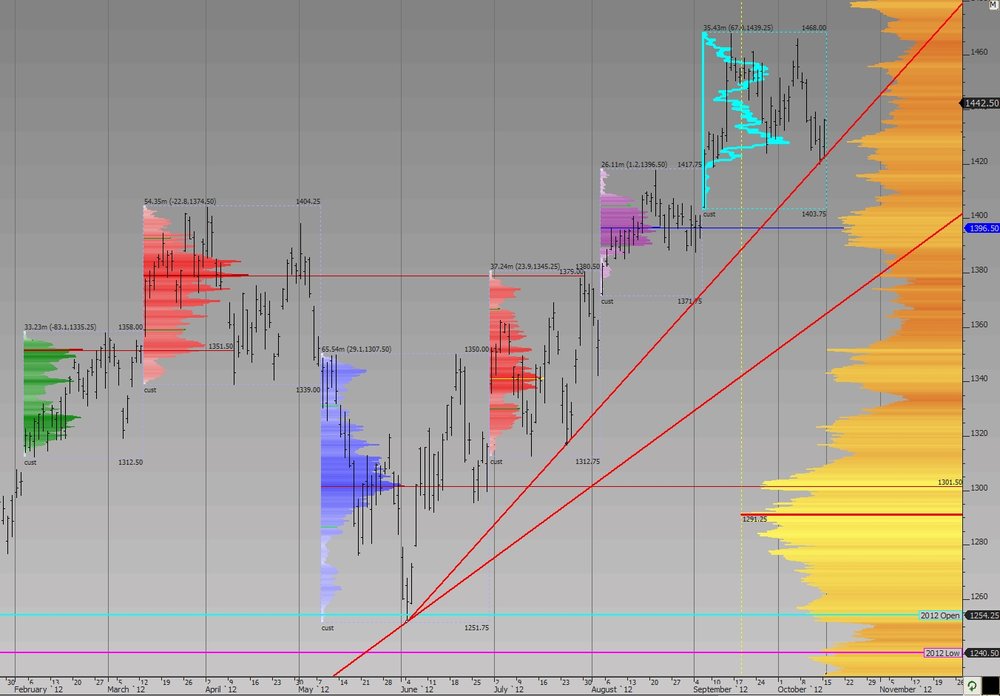

This looks like a BS move up. I suspect that it is moving up to about 1458 and will then move down significantly to below 1414, but it really all depends on what develops. The turn at 1416 lacked volume.The actionable trade is to take shorts starting at 1457 to the recent high around 1466. To begin shorting, I need to see a shorter term change in direction. I will short with small stops and reenter short if I get taken out. I don't mean that I will start shorting at 1457 and stay short until 1466. If there isn't a directional change, then I won't short at all. If there is a directional change and then it changes direction again, i will stop shorting and wait for a break out of the developing range.

Why do you think it's BS? Just because it got there quickly doesn't mean it's BS imo. The move back lower so far is within the current uptrend and it looks to me like they've been trying to find a low. The fact that the Fed and ECB are committing to do "all it takes" to fix the problems and that this means one thing for the real value of those currencies, means we are likely to see higher and higher prices imho. Now that's not to say that we can't correct at all in the meantime, but right now it seems to me that we could see a retest of recent highs. Today could well be an important day to gauge the chances of this scenario as news/results could be supportive, so if they aren't...

-

Morning. Won't be trading today as not feeling so well - bit fuzzy so will be here but doing other stuff. Sept CPI came in slightly higher (0.6% exp 0.5%) although ex food&energy was lower (0.1% exp 0.2%). 9:15am is Industrial Production (exp 0.2% from -1.2%). We've had some decent earnings already today (GS:2.85 exp 2.27, JNJ:1.25 exp 1.21) with IBM & INTC amongst those reporting after close today. Greeks saying they expect the next aid tranche and Germany talking about having a credit line with Spain (as Spain still saying they won't request a bailout). To me, this is potentially upbeat and given the market action looks to have been base building over the last few days, I would want to see a move to the upside. A failure to see a decent push and/or a selloff taking place wouldn't be great considering imho.

Here's a chart anyway:-

-

I have two questions to put to you.1 ...do you think that Navy Seal Training is based on discipline.

I'm guessing not very much, but then they most likely take people who have already received a highly disciplined form of training.

2 .. do you think that the majority of people here on TL think that discipline is one of the main keys to successful trading .... maybe even the most important element of tradingI think the majority of people on the internet believe finding brilliant entry systems is the most important factor in success at trading.

-

Negotiator, Which ‘discipline’ are you talking about? Applied to what? At what point?Here’s why I ask

ie In the replies already posted at least three different ‘uses’ of the word have come up.

In my illustration taking off on the OP, I left ‘motivation’ and ‘passion’ in the same sentence because of sufficient differentiation btwn them… Please make the same qualities of differentiation in the various ‘disciplines’ and ‘places’ and 'durations' they are applied in trading before we jump into attempting answers.

Thanks.

Interesting isn't it? Anyway, I was referring more to discipline as categorised by 'application'.

-

-

I think one of the most neglected areas of trading is the professionalism to plan, prepare and focus on trading. Psychological issues I would agree need to be dealt with and not ignored however, they are much more likely to impact upon performance when there is ambiguity about what the trader is trying to achieve.

-

Trading requires self reliant clear thinkers, who will do what ever it takes to succeed.Very important. Planning, observing the developing market and any developing opportunity, deciding on a course of action and then taking it with focus shifting to the management of the position (from the opportunity) encapsulates the way a trader should be. Clear thinking, clear acting.

-

This is probably a question which is more broadly applicable than to just trading and it would probably be helpful to hear from those well versed in current (not always necessarily correct though) views in the field of psychology. Is it enough to be just very disciplined at something in order to become successful at it whilst not having bucket loads of natural ability and possibly more importantly, the passion for it? I would note that by success I mean replicable positive results, not necessarily be at the very top of the tree so to speak.

My feeling is it depends. Probably a great deal on the type of guidance the individual receives. I think that natural ability is only fulfilled with discipline. Clearly therefore, there will be some individuals with very little need for external influence to experience some degree of success. Yet there will be some who are extremely disciplined who lack the flair and intuition (or whatever you want to call it but please, that's a different thread!) to know what they should be doing and there are those who have the flair and so on but not the discipline. How important do you consider each factor?

-

negoc8r, re: “point of diminishing returns for this kind of work (and actually the relationship inverts).” Got time to explain that further? thxI simply meant that for some, the more preparation they put in the more fixated they become on a particular outcome and the less likely they are to focus on what the market is actually telling them as it trades.

-

Thanks Negotiator,I guess its just a risk I have to take but I'll see how much capital I could raise for another broker. The main problem being that most of the big ones (IB) require a 10k minimum.

Just out of interest, who are you with?

Best regards.

Several but I wouldn't necessarily recommend you go with any as such. I think that there's no way to be absolutely sure that your money is safe so it's important to keep an eye on things and plan for the possibility of things going wrong.

-

6E sold off after S&P did their 2 notch downgrade of Spain after US cash close... damn shame I was not at my trading platform, I probably had turned off around 9:30pm, but who knew right?But 6E has now rallied powerfully, recouping the losses and plenty more besides.

My take is this:

Big players are buying 6E whenever it dips, in anticipation that Spain will eventually concede they need a bailout. I recently drew comparison between the Spanish bailout officials and Baghdad Bob - do you remember him? Spain insist that they don't need a bailout and that the downgrade is not justified... peh... we'll see.

All that said, if Moody's downgrade Spain, and I am at my desk, I will be spamming sell 6E as fast as possible. The sell-off won't carry on forever... because the big guys will step in to buy it, confident in the knowledge that a bailout is due. But the knee jerk reaction will definitely be a sell. Just my view.

Someone probably knew or more likely anticipated it. Look at the markets over the last few days. Fed and ECB are totally committed to destroying the value and confidence of currency (amongst others) so my view is that any selloff will be bought back and move us higher ultimately. Still I could be wrong. But you don't need to be 'right' to make money

-

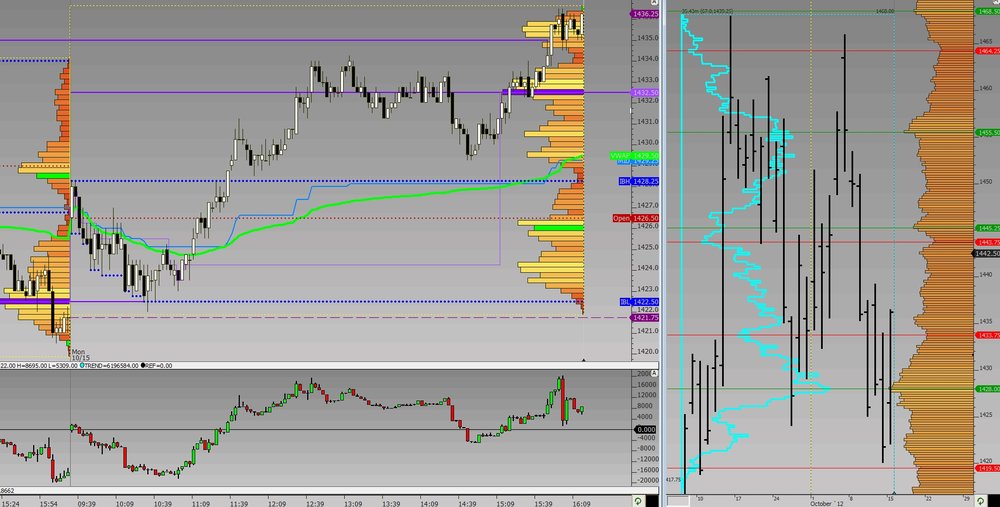

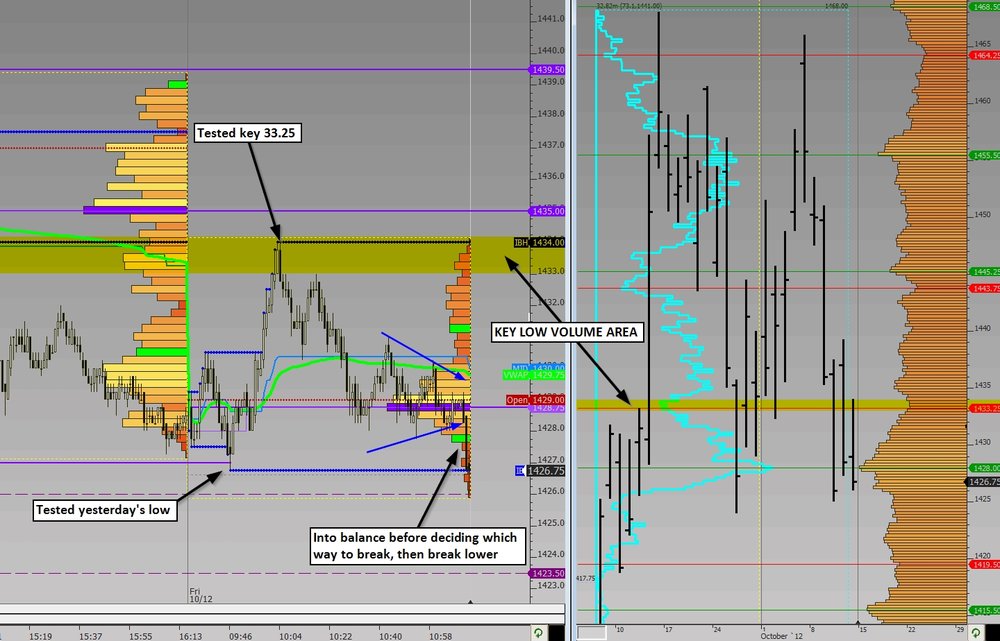

Both yesterday's low and the overnight low were poor, suggesting a further test lower down the line is possible. Today is about whether we can hold above 28.00 and develop in the less well defined middle development. Initial Jobless Claims surprised to the downside.

-

-

-

Found this review by Brownsfan:-http://www.traderslaboratory.com/forums/brokers-data-feeds/1904-review-open-ecry-futures-broker.html

Maybe he still uses them. If he does perhaps post in that thread and he could well reply to you

Day Trading the E-mini Futures

in E-mini Futures

Posted

Just in case anyone had missed it:-