Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

3710 -

Joined

-

Last visited

-

Days Won

1

Posts posted by Soultrader

-

-

Hi bf, yes I receive all of the notices via email and act as soon as I receive them. The dispute function we took off as it was not a real useful solution, I feel like the simple report and then check option tends to be smoother and easier.

-

The fact that James is so quick to respond and so helpful in many ways, is one of the reasons this forum stands out from the rest.But I think we shouldn't waste his time with asking for a load of little "nice-to-have" features

Thanks fw

As long as I can handle it with my limited amount of programming knowledge then i dont mind cause I also learn something new. If its beyond the scope of my abilities, thats when it gets costly and could take some time.

As long as I can handle it with my limited amount of programming knowledge then i dont mind cause I also learn something new. If its beyond the scope of my abilities, thats when it gets costly and could take some time. -

Let me start this off with a big "In My Opinion".....I am considering this idea also. It seems like the best traders learn to trade their prime setups, learn to wait for them, and get out when the subsequent price action demonstates that the entry does not meet their "prime trade" requirements. If you find you only need a few of those large fast breakouts to make your money stick with that.

Depends on the type of trader since high frequency types Ive seen would definitely not apply here. But personally I approach trading in a very similar manner, waiting for setups I am familiar based on support and resistance analysis. I only watch price levels that I am focused on any dont even bother with anything in between. The exit is rather different as I dont consider myself experienced enough to know when price demonstrates that I am wrong. Stops are usually my protective measure but I also minimize my risk right away by scaling out and then moving my stop to b/e. The remaining portion I will try to let it ride to my next predetermined level. The only problem with this approach is that I am never able to stay in a decent trend. On a contrary, trades that often offer high probability of success in my trading are breakout failures. I do not trade breakouts after being burned like a hundred million times but instead have developed into a type where I often watch for failures. Moves that fail tend to reverse rapidly and fast money is often made through such setups.

My thoughts on stop placements is such that every setup requires a different parameter. A fixed pt or dollar amount stop I think is not suitable as it does not take into consideration the setup and structure of the market. Stops based on swing highs/lows and S&R are the types I am most comfortable with. If I am late getting into a move, I wont even chase it as my risk becomes too high. As I scale out always, entry timing is extremely important to any successful trade I may take. I could be wrong in terms of direction, but scaling out has turned a minus trade into a slightly positive trade. This probably means my analysis is not spot on but able to survive through money management and exit strategies that I am good at.

Its interesting to reflect on my own journey... in the initial phases I was so into strategies, setups, market internals, etc... trying to find technical tools and setups that could provide profits. Nowadays I dont even bother learning a new strategy but focus primarily on risk and money management as well as keeping my own emotions in check. I really think that trading taps into the hidden self in which one really needs to admit and accept all of their bad habits, negative faults in order to build a successful trading style around it.

-

Just want to make it easier for everyone

Ppl have different needs and requirements... just like trading

Ppl have different needs and requirements... just like trading

-

-

Thanks for your replies.However, I'm lazy.

I would like to put a link on my desktop that would bring up TL and it would already be on those pages. When I click the links you referred to they simply create a link that is a search string with a number assigned.

Once that number expires, the link no longer works.

There has to be a static URL that links to this stuff???

Thanks

Hi David,

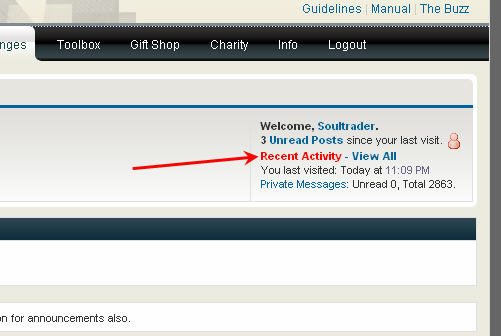

Try this link here: Traders Laboratory - Latest Forum Activity

I will be posting this url up somewhere on the forum shortly as well. Thanks.

-

it would be alright if you have this link at the top of the page, with default to 50 threadsTraders Laboratory - Latest Forum Activity

people can look at the topics at a glance... and choose whatever that catches their eyes.

about this page:

http://www.traderslaboratory.com/forums/

the design is clean, and the categories are nicely structured,

but difficult to find threads because they are buried in another layer.

also, when people do not see what catches the eyes, they tend to move away instead of dig deeper.

Ive set the default to 50. Still working on rewriting the url and will look to implement this in a more convenient area. Thanks for the suggestions Tams.

-

So basically a page listing just latest and new posts?

-

That is an excellent idea Soultrader.I use eSignal and they have a panel of dedicated programmers both in-house and independent and they do excellent stuff. But one notices that there are many gaps and unfilled requests. This happens primarily because the established panel of programmers are reluctant to take on tiny projects and quite inflexible on their rates

Another model that is very interesting is the eLance.

The way I see it there could be a) individual requests b) common requirements for which the costs could be shared.

Jose

Hi Jose,

Thank you very much for your feedback! I am aware of eLance but wanted to offer an arena specialized in trading related programming. I figured with the community base we have on TL, this model may work. Also note that we have a number of very talented programmers on board with us. One thing all members should know is that if we decide to offer this function, it would be commercial in order to support the ongoing costs of the system, support, and maintenance.

Still doing some research on my end but should have some answers shortly. Thanks!

-

Just a little suggestion - but it would make quite a big difference at least for the way I use TL:In the "New Posts" view (and the others where threads are shown) if you want to see the latest post you'd have to click on this very tiny little right arrow (in the column "Last Post"), whereas to the left of it there is a big link with the name of the person posting.

Maybe I am getting a little old but it would be certainly nice to have this arrow at least twice the size as to make it much easier to click it (It normally is much less interesting to see information about the person posting).

Some extreme solution might be to even make the whole cell (not only the arrow) a link to the last post.

If the user really wanted more information on the last person posting he might click then from the posting.

Hi uexkuell,

I havent forgotten about your request!

Im still trying to find a solution to this. Enlarging the arrow would make not make the template look too appealing and the extreme solution is something we cant implement at the moment. Ill bounce off some ideas to my coder and see what we can do. Thanks.

Im still trying to find a solution to this. Enlarging the arrow would make not make the template look too appealing and the extreme solution is something we cant implement at the moment. Ill bounce off some ideas to my coder and see what we can do. Thanks. -

one suggestion:we post a lot of codes in this forum.

can you put the Code tag button in the main message window? instead of the Advanced window.

TIA

Hi Tams,

This has been added per your request as well. Thanks.

-

James:the Code tag adds extra spaces in the bottom of the code window:

This text is wrapped with Code tag

This text is wrapped with HTML tag

This text is wrapped with PHP tag

Thanks Tams, I think I have fixed this issue. I should probably get rid of the php and html tags as we wont use them here.

-

Guess db and tams already answered the question

The reason why its set at a hour is to avoid abuse. Thanks.

The reason why its set at a hour is to avoid abuse. Thanks. -

I took a look at quantifying the theory that all the 'action' is occuring on Globex and not during regular pit session hours. Here is a first pass attempt.The futures market is generally open ~23 hours a day. The S&P Cash Index is open for 6.5 hours of the day. Then there is the 15-min stub period from the cash close to the futures close.

The European market is the 2nd most active market in the world and this is where I want to focus first. It starts to get complex because world clocks are not aligned -- time changes seasonally -- creating diff't amounts of overlapping sessions.

Some assumptions have to be made or else this becomes a major 'get lost in trees' exercise.

So here is my assumption: only compare the 6.5 hours of US cash index (9:30am to 4pm NY time) to the 6.5 hours prior to the cash/futures index open (3am to 9:30am NY time). The 'amount of time' in these two time periods is the same and therefore we will not be comparing a 6.5 hour period to a ~17 hour period of time -- as you would if you just did 'pit' vs 'globex'.

Here is the chart result, shown as a 20-day rolling moving average of the ratio of pit range vs 'euro session' range. The Red Line is the average for that year. Year to date, pit has represented 63.2% of the overall '13 hour period' measured.

note to James (TL Founder): could you start a 'Market Statistics' Forum?? --- unless that is what 'Futures Laboratory' is meant for.....

Hi Frank, interesting suggestion. Ive added this temporarily under the Welcome to Traders Laboratory category titled "Market Statistics". Ill be doing rearranging categories this week so may move this in a different category block. Thanks.

-

I know you know way more about CQG than I do, given that I've never even used it before, but they do say they support OCO on their website...I'm just curious now, since it's right there on their website. It also could be that we're talking about completely different things, since I don't know much about automated trading which seems to be the topic of discussion right now. I don't know what you think about Ninja, but I use OCO usually multiple times per day with Ninja on Globex, and I have no complaints about that part of the platform. Though I'm not sure what data feed you'd have access to there that would work with Ninja.Those need to be inputted manually. With automation CQG only provides market order as the order type. With the Apama plugin, additional order types can be added but after seeing a demo of it Im not convinced in paying around $1500/month for it. Regarding datafeed, CQG is also a direct market data vendor so I get my data from CQG as well.

-

Thanks diablo,

Well the beauty of it is that those looking for help can easily identify the provider through the forums. Has he been active? Is he trustworthy? etc...

Obviously more long time posters will have credibility over first timers. Also wouldnt escrow services solve alot of the headaches?

-

I would think there are a lot more platforms besides TWS that offer OCO. Off the top of my head, the only ones that I know of are Ninja, CQG, and X Trader (you have to use some kind of plugin with X Trader though I think).CQG definitely can not as I use it at the moment. Even with the Apama plugin, smart orders can not be routed. Im a bit worried about X Trader data as well as they are not direct market data vendors. Would you know where they obtain their data? Thanks.

-

Thanks Kiwi, those are actually what we were looking for. OCO bracket orders and stop limits. In addition I would be interested if system trades can be made depending on the offer and bid sizes.

Its unfortunate IB no longer accepts Japanese citizens due to the FSA wanting locals to trade Japanese markets only. Will need to establish an offshore entity and create an account as an institution for IB. That would probably put me under the radar with the tax agency here.

-

Its interesting that I am in the process of completely eliminating intuition from my daily trading.Having spent 5 years watching the market and trading it in real time (HSI, SPI, STW) I realized that my intuition about the markets, my real time execution, and my attention to operational details were not my fundamental strengths. Said another way, it had become boring and I suspected that I wasn't going to get better at it.

So, in my inimitable style I decided on a radical change.

My strengths are: understanding of the market and setups, solving problems and programming. I like newness and I love problems and the satisfaction I get solving them.

So I am in the process of automating my trading style. My first system, Peewee, was an attempt at it and didn't quite work. I ended up with something that I didn't really like but it had a nice profit factor and even on really ugly markets stayed above 1.5 so I implemented it. I've been live on it for 2 weeks now and I'm getting kinda fond of it. While I work on Popsicle, Peewee trades HSI. Every so often TWS pipes up and says "Trade Entered" and I check to see what happened and whether it looks ok. I no longer jump each time this happens. In the first week I intuitively interfered with it about every second trade but after 3 days I realized it was better off without me so now I let it go.

And the damned thing makes money almost every day. I now reserve my intuition for generating ideas to test and program. Once they're implemented I just let them go.

Hi Kiwi, definitely something I wish I could do as well if I could program. I know in the back of my mind programming will be a requirement for trading and its a matter of me dedicating a few years to learning it.

I did notice you have been discussing your system frequently hence the realization I had that you had probably adjusted your trading. Quick question regarding your current execution... is your system able to place complex order types? Im actually with a buddy of mine as I write who is backtesting a few things related to the Dax and Euro Stoxx 50 but the platform he uses can only do market orders for entry. Do you know of any retail platforms available that could also implement smart order types?

-

Hi all,

I am looking for some feedback from the TL programmers and those who are seeking programming help to develop your strategies, indicators, trade systems, etc...

TL is a free site but requests such as programming can often be hard as this is time consuming for the programmer. As a result, I am contemplating whether to offer a commercial service market place in which those seeking programming help can hire programmers directly at a specified fee. This could be in a format where you would submit a request and then programmers would bid on that project. This does not necessarily have to be restricted to programming. It could be merely seeking direct mentorship or closer help from fellow members as well.

Any thoughts? Thank you!

-

No problem Rob. I should really make an event system for the site.

-

Im actually on the exact opposite side of brownsfan. Having strict rules was okay for execution but psychologically it was damaging for me. I was too attached to my trades which resulted in cheating and moving my stops. Also I could not bear the frustration of missing a move when my signals did not fire but felt intuitively the markets may move.

Rule following also seems to be a direct conflict between who I am as a person. As a result intuitive trading works for me as long as strict risk management is in place. I also do not want ppl reading this to misinterpret intuitive with impulsive. Having a plan is vitally important... but I do often ditch the initial plan and create a new plan as the day evolves.

-

Welcome to TradersLaboratory!

This is a guide for all new members to explore the various functionality and features of the website. Traders Laboratory is an online community for traders to discuss and share information related to trading. Most members on TradersLaboratory are short term active traders and thus our focus on this website.

Website Categories

- Forum - This section allows members to interact with other members through the discussion format

- Videos - This section allows members to upload and share videos and to interact in a multimedia format

- Reviews - This section allows members to post reviews of their brokers, softwares, trading books, etc...

- Blogs - This section allows members to establish their own blogs

- Chat - This section is dedicated for real-time interaction via a chat format. The chat room is usually busy during US market hours.

- Exchanges - This section lists global exchanges and the financial instruments offered

- Toolbox - A bunch of useful tools for traders

- Gift Shop - A webstore hosted by Cafe Press that provides TL gifts

- Charity - Our joint charity program with RoomtoRead to provide libraries and reading centers across developing nations

Registration Process

Activation Email

Upon registering with TradersLaboratory, an activation email is dispatched to activate your account. We do this to avoid spam bots from registering and posting. If you wish to post and interact with other members you must activate your account. If you have not received an activation mail, please check your spam and junk folders as it may be filtered in there. If not, please following this link to resend your activation email: http://www.traderslaboratory.com/forums/register.php?do=requestemail

Password Reset

If you have lost your password, please follow this link to have your password reset: http://www.traderslaboratory.com/forums/login.php?do=lostpw

Please note that we do not store individual passwords. Please do not ask for us to provide your password as this is unavailable to us. Simply follow the reset link and then change your password manually via USERCP.

Website Information and Contacts

We ask that all members respect one another and approach in a professional manner on TL. To view our forum guidelines please visit this link: http://www.traderslaboratory.com/forums/guidelines

We also have a simple video manual that goes over some of the functionality of the website. To view this manual, please follow this link: http://www.traderslaboratory.com/forums/manual/

Email contacts are listed below:

General support: support@traderslaboratory.com

Partnership: partners@traderslaboratory.com

Site Admin and Owner: jameslee@traderslaboratory.com

Please use the following emails to contact us for general inquiries regarding the website, account, abuse, violation of copyright laws, partnerships, feedbacks, etc...

New to forums? Where to Start?

If you are new to this community and would like to begin by introducing yourself, why not start at the Introduction forum? You can do so by following this link (make sure your account is activated): Post on the Introduction Forums

So you've already introduced yourself and would like to start asking trading questions? If you are new to trading, you can start by posting away in the Beginners Forum. Begin Posting Now!

If you are already familiar with the forum and the forum structure, please feel free to post away in various categories of the board.

Keep in Touch

For users with Firefox or Internet Explorer, we also provide a cool toolbar for members to stay connected with TradersLaboratory. This toolbar will be placed directly within your browser. It is 100% safe and we do not store any of your private information through this toolbar. As a matter of fact, this toolbar is provided by Conduit and not by TradersLaboratory.com. You can download this toolbar by following this link: http://www.traderslaboratory.com/forums/toolbar/

Recommended Threads for Beginners

There is an ongoing thread that lists recommended threads for beginners. You can view this list here: http://www.traderslaboratory.com/forums/f30/best-tl-2954.html

One of my personal favorites is by bootstrap titled, "I Look Back Now and Wonder". You can read this thread here: http://www.traderslaboratory.com/forums/f30/i-look-back-now-wonder-4014.html

Thank you and please enjoy your stay at TradersLaboratory!

- Forum - This section allows members to interact with other members through the discussion format

-

How Important is Intuition in Your Trading?

I definitely rely alot on intuition based on global market information, market reaction to earnings/news, and then determining the potential of a trade at a S&R level. As a result my style is shifted heavily towards the discretionary side which lacks any type of systematic approach. I do not have concreate rules at all except risk management. Perhaps my style has transformed this way due to my lack of progamming skills or perhaps by being around and learning from discretionary traders. We often phrase the markets in such ways like, "Market smells funny", "Market feels ready for a bounce", "Markets smell like fear", etc...

The topic here is how much intuition do you use in your trading? What are the factors that you consider part of your intuition? Is there an edge for intuitive traders vs systematic traders? Are intuitive traders more flexible in adjusting with the markets? I often view my trading as "free style trading". Very quick to change my mind, and S&R levels are often dynamic adjusting levels throughout the day and night. If I was told to write a book explaining my methodology, I probably could not at this point in my career.

Lets get this discussion rolling

Analysing Quality Entry with E-Ratio (MAE/MFE)

in Trading Indicators

Posted

Thanks for the notice. Ive added the xlsx extension.