Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

SunTrader

-

Content Count

1015 -

Joined

-

Last visited

Posts posted by SunTrader

-

-

"Anything is possible", but it probably won't help Gold at all.

Those are possible reasons to sell the dollar but not necessarily reasons to buy Gold.

Buying Gold is not automatic when selling the Dollar.

-

-

I don't disagree with the idea that .....

.....

BTW chart illustrates what Tom Bierovic/Playing for Keeps in Stocks & Futures calls a type II bullish multiple divergence.

-

Kick it to the curb. Or is there a rookie/newbie section here?

-

Divergences like trendline breaks, like moving averages, like XYZ etc work, except for when then don't work

Knowing the difference, hopefully, is the key.

-

Those who believe in manipulation, are.

-

......

There is only one reason why you want to compare current price with recent price.What is the reason?

To determine if current price is relatively cheap or relatively expensive

.....

Not the only reason.

Trend and momentum are two more reasons I can think of when comparing price to a previous price.

-

True. Day to day I trade the markets. This is all background noise to me.

-

....so let's kick it still for a couple of more decades .....Very little likelihood we can keep it going beyond a couple more years.

-

Most likely debt ceiling crisis...Most likely nothing, actually is the better description - for both.

Neither want to acknowledge debt problems and are "kicking the can" down the road.

-

........ The first Gold to Go vending machine in the United States was installed in Boca Raton, Florida in December 2010.....Where?

And note my location before you reply.

-

Seems obvious to me. Market has spoken.

Next the debt ceiling fight (deadline Oct 17th) is what matters to the markets.

We have had shutdowns before. It is all political.

But debt ceiling is an economic issue. Possible default, although highly unlikely at this point, would be big, very big.

+ + +

Who was it that said Gold is bullish? Anyone? Bueller?

It hasn't been since 2011 fa-cri-sakes.

-

maybe he's earning more in this way and it is taking less time and stress then trading does......why not? what is wrong with that?TW

Nothing wrong with it.

Those who can't, teach,

-

easy to talk, hard to do it.....come on!What is that? Teach, talk or write a book about trading rather than actually trade.

-

(Sintrader) :rofl:

.........

But if I haven't convinced you,and you really think you need a mentor why not ask one of the worlds leading EW "experts" (Prechter) exactly how much money he's made shorting the market since 2009?

Oh yeah and he did even better in the mid 90's year after year calling for a crash.

He was right ........ eventually. :doh:

But he makes his by teaching, not trading.

Can you imagine. Wow!

Another rule follower. Actually he probably wrote a few that even old man Elliott probably never fathomed.

-

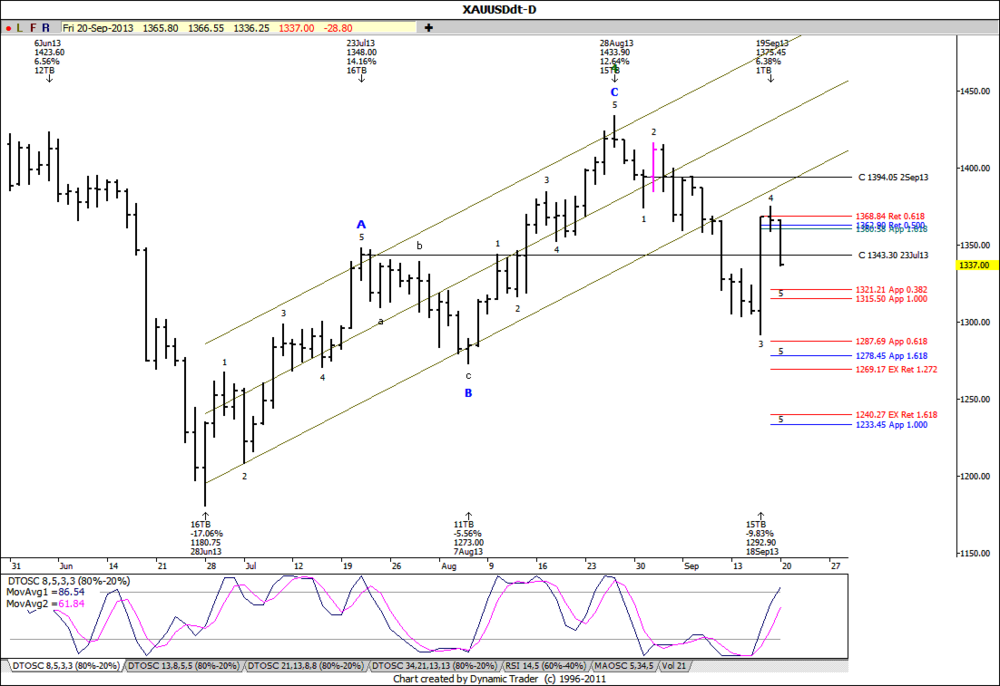

Here's the issue as i see it, you have qualified waves 1, 2 and 3, then you have potentially qualifying waves 4 and 5, which may or may not develop.

If waves 4 and 5 do not develop does that mean you had the "wrong count" for waves 1, 2 and 3?

I am not saying you can't trade whatever way you trade, just that there are many claims made in this business without definitive supporting evidence, such as the market always moves in 5 waves. Unfortunately this is always supported by after the fact examples, which ignore or violate prior examples and/or wave moves in order to fit the mold.

Kind of merged two posts together here so I'm guessing the question is directed towards me?

EW is no different than any other technical way of trading. Decide what you believe is happening, put a trade with a stop in place and wait for the results.

Do wave counts change - all the time. So.

Do OB/OS oscillators swing back and forth or give wrong or just plain lagging signals. And lets talk about the Lag Kings themselves MA's or MA crossovers.

Whether I am using EW or a few other things in my tech toolbox I lay out what I think price should do to confirm I am right AND what price should to confirm I am wrong.

Not much more you can do no matter what you use.

-

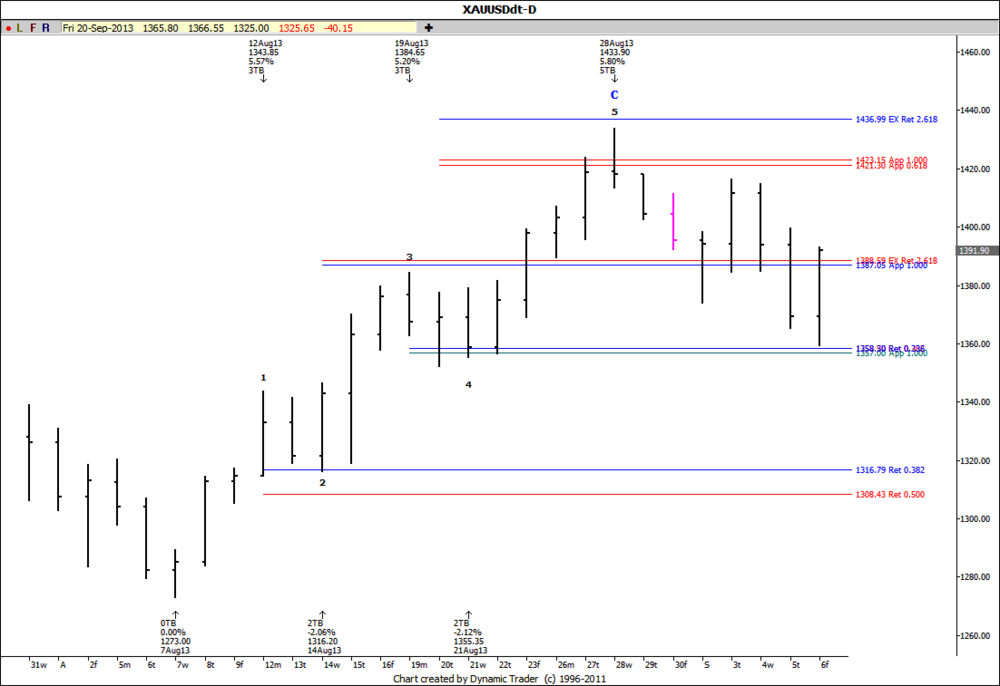

somehing like that.....c=a and the correction (or at least one leg to the upside seems to be done)......classical zigzagThanks but you stick with yours and I'll stick with mine because as you can see with this chart version with fib time and price levels all duly noted for each wave they are almost perfect.

Waiting around for 100% perfection is :doh:.

-

oh no no....totaly wrong........this is corrective all the way (what you labeled12345)....it is channeling too well, corrections are almost the same......so no......late in the evening here but tomorrow I will redo the counting and post it here.......DEFINITELY WRONG!TW

Hate to sounds like a broken record.

Post away but as I say agree to disagree.

You might be right but there is never definite in trading. You should know that.

If you don't well ........

-

indeed guidelines, as most of the original work uses words like "most likely", "typical", and so on, nothing specific.However, there are still some rules that need to be there. For example the third wave should not be the shortest one.

TW

They were all guidelines - originally.

So then I am wrong on this Gold chart.

Wave 3 of Wave A is the shortest. Throw the count out.

Except it worked. That is what I go by. Otherwise I am waiting around for things to be perfect. And miss out.

As I said, we can agree to disagree.

-

price action is the first to look at, of course.....but even that is considered to be labeled with Elliott (range = corrective wave, trend = impulsive wave, etc.)TW

That is what I do. But I don't force it to make a count that in actuality is not there.

EW is NOT there 100% of the time in 100% of the markets.

As you know Elliott developed it on the Dow.

BTW originally these "rules" were no such thing. They were in fact guidelines.

It was only after prodding from the public and his book publishers he felt obligated to "iron-clad" his theory. Give them what they want. Nothing in trading then, now or in the future is absolute.

-

I disagree completely with your statement......it just means that your count was wrong, and you missed something......this is why you are supposed to have a SL......I trade 7+ years now using mainly ElliottTW

Did I say I trade without a stoploss.

Anyway we will have to agree to disagree.

And I'll continue using EW - when it is right - but always trade price above all.

-

Markets (in the form of price waves however they are defined and labeled) are sometimes known to not follow the rules,

What then?

By that as an example an impulsive wave 3 (in a picture perfect five wave move) turns out to be the shortest wave - start the count all over?

Its no good even though price turns and reacts as it should to a 5 wave completion

Don't tell me bring out the X's and Y's or alternative mangled labeling re-labeling sheeesh.

Price marches on.

-

Proposition: I may value PM’s even less than you do… AU is worth about $32 an oz. :rofl:…

Right now it.

What it will be "worth" in the future is anyone's guess.

Gold used to "worth" something north of $1900 :doh:

-

Rising real rates will pressure PM's v fiats. I’ll quietly accumulate… welcoming lower ‘prices’ (… prices are now a false metric anyways … ‘built in’ as a true metric, but they ain’t…)ie It’s all good in the long run…

Hm...rising rates… in a ‘new’ world where the borrowers can’t pay… and expect to be bailed out… meanwhile, Fed is leveraged more than any (surviving) hedge fund ever…

Kyle Bass: "The Next 18 Months Will Redefine Economic Orthodoxy For The West" | Zero Hedge

/

...

PM’s are a lousy investment. Actually, they should not be considered to be an ‘investment’

- or even a ‘trade’… they actually shouldn’t ‘move’ enough to be a ‘trade’

…but as safe savings tucked away… regardless of what fiats do… continues to work for me…

money humoris

///////////////

'quieted' down enough now...

:rofl:

:rofl:we now return you to your regularly scheduled posting...

What was there something like five people in the audience?

Fiat Chicken, I like that. Otherwise known as Pieces/Parts Chicken.

But he uses the same old same old that people valued money only because it was backed by Gold which had value.

Yeah but then w does Gold have value?

Dig it up, sell it to someone else, who then bury it back down in the ground.

Sounds like a value proposition to me.

Well more like sounds like a good sales pitch to me.

Anything no matter how precious or how many industrial uses there are is only as valuable as the market place says it is.

100 Pips a Week Compounding Billionaires

in General Trading

Posted

I don't know why I am bothering posting here since I am one of those "idiots" who find trading opportunities every single freakin' trading day, with a few exceptions over the course of the year.

But if you filter out 44 out 50 trading opportunities then you didn't have 50 trading opportunities, You had 6 otherwise why filter them out.

BTW it is George Soros - one s.

Keep the insults coming oh great one.