Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

enochbenjamin

-

Content Count

173 -

Joined

-

Last visited

Posts posted by enochbenjamin

-

-

EJ - can you explain how you enter b/c I'm not sure how your entry level is identified on that chart. Are you anticipating the candle pattern to form or do you wait for some sort of confirmation?Thanks.

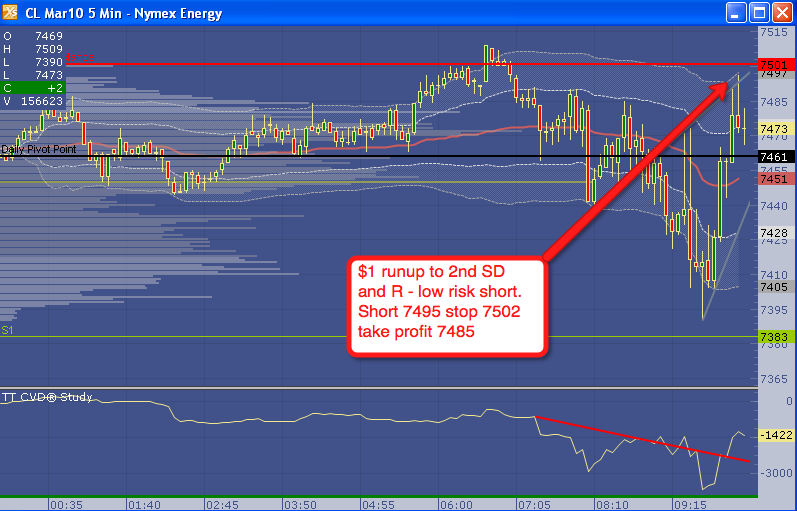

It is a little easier for me to enter with a shooting star. I already know and am watching the Resistance levels. In the above example the pivot was 7489 and the second standard deviation was just a few ticks away providing a resistance zone (for me). So as soon as I see the price retreating and the shooting star forming i will enter. I enter before I get confirmation as to keep my stops as tight as possible. In the first chart I posted you will see my stop was 7 ticks and not my standard 5 - that was because I did not catch it fast enough to have my stop above the star.

If you want confirmation you could wait to enter below the close of the shooting star candle. This increases the amount you have to risk and is much harder with tweezers.

If there is a confluence of resistance levels (R1, 2nd SD, 00, yesterdays high) at/near the same price I have been known to set a limit with a wider stop to account for an overshoot. Then once the overshoot does or does not occur I quickly reduce the stop to 5 ticks and let the chips fall.

-

Post away EJ!If you want, feel free to start a thread in the candlestick corner on this too. I'm sure you will get some interest.

Thanks for the suggestion. I just started a thread Tweezers & Shooting Stars

-

-

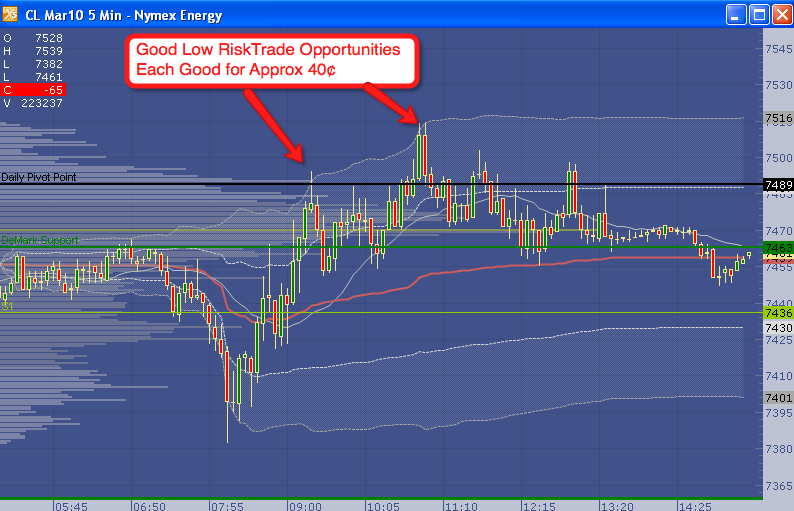

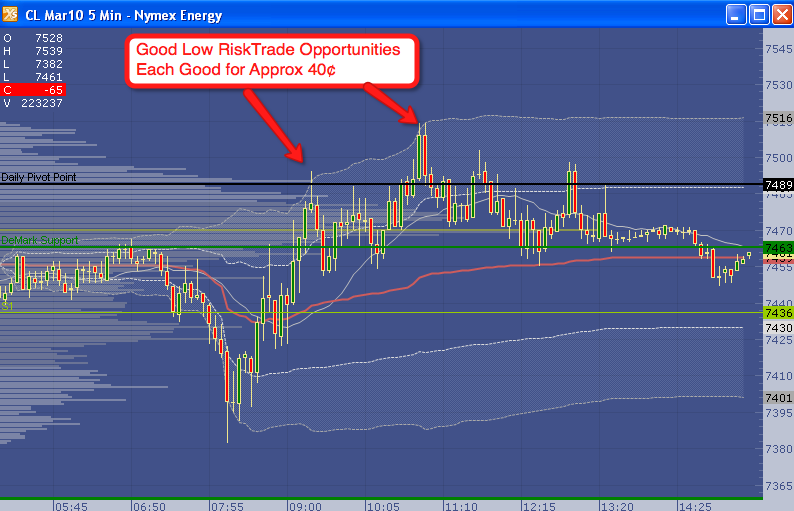

My bread and butter trades are scalps of shooting stars and tweezer tops into some sort of resistance.

Ideally one of the two candle formations will occur after a nice price move up to resistance. Today there was a $1 move up in oil that gave a nice shooting star in to resistance.

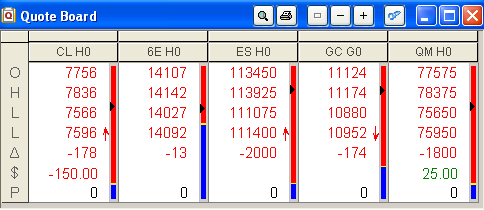

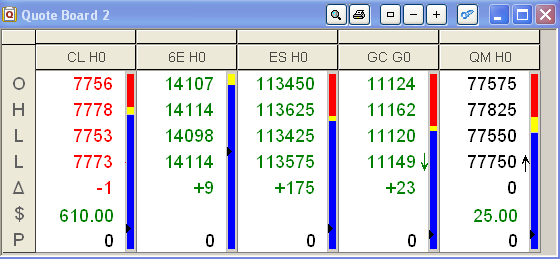

If I am on top of my game I will short 3 contracts with a 5 tick SL. I will take the first off at 8 ticks, the second at 13 ticks and the third off for 21 ticks. In crude oil (CL) my main vehicle thats $150 risked for $420 in profit. I almost always get the 8 ticks so even if I get stopped out before hitting my next two targets it is only a loss of $20. Very low risk trades.

The beauty of oil is that there are 3-4 opportunities to take this type of trade almost every day.

I define resistance as any level where price will pause and give you a bounce. In crude oil it is rare for price to just blast thru these levels. Usually price will approximate the level and quickly bounce. Then it may test the level again, completely retreat or blast thru. I am only interested in the initial bounce and tweezers or a shooting star into any resistance level give me the confidence to take this trade.

Please feel free to comment and/or share how you utilize tweezers and shooting stars.

-

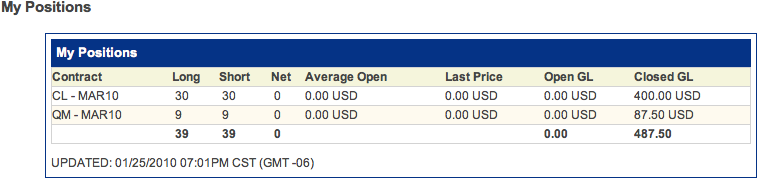

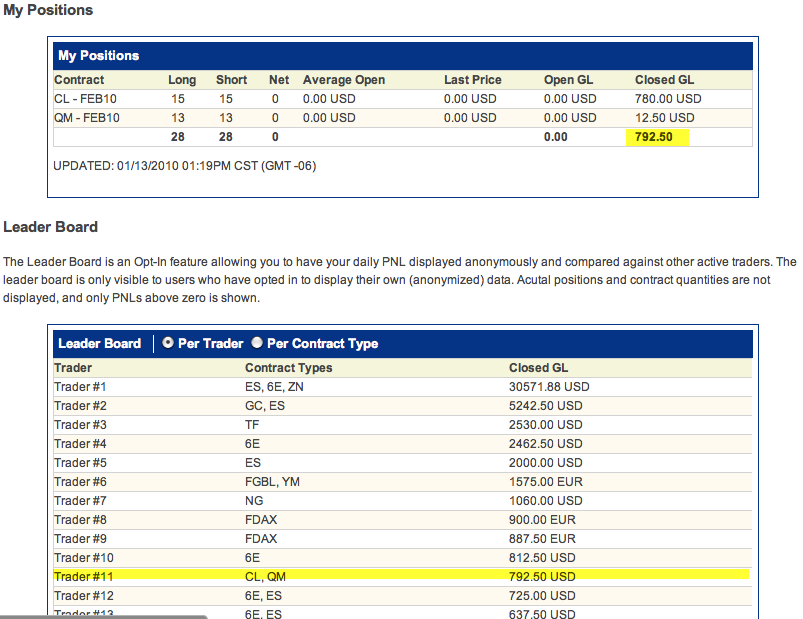

For some reason I cannot pull up my fill record so trust me when I say I ONLY had 17 trades. Still overtrading. I ended the day with $160 trading QM & CL. Had just 7 trades and a whole lote more money at 1:15 CST before I cracked and made 10 trades in 15 minutes. But I am getting better :-)

On another noteI had a short QM at 7489 with a 10 tick SL and for some unknown reason took it off for a 4 tick loss. Anybody trading oil knows what happened next.

I'll only post the disciplined trade.

-

-

Speaking of oil....

My trend is a bit disturbing. Down $1700 today before making a few great trades to make it respectable. What's really bothersome is that each day for the past 4 or 5 sessions I've done a single trade that nets over 1k. Problem is I am not managing my money very well. I know what needs to be done and it will be fixed.

I promise everyone on this thread I will have less than 15 trades tomorrow. Aiming for 6 or less actually.

-

Thanks for the encouraging comments.

-

Is that 30 individual trades or is that cumulative and trading multiple contracts? If that's the # of trades being done, that's a lot IMO. I'm shooting for around 5 per day to give you an idea. Not saying it's bad, just is quite a bit of trading.Its individual trades. Don't be nice - you can rip me. I know its idiotic. My best days are never more than 10 trades. I have been overtrading because I have been starting each day down so much. I am a counter trend trader and if I am not patient and dont follow my setups to the "T" I lose. I did very well in dec. and was overly anxious to start the new year. I am still profitable but just DONATING too much to the broker.

-

-

Do you scalp?

Most of the time. When I scalp and I know I am scalping I can pull 8 - 10¢ out of oil with regularity. My problems occur when I enter a trade as a counter trend scalp and decide it can be a swing trade. Then I widen my stop and usually get burned. The trade I made to make up my losses was a single trade that netted 2k, however that is not what I am comfortable with. My identity when I am on is to be a bricklayer and come to the market everyday and take advantage of the bearish nature of commodities.

Just typing this lets me see the error of my ways, so thanks for allowing me to have this cathartic experience.

-

When a stock market is crashing and stock prices are falling and everyone is selling all day who are the people doing all the corresponding buying all day? Why on earth would anyone buy during a stock market crash and how come liquidity doesn't just cease?Somebody needs to take profits. Sell high, buy low. Plus there is some sorta rule about market makers having to take trades or else the market just won't go.

-

Going against the trend + overtrading = not good!well i always go against the trend, but i feel ya on the overtrading part! Took 45 trades in oil today - mostly because i was behind and was trying to erase my loss.

i have actually gone back and looked at my best days - rarely do i do more than 10 - 12 trades. On losing days I always seem to be in the 20 - 30 range. hmmmm.....

-

To frustrated to click a screenshot.

-300 today after being down $2200. It seems I get disciplined only after taking a big loss. I need to work on that...

-

-

funny day but turned out ok.

i guess i should explain the funny part - when i booted up this morning i had gaps in my data and since I use vwap and peak volume the info was useless. i was forced to turn everything off and try and remember how to draw DeMark Trendlines. So I traded trendline breaks off of shooting stars all day with absolutely no indicators. I surprised myself.

-

Been in Florida for the past 5 days so little internet. I did some trading at whole foods. Friday +200 and Tuesday +320.

-

Had to catch a plane at 8am so only traded for 10 minutes. +140 w/CL

-

thanks Brownsfan for the link regarding posting images.

:-)

-

-

Have you ever tried a 21 SMA or EMA. Note location of the pivot point. If price is above the pivot wait for a retrace to the 21 MA and buy. If price is below the pivot wait for a pop up to the 21 MA and sell.

This is how I used to trade treasuries when the market got away from me.

-

sorry for the above, I'll just tell you I did +310 trading CL until I firgure out how to link images.

-

Patience. Gave away half of my gains by jumping in too early. With 5¢ stops you cannot afford to be early!

-

EUREX is the world's biggest futures exchange.This is no longer true. Chicago has reclaimed it's throne as the center of the futures world.

Tweezers & Shooting Stars

in The Candlestick Corner

Posted

Just wanted to point out that all of my examples will be shorts at resistance. I am a directional trader who firmly believes that deliverable commodities have built in selling pressure so no matter how bullish the markets become there will be ample selling at almost every level.

Also for some reason support levels are more "grey" than resistance levels so my tight stops do not work as well at support. I would love to hear from others so I can learn if this is a bias I have or if there is some consensus on the issue.