Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

enochbenjamin

-

Content Count

173 -

Joined

-

Last visited

Posts posted by enochbenjamin

-

-

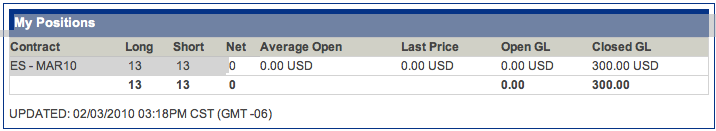

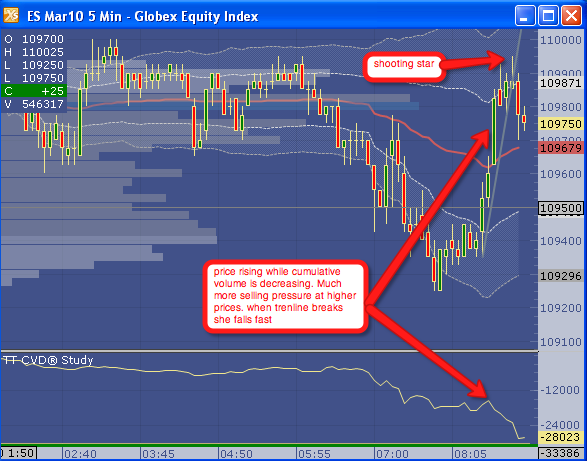

Man! You see that cumulative delta today! Some serious accumulation at the LOWS!

-

Your CVD line from XStudy was showing the correct information at the time........Thanks so much. I have been looking CVD for a couple of months but it was not until your post that I figured out how to use it. You have really helped me stay OUT of some CL trades the past couple of days as CVD kept making new highs at resistance levels.

Too bad I hesitated on that 9950 trade - it turned out to be a pretty good deal.

-

-

-

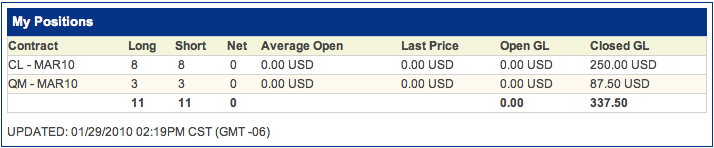

Like I posted before, trending days are not for me. A few reasonable trades on the other futures saved me from annihilation.Amen! I hate trending days - give me a range bound market any day! lost -250 in Oil and had to switch over to ES to make some money.

+287.50 for the day

-

broke a lot of rules -1100

-

After posting about doubling up - I think its only fair to let everyone know that I do not have the balls to trade like this.

-

sure corn price will not go to zero,but an account balance can.

The math is easy to determine how low you can go. Buy now and double up every 50 cents it goes down. 2001 was the last time corn traded below $2. If you can afford a $2 drop in corn then the math says you can't lose buying corn and by doubling your position every 50 cent decline you will be profitable even if prices do not recover to current levels.

-

I have a book which I will dig up and post the title (even though its out of print) that basically instructs you to buy corn or any grain that is near a x time low. then double up every 50¢ it drops. You can't lose.

-

buy corn because it can't go much lower. unlike stocks a deliverable commodity will not go to zero - the farmer has fixed costs and will not sell his product for less than it cost to bring it to market.

corn can only go so low.

-

I actually use VWAP with Standard Deviation Lines in conjunction with pivot points. I also like drawing trend lines and if a trend line break occurs around a level with both pivots and VWAP/SD I am confident about the possibile outcome of the trade.

-

I guess it's all in how you view things, but I trade oil straight through till 230pm EST. For my trading, I don't see a 'lunch' often in oil.Maybe I have rationalized this lunch chope zone thing since looking at my stats my bigest and almost all of my losing trades happen between 10:30 - 12:00 CST.

If you and others are making money during those times I must assume that its a mental issue with me.

-

And only 11 trades?!

(Actually 12 - I just made a late afternoon trade is ES +75)

My numbers are lower than I like (I prefer to be on the other side of 500) but I am back to profitable with only one losing day (small) this week.

Thanks to all in this thread for keeping me honest!

-

-

-

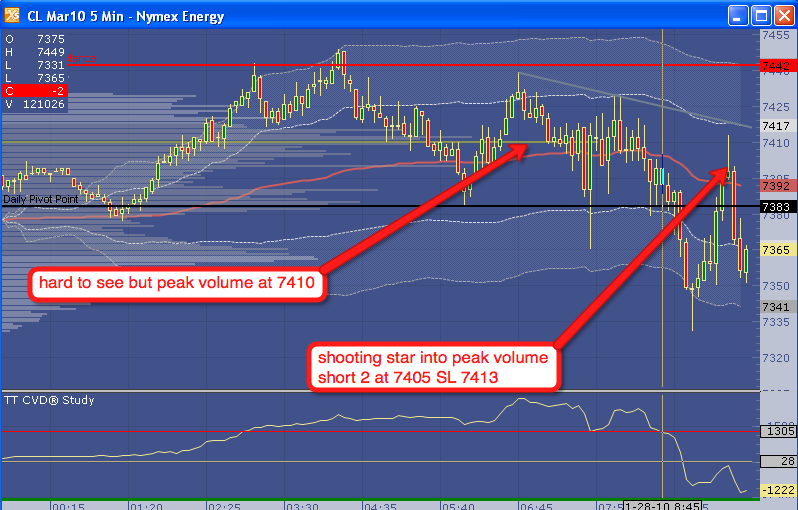

Here is a video I shot of me missing my setup (over 1 tick):

It is a small (technically not a shooting star) just above the negative SD. I draw a trendline which if broken coincides with SD. price almost immediately drops 30+ cents.

-

I normally don't trade CL from 10:30 - 12:00 CST (11:30 - 1 EST) because the market usually just chops around during this time. However this week there have been MASSIVE price drops during this time - does anybody other than me think this a bit odd???

-

-

-

Specific to scalping I have found that fading the trend at either 2nd SD to be most effective - can anyone confirm or refute this claim?

-

-

EJ - do you have an EL code you can post for the vwap bands?Nothing to do with trading - but where did u get EJ from? I have never been called EJ before. My first name is Enoch and my middle name is Benjamin. Just curious???

-

EJ - do you have an EL code you can post for the vwap bands?Unfortunately i do not. I discovered VWAP here in the Jperl threads. You might find code over there.

i use x_trader and vwap is a standard feature. please note that all vwaps are not created equal. I have tried it in several software apps and found only three to be accurate: X_trader, Ensign Windows and Investor R/T.

To be 100% honest I do not really understand how SD works - all I know is that after observing it for over a year price rarely goes much further than the 2nd SD. Since trading is a probabilities game knowing that the 2nd SD is a price extreme gives me a little edge. Add a significant resistance level and vavoom! (felix the cat)

Now if I could only be so disciplined to only take those high probability trades :doh:

-

The phenomenon of prices to follow a trendline is sometimes amazing.Just curious - how does this trendline help you?

Tweezers & Shooting Stars

in The Candlestick Corner

Posted