Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

enochbenjamin

-

Content Count

173 -

Joined

-

Last visited

Posts posted by enochbenjamin

-

-

-

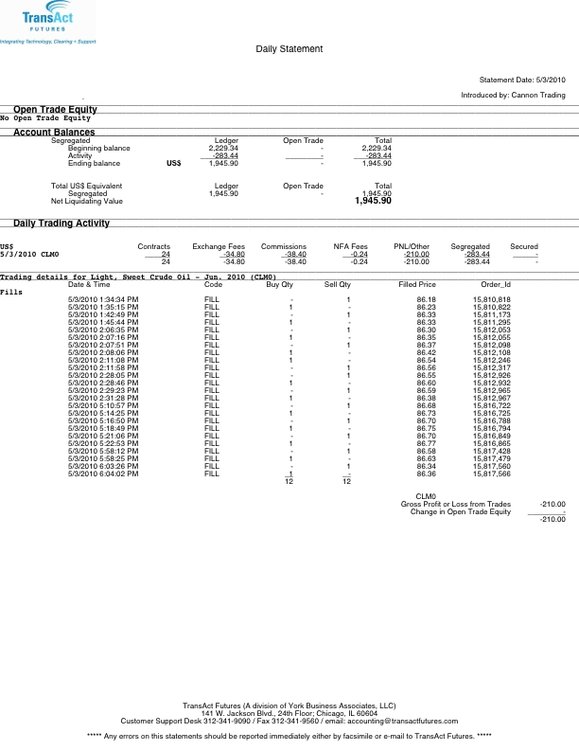

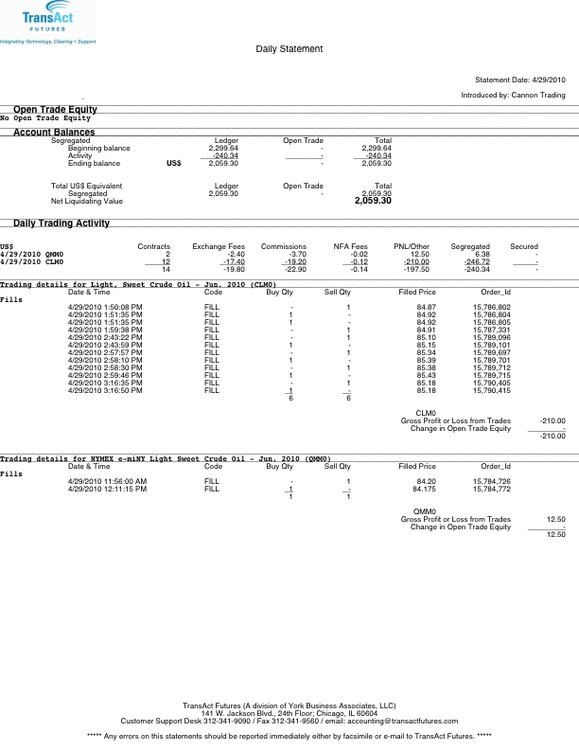

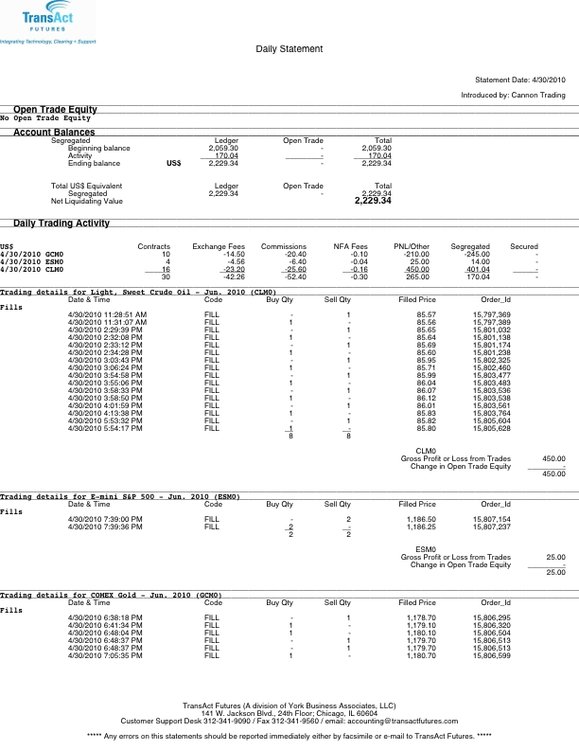

Hi enoch,You're still in so long as you post screen captures of your last two statements and PM me your closing equity by 12 noon EDT Sunday. I will be posting the Week One summary tomorrow after we get home from church, unless you get your stuff in sooner. I have the data from the other seven participants, and you are the last hold out for the week. If you do not post by then, you will be out of the official tally. You can rejoin whenever you wish, but you will be starting from the starting line by doing so.

If you decide you do want to stay in, you must post screen captures of your statements every morning like the rest of us. I will allow some excessive slippage this week as it was the inaugural week and it is a new addition to our routines, but going forward, we must all abide by the same standard. Sounds fair enough, right?

Best Wishes,

Thales

I'm still in... this is a good exercise in discipline for me!

Thanks!

-

Or, rather, poor money management leads to their destruction. I agree completely. And money management, albeit a far more aggressive MM than is usually advocated among traders, will be key to succeeding at reaching the million...This reminds me of advice Linda Raschke once gave in an interview in "Inside Advantage," a defunct newsletter published by Murray Ruggiero in the '90's:

You can start out trading a $4000 account trading a 1 lot ... but you don't position trade .... you should be in there [and day trade] and try to grab $200 a trade until you can build up ...there is no reason you couldn't average $1000/week trading a one lot ... throw all the percentage crap out the window ... it is much more important to say I was able to make $2000 a month [than I made 300% on my margin] ... if you are making $20000-$25000 [per year] off of a one lot, that is fabulous. That is what I try to do

Excellent post. I think the late George Lane NEVER funded an account with more than $5000 and constantly withdrew the funds. If I recall correctly his reasoning had more to do with distrust of brokers than trading, but his premise is still valid - that if you know how to trade you should be able to make a living off of a 5k account. This "Race" will either prove or disprove this statement.

Linda's comments remind me of another trader whose name i can't recall at the moment who stated that he never saw a trader on the floor who hit homeruns who lasted. Most of the seasoned veterans hit singles and doubles all day every day - week after week and year after year. I think a lot of traders get lulled in reading about the "Market Wizzards" who are not normal people - they are the Michael Jordans of the world. The aforementioned trader also recalls when he first started a veteran asked him why he was trying to capture so much all the time and explained to him that if he just tried to get $300/day he would be making a very respectable $72,000/year. That's when his light bulb went off and he started adding size NOT ticks to his $300 nut. If you can consistently get $300/day with a single contract get up to 20 contracts and your earning 1.5 million/year.

Now don't get me wrong - trading size is a lot harder than it sounds. I can trade 1 lots fairly well. I've managed 2,3 and even 4 without too much of a problem. But for some reason my psyche has a hard time getting up to 5/6 contracts and I do some pretty bizarre things that result in some pretty significant losses in a short amount of time (seconds).

Anyway I might be rambling as I started the whiskey wind-down and the real reason I logged on was to see if I was still in the race after I forgot to post my losing statement yesterday. I think I did post that I hit my max loss yesterday - had made up for it today and had a $500+ day but got greedy after my quitting time and ended up with just $265 today.

I feel this post is getting long and not sure I'm adding anything of value, so good nite all!

-

Will re-read it - a good thought. Seems like 99% of my battle is between my two ears.as is the case for most of us!

-

glitch in the software made me lose my mind so i proceeded to blow my days wad ($200) in about 15 mins.

note to self: when things go haywire - stay calm and make rationale decisions. I was long CL at 8492 and my platform went bananas on me - I called my broker and asked where I was and he informed me that my position was positive. Without looking at a chart I said flatten me - which he kindly did for a 1 tick loss at 8491. If you were watching crude this morning you know that 8491 WAS the swing low before taking off to 8547. After seeing that what I did next was inexcusable and if I do it much I will be out of this race in no time.

I can take something positive away from the day - I quit when I hit my daily loss limit. So I can come out and play tomorrow!

-

Are you serious? Somebody actually charges for a "rolling pivot" indicator?

I use sierra charts and I just add a study "variable period indicator" and adjust the variable period to any timeframe i like.

I have used amibroker, ensign and a few other charting platforms and was able to accomplish this with all of them for FREE. My most profitable trading strategy involved a rolling 4 hr pivot with corn. It was an ATM machine during the bull run of 08.

I am sure if you do your homework you can get rolling pivots on just about any platform for little or no cost.

-

Unlike Thales and Sick I have never taken a sandbox to 1mil. I've made a few pennies before but never amassed a cool million in 20 weeks. So..... I will be an active observer, sincerely hoping multiple people accomplish this feat.

Good trading to all!

-e.b.

-

When Wyckoff wrote his stuff,daytrading wasn't invented yet.

Not true - Pit traders have been day trading in Chicago for 100+ years.

-

collective2's free (for now) competition: Zignals; build your trading system to sell trading systems in our MarketPlace

-

Ninja lets you execute trades through the dom and routes them to C2 but they say in the literature that their is a possibility of the trade not being sent so you would then need to login on the website and close out the trade, so a winning trade on your end could be a loser for any customers. The site was also hacked a while back.I said a little bit back I was considering C2 but have since decided against it. My reasons are mostly other than what I mentioned above.

I don't use ninja and never will so that leaves me with the 1989 order entry platform that collective2 provides (complete with delayed quotes). Not going to work!

But, I'll be honest...if I blow my account out again I will definitely be using their service to get my mojo back!

-

side note on collective2

I have been thinking hard about it and I think that it does not work if you are really trading. I concluded this by rushing trying to get my orders into their not so user friendly system while trying to manage a REAL trade. If you are anything like me you need to FOCUS on managing your trades and preserving capital. There is no time for distractions. Maybe when you become a zen market wizard you can multi-task while managing your positions, but until you reach nirvana - concentrate on making money by actually trading.

As always, just my 2¢

-

I think trendlines are very important in avoiding the chop in oil. Wait for the candle to close below the trendline if you want to be conservative. A really good way to construct trendlines with oil is to connect higher low fractals for up trendlines. More on fractals later.

The tease on fractals has me a waitin...appreciated the wisdom on this post. Oil has made it to my screens - have been too chickensh** to trade it as of yet. Will continue to be a voyeur - but am curious to your method of connecting higher low fractals (how low of a time pattern do you go which you have found to be reliable)

Thanks

Sorry! Didn't mean to tease. I normally only short CL and there have not been great entries (I've been trading gold until I like my setups in CL). I've attached a chart from 4/13 that shows a simple trendline formed from connecting 2 fractal points. If I was trading this setup I would wait for the break - then wait for the most recent fractal high to be breached by 1 or more tick to enter. The filter I would use is just a 21 period EMA. Hope this benefits someone.

Note: I have this chart set up next to a chart with VWAP/SD/Pivots and ideally would take the trade if it coincided with another s&r level.

-

It's interesting you say avoid the first 2 hours and I try to be done by then.Beauty is in the eye's of the beholder but IMO to not trade when oil is really moving can be a detrimental rule to have in place.

Brownsfan - I think you misunderstand what I said - I agree that if you can finish during the first 2.5 hours it is in your best interest. I am stating to avoid the middle 2 hrs of oils pit session - from 10:30 - 12:30 central standard time. The oil pit has been open since 8am CST giving you a good 2.5 hrs to make hay.

For me personally I always try to finish by 10:30 am CST.

-

Filters are what I find important in trading oil. There are so many signals and if you take them all you will lose!

Trendlines

I think trendlines are very important in avoiding the chop in oil. Wait for the candle to close below the trendline if you want to be conservative. A really good way to construct trendlines with oil is to connect higher low fractals for up trendlines. More on fractals later.

Time of Day

From 10:30 - 12:15/12:30 CST illogical moves happen on low volume. Avoid trading this time of day. Don't worry about the periodic days when big moves happen during this time - they are tricky. Between 12:30 and 1:15 a strong move in one direction will occur almost EVERY day. more often than not it is EOD profit taking and will be counter to the days move. It will start slow and be violent and fast towards the end.

Support & Resistance

S&R are critical to getting low risk entries. VWAP/Standard Deviation, Pivot Points, Yesterdays high, low, close. Look for confluence of multiple levels coupled with a trendline break for breakouts and look for a shooting star into the same levels for fade moves.

Position Size

If you want to catch a big move in oil it is best you use multiple contracts and take profit on 1 at a predetermined price so that you can lower your risk on the runner. For example, if you trade 2 contracts with say an 8¢ stop. Take profit on 1 contract at 10 ticks (fairly easy if you entry is good). Now you essential are playing with the houses money on the second contract - even if stopped out you are up $20. So let that baby run to the next logical turning point (pivot, SD, VWAP, whatever). Utilizing this method will keep your losses small while allowing you some nice winners - often with 5,8, 13:1 ratios.

Money Management

If you want to trade oil for the long run you better be disciplined about knowing when its not your day and quitting! Have a daily loss limit and stick with it! Make sure the daily loss limit is smaller than your average winning day. I repeat quit when you hit this number! Also have a value that once hit - the worse you can do is break even. For example if you book $500 at any point in the day - make sure you never go below zero. You can make money quick in oil but you can lose it quicker. Another way of dealing with this is quitting after 3 losing trades in any session. In oil more as with any other market I have traded disciplined money management is the key to staying alive. Oil is more volitile than most markets so the tendancy to overtrade is greater and thus the possibility of losing big increases.

Be careful, be disciplined and oil will be good to you. Just remember to repeat before every trade "the market pays you to be disciplined!"

-

I have been using a Volume Balance type indicator to let me know when a move is over and it has taken me last week and this week to integrate it into my style.

Are you referring to On Balance Volume?

-

You are correct auto trading does help tremendously. When I was using interactive brokers I used a third party app called autotrader (AutoTrader Software - Home). The thing I liked best is move to break even after x ticks.

-

I'll admit I am underfunded and being underfunded while getting advice from a hedge fund manager has led me to unnecessarily lose a lot of money. So I have come to the following conclusion. The less funds you have the shorter the timeframe you should trade with very reasonable targets. The objective being to build your account with small but consistant wins.

Start with $5000. Pick a market with ample opportunities - for me CL with a 21¢ target and a 5¢ SL - so risking $50 to make $210. Next never lose more than 3 trades in any given day ($150/day). This takes discipline but can be done. I did it for approximately 4 months - trading 1 contract making between $1000 - $2300/week.

However, once your discipline breaks down you are doomed. The two weeks prior to the Christmas break I did 2000+/week. Then the kids got off and I started spending money.... Come the new year I decided I am consistant and I spent too much over x-mas, so I'll just jump from 1 contract to 4 with the same strategy. To make a long story short lets say the emotions are not the same (for me) with 4 contracts on the line as it was with 1. I started losing. I started risking more than 5¢ with more contracts than I should have. I was rewarded a few times for this bad behavior and wound up losing my previous 4 months gains.

Ok - what am I saying here - I'm saying that if you are EXTREMELY disciplined and consistently make more money on your winning days than you lose on your losing days, you can earn a decent living. Consistency is the key - just hit singles and doubles and don't get greedy after earning your consistency.

Pete Rose was never a home run hitter but I'm sure most baseball players would have loved to have had the career he had. If nothing else charlie hustle was consistant.

-

it takes all of 2 seconds to glance at the volume and see which month to trade. As of this moment May has trade volume 203431 and June has 299717. yesterday was the first day I noticed June with more volume than May and they were pretty close - you could have safely trader either. Today there is almost a 100k difference. Pretty obvious where this is going.

-

Alright, still thinking about what EB said. Still.

I have a new progression step from newbie trader to professional live trader.

1. SIM privately

2. SIM trade posting your daily results.

3. SIM trade with others following along with their own real money trading

4. Trade your own money live.

If SIM is going well and you have a plan that is executable in a live setting, why not go start an account at Collective2.com

You have minimal fees and you can go on simply SIM trading. If you are really any good, people will begin to pay you to follow your trading. Now you have hardly any risk yet rather large potential for income but it is all based on results. Want to prove you can trade well without risking any of your trading capital? This seems like a no brainer.

Am I missing something?

Great idea, but...I've played with collective2 before and found it hard to enter real trades and then turn around and enter the trades on their system. But your concept is dead on.

-

Are you saying you delibarately use different entry orders for your SIM than your real trades?uhmmmm....

-

An example occured at approximately 10:45 this morning in CL. I have noted some a.m. resistance at 8510 and R2 at 8491. My VWAP/2nd SD is at 8514 so I make note to self - A shooting star into 8515 would set up a perfect short. If I was SIM trading I would set a sell stop at 8515 with a 10¢ stop and wait for the fun! But with real money I only enter with limits... so I have to sit on pins and needles. And what do you know... we get a shooting star at 8515 (goes to 8523). I should be short, but I'm not - the DOM is moving too fast for me and I get short 8494 - the problem with this entry for me is I know my SL should be above the shooting star - but thats 30¢ away now and way out of my risk parameters. Next price retraces about 15¢ and takes me out with a loss of 10¢. Now I'm pissed cuz I know that price is going back to the VWAP at 8470. But it chops around on the way down and I make several stupid mistakes to max out my daily loss on what should have been 1 simple trade.

For me its a big difference. Maybe I should just try trading with stops instead of limit orders.

I don't know but I'm figuring it out.

PS - I know what happened after the first loss has nothing to do with SIM vs REAL trading - that has 100% to do with discipline.

-

I know nobody wants my opinion, but here goes.

SIM trading cannot duplicate the emotions that arise from within when real money is on the line. With SIM trades I can set a target of $1 and watch it get 80¢ and retrace back down to 20¢ before hitting my target of 100¢. Now for real life - no way I'm watching 60¢ of profits disappear. Its just not the same.

If we had a SIM contest I'm certain I can trade circles around just about anybody. But in the real world I am just a below average trader who barely eeks out a profit. But I take my lumps with real money because I sincerely believe that is the cost of tuition for this profession. I will never learn how to control my emotions SIM trading - I will only get that feeling when the rent money is on the line!

Growing up I was the Monopoly king in my family. I would always have houses hotels everywhere and the fam would always say your going to be a landlord one day. Well that day came and I can tell you while the concept is there Monopoly does nothing to prepare you for collecting rent from real people struggling to get by. There is no book you can read that can explain the mixed feelings you have evicting a single mom with young kids. The only way to know how it feels is to go to court and experience it.

I'm not saying that SIM trading doesn't have its merits - all I'm saying is that SIM trading will not allow you to experience the anxiety of risking your hard earned money. There is nothing that can mimic the experience of losing.

just my 2¢'s worth.

Side note: I mainly trade CL because the volatility usually provides many opportunities daily. But after a losing streak I switch over to 6B because it has similar volatility but with a lower risk/tick ($6.25/tick). Once I get my confidence back with 6B - I earn the right to trade CL again. I've tried to do the same with QM but 6B seems to work better for me. Maybe others might consider trading something (YM?) with less risk until you feel confident to trade CL.

Just food for thought.

-

I'm glad someone made money on that move....Your ability to wait out the price action for the great moves is amazing Bathrobe.

]

I agree if I had your patience I would make a whole lot more loot.

I got short at 8253 - initially had an 8¢ stop - after the entry candle closed I moved the stop to 1 tick above to 8255. So I was only risking 2¢ and I was confident price was going to 8200. risking $20 to make $530 - excellent R:R ratio in my book.

Please don't ask me where i got out. Ok - I made $30 on the trade! Seconds after I exited price was at 33 and I knew I made a mistake. The story of my life. One of these days I'll be willing to lose the 20 bucks!

Patience is a virtue.

-

Or you just trade the contract w/ the most volume, which takes about 5 seconds to scan in the morning. Once again, problem solved w/ a 5 second routine.100% true - AND if you wait till the day before delivery notices are sent out (if your broker lets you get that close) your charts are gonna have gaps all over the place! Volume dries up well before notices are sent out.

The Race

in Traders Log

Posted

I agree --- today was a day i dream about in crude oil - a shorters paradise - and I lost money. Days like today I usually make hay but something was not right in my head and I'm wondering if it was "the race".

2 bad days in a row.