Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

analyst75

-

Content Count

700 -

Joined

-

Last visited

-

Days Won

2

Posts posted by analyst75

-

-

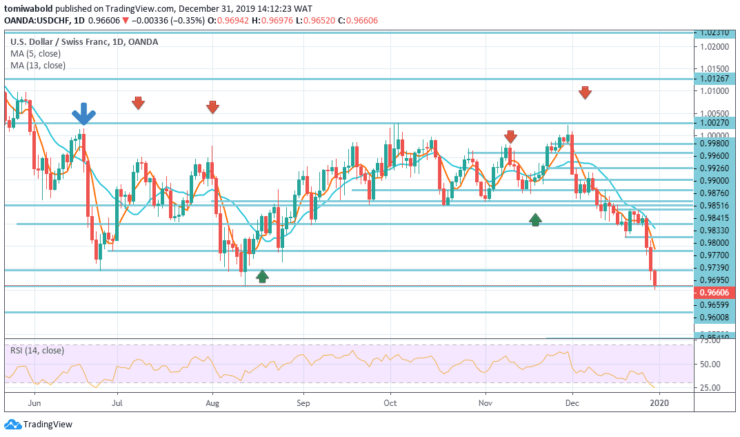

The USDCHF Is Weakening While Selling Continues Beneath 0.9695 Level

USDCHF Price Analysis – December 31

After the Asian session, moving sideways near the level of 0.9695, the USDCHF pair lost its movement in the last hour and touched the lowest level since early November at 0.9662. At the time of writing, the pair fell by 0.23% per day at 0.9660 level.

Key Levels

Resistance Levels: 1.0231, 0.9833, 0.9695

Support Levels: 0.9659, 0.9600, 0.9541

USDCHF Long term Trend: Bearish

In a broader context, the long-term outlook stays bearish, as USD / CHF is in the range of 0.9659 / 1.0231. In any case, a decisive breakthrough of 0.9659 level is required to indicate the resumption of a downtrend.

Otherwise, more side trading may be recorded with the risk of another rebound. Meanwhile, a breakthrough of the level at 0.9695 support may aim at the level at 0.9541 support.

USDCHF Short term Trend: Bearish

The intraday bias in USDCHF stays on the downside at this phase. At the moment, a plunge from the level of 1.0027 may break below the support level of 0.9659.

On the other hand, a slight break of resistance above the level at 0.9739 may change the neutrality of the intraday bias and lead to consolidation first, before starting another decline.

Instrument: USDCHF

Order: Sell

Entry price: 0.9659

Stop: 0.9739

Target: 0.9541Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Source: https://learn2.trade

-

Stellar (XLM) Pullback Inconclusive, Further Selling Pressure Likely

Key Resistance Levels: $0.09, $0.10, $0.11

Key Support Levels: $0.06, $0.05,$0.04XLM/USD Long-term Trend: Ranging

Stellar has been relatively slow in price movement. On December 17, the coin fell to a low of $0.042. In defense of the current low, the price pulled back to a high of $0.046. The price movement has been insignificant as the market commences consolidation above the current price level.Consolidation at the oversold region implies that buyers and sellers have reached equilibrium at the current price level. Stellar lacks buying at a lower level as the bears may take undue advantage to sink XLM to the $0.036 low. Alternatively, if the bulls continue their hold above the $0.042, the market will continue the sideways trend.

Daily Chart Indicators Reading:

Stellar is making frantic efforts to rise, as the coin is trading above the 25% range of the daily stochastic. This implies that the market is also in a bullish momentum. The 21-day SMA and the 50-day SMA are trending horizontally indicating the price range.XLM/USD Medium-term bias: Bearish

On the 4 hour chart, the bear market exhausted its bearish run at the $0.042 support level. The coin is in a bullish move but it is struggling above the $0.046 price level. The price action is characterized by small body candlesticks that are responsible for the range-bound movement.

4-hour Chart Indicators Reading

The Relative Strength Index period 14 level 52 is above the centerline 50 which indicates that the price is rising. XLM may further depreciate if the support line of the channel is breached.General Outlook for Stellar

Stellar is still in a downtrend. The coin is still at the bottom of the chart. Buyers are scarce at the lower price level to push Stellar upward. The market may depreciate further if the bulls fail to hold the $0.042 support.Stellar Trade Signal

Instrument: XLM/USD

Order: Buy Limit

Entry price: $0.041

Stop: $0.035

Target: $0.08Source: https://learn2.trade

- Broker

- Benefits

- Min Dep

-

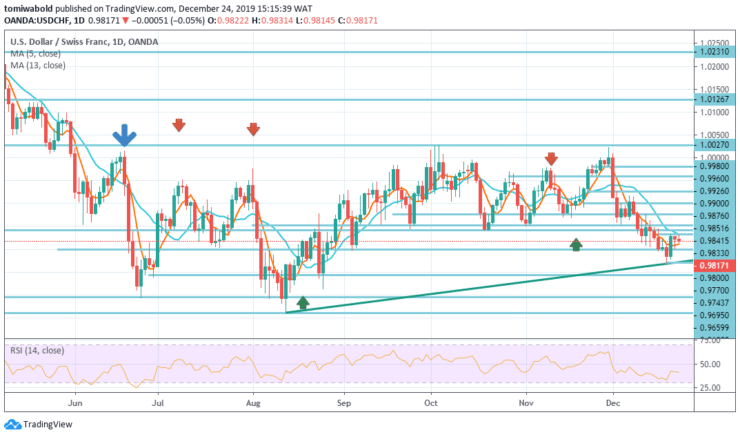

USDCHF Market Activity Subdued Beneath 0.9833 Level

USDCHF Price Analysis – December 24

The USDCHF pair recorded a small daily gain on Monday and entered the consolidation phase on Tuesday, as the markets seem to be already in a festive mood. At the time of writing, the pair remained unchanged at 0.9817 level.

Key Levels

Resistance Levels: 1.0231, 1.0027, 0.9876

Support Levels: 0.9770, 0.9659, 0.9541

USDCHF Long term Trend: Ranging

In the long run, the long-term trend remains neutral, while the USDCHF is trending in the range of 0.9659 / 1.0231. In any case, a decisive breakthrough of the level at 1.0231 is necessary to indicate the resumption of an uptrend.

Otherwise, trading with a large range may be registered with the risk of another fall. Meanwhile, a break of the support level of 0.9695 may try to break through the support level of 0.9541.

USDCHF Short term Trend: Bearish

USDCHF remains in the range of the level at 0.9770 and its intraday bias remains neutral. An even greater fall is expected as long as the resistance level of 0.9876 holds.

On the other hand, below the level of 0.9770, a fall from level 1.0027 may again be activated and approach the minimum level of 0.9659. Although a breakthrough of the level at 0.9876 can change the bias back to the side of increasing the resistance level at 1.0027.

Instrument: USDCHF

Order: Sell

Entry price: 0.9833

Stop: 0.9876

Target: 0.9695Source: https://learn2.trade

-

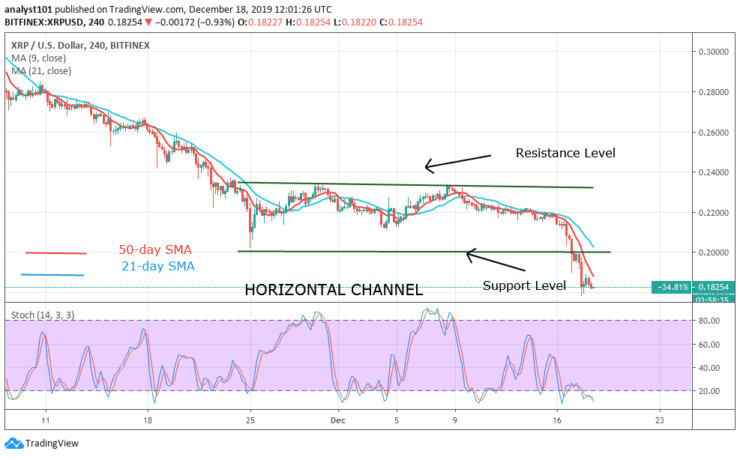

XRP Price Deepens At The Oversold Region As Buyers Emerge

Key Resistance Levels: $0.30, $0.40, $0.45

Key Support Levels: $0.25, $0.20, $0.15XRP/USD Long-term Trend: Bearish

Ripple has depreciated further and it is now trading at $0.18 at the time of writing. The price was previous fluctuating between the levels of $20 and $0.23. It was assumed in the previous analysis that if the bears break the $0.20 low, the downtrend will resume. On December 17, the bears break the $0.20 support, and the downtrend resumed. The market has fallen to $0.18 which is the previous low in 2017. The coin will likely pause and rebound at this support level. On the other hand, selling pressure may continue.

Daily Chart Indicators Reading:

The Relative Strength Index period 14 level 21 indicates that Ripple is oversold as the market reaches the oversold region, buyers are likely to emerge. In the oversold region, buyers emerge to take control of price. The 21-day SMA and the 50-day SMA are pointing southward indicating the downward move.XRP/USD Medium-term Prediction: Ranging

On the 4-hour chart, the bears have broken the support at $0.20 as the market falls to the low of $0.18. The bears have terminated the price range of $0.20 and $0.23. The price has fallen to a low of $0.18 as the market consolidates above it. Ripple may rebound if the bulls defend the current level. However, if the bears break the current level, Ripple will be in serious depreciation.

4-hour Chart Indicators Reading

The stochastic is trading now below the 20% range of the oversold region. This indicates that the coin is in a bearish momentum. The blue and red lines of the daily stochastic are trending horizontally meaning that the bearish momentum has been weakened.General Outlook for Ripple (XRP)

Ripple is now in a bear market as price breaks the support line of the horizontal channel. The bearish trend also terminates the sideways trend. Ripple is currently fluctuating above $0.18. A rebound is possible if the bulls defend the support level. Besides, the coin is in the oversold region suggesting buyers to take control of price.Ripple (XRP) Trade Signal

Instrument: XRPUSD

Order: Buy

Entry price: $0.18

Stop: $0.10

Target: $0.23Source: https://learn2.trade

-

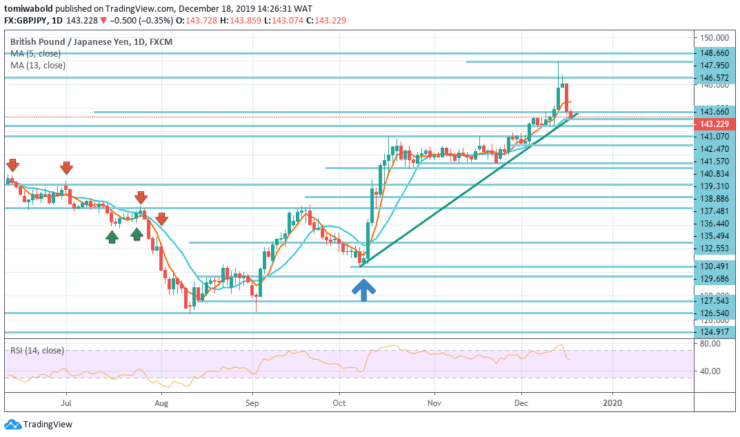

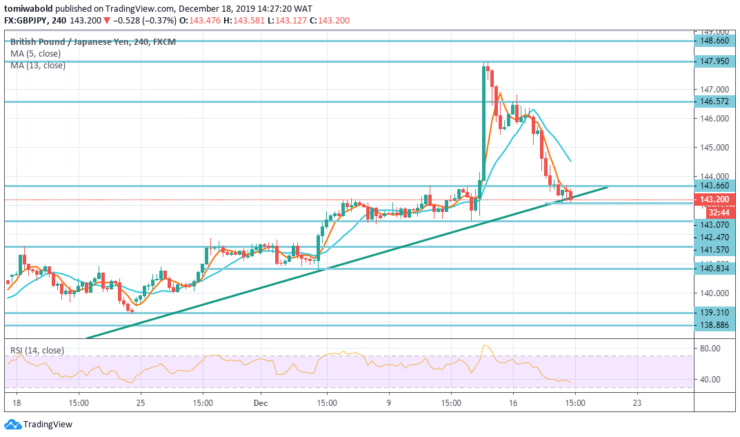

GBPJPY Reverses To The Downside In A Corrective Move

GBPJPY Price Analysis – December 18

Since the trading session on Tuesday, the currency pair has fallen by almost 303 basis points against the Japanese yen. As for the near future, the GBPJPY exchange rate may recover on a cluster formed by the daily trend line at 143.07. If the cluster holds, a reversal is possible during this session.

Key Levels

Resistance Levels: 148.66, 147.95, 146.57

Support levels: 142.47, 139.31, 126.54

GBPJPY Long term Trend: Bullish

In the longer term, an increase from the level of 126.54 may likely be a consolidation pattern from the level of 122.75 (low) or the beginning of a fresh uptrend. In any case, a more rally is anticipated, while the support level of 139.31 is held in the resistance zone of the level of 146.57 / 148.66.

The result from here may show the scenario it is supposed to be. Failure to do so may expand long-term range trend. A decisive breakout of the level at 148.66 may have long-term bullish consequences.

GBPJPY Short term Trend: Bullish

GBPJPY intraday bias remains neutral as the correction from the level of 147.95 expands. The downtrend is expected to be limited above the support level of 142.47, which may lead to continued growth.

On the other hand, above the level of 147.95, it can reach the level of structural resistance of 148.66 in the first place. A breakout may reach the next key resistance in the following. Nevertheless, a break of the level at 142.47 may indicate a short-term trend and lead to a further rollback to the support level of 139.31.

Instrument: GBPJPY

Order: Buy

Entry price: 142.47

Stop: 139.31

Target: 148.66Source: https://learn2.trade

-

Sterling Advances Barely Hours To UK Elections As Latest Poll Predicts Conservatives Win

In just two days from now, a major event that will set the trend for the currency market for the year 2020, the UK elections will be held. In the face of a Brexit extension, UK prime minister had pushed for an earlier election in the hopes of having a majority conservatives win in the parliament which will make the Brexit deal pass through easily.

As the clock ticks, with barely less than 48 hours to this epochal event, the newest poll by Survation conducted for ITV’s good morning Britain show predicts a Boris Johnson win by 14 pts. ahead of Jeremy Corbyn‘s Labour party. The Brexit deal seemed to give the conservatives an edge as it accounted for 32% of the vote decision while NHS gave Labour party a slight edge. On the overall, a majority vote of 42% was predicted for the conservatives while Labour had 28%.

Market Reaction as the Clock Ticks

Optimism looms in the market as the prediction of a conservatives win will ease Britain’s exit from Europe by January 31 deadline.The EUR/GBP pair continued to fall till the early hours of today breaking the 0.8411 trend line targeting the 0.8149 resistance level. GBP/USD pair rebounded to consolidate briefly targeting 1.3381 resistance levels. Technical analysis within a 4-hour MACD shows that both pairs may likely touch down. CAD edged slightly higher advanced by USMCA news but yet to consolidate gains.

The USD against a basket of five major currencies held steady awaiting FOMC’s minutes due out tomorrow.

Against a basket of currencies, NZD’s dominance is the highest. Sterling also gained momentum firmed up by approaching UK elections.

The safe-haven, the Japanese yen, and Swiss franc remain pressured as major events that will shape the market for 2020 are been anticipated.

On the Asia side, significant market activity wasn’t recorded as most currency pairs held steady within a day’s range.

In the Asian stock market, not so much activity was recorded being weakened by recently released Chinese PMI numbers.

Most of the indexes closed a little lower while US stocks rose swiftly after Friday’s release of US non-farm payroll reports. The outcome of the December 15 deadline set by the US for the signing of a preliminary trade pact will determine the week’s direction and even further into the year 2020.

Also due out later in the week is UK GDP figures and ZEW released out of Germany.

-

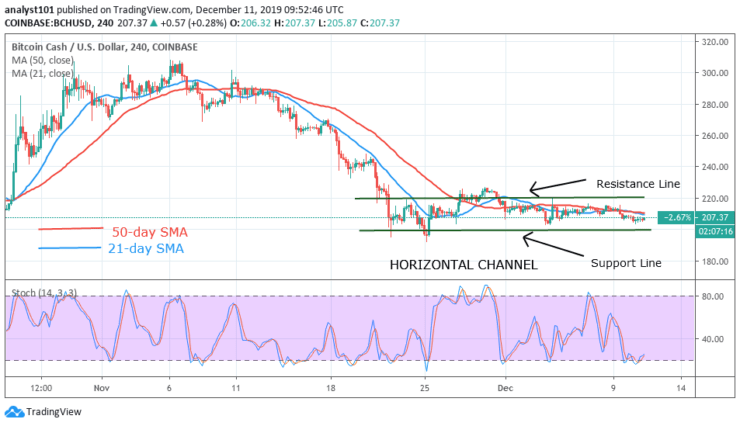

Bitcoin Cash (BCH) Holds At The Bottom, Is The Consolidation Ongoing?

Key Resistance Levels: $275, $300, $325

Key Support Levels: $200, $160, $120BCH/USD Price Long-term Trend: Ranging

Bitcoin Cash had been trading in the large price range between the levels of $200 and $240. Presently, the coin is now fluctuating at the bottom of the chart. In retrospect, the bulls break the $240 resistance line and reached a high of $310. The coin was resisted as BSH drops back to a range-bound zone.The bears tested the low at $200 but there was a pulled back. The pullback was a correction as the upward move was stopped at $227. BCH is trading between the low at $200 and $227. The bulls are now having difficulty to move upward because of the resistance at $227. Conversely, the bears have failed to break the low of $200.

Daily Chart Indicators Reading:

The Fibonacci tool indicates that the coin reverses at the 1.272 extension level. BCH will resume the downtrend if the downtrend line or the support line is broken below. The RSI period 14 level 35 is indicating that the price is falling.BCH/USD Medium-term bias: Ranging

On the 4-hour chart, the coin is fluctuating between the levels of $200 and $220. The bulls tested and broke the $220 price level but fell back to the range-bound zone. The price is trading below the $227 resistance level; a break is being expected shortly.

4-hour Chart Indicators Reading

The market is trading above the 20% range of the daily stochastic. This signifies that BCH is in a bullish momentum. The blue and red lines are trending horizontally indicating that price is fluctuating.General Outlook for Bitcoin Cash (BCH)

Bitcoin Cash is still confined within the price range of $200 and $240. Presently, BCH is in a tight range; a break above $227 will move price to the high of $240. Nevertheless, a break below $200 may weaken the coin to a low of $160.Bitcoin Cash Trade Signal

Instrument: BCHUSD

Order: buy

Entry price: $203

Stop: $175

Target: $241Source: https://learn2.trade

-

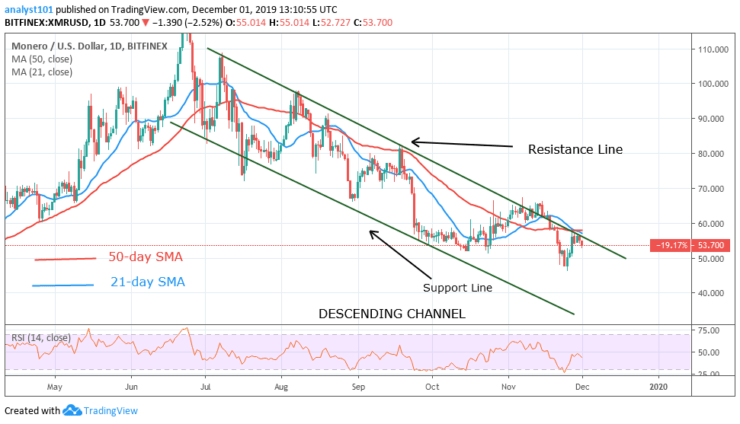

Monero (XMR) Faces Selling Pressure After Breakout Attempt

Key Resistance levels: $70, $80, $90

Key Support Levels: $40, $30, $20XMR/USD Price Long-term Trend: Bearish

The coin had been trading above $50 in October in a sideways trend. In November, Monero made a positive move and broke above the $60 price level. The bulls could not sustain the move above the upper price level as the coin was resisted at $65. Monero drops and breaks the low at $50 to a new low of $47. The coin is falling after pulling back to retest the previous low at $50. There are indications that the coin will fall as the previous low has been broken. If the selling pressure continues, the price will reach the lows of either $34 or $40.

Daily Chart Indicators Reading:

The downward move has been characterized by a series of lower highs and lower lows. The coin retested the resistance line and made a downward move. The price may fall and reach the lower lows of the support line. The XMR has fallen and reached level 42 of the daily RSI period 14. It also indicates that the coin will fall as it is below the center line 50.XMR/USD Medium-term bias: Bullish

On the 4-hour chart, the pair drops to the low of $46 and commences an upward move. The upward move was short-lived as the coin was resisted at $56. If the coin continues its falls and breaks below $46, the downward move will resume.

4-hour Chart Indicators Reading

The coin falls to the support of the 26-day EMA, if it breaks below it, the coin will resume depreciation. The pair is now trading in the oversold region below 20% of the daily stochastic. This indicates that the market is in a strong bearish momentum.General Outlook for Monero (XMR)

Monero is trading in the bearish trend zone which tends to fall. Nevertheless, all the indicators are showing bearish signals. The coin is falling after testing the resistance line, if the coin holds above the support at $50, Monero will make an upward move. On the other hand, if it drops below $47, the downtrend will resume.Monero (XMR) Trade Signal

Instrument: DASH/USD

Order: Buy Limit

Entry price: $47

Stop: $30

Target: $60Source: https://learn2.trade

-

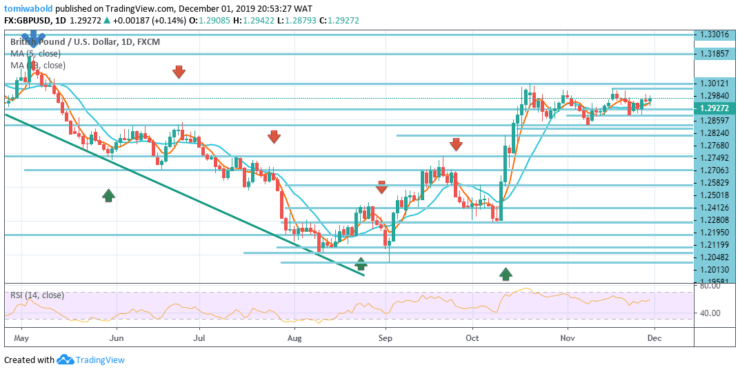

GBPUSD Price: Following Recouping From The Low, British Pound Anticipates Upward Momentum

GBPUSD Price Analysis – December 1The pound had a positive prior week as traders anticipate to build the scenario for buyers to step in, and now it seems likely to continue on the upside. If we can exceed the crucial level on the level at 1.3012, it is likely that the pound sterling takes off towards the level of 1.3185, and then possibly even the level of 1.3301 depending on the extent buyers push the FX pair.

Key Levels

Resistance Levels: 1.3301, 1.3185, 1.3012

Support Levels: 1.2768, 1.2582, 1.1958

GBPUSD Long term Trend: Bullish

In the longer term, the increase from the level at 1.1958 is viewed as consolidation from beneath. A new advance towards resistance on the level at 1.3301 may be seen. At the moment, this may continue to be the preferred scenario as long as the level at 1.2582 resistance turned support stays intact.

However, the firm break of the level at 1.2582 may shift the target towards the level at 1.1958 low and further beneath. The outlook stays bullish, displaying an intact uptrend in the short and long-term.

GBPUSD Short term Trend: Bullish

GBPUSD remained in consolidation since hitting the level at 1.3012 in the prior week while the trend is unaltered. The initial bias may stay neutral initially for this week. The retracement may be limited by the level at 1.2768 support.

Although on the positive side, the break of the level at 1.3012 may reactivate the entire rally from the level at 1.1958. However, the break of the level at 1.2768 may advance a further plunge to the level at 1.2582 resistance turned support.

Source: https://learn2.trade

-

The 419 plan is that you send money to get 100% profits of what you send in less than 50 minutes.

They ask you to send more money once you send first amount.

They don’t have any website. Even if they do, they can pull it down.

They have no physical office.

They claim you cannot comment cause of spamming, but they often remove members (who can’t comment). Needless to say, those members have been scammed or realized they’re criminals and instead, they think his presence in the group is no longer needed.

They appear religious.

They use multiple phone numbers belonging to part of their groups to give fake testimony, to deceive people. Alerts shown are money from fools who send money to them. They’re not from investors who get paid.

You join them or they add you.

People should start massive campaigns against these idiots who come in different investment names.

The public should be warned.

TO REITERATE

This is a scam. They have duped many people.... Promising to double their money everyday.

If this was possible, every Nigerian would be rich.

They are smart liars and a group of fraudsters, who will do everything possible to convince you they're genuine and God-fearing.

Once they collect your money, they remove you from their group. You can't even comment so that others won't know they're criminals.

Those who share fake testimonies are part of a large group of the scammers... And they're the ones that can post.. In order to deceive people that this is real.

The alerts they show you are actually alerts of funds sent by their victims (mumus/magas, who want to become rich by having their monies doubled).

They're now targeting WhatsApp, Telegram, Facebook and Instagram, looking for victims to join them. The go as far as hacking social media accounts so that they can deceive and lure your friends and family by posting the scam business, as if you had tried and trusted them (thus ruining your reputation). Now ask yourself, would a legitimate business hack people’s accounts so that they can get more clients?

Would they add you to their groups without your consent?

They have no websites and no offices... Sometimes, their written English is terrible. Even if they do, they can always pull the websites and move offices and remove their SIMs.

You can only PM the admin that will eventually block you once they succeed in stealing your money.

And they are desperately looking for more victims.

Please run for your life.

-

This is another scam business on a WhatsApp group.

Their WhatsApp number is: +234 706 194 7833

They will look for your number and add you to their WhatsApp group without your permission. They will then ask you to leave the group if you don’t like what they’re doing.

The moderators are maniacal criminals who would quickly remove you from the group if you ever question what they do, and also private message you to abuse you (PM, DM, PC).

Unlimited 100% Fixedgame promises to give you numbers that win sports bets 100% of the time. They say you cannot lose because they have access to secrets of fixed matches.

But you need to send money to get the numbers to do sports betting games. Send money to them at your peril… They remove you quickly from their group afterwards.

Mission accomplished.

If they know numbers that could win 100% of the time, why can’t they and their family only play the game and become rich? Why must they spend a lot of time and energy persuading people to be rich?

These scoundrels use many means to dupe people, but it boils down to, “SEND MONEY TO RECEIVE MONEY.”

They have many cousins, like Assured Wealth Management, Lavita Ricca Investment, and others.

This is more info about them: https://www.nairaland.com/5169885/assured-wealth-management-latest-scam

https://www.nairaland.com/5028627/how-got-scammed-10k-lavita

-

USDCHF: Upside Momentum Attempt At Parity Losses Steam, Running Into Sellers

USDCHF Price Analysis – November 26The USDCHF reached a new daily high of the level at 0.9987 at the start of the European session but failed to maintain momentum as investors refrained from taking important positions pending further developments on the trade dispute between the United States and China. At the time of writing, the pair was up 0.07% on the day on the level at 0.9970.

Key Levels

Resistance Levels: 1.0231, 1.0126, 1.0027

Support Levels: 0.9869, 0.9798, 0.9659

USDCHF Long term Trend: Bullish

Overall, only the medium-term trend stays neutral, with USDCHF remaining in the range of the level at 0.9659 / 1.0231. In all cases, a decisive break of the level at 1.0231 is needed to indicate a recovery of the uptrend.

Otherwise, a more parallel trend may lead to another plunge. Meanwhile, the support break of the level at 0.9890 may instead target support on the level at 0.9841. The outlook is bullish, displaying yet an intact uptrend in the short and long-term trend.

USDCHF Short term Trend: Bullish

The USDCHF is losing ground from the upside, as shown by the 4-hour RSI. But with minor support intact on the level at 0.9949, the intraday bias stays slightly higher. Consolidation starting on the level at 1.0027 should end at the level at 0.9869.

A new advance may be seen to test the level at 1.0027 again first. While a break there may resume its total advance from the level at 0.9659 to retracement from the level at 1.0237 to 0.9659 to 1.0126. On the flip side, a break of the level at 0.9949 minor support may tip the balance forward to extend the consolidation with another foot down.

Instrument: USDCHF

Order: Buy

Entry price: 0.9964

Stop: 0.9890

Target: 1.0231Source: https://learn2.trade

-

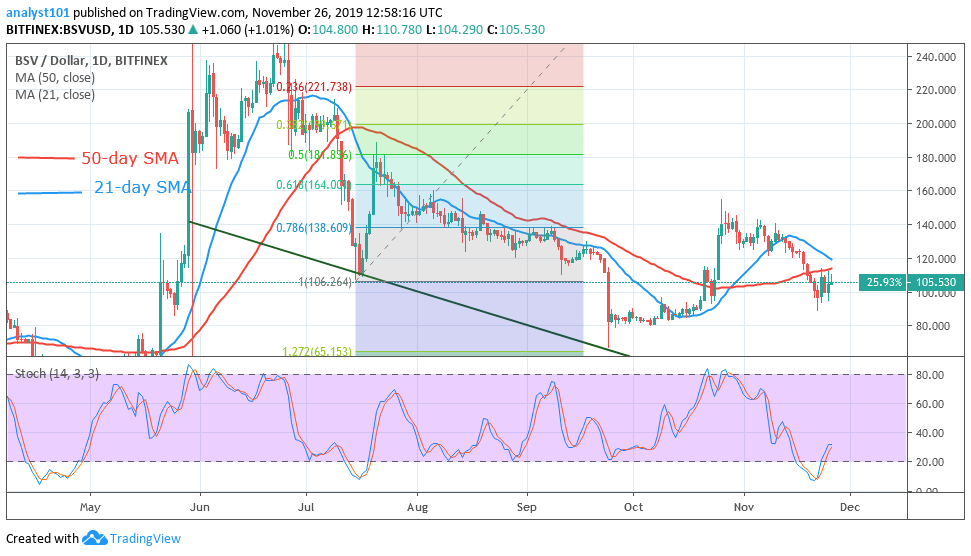

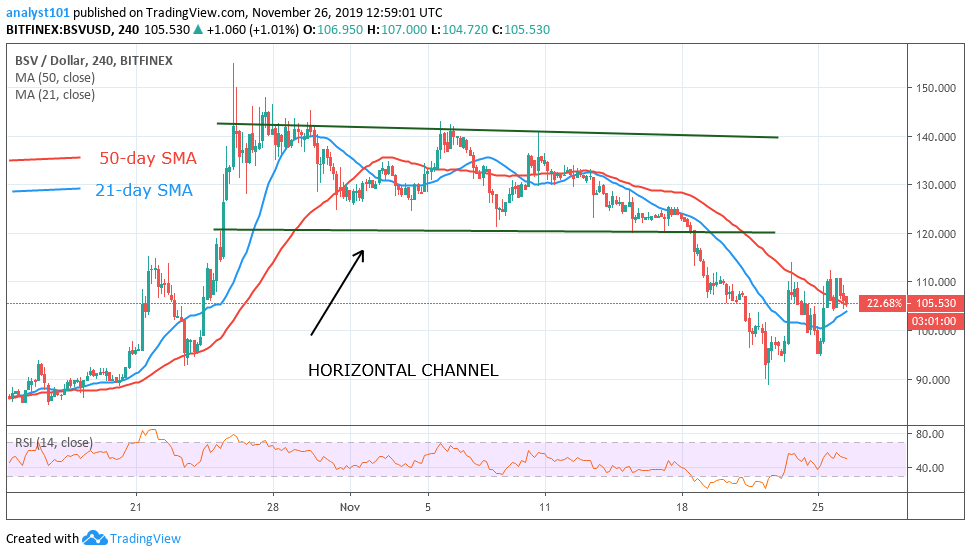

Bitcoin SV Makes Upward Corrections But Struggles To Push Price Above $110

Key Resistance levels: $220, $240, $260

Key Support Levels: $160, $140,$120BSV/USD Long-term Trend: Bullish

Bitcoin SV is making a surprising upward move after surviving a downtrend from the overhead resistance at $150. The coin fell to a low of $92 and commenced a bullish move. The price upward move can be sustained if the bulls overcome the initial resistance at $115 and $ 120.Presently, the coin is trading at $108, attempting to break above the previous low in July. In July, the previous low was supported as the market moved up to the $180 price level. Today, the previous low is a resistance level, the price has to break above that low and close. However, BSV will fall to the low of $80, if the bulls fail to break the initial resistance levels.

Daily Chart Indicators Reading:

Bitcoin SV is in a bullish momentum above 20% range of the daily stochastic. The market is expected to rise and revisit the previous high of $140. The rise of BSV is depended upon the bulls breaking above the 21-day and 50-day SMAs. The price will be in the bullish trend zone if the price is above the SMAs.BSV/USD Medium-term bias: Bullish

On the 4-hour chart, the price tested the support above $92 before embarking on the bullish movement. The formation is in the form of a bullish double bottom indicating that the coin is likely to rise. The coin is expected to rise above the $120 and retest the overhead resistance at $140.

4-hour Chart Indicators Reading

There are prospects of the coin rising because the price is above the 21-day and 50-day SMAs. The RSI period 14 level 53 indicates that price is above the centerline 50 which means Bitcoin SV is in a bullish trend.General Outlook for Bitcoin SV (BSV)

Bitcoin SV is in a bullish momentum. All the indicators are showing signs that BSV is in a bullish trend except the moving averages. On the daily chart, the price bars are still below the 21-day SMA and the 50-day SMA meaning that the coin is the bearish trend zone. The 50-day SMA is acting as a resistance to BSV. However, the coin will be in an uptrend once the price is above SMAs.BSV Trade Signal

Instrument: BSVUSD

Order: buy

Entry price: $105

Stop: $92

Target: $140Source: https://learn2.trade

-

EURUSD Is Dominated By The Bull Market Throughout As The Pair Seek To Recover

EURUSD Price Analysis – November 18

The bulls had full control today, moving the market up during the entire European session as the FX pair confirmed its breakout past the high of the prior session after trading up to 1.1068 above during the day.

Key Levels

Resistance Levels: 1.1501, 1.1412, 1.1278

Support Levels: 1.0989, 1.0879, 1.0780

EURUSD Long term Trend: BearishEURUSD at the moment, the rebound from the 1.0879 level is initially seen as a remedy and, in the case of a further increase, the increase may be contained by the level at 1.1412 retracements from the level at 1.0879.

Although the downward trend from the 1.1501 (high) level may resume later. However, the sustained plunge from the 1.1412 level may change this bearish position and lead to a greater increase in the retracement to the level at 1.1501.

EURUSD Short term Trend: RangingThe EURUSD intraday bias stays neutral for the initial position and a further plunge is anticipated as long as the resistance remains at the level at 1.1073. Also, the corrective rebound from the level at 1.0879 is expected to end at 1.1501.

Meanwhile, past the low of the level at 1.0989, the bias will be revised downward to repeat the low of the level at 1.0879. However, the breakout of the level at 1.1073 may soften this bearish trend and push up the bias for the level at 1.1175.

Instrument: EURUSD

Order: Buy

Entry price: 1.1073

Stop: 1.0989

Target: 1.1412Source: https://learn2.trade

-

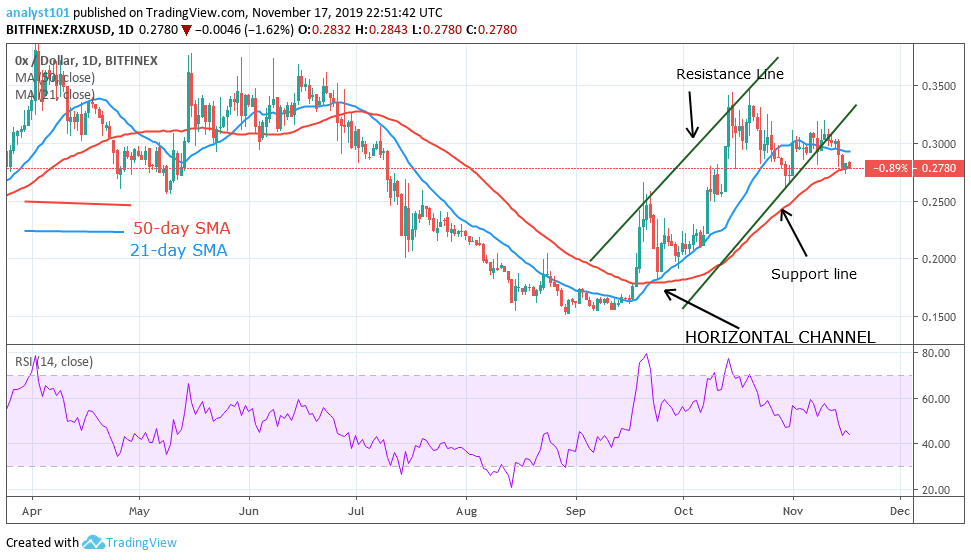

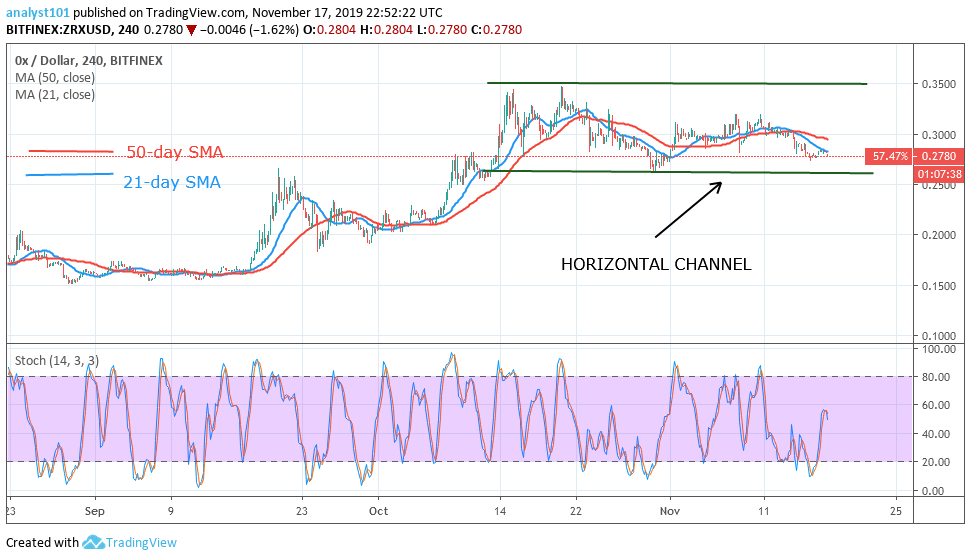

0X (ZRX) Continues To Disappoint Investors

Key Resistance levels: $0.30, $0.35, $0.40

Key Support Levels: $0.20, $0.15,$0.10ZRX/USD Price Long-term Trend: Bearish

The ZRX/USD pair is in a downward move after the market retests the $0.30 price level. In October, the coin was in a bullish move and tested the $0.35 resistance level. The bulls tested the $0.35 price level again and formed a bearish double top. With the formation of the bearish double top, the coin fell to the support line of the channel.The bulls may a retest at the $0.30 price level and resumed the downward move. The market has fallen to a low of $0.27 and it is consolidating above that level. This was the previous low in May. However, if the price breaks below $0.27, the pair will drop to a low at $0.20. Nevertheless, if the $0.27 support holds, the price will move up.

Daily Chart Indicators Reading:

The price has fallen to the support of the 50-day SMA and if the 50-day SMA holds, the 0x will move up to retest the resistance level. The RSI period 14 level44 indicates that the price is in the range-bound zone.ZRX/USD Medium-term bias: Ranging

The bulls move up to test the resistance at $0.35 on two occasions and commenced a sideways move. The coin is fluctuating between the levels of $0.27 and $0.35. Nevertheless, the bears tested the support line and rebounded. The pair is likely to continue with the sideways move.

4-hour Chart Indicators Reading

The 21-day SMA and 50-day SMA are trending horizontally indicating that price is in a sideways move. The stochastic indicator is above the 40% range indicating that price is in bullish momentum.General Outlook for 0x

The ZRX/USD pair is in a downward move but the price is ranging above the $0.27 support level. After the sideways move above $0.27 and if the bears break below the support level, the selling pressure will resume.0x Trade Signal

Instrument: ZRXUSD

Order: Buy Limit

Entry price: $0.25

Stop: $0.20

Target: $0.35Source: https://learn2.trade

-

EOS Begins A Gradual Rally; Can It Reach The Resistance Level At $6?

Key Resistance Levels: $5, $6, $7

Key Support Levels: $3, $2,$1

EOS Price Long-term Trend: Bullish

EOS is in a bullish move but it is encountering penetration at the $3.70 price level. The market pulls back and continues to trade below $3.70. EOS has made concerted efforts at the resistance so as to move up the price ladder.

Previously, the bulls have successfully prevailed over the downtrend line as the coin moves up. Similarly, if the current resistance level is surmounted, the coin will move up again to either $4.60 or $5 price level. Nonetheless, if EOS fails to move up, the coin will fall and find support at $3.20.

EOSUSD - Daily Chart

Daily Chart Indicators Reading:

The RSI period 14 levels 58 signify that EOS is falling and approaching the sideways trend zone. EOS is at the point of a bullish crossover which means that EOS may rise. The downtrend line has already been broken as the market went up. It is unlikely for the selling pressure to resume and price fall below the downtrend line. If it does price may retrace to a low of $ 3.20.

EOS/USD Medium-term bias: Bullish

On the 4-hour chart, the EOS fell to a low of $2.60 in September and October to resume a bullish move. In September, the market went up but was resisted and it dropped to another low at $2.60.

At this low, a trend line is drawn to establish the level of price movement. The uptrend is said to be continuing if the price makes higher highs and higher lows. Nevertheless, if the market falls and breaks below the trend line, the uptrend is said to be ended.

EOSUSD- 4-Hour Chart

4-hour Chart Indicators Reading

EOS is below 40% of the stochastic indicator signifying that price is in a bearish momentum. The EMAs are trending upward suggesting that EOS is rising.

General Outlook for EOS

EOS is in a bullish market. At a low of $2.60 in September the bull market was short-lived as it was terminated at $3.20 price level. The bulls embarked on another bullish move in October but faced another resistance at $3.70 after breaking the initial resistance at $3.20.

As already indicated in the price analysis, EOS may move up, if it takes care of $3.70 price level. However, on the 4-hour chart, if EOS pulls back and breaks below the trend line, the market will drop again.

EOS Trade Signal

Instrument: EOSUSD

Order: Buy

Entry price: $3.40

Stop: $2.50

Target: $6.0

Source: https://learn2.trade

-

Tips On How Best To Handle Bitcoin Market Crashes

In a scenario where the price of Bitcoin is crashing, what would be the best reactions to take?

Below are a few things an investor can do to weather the storms of a market crash.

Maintain a Calm State of Mind

Trading Bitcoin mandates that one has a disciplined mind state, meaning that your emotions must be in check at all times. Allowing your emotions to cloud your judgment in unfavorable market conditions is never the best option and in most cases, ends in disappointment and regrets. What you should do instead is take a break, evaluate what is happening and make logical decisions.

Most times, it is best to do nothing rather than taking an action that might end up going against you.

Try Not to Obsess

Sitting in front of your screens all day is not going to change anything happening in the markets. Spending time making analysis and plotting charts is fine, but don’t waste hours obsessing over the predicament you might be facing. It is advisable to engage yourself with something more constructive.

However, if you still have to trade, select a limit order and move on to something else.

Do Not Lose Focus of the Main Aim

The fact that Bitcoin may be facing a crash at a time does not mean that the overall demand for Bitcoin is gone, it is usually just a temporary downturn. The crypto market possesses the most assorted investor base of any other sector, it is safe to say that the market will almost certainly bounce back.

Always adhere to your trading strategy. Do not let the current situation drive you to make drastic trading decisions only for the market to turn around days later, causing you further losses or opportunities.

The crypto market is an extremely erratic playing field and huge plunges and rallies are always expected.

Source: https://learn2.trade

-

FTX Crypto Derivatives Exchange: The New Trend In Future Options Trading

With a growing demand for crypto derivatives trading, new crypto derivatives exchange platforms are now emerging. Derivatives trading, account for more than half of 24-hour trading volumes recorded. The new chip on the block is FTX, crypto derivatives exchange from FTX trading ltd, a company based in Antigua and Barbuda.

More on FTX

FTX crypto offerings consist of futures, FTT token which is leveraged and OTC trading. It has created a niche for itself by its leveraged token and trading indices. Though quite new, trades recorded on it may not have been substantial, but analysts believe with the variety of crypto offerings it’s giving, it may soon witness phenomenal growth.

Recently, FTX brought on board its trading indices, eight well-known cryptocurrencies that are China-linked. These are BTM, IOST, NEO, NULS, ONT, QTUM, TRX, and VET.

FTX has also built a name for itself in China despite china’s anti-crypto stance. The coins will be available to traders as a perpetual futures contract while providing a leverage time value of more than a hundred.

Listed on its platform for futures trading are major cryptocurrencies and index coins like Bitcoin(BTC), Ethereum(ETH), Litecoin (LTC), Ripple(XRP), Altcoin Index, Midcap Index, Shitcoin Index, and Exchange Token Index.

FTX Features

FTX gives you ‘leverage’ on your capital with its leverage time value of more than a hundred.

Its futures contract has a time tenure of the current quarter, next quarter and a perpetual future(DRGN-PERP).

FTX futures are Stablecoins-settled so this allows you to make deposits with Stablecoins while capturing your profit and loss(PNL) also. Thus, no need for bank account linkage.

Flexible collateral which may be Stablecoins or fiat currency.

No deposit or withdrawal fee.

Low trading fees that target the high volume user.

Bonus for sign up through referrals for its users.

Being backed by Alameda Research, a top cryptocurrency liquidity provider, FTX has access to top order books.

Various payment methods in the form of deposits like TUSD, USDC, PAX, Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Tether, Stablecoins and others which are FTX recognized are accepted on its platform.

FTX index futures contracts are the first of its kind.

FTX also offers its users the ability to activate 2 Factor Authentication (2FA) using Authy or Google Authenticator.

FTT: FTX Leveraged Tokens

Its Leveraged Tokens are ERC20 tokens that help users manage risk while reinvesting profits back into the asset being traded.

Is FTX Legit?

Not much can be said as regards this since it is still new but there have not been any regulatory violations or theft cases since its inception. However, details about the FTX method of storage of user funds are relatively unknown.

FTX Verification

The need for verification may arise for withdrawals above a thousand USD and for users who wish to increase their withdrawal limits. For this, an identity proof document with proof of address, ID document, the scanned front and back with a picture tagged “FTX” and date may be required.

Ending

FTX Exchange has created a niche for itself although it is advised for users to use the online tool and learn more to make the best choice of any trading tool or exchange.

Source: https://learn2.trade

-

Latest Releases May Push Recovery Past The Level At 1.30 Handle: What Next For GBPUSD?

GBPUSD Price Analysis – November 3

Due to recent news release, the GBPUSD pair may recover further past the horizontal line on the level at 1.30 handle. The pair exited the prior week higher at the level 1.2940. Trending about 28 pips higher after the open, the Cable was unable to hold its gains as the sellers took control ending the day below its opening price. As the new session begins, the 1.3000 level is critical and may limit a further advance.

Key Levels

Resistance Levels: 1.3301, 1.3185, 1.3012

Support Levels: 1.2582, 1.2195, 1.1958

GBPUSD Long term Trend: Bullish

In the longer picture, the present scenario affirms the case of medium-term bottoming on the level at 1.1958. However, at this stage, the rise from the level at 1.1958 is seen as consolidating from the previous fall.

And a further advance may be seen back towards 1.3301 resistance. As of now, this scenario may stay as the likely trend in as much as the level at 1.2582 resistance turned support is intact. Although the GBPUSD displays a short-term downtrend, its likely a correction, as both the medium and long-term trends are still bullish.

GBPUSD Short term Trend: Ranging

On the 4-hour time frame, the bias stays neutral before the next open as the GBPUSD is staying in consolidation from the level at 1.3012 from the last session while the outlook is unchanged.

Meanwhile, in the event of another retracement, the downside may be contained above the level at 1.2582 resistance turned support to effect another advance northwards. On the upside, the break of the level at 1.3012 may further its advance from the level at 1.2195.

Source: https://learn2.trade

-

Malta’s Financial Authority Raises Alarm Of New Scam

According to a report filed on the 31st of October, the Malta Financial Services Authority (MFSA) has alerted the public of a Bitcoin scam. This new scam bears the same qualities as another scam that has been spotted in the past.

The MFSA has cautioned the public to avoid the body called ‘Bitcoin Future’ which seems to be displaying similar deceptive properties as another known as ‘Bitcoin Revolution’. The MFSA has already released 2 public warnings this year on Bitcoin Revolution. The report points out that these scam projects seem to always reappear on the internet as ads, after changing their labels to shield them from getting spotted.

The regulatory authority stated that the ads sold fake promises like “a way to build your life better” and “a unique opportunity for Maltese”, and directed the public to a precise webpage where the fake ads were being sold.

As a disclaimer, the MFSA has said that Bitcoin Future is not recognized as a legal corporation in Malta, does not have permission to deliver financial services in any way to the country, and does not conform to the transitory provision concerning Article 62 of the Virtual Financial Act of Malta.

To sum it up, the regulatory body has said that Bitcoin Future seems to be a global “get-rich-quick” scam and has advised its citizens to desist from engaging with it and that those who do would be doing so at their own risk.

The report also consisted of a link to an authorized list of financial entities that have been certified by MFSA, and procedures to identify if a service provider is a scam or not.

New Strategy and Alliance by the MFSA

In September, the MFSA broadcasted a scheme for vigorously monitoring and managing risks on cryptocurrency corporations.

The strategy, which will span from 2019 through 2021, disclosed that the regulatory body plans on upgrading their approach and will be working directly with the Financial Intelligence Analysis Unit, also with other global authorities.

Sometime this year, the MFSA contacted CipherTrace, a blockchain security corporation, to oversee cryptocurrency-related activities in the country and to battle fraudulent activities and terrorism financing.

Source: https://learn2.trade

-

Fall Reversal On The EURJPY After Tumbling Below The Key Technical Support Level At 120.35

EURJPY Price Analysis – November 1

EURJPY currency pair tumbled and breached a significant horizontal zone on the level at 120.35 during yesterday’s trading session. As for the near future, buyers on EURJPY may take the exchange rate back to the upside to retest the price level at 121.10/121.47 within this session or the following trading session.

Key Levels

Resistance Levels: 127.52, 125.23, 123.37

Support Levels: 119.11, 117.08, 115.86

EURJPY Long term Trend: Ranging

In the EURJPY longer-term picture, the present scenario reinforces the idea that a medium-term bottom is formed around the lower horizontal zone at the support on the level at 117.08, on a bullish structure trendline in daily outlook, above the level at 115.86 critical support.

However, a decisive break of the level at 120.78 support turned resistance may reinforce this case and bring further advance to the falling outlook resistance presently on the level at 125.23. The FX pair displays weakness for the time being (as per its long term downtrend) with just the medium-term pattern as yet being bullish.

EURJPY Short term Trend: Ranging

The flipside of the EURJPY is remaining in consolidation from the level at 121.47 and it’s intraday bias at the current moment stays neutral. Meanwhile, in the likely event of a deeper plunge, its downside may be restricted above the level at 119.11 support to bring another rally to the upside zone.

As for the near future, buyers on EURJPY may take exchange rate back to retest the price level at 121.10/121.47 on the upside, a break of the level at 121.47 may re-energize the advance from 117.08 to the level at 123.37 next.

Instrument: EURJPY

Order: Buy

Entry price: 120.78

Stop: 119.11

Target: 123.37

Source: https://learn2.trade

-

Brexit Aftermath: The Market Reaction Of Bitcoin, Gold And Pound Sterling To Headline News In The EURO Zone

After the UK made it public to exit from the EURO bloc, the market cap for Bitcoin and Gold has increased almost by $133 billion and $1 trillion. Is this the Brexit aftermath?

As it is, the end may be near for Brexit. In the recent declaration an accord is reached between the British government and the EU, everyone is on the lookout for the final date Brexit will conclude. And based on this scenario, an analysis is drawn on the aftermath of this separation in the politics of the EURO bloc and the effect on the price of Bitcoin, Gold and pound sterling.

Bitcoin: Since the start of Brexit, Bitcoin’s market cap had spiked higher and recovered about $10 billion worth. Before Brexit, the cryptocurrency of the first choice had been stable in price after crashing to a market cap of about $2.9 billion low around January 2015. However, after the crash, the cryptocurrency had spiked to about 300% within 18 months while the next super halving of the project is expected on the network from 25 to 12.5 fresh Bitcoin’s per 10 minutes.

As of mid-2016, the most liquid GBP market was the London based Coinfloor exchange. The exchange did around 772 Bitcoins’ worth of volume that day, valued back then at around $4.9 million, with data from the technical back end at the Trading view.

The Pound Sterling: The British national currency had crashed by almost 20% on the night of the vote after hitting a momentary high of about $1.5 versus the USD for about 8 months. Since crashing to a low of about $1.2 as at March 2017, the Pound sterling had rallied 6% within a 4-week time frame, after the UK parliament decided to vote and activate the Article 50 while then the Brexit journey began for the UK taking it two years to discuss its planned exit from the EURO bloc.

Gold: The safe-haven asset also spiked higher around the same time frame from mid-March to mid-April 2017 with its price rising about 7% versus the USD. Nevertheless, this scenario didn’t play out on Bitcoin as in March 2017, beginning with its price at $1000, Bitcoin had surged to hit an all-time value of about $1300, as a result of markets expectation for a Bitcoin ETF being endorsed. However, after its nullification was declared on 10th March 2017, the cryptocurrency fell to a low of about $888 which occurred concurrently with the UK’s law passage for its exit from EURO bloc. Ever since then as the UK’s Brexit discussions with the EU raged on, so did the Pound against the US-dollar and Bitcoin gained more to its price.

Bitcoin, Gold, and Pound Sterling Reactions to Brexit

During this timeframe transversing Brexit discussion and its process, the Pound lost the majority of its 15% gains recovered, to tumble from a high of $1.43 to hit $1.20 on 3 September. In a similar multi-day timeframe, gold broke out of its basic $1400 resistance level to rally 15% versus the US-dollar. While Bitcoin gained higher, then again, stayed on the level around $8,000—yet the genuine story of those 17 months incorporates the cryptocurrency crashing towards $3,000 (December 2018) preceding the move spiking to a high of almost $14,000 in June this year.

Source: https://learn2.trade

-

Despite Running To The Highest Close In Six Months, GBPUSD May Fail To Reverse

GBPUSD Price Analysis – October 20

The GBPUSD had closed on Friday above its opening price after recovering from early selling pressure and trending higher for the 4th day consecutively in a row. After failing to reverse from its highs, the FX pair is unstable and due to weekend UK parliament vote on Brexit, with this scenario, the pair is likely to gap while it reopens on Monday morning in Asia (Sunday evening in the US).

Key Levels

Resistance Levels: 1.3301, 1.3185, 1.2988

Support Levels: 1.2582, 1.2204, 1.1958

GBPUSD Long term Trend: Bullish

On the daily picture, the bulls took charge in the previous session and exited the day above its opening price, however, the pair failed to move past the prior’s day’s trading range and the price likewise failed to reverse below the previous day’s range.

The GBPUSD had rallied upwards to as high as the level at 1.2988 last week, before forming a temporary top there. In the case of a reverse, the fall may be contained by the level at 1.2582 resistance turned support to bring rise resumption.

GBPUSD Short term Trend: Bullish

An impermanent top is structured on the level at 1.2988 and intraday bias in GBPUSD stays on the upside. A few consolidations may be seen. Be that as it may, any pullback ought to be contained above the level at 1.2582 support to bring rise resumption.

Meanwhile, on the upside, a break of the level at 1.2988 will stretch out the recovery from the level at 1.1958 to 1.2582 from 1.2204 at 1.3185 next. Without bias analysis, the outlook is bullish and displaying an intact uptrend in the short and long-term.

Source: https://learn2.trade

-

The Economic Proscription of U.S. Farmers by China Maybe Forever

Similar to a black eye on the face, it’s placing an indelible imprint. The retaliatory levies by China over U.S. commodity producers, such as soybeans, which seem to be forever. The moment such happens for the market it becomes irreversible.

It’s a dread numerous farmers from North Dakota to Mississippi have recognized for as far back as last year. They worry that they’ve put millions in soybean development on account of China. Since Chinese focus is now transferred towards Brazil rather, that market might be gone forever.

Once the confidence merchants have in the U.S. declines as a steady provider because of the trade dispute, the more vital its important for them to support and further broaden other avenues.

The developing danger for American agribusiness presently is that a great part of the piece of the overall industry lost throughout the year will be hard or difficult to win back at any point shortly, the Boston Consulting Group said in a detailed analysis discharged on Wednesday.

This is for the most part because of long term contracts that are regularly recorded among purchasers and sellers, contingent upon the item. The lesson from the analysis shows that U.S. farmers need to turn out to be less reliant on China, and simply trust in the best concerning those customers organizing a rebound sooner or later.

For the time being, China is going to Australia, Brazil, New Zealand, Russia, and also for its domestic producers as an option in contrast to American developed crops and animal proteins.

From the detailed analysis:

“The risk that U.S. agribusinesses may for all time lose foreign market share of the overall industry isn’t only hypothetical. In past trade disputes, for example, one with China including beef, the US has not recaptured its lost share. As a result of the increase of U.S. crops and food materials more costly than other choices, high duties bring down the price to merchants who plan to expand. Also, the fewer confidence merchants have in the US as a steady provider, in perspective on the potential for future trade disputes, the more important it progresses toward becoming for them to support and further expand. After some time, merchants could loosen up complex associations with suppliers from the U.S.”

China Receives Blames for the Pressure

And this is so because China is important to American farmers. China purchased $19.5 billion in U.S. agricultural items as of 2017, representing 14% of exports of farm produce, in light of BCS analysis. In July 2018, China slammed a 25% levy on U.S. agricultural items.

Exports at that point declined by an incredible 53% for the year. While exports to China have declined also for this year, over past years free fall.

There is another motivation behind why some China customers may not come back to the U.S. China is extending its very own crop acreage, particularly for soybeans. After some time, China will turn out to be progressively independent. Except if request increases generously, China will purchase its very own soybeans, regulating export development and under control in any case.

“Individuals in the business were in a condition of cheerfulness, believing that a bargain would soon be reached,” says Michael McAdoo, associate, and related executive for BCS in Montreal. “Our analysis demonstrates that regardless of whether there is a bargain, there is worry that a similar volume won’t return. They need to try different markets,” he declared.

Source: https://learn2.trade

Insights from Learn2.trade

in Market News & Analysis

Posted

EURUSD Rallies Maintain Upside Momentum Close To The Price Level At 1.1200

EURUSD Price Analysis – December 30

The EURUSD pair spiked to the highest level since mid-August at the price level of 1.1211 and entered the consolidation phase. At the time of writing, the pair was ranging near the price level of 1.1200, adding 0.2% per day.

Key Levels

Resistance Levels: 1.1515, 1.1450, 1.1280

Support Levels: 1.1178, 1.0981, 1.0879

EURUSD Long term Trend: Ranging

In the larger trend, the rebound from the level at 1.0879 is considered as a corrective movement at this stage. While anticipating a further advance, the growth potential may be contained by the recovery from the level at 1.1450 to 1.0879 to 1.1515.

While the downtrend from the level at 1.1450 (high) may continue at a later time. Nevertheless, a steady breakthrough of the 1.1515 level may weaken this bearish look and lead to stronger growth past the upside level at 1.1515.

EURUSD Short term Trend: Bullish

EURUSD so far advances to the level at 1.1210 during today’s trading. Violation of resistance on the 1.200 level indicates the continuation of the entire rebound from the level at 1.0879.

The intraday bias is currently on the rise for a 100% forecast from the level at 1.0879 to 1.1178 from 1.0981 to 1.1280 in the following sequence. In any case, the short-term forecast will stay cautious as long as the support of the level at 1.1066 persists, howbeit a pullback occurs.

Instrument: EURUSD

Order: Buy

Entry price: 1.1178

Stop: 1.1066

Target: 1.1450

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Source: https://learn2.trade