Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

carltonp

-

Content Count

168 -

Joined

-

Last visited

Posts posted by carltonp

-

-

I think there is a misunderstanding of terminology here.When I first read about your "pause" theory, I thought you meant there were no trading, thus the pause.

but you meant the trading was going on, but the price did not change. ie they were trading at the same price.

so yes, the price did not change between 15:04:30 and 15:04:36. There were 6 trades during that time, they were all consummated at 11534. Maybe they were traded at bid price, ,maybe they were traded at ask price, but they were traded at the same price.

Whoopee.

My program works. I reviewed every single price pause you provided and my formula was able to call it.

Cheers mate

-

There were no price updates,don't know if the price paused.

Hi Tams,

I'm afraid I'm not making myself clear. Looking at the sample of prices and times again that you provided below.

Between 15:04:30 and 15:04:36 the price was 11534 - that is six seconds.

My question is, did the price pause at 11534 For six seconds?

20111014,15:04:30,11534.000000,2

20111014,15:04:34,11534.000000,3

20111014,15:04:36,11534.000000,1

-

here's my data from IB (in ET time)enjoy

Tams, I've been pouring over the figures line by line.

So, does the following mean the price paused at 11534 for six seconds? I guess not.

20111014,15:04:30,11534.000000,2

20111014,15:04:34,11534.000000,3

20111014,15:04:36,11534.000000,1

I'm trying to establish if anyone has observed the price pausing at the times I noted them to pause.

Cheers

-

Hi Tams,

I wonder if you, or indeed any trader that trades YM, verify some prices for YM today?

As you're aware, I have been trying out a strategy that revolves around when prices pause.

Below is a list of times that the price of YM paused and the length of time it paused:

14-10-2011 15:00:58.58 Highlight 10 seconds, value =11536

14-10-2011 15:02:08.08 Highlight 10 seconds, value =11535

14-10-2011 15:03:25.25 Highlight 10 seconds, value =11533

14-10-2011 15:04:03.03 Highlight 10 seconds, value =11533

14-10-2011 15:04:39.39 Highlight 10 seconds, value =11534

14-10-2011 15:04:44.44 Highlight 15 seconds, value =11534

14-10-2011 15:05:19.19 Highlight 10 seconds, value =11534

14-10-2011 15:06:27.27 Highlight 10 seconds, value =11533

14-10-2011 15:06:44.44 Highlight 10 seconds, value =11533

14-10-2011 15:06:49.49 Highlight 15 seconds, value =11533

I'm sure there are traders that, like me, record their trades. Can you please look back and tell me if you noticed that the price paused at any of those times?

For example, the first trade on the list paused from 15:00:48 to 15:00:58 and so on....

This is really important, so you're help will be greatly appreciated.

Cheers

-

OP, it may take you sooner or later but if you don't give up then success is just around the corner ... never give in!

Thats great mate.....

Sometimes I really feel like I just wanna throw in the towel....

This is a hard business...

-

Probably no one is commenting, because it's not a well known or widely used practice.

Thanks mate.

I will continue investigating....

-

Hi Tams,

Thanks for the detailed response - really appreciate it mate. Below is the output from tracert - its not so great.

It totally makes sense about what you said about esignal and IB (don't know what I was thinking :-)

-

You need to look at the number of hops.the more hops between you and the broker,

the more chances for error.

when you are designing a strategy,

you have to take into account all the variables,

including those that are beyond your control.

Hi Tams, just spent the last 45 mins watching todays recording. I have data feed coming in from both esignal and IB. I have checked every pause and compared them both and the pauses have all been in sync with each other.

Therefore, there is a problem it would be coming from my PC or my ISP, and I don't think there is any issues with either my PC or ISP.

Cheers

-

..Ive been learning about trading futures for over 3 years..in the last year concentrated mainly on technical analysis..shooly76, I feel your pain. Have you actually spent the last three years learning? Or did you have a day job and learn trading in the evenings.

I myself are going through similar ups and downs as you.

-C-

-

Just applied the tracert command and the output shows a healthy connection....

-

maybe that tells you something about the theory?I don't know, I am open for ideas. Maybe the proposal needs more research and refinement?

Thats interesting because traders are usually quick to comment on theories that are seen as not having any edge what-so-ever ...

-

you can do a latency test to see how many hops and the time delays between you can your broker.there are free website that can do it for you,

also, IB's website has instructions.

Thats cool. Tams, thanks.

I notice that nobody wants to stick there neck out and comment on the strategy - same with ET. Don't understand why....

-

Hi Carlton,Thus, with the combination of these data pauses occurring via data providers, ISP or computer issues...how will you be able to determine if it's a real price pause or an data stall via your data provider, ISP or computer connection.

HI wrbtrader,

That is a good question, and one that I probably could never answer with all certainty. However, a very polite engineer at IB kindly did some tests with me and for 30 mins we both synchronized on clocks and watched the pauses independently.

Having said that, I will never know for sure.

The question still remains: is this a strategy, worth pursuing in your opinion, if valid?

Cheers

-

Hello Traders,

I'm trying to formulate a strategy that might take advantage of price pause after an instrument has paused.

Let me provide an example.

I have written a program that will alert me to when a price has paused for 5, 10 or 15 seconds. Also, the program will show me how many times a price has paused at the aforementioned seconds during, say a 5 min interval.

The strategy that I deploy using the formula is as follows:

YM (mini-dow) has reached an overbought/oversold stage on 5min chart. During the overbought/oversold stage the price pauses for 5 seconds at, say 11000. The price moves to 11005, and then 11008, but returns to 11000 and pause again for 5 seconds. The price then moves to various other prices but then returns to 11000 and then pauses for 10 seconds. This is all happening during the 5 min bar interval.

So, my strategy is to wait for a pullback on the following 5 min interval a enter at 11000 in the direction of the current trend.

So, my question is, can someone please tell me how I might improve on that stratey?

Alternatively, can someone please tell me if they deploy a strategy using price pauses in their trade setups? And any ideas would be great.

Cheers

Carlton

-

Josh,

What trading platform do you use?

-

I use IB with MultiCharts.The charting program captures the data from IB automatically and saves them in a database in my computer.

I hope you have observed a few things with this data:

1. the time scale is in 1 second increments.

ie. The data is aggregated.

a) IB sends out their data in approx 250~300 second increments.

(Other data provider might do better, read the fine print on their service agreement.)

b) The market moves faster than 1 trade per second, but the retrieved data from the computer's own database is at 1 second increment. That means the charting software is further aggregating the data.

2. there is no bid ask size.

Because of the auction nature of the market, the changes in bid and ask is actually more frequent than the consumated trade price. ie. you should have MORE data points seesawing back and forth on both size, even if the bid ask price do not move, the size would.

Currently there are few retail software that can reliably capture all the data. ie. even if the data provider is sending you true ticks, your software might not be able to save all the quotes into your computer's database. MultiCharts has started using tick ID, which can time stamp and sequence the data into more traceable format. But I have not utilized it yet.

If you capture all the market's data, the database size would be enormous. It was a cost prohibitive undertaking a few years ago, that's why most software aggregate their data. With today's harddisk cost, database size is no long an issue, you will see more software with true tick databases in the near future.

Thanks Tam.

Some of what you mentioned I was made aware by IB support staff on Friday i.e 250ms increments, and that their data is aggregated. However, it never dawned on me that there might be additional aggregation in the software itself.

I also didn't pay attention to the fact there isn't any bid / ask size.

I have decided to use Esignal as data provider and solely use IB as the broker. I know Esignal provide tick by tick data, however I'm going to ask Esignal if they provide trades at bid and trades at ask through the API(application programming interface) as I need to import that crucial piece of information into my spreadsheet.

Anyway, you've been extremely helpful with this (and other) issues.

Appreciate mate.

Cheers

-

from my database.I collected the data in real time.

This is only one minute's worth of data, just enough for you to get a feel for the bid ask interaction.

Tams, who are your providers? How do you collect the data realtime?

Cheers

-

Open up a time and sales window, and look at the preferences for that window. You should see the option to color transactions executed at the bid and at the ask separately. Most people will color the transaction executed at the ask green, as this represents a market buy, and at the bid red, as this represents a market sell. This window will show every transactions. The time and sales window is "the tape." This is what people are looking at when they talk about tape reading.What software do you use?

Josh, I think I've been bit of a numpty (British term for what Americans call a Putz).

Do you remember when Gosu said 'That policy would seem to make suspect any trade decision based on what's showing on the bid and ask at any given time regardless of the flawlessness of the data itself.'

What is exactly what I was doing, when it actual fact I thought I was doint what you thought I was doing when you said I think carlton is talking about transactions that have been executed, not orders in the book.

It's still possible to write a formula for that, just going to require a little more thought....

Thanks mate....

-

Open up a time and sales window, and look at the preferences for that window. You should see the option to color transactions executed at the bid and at the ask separately. Most people will color the transaction executed at the ask green, as this represents a market buy, and at the bid red, as this represents a market sell. This window will show every transactions. The time and sales window is "the tape." This is what people are looking at when they talk about tape reading.What software do you use?

Thanks Josh,

I use Esignals advanced a charting software.

-

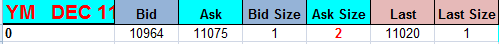

here's the bid ask trade of the YM Mar 11 contract for 20110214 8:45:00 to 8:45:59enjoy

Wow! Where did you get that from?

-

you might be able to guess if you know the quote before and the quote after.I don't know when did you get that quote,

but YM spreads are much tighter, usually at 2 ticks wide, and occasionally oscillate between a 1~5 ticks window.

(see my example above)

Ok, looking at you example, would you say that the last trade price of 10966 was executed at ask?

-

I think carlton is talking about transactions that have been executed, not orders in the book.Ditto the above.

Josh, is it possible to determine if a transaction has been executed at bid or ask, realtime?

Cheers

-

There is no way to tell.[/code]

Thanks for responding Tams, however, I think you might be wrong. Going to investigate further.

Cheers

-

Price Pause Strategy

in General Trading

Posted

It gives me the confidence to build on my strategy.

Thanks Tams