Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

GlassOnion

-

Content Count

146 -

Joined

-

Last visited

Posts posted by GlassOnion

-

-

. Provide simple basic education on auctions and a simple, basic, fast and reliable charting/trading platform . Anyway.

I have heard ( seen ? ) you mention auctions in the past. Care to elaborate here or in another thread? Or aim me towards some literature ?

-

I want to start a thread for discussion on why some traders go down the path of complicating trading, when there is so many possibilities that require only some experience and a bit of risk/trade management.

I don't necessarily want to talk about actual trading setups, just in general.

There are many ways to trade, the most common boil down to S/R bounces, breakouts of S/R.

Now to trade these just requires some charts a few line tools and practice.

There are others who want to understand how/why/who/where/when/color of socks etc.... price moves, suggesting once they know this they will trade risk free, or with high rate of wins.

They will study all sorts of theoretical stuff on order flow trying to understand complex maths and other complex material

I am suggesting that people keep it simple, stupid.

Would a poker player learn how cards are made, in which factory, who made them etc. It might be nice to know, but pointless to his performance

Discuss...

-

I read a lot of stories on here about how people had to go through this long, torturous process to become successful at trading Forex. It's so common that it almost seems like there's a union mentality about the whole thing. You know, the whole "you gotta pay your dues" and "you gotta get crapped on a lot before being successful" type of thinking. You can see written in between the lines of what people post here.

If someone was successful right out of the gate, I have to wonder if they should just keep it to themselves. My guess is that those who have already made up their minds that nobody can go from zero to making a living at this game in 6 months would call someone a liar who decided to share their success after actually pulling it off. After all, it's natural human psychology to tear down what something that doesn't jive with one's pre-conceived notions than to challenge their one's own beliefs.

-

With all things NOT being equal.

The Beatles had 8 days a week.

And things are not always what they seem.

A door is not a door when it is a jar.

And now we Rover on Mars beaming back signals.

I wish somebody would beam me up.

-

For many years, the chinese have always loved the number 8 because if pronounced in mandarin, it sounds like "prosperity" -

In period 8 feng shui meaning from the years 2004 to 2023 , any number that ends with a 8 will also become properous. so if you start a business on the 8 of any month or 18, 28 will always be very very lucky and prosperous.

When choosing wedding dates, most Geomancers would not choose a date that is 8th day of the lunar month 8 because that day can be too strong for the couple and so that marriages can break. however the day has to balance also with the couple's birthdate and time and see if it can be used.

If you turn the 8, 180 degrees, it will still look like a 8 -

A word of caution - the number 8 can be so strong that some people cannot carry this number. An example - there was a man who owned a luxury car and had a number plate 168 which was too strong for his own destiny and so his business went down.

-

It seems that there is an abundance of "system" related posts.Since systems alone do not directly impact an individual’s ability to become a successful trader, I felt that it was time to try a different angle. Please don't misunderstand me on this, all the good folks here that have shared their systems are to be commended. I personally couldn't see myself spending as much time as they do maintaining their threads.

However, the 95% and the 5% are still on the opposite sides of the fence. The systems are of little use to those who seek them the most, because those who seek them the most lack a certain self - awareness. Having said that, I'd like to invite TL users to post useful quotes and snippets from various sources (books, magazines, personal experience, etc.), which they feel exemplify some of this much needed "awareness" (consciousness).

I'll kick it off with one of my favorites, and will do my best to keep posting as I find and remember others in the future. Please pitch in if you've got some goodies to share.

Taken From:

THE NEW MARKET WIZARDS (CONVERSATIONS WITH AMERICA'S TOP TRADERS)

By: JACK D. SCHWAGER

.

Interview with Victor Sperandeo:

Schwager – “You almost seem to be implying that intelligence is an impediment to successful trading. How would you explain that?”

Sperandeo – “Assume that you're a brilliant student who graduates Harvard summa cum laude. You get a job with a top investment house, and within one year, they hand you a $5 million portfolio to manage. What would you believe about yourself? Most likely, you would assume that you're very bright and do everything right. Now, assume you find yourself in a situation where the market is going against your position. What is your reaction likely to be? "I'm right." Why? Because everything you've done in life is right. You'll tend to place your IQ above the market action.

To be a successful trader, you have to be able to admit mistakes. People who are very bright don't make very many mistakes. In a sense, they generally are correct. In trading, however, me person who can easily admit to being wrong is the one who walks away a winner.

Besides trading, there is probably no other profession where you have to admit when you're wrong. Think about it. For example, consider a lawyer who, right before a big case, goes out with his girlfriend and stays up half the night. The next day, he's drowsy and inadequately prepared. He ends up losing the case. Do you think he's going to tell the client, "I'm sorry, I went out last night and stayed up too long. If I were sharper, I would have won the case. Here's your money back." It will never happen. He can always find some excuse.

He would probably say something like, "I did the best I could, but the jury was biased." He will never have to admit he was wrong. No one will ever know the truth except him. In fact, he'll probably push the truth so far into his subconscious that he'll never admit to himself that his own actions caused the loss of me case.

In trading, you can't hide your failures. Your equity provides a daily reflection of your performance. The trader who tries to blame his losses on external events will never learn from his mistakes. For a trader, rationalization is a guaranteed road to ultimate failure.”

__________________

-

London Olympics could net British economy profit of 13 billion pounds.

London Olympics could net British economy profit of 13 billion pounds - Sport - DNA

-

Investment Firm Offers To Buy Peregrine Customer Claims.

http://blogs.wsj.com/deals/2012/07/12/investment-firm-offers-to-buy-peregrine-customer-claims/

-

-

Mystic,

Can we expect anymore videos from you?

-

-

Dodd - Frank.

The Government thinks it has to protect me from myself.

Stay out of my business.

-

When you don't sleep for 30 hours and still feel energized because your trade is going your way.

-

Waiting with baited breath. ..

-

Most of the "Big Swinging Dicks" I have read about are guy's ( can a female be a Big Swinging Dick? ) who have made one really big score, usually luck, or being in the right place at the right time, and ride the legend forever.

-

this one has a nice potential imho...I like that... will add that to my "Watch List". Am also watching G/J and E/J.

-

The chicks look Hot, but I don't think it's going to be enough to push me over the Viewing Threshold.

-

More useless informationbobc

"another enemy"

Yes, and your post is even more useless.

-

Potential long on the EUR/USD...not particularly fond of the time of day, though...Tes... also european Bank Holiday. True start if the trading week will be Tues London.

-

AUDUSD - for patriotic reasons, and the fact it is one massive uptrend

(thinking AUDEUR, might get interesting - just a gut feel)

Yes ! agree with EUR/AUD, as well as GBP/AUD

-

http://rivistastudio.files.wordpress.com/2011/01/immagine-22.png?w=236&h=215a junta decided that this cattelan sculpture representing traders simbol can stay in front of midnight palace in milan.seems a joke but its all true.

hahahaha :rofl::rofl::rofl:

-

A priest and a rabbi are sitting next to each other on an airplane. After a while the priest turns to the rabbi and asks, “Is it still a requirement of your faith that you not eat pork?”

The rabbi responds, “Yes, that is still one of our beliefs.” The priest then asks, “Have you ever eaten pork?”

To which the rabbi replies, “Yes, on one occasion I did succumb to temptation and tasted a ham sandwich.” The priest nodded in understanding and went on with his reading.

A while later, the rabbi spoke up and asked the priest, “Father, is it still a requirement of your church that you remain celibate?”

The priest replied, “Yes, that is still very much a part of our faith.”

The rabbi! then asked him, “Father, have you ever fallen to the temptations of the flesh?”

The priest replied, “Yes, rabbi, on one occasion I was weak and broke with my faith.”

The rabbi nodded understandingly. He was silent for about five minutes, and then he said, “Beats the hell out of a ham sandwich, doesn’t it?”

-

An oldie, but good for another laugh!!

A man escapes from prison where he has been for 15 years.

He breaks into a house to look for money and guns and finds a young

couple in bed.

He orders the guy out of the bed and ties him to a chair.

While tying the girl to the bed, he gets on top of her, kisses her

neck, then gets up and goes into the bathroom.

While he's in there, the husband whispers to his wife, "Listen, this

guy's an escaped convict - look at his clothes! He probably spent lots

of time in jail and hasn't seen a woman in years. I saw how he kissed

your neck.

If he wants sex, don't resist, don't complain, do whatever he tells you.

Satisfy him no matter how much he nauseates you. This guy is probably

very dangerous. If he gets angry, he'll kill us Be strong, honey. I

love you."

To which the wife responds, "He wasn't kissing my neck. He was

whispering in my ear. He told me he was gay, thinks you're cute, and

asked if we had any Vaseline. I told him it was in the bathroom. Be

strong, honey. I love you, too."

-

Or, does it become a "Self Fulfilling Philosophy"?

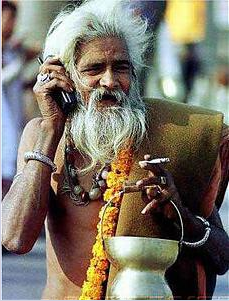

Best Phone For Trading ?

in General Trading

Posted

Hi,

I have searched through old threads about phones for trading. They are a bit dated now so I was wondering if people would give their views and experiences of the best phones to use for trading.

It would also be useful if people might suggest how much data capacity would be required. I am entitled to a new phone and want to make the right decision.

I may also choose a different plan if required. At the moment I have 2GB data per month.

Any input would be greatly appreciated.